EDI BEST client format supported by KB valid from ... - Komerční banka

EDI BEST client format supported by KB valid from ... - Komerční banka

EDI BEST client format supported by KB valid from ... - Komerční banka

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

k<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong> <strong>supported</strong> <strong>by</strong> <strong>KB</strong><br />

<strong>valid</strong> <strong>from</strong> 12th June 2010<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

1/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

1 Introduction ...................................................................................................................................2<br />

1.1 Purpose of this document.....................................................................................................2<br />

1.2 Characteristics of <strong>EDI</strong> <strong>BEST</strong> <strong>format</strong>.....................................................................................3<br />

1.2.1 <strong>EDI</strong> service...........................................................................................................................3<br />

1.3 Char set for UNOA syntax level ...........................................................................................4<br />

1.3.1 Other services......................................................................................................................5<br />

1.4 Main characteristics of operation with <strong>EDI</strong> batches .............................................................5<br />

1.5 SEPA payments - new non-accounting optional data..........................................................5<br />

2 Formal check of <strong>EDI</strong>_<strong>BEST</strong> <strong>format</strong>..............................................................................................5<br />

2.1 Domestic payments..............................................................................................................6<br />

2.1.1 General in<strong>format</strong>ion .............................................................................................................6<br />

2.1.2 Description of import fields ..................................................................................................7<br />

2.2 Foreign payments...............................................................................................................10<br />

2.2.1 General in<strong>format</strong>ion ...........................................................................................................10<br />

2.2.2 Description of import fields ................................................................................................11<br />

2.2.3 Difference between standard Foreign payment and SEPA payment................................19<br />

2.2.4 Sorting of SEPA optional data ...........................................................................................19<br />

2.2.5 SEPA optional data in the SEPA foreign payment of the Outgoing <strong>EDI</strong>_<strong>BEST</strong> <strong>format</strong> ....20<br />

2.3 <strong>EDI</strong>_<strong>BEST</strong> <strong>format</strong> - electronic statement ...........................................................................20<br />

2.3.1 Main characteristics...........................................................................................................20<br />

2.3.2 Main <strong>format</strong> of electronic statement - booked transactions <strong>from</strong> the previous<br />

business day in the <strong>EDI</strong>_<strong>BEST</strong> <strong>format</strong> ..............................................................................22<br />

2.3.3 Sorting of types of records in the Electronic statement file, if containing<br />

non-accounting SEPA in<strong>format</strong>ion.....................................................................................26<br />

2.3.4 SEPA optional data for INCOMING AND OUTGOING SEPA payments in Transaction<br />

history of the <strong>EDI</strong>_<strong>BEST</strong> <strong>format</strong>.........................................................................................26<br />

2.4 <strong>EDI</strong>_<strong>BEST</strong> <strong>format</strong> - Error report (only for <strong>EDI</strong> <strong>client</strong>s) .......................................................31<br />

2.5 <strong>EDI</strong>_<strong>BEST</strong> <strong>format</strong> - advice .................................................................................................36<br />

2.5.1 Main characteristics...........................................................................................................36<br />

2.5.2 Main <strong>format</strong> of ADVICE for domestic and foreign payments - current payments of the<br />

specific day in the <strong>EDI</strong>_<strong>BEST</strong> <strong>format</strong> ................................................................................38<br />

2.5.3 Sorting of types of records in the ADVICE file...................................................................41<br />

2.5.4 SEPA optional data for INCOMING AND OUTGOING SEPA payments<br />

in ADVICE of the <strong>EDI</strong>_<strong>BEST</strong> <strong>format</strong>..................................................................................41<br />

2.6 SEPA - Presentation examples of Identification codes for INCOMING and Outgoing<br />

SEPA payments .................................................................................................................44<br />

1 Introduction<br />

1.1 Purpose of this document<br />

Services provided <strong>by</strong> <strong>KB</strong> within the framework of the application server (AS) and enabling operation<br />

with batches in the <strong>EDI</strong> <strong>BEST</strong> <strong>format</strong>:<br />

