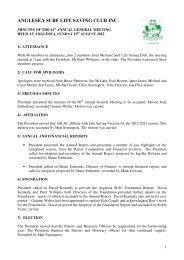

62nd Annual Report 2012/2013 - Anglesea Surf Life Saving Club

62nd Annual Report 2012/2013 - Anglesea Surf Life Saving Club

62nd Annual Report 2012/2013 - Anglesea Surf Life Saving Club

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANGLESEA SURF LIFESAVING CLUB FOUNDATION<br />

A.B.N. 14 944 812 708<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 APRIL <strong>2013</strong><br />

1 Statement of Significant Accounting Policies<br />

The trustees of the trust have prepared the financial statements of the trust on the basis that the<br />

trust is a non-reporting entity because there are no users dependent on general purpose financial<br />

statements. The financial statements are therefore special purpose financial statements that have<br />

been prepared in order to meet the needs of beneficiaries.<br />

The financial statements have been prepared in accordance with the significant accounting policies<br />

disclosed below, which the trustees have determined are appropriate to meet the needs of<br />

members. Such accounting policies are consistent with the previous period unless stated otherwise.<br />

The financial statements have been prepared on an accruals basis and are based on historical<br />

costs unless stated otherwise in the notes. The accounting policies that have been adopted in the<br />

preparation of these statements are as follows:<br />

Trade and Other Receivables<br />

Trade receivables are recognised initially at the transaction price (i.e. cost) and are subsequently<br />

measured at cost less provision for impairment. Receivables expected to be collected within 12<br />

months of the end of the reporting period are classified as current assets. All other receivables are<br />

classified as non-current assets.<br />

At the end of each reporting period, the carrying amount of trade and other receivables are<br />

reviewed to determine whether there is any objective evidence that the amounts are not<br />

recoverable. If so, an impairment loss is recognised immediately in income statement.<br />

Cash and Cash Equivalents<br />

Cash and cash equivalents include cash on hand, deposits held at call with banks, other short-term<br />

highly liquid investments with original maturities of three months or less, and bank overdrafts. Bank<br />

overdrafts are shown within short-term borrowings in current liabilities on the balance sheet.<br />

Revenue and Other Income<br />

Revenue is measured at the fair value of the consideration received or receivable after taking into<br />

account any trade discounts and volume rebates allowed. For this purpose, deferred consideration<br />

is not discounted to present values when recognising revenue.<br />

Interest revenue is recognised using the effective interest rate method, which for floating rate<br />

financial assets is the rate inherent in the instrument.<br />

Dividend revenue is recognised when the right to receive a dividend has been established.<br />

These notes should be read in conjunction with the attached compilation<br />

report of West Carr & Harvey.<br />

<strong>Anglesea</strong> SLSC <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>/13 41