BUSINESS Loan Application Checklist - BECU

BUSINESS Loan Application Checklist - BECU BUSINESS Loan Application Checklist - BECU

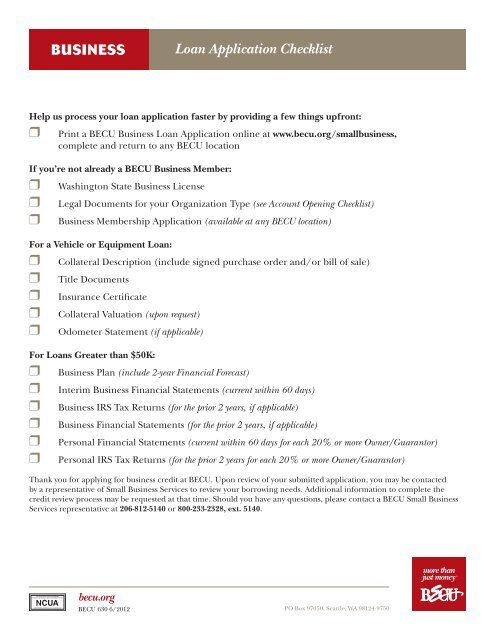

BUSINESS Loan Application Checklist Help us process your loan application faster by providing a few things upfront: r Print a BECU Business Loan Application online at www.becu.org/smallbusiness, complete and return to any BECU location If you’re not already a BECU Business Member: r r r Washington State Business License Legal Documents for your Organization Type (see Account Opening Checklist) Business Membership Application (available at any BECU location) For a Vehicle or Equipment Loan: r r r r r Collateral Description (include signed purchase order and/or bill of sale) Title Documents Insurance Certificate Collateral Valuation (upon request) Odometer Statement (if applicable) For Loans Greater than $50K: r r r r r r Business Plan (include 2-year Financial Forecast) Interim Business Financial Statements (current within 60 days) Business IRS Tax Returns (for the prior 2 years, if applicable) Business Financial Statements (for the prior 2 years, if applicable) Personal Financial Statements (current within 60 days for each 20% or more Owner/Guarantor) Personal IRS Tax Returns (for the prior 2 years for each 20% or more Owner/Guarantor) Thank you for applying for business credit at BECU. Upon review of your submitted application, you may be contacted by a representative of Small Business Services to review your borrowing needs. Additional information to complete the credit review process may be requested at that time. Should you have any questions, please contact a BECU Small Business Services representative at 206-812-5140 or 800-233-2328, ext. 5140. becu.org BECU 630 6/2012

- Page 2 and 3: Business Loan Application 1. PRODUC

- Page 4 and 5: Information for Government Monitori

- Page 6: B. LIFE INSURANCE (List only those

<strong>BUSINESS</strong><br />

<strong>Loan</strong> <strong>Application</strong> <strong>Checklist</strong><br />

Help us process your loan application faster by providing a few things upfront:<br />

r<br />

Print a <strong>BECU</strong> Business <strong>Loan</strong> <strong>Application</strong> online at www.becu.org/smallbusiness,<br />

complete and return to any <strong>BECU</strong> location<br />

If you’re not already a <strong>BECU</strong> Business Member:<br />

r<br />

r<br />

r<br />

Washington State Business License<br />

Legal Documents for your Organization Type (see Account Opening <strong>Checklist</strong>)<br />

Business Membership <strong>Application</strong> (available at any <strong>BECU</strong> location)<br />

For a Vehicle or Equipment <strong>Loan</strong>:<br />

r<br />

r<br />

r<br />

r<br />

r<br />

Collateral Description (include signed purchase order and/or bill of sale)<br />

Title Documents<br />

Insurance Certificate<br />

Collateral Valuation (upon request)<br />

Odometer Statement (if applicable)<br />

For <strong>Loan</strong>s Greater than $50K:<br />

r<br />

r<br />

r<br />

r<br />

r<br />

r<br />

Business Plan (include 2-year Financial Forecast)<br />

Interim Business Financial Statements (current within 60 days)<br />

Business IRS Tax Returns (for the prior 2 years, if applicable)<br />

Business Financial Statements (for the prior 2 years, if applicable)<br />

Personal Financial Statements (current within 60 days for each 20% or more Owner/Guarantor)<br />