• Profi<strong>banka</strong><br />

• Direct channel<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

2/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

• <strong>EDI</strong><br />

• MC (MultiCash)<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

The purpose of this document is to describe the <strong>EDI</strong>_<strong>BEST</strong> <strong>format</strong> and required <strong>valid</strong>ations for<br />

IMPORTING data and to define the structure of data EXPORT in relation to the existing<br />

UN/<strong>EDI</strong>FACT PAYMUL domestic, PAYMUL foreign, DIRDEB, FINSTA, BANSTA, CREMUL and<br />

DEBMUL subsets and interrelated accounting SW of <strong>client</strong>s. The above-mentioned IMPORT and<br />

EXPORT concerns <strong>KB</strong> Direct banking services (DCS).<br />

The description is divided into the following sections:<br />

• Import<br />

• <strong>format</strong> field declarations - domestic payments<br />

• list of field <strong>valid</strong>ations - domestic payments<br />

• <strong>format</strong> field declarations - foreign payments<br />

• list of field <strong>valid</strong>ations - foreign payments<br />

• Export<br />

• <strong>format</strong> field declarations - electronic statements<br />

• <strong>format</strong> field declarations - error report<br />

• <strong>format</strong> field declarations - Advice<br />

• There is only one type of detected errors:<br />

• E = error - this will cause rejection<br />

• W = warning - this is merely a warning and will not cause rejection of the batch. The <strong>client</strong><br />

decides whether to keep the batch in processing (it is not applied in DC and <strong>EDI</strong>).<br />

1.2 Characteristics of <strong>EDI</strong> <strong>BEST</strong> <strong>format</strong><br />

1.2.1 <strong>EDI</strong> service<br />

<strong>EDI</strong> <strong>client</strong>s can transfer (to <strong>KB</strong>) payment orders generated in their accounting systems <strong>by</strong> means of<br />

standard UN/<strong>EDI</strong>FACT <strong>format</strong>s approved as a national standard and defined within the TNK 42<br />

group. <strong>EDI</strong>_<strong>BEST</strong> is the <strong>KB</strong> Inhouse, to which subsets are converted. In addition, this Inhouse is<br />

offered as one of the <strong>supported</strong> <strong>format</strong>s used in DC and Profi<strong>banka</strong>.<br />

Relations between INHOUSE and UN/<strong>EDI</strong>FACT subsets:<br />

• domestic payment<br />

<strong>EDI</strong>_<strong>BEST</strong> domestic payment = PAYMUL<br />

domestic<br />

• collection<br />

<strong>EDI</strong>_<strong>BEST</strong> domestic payment = DIRDEB<br />

• foreign payment<br />

<strong>EDI</strong>_<strong>BEST</strong> foreign payment = PAYMUL foreign<br />

• electronic statement<br />

<strong>EDI</strong>_<strong>BEST</strong> electronic statement = FINSTA<br />

• bank’s response to a payment<br />

<strong>EDI</strong>_<strong>BEST</strong> report = BANSTA<br />

• debits carried out during the current day <strong>EDI</strong>_<strong>BEST</strong> debit advice = DEBMUL<br />

• credits carried out during the current day <strong>EDI</strong>_<strong>BEST</strong> credit advice = CREMUL<br />

The <strong>EDI</strong>FACT standard allows the transmitting of requirements for cancelling previously sent orders.<br />

Cancellation can only be completed if the original payment is still in the waiting status and its<br />

processing has not started yet. Client ID and the order identification generated <strong>by</strong> the <strong>client</strong> (35<br />

chars) form a unique identification for pairing the original and cancellation order. Cancellation<br />

batches must not contain orders other than cancellation ones.<br />

<strong>KB</strong> uses the following rule to map the type of charges in PAYMUL:<br />

<strong>EDI</strong> subset<br />

<strong>KB</strong> INHOUSE<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

