August 2012 - National Crop Insurance Services

August 2012 - National Crop Insurance Services

August 2012 - National Crop Insurance Services

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

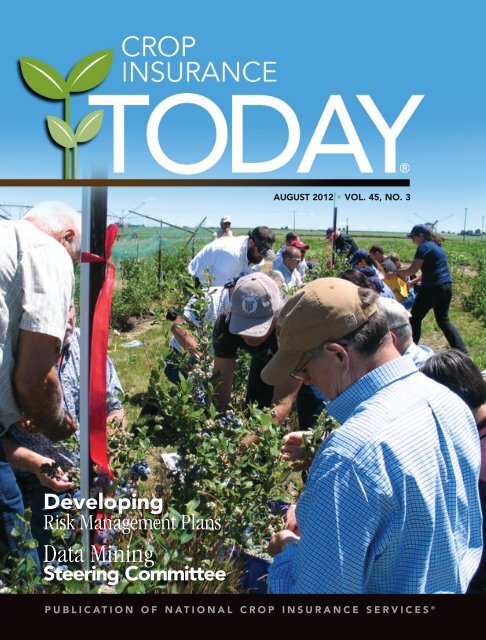

AUGUST <strong>2012</strong> • VOL. 45, NO. 3<br />

Developing<br />

Risk Management Plans<br />

Data Mining<br />

Steering Committee<br />

P U B L I C A T I O N O F N A T I O N A L C R O P I N S U R A N C E S E R V I C E S ®

We give you the support you need to stand<br />

with America’s Producers<br />

FROM OUR SERVICE TO OUR TECHNOLOGY, RCIS ® IS PARTNERING WITH YOU TO<br />

INSURE AMERICA’S FARMERS AND RANCHERS. GO TO RCIS.COM TO LEARN MORE.<br />

We grow stronger every day—together SM<br />

Rural Community <strong>Insurance</strong> Agency, Inc., D/B/A RCIS. RCIS is an equal opportunity provider. © <strong>2012</strong> Rural Community <strong>Insurance</strong> Agency, Inc. All rights reserved.

TODAYPRESIDENT’S MESSAGE<br />

“What is, and What<br />

Should Never Be....”<br />

Laurie Langstraat, Editor<br />

TODAY IS PROVIDED AS A SERVICE OF<br />

NATIONAL CROP INSURANCE SERVICES ®<br />

TO EDUCATE READERS ABOUT THE RISK<br />

MANAGEMENT TOOLS PRODUCERS USE<br />

TO PROTECT THEMSELVES FROM<br />

THE RISKS ASSOCIATED WITH<br />

PRODUCTION AGRICULTURE.<br />

TODAY is published quarterly–February, May,<br />

<strong>August</strong>, and November by<br />

<strong>National</strong> <strong>Crop</strong> <strong>Insurance</strong> <strong>Services</strong><br />

8900 Indian Creek Parkway, Suite 600<br />

Overland Park, Kansas 66210<br />

www.ag-risk.org<br />

If you move, or if your address is incorrect,<br />

please send old address label clipped from recent issue<br />

along with your new or corrected address to<br />

Laurie Langstraat, Editor, at the above address.<br />

NCIS ® EXECUTIVE COMMITTEE<br />

Steve Rutledge, Chairman<br />

Ted Etheredge, Vice Chairman<br />

Tim Weber, Second Vice Chairman<br />

NCIS ® MANAGEMENT<br />

Thomas P. Zacharias, President<br />

P. John Owen, General Counsel<br />

James M. Crist, CFO/COO<br />

Frank F. Schnapp, Senior Vice President<br />

Mike Sieben, Senior Vice President<br />

Creative Layout and Design<br />

by Graphic Arts of Topeka, Inc., Kansas<br />

Printed on recycled paper.<br />

Recently, I did an interview with Chris<br />

Clayton of DTN following Secretary-Vilsack’s<br />

White House Press Briefing on the drought, and<br />

Chris asked me if I had any song lyrics that<br />

came to mind as we discussed the drought<br />

situation and the critically essential role of crop<br />

insurance for the summer of <strong>2012</strong>.<br />

In last year’s summer issue of TODAY<br />

magazine, we pulled Fire and Rain from the<br />

“deep tracks” to talk about the flooding along the<br />

Mississippi and Missouri Rivers as well as the<br />

prolonged drought occurring in the Southern<br />

Plains, particularly in the states of Kansas,<br />

Oklahoma, and Texas. This year, as our industry<br />

Tom Zacharias, NCIS President responds to the drought of <strong>2012</strong>, we deal not<br />

only with the severity of the drought, but in<br />

addition, the politics of the Farm Bill, the associated negative publicity campaign of our<br />

critics, the uncertainty of a presidential election, and a struggling US and world economy.<br />

So upon further reflection, I went to the “vinyl” and pulled some classic Led Zeppelin<br />

from the shelf—What Is, and What Should Never Be.<br />

What Is<br />

The Drought of <strong>2012</strong><br />

Unfortunately, we have not seen the end of the drought of <strong>2012</strong>. We could be in for<br />

a prolonged drought that began with the drought conditions in 2011 in the Southern<br />

Plains. No one knows.<br />

We do know that over one-half of U.S. counties have been declared natural disaster<br />

areas. According to USDA’s July 31, <strong>2012</strong> Weekly Weather and <strong>Crop</strong> Bulletin, we do know<br />

the condition of this year’s corn and soybean crops are both tracking with the 1988 crop<br />

conditions. The 1988 drought was the worst in recent history, with a loss ratio (total<br />

indemnities divided by total premium) of 2.45. We do know that crop insurance losses<br />

on that scale would cost insurance companies, farmers and taxpayers billions of dollars.<br />

Continued Pressure On the Agricultural Production Sector<br />

We do know agricultural commodity prices have risen to historic levels, and could<br />

continue to rise. According to the June 29, <strong>2012</strong> USDA Grain Stocks Report, U.S. stocks<br />

of most major grain crops, with the exception of soybeans, have dropped significantly<br />

compared to this same time last year. This is the short term outlook. Long term, we<br />

expect to continue to observe increased population and income growth. World population<br />

reached approximately seven billion people at the end of October 2011, and is<br />

expected to exceed eight billion in population by 2025. We do know short-term crop<br />

shortages relative to demand and long term population and income growth will<br />

continue to put enormous pressure on the agricultural production sector.<br />

Continued on page 27<br />

CROP INSURANCE TODAY ® 1

VOL. 45, NO. 3<br />

AUGUST <strong>2012</strong><br />

Table of Contents<br />

1 “What is, and What Should Never Be....”<br />

4 Developing Risk Management Plans<br />

16<br />

10 <strong>Crop</strong> <strong>Insurance</strong> Rate of Return: Issues & Concerns<br />

16 2011 Research Review<br />

23 RMA/AIP Data Mining Steering Committee<br />

30 NCIS Adjuster Training in Full Swing<br />

32 Industry Support of FFA<br />

35 <strong>Crop</strong> <strong>Insurance</strong> & Specialty <strong>Crop</strong>s<br />

30<br />

Visit<br />

www.cropinsuranceinamerica.com<br />

32<br />

Copyright Notice<br />

All material distributed by <strong>National</strong> <strong>Crop</strong> <strong>Insurance</strong> <strong>Services</strong> is protected by copyright and other laws. All rights reserved.<br />

Possession of this material does not confer the right to print, reprint, publish, copy, input, transform, distribute or use same<br />

in any manner without the prior written permission of NCIS. Permission is hereby granted to Members in good standing of<br />

NCIS whose Membership Class (and service area, if membership is limited by service area) entitles them to receive copies<br />

of the enclosed or attached material to reprint, copy or distribute such NCIS copyrighted material in its present form<br />

solely for their own business use and solely to employees, adjusters or agents who are under contract with them, and<br />

as a condition to receiving such copies, such employees, adjusters and agents agree that they will not reprint, copy or<br />

distribute, or permit use of any such NCIS copyrighted material to or by any other person and/or company, or transform<br />

into another work such NCIS copyrighted material, without prior written permission of NCIS.<br />

© 2011 <strong>National</strong> <strong>Crop</strong> <strong>Insurance</strong> <strong>Services</strong>, Inc.

