Contact Magazine 01.2011 - British Polish Chamber of Commerce

Contact Magazine 01.2011 - British Polish Chamber of Commerce

Contact Magazine 01.2011 - British Polish Chamber of Commerce

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

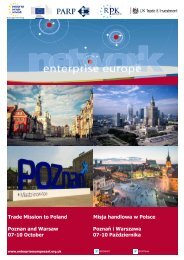

International Business Voice<br />

ISSN 1425-1779<br />

NO. 1 • 2011 | (96)<br />

the magazine <strong>of</strong> the <strong>British</strong><br />

<strong>Polish</strong> <strong>Chamber</strong> <strong>of</strong> <strong>Commerce</strong><br />

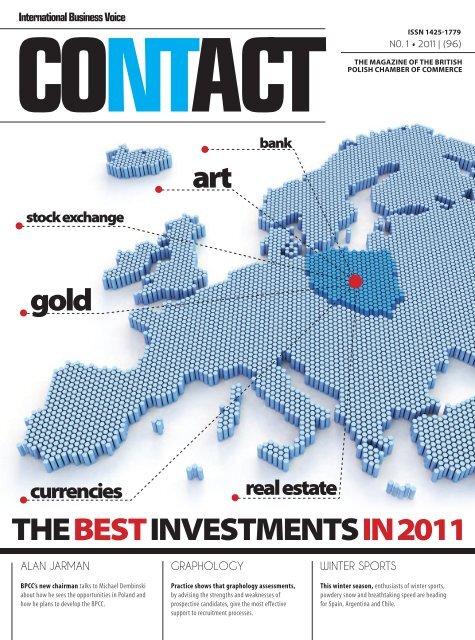

art<br />

bank<br />

stock exchange<br />

gold<br />

currencies<br />

real estate<br />

the best investments in 2011<br />

alan jarman<br />

BPCC’s new chairman talks to Michael Dembinski<br />

about how he sees the opportunities in Poland and<br />

how he plans to develop the BPCC.<br />

graphology<br />

Practice shows that graphology assessments,<br />

by advising the strengths and weaknesses <strong>of</strong><br />

prospective candidates, give the most effective<br />

support to recruitment processes.<br />

winter sports<br />

This winter season, enthusiasts <strong>of</strong> winter sports,<br />

powdery snow and breathtaking speed are heading<br />

for Spain, Argentina and Chile.

AGENCJA<br />

MIENIA WOJSKOWEGO<br />

ATTRACTIVE FORMER MILITARY<br />

REAL ESTATE THROUGHOUT<br />

THE COUNTRY<br />

• building plots • leisure centers • warehouses<br />

Hel, Przybyszewskiego St.<br />

Kraków, Rakowicka St.<br />

Location: Hel, north Poland<br />

Voivodeship: pomorskie<br />

Area: 5.8232 ha<br />

Real estate category: residential development<br />

Location: Kraków, south Poland, 10 min. to the Old Town<br />

Voivodeship: małopolskie<br />

Area: 0.9580 ha<br />

Real estate category: services, residential development<br />

Poznań, Bukowska St.<br />

Nowy Dwór Mazowiecki, Modlin Fortress<br />

Location: Poznań, west Poland, near airport Ławica<br />

Voivodeship: wielkopolskie<br />

Area: 10.5898 ha<br />

Real estate category: trade, service<br />

Location: Near Warsaw, central Poland, near<br />

aiport Modlin<br />

Voivodeship: mazowieckie. Area: 55.0233 ha<br />

Real estate category: recreational property<br />

www.amw.com.pl

Editorial 3<br />

International Business Voice<br />

Honorary President (PL)<br />

Ric Todd<br />

H.M. Ambassador<br />

Honorary President (UK)<br />

Barbara Krystyna<br />

Tuge-Erecińska<br />

it’s a good time<br />

to invest<br />

DOROTA<br />

GOLISZEWSKA<br />

BPCC HEAD OFFICE IN UK<br />

<strong>British</strong> <strong>Polish</strong> <strong>Chamber</strong> <strong>of</strong> <strong>Commerce</strong><br />

43-45 Portman Square<br />

London W1H 6HN<br />

Tel: +44 (0) 207 969 2789<br />

Fax:+44 (0) 207 969 2800<br />

BPCC IN POLAND<br />

ul. Fabryczna 16/22, 00-446 Warszawa<br />

Tel: +48 22 320 01 00<br />

Fax: +48 22 621 19 37<br />

www.bpcc.org.pl<br />

e-mail: name.surname@bpcc.org.pl<br />

Martin Oxley, chief executive <strong>of</strong>ficer<br />

Paweł Siwecki, operations director<br />

Michael Dembiński, head <strong>of</strong> policy<br />

Ewa Świętochowska, membership manager<br />

Dorota Kierbiedź-Jaskólska,<br />

portal and e-commerce manager<br />

Tessa Sujka-McIver, events manager<br />

Sławka Kroszczyńska, administration manager<br />

Marta Mikliszańska, project manager Policy Groups<br />

Izabela Niewińska, events executive<br />

Maria Kowalewska, membership executive<br />

Krzyszt<strong>of</strong> Litwiniec, membership executive<br />

Kuba Piegat, media assistant<br />

Gabriela Jatkowska, policy group assistant<br />

Regional Offices in Poland & the UK:<br />

UK: Michael Clay, vice chairman michael.clay@bpcc.org.pl<br />

Katowice: Witold Turant, regional director, katowice@bpcc.org.pl<br />

Kraków: Agnieszka Libura, regional director, krakow@bpcc.org.pl<br />

Łódź: Piotr Grabowicz, honorary chairman, lodz@bpcc.org.pl<br />

Wrocław/Poznń: Ilona Chodorowska, regional director, wroclaw@bpcc.org.pl<br />

employer: <strong>British</strong> <strong>Polish</strong> <strong>Chamber</strong> <strong>of</strong> <strong>Commerce</strong><br />

publisher: Concept Publishing Polska sp. z o.o.,<br />

al. J.Ch. Szucha 8, 00-580 Warszawa<br />

tel.: +48 22 627 26 60, faks: +48 22 627 26 71,<br />

biuro@cppolska.com.pl, www.cppolska.com.pl;<br />

Account Manager: Sebastian Lizakowski<br />

editorial <strong>of</strong>fice:<br />

Editor in Chief: Dorota Goliszewska; editor@bpcc.org.pl<br />

Editorial Director: Marzena Mróz;<br />

Pro<strong>of</strong>-reading: Małgorzata Mierżyńska;<br />

Layout design: Łukasz Szczepanowski; DTP: Piotr Żak;<br />

Photoeditor: Joanna Potępska; Advertising Director:<br />

Małgorzata Solarczyk; Advertising: Anna Kurowska,<br />

Katarzyna Kościuszko; Printing House: Regis Print<br />

The best investments in 2011. This is the<br />

headline <strong>of</strong> our extensive, special report<br />

published in the Hot Topic section. Contrary<br />

to your expectations, the report will not give<br />

you any suggestions, hints and tips or recommendations<br />

about how to invest your money<br />

to generate the highest possible return. The<br />

financial crisis that began two years ago with<br />

the collapse <strong>of</strong> the Lehman Brothers bank<br />

effectively calmed down investors, analysts<br />

and journalists, showing that nothing is what<br />

it seems to be and that all kinds <strong>of</strong> forecasts<br />

should be approached with great caution.<br />

And, most importantly, that they should be<br />

considered as only one <strong>of</strong> the possibilities.<br />

And also that you should always be guided by<br />

common sense, intuition and skepticism.<br />

You need to save money. It’s a cliche, but<br />

we’ve recently been reminded <strong>of</strong> it by, even if<br />

only, the government plans to make changes<br />

to the retirement pension system. It’s more<br />

than certain that without your personal<br />

prudence and foresight, without investment<br />

decisions made as soon as today, your life on<br />

BPCC PATRONS:<br />

retirement may not be one <strong>of</strong> affluence. But<br />

it’s not only about such distant things as your<br />

retirement. Let’s save money then! <strong>Contact</strong>’s<br />

special report describes a range <strong>of</strong> possibilities<br />

to make your money work for you: from<br />

secure term deposits, to today’s sure things<br />

such as real estate or gold, to investing in<br />

currencies and securities (which requires a<br />

knowledge <strong>of</strong> the rules <strong>of</strong> the game and <strong>of</strong><br />

the market), to investments in works <strong>of</strong> art.<br />

It’s good to remember that the return <strong>of</strong><br />

optimism among investors after the lean years<br />

has resulted in investment funds rebuilding<br />

their assets, and that structured products are<br />

still very popular – it’s true that they <strong>of</strong>fer<br />

moderate returns, but they <strong>of</strong>fer capital protection.<br />

Your choice will depend on whether<br />

you prefer secure investments or are ready to<br />

accept a higher-than-standard risk.<br />

The macroeconomic forecasts for Poland<br />

for the next few years are optimistic. Our<br />

economy is expected to grow at the pace <strong>of</strong><br />

almost 4 percent or even higher. It’s a good<br />

time to invest.