3/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

OUR<br />

BEN<br />

SHA<br />

BN1<br />

BN2<br />

STD<br />

SLV<br />

Other<br />

OUR<br />

BEN<br />

SHA<br />

SHA<br />

BEN<br />

SHA<br />

SLV<br />

SHA<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

Clients not using <strong>EDI</strong> can use this <strong>format</strong> in Profi<strong>banka</strong> and Direct channel services directly <strong>from</strong> their<br />

accounting systems instead of the <strong>BEST</strong> <strong>format</strong> (domestic and foreign payments, statements and<br />

debit and credit advise). Apart <strong>from</strong> the actual <strong>EDI</strong> server, cancellation batches can only be sent via<br />

Direct channel. In this case, an identical Creation date is necessary in addition to Identification<br />

generated <strong>by</strong> the <strong>client</strong> (Item sequential number).<br />

1.3 Char set for UNOA syntax level<br />

Texts in <strong>EDI</strong> subsets are in the UNOA <strong>format</strong> - capital characters of the English alphabet.<br />

UNOA level allows the characters specified in the following table to be used:<br />

capital characters<br />

A to Z<br />

numbers 0 to 9<br />

space<br />

dot .<br />

comma ,<br />

minus -<br />

left parenthesis (<br />

right parenthesis )<br />

slash /<br />

equal sign =<br />

exclamation mark !<br />

quotation marks "<br />

percent sign %<br />

asterisk *<br />

semi-colon ;<br />

“less than” sign <<br />

“greater than” sign ><br />

Reserved characters are those used as separators and limiters of message elements and segments.<br />

In spite of the fact that these can be changed and the change declared in the UNA segment, <strong>KB</strong> shall use those<br />

defined <strong>by</strong> the standard. For the future, the * (asterisk) sign is considered to be used as another separator.<br />

apostrophe ´ segment end character<br />

plus + data element separator<br />

dot . decimal separator<br />

colon : partial data element separator<br />

question mark exemption character<br />

• Code page<br />

• DC and <strong>EDI</strong> - requires windows-1250 – Windows Eastern European (Windows<br />

CRLF line feed)<br />

• PCB - requires windows-1250 – Windows Eastern European (PCB line feed can be<br />

managed <strong>by</strong> both CRLF (#13#10) and Unix LF (#10) or MAC CR (#13)<br />

• MC – requires CP852<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

4/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

1.3.1 Other services<br />

• <strong>BEST</strong> <strong>format</strong> includes:<br />

• Domestic payment orders (Import): accounting and non-accounting data<br />

• Foreign payment orders (Import): accounting and non-accounting data derived <strong>from</strong> the<br />

needs of SWIFT messages in foreign payment orders.<br />

• Electronic statement (Export): accounting and non-accounting data provided <strong>by</strong> printout<br />

(paper) statements and all identification data and notes related to transactions.<br />

• Error report (Export) - <strong>EDI</strong> <strong>client</strong>s only<br />

• Advice (Export) - accounting and non-accounting data of transactions processed during the<br />

business day<br />

1.4 Main characteristics of operation with <strong>EDI</strong> batches<br />

IMPORT<br />

• The <strong>client</strong> transfers a batch of payment orders in the UN/<strong>EDI</strong>FACT <strong>format</strong> to the bank. <strong>EDI</strong><br />

server in the 24x7 mode converts received batches (converts them into the <strong>EDI</strong>_<strong>BEST</strong><br />

<strong>format</strong>) and sends a batch to AS. AS will send the <strong>valid</strong>ation result to the specified<br />

directory; <strong>from</strong> here, the file is immediately picked up, converted into the UN/<strong>EDI</strong>FACT<br />