Your ticket to...<br />

Intuitive deployment<br />

<br />

Faster claims processing<br />

Robust reporting tools<br />

More business opportunities<br />

Advanced claims tools<br />

Contact your RVP or marketing representative for your training schedule.<br />

®<br />

Producers Ag <strong>Insurance</strong> Group, Inc., d/b/a ProAg®, is a wholly owned subsidiary iary<br />

of CUNA Mutual ual Group. ProAg is an equal opportunity portu<br />

provider. © <strong>2012</strong> ProAg. All Rights Reserved.<br />

www.ProAg.com<br />

®<br />

The Past, Present and Future of Agricultural Risk Management. ®

TODAYcrop insurance<br />

Developing<br />

Risk Management Plans<br />

By Dr. Laurence Crane, NCIS<br />

This article summarizes the activities of<br />

an RMA funded Competitive Cooperative<br />

Partnership Agreement awarded to NCIS as<br />

part of the Risk Management Education<br />

and Outreach Partnerships Program. NCIS<br />

presented educational workshops this<br />

spring and summer in cooperation with<br />

the University of Arkansas–Pine Bluff, and<br />

Alcorn State University in Mississippi. The<br />

objective of these workshops was to help<br />

African-American farmers and ranchers in<br />

Arkansas and Mississippi develop risk<br />

management plans for their farms. This<br />

training consisted of a series of three<br />

sequential workshops in each state and<br />

sixty hours of individualized instruction<br />

and homework assignments.<br />

4 AUGUST <strong>2012</strong><br />

Project Overview<br />

Risk management planning continues<br />

to be a timely topic as farmers face historically<br />

high input and energy costs, fewer<br />

off-farm employment opportunities, and<br />

increased financial and marketing risks.<br />

The goal of this project was to assist limited<br />

resource and African-American producers<br />

of specialty crops and underserved<br />

commodities in Arkansas and Mississippi in<br />

responding to risk in the five special<br />

emphasis areas of production (crop and<br />

livestock insurance), marketing (strategies<br />

and farmers markets), financial (farm management<br />

strategies), legal (liabilities and<br />

estate planning), and human resource<br />

(labor) management. Individualized risk<br />

management responses were formulated<br />

using the business planning approach.<br />

An applied education program consisting<br />

of six workshops and individualized<br />

counseling was developed and conducted<br />

via a partnership of two trainers, two state<br />

host coordinators (SHC) and twelve local<br />

educators (Extension Associates). Specific<br />

project objectives were to use business<br />

planning to: 1) review risk management<br />

principles, practices, and tools to familiarize<br />

producers with how they can be effectively<br />

applied in a holistic approach to their<br />

farm situation; 2) assist producers in conducting<br />

an effective risk assessment of their<br />

own farm business; 3) inform producers of<br />

Risk management planning<br />

continues to be a timely<br />

topic as farmers face<br />

historically high input and<br />

energy costs, fewer off-farm<br />

employment opportunities,<br />

and increased financial and<br />

marketing risks.<br />

alternative risk management strategies,<br />

including crop and livestock insurance,<br />

and delineate financial and marketing<br />

opportunities for alternative case scenarios;<br />

4) assist producers with formation<br />

and adoption of their own individualized<br />

risk response strategy; and, 5) review the<br />

financial implications and legal considerations<br />

of their chosen strategy.<br />

The primary outcome of this educational<br />

effort was for participants to develop the<br />

skills and to understand their own operations<br />

well enough to develop personal risk<br />

management strategies for each of the five<br />

risk emphasis areas specified above. The<br />

extended duration and iterative nature of<br />

the program, with sequential workshops<br />

and personal follow-up, provided participants<br />

with an opportunity to both develop<br />

and revise plans with their own data and<br />

have it professionally reviewed. This concentrated<br />

and hands-on approach to education<br />

typically leads to long-term behavioral<br />

change and is consistent with the philosophy<br />

that behavior changes are more<br />

likely with sustained personal support.<br />

Priority and Emphasis<br />

This activity focused on producers of specialty<br />

crops where there is no insurance coverage,<br />

and producers of underserved commodities<br />

that are covered by crop insurance<br />

but have a participation rate lower than the<br />

national average. Many of these producers<br />

have limited historical knowledge and/or<br />

personal experience with insurance programs.<br />

It is imperative that they receive the<br />

tools necessary to benefit from the use of<br />

crop insurance where available and learn

Dr. Crane (far left) with the farmers and ranchers who attended the workshops at the University of Arkansas-Pine Bluff.<br />

Extension Associate, Kandi Williams, (front row, second from right) UAPB & Silas H. Hunt Community Development Corporation Small Farm<br />

Program, Texarkana, Arkansas noted: “From this risk management training, the producers worked on case studies that helped them understand<br />

and better manage their farm enterprises. Some of the producers are still working on goals that they agreed to complete after the training. It has<br />

been inspiring to see them take information from the workshops and actually achieve short-term goals discussed during the training.”<br />

Dr. Crane with the farmers and ranchers who participated in the workshops in Jackson, MS, coordinated by Alcorn State University.<br />

Ralph Arrington, (back row, 3rd from right) Agricultural Educator with Alcorn State Extension, was pleased with the workshops and felt<br />

the participants were “provided a successful opportunity to set goals and decrease their risks.”<br />

how it can be used in concert with the other<br />

risk management and cost control strategies<br />

they employ.<br />

Partnering<br />

Project partners were Dr. Laurence<br />

Crane, NCIS Vice President-Education and<br />

Communication; Dr. Albert Essel, Associate<br />

Dean for Extension, Delaware State<br />

University; Dr. Henry English, Small Farm<br />

Project Director, University of Arkansas-<br />

Pine Bluff; and Mr. Anthony Reed, Interim<br />

Assistant Extension Administrator, Alcorn<br />

State University in Mississippi. Dr. English<br />

and Mr. Reed are the Small Farm Program<br />

Coordinators in their respective states, and<br />

were selected based on their membership<br />

in and personal relationships with Small,<br />

Limited Resource and African-American<br />

farmers, and their history of delivering<br />

exceptional educational programs to these<br />

farmers and ranchers.<br />

Dr. Essel assisted in managing the project<br />

and teaching the workshops. Dr. Essel<br />

has co-authored several extension publications<br />

on all aspects of marketing and financial<br />

risk management. He has extensive<br />

CROP INSURANCE TODAY ® 5

educational experience in the South working<br />

with African-American producers on a<br />

wide array of farm and risk management<br />

issues, including business planning, financial<br />

and economic development and marketing<br />

strategies common in the region. Dr.<br />

Essel is a gifted teacher and relates well<br />

with Limited Resource and African-<br />

American producers and ranchers due to<br />

his personal background and professional<br />

experiences at Fort Valley State University,<br />

Virginia State University, and Delaware<br />

State University. Additionally, he has been<br />

involved with outreach programs at almost<br />

all of the 1890 Land-Grant Universities.<br />

Each participant was expected<br />

to develop a personalized<br />

risk management action plan<br />

for each special emphasis<br />

topic (production, marketing,<br />

financial, human, legal) over<br />

a period of time following<br />

the initial workshop.<br />

Project Delivery<br />

The delivery of this risk management<br />

education program consisted of two<br />

major components: workshops and individualized<br />

study. Three day-long (6<br />

hours, 18 hours total) sequential workshops<br />

were conducted in each state<br />

approximately 30 days apart. There were<br />

52 producers (21 in Arkansas and 31 in<br />

Mississippi) who attend all three workshops.<br />

Workshop activities were designed<br />

to build upon each other with specific<br />

homework (individual study) assignments<br />

to be conducted following each workshop.<br />

The three homework assignments<br />

were designed to take approximately 20<br />

hours each to complete. The twelve local<br />

Extension Associates were responsible to<br />

follow-up individually with the producers<br />

to ensure that homework assignments<br />

were completed.<br />

The workshops were instructional with<br />

“hands-on,” participatory exercises.<br />

Participants worked through several case<br />

The workshops consisted of classroom instruction, group discussion, and personal assignments.<br />