Personal IRS Tax Returns (for the prior 2 years for each 20% or more Owner/Guarantor)<br />

Thank you for applying for business credit at <strong>BECU</strong>. Upon review of your submitted application, you may be contacted<br />

by a representative of Small Business Services to review your borrowing needs. Additional information to complete the<br />

credit review process may be requested at that time. Should you have any questions, please contact a <strong>BECU</strong> Small Business<br />

Services representative at 206-812-5140 or 800-233-2328, ext. 5140.<br />

becu.org<br />

<strong>BECU</strong> 630 6/2012

Business <strong>Loan</strong> <strong>Application</strong><br />

1. PRODUCT<br />

Welcome to Boeing Employees’ Credit Union (<strong>BECU</strong>). Please complete application in ink, sign it and bring it to a <strong>BECU</strong> location to apply.<br />

If you have any questions, please contact a <strong>BECU</strong> representative at 206-812-5140 or, outside Seattle at 1-800-233-2328 ext 5140.<br />

TYPE OF REQUEST<br />

Line of Credit Term <strong>Loan</strong> Commercial Real Estate<br />

AMOUNT<br />

COLLATERAL<br />

PURPOSE:<br />

2. <strong>BUSINESS</strong> INFORMATION<br />

STATE UNIFORM <strong>BUSINESS</strong> IDENTIFIER (UBI) NUMBER<br />

FEDERAL TAX IDENTIFICATION NUMBER (EIN OR SSN)<br />

<strong>BUSINESS</strong> NAME (AND DBA, IF APPLICABLE)<br />

YEARS IN <strong>BUSINESS</strong><br />

<strong>BUSINESS</strong> STRUCTURE<br />

Sole Proprietorship Partnership Corporation LLC<br />

<strong>BUSINESS</strong> TYPE / INDUSTRY<br />

DESCRIBE YOUR <strong>BUSINESS</strong>:<br />

ANNUAL SALES<br />

$<br />

ANNUAL NET INCOME<br />

$<br />

<strong>BUSINESS</strong> LOCATION / STREET ADDRESS (REQUIRED) CITY STATE ZIP<br />

MAILING ADDRESS IF DIFFERENT FROM ABOVE CITY STATE ZIP<br />

<strong>BUSINESS</strong> PHONE<br />

<strong>BUSINESS</strong> FAX<br />

EMAIL ADDRESS<br />

By providing your e-mail address, you agree that <strong>BECU</strong> may send marketing<br />

information regarding products and services to you electronically.<br />

3. <strong>BUSINESS</strong> OWNER / GUARANTOR - Please list all owners with ownership of 20% or greater<br />

OWNER/GUARANTOR #1 NAME<br />

OWNER/GUARANTOR #2 NAME<br />

SOCIAL SECURITY NUMBER<br />

SOCIAL SECURITY NUMBER<br />

TITLE OWNERSHIP % TITLE OWNERSHIP %<br />

PERSONAL ADDRESS (REQUIRED)<br />

PERSONAL ADDRESS (REQUIRED)<br />

CITY STATE ZIP CITY STATE ZIP<br />

OWNER/GUARANTOR #3 NAME<br />

OWNER/GUARANTOR #4 NAME<br />

TITLE OWNERSHIP % TITLE OWNERSHIP %<br />

PERSONAL ADDRESS (REQUIRED)<br />

PERSONAL ADDRESS (REQUIRED)<br />

CITY STATE ZIP CITY STATE ZIP<br />

<strong>BECU</strong> 612 2/2012

Financial Summary<br />

Financial Statement Submitted with this Summary<br />

Current Financial Statement on File with Creditor<br />

Assets Amount Liabilities Amount<br />

Cash and Equivalents $ Current Liabilities (A/P, LOC, Accruals) $<br />

Account/Trade Receivables $ Long Term Liabilities (Equipment, Vehicles, RE) $<br />