<strong>format</strong> - BANSTA subset and sent to the <strong>client</strong>. A report detects the 1st found error for a<br />

single payment. This way, the <strong>client</strong> receives a response for each sent payment and can<br />

diagnose, based on OK / NOK status, whether the payment was formally correct and<br />

accepted.<br />

EXPORT<br />

In case of <strong>EDI</strong>, it is not the <strong>client</strong> who initializes downloading of the statement; however, the bank<br />

guarantees that the data for the <strong>client</strong> will be distributed as soon as it is available.<br />

• <strong>KB</strong> will place both the statements and reports in the specified directory; <strong>from</strong> here, the file is<br />

immediately picked up, converted into the UN/<strong>EDI</strong>FACT <strong>format</strong> - FINSTA and BANSTA or<br />

CREMUL and DEBMUL subsets and sent to the <strong>client</strong>. This means the <strong>client</strong> will receive<br />

the accounting response for every formally accepted payment. The “OK” accounting is<br />

included in FINSTA, the “NOK” accounting with rejection reasons specified is included in<br />

the morning BANSTA. In addition, ADVICE will be downloaded according to requested<br />

timing of individual <strong>client</strong>s.<br />

1.5 SEPA payments - new non-accounting optional data<br />

SEPA - Single European Payment Area<br />

SEPA non-accounting optional data<br />

• The <strong>client</strong> will be able to transfer the payment in EUR to EU countries under better<br />

conditions. At the same time, he/she can transfer other non-accounting data to their<br />

partner. See Foreign payment - new types of records.<br />

• The <strong>client</strong> will be able to use new non-accounting optional data on his/her side for SEPA<br />

payments to exchange with their partner. He/she will receive these data in the new types of<br />

records in the ADVICE or in the Electronic statement.<br />

2 Formal check of <strong>EDI</strong>_<strong>BEST</strong> <strong>format</strong><br />

Note:<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

5/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

• All text fields must be aligned to the left ("X" <strong>format</strong>); all numeric fields must be aligned to<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

the right ("9" <strong>format</strong>). For amounts, the <strong>format</strong> uses imaginary decimal part specified in<br />

the "V" <strong>format</strong>).<br />

• Spaces are default values for text fields<br />

• Zeroes are default values for numeric fields<br />

• Conversion according to the UNOA set must be ensured<br />

2.1 Domestic payments<br />

2.1.1 General in<strong>format</strong>ion<br />

The file with payments contains one header, “n” payments and one footer. Record length - fixed<br />

600 <strong>by</strong>tes.<br />

Specifying priority in the payment - typically, a payment transferred in a batch will be processed with<br />

priority 5 in <strong>KB</strong>I. Priority levels 0 - 9 are available in <strong>KB</strong>I; 9 is the lowest priority. Priorities 0 to 2 are<br />

system priorities not available to <strong>client</strong>s. Any attempt to choose these will be changed to the standard<br />

<strong>KB</strong> priority. You can enter the priority in Payer’s comment or Beneficiary’s comment as a ”priority X”<br />

string, where X stands for 3 to 9. If the payment is transferred online, the priority shall be taken into<br />

consideration for queuing for transfer to <strong>KB</strong>I within the specific batch. If the transfer is carried out <strong>by</strong><br />

uploading the batches, the priority must be detected and transferred during uploading. The <strong>client</strong> can<br />

enter priority in the Debit or Credit comment fields or at the second left position of Constant symbol.<br />

The Debit comment field is detected for the priority first. If it does not contain the "PRIORITY" string,<br />

the Credit comment field is detected. If again the string is not there, CS is detected. If no priority is<br />

entered or priority 0, 1 or 2, the <strong>KB</strong>I standard priority of value 5 is transmitted, otherwise the <strong>client</strong>'s<br />

requirement will be transmitted.<br />

• Checking file integrity - number of payments (in the footer) = number of payments in the<br />

file,<br />

• In<strong>valid</strong> Constant symbols according to ČNB order (for the latest list, see help for Moje<strong>banka</strong> and Profi<strong>banka</strong>)<br />