Here, participants are completing a hands-on assignment to conduct an inventory assessment of<br />

their farm. Because writing focuses thinking, participants were required to document their<br />

thoughts throughout the workshop.<br />

Participants were grouped together by the types of commodities they produced (row crops, vegetables,<br />

livestock, etc.) and worked together to identify the common risks they face and discussed<br />

potential risk management strategies. Here, Dr. Laurence Crane is discussing the use of<br />

enterprise budgeting in making decisions. Dr. Crane attributed the success of the program to its<br />

focused and personal design: “This concentrated and hands-on approach to education typically<br />

leads to long-term behavioral change and is consistent with the philosophy that behavior<br />

changes are more likely with sustained personal support.”<br />

A critical aspect to the success of this activity was the support and follow up by local Extension<br />

Educators. Here, Dr. Henry English (right) is discussing this work assignment with Stephan<br />

Walker, multi-county agent for Jefferson, Desha, Lincoln and Pulaski counties for the Small Farm<br />

Program at the University of Arkansas at Pine Bluff.<br />

6 AUGUST <strong>2012</strong>

examples and began applying the principles<br />

learned to their own operations.<br />

Participant progress and learning was<br />

monitored with the Personal Response<br />

System (PRS) and other written assessment<br />

techniques. PRS technology was<br />

particularly well-suited for this workshop<br />

as risk assessment and response strategies<br />

can be quite personal. Individuals<br />

who may be hesitant to speak orally can<br />

simply respond to questions anonymously<br />

by pressing numbers on a devise<br />

resembling a TV remote control. A computer<br />

and receiver process the responses<br />

instantly and graph the results for all to<br />

see. The PRS was used periodically<br />

throughout the workshops to engage participants<br />

and monitor the progress of<br />

their understanding.<br />

Each participant was expected to<br />

develop a personalized risk management<br />

action plan for each special emphasis<br />

topic (production, marketing, financial,<br />

human, legal) over a period of time following<br />

the initial workshop. This required<br />

participants to evaluate the risk situation<br />

of their operations, set goals for managing<br />

risk, interact with professionals (e.g. loan<br />

officer, crop insurance agent, estate planning<br />

advisor, etc.), and develop specific<br />

strategies to measure and manage risk. All<br />

workshop materials and supporting documents<br />

were provided in hard copy and<br />

electronically for review and downloading.<br />

The State Coordinators, working with<br />

the local educators, made contact with the<br />

participants at regular intervals to offer<br />

assistance and encourage them in their<br />

efforts. Involving local educators and<br />

other local resource people (crop insurance<br />

agents, lenders, etc.) strengthened<br />

the network of advisers that participants<br />

could tap into and obtain additional information.<br />

These resources provided a support<br />

network that enabled adoption of<br />

program materials and increased the<br />

probability of long-term success.<br />

Results<br />

The primary outcome of this educational<br />

effort was for participants to possess<br />

the skills and to understand their<br />

own operations well enough to develop<br />

personalized risk management strategies<br />

for each of the five emphasis areas (production,<br />

financial, marketing, legal,<br />

human). Participants were expected to<br />

spend at least 20 hours completing homework<br />

assignments after each workshop<br />

for a total of 60 hours expected. On the<br />

written evaluation form they reported<br />

spending an average of 22.4 hours per<br />

session for a total of 67.4 hours of personal<br />

homework. Moreover, each of the 52<br />

participants established a goal in each of<br />

the five risk emphasis areas and delineated<br />

three specific actions they would take<br />

during the next year to reach each goal.<br />

A secondary outcome of this project<br />

was to develop and foster a long-term<br />

working relationship between the farmer<br />

participants and local educators.<br />

Moreover, this educational approach also<br />

improves the skills of these educators.<br />

The personal interaction of these farmers<br />

with the local Extension Associates as<br />

designed in this project has the potential<br />

of creating long-lasting relationships that<br />

will be mutually beneficial.<br />

The most important indicator of success<br />

was the strong participation by the<br />

AgriLogic <strong>Insurance</strong> <strong>Services</strong>, LLC<br />

“The <strong>Crop</strong> <strong>Insurance</strong> Company In Your Community”<br />

AgriLogic <strong>Insurance</strong> <strong>Services</strong>’ strategy is to provide agents with customized risk management solutions that<br />

allow their producers to minimize their production risk and manage their farm operations. ALIS is committed<br />

to building long term relationships with crop insurance agents and agricultural producers. Experience the<br />

AgriLogic difference.<br />

<br />

agriculture in your area<br />

<br />

<br />

Help continue our unprecedented growth... NOW HIRING ALL POSITIONS.<br />

Contact us today to learn about career opportunities with AgriLogic at hr@agrilogic.com<br />

or visit our website at www.agrilogic.com and click on Career Opportunities.<br />

888-AGLOGIC (254-6442) l WWW.AGRILOGIC.COM<br />

CROP INSURANCE TODAY ® 7

participants who returned each time and<br />

actively participated in each of the three<br />

workshops. At the conclusion of the last<br />

workshop several farmers commented<br />

orally and on the written evaluation that<br />

they were grateful for the opportunity to<br />

participate, had learned more than<br />

expected, and wished the series could<br />

continue on a regular basis.<br />

See testimonials from program participants<br />

on page 14.<br />

Developing the skills to prepare financial statements was one of the workshop activities. Here, Dr.<br />

Albert Essel is helping a group of row crop farmers prepare a balance sheet and income statement<br />

for their farms. Dr. Essel commented about the program success, stating, “Over the years, I have<br />

been involved with many educational interventions in agricultural risk management for socially disadvantaged<br />

producers and educators who conduct programs for underserved audiences. The<br />

response that we received from these producers in Mississippi and Arkansas during this series<br />

gives me hope that for once we have hit the target. The energy, enthusiasm and desire to learn<br />

tools for managing farm risk among the participating producers was exhilarating and infectious.”<br />

This program integrated the use of existing<br />

educational materials at the local level. Here,<br />

Mr. Anthony Reed, Alcorn State University<br />

discusses the publication, “Legal Risks Facing<br />

Family Farms: What Every Small Farmer<br />

Should Know.” Mr. Reed, who was the State<br />

Host Coordinator in Mississippi commented,<br />

“I believe the participants in the RMA/NCIS<br />

class received a holistic approach to risk management<br />

that I feel will help to sustain,<br />

enhance and minimize their risks on their<br />

farming enterprise.”<br />

Each Participant who completed the program was presented with a certificate in recognition of<br />

successfully completing the “Developing Personal Risk Management Plans” short course of<br />

instruction, including eighteen hours of classroom instruction and sixty hours of supervised individual<br />

study. Here, Roddric Bell, RMA Senior Risk Management Specialist/Outreach Coordinator,<br />

Jackson Regional Office (left), and Dr. Laurence Crane, NCIS (right), present Audrey German,<br />

Edwards, Mississippi, with her Certificate of Completion.<br />

Participants were expected to set a goal in each<br />

of five risk management areas (production, marketing,<br />

financial, human resource, legal), and<br />

identify three specific actions they will take to<br />

accomplish each goal. Here, Dr. Henry English is<br />

helping vegetable growers establish their goals.<br />

Dr. English, who was the State Host Coordinator<br />

for Arkansas commented, “I was quite pleased<br />

by the interest that the participants showed in<br />

the material that was presented. Several famers<br />

indicated that this was their first time being<br />

exposed to this quality of education on these<br />

topics, and they really appreciated the effort to<br />

help them learn the material.”<br />

8 AUGUST <strong>2012</strong>

The Next Evolution in Mapping<br />

AXIS has evolved and<br />

EASYmapping is ushering in the next<br />

phase of<br />

crop insurance mapping. ping.<br />

{ Faster. Easier. Better. }<br />

Rebuilt from the ground up with all of your feedback in mind, we’re<br />

e<br />

setting the new standard for crop insurance mapping.<br />

Considering this unprecedented increase<br />

in application performance, is it<br />

a mapping Evolution<br />

or an industry Revolution?<br />

naucountry.com |<br />

1.888.NAU.MPCI<br />

© <strong>2012</strong> NAU<br />

Country<br />

<strong>Insurance</strong> Company.<br />

All Rights Reserved. NAU<br />

Country<br />

<strong>Insurance</strong> n<br />

Company is an Equal<br />

Opportunity Provider. The links logo is a registered service mark of<br />

QBE <strong>Insurance</strong> Group, Limited. NAU Country<br />

is a registered service mark of<br />

NAU Country <strong>Insurance</strong> Company.