4<br />

contents <br />

People<br />

6<br />

Events<br />

8<br />

Companies<br />

10<br />

Alan Jarman,<br />

BPCC’s new chairman: View <strong>of</strong> the<br />

<strong>Polish</strong> market.<br />

BPCC members’ careers: promotions,<br />

new responsibilities.<br />

An overview <strong>of</strong> events<br />

organised by BPCC, including BPCC<br />

Head Strat 2011, Grand Business<br />

Networking, International Christmas<br />

Evening in Wrocław and The<br />

Renewable Energy Conference<br />

Market analyses<br />

and special reports<br />

by BPCC members. HSBC’s report<br />

“The World in 2050” and the PwC’s<br />

Annual Global CEO Survey<br />

Hot topic<br />

12 - 31<br />

The best investments in 2011<br />

<strong>Contact</strong>’s special report describes a range <strong>of</strong> possibilities to make<br />

your money work for you: from secure term deposits, to today’s<br />

sure things such as real estate or gold, to investing in currencies<br />

and securities (which requires a knowledge <strong>of</strong> the rules <strong>of</strong> the<br />

game and <strong>of</strong> the market), to investments in works <strong>of</strong> art.<br />

new tools<br />

32<br />

news from...<br />

34<br />

After hours<br />

40<br />

Graphology<br />

as the most effective support to<br />

recruitment processes<br />

the <strong>British</strong> Embassy<br />

The <strong>Polish</strong> Embassy<br />

Too big to fail<br />

Winter sports<br />

This Winter season the enthusiasts<br />

<strong>of</strong> Winter sports are heading for<br />

Spain, Argentina and Chile.<br />

Fot: Shutterstock.com, Getty Iamges/FPM

WYG International<br />

creative minds safe hands<br />

Engineering<br />

Environment<br />

International Development<br />

Management Services<br />

Planning & Design<br />

WYG in Poland<br />

tel: +48 22 492 71 00<br />

fax +48 22 492 71 13<br />

ul. Marynarska 15<br />

02-674 Warszawa<br />

www.wyginternational.pl<br />

Transport Planning<br />

www.wyginternational.pl<br />

creative minds safe hands

6<br />

people <br />

L<br />

ooking at Poland, one has<br />

to be aware <strong>of</strong> the size,<br />

attractiveness and opportiunities<br />

<strong>of</strong> the market<br />

in the near and long term.<br />

With GDP growth double that<br />

<strong>of</strong> the EU average, and the size<br />

<strong>of</strong> total GDP making Poland<br />

the world’s 21st largest economy<br />

(which, for example, is double the<br />

size <strong>of</strong> Hong Kong), it is a market<br />

that can’t be ignored.<br />

“Trade flows are also impressive<br />

when viewed on the world stage,<br />

ranked as the 26th largest economy<br />

for inbound and outbound trade,<br />

and with Poland also being ranked<br />

by AT Kearney as the 6th most<br />

favourable destination for foreign<br />

direct investment, it is easy to see<br />

why Poland should be billed as the<br />

EU’s leading emerging economy.<br />

“The economy is also more open<br />

today than ever before, with nearly<br />

10% <strong>of</strong> imports arriving from<br />

China, coupled with 25% <strong>of</strong> its<br />

imports and exports crossing the<br />

border into Germany.<br />

“So the economic picture is both<br />

strong and very encouraging.<br />

Added to this is the stability <strong>of</strong> the<br />

macro picture, which is sometimes<br />

lacking in developing economies.<br />

With a stable political and legal system, strong<br />

pr<strong>of</strong>essional services and the benefits <strong>of</strong> being<br />

under the EU’s umbrella, the overall picture is<br />

very compelling,” says Mr Jarman.<br />

In terms <strong>of</strong> <strong>British</strong> business, it is the mediumsized<br />

firms that need to take a closer look at<br />

Poland. “Multinationals are here in abundance,”<br />

he says, – “but there exist plenty <strong>of</strong> opportunities<br />

for mid-cap companies in the <strong>Polish</strong> market.<br />

Sectors such as renewable energy stand out. The<br />

good news is that the business agenda’s <strong>of</strong> the<br />

<strong>Polish</strong> and UK government are aligned. In the<br />

UK, it is the private sector that will stimulate<br />

economic growth. In Poland, the privatisation<br />

agenda will <strong>of</strong>fer new business opportunities.”<br />

But it’s not a market for quick pr<strong>of</strong>its. “<strong>British</strong><br />

businesses should look at Poland from a<br />

longer-term aspect – they should seek to gain<br />

an understanding <strong>of</strong> a market that’s not as<br />

familiar from the point <strong>of</strong> view <strong>of</strong> culture as,<br />

say Commonwealth countries; however, my<br />

alan jarman,<br />

bpcc’s new chairman<br />

view <strong>of</strong><br />

the polish<br />

market<br />

The BPCC’s new chairman,<br />

as <strong>of</strong> January the 1 st 2011, is<br />

Alan Jarman, CEO, HSBC BANK<br />

Polska S.A. He talks to Michael<br />

Dembinski about how he sees the<br />

opportunities in Poland unfolding,<br />

HSBC’s view <strong>of</strong> the <strong>Polish</strong> market,<br />

and how he plans to develop the<br />

BPCC in his role as chairman<br />

overriding message is the size <strong>of</strong> the prize –<br />

worthy <strong>of</strong> investment in time and energy to<br />

understand and then enter the market,” says<br />

Mr Jarman.<br />

HSBC has been in Poland for nearly 20 years.<br />

Today, its goal is to become the leading international<br />

bank for corporates and the leading<br />

bank in the premium segment for individuals.<br />

“We are excited about Poland’s<br />

size, demographics and connectivity<br />

to other markets which makes<br />

Poland one <strong>of</strong> HSBC’s top European<br />

strategic markets . We will be<br />

looking to deliver market-leading<br />

propositions for our customers,<br />

learning from our experience in<br />

other markets, and delivering<br />

seemless cross border banking,”<br />

he says.<br />

Looking at how Mr Jarman will<br />

make the <strong>Chamber</strong> more effective,<br />

he says that there is “plenty to shout<br />

about in terms <strong>of</strong> business opportunities<br />

that Poland can bring to<br />

UK business”. He stresses the need<br />

for cooperation at government and<br />

industry levels – working together<br />

with the UK chambers network,<br />

the Federation <strong>of</strong> Small Businesses,<br />

Institute <strong>of</strong> Directors and CBI to<br />

raise awareness <strong>of</strong> Poland among<br />

their members.<br />

“Another valuable partner is the<br />

UKTI”, he says; “The appointment<br />

<strong>of</strong> Stephen Green, the former chairman<br />

<strong>of</strong> HSBC, as the new minister<br />

for trade and investment, shows seriousness<br />

<strong>of</strong> intent and global outlook<br />

<strong>of</strong> the UK. UKTI can’t and indeed<br />

shouldn’t do its job on its own – it<br />

must work in partnership with the<br />

private sector – here in Poland the BPCC and<br />

its members work very closely with the <strong>British</strong><br />

Embassy and the UKTI team there.”<br />

Where will Mr Jarman place priority on in<br />

terms <strong>of</strong> the development <strong>of</strong> the <strong>Chamber</strong>?<br />

“This is a time to renew the aims <strong>of</strong> the chamber,<br />

engage with the members and stakeholders<br />

to deliver them, and therefore ensure we<br />

continue to progress. We’ve been listening to<br />

what our members want and need, and intend<br />

to improve our delivery against this.<br />

“We’ll be extending the scope <strong>of</strong> the policy<br />

groups; improving the <strong>Chamber</strong>’s regional presence<br />

across Poland and the UK; communicating<br />

more effectively with members and stakeholders<br />

both online and in print; and finally ensuring<br />

our events calendar delivers real value. Finally,<br />

making sure that this is our <strong>Chamber</strong>, with<br />

everyone feeling engaged in its agenda and<br />

progress, and something we can all be rightly<br />

proud <strong>of</strong>,” he says.

