Annexure XIV Continued⦠- Edelweiss

Annexure XIV Continued⦠- Edelweiss

Annexure XIV Continued⦠- Edelweiss

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Finance cost<br />

Finance costs include interest on term loans, interest on cash credits/working capital loans and interest paid on<br />

inter-corporate deposits.<br />

Recent Developments<br />

On April 9, 2011, we sold our sponge iron business, which we do not regard as core to our strategy going<br />

forward, which is to focus on our coal beneficiation and power generation businesses. The sale was<br />

consummated through our divestment of 81.20% of the equity share capital of Aryan Ispat and Power Private<br />

Limited, through which we operated our sponge iron business. The assets of Aryan Ispat and Power Private<br />

Limited also include an 18 MW power project and a coal beneficiation plant with a designed capacity of 0.70<br />

million tons per annum. For further details, please see the section titled "Our Business — Coal Beneficiation<br />

Plants" on page 144 of this Draft Red Herring Prospectus. In April 2011, we also commissioned a coal<br />

beneficiation plant with a designed capacity of 5.00 million tons per annum in Himgir. For further details,<br />

please see the section titled "History and Certain Corporate Matters" on page 196 of this Draft Red Herring<br />

Prospectus.<br />

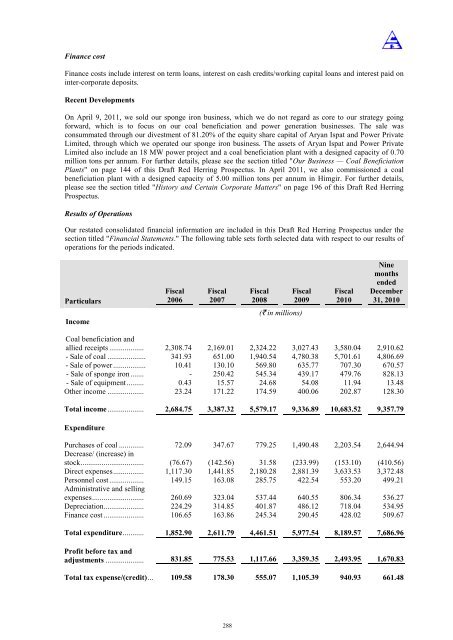

Results of Operations<br />

Our restated consolidated financial information are included in this Draft Red Herring Prospectus under the<br />

section titled "Financial Statements." The following table sets forth selected data with respect to our results of<br />

operations for the periods indicated.<br />

Particulars<br />

Income<br />

Fiscal<br />

2006<br />

Fiscal<br />

2007<br />

Fiscal<br />

2008<br />

Fiscal<br />

2009<br />

(` in millions)<br />

Fiscal<br />

2010<br />

Nine<br />

months<br />

ended<br />

December<br />

31, 2010<br />

Coal beneficiation and<br />

allied receipts .................. 2,308.74 2,169.01 2,324.22 3,027.43 3,580.04 2,910.62<br />

- Sale of coal .................... 341.93 651.00 1,940.54 4,780.38 5,701.61 4,806.69<br />

- Sale of power ................. 10.41 130.10 569.80 635.77 707.30 670.57<br />

- Sale of sponge iron ....... - 250.42 545.34 439.17 479.76 828.13<br />

- Sale of equipment ......... 0.43 15.57 24.68 54.08 11.94 13.48<br />

Other income ................... 23.24 171.22 174.59 400.06 202.87 128.30<br />

Total income ................... 2,684.75 3,387.32 5,579.17 9,336.89 10,683.52 9,357.79<br />

Expenditure<br />

Purchases of coal ............. 72.09 347.67 779.25 1,490.48 2,203.54 2,644.94<br />

Decrease/ (increase) in<br />

stock ................................. (76.67) (142.56) 31.58 (233.99) (153.10) (410.56)<br />

Direct expenses ................ 1,117.30 1,441.85 2,180.28 2,881.39 3,633.53 3,372.48<br />

Personnel cost .................. 149.15 163.08 285.75 422.54 553.20 499.21<br />

Administrative and selling<br />

expenses ........................... 260.69 323.04 537.44 640.55 806.34 536.27<br />

Depreciation ..................... 224.29 314.85 401.87 486.12 718.04 534.95<br />

Finance cost ..................... 106.65 163.86 245.34 290.45 428.02 509.67<br />

Total expenditure ........... 1,852.90 2,611.79 4,461.51 5,977.54 8,189.57 7,686.96<br />

Profit before tax and<br />

adjustments .................... 831.85 775.53 1,117.66 3,359.35 2,493.95 1,670.83<br />

Total tax expense/(credit) ... 109.58 178.30 555.07 1,105.39 940.93 661.48<br />

288