TODAYcrop insurance<br />

<strong>Crop</strong> <strong>Insurance</strong> Rate of Return<br />

Issues & Concerns<br />

By Frank Schnapp, NCIS<br />

In recent months, a variety of claims<br />

have been aired in the press regarding<br />

the cost of delivery of the Federal crop<br />

insurance program and the profitability of<br />

the private sector companies that deliver<br />

the program to farmers. These claims<br />

place the crop insurance industry in an<br />

unfavorable light, arguing that the industry<br />

is too profitable, that profits are guaranteed,<br />

and that Administrative and<br />

Operating (A&O) expense payments are<br />

excessive. Naturally, the companies participating<br />

in the program disagree. They<br />

argue that if profits were generous or<br />

excessive, new insurance companies<br />

would be entering the program on a regular<br />

basis. This is simply not taking<br />

place. At one time, 49 companies participated<br />

in the Federal program, but in<br />

recent years the number of insurers has<br />

not exceeded 16.<br />

One explanation for the negative<br />

press received by the program is simply<br />

misinformation. Discussions of the<br />

industry’s profitability often disregard<br />

recent funding reductions to the program,<br />

confuse basic financial concepts used to<br />

calculate industry returns, and fail to take<br />

into account that industry returns vary<br />

over time and differ across geographic<br />

regions. There are also serious questions<br />

about the data used to estimate the industry’s<br />

rate of return.<br />

Unfortunately, public statements<br />

regarding the rate of return have confused<br />

the issue even further. Industry<br />

leaders have met with the government to<br />

clarify the issues and look forward to<br />

continued dialogue. Among the concerns<br />

voiced about the rate of return estimates<br />

being discussed publicly are that<br />

they:<br />

• Confuse gross revenues with net<br />

income;<br />

• Assume that government A&O payments<br />

to companies on behalf of producers<br />

cover all program delivery<br />

costs, which they do not;<br />

• Fail to account for certain other operational<br />

costs such as reinsurance;<br />

• Ignore recent changes in the program;<br />

and<br />

• Fail to provide insurance companies<br />

with the reasonable rate of return indicated<br />

by government’s own study.<br />

Up till now, the crop insurance industry<br />

has not attempted to respond to the<br />

misinformation appearing in the press.<br />

However, in view of the ongoing attacks<br />

against the program, the moment seems<br />

right to present an overview of the industry’s<br />

finances as a counterweight to the<br />

distortions being presented to the public.<br />

Unfortunately, statements<br />

by government officials<br />

regarding the rate of return<br />

have confused the issue<br />

even further. Industry<br />

leaders have met with<br />

the government to clarify<br />

the issues and look forward<br />

to continued dialogue.<br />

How <strong>Crop</strong> <strong>Insurance</strong><br />

Works<br />

In virtually every other Property and<br />

Casualty (P&C) line of insurance, insurance<br />

companies determine the rates they<br />

charge based on their own loss experience,<br />

expenses, and profit objectives.<br />

The Federal crop insurance program<br />

operates on an entirely differently basis.<br />

The Risk Management Agency (RMA) of<br />

the US Department of Agriculture establishes<br />

the rates that every farmer will pay.<br />

These represent expected indemnities<br />

only, without taking into account<br />

expenses or profit for the insurance company.<br />

Since no insurance company can<br />

operate without the ability to recoup its<br />

expenses or earn a profit, the government<br />

created a separate contractual<br />

arrangement by which it can enlist the<br />

services of the private sector in delivering<br />

the program to all eligible farmers while<br />

simultaneously providing participating<br />

insurers the ability to recoup their program<br />

delivery costs and the opportunity<br />

to earn a reasonable return.<br />

The Standard Reinsurance Agreement<br />

(SRA) is a cooperative financial assistance<br />

agreement that outlines the responsibilities<br />

of insurance companies in delivering<br />

the program and specifies the financial<br />

arrangements under which the companies<br />

operate. One section within the SRA<br />

establishes the amount of A&O the government<br />

pays to compensate insurers for<br />

their cost of delivering the program.<br />

Delivery costs would be included as part<br />

of the premium in any other line of insurance,<br />

but the government has chosen to<br />

10 AUGUST <strong>2012</strong>

eimburse these costs by making A&O<br />

payments on behalf of insured farmers.<br />

As mentioned above, rates for the<br />

Federal crop insurance program exclude<br />

any loading for the insurer’s profit.<br />

Instead, the SRA allows an insurance company<br />

to retain a portion of the total underwriting<br />

gains (defined as the difference<br />

between premiums and indemnity payments)<br />

produced on its book of business.<br />

At the same time it also requires the insurer<br />

to retain a portion of any underwriting<br />

losses. In the five Corn Belt states, an<br />

insurer’s maximum underwriting gain is<br />

currently 34.75 percent of premium, while<br />

its underwriting loss can be as much as 94<br />

percent of premium. In other states,<br />

underwriting gains are capped at 42.6 percent<br />

while underwriting losses can be up<br />

to 51.5 percent of premium. What should<br />

be kept in mind is that the underwriting<br />

gain or loss a company earns in a year<br />

depends primarily on the weather. When<br />

weather conditions are good and farmers<br />

have high yields, fewer claims are reported<br />

and companies are able to earn underwriting<br />

gains. However, in a year with poor<br />

weather conditions and low yields, farmers<br />

report more claims and insurers absorb<br />

underwriting losses. If poor weather<br />

affects a large number of states, the underwriting<br />

losses in those states could swamp<br />

the gains earned throughout the rest of the<br />

country. Due to the potential for widespread<br />

losses, crop insurance is much riskier<br />

than most other P&C lines of insurance.<br />

This point can be illustrated by considering<br />

how often an industry loses money.<br />

Industry sources report that the P&C industry<br />

as a whole has lost money only once, in<br />

2001, due to the unprecedented attack on<br />

the World Trade Center in New York City.<br />

In comparison, the crop insurance industry<br />

has lost money in two years over just the<br />

past two decades, in 1993 and 2002. If the<br />

current SRA had been in effect during 1983<br />

and 1988, two years with widespread crop<br />

failures, the industry would have lost<br />

money in those years as well.<br />

Recent Program Changes<br />

The finances of the crop insurance program<br />

regularly come up for Congressional<br />

review as part of the Farm Bill debate.<br />

Reforms introduced in the 2008 Farm Bill<br />

were estimated to have reduced industry<br />

revenues in excess of $6 billion over the<br />

ten year budgeting period. In addition,<br />

RMA renegotiates the terms of the SRA<br />

every five years. Based on information<br />

released by RMA, the recently completed<br />

negotiations for the 2011 SRA reduced<br />

industry underwriting gains and A&O payments<br />

by an additional $6 billion over the<br />

next 10 years. Under the terms of that<br />

agreement, government estimates of private<br />

sector underwriting gains (not Net Income)<br />

were 14.5 percent of retained premium.<br />

Shortly after the conclusion of the SRA<br />

negotiations, RMA reduced its <strong>2012</strong> premium<br />

rates for corn and soybeans. These<br />

changes are estimated to reduce prospective<br />

underwriting gains by an additional 2<br />

percent of retained premium.<br />

The President’s 2013 Budget proposal<br />

now seeks to reduce the overall return to<br />

the companies even further. This is a matter<br />

of serious concern for the industry.<br />

Even prior to the recent reductions, there<br />

were a number of states where companies<br />

have little or no opportunity to earn a fair<br />

return. The significant uncertainties<br />

regarding the adequacy of returns for the<br />

entire program and by region raise the<br />

issue of whether adequate incentives exist<br />

for private sector delivery of the program<br />

on a nationwide basis.<br />

CROP INSURANCE TODAY ® 11

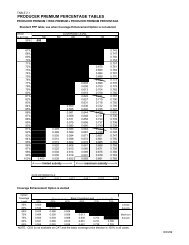

Table 1.<br />

<strong>Crop</strong> <strong>Insurance</strong> Industry Income Statement<br />

In Millions of Dollars<br />

Premium and Equity<br />

Gross Premium (a) 10,417<br />

Retained Premium after reinsurance and Quota Share (a) 8,265<br />

Equity (b) 10,871<br />

Revenue<br />

Underwriting Gain/Loss (c) 1,033<br />

Investment Income on Equity (d) 353<br />

A&O Payments (e) 1,332<br />

Expense<br />

Loss Adjustment and Company Overhead (f) (629)<br />

Commissions and processing fees (g) (1,132)<br />

Cost of borrowed funds due to delay in payment of<br />

A&O and Underwriting Gain (h)<br />

(42)<br />

Income = Revenue – Expense<br />

Pretax Income 915<br />

Federal Income Tax (i) (287)<br />

After-tax Net Income 628<br />

Rate of Return<br />

Return on Equity (ROE) 5.8%<br />

Cost of Capital (Required Return on Equity) (j) 12.7%<br />

(a) Estimated <strong>2012</strong> premium is based on 2011 actual premiums adjusted for corn and soybean rate changes<br />

and commodity price changes. Retained Premium is based on 2011 premium retention percentages and<br />

is net of Quota Share.<br />

(b) For the purpose of this exhibit, industry equity has been developed under the assumption that the industry<br />

holds sufficient capital to make commercial reinsurance unnecessary. Federal Regulations require companies<br />

to hold capital of no less than twice the company’s maximum possible underwriting loss. This<br />

assumption obviates the need to include the cost of reinsurance as an expense.<br />