people 7<br />

piotr<br />

rusinek<br />

On January the 3rd 2011 Piotr<br />

Rusinek has joined EC Harris as<br />

Deputy Leader in our Lenders<br />

and Investors department.<br />

EC harris<br />

new Deputy leader<br />

Douglas<br />

changes in the managament board<br />

Agnieszka<br />

Mosurek-Zava<br />

Douglas, the biggest perfumery chain in<br />

Poland and owner <strong>of</strong> the first authorized<br />

e-shop, announces changes in its management<br />

board. Agnieszka Mosurek-Zava, member <strong>of</strong><br />

sławomir sołkiewicz<br />

In the end <strong>of</strong> January 2011 Sławomir<br />

Sołkiewicz, hitherto Director <strong>of</strong> the<br />

Leading Factory <strong>of</strong> Imperial Tobacco<br />

Polska, was promoted to the post <strong>of</strong><br />

Operations Director Central Europe<br />

& USA.<br />

Piotr is a Chartered Quantity Surveyor<br />

and has a BSC (Hons) in Quantity Surveying.<br />

He started his business career as<br />

a quantity surveyor in the UK and since<br />

moving to Poland fourteen years ago he<br />

has been one <strong>of</strong> the leading pr<strong>of</strong>essionals<br />

in his field. Before joining EC Harris<br />

Piotr held the position <strong>of</strong> Project Director<br />

being responsible for the management<br />

and development <strong>of</strong> cost management and<br />

transactional services.<br />

the Management Board, was nominated GM<br />

Douglas Poland and Regional Director Poland,<br />

Czech Republic, Latvia and Lithuania.<br />

Agnieszka Mosurek-Zava has been working<br />

for Douglas since 2001, the start <strong>of</strong> Douglas<br />

operations in Poland. She was in charge <strong>of</strong> the<br />

key business areas - new perfumeries, business<br />

development, sales, marketing and purchase.<br />

Under her supervision Douglas has built<br />

its leader position on the <strong>Polish</strong> perfumery<br />

market. This was further confirmed by the<br />

opening <strong>of</strong> Douglas House <strong>of</strong> Beauty, the<br />

biggest perfumery in Poland (1200 sqm) in<br />

Waraw’s Arkadia.<br />

imperial tobacco polska<br />

New Operations Director<br />

Central Europe & USA<br />

Sławomir Sołkiewicz began his work at<br />

Imperial Tobacco (previously Reemtsma) in<br />

1994 as an intern in the tobacco purchasing<br />

department. He was subsequently responsible<br />

for managing the following areas: tobacco<br />

purchasing, product development and quality<br />

management. Promoted to the post <strong>of</strong> Production<br />

Director at Imperial Tobacco Polska S.A.<br />

he was responsible for numerous projects,<br />

including the implementation <strong>of</strong> an integrated<br />

management system consistent with ISO 9001,<br />

ISO14001, HACCP.<br />

DTZ<br />

new marketing<br />

director<br />

robert borowicz<br />

At the beginning <strong>of</strong> the year, Robert<br />

Borowicz was appointed as new Marketing<br />

and PR Manager <strong>of</strong> DTZ in Poland.<br />

Robert replaced Maksymilian Pawłowski on<br />

this position who left the company after almost<br />

4 years. Robert is responsible for corporate<br />

communication, internal communication and<br />

marketing. Robert Borowicz graduated from<br />

the faculty <strong>of</strong> Journalism and Political Science at<br />

Warsaw University. His specialization is Public<br />

Relations and Media Marketing. He has also<br />

studied at George Brown College in Toronto.<br />

the best<br />

object manager 2010<br />

wojciech liszka<br />

Director <strong>of</strong> Sales and<br />

Marketing in the Radisson<br />

Blu Hotel Krakow<br />

has been appreciated<br />

by the readers <strong>of</strong> MICE<br />

Poland, as the best<br />

Object Manager 2010.<br />

The MICE Poland Personality <strong>of</strong> the Year is an<br />

award for people in the MICE industry granted<br />

by the industry representatives. People <strong>of</strong><br />

outstanding pr<strong>of</strong>essionalism and efficiency were<br />

appreciated for the third time in Poland. In the<br />

“Object Manager” category in which Wojciech<br />

Liszka was the winner, the jury has set store by<br />

paying particular attention to ethics in action,<br />

contribution to the meetings industry, CSR<br />

initiatives, innovation and creativity, and above<br />

all – quality <strong>of</strong> the managed object.

8<br />

events <br />

Krakow:<br />

BPCC Head<br />

Start 2011<br />

The Whisky<br />

tasting Tour<br />

<strong>of</strong> Scotland<br />

20th January 2011 saw one <strong>of</strong> the best events BPCC Krakow has staged in<br />

recent times – “BPCC Head Start 2011” a great evening <strong>of</strong> networking and<br />

business.<br />

The event attracted nearly 300 participants and<br />

was organized in the brand new Hilton Hotel<br />

in Krakow. 2011 will be a great year for <strong>British</strong><br />

<strong>Polish</strong> business. This was confirmed by Martin<br />

Oxley, CEO BPCC and the participating<br />

audience. A superb musical interlude from the<br />

<strong>British</strong> International School in Krakow was followed<br />

by a buffet and informal networking.<br />

The evening concluded with a marathon lottery<br />

wonderfully led by BPCC Board Director Joe<br />

Smoczynski and Agnieszka Libura, BPCC<br />

Director in Krakow. The evening took place<br />

thanks to our kind Corporate sponsors Porsche,<br />

Roncato, Hilton International and Mazars.<br />

If you are interested in expanding your business<br />

in Malopolska please do not hesitate to get in<br />

touch with either Martin Oxley, CEO BPCC<br />

or Agnieszka Libura, Director BPCC Krakow..<br />

You may find some pictures – in the link:<br />

http://www.mga.webd.pl/MGA/bm/<br />

On January the 13th more than 50<br />

senior managers and representatives<br />

<strong>of</strong> <strong>Polish</strong> and international<br />

companies took part in the Scottish<br />

Evening, a popular annual event<br />

organised in Łódź.<br />

Hosted by the Lodz Special Economic Zone<br />

and BPCC, the Scottish Evening took place<br />

amidst the beautiful architecture <strong>of</strong> the Scheibler<br />

Palace, part <strong>of</strong> which has been adapted for the<br />

Museum <strong>of</strong> Cinematography, with a interesting<br />

selection <strong>of</strong> movie art exhibits. The main attraction<br />

<strong>of</strong> the evening was a presentation <strong>of</strong> a spe-<br />

INTERNATIONAL<br />

CHRISTMAS<br />

EVENING<br />

IN WROCLAW<br />

As it has already become a tradition, The<br />

International Christmas Evening in Wroclaw<br />

was co-organised by 5 international chambers<br />

<strong>of</strong> commerce: the American <strong>Chamber</strong> <strong>of</strong> <strong>Commerce</strong><br />

in Poland, the <strong>British</strong>-<strong>Polish</strong> <strong>Chamber</strong> <strong>of</strong><br />

<strong>Commerce</strong>, the French <strong>Chamber</strong> <strong>of</strong> <strong>Commerce</strong><br />

and Industry in Poland, the <strong>Polish</strong>-German<br />

<strong>Chamber</strong> <strong>of</strong> Industry and <strong>Commerce</strong> and the<br />

Scandinavian-<strong>Polish</strong> <strong>Chamber</strong> <strong>of</strong> <strong>Commerce</strong>.<br />

The event took place on December 8th in<br />

Wroclaw’s Puppet Theatre. Dim candle lights <strong>of</strong><br />

glittering Christmas trees and the overwhelming<br />

fragrance <strong>of</strong> fresh spruces created a unique and<br />

unforgettable atmosphere. The first part <strong>of</strong> the<br />

artistic programme was devoted to international<br />

traditions. A choir <strong>of</strong> international children<br />

from the <strong>British</strong> International School <strong>of</strong> Cracow<br />

dressed in their national attires, sung carols<br />

from all over the world. This was followed by a<br />

performance <strong>of</strong> international Christmas carols<br />

by Wroclaw’s most famous gospel band – the<br />

Spirituals Singers Band. The rest <strong>of</strong> the evening<br />

continued alongside modern tones <strong>of</strong> various<br />

Christmas melodies from all over the world<br />

as well as delicious <strong>Polish</strong> Christmas cuisine.<br />

During the cocktail a fortune teller was available<br />

to reveal what the future held in store for those<br />

brave enough to ask. The highlight <strong>of</strong> the event<br />

was the Grand Prize Lottery Draw with its valuable<br />

prizes.<br />

Our special thanks go to Platinum sponsors: KPMG<br />

and ENEL-MED CENTRUM MEDYCZNE; to Golden<br />

sponsors: ING and VOLVO; to Silver Sponsors: EURO<br />

PARK LOGISTICS and SKALSKI; to Bronze sponsors:<br />

ALMA CONSULTING GROUP, QNH, KAUFLAND,<br />

DOTPAY and SÜDZUCKER; to Product sponsors: BISC<br />

WROCŁAW, FAGOR MASTERCOOK, MG NETWORK, PM<br />

GROUP, XPRESS, BUKIETY BARANOWSKA, CADBURY,<br />

COCA-COLA, LAMBERTZ, ADORIA and STARBUCKS<br />

COFFEE; to Lottery sponsors: FAGOR MASTERCOOK,<br />

XPRESS, TRINITY CORPORATE SERVICES, Q4NET,<br />

SCANDIC WROCŁAW, BISSOLE BUSINESS TRAVEL, ING,<br />

GRAFTON RECRUITMENT, BUKIETY BARANOWSKA,<br />

HERTZ, RABEN, HOTEL MONOPOL WROCŁAW, KELHAM<br />

GROUP, CPL JOBS, WROCŁAWSKI PARK WODNY, ENEL-<br />

MED CENTRUM MEDYCZNE, STEELCASE, SAMSUNG,<br />

SONY ERICSSON and last but not least the Main<br />

Media Partner - WARSAW BUSINESS JOURNAL.