• 0178 Guaranteed cheques<br />

• 1178 Payment cards<br />

• 2178 Cheques exceeding CZK 6500<br />

• 3178 Bank cheques awaiting clearance<br />

• 9 Cash<br />

• 3 Cheques in “short way”<br />

• 5 Cancellations<br />

• 0006 non-existing account<br />

• 1 execution<br />

• 51 execution<br />

• 0898 CHARGES<br />

• Only simple payment orders can be entered:<br />

• Payments in CZK within <strong>KB</strong> (payments and collections – regular)<br />

• Payments in FC within <strong>KB</strong> (same currency for account and contra-account)<br />

• Payments in FC within <strong>KB</strong> with conversion (different currency for account and contraaccount)<br />

• Payments in FC with agreed individual FX rates (FOREX) within <strong>KB</strong><br />

• Payments <strong>from</strong> FC to CZK, routed to Other Bank (regular, Express, Express with advice)<br />

In the Direct channel (DC) service, it is possible to transfer cancellation batches where only those<br />

orders that the <strong>client</strong> wants to cancel can be included in the batch. The in<strong>format</strong>ion specifying that<br />

cancellation is to be performed is contained in the batch header (CAN constant), where all records<br />

are considered cancelling ones regardless of the record type. A payment will be cancelled if it is not<br />

in the final status (rejected, booked, cancelled) and its Creation date and Payment sequential<br />

number are identical.<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

6/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

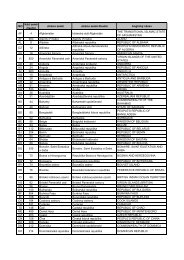

2.1.2 Description of import fields<br />

IMPORT in <strong>EDI</strong>_<strong>BEST</strong> <strong>format</strong><br />

Type of record - HI<br />

HEADER<br />

Type of record - 03<br />

Payment order 1<br />

Single payment orders<br />

Data file<br />

.<br />

.<br />

.<br />

Payment order n<br />

Type of record - TI<br />

FOOTER<br />

Fixed record size 600 <strong>by</strong>tes.<br />

Table comparing data content of <strong>BEST</strong> <strong>format</strong> x <strong>EDI</strong>_<strong>BEST</strong> (compulsory in<strong>format</strong>ion is in bold,<br />

in<strong>format</strong>ion with altered meaning is in grey cells)<br />

Header: domestic payments<br />

Se<br />

r.<br />

no.<br />

Name<br />

1. Type of<br />

message<br />

2. Type of<br />

<strong>format</strong><br />

3. Date of<br />

sending<br />

4. File<br />

identificati<br />

on<br />

5. CLI_<strong>KB</strong>I_<br />

ID<br />

leng<br />

th<br />

offse<br />

t<br />

<strong>format</strong><br />

Item:<br />

PAYM<br />

UL/DIR<br />

DEB<br />

data content in<br />

the <strong>EDI</strong> <strong>BEST</strong><br />

service<br />

2 0 X(2) HI HI<br />

required checks<br />

9 2 X(9) „<strong>EDI</strong>_<strong>BEST</strong> „ a constant defining the type of <strong>format</strong><br />

6 11 yymmd<br />

d<br />

CAINP<br />

D<br />

14 17 X(14) CUNIQ<br />

N<br />

35 31 X(35) CAIDK<br />

LI<br />

date of sending -<br />

refers to the check<br />

of duplicate data<br />

within the<br />

specified current<br />

date<br />

identification of<br />

the source file<br />

- identification of<br />

the <strong>client</strong>,<br />

assigned <strong>by</strong> <strong>KB</strong>I<br />

6. Cancellatio 3 66 X(3) CANC Cancellation sign CAN = cancellation file<br />

Date of creation of the file - YYMMDD <strong>format</strong>. If<br />

<strong>valid</strong>. type Creation date=current d. is activated, it<br />

must be identical with the current date<br />

Otherwise, only formal <strong>valid</strong>ation applied. (-31 to<br />

+364 days)<br />

Not <strong>valid</strong>ated; however, it is necessary to get back to the<br />

formal response to the REPORT <strong>valid</strong>ation in the Header<br />

and to transfer to AS. This in<strong>format</strong>ion will also be<br />

returned in the <strong>EDI</strong>_<strong>BEST</strong> electronic statement.<br />