(c) Estimated underwriting gain is based on RMA’s long-term estimated underwriting gain (14.5% of<br />

Retained Premium) as of June 28, 2010, reduced by the estimated impact of the new RMA ratemaking<br />

methodology (2.0% of Retained Premium) for the <strong>2012</strong> year. Additional reductions in underwriting gains<br />

are anticipated for 2013 but are as yet unknown.<br />

(d) Equity is invested in short-term instruments to ensure that the money will be readily available when needed.<br />

Investment income is based on the Wall Street Journal prime rate of 3.25% as of July 9, <strong>2012</strong>. No<br />

investment income is earned on insurance policy cash flows due to the brief period between collection of<br />

premium and payment of indemnities.<br />

(e) <strong>2012</strong> A&O payments have been estimated based on the provisions of the 2011 SRA.<br />

(f) Loss adjustment and overhead expenses are the average of 2009 and 2010 actual expenses reported in<br />

the most recent Grant Thornton report adjusted for annual inflation of 2 percent.<br />

(g) Commissions are based on provisions in the 2011 SRA that provide up to 85% of A&O for agent commissions<br />

and processing fees. The SRA also allows additional agent compensation, which is not included in<br />

the figures presented here.<br />

(h) Delays in receiving A&O and underwriting gains impose a financial cost on the industry estimated to be<br />

-0.5% of Retained Premium.<br />

(i) Applies a Federal corporate tax rate of 35% on operating income and 25.4% on investment income<br />

(obtained from the 2009 Milliman study).<br />

(j) The average cost of capital as shown in the 2009 Milliman study prepared under contract with RMA.<br />