events 9<br />

The renewable<br />

Energy<br />

Conference<br />

Marek Cieślak, Deputy Mayor <strong>of</strong> Łódź,<br />

Martin Oxley, CEO BPCC<br />

cially chosen selection <strong>of</strong> five Malt Whiskies, accompanied<br />

by haggis, the world-famous Scottish<br />

delicacy (akin to <strong>Polish</strong> kaszanka). The Whisky<br />

Tasting Tour <strong>of</strong> Scotland was expertly presented<br />

with passion and expressiveness by Martyn<br />

O’Reilly, president <strong>of</strong> the Caledonian Society<br />

<strong>of</strong> Warsaw. Guests also had the opportunity to<br />

exchange opinions and business cards during<br />

the subsequent business mixer, accompanied by<br />

the strains <strong>of</strong> bagpipers from the Czestochowa<br />

Bagpipes Band.<br />

The <strong>British</strong> <strong>Polish</strong> <strong>Chamber</strong> <strong>of</strong> <strong>Commerce</strong> in the<br />

UK organised ‘ The Renewable Energy Conference’<br />

at the Radisson Blue Hotel in Portman<br />

Square on the 26th January 2011 together with<br />

the Conservative Friends <strong>of</strong> Poland.<br />

Many attended the conference and the Minister<br />

<strong>of</strong> Energy and Climate Change - Mr. Charles<br />

Hendry was to speak at the event. Unfortunately,<br />

due to urgent Government business, he was unable<br />

to do so and Teresa Potocka <strong>of</strong> the Conservative<br />

Friends <strong>of</strong> Poland gave an overview <strong>of</strong> the<br />

state <strong>of</strong> gave an overview <strong>of</strong> the state <strong>of</strong> the UK<br />

renewable energy scene. The participants said<br />

afterwards that they were captivated by the quality<br />

<strong>of</strong> the speakers and enthralled with the latest<br />

developments in this field. Particular note was<br />

taken <strong>of</strong> the Vertical Wind Turbine presented by<br />

Michael Clay and a HUGE number <strong>of</strong> enquiries<br />

placed with the Bio Fuel Speakers John Dickinson<br />

and Peter O’Hara for the only truly GREEN<br />

Fuel in the world as confirmed by Offgem and<br />

currently being used by the Royal Family in the<br />

UK. There was an overview <strong>of</strong> the Renewable<br />

energy situation in Poland by Michael Clay<br />

BPCC Vice Chairman, and a presentation by<br />

Chris Dodson <strong>of</strong> Torftech on Bio Mass plants.<br />

Dr. Andrew Blatiak spoke about Photo Voltaic<br />

and Stephen Hubble made a speech about Waste<br />

to Energy and the first <strong>of</strong> their projects in Lower<br />

Silesia. The last presentation was done by Robert<br />

Windmill <strong>of</strong> the Law firm Windmill Gasieweski<br />

Roman which is based in Warsaw.<br />

Grand Business<br />

Networking<br />

The very first Grand Networking for<br />

Business was held on the 10th <strong>of</strong><br />

February at Nowa La Boheme Restaurant<br />

and opened a series <strong>of</strong> events<br />

for senior management.<br />

Business Breakfast<br />

social housing<br />

The provision <strong>of</strong> social housing<br />

was the subject <strong>of</strong> a special<br />

PPP-focused breakfast on 27th<br />

January in the InterContinetal<br />

Hotel in Warsaw.<br />

The deputy mayors <strong>of</strong> Katowice (Mr.<br />

Marcin Krupa) and Łódź (Mr. Paweł Paczkowski),<br />

and Warsaw’s head <strong>of</strong> housing<br />

(Mr. Marek Goluch and Mr. Włodzimierz<br />

Ejchorszt) were the special guests. The<br />

deputy mayors began by outlining the<br />

situations in their cities. In each case, social<br />

housing is required for those families who<br />

are evicted from properties belonging to<br />

the municipality (usually for not paying<br />

the rent). Social problems (long-term unemployment,<br />

alcohol or drug abuse) <strong>of</strong>ten<br />

accompany these families. The cities’ needs<br />

for such housing in each case amount to<br />

several hundred units. BPCC members<br />

A4E (Katarzyna Jaszczuk, Development<br />

Manager), Reed in Partnership (Robert<br />

Zamarlik, Recruitment Manager), Saritor<br />

(Marcin Osowski, Commercial Director)<br />

and Hogan Lovells (Sławomir Mikołajuk,<br />

Attorney) explained how they see the<br />

issue. A vigorous question and answer session<br />

followed.<br />

The venue, situated in the Opera, was an inspiration<br />

for our guests to wear carnival masks - all<br />

the guests who went the extra mile were awarded<br />

prizes sponsored by Douglas, Imola Gokarty<br />

& More, and Tagomago. The event was an opportunity<br />

to meet delegates from 2 <strong>British</strong> trade<br />

missions which were in Warsaw and representatives<br />

from Łódzka Agencja Rozwoju Regionalnego<br />

- our Partner for the evening.<br />

The restaurant filled in very quickly with Members<br />

swapping business cards and enjoying its<br />

ambient interiors over a glass <strong>of</strong> sparkling wine.<br />

The lottery prize draw was full <strong>of</strong> amazing prizes<br />

sponsored by AMS Grzebieluch, Le Meridien<br />

Bristol, InterContinetal Warsaw, Mamaison Le<br />

Regina, Marriott hotel, Bryza Resort &SPA, and<br />

Mercure Mrągowia. Congratulations to all lucky<br />

winners!

10<br />

companies <br />

forty years<br />

from now<br />

HSBC has published a fascinating report<br />

entitled The World in 2050 - Quantifying<br />

the shift in the global economy.<br />

It takes a look at the 19 emerging<br />

economies - including that <strong>of</strong> Poland<br />

- and charts their rapid rise against 11<br />

countries <strong>of</strong> today’s rich world.<br />

Looking at GDP per capita, Poland’s is expected<br />

to carry on cantering ahead at an annual growth<br />

rate <strong>of</strong> between 3.7% and 4.0%, slowing down<br />

fractionally in each successive decade. The UK’s<br />

growth will be much slower, but it is expected to<br />

accelerate while Poland’s slows (1.4% to 2.0%).<br />

The upshot <strong>of</strong> this is that by 2050, UK GDP<br />

per capita is expected to be $69,000 (up from<br />

$35,000 last year), while in Poland it should<br />

be $51,000 (up from $11,000). Eventhough<br />

Poland’s GDP per capita is currently three times<br />

lower than the UK’s, in 40 years time it will only<br />

be a quarter less.<br />

No overtaking <strong>of</strong> the UK, then; but solid performance<br />

is expected nevertheless from Poland’s<br />

economy. But could Poland do better? Factors<br />

that are seen by the HSBC researchers as crucial<br />

include demographics. The UK’s working<br />

population is expected to grow, albeit at a very<br />

slow rate (0.1% to 0.3% a year over the next 40<br />

years). However Poland’s working population<br />

is expected to shrink- and at an alarming rate -<br />

from 27 million to less than 19 million. (One<br />

growth<br />

Vivendi’s EUR 2 billion dispute over PTC<br />

December 15th , 2010 finally brought<br />

an end to the EUR 2 billion plus and the<br />

11 year long dispute over control <strong>of</strong> PTC<br />

(Era), a leading <strong>Polish</strong> telecom company,<br />

involving, among others, Vivendi,<br />

Deutsche Telekom, Elektrim and the<br />

<strong>Polish</strong> State Treasury. The signing <strong>of</strong> the<br />