Inventory $ Notes Payable to Owners $<br />

Fixed Assets $ Total Liabilities $<br />

Other (Intangibles) $ Net Worth (total assets minus total liabilities) $<br />

Total Assets $ Total Liabilities and Net Worth $<br />

Business Income Summary<br />

Current Year Fiscal Year End: Fiscal Year End: Fiscal Year End:<br />

Number of Months<br />

Sales $ $ $ $<br />

Net Income $ $ $ $<br />

Depreciation/Amortization $ $ $ $<br />

Interest Expense $ $ $ $<br />

Describe how this loan will benefit your business:<br />

4. LOAN REQUESTS MORE THAN $50,000<br />

For loan requests of $50,000 or more, please provide us the following items with this completed application:<br />

Business Plan (include 2 year Financial Forecast)<br />

Interim Business Financial Statements (current within 60 days)<br />

Business IRS Tax Returns (for the prior 2 years, if applicable)<br />

Business Financial Statements (for the prior 2 years, if applicable)<br />

Personal Financial Statements (current within 60 days for each 20% or more Owner/Guarantor)<br />

Personal IRS Tax Returns (for the prior 2 years for each 20% or more Owner/Guarantor)<br />

Some applications may require further consideration and additional information may be requested.<br />

AGREEMENTS and SIGNATURES<br />

By signing below, each of you certifies that the information contained herein is complete and accurate. You further authorize <strong>BECU</strong> to obtain a consumer<br />

credit report and a business credit report for use in assessing your personal creditworthiness in connection with this application by the Business and you<br />

agree that, as long as the credit account is open, we may obtain credit reports about you from time to time. You certify that the execution, delivery and<br />

performance of this <strong>Application</strong> has been authorized by all necessary corporate action by the Business. You agree that credit accounts will be used primarily<br />

for business purposes, and not personal, family, or household purposes.<br />

NAME/TITLE SIGNATURE DATE<br />

NAME/TITLE SIGNATURE DATE<br />

NAME/TITLE SIGNATURE DATE<br />

NAME/TITLE SIGNATURE DATE<br />

LOCATION REPRESENTATIVE EMPLOYEE #<br />

If your application for credit is denied, you have the right to a written statement of the specific reasons for the denial. To obtain this statement, please<br />

contact Small Business Services, P.O. Box 97050 Seattle, WA 98124 or 206-812-5140 within 60 days from the date you are notified for our decision.<br />

We will send you a written statement of reasons for the denial within 30 days of your request for this statement.<br />

<strong>BECU</strong> 612 2/2012

Information for Government Monitoring Purposes<br />

Please complete this section if you are a sole proprietorship applying for a loan secured by a dwelling (house, condominium, co-op, or multi-family<br />

such as duplex, triplex fourplex, apartment building, etc.) and the purpose is to purchase or improve a dwelling or refinance the purchase or<br />

improvement.<br />

The following information is requested by the federal government agencies for certain types of loans related to a dwelling in order to monitor <strong>BECU</strong>’s<br />

compliance with the equal credit opportunity, fair housing and home mortgage disclosure laws. You are not required to furnish this information, but are<br />

encouraged to do so. You may select one or more designations for “Race.” The law provides that <strong>BECU</strong> may not discriminate in the basis of this information,<br />

or on whether you choose to furnish it. However, if you choose not to furnish the information and you have made this application in person, under federal<br />

regulations <strong>BECU</strong> is required to note ethnicity, race and sex on the basis of visual observation or surname. If you do not wish to furnish the information,<br />

please check below.<br />

APPLICANT<br />

I do not wish to furnish this information<br />

ETHNICITY: RACE OR NATIONAL ORIGIN: SEX<br />

Hispanic or Latino American Indian or Alaska Native Native Hawaiian or Other Pacific Islander Male<br />

Not Hispanic or Latino Asian White Female<br />

Black or African American<br />

CO-APPLICANT<br />

I do not wish to furnish this information<br />

ETHNICITY: RACE OR NATIONAL ORIGIN: SEX<br />

Hispanic or Latino American Indian or Alaska Native Native Hawaiian or Other Pacific Islander Male<br />

Not Hispanic or Latino Asian White Female<br />

Black or African American<br />

FOR CREDIT UNION USE ONLY<br />

This information in the above section was obtained on the basis of visual observance or surname<br />