Net Income, Return on<br />

Equity, and Cost of<br />

Capital<br />

In order to respond to the public<br />

debate regarding the profitability of the<br />

program, we first need to clarify the distinction<br />

between gross revenue and net<br />

income. The net income, or profit, of a<br />

business is the difference between its revenue<br />

and expense. For a crop insurer, revenues<br />

consist of underwriting gains and<br />

A&O payments, as well as any income<br />

earned from the investment of the insurer’s<br />

capital. Program delivery expenses include<br />

loss adjustment expense, agent compensation,<br />

and company overhead. Net income<br />

is also net of Federal, state, and local taxes.<br />

While net income is important in itself,<br />

companies also need to know how well<br />

they are performing in comparison to their<br />

peers and other industries. The accepted<br />

standard for measuring the profitability of a<br />

company or an industry is its Return on<br />

Equity (ROE), defined as the ratio of net<br />

income to the equity (i.e., capital) invested<br />

in the business. According to financial theory,<br />

unless ROE is competitive with other<br />

uses for capital, capital will be withdrawn<br />

from an industry and be reinvested in<br />

industries with better rates of return. In<br />

general, the riskier a business, the greater<br />

its rate of return needs to be. Financial theory<br />

refers to the required rate of return of<br />

a business as its cost of capital. In effect, a<br />

company needs to achieve an ROE equal<br />

to its cost of capital in order to remain<br />

viable over the long term.<br />

Cost Effectiveness<br />

Another issue raised during public discussions<br />

has been the A&O payments<br />

made to the companies. A&O has often<br />

been described as extra profit that companies<br />

make in addition to their underwriting<br />

gains. The reality is that A&O is used to<br />

compensate insurers for their cost of delivery.<br />

A&O is paid on behalf of farmers<br />

rather than included as part of the premium<br />

in order to reduce farmers’ out-ofpocket<br />

cost for risk protection.<br />

One question critics raise with regard<br />

to A&O is whether the government is<br />

overpaying for private sector delivery of<br />

the program. This question can be<br />

addressed by comparing the cost of delivery<br />

of the Federal crop insurance program<br />

to other P&C lines of insurance.<br />

That comparison has been published in a<br />

report prepared by Grant Thornton LLP 1 .<br />

The report demonstrates that the crop<br />

insurance industry is vastly more cost<br />

effective than other sectors of the insurance<br />

industry. Total delivery expense in<br />

2010 for the crop insurance industry was<br />

roughly 25 percent of expected indemnities.<br />

For the P&C industry in total, the<br />

comparable cost was in excess of 65 percent.<br />

Over the most recent five year period,<br />

loss adjustment expense for the crop<br />

12 AUGUST <strong>2012</strong>

insurance industry averaged just 2.5 percent<br />

of expected indemnities versus 14.6<br />

percent for Homeowners and Private<br />

Passenger Auto Physical Damage insurance.<br />

Agent compensation was 16.3 percent<br />

in comparison to 18.1 percent for<br />

the P&C industry in total. Company overhead<br />

expense for the crop insurance<br />

industry was only 4.9 percent versus 22.6<br />

percent for the P&C industry as a whole.<br />

Clearly, the industry has very little fat left<br />

to trim.<br />

<strong>Crop</strong> insurers also raise a question with<br />

regard to A&O payments, but their question<br />

is whether the amount of A&O they<br />

receive is adequate to cover their delivery<br />

cost. A&O has been cut drastically over<br />

time, from 35 percent of premium in the<br />

early years of the program, to an estimated<br />

11 percent in 2011. Prior reductions had<br />

been feasible due to the rapid growth of<br />

the program, which enabled companies to<br />

spread their costs over a larger base. It<br />

needs to be recognized, however, that the<br />

current A&O reimbursement is a fraction of<br />

the amount that other insurers receive for<br />

delivering the Federal Flood insurance program,<br />

a program in which insurers share<br />

none of the risk, and a fraction of the premium<br />

expense loading in other sectors of<br />

the P&C industry. Out of this reduced<br />

A&O allotment, critics of the industry argue<br />

that companies should be able to pay loss<br />

adjusters to investigate and settle claims on<br />

one out of every four policies, cover company<br />

overhead costs such as employee<br />

salaries, benefits, rent, and utilities, and<br />

compensate agents for delivery of the program<br />

to farmers. This is simply not feasible.<br />

The reality is that A&O does not now<br />

and has not been adequate to cover program<br />

delivery cost for the past 15 years.<br />

Companies have been compelled to dig<br />

into their own pockets instead to pay the<br />

portion of expenses not covered by A&O.<br />

Measuring the <strong>Crop</strong><br />

<strong>Insurance</strong> Industry Rate<br />

of Return<br />

Because companies within the crop<br />

insurance industry differ with respect to<br />

their scale of operation, regional spread of<br />

business, and organizational structure,<br />

there is no single rate of return that can be<br />

Another issue raised<br />

during public discussions<br />

has been the A&O<br />

payments made to the<br />

companies. A&O has<br />

often been described as<br />

extra profit that companies<br />

make in addition to their<br />

underwriting gains.<br />

ascribed to every company in the industry.<br />

The following analysis instead attempts to<br />

estimate the average rate of return expected<br />

for the industry as a whole. Results<br />

have been developed based on an estimate<br />

of <strong>2012</strong> premium. These results do<br />

not reflect actual experience for 2011 or<br />

what may happen in <strong>2012</strong> due to effect of<br />

the drought. Instead, they represent what<br />

would have been expected for <strong>2012</strong> at the<br />

start of the year, before effects of the<br />

drought became apparent.<br />

• As noted above, the level of underwriting<br />

gains negotiated under the 2011<br />

SRA were estimated to be 14.5 percent<br />

of retained premium. However, underwriting<br />

gains are now expected to be 2<br />

points less than this due to the effect of<br />

the <strong>2012</strong> rate reductions.<br />

• A&O has been estimated based on the<br />

provisions of the 2011 SRA.<br />

• Estimated loss adjustment and industry<br />

overhead expenses for <strong>2012</strong> are the<br />

average of 2009 and 2010 actual<br />

expenses from the most recent Grant<br />

Thornton report adjusted for annual<br />

inflation of 2 percent;<br />

• Commissions are based on provisions<br />

in the 2011 SRA that provide up to 85<br />

percent of A&O for commissions and<br />

processing fees. Total agent compensation<br />

is limited to 100 percent of A&O<br />

plus an additional 5 percent for processing.<br />

• The delay in receiving A&O and underwriting<br />

gains imposes a financial cost<br />

on the industry of 0.5 percent of<br />

retained premium;<br />

• Equity retained in support of the program<br />

has been developed under the<br />

assumption that industry capital fully<br />

satisfies the requirements of the Code<br />

of Federal Regulations. This eliminates<br />

the need for commercial reinsurance<br />

and allows the cost of reinsurance to<br />

be excluded from the analysis.<br />

• Investment income is earned through<br />

the investment of the insurer’s equity<br />

in the bond markets. Equity is<br />

assumed to be invested in short-term<br />

instruments at 3.25% to ensure that the<br />

money will be available when needed.<br />

No investment income is earned on<br />

premium cash flows since premiums<br />

are collected close to the time when<br />

indemnities are paid.<br />

The attached exhibit estimates the<br />

crop insurance industry expected rate of<br />

return. Once all of the relevant factors<br />

have been taken into account, the industrywide<br />

expected return on equity of 5.8<br />

percent is well below the estimates<br />

quoted in the press. It is also significantly<br />

less than the industry’s cost of<br />

capital as reported in the 2009 Milliman<br />

study commissioned by RMA 2 . The<br />

industry’s rate of return is roughly half<br />

of the level needed to retain capital in<br />

the program. While critics might argue<br />

that an adequate rate of return could be<br />

achieved if industry were to reduce its<br />

expenses even further, this is not the<br />

case. Even if A&O covered all program<br />

delivery costs, industry ROE would be<br />

just 8.3 percent, still well below the<br />

industry’s cost of capital.<br />

Additional Observations<br />

on the Rate of Return<br />

The one certainty in the crop insurance<br />

industry is that change is continual.<br />

Ongoing program changes may bring<br />

about further changes. How these may<br />

affect the industry is yet to be determined.<br />

Additional points to keep in mind with<br />

regard to the results shown here are that<br />

returns earned by the industry are not<br />

guaranteed. Companies are exposed to<br />

considerable risk that may cause their<br />

results to vary widely from year to year<br />

and from region to region. The high<br />

degree of risk has not been adequately<br />

considered in any analysis provided by the<br />

government. Furthermore, an adequate<br />

CROP INSURANCE TODAY ® 13

ate of return at the national level may not<br />

ensure an adequate return for individual<br />

states. Certain states, particularly in the<br />

Southern Plains, have extremely low or<br />

even negative expected rates of return,<br />

which has serious implications for the<br />

long-term viability of the private delivery<br />

system in those regions.<br />

As the <strong>2012</strong> Farm Bill<br />

debate continues, it is<br />

hoped that everyone<br />

recognizes that the crop<br />

insurance system is working<br />

exactly as Congress<br />

intended by reducing<br />

taxpayer risk and speeding<br />

relief to growers when<br />

they need it the most.<br />

Summary<br />

As the <strong>2012</strong> Farm Bill debate continues,<br />