settlement papers took place on January<br />

14th , 2011, just after Elektrim’s exit<br />

from bankruptcy<br />

reason behind Poland’s impressive catching-up<br />

with the UK in terms <strong>of</strong> GDP per capita is that<br />

there will be fewer Poles to share the wealth.)<br />

Poland’s policy-makers will need to devise an<br />

immigration strategy that will be able to fill the<br />

employers’ future need for a qualified workforce<br />

while at the same time squaring with the demands<br />

<strong>of</strong> Poland’s membership <strong>of</strong> the Schengen<br />

group <strong>of</strong> countries. A pro-family policy <strong>of</strong> tax<br />

incentives also seems to be required if, by 2050,<br />

large numbers <strong>of</strong> <strong>Polish</strong> pensioners can be paid<br />

for by a shrinking workforce.<br />

It is worrying to note that only Japan’s population<br />

is expected to shrink faster than Poland’s.<br />

Education is another factor. If Poles were to<br />

increase the number <strong>of</strong> years <strong>of</strong> schooling attended,<br />

the <strong>Polish</strong> economy could move faster<br />

up the value-added ladder, with more jobs in<br />

R&D, high-tech industries, life sciences and IT,<br />

and thus accelerate GDP growth.<br />

Salans, as Vivendi’s counsel, conducted and<br />

hosted the negotiations and the signing. The<br />

team was led by Tomasz Dąbrowski, Warsaw<br />

Managing Partner, with sterling support<br />

provided by Anna Maria Pukszto, partner<br />

and head <strong>of</strong> Warsaw Insolvency, and over 15<br />

lawyers from the Corporate, RRI and Tax<br />

teams. The final stage <strong>of</strong> the negotiations<br />

involved over 20 law firms in 5 jurisdictions,<br />

including Orrick, Hengeler Mueller,<br />

Bingham McCutchen, Clifford Chance,<br />

Slaughter and May, and major <strong>Polish</strong> law<br />

confidENCE<br />

Two years removed from the depths<br />

<strong>of</strong> recession, CEOs’ confidence in<br />

future growth has returned to nearly<br />

pre-crisis levels, according to PwC’s<br />

14th Annual Global CEO Survey –<br />

“Growth re-imagined”.<br />

In the worldwide poll <strong>of</strong> 1,201 CEOs, 48% said<br />

they were “very confident” <strong>of</strong> growth in the<br />

next 12 months. That’s a major shift from the<br />

31% last year who were “very confident” last<br />

year and approaches the 50% reached in 2008<br />

before the onslaught <strong>of</strong> the economic crisis. The<br />

PwC survey results were released at the World<br />

Economic Forum annual meeting in Davos. In<br />

total, 88% <strong>of</strong> CEOs said they now have some<br />

level <strong>of</strong> confidence in the prospects <strong>of</strong> the next<br />

12 months, up from 81% last year. In Poland<br />

as many as 94% <strong>of</strong> CEOs surveyed by<br />

PwC declared so as well.. Longer<br />

term, 94% now are confident <strong>of</strong><br />

growth three years from now,<br />

an increase <strong>of</strong> two percentage<br />

points. With regard<br />

to the three-year perspective,<br />

optimism <strong>of</strong> CEOs<br />

in Poland also increased and<br />

amounts now to 96% (3/4 <strong>of</strong> them<br />

being “strongly convinced” CEOs).<br />

Renewed confidence was spread<br />

across all continents, with CEOs<br />

firms. Briefly, at closing Vivendi received<br />

EUR 1.25 billion and withdrew all claims<br />

for PTC, Deutsche Telekom group became<br />

the sole owner <strong>of</strong> PTC - paying Vivendi<br />

and Elektrim EUR 1.4 billion for it. And<br />

finally, Elektrim paid <strong>of</strong>f its creditors, the<br />

<strong>Polish</strong> State Treasury and the bondholders<br />

in particular.<br />

The Salans Litigation & Arbitration team,<br />

led by Wojciech Kozłowski and including<br />

Katarzyna Bilewska and Patrick Radzimierski<br />

among others, conducted wide-ranging litiga-

e-imagined provident’s<br />

round table<br />

RESTORED?<br />

companies 11<br />

More results: www.pwc.com/ceosurvey<br />

in India, Austria, Colombia, Peru, China, Thailand<br />

and Paraguay particularly upbeat about<br />

near term growth. Regionally, CEOs in Western<br />

Europe were the least confident. German CEOs<br />

were an exception, with nearly 80% <strong>of</strong> CEOs<br />

“very confident,” up from about 20% last year.<br />

Strategically, the best opportunities for growth<br />

Provident as the first financial institution<br />

conducts social dialogue<br />

in the next 12 months will come from the <br />

with the company’s environment.<br />

development <strong>of</strong> new products and services and <br />

Round table was organized in the<br />

fourth quarter <strong>of</strong> 2010.<br />

from increasing share in existing markets, both<br />

cited by 29% <strong>of</strong> CEOs, and by penetration <strong>of</strong><br />

new markets, 17%. Mergers and acquisitions,<br />

joint ventures and alliances trailed as growth<br />

strategies. In Poland the shift is not as clearly<br />

visible as it is globally - 31% <strong>of</strong> CEOs want<br />

to focus on the development <strong>of</strong> new products<br />

and services, while 37% on increasing<br />

shares in existing markets. “CEOs have<br />

emerged from the bunker mentality<br />

<strong>of</strong> surviving the recession. They<br />

now see renewed opportunity<br />

for growth, even in<br />

the near term, and are<br />

determined to take advantage<br />

<strong>of</strong> better global<br />

economic conditions<br />

and increased customer<br />

demands,” said Dennis<br />

M. Nally, Chairman <strong>of</strong><br />

PwC International..<br />

shares is over<br />

tion related to the dispute over a 48% stake<br />

in PTC. It was one <strong>of</strong> the biggest, longest<br />

and most complex shareholder disputes in<br />

European legal history. It involved over 100<br />

court and arbitration cases (including over<br />

40 cases in Poland alone) in a number <strong>of</strong><br />

jurisdictions (<strong>Polish</strong>, Austrian, Swiss, English<br />

and American), conducted at all levels <strong>of</strong> the<br />

court system, including supreme courts in<br />

Poland, Austria and the United Kingdom and<br />

attracted extensive media and press coverage<br />

both in Poland and internationally.<br />

The report contains a summary <strong>of</strong> the meeting<br />

as well as the answers to the expectations<br />

towards the company that were raised by the<br />

stakeholders represented by, amongst others:<br />

customers, suppliers, business partners,<br />

employees, trade unions, state authorities,<br />

non-governmental organizations and the<br />

media. Provident is the first financial institution<br />

that decided to have such a form <strong>of</strong><br />

dialogue with the company’s environment.<br />

31 Provident stakeholders representing all<br />

key groups from the company’s surroundings<br />

accepted the invitation to the Round Table<br />

meeting. During the meeting they had the<br />

opportunity to express their opinions and<br />

doubts related to the company’s activity. On<br />

the basis <strong>of</strong> the discussions 32 expectations<br />

towards the company were formulated referring<br />

to various areas <strong>of</strong> the company’s activity:<br />

from the product, through the relations with<br />

the customers to the employee issues and the<br />

communication with the company’s environment.<br />

The report contains the company’s<br />

answers to those expectations.<br />

“Holding discussions at a Round Table with<br />

the company’s stakeholders is a big challenge<br />

for each enterprise – says Tomasz Trabuć,<br />

the head <strong>of</strong> the PR Department. – The sole<br />

preparation <strong>of</strong> the meeting at such a level<br />

which engages many different institutions<br />

including persons holding important public<br />

functions requires the hard work <strong>of</strong> many<br />

people. The stakeholders must believe that<br />

participation in such an event will be a good<br />

investment <strong>of</strong> their time”.<br />

Partners to the dialogue with the stakeholders:

12<br />

hot topic <br />

bank deposits<br />

art<br />

real estate<br />

currencies<br />

the best<br />

INVESTMENTS<br />

in 2011<br />

gold<br />

Warsaw Stock Exchange

hot topic 13<br />

chapter 1<br />

by: Jarosław Horodecki<br />

illustrations: Kinga Nieśmiałek<br />

Security<br />

comes first<br />

Bank deposits. In addition to treasury<br />

bonds, bank deposits are considered as<br />

the least risky form <strong>of</strong> investment. All the<br />

same, you can still fall into a trap even<br />

with a bank deposit.<br />

It may seem that depositing money<br />

in a standard bank deposit account<br />

requires no effort. It may appear that<br />

all it takes is to find a deposit account<br />

that earns the highest interest and<br />

then pay some money into it for the term <strong>of</strong><br />

your choice: from a few to between ten and<br />

twenty months. However, with this type <strong>of</strong><br />

an investment vehicle, you may sometimes<br />

end up with a gain only slightly higher than<br />

the inflation rate. What’s more, you should<br />

remember that gains on investments in bank<br />

deposits are subject to capital-gains tax.<br />

Therefore, before making the final choice, it’s<br />

better to scrutinise the products <strong>of</strong>fered by<br />

banks and consider what would be the best<br />

choice in your particular situation.<br />

“When choosing a term deposit, the majority<br />

<strong>of</strong> customers focus on the interest rate<br />

<strong>of</strong>fered by the bank,“ says Antoni Leonik,<br />

director <strong>of</strong> private banking and asset management<br />

at HSBC Bank Polska. ”Of course, the<br />

interest rate on a deposit depends on its term<br />

and the amount deposited by the customer.<br />

The truth is, however, that in many cases<br />

banks are ready for individual negotiations<br />

with the customer where the final interest<br />

rate <strong>of</strong>fered by the bank can be considerably

14<br />

hot topic <br />

higher than the standard rate.<br />

Sometimes banks <strong>of</strong>fer this negotiation<br />

opportunity in the case <strong>of</strong> deposits for as<br />

little as PLN 50,000. Everything depends<br />

on whether or not they are particularly<br />

interested in gathering new deposits at the<br />

time when the customer is interested<br />

in opening a deposit account.<br />

Another factor that can make<br />

the bank agree to negotiate<br />

the interest rate is the deposit<br />

term: the longer the term, the<br />

more likely it is that the bank<br />

will meet the customer halfway.<br />

There is, however, no point in<br />

arranging a long term, as it’s doubtful<br />

that the customer will keep the money in the<br />

deposit account for its entire duration.<br />

“It’s good to take care in finding out how<br />

much the bank would charge you for cancelling<br />

the deposit before the end <strong>of</strong> its term,”<br />

Antoni Leonik advises. ”In some cases, if the<br />

customer cancels the deposit early, he or she<br />

may end up with no interest at all. However,<br />

in most cases, he or she will be paid at least a<br />

portion <strong>of</strong> the interest accrued from the date<br />

<strong>of</strong> opening the deposit to the date <strong>of</strong> its early<br />

termination.<br />

You should also check whether the<br />

interest rate on your preferred deposit<br />

is a fixed or a variable rate.<br />

This is where the customer<br />

becomes a market analyst.<br />

Will inflation rise or fall?<br />

Will the central bank raise<br />

or lower interest rates?<br />

”Everything depends on how<br />

long you would like your<br />

money to stay “frozen”<br />

in the deposit account,”<br />

says the representative <strong>of</strong><br />

HSBC Bank Polska. “In<br />

the case <strong>of</strong> a fixed interest<br />

rate, you can precisely<br />

calculate the interest you<br />

will be paid at maturity, even<br />

before opening the deposit<br />

account.<br />

This stability <strong>of</strong>fered by such<br />

deposits doesn’t always pay. For<br />

example, if the inflation rate rises and the<br />

interest rate on your deposit stays the<br />

same throughout its term, you may<br />

end up with no interest at all in<br />

real terms, i.e. after the interest<br />

is adjusted to the rate <strong>of</strong> inflation<br />

and the capital-gains tax<br />

you will have to pay.<br />

”If you predict that interest rates<br />

will rise, then it’s better to choose<br />

a short-term or a mid-term deposit account,”<br />

Antoni Leonik advises. ”If you follow<br />

this strategy, you may earn higher interest on<br />

your next deposit for a new term. In contrast,<br />

in many cases banks are ready for<br />

individual negotiations with the customer<br />

where the final interest rate <strong>of</strong>fered by<br />

the bank can be considerably higher than<br />

the standard rate<br />

if you think that interest<br />

rates (and the rate <strong>of</strong> inflation)<br />

will stay unchanged or<br />

if you think they will fall, it<br />

may be more pr<strong>of</strong>itable to<br />

use a long-term deposit with<br />

a fixed interest rate.<br />

Another factor you may try to<br />

predict is the banks’ demand<br />

for money. If it turns out that<br />

banks are in need <strong>of</strong> cash, we may<br />

see another battle for deposits similar<br />

to that in 2009. This, however, is difficult<br />

to predict. What’s more, we should not<br />

expect it to happen again in the near future.<br />

Especially because the number <strong>of</strong> loans<br />

granted by banks will certainly fall as a result<br />

<strong>of</strong> the recent decisions made by the Banking<br />

Supervision Commission.<br />

A less pr<strong>of</strong>itable alternative to bank deposits<br />

is a savings account. This, however, is not<br />

a way to invest capital, but it is rather an<br />

addition to your current account that earns<br />

interest at a rate close to nothing.<br />

“Savings accounts, which carry interest rates<br />

higher than those <strong>of</strong>fered with current accounts<br />

and lower than those with deposit accounts,<br />

are an interesting solution if you want<br />

to save your surplus cash regularly,” says the<br />

director <strong>of</strong> HSBC Bank Polska. ”With a savings<br />

account, you can withdraw your money<br />

at any time, while interest is calculated for the<br />

actual number <strong>of</strong> days during which<br />

the money was deposited in<br />

the account. This way you<br />

can withdraw your money<br />

from the account whenever<br />

you need it, without<br />

losing interest on the<br />

entire amount.<br />

In most cases, however,<br />

the interest rates <strong>of</strong>fered on<br />

savings accounts are far from<br />

attractive. What’s more, banks<br />

<strong>of</strong>ten charge hefty fees for withdrawals<br />

from such accounts. Only<br />

the first withdrawal in a<br />

given period is free. For<br />

every additional withdrawal<br />

in the same period, the fee is so<br />

high that it simply doesn’t pay<br />

to withdraw any money from the<br />

account. If you don’t need to keep<br />

any money in a savings account for<br />

a rainy day, it’s better to keep your<br />

savings in term deposit accounts, as<br />

these <strong>of</strong>fer one more advantage: terminating<br />

a term deposit usually means<br />

no interest, which in turn discourages<br />

you from spending your money on<br />

impulse.

advertorial 15<br />

The best investment for 2011<br />

is in the diversity <strong>of</strong> your people!<br />

Diversity & Inclusion programs seem to be a buzz word in the<br />

modern executive rooms. The trend to create a fully diverse and<br />

inclusive corporate environment finely made its way to Poland.<br />

What we observe, however, is a<br />

substantial doubt among the<br />

managers how the creation <strong>of</strong><br />

the diverse and inclusive culture<br />

can really help people to achieve<br />

better results or simply become more efficient<br />

and satisfied workers. For these still in doubt,<br />

some facts and figures:<br />

The term ‘diversity’ made its way into business<br />

to describe the existence and methods <strong>of</strong><br />

communication and cooperation between the<br />

cultural entities, such as departments as well as<br />

the functional, pr<strong>of</strong>essional, national, gender<br />

and age groups. The fact that demographically,<br />

Poland is a very monolithic society and we don’t<br />

experience many problems with race or religious<br />

discrimination in the work place, does not mean<br />

that the notion <strong>of</strong> the diversity friendly culture<br />

is not for us!<br />

As a test, ask yourself a series <strong>of</strong> questions:<br />

1. Do your departments cooperate smoothly<br />

or do you hear complaints <strong>of</strong> the type: “they<br />

don’t understand our procedures”, “it takes<br />

ages to get their attention”, “they live in their<br />

own world and don’t care about others”.<br />

2. How efficient is your top-bottom-top communication:<br />

Do your employees come to<br />

their managers with ideas? Do the employees<br />

know what the Mission, Vision and Strategic<br />

Goals <strong>of</strong> your business are?<br />

3. If your company is involved in cross-national<br />

projects how many times have you heard:<br />

Kelham Group<br />

www.kelhamgroup.eu<br />

“It’s impossible to get my German colleague<br />

on the mobile after 6.00 p.m. – even to discuss<br />

a problem– very difficult to work with!”<br />

“No more Spanish on my team! Cannot rely<br />

on them!”<br />

4. What is your employees’ age make up? Do<br />

you have 30+ managers whose teams are made<br />

<strong>of</strong> 45+ employees? How many 40+ managers<br />

work with the teams <strong>of</strong> 20+ people? Do you<br />

know how to motivate these age groups, make<br />

them efficient and satisfied?<br />

5. And finally gender questions: How many<br />

women have you got on the Management<br />

Board in your organization (%)? Do you<br />

have procedures to support new mothers and<br />

fathers? What about the work-life balance?<br />

• Organisational & Personnel Development consulting<br />

• Design & implementation <strong>of</strong> the skills training workshops<br />

• Needs driven selection & implementation <strong>of</strong> the psychometric tools, such as International Pr<strong>of</strong>iler,<br />