This is assigned <strong>by</strong> the <strong>KB</strong>I system and must be equal<br />

to the identification in DB (note - it is defined as item 8<br />

(10) in DB)<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

7/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

n sign for<br />

the whole<br />

ODE<br />

file<br />

7. Filler 529 69 X(529) presently not used not <strong>valid</strong>ated<br />

and not checked<br />

8. File 2 598 X(2) CRLF not <strong>valid</strong>ated<br />

sentinel<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

Footer: domestic payments<br />

Se Name<br />

r.<br />

no<br />

.<br />

1. Type of<br />

message<br />

2. Type of<br />

<strong>format</strong><br />

3. Date of<br />

sending<br />

4. Number<br />

of records<br />

5. Checksu<br />

m<br />

len<br />

gth<br />

off<br />

set<br />

<strong>format</strong><br />

Item:<br />

PAYM<br />

UL/DIR<br />

DEB<br />

data content in<br />

the <strong>EDI</strong> <strong>BEST</strong><br />

service<br />

2 0 X(2) TI TI<br />

required checks<br />

9 2 X(9) „<strong>EDI</strong>_<strong>BEST</strong> „ a constant defining the type of <strong>format</strong><br />

6 11 yymmd<br />

d<br />

CAINP<br />

D<br />

6 17 9(6) CSUML<br />

I<br />

18 23 9(16)V9<br />

(2)<br />

CSUM<br />

AM<br />

date of sending<br />

the medium<br />

Number of<br />

payments in the<br />

file<br />

the sum of the<br />

Amount field for<br />

all payments<br />

YYMMDD <strong>format</strong>; it should equal the 12th to 17th<br />

positions in the header and should equal the current<br />

date<br />

number of records of type 01 transferred in the file<br />

sum total of all payments<br />

It will not be <strong>valid</strong>ated<br />

6. Filler 557 41 X(557) presently not not <strong>valid</strong>ated<br />

used and not<br />

checked<br />

7. File<br />

sentinel<br />

2 598 X(2) CRLF not <strong>valid</strong>ated<br />

Data record Domestic payment<br />

Ser.<br />

no.<br />

Name<br />

leng<br />

th<br />

offs<br />

et<br />

<strong>format</strong><br />

Item:<br />

PAYM<br />

UL/(DI<br />

RDEB)<br />

data content in<br />

the <strong>EDI</strong> <strong>BEST</strong><br />

service<br />

required checks<br />

1. Type of 2 0 X(2) 01 01 for payments<br />

record<br />

2. Seq. No. 35 2 X(35) CASER<br />

Q<br />

Item sequential<br />

number - must be<br />

unique for specific<br />

subject on specific<br />

creation date.<br />

Alphanumeric -<br />

must not be<br />

empty.<br />

Item sequential number - must be unique for the<br />

specific subject on the specific creation date.<br />

Alphanumeric field. Must not be in<strong>valid</strong> (in<strong>valid</strong><br />