it is hoped that everyone recognizes that the<br />

crop insurance system is working exactly as<br />

Congress intended by reducing taxpayer risk<br />

and speeding relief to growers when they<br />

need it the most. This is why farmers and<br />

their bankers are strong proponents of the<br />

existing crop insurance structure and have<br />

asked that it not be weakened further. The<br />

crop insurance companies are doing more<br />

with less and fear that the misinformation<br />

reported in the press may undermine the<br />

successful public-private partnership that has<br />

taken more than three decades to build.<br />

The crop insurance industry welcomes<br />

the opportunity for an open and honest dialogue<br />

regarding the profitability of the program.<br />

We believe that an impartial analysis<br />

of the industry’s profitability will demonstrate<br />

that the industry is earning a rate of<br />

return less than industries of similar risk, and<br />

well below the industry’s cost of capital.<br />

1 h t t p : / / w w w. a g - r i s k . o rg / N C I S P U B S /<br />

SpecRPTS/GrantThornton/Grant_Thornton_R<br />

eport-2011.pdf<br />

2 Table 1 from Historical Rate of Return Analysis,<br />

prepared by Milliman, Inc., <strong>August</strong> 18, 2009<br />

14 AUGUST <strong>2012</strong><br />

Risk Management Education &<br />

Outreach Partnerships Program<br />

Farmer and Rancher Testimonials<br />

“The first exercise was one of the best I<br />

had, because it helped me realize I really<br />

didn’t know what I had for assets. The lesson<br />

for that week was to go home and look<br />

at everything and do an inventory and see<br />

what assets you have. What I learned really<br />

surprised me. This was a really great class<br />

to do. I learned about risk management,<br />

and about asset and liability management.<br />

I would tell everybody-if you are into<br />

farming, you need to take this class.”<br />

–Keith January, Sr., Fayette<br />

Jefferson County, Mississippi<br />

“This workshop has been most helpful<br />

to me because I have learned the different<br />

aspects of risk management on a farm.<br />

There are great aspects of record keeping,<br />

and financial record keeping is one of the<br />

most important things in taking care of the<br />

business on the farm.”<br />

–Sandra Bennett<br />

Madison County, Mississippi<br />

“I enjoyed participating in the workshops.<br />

I learned a lot about business planning as<br />

well as risk and goal setting and asset<br />

management; basically what is being looked<br />

at by bankers and other people these days<br />

in agriculture. I’m glad I participated in the<br />

program and thankful that Alcorn State<br />

University invited me to participate and it<br />

should be very beneficial to me.”<br />

–Louis Sanders, Mound Bayou<br />

Bolivar County, Mississippi<br />

See the complete, Developing Risk Management Plans article<br />

starting on page 4.<br />

Personalized Risk Management Strategies

TODAYcrop insurance<br />

2011<br />

Research Review<br />

By Dr. Mark Zarnstorff, NCIS<br />

Each year NCIS sponsors research<br />

projects on a variety of crops. The purpose<br />

of the research varies, but it could<br />

be to study new crops or changes in crop<br />

varieties/practices, to verify accuracy of<br />

loss charts and procedures, or develop<br />

improved loss instructions. All research<br />

projects are conducted for a period of at<br />

least three years. If, for some reason,<br />

results are not obtained for one or more<br />

years, the research project can be extended.<br />

University experiment stations and<br />

agricultural colleges conduct the research,<br />

often at more than one location across the<br />

United States. The results of the 2011<br />

research program are summarized below.<br />

It is important that these results are not<br />

used exclusively, but combined with the<br />

results from previous years’ research and<br />

any subsequent research.<br />

Canola–Saskatchewan<br />

This research was done to reexamine<br />

the influence of defoliation during the<br />

early stages of hybrid canola growth and<br />

development. The original research was<br />

done in the early 1980s on open pollinated<br />

varieties that have very different<br />

Soybeans V2 stage.<br />

growth rates and plant vigor compared<br />

with the hybrid varieties grown currently.<br />

This trial was done at two locations just<br />

out of Saskatoon, Saskatchewan during<br />

the 2011 growing season. The treatments<br />

were based on different leaf stages of<br />

2, 4, 6, 8, and 10 full leaves with defoliation<br />

levels of 0, 50, and 100 percent.<br />

The response to the defoliation treatments<br />

are below:<br />

Loss<br />

Defoliation 50% 100%<br />

2 Leaf 0% 5%<br />

4 Leaf 12% 24%<br />

6 Leaf 6% 28%<br />

8 Leaf 4 28%<br />

10 Leaf 3 28%<br />

Corn–Kansas<br />

This is the last year of the corn research<br />

project that is focused on the effect of stand<br />

reduction and the accuracy of the use of the<br />

one-for-one factor in stand reductions<br />

occurring after the 11-leaf stage. The treatments<br />

are stand reductions of 0, 25, 50, and<br />

75 percent being applied at the 7, 10, 13,<br />

and 17-leaf stages. The experiment was<br />

done under irrigation at an elevation of 2800<br />

ft at Garden City, Kansas. The response to<br />

the stand reduction treatments are below:<br />

Loss<br />

Leaf Stage 7 leaf 10 leaf 13 leaf 17 leaf<br />

25% Stand Loss 19% 9% 6% 23%<br />

50% Stand Loss 3% 23% 17% 28%<br />

75% Stand Loss 46% 53% 52% 68%<br />

16 AUGUST <strong>2012</strong>

Collecting wheat samples in Washington.<br />

Corn–Illinois, Minnesota,<br />

Ohio<br />

This research is being conducted to<br />

determine the accuracy of the maturity<br />

line appraisal method for corn. Previous<br />

research suggested that the current maturity<br />

line appraisal method may be underestimating<br />

the final yields when done at<br />

the early milk lines. The research was<br />

done in three states to try and determine<br />

the actual corn fill rates and if the current<br />

factors are adequate or if different factors<br />

may be more appropriate. The research<br />

shows that the current appraisal method<br />

underestimates yield by approximately<br />

44 percent at the 1/4 kernel stage to<br />

about 28 percent at the doughy<br />

stage. The appraisal method estimated<br />

yield within five percent of the actual<br />

yield when the appraisal was done in the<br />

extended kernel stage.<br />

Cotton–Arizona<br />

This study was initiated to determine<br />

the effects of plant cut-offs in cotton, that<br />

is specific to the growing conditions of<br />

Arizona. This research looks at the cutoffs<br />

during vegetative and reproductive<br />

stages of growth. The treatments were<br />

cutoffs at node 2, 4, 8, 12, 16, and 24 with<br />

the cutoff occurring at the top node, and<br />

then at 2 nodes and 4 nodes below the<br />

top node. An example would be at node<br />

16, the cut-offs would occur at C16, C14,<br />

and C12.<br />

The growth stage at which the plant<br />

cut-offs were removed had a significant<br />

effect on cotton yield. The loss percentages<br />

were consistently lower than what<br />

the current charts would suggest.<br />

Node Cut 2 4 8 12 16 24<br />

Terminal 9% 6% 2% 9% 9% 3%<br />

Cut 2 Nodes 11% 5% 7% 9% 4%<br />

Cut 4 Nodes 12% 8% 9% -1%<br />

Cotton–South Carolina<br />

This study was initiated to determine<br />

the effects of plant cut-offs in cotton that is<br />

specific to the growing conditions of South<br />

Carolina. This research was conducted<br />

under dryland and irrigated conditions.<br />

This study looks at the cut-offs during vegetative<br />

and reproductive stages of growth.<br />

The treatments were cutoffs at node 2, 4, 8,<br />

12, 16, and 24 with the cutoff occurring at<br />

the top node, and then at 2 nodes and 4<br />

nodes below the top node. An example<br />

CROP INSURANCE TODAY ® 17

and first open boll (approximately 16 fruiting<br />

branches) and was done under subsurface<br />

drip irrigation. Losses are outlined<br />

below:<br />

Defoliation was another aspect of this<br />

trial. Defoliation at levels of 0, 50, and 100<br />

percent were done at the same stages as<br />

the limb removals. Results are as follow:<br />

Loss<br />

Defoliation 50% 100%<br />

R8 11% 35%<br />

R12 20% 65%<br />

R16 13% 20%<br />

Counting tillers.<br />

would be at node 16, the cut-offs would<br />

occur at C16, C14, and C12.<br />

The growth stage at which the plant<br />

cut-offs were removed had a significant<br />

effect on cotton yield. The loss percentages<br />

were consistently lower than what the current<br />

charts would suggest. The later stages<br />

of development actually saw increased<br />

yields under irrigation from the removal of<br />

the upper most nodes.<br />

Irrigated Loss<br />

Node Cut 2 4 8 12 16 24<br />

Terminal 10% -5% -7% -13% -21% -14%<br />

Cut 2 Nodes 6% -10% 13% -28% -27%<br />

Cut 4 Nodes 14% 20% -3% -26%<br />

Dryland Loss<br />

Node Cut 2 4 8 12 16 24<br />

Terminal 4% 12% 10% 10% 3% -5%<br />

Cut 2 Nodes 12% 7% 10% 2% -6%<br />

Cut 4 Nodes 18% 19% 34% -9%<br />

Cotton–Texas<br />

This trial was initiated to look at the differences<br />

in the impact of limb removal and<br />

defoliation on the production of “stripper”<br />

and “picker” cotton in the High Plains of<br />

Texas. The development of newer varieties,<br />

with a combination of genetic characteristics<br />

between the traditional “stripper”<br />

and “picker” types, has resulted in some<br />

questions in how these newer varieties will<br />

respond to defoliation and vegetative limb<br />

removal. This study looks at removal of the<br />

reproductive limbs at levels of 0, 25, 50, 75,<br />

and 100 percent at first flower (approximately<br />

eight fruiting branches); one-inch<br />

boll (approximately 12 fruiting branches);<br />

Loss<br />

Limb Removal 35% 50% 75% 100%<br />

R8 3% 1% -2% 1%<br />

R12 -2% -1% 10% 29%<br />

R16 16% 32% 44% 94%<br />

Cotton–Texas<br />

This study was initiated to determine the<br />

effects of plant cut-offs in cotton that is specific<br />

to the growing conditions of Texas.<br />

The trial was conducted under dryland and<br />

irrigated conditions and looks at the cut-offs<br />

during vegetative and reproductive stages<br />

of growth. The treatments were cutoffs at<br />

node 2, 4, 8, 12, 16, and 24 with the cutoff<br />