This application was received by mail, telephone, or internet.<br />

CHANNEL CODE REP. INITIALS APP ID<br />

<strong>BECU</strong> 4080 7/2012

Business Personal Financial Statement<br />

1. <strong>BUSINESS</strong> INFORMATION and OWNERSHIP<br />

<strong>BUSINESS</strong> NAME AS INDICATED ON THE <strong>BUSINESS</strong> LOAN APPLICATION<br />

INDIVIDUAL INFORMATION<br />

JOINT INFORMATION<br />

NAME SOCIAL SECURITY NUMBER NAME SOCIAL SECURITY NUMBER<br />

ADDRESS<br />

ADDRESS<br />

CITY STATE ZIP CITY STATE ZIP<br />

PHONE EMAIL ADDRESS PHONE EMAIL ADDRESS<br />

ASSETS Note: Complete SCHEDULES first LIABILITIES<br />

Cash on Hand and in Banks Sched. A jĈched. A Sched. A<br />

Cash Value of Life Insurance Sched. B Notes Due to Relatives and Friends Sched. H<br />

Marketable Securities Sched. C Credit Cards Payable Sched. H<br />

<strong>Loan</strong>s on Life Insurance Policies<br />

Contract Accounts Payable<br />

Other Liabilities Due within 1 Year - Itemize<br />

Sched. H<br />

Sched. H<br />

TOTAL LIQUID ASSETS $ Taxes Due Sched. H<br />

Business Value Margin <strong>Loan</strong>s Sched. H<br />

Notes and Accounts Receivable - current<br />

Notes and Accounts Receivable – over 90 days<br />

Sched. D<br />

Sched. D<br />

Notes Due from Relatives and Friends Sched. D TOTAL SHORT TERM LIABILITIES $<br />

Real Estate Owned Sched. E Real Estate Mortgages Payable Sched. E<br />

Mortgages and Contracts Owned<br />

Personal Property<br />

Sched. F<br />

Sched. G<br />

IRA and Tax Deferred Accounts TOTAL LONG TERM LIABILITIES $<br />

Other Assets – Itemize (see attached itemization) Total Liabilities<br />

TOTAL ASSETS<br />

TOTAL LONG TERM ASSETS $ Net Worth (Total Assets Minus Total Liabilities)<br />

ANNUAL INCOME<br />

TOTAL LIABILITIES AND NET WORTH<br />

ESTIMATE OF ANNUAL EXPENSES<br />

Salary Bonuses and Commissions $ Income Taxes $<br />

Dividends and Interest $ Other Taxes $<br />

Rental and Lease Income (Net) $ Insurance Premiums $<br />

Alimony, child support, or separate maintenance income need not be revealed if you Mortgage Payments $<br />

do not wish to have it considered as a basis for repaying this obligation.<br />

Other Income – Itemize $<br />

Rent Payable $<br />

Provide the following information only if Joint Account: Other Expenses $<br />

Other Persons Salary, Bonuses, and Commissions $<br />

Alimony, child support, or separate maintenance income need not be revealed if you<br />

do not wish to have it considered as a basis for repaying this obligation.<br />

Other Income – Itemize $<br />

TOTAL $ TOTAL $<br />

GENERAL INFORMATION<br />

CONTINGENT LIABILITIES<br />

Are any assets pledged other than described on SCHEDULES Yes No As endorser, Co-maker or guarantor Yes No<br />

Are you a defendant in any suits or legal actions? Yes No On leases or contracts Yes No<br />

Date of most recent Income Tax return filed Year: Legal Claims Yes No<br />

Have you ever been declared bankrupt in the last 10 years? Yes No Federal – State Income Taxes Yes No<br />

Are you partner or officer in any other venture Yes No Other Yes No<br />

SCHEDULES<br />

A. CASH IN BANKS AND NOTES DUE TO BANKS (List all Real Estate <strong>Loan</strong>s in Schedule E) Addition Information Requested<br />

Name of Bank Type of Account Type of Ownership On Deposit Notes Due Banks Collateral (if any) and Type of Ownership<br />