W.E.R.T, Itim Focus<br />

•Business & development coaching<br />

38 Brackenridge, Carrickfergus<br />

BT38 8FW, UK<br />

+44 2895 81 12 66<br />

ul. Traktorowa 12<br />

52-213 Wrocław, Polska<br />

+48 600 36 82 54<br />

Magda Stobińska-Kelham<br />

Managing Partner<br />

Kelham Group<br />

The answers to these questions will give you<br />

an indication <strong>of</strong> the wide scope <strong>of</strong> issues that<br />

“diversity” encompasses. And now, what is “Inclusion”<br />

about? In simple words it is a concept<br />

that will help you to discover, nourish and utilize<br />

the potentials and talents <strong>of</strong> your people! In the<br />

inclusive company every individual feels good<br />

about the things they do, so they are satisfied and<br />

motivated to do even more! Isn’t it really every<br />

manager’s dream? Have a team <strong>of</strong> pr<strong>of</strong>essionals<br />

<strong>of</strong> different, but complementary skills, who communicate<br />

well, feel motivated and overachieve<br />

their targets? You may smile, but that’s what<br />

‘Inclusion’ is about - diagnosing the strengths,<br />

understanding differences, utilizing talents and<br />

potentials to achieve a common business goal.<br />

If you wish to improve your business bottom<br />

line, attract and retain quality people, enhance<br />

your image on the market or make the efficiency<br />

<strong>of</strong> your internal operations better, it’s worthwhile<br />

developing a long term “Diversity & Inclusion”<br />

program for your organization. And remember<br />

to make your people aware that not only the<br />

company but they will benefit in the process.<br />

Above, you will see the results <strong>of</strong> the research carried<br />

out in 2007 on the sample <strong>of</strong> 52 companies<br />

from the EU market. The figures speak for<br />

themselves.

16<br />

hot topic <br />

chapter 2<br />

by: Roman Przasnyski, Open Finance<br />

illustrations: Kinga nieśmiałek<br />

Going on a currency<br />

Roller Coaster<br />

The pace <strong>of</strong> changes in exchange rates which generally move in long trends each<br />

lasting for a few years, has recently visibly increased. This situation is unfavourable<br />

in many ways. It may, however, provide opportunities to increase your capital.<br />

began to be described as a trash currency<br />

destined to lose its position, another wave<br />

<strong>of</strong> crisis turmoil emerged, this time hitting<br />

Europe. Greece’s budget deficit and public<br />

debt trouble, the weeks’ long negotiations<br />

over support for this country, combined<br />

with a subsequent threat <strong>of</strong> Greece’s problems<br />

spreading to other parts <strong>of</strong> Europe,<br />

such as Ireland, Spain, Portugal and Italy,<br />

for dealing with the crisis as adopted by the<br />

majority <strong>of</strong> European Union countries and<br />

the United States. The policy <strong>of</strong> extremely<br />

low interest rates and quantitative easing<br />

pursued by the Fed since the beginning<br />

<strong>of</strong> this century is causing the US dollar to<br />

weaken, while European countries’ efforts to<br />

reduce their budget deficit and public debt<br />

levels and to keep their finance in balance<br />

In Poland, the US dollar was, for a long<br />

time, perceived as the perfect investment.<br />

The great shock which came when<br />

the scale <strong>of</strong> the global financial crisis<br />

became apparent, with its symbolic climax<br />

being the collapse <strong>of</strong> the Lehman Brothers<br />

bank in the autumn <strong>of</strong> 2008 caused the US<br />

dollar to strengthen by 20 percent against<br />

the euro in a matter <strong>of</strong> a few weeks. In<br />

Poland, at that time, the US currency rose<br />

from slightly over PLN 2 in the summer <strong>of</strong><br />

2008 to PLN 3.9 in early 2009, meaning<br />

that the <strong>Polish</strong> currency lost as much as 94<br />

percent against the dollar.<br />

When the shock went away and the situation<br />

became a little calmer, the US Federal<br />

Reserve gave the US financial markets and<br />

the country’s economy a special treatment,<br />

i.e. extreme easing <strong>of</strong> the country’s monetary<br />

policy, combined with printing money, and<br />

the trend in the US dollar changed dramatically.<br />

The value <strong>of</strong> the US currency began to<br />

plummet. In February 2009, in took 1.25<br />

dollars to buy one euro. However, at the end<br />

<strong>of</strong> that year, it took as much as 1.5 dollars,<br />

meaning that the US currency lost 20 percent<br />

against the euro. When the US dollar<br />

At the dot-com bubble burst, many people<br />

who failed to notice and recognise the<br />

change, suffered great losses on their<br />

investments in the US dollar.<br />

led to serious weakening <strong>of</strong> the euro<br />

and the view that both the single currency<br />

and the entire Eurozone may collapse. From<br />

December 2009 to May 2010, the value <strong>of</strong><br />

the euro fell by 20 percent. A later reversal<br />

<strong>of</strong> this downward trend led to the euro making<br />

up for most <strong>of</strong> its losses. The Irish crisis<br />

caused the euro to lose only 6 percent.<br />

What we have seen in the last several<br />

months is that significant changes in the<br />

world currency market cause the values <strong>of</strong><br />

major currencies to change by around 20<br />

percent. Less turbulent events and changes<br />

in the main trends result in changes by a few<br />

percent, quite large for a currency market.<br />

Although predicting the situation in currency<br />

markets is difficult (because it is impossible<br />

to say whether, and if so, when and<br />

where another crisis will explode and what<br />

its scale will be), some prevailing trends<br />

can still be seen. In the world market, such<br />

trends are the result <strong>of</strong> different solutions<br />

are <strong>of</strong> benefit to the euro.<br />

The <strong>Polish</strong> currency market is overwhelmingly<br />

influenced by what happens in the<br />

world markets, including Central and<br />

Eastern Europe. The factors that weigh in<br />

favour <strong>of</strong> the strengthening <strong>of</strong> the <strong>Polish</strong><br />

currency, which are related to Poland’s<br />

economic situation and prospects, are<br />

<strong>of</strong>ten disrupted by such external influences.<br />

These influences cause the values <strong>of</strong><br />

foreign currencies to fluctuate by around 10<br />

percent against the <strong>Polish</strong> zloty. In the case<br />

<strong>of</strong> the euro, the exchange rate in the first<br />

half <strong>of</strong> the year fluctuated between PLN<br />

3.82 and PLN 4.23. As far as the US dollar<br />

is concerned, the difference from June to<br />

October was around 22 percent. The Greek<br />

crisis pushed the value <strong>of</strong> the dollar against<br />

the <strong>Polish</strong> currency up to over PLN 3.5,<br />

while a subsequent reversal pulled it down<br />

to slightly above PLN 2.72. As a result <strong>of</strong><br />

Ireland’s trouble, the <strong>Polish</strong> zloty weakened

8<br />

hot topic 17<br />

by almost 15 percent in just a few weeks. If<br />

we ignore the extreme values, which are generally<br />

short-lived, fluctuations over a period<br />

<strong>of</strong> a few months are about 5 to 10 percent.<br />

Longer-lasting disruptions on a larger scale<br />

are possible only if another European country,<br />

such as Spain or Italy, gets into solvency<br />

trouble or in the event <strong>of</strong> Poland having<br />

serious financial difficulties.<br />

The currency market is not the easiest<br />

market for individual investors. To stay<br />

afloat in this market, you need to have<br />

some experience, keep your eyes wide open<br />

to various phenomena (both market and<br />

bureau de change is a little bit old-fashioned<br />

method - it is not very practical and not<br />

very effective, as the high buy/sell spread<br />

would significantly reduce your potential<br />

gains. Derivatives, mostly futures contracts,<br />

are yet another possibility, traded in on the<br />

Warsaw Stock Exchange, as well as forex<br />

instruments <strong>of</strong>fered by specialised trading<br />

platforms operated by some brokerage firms<br />

and companies.<br />

All it takes to use currency futures contracts<br />

is an investment account with a separate<br />

derivatives account. The minimum investment<br />

limit is a few hundred zlotys (buying<br />

Using forex platforms normally<br />

requires an investment <strong>of</strong> at least US$<br />

10,000. In practice, however, you will need<br />

around US$ 50,000 to freely take advantage<br />

<strong>of</strong> trading opportunities.<br />

by investing, say, US$ 10,000, you enter<br />

into a contract worth half a million dollars.<br />

This multiplier is a powerful weapon but,<br />

at the same time, a double-edged sword. If<br />

the exchange rates change in line with your<br />

expectations, your gains will grow rapidly.<br />

However, even a slight change in the opposite<br />

direction can quickly make your initial<br />

investment go up in smoke.<br />

Recently, structured products based on<br />

exchange rate changes have been gaining<br />

popularity. The main advantage <strong>of</strong> these<br />

products is that the risk <strong>of</strong> loss is reduced.<br />

In such products, the investor is generally<br />

guaranteed to get back the nominal amount<br />

<strong>of</strong> the money invested or a specified part <strong>of</strong><br />