occurring at the top node, and then at 2<br />

nodes and 4 nodes below the top node. An<br />

example would be at node 16, the cut-offs<br />

would occur at C16, C14, and C12.<br />

The weather conditions were extremely<br />

difficult for growing cotton, especially under<br />

the dryland conditions due to extreme<br />

drought. The response to the various treatments<br />

varied greatly and will be examined<br />

to determine their fit before any changes are<br />

incorporated into the loss procedures.<br />

Irrigated Loss<br />

Node Cut 2 4 8 12 16 24<br />

Terminal 6% 23% 5% 22% -13% -8%<br />

Cut 2 Nodes 18% 10% 17% 13% 3%<br />

Cut 4 Nodes 21% 9% 6% 15%<br />

Dryland Loss<br />

Node Cut 2 4 8 12 16 24<br />

Terminal 2% -4% 8% -5% 11% 8%<br />

Cut 2 Nodes 29% 8% 26% -11% -17%<br />

Cut 4 Nodes 19% -37% -16% 8%<br />

Dry Beans–Nebraska<br />

This is the third year of a three-year<br />

study of the influence of defoliation on two<br />

new plant architecture classifications of dry<br />

beans. Historically, dry beans have been<br />

18 AUGUST <strong>2012</strong>

classified as either bush (Type I), vining<br />

(Type III) or as pole (Type IV). Plant<br />

breeders have started developing new varieties<br />

that are not true bush types (not<br />

determinant like a true bush) but are more<br />

upright in architecture than the true vining<br />

types that were very prostrate. These new<br />

varieties are classified as Type IIa (Upright<br />

short vines–USV) and Type IIb (Upright<br />

vines–UV).<br />

This trial looked at two varieties, one a<br />

UV (Matterhorn) and one a Type III (Beryl)<br />

with plant defoliation at three different stages<br />

of growth, V4, R1, and R3 and imposed four<br />

different levels of defoliation: 0, 33, 66, and<br />

100 percent. There was no difference in the<br />

response of the two varieties at the different<br />

stages of growth and levels of defoliation<br />

over the three years of the trials.<br />

Dry Field Peas–<br />

Saskatchewan, Canada<br />

2011 was the third year for this trial<br />

looking at node removal or cut-offs in<br />

field peas. The current varieties used for<br />

dry pea production are almost exclusively<br />

semi-leafless varieties that have little to no<br />

leaf area but rather an enlarged stipule at<br />

the base of each node or branch. This<br />

leaves no “defoliation” as a means of<br />

determining losses, so we are left with cutoffs<br />

or node removal as the way to determine<br />

the losses due to hail damage.<br />

Treatments consisted of the plant having<br />

0, 25, 50, 75, or 100 percent of the above<br />

ground nodes removed at the four, eight,<br />

12, 16 node stages and at the second<br />

flower bloom (approximately 20 nodes).<br />

The 2011 growing season was different<br />

than 2009 or 2010 because it was more<br />

“normal”—drier than 2010 but warmer<br />

than 2009. The three years of the study<br />

had data from the range of weather that is<br />

often experienced in Saskatchewan so<br />

should provide a good average for what<br />

can be expected.<br />

Loss<br />

Nodes Removed 25% 50% 75% 100%<br />

Losses at Stage V4 –% 5% –% 11%<br />

Losses at Stage V8 17% 28% 31% 45%<br />

Losses at Stage V12 35% 55% 74% 85%<br />

Losses at Stage V16/R1 45% 62% 73% 87%<br />

Losses at Stage R2 49% 74% 89% 95%<br />

Rice.<br />

Dry Field Peas–<br />

Washington<br />

The state of Washington is a traditional<br />

growing area for dry field peas. The<br />

climate is much different than<br />

Saskatchewan or North Dakota in that the<br />

summer is much warmer and drier than<br />

those found in the upper Great Plains.<br />

Field peas may not have as much potential<br />

for recovery if cut-off by hail as the<br />

plant develops because of this. A trial<br />

was initiated in 2010 to study the affect of<br />

hail on cut-offs of dry field peas. The current<br />

varieties used for dry pea production<br />

are almost exclusively semi-leafless varieties<br />

which have little to no leaf area but<br />

rather an enlarged stipule at the base of<br />

each node or branch. This leaves no<br />

“defoliation” as a means of determining<br />

losses, so we are left with cut-offs or<br />

node removal as the way to determine<br />

the losses to hail damage. Treatments<br />

consisted of the plant having 0, 25, 50,<br />

75, or 100 percent of the above ground<br />

nodes removed at the 4, 8, 12 node<br />

stages and at the second flower bloom<br />

(approximately 14 nodes in 2011 due to<br />

dry weather). Removal of nodes at the 4-<br />

node stage had little effect on the production<br />

of the peas. Losses for the 8-node<br />

treatment were not very severe until it<br />

reached 100 percent of the nodes<br />

removed. The losses increased as the age<br />

of the plant advanced especially with<br />

damage of 75 or 100 percent of the nodes<br />

removed.<br />

Loss<br />

Nodes Removed 25% 50% 75% 100%<br />

Losses at Stage V4 –% 31% –% 53%<br />

Losses at Stage V8 47% 45% 84% 63%<br />

Losses at Stage V12 70% 48% 100% 100%<br />

Losses at Stage R2 69% 90% 100% 100%<br />

Rice–Arkansas<br />

This study was developed to compare<br />

some of the new hybrid rice varieties to a<br />

conventional rice variety with respect for<br />

the tendency to shatter. Various observations<br />

have been made over the past two<br />

years that the new hybrid rice varieties<br />

have a greater yield potential than the<br />

conventional varieties, but that under<br />

field conditions they may also have a<br />

greater tendency to shatter the seed<br />

before harvest. This experiment looked at<br />

the conventional variety “Wells” and<br />

compared these to the hybrid varieties<br />

“Arize 1003”, “CLXL729,”“CLXL745,” and<br />

“XL723.” These varieties were planted<br />

within the rice variety tests that were<br />

planted at seven different locations with<br />

the rice growing of Arkansas. Just prior to<br />

harvest, ten representative heads of each<br />

variety tested were clipped and placed in<br />

CROP INSURANCE TODAY 19

a bag. The ten heads were then “slapped”<br />

against the collector’s leg for ten times<br />

resulting in seeds that either remained<br />

attached to the panicle or were loose.<br />

These seeds were then weighed and<br />

counted to determine the percent of shatter<br />

for each variety. The ease of shatter<br />

was greater in 2011 than 2010 for all varieties,<br />

including the conventional “Wells.”<br />

Percent of Shatter<br />

Variety 2011 Two Year Average<br />

Arize 1003 52% 52%<br />

CLXL729 75% 62%<br />

CLXL745 60% 50%<br />

XL723 76% 66%<br />

Wells 51% 37%<br />

Soybeans–Missouri<br />

A trial that began in 2009 continued to<br />

look at the removal of nodes at various<br />

times during the vegetative and reproductive<br />

stages. The stages that were studied<br />

were the V3, R1, and R3 stages with<br />

node removal rates of 25, 50, 75, and 100<br />

percent. The differences in response to<br />

the level of node removal at the different<br />

stages are similar to those shown in previous<br />

studies in Indiana and Iowa.<br />

Loss<br />

Nodes Removed 25% 50% 75% 100%<br />

Stage V4 3% 4% 13% 78%<br />

Stage R1 4% 7% 33% 100%<br />

Stage R3 5% 33% 47% 100%<br />

Wheat–Washington<br />

This trial was done to research the<br />

different factors that can influence the<br />

yield of soft white winter wheat in the<br />

Pacific Northwest. This research looked<br />

at four different seeding rates for two<br />

different varieties in two different climatic<br />

areas of wheat production in<br />

Washington State. The seeding rates<br />

were 50, 75, 100, and 125 percent of<br />

“normal” for the different growing areas.<br />

Some of the factors that were measured<br />

were number of plants established in the<br />

spring, the number of heads per plant,<br />

the kernels per head, the 1000 kernel<br />

weights, and yields. The planting areas<br />

were considered to be a ‘high rainfall”<br />

around Pullman and a medium rainfall<br />

area around Davenport.<br />

The number of plants per foot of row<br />

increased only at the highest seeding<br />

rate at Davenport and there was no difference<br />

between seeding rates at<br />

Pullman except for the lowest rate. The<br />

number of heads per plant was highest<br />

for the lower seeding rates for “Madsen”<br />

at Davenport and at Pullman. There was<br />

no difference for “Eltan” at either location.<br />

The numbers of kernels per head<br />

were not significantly different for<br />

“Eltan” at either location, while the<br />

lower seeding rates had greater seed<br />

numbers for “Madsen” at both locations.<br />

Yield at Davenport for “Eltan” was<br />

greater for the 75,100, and 125 percent<br />

seeding rates compared to the 50 percent<br />

seeding rate while there was no<br />

difference between the higher three<br />

seeding rates. There was no difference<br />

in Yield for “Madsen” between the 100<br />

and 125 percent seeding rates which<br />

were both greater than the lower<br />

seeding rates.<br />

Errors and Omission <strong>Insurance</strong><br />

For Your Agency<br />

Full lines of coverage including MPCI <strong>Crop</strong> <strong>Insurance</strong><br />

We will work diligently to offer you quotes with<br />

reputable companies at competitive prices<br />

To obtain a quote for your agency call 1-800-769-6015<br />

American <strong>Insurance</strong> <strong>Services</strong>, LLC.<br />

Premium financing is available<br />

We have over 35 years experience in all lines of insurance<br />

www.tomstanleyinsurance.com<br />

20 AUGUST <strong>2012</strong>

a bag. The ten heads were then “slapped”<br />

against the collector’s leg for ten times<br />

resulting in seeds that either remained<br />

attached to the panicle or were loose.<br />

These seeds were then weighed and<br />

counted to determine the percent of shatter<br />

for each variety. The ease of shatter<br />

was greater in 2011 than 2010 for all varieties,<br />

including the conventional “Wells.”<br />

Percent of Shatter<br />

Variety 2011 Two Year Average<br />

Arize 1003 52% 52%<br />

CLXL729 75% 62%<br />

CLXL745 60% 50%<br />

XL723 76% 66%<br />

Wells 51% 37%<br />

Soybeans–Missouri<br />

A trial that began in 2009 continued to<br />

look at the removal of nodes at various<br />

times during the vegetative and reproductive<br />

stages. The stages that were studied<br />

were the V3, R1, and R3 stages with<br />

node removal rates of 25, 50, 75, and 100<br />