See Attached Itemization<br />

Cash on Hand<br />

TOTALS $ $<br />

<strong>BECU</strong> 616 7/2012

B. LIFE INSURANCE (List only those Policies that you own)<br />

Cash Surrender<br />

Company<br />

Face of Policy<br />

Value<br />

Policy <strong>Loan</strong> from<br />

Insurance Co.<br />

Other <strong>Loan</strong>s Policy as<br />

Collateral<br />

Beneficiary<br />

See Attached Itemization TOTALS $ $<br />

C. SECURITIES OWNED (Including U.S. Government Bonds and all other Stocks and Bonds)<br />

Face Value-Bonds<br />

# of Shares/Stocks<br />

Description<br />

(indicate those not registered in your name)<br />

Type of<br />

Ownership<br />

Cost<br />

Market Value<br />

U.S. Gov. Sec.<br />

Market Value<br />

Marketable Sec.<br />

Market Value<br />

Not Readily<br />

Marketable<br />

Amount Pledged<br />

To Secured <strong>Loan</strong><br />

See Attached Itemization TOTALS $ $ $<br />

D. NOTES AND ACCOUNTS RECEIVABLE (Money Payable or Owed to You Individually-Indicate % of your Ownership Interest)<br />

Maker/Debtor % When Due Original Amount<br />

Balance Due<br />

Current Accounts<br />

Balance Due<br />

Over 90 Days<br />

Balance Due Notes<br />

Relatives and Friends<br />

Security<br />

(if any)<br />

See Attached Itemization TOTALS $ $ $<br />

E. REAL ESTATE OWNED (Indicate % of your Ownership Interest)<br />

Title in Name Of %<br />

Description<br />

and Location<br />

Date<br />

Acquired<br />

Original Cost<br />

Present Value<br />

of Real Estate<br />

Mortgage or Contract Payable<br />

Balance Due Payment Rent Income Net Cash Flow Maturity<br />

See Attached Itemization TOTAL $ TOTAL $<br />

F. MORTGAGES AND CONTRACTS OWNED (Indicate % of your Ownership Interest)<br />

Maker<br />

Cont. Mtg. %<br />

Property Covered Starting Date Payment Maturity Balance Due<br />

Name<br />

Address<br />

See Attached Itemization TOTAL $<br />

G. PERSONAL PROPERTY (Indicate % of your Ownership Interest)<br />

Description % Date When New Cost When New Value Today<br />

<strong>Loan</strong>s on Property<br />

Balance Due<br />

To Whom Payable<br />

See Attached Itemization TOTAL $<br />

H. NOTES, ACCOUNTS, BILLS AND CONTRACTS PAYABLE<br />

Other Obligors<br />

Notes Due to<br />

Payable to<br />

When Due<br />

(if any)<br />

Relatives and Friends<br />

Notes Due “Others”<br />

Not Banks<br />

Accounts and Bills<br />

Contracts Payable<br />

Collateral Payable<br />

(if any)<br />

See Attached Itemization TOTAL $ $ $ $<br />

This information and the information provided on all accompanying financial statements and schedules are provided for the purpose of obtaining credit.<br />

You acknowledge that representations made in this Statement will be relied on by <strong>BECU</strong> in its decision to grant such credit. This Statement is true and<br />

correct in every detail and accurately represents your financial condition on the date given below. <strong>BECU</strong> is authorized to make all inquiries necessary to<br />

verify the accuracy of the information contained herein and to determine the creditworthiness of the undersigned. You will promptly notify <strong>BECU</strong> of any<br />

subsequent changes, which would affect the accuracy of this Statement. <strong>BECU</strong> is further authorized to answer any questions about Creditors<br />

experience with you. You are aware that any knowing or willful false statements regarding the value of the above property for purposes of influencing<br />

the actions of Creditors can be a violation of federal law 18 U.S. C. section 1014 and may result in fine, imprisonment or both. You also, authorize<br />

<strong>BECU</strong> to investigate your personal credit history as part of the above referenced Business <strong>Loan</strong> <strong>Application</strong>.<br />

By signing below, you declare that you have read and understand the above statement.<br />

SIGNATURE<br />

DATE<br />

If you are guaranteeing this credit jointly, both guarantors must initial the<br />

box below.<br />

SIGNATURE DATE We intend to jointly guarantee<br />

this credit<br />

GUARANTOR INITIALS GUARANTOR INITIALS<br />

<strong>BECU</strong> 616 7/2012