the money, normally 80-90 percent. However,<br />

financial leveraging is not used in the<br />

case <strong>of</strong> structured products, so high gains<br />

are difficult to achieve.<br />

macroeconomic in nature) and your finger<br />

on the pulse. In other words, you must be<br />

ready to close a position any time there are<br />

any indications that the situation is going<br />

to change. Above all, however, you need<br />

to reduce risk, which means you should<br />

only invest a small portion <strong>of</strong> your capital.<br />

Generally, the money you invest in currency<br />

markets should account for between a few<br />

and ten percent <strong>of</strong> your capital, though your<br />

exposure will depend on the instrument<br />

you use. You can choose from a number <strong>of</strong><br />

options. The easiest method is to buy currency,<br />

though this option is available mostly<br />

as part <strong>of</strong> a private-banking service. Using a<br />

or selling a single contract). However,<br />

currency futures contracts are available<br />

only for euros, US dollars and Swiss francs.<br />

Using forex platforms normally requires an<br />

investment <strong>of</strong> at least US$ 10,000. In practice,<br />

however, you will need around US$<br />

50,000 to freely take advantage <strong>of</strong> trading<br />

opportunities. Here the choice <strong>of</strong> currencies<br />

and instruments is much wider. A characteristic<br />

feature <strong>of</strong> futures trading is financial<br />

leveraging: if, for example, you wish to<br />

buy a futures contract for US$ 10,000, you<br />

actually pay only a few percent <strong>of</strong> the value<br />

<strong>of</strong> the contract. In the case <strong>of</strong> platforms,<br />

it’s even only 1-2 percent. This means that<br />

Open House<br />

March 12th, 2011<br />

10:00-14:00<br />

Open House<br />

March 12th, 2011 10:00-14:00

18<br />

hot topic <br />

WARSAW<br />

chapter 3<br />

by: adam mielczarek<br />

illustrations: Łukasz Szczepanowski<br />

Time<br />

to rationalise<br />

moscow<br />

A 16-percent rise in the WIG20 index, a PLN 450 billion turnover, 29<br />

debuts, plus a completely new instrument that lets you “buy an index”.<br />

The image <strong>of</strong> the Warsaw Stock Exchange is quite impressive. However,<br />

in the upcoming year the picture is not going to be so rosy, though opportunities<br />

for making money will always be there.<br />

london<br />

tokio<br />

Looking back at the last twelve months<br />

leaves no doubt – the Warsaw Stock Exchange<br />

is the leader <strong>of</strong> the financial market<br />

in Central Europe. With a capitalisation<br />

<strong>of</strong> over PLN 800 billion, which accounts<br />

for about 60 percent <strong>of</strong> Poland’s GDP, the<br />

Warsaw Stock Exchange (WSE) has outclassed<br />

its competitors in the region. Today, it is a stock<br />

exchange where 394 companies are listed and<br />

derivatives are doing very well. It is also a place<br />

that attracts companies from outside <strong>of</strong> Poland<br />

and shows that Poland is indeed a good destination<br />

to go in search <strong>of</strong> capital and to make quite<br />

a good pr<strong>of</strong>it.<br />

The levels <strong>of</strong> WSE indices speak for themselves.<br />

WIG20, the index which lists the largest<br />

companies, is at 2783 points, up by 16 percent<br />

compared to a year ago. The figures for WIG,<br />

the index that represents the entire market are,<br />

respectively, 47770 points and 19 percent. Add<br />

to this the impressive rises in industry-specific<br />

indices. The Warsaw Stock Exchange’s daily<br />

turnover is higher than that on stock exchanges<br />

in Prague, Vienna and Budapest.<br />

It were the monitors placed in the building<br />

<strong>of</strong> the Warsaw Stock Exchange that showed<br />

Poland as the “green island” on the map <strong>of</strong><br />

Europe in stagnation. However, no tree grows<br />

as high as the sky, which means that any period<br />

<strong>of</strong> good luck must come to an end one day.<br />

It’s something that stock market analysts are<br />

well aware <strong>of</strong>. They are cautious (after all, stock<br />

market moods change like the weather), but all<br />

the same agree on one thing: the upcoming year<br />

is a time to rationalise.<br />

”Share prices are already relatively high and<br />

the improvement in corporate earnings has<br />

certainly been factored in to a large extent,” says<br />

Jacek Welc, a specialist in business valuation, an<br />

economist and president <strong>of</strong> WNP Ekspert, who<br />

specialises in business valuation. The barrier,<br />

he says, is a P/E ratio <strong>of</strong> 16, a level above which

hot topic 19<br />

welcome to<br />

hilton garden inn kraków<br />

Situated close to the heart <strong>of</strong> the city – in between the Old Town and the Jewish Quarter <strong>of</strong> Kazimierz the hotel is ideally<br />

located. Hotel guests can admire the Wawel Castle and Skalka monastery from the windows <strong>of</strong> half <strong>of</strong> the rooms .<br />

The other half overlook green fields and trees which have a calming effect. For those who arrive by car there is ample<br />

parking which is unusual in Krakow.<br />

The hotel has 154 well-appointed<br />

rooms spread over six floors all<br />

featuring the brand’s key signature<br />

<strong>of</strong>ferings including:<br />

• the Garden Sleep System bed,<br />

• comfortable working area: large desk with<br />

ergonomic Mirra ® chair, designed by<br />

Herman Miller,<br />

• complimentary cable and WiFi internet<br />

access in all guest rooms,<br />

• round-the-clock business centre with free<br />

access, where you can check emails even if<br />

travelling without your laptop.<br />

areas – a multifun-ctional space <strong>of</strong> 220 square<br />

metres – a spacious foyer with a view <strong>of</strong> the<br />

Wawel Castle and an exclusive VIP boardroom<br />

– prepared to host 14 guests and equipped with<br />

the latest technological solutions. Special effort<br />

is made to provide our guests with a great culinary<br />

experience combined with good value for<br />

money. The hotel restaurant <strong>of</strong>fers light, standard<br />

yet delicious food – a collection <strong>of</strong> dishes<br />

suitable for everyone. All those burger fans will<br />

be satisfied, along with those who always look<br />

for something special like goulash <strong>of</strong> wildboar or<br />

sautéed liver & oyster mushroom salad.<br />

experts in the mixing <strong>of</strong> anything that comes<br />

in a liquid form. There’s no need to add that<br />

they have around 200 different types <strong>of</strong> alcohol<br />

to work with, which in its essence creates<br />

a unique collection, unmatchable with any<br />

other Bar in Poland. Our special <strong>of</strong>fer brings<br />

you cocktails served in large glasses, which, as<br />

most <strong>of</strong> our dishes, are made to share – our<br />

aim is to bring unforgettable moments to<br />

our client’s social life. Conoisseurs with more<br />

ambitious tastes can enjoy our house-special<br />

– a cocktail made only from the best available<br />

alcohols topped with beautiful and glittering<br />

To make you feel at home the hotel has an open<br />

fireplace where you can rest with a glass <strong>of</strong> wine<br />

after a hard day’s work. If you forget something<br />

you can always call by our 24-hour Pavilion<br />

Pantry – a smart shop full <strong>of</strong> snacks, beverages,<br />

cosmetic items, umbrellas and pendrives. The<br />

hotel, as a whole concept is designed to be a<br />

hassle-free place. This main theme can be seen in<br />

most areas <strong>of</strong> the building, especially the public<br />

areas. Our modern and top-notch conference<br />

rooms are fully equipped with the latest<br />

multimedia equipment, which can be controlled<br />

simply at the press <strong>of</strong> a button. That enables<br />

maximum multi-functionality and flexibility<br />

which provides all you need for a successful<br />

meeting. The conference space is divided into 2<br />

Our best attraction, though, is the “GLOBE”<br />

– our fine cusine Restaurant, Bar and Café. It’s<br />

the apple <strong>of</strong> our eye, a finale for our concept <strong>of</strong><br />

being a universal and open space for everyone.<br />

The Globe is a truly democratic place reflecting<br />

a colourful and multiethnic world, an<br />

escape for people looking for different flavours<br />

<strong>of</strong> the world. You can jump in for a take-away<br />

c<strong>of</strong>fee during traffic, you can come for a cocktail<br />

especially prepared for you, or simply indulge<br />

your taste-buds. The menu prepared by<br />

our talented chef allows you to enjoy a journey<br />

around the various places <strong>of</strong> our Globe. This is<br />

the first and the only venue in Kraków which<br />

is amember <strong>of</strong> <strong>Polish</strong> Bartender Association –<br />