characters, empty (spaces), duplicate)<br />

Only SWIFT set characters are allowed.<br />

3. Creation<br />

date<br />

8 37 yyyym<br />

mdd<br />

4. Due date 8 45 yyyym<br />

mdd<br />

5. Account<br />

currency<br />

code<br />

CAINP<br />

D<br />

CAVAL<br />

D<br />

3 53 X(3) CACU<br />

RN<br />

Date of creating<br />

the item<br />

Required due<br />

date<br />

ISO code of the<br />

currency<br />

6. Amount 15 56 9(13)V9 CAAM amount of 1. numeric<br />

1. <strong>valid</strong> date YYYYMMDD<br />

2. If <strong>valid</strong>. type Creation date=current d. is activated,<br />

it must be identical with the current date<br />

Otherwise, only formal <strong>valid</strong>ation applied. (-31 to<br />

+364 days)<br />

1. <strong>valid</strong> date YYYYMMDD<br />

2. not older than the current date<br />

3. equal to the current date or up to + 364 days<br />

4. must not be a holiday or calendar day off<br />

ISO code of the currency<br />

1. matches the code of currency of the account<br />

2. Collection order may only be for CZK<br />

3. For other currencies, contra-account currency<br />

must be checked; if it is not CZK, the contraaccount<br />

bank code may only be 0100<br />

4. Weak currencies should be entered without<br />

decimals<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

8/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

of<br />

(2) NT payment 2. not zero<br />

payment<br />

3. the last positions must be 00 for weak<br />

currencies<br />

7. Operatio<br />

n code<br />

8. Contraaccount<br />

currency<br />

code<br />

9. Conversi<br />

on code<br />

1 71 X(1) constan<br />

t<br />

accordi<br />

ng to<br />

the<br />

message<br />

0 -for PAYMUL<br />

(CARTCC=11),<br />

1 - DIRDEB<br />

(CARTCC=32)<br />

3 72 X(3) Contra-account<br />

currency for<br />

payments with<br />

conversion in <strong>KB</strong><br />

1 75 X(1) For payments with<br />

conversion in <strong>KB</strong> -<br />

in<strong>format</strong>ion on<br />

whether the amount<br />

is in the account<br />

currency (U) or<br />

contra-account<br />

currency (C)<br />

10. CS 10 76 9(10) CAEPC<br />

H<br />

11. AV 140 86 X(140) CACMS<br />

message<br />

G1-2<br />

12. Code of 7 226 9(7) CABKI<br />

payer’s<br />

D<br />

bank<br />

(CABK<br />

SD)<br />

13. Payer’s<br />

account<br />

number<br />

14. Payer’s<br />

VS<br />

15. Payer’s<br />

SS<br />

16. Payer’s<br />

comment<br />

17. Code of<br />

beneficia<br />

ry’s bank<br />

16 233 9(16) CAFAC<br />

C<br />

(CALA<br />

CC)<br />

10 249 9(10) CADBP<br />

R<br />

(CACR<br />

PR)<br />

10 259 9(10) CADBA<br />

N<br />

(CACR<br />

AN)<br />

140 269 X(140) CADBI<br />

D1 - 4<br />

(CACRI<br />

D1-4)<br />

7 409 9(7) CABKS<br />

D<br />

(CABK<br />

ID)<br />

0 - payment, 1 - collection<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

if spaces or zeroes - then contra-account currency =<br />

account currency<br />

if account currency NOT = contra-account currency, then<br />

payment with conversion<br />

If currency NOT CZK, then only the “0100”<br />

beneficiary’s bank allowed.<br />

If “P”, then amount in contra-account currency, else<br />

amount in account currency<br />

For payments transferred <strong>from</strong> <strong>EDI</strong>, “P” is always used.<br />

Constant symbol Does not contain illegal CS.<br />

Include into Priority detection as the 3rd criterion<br />

message for not <strong>valid</strong>ated<br />

beneficiary<br />

Bank code 0000100<br />

payer’s account<br />

number<br />

according to the<br />

planned adjustment<br />

of ČNB, it will not<br />

be possible to<br />

distinguish 2<br />

payer’s variable<br />

symbols and the<br />

in<strong>format</strong>ion will be<br />

replaced with<br />

beneficiary’s VS.<br />

according to the<br />

planned adjustment<br />

of ČNB, it will not<br />

be possible to<br />

distinguish 2<br />

payer’s specific<br />

symbols and the<br />

in<strong>format</strong>ion will be<br />

replaced with<br />

beneficiary’s SS.<br />

Payer’s comment<br />

Code of<br />

beneficiary's bank<br />

Zeros must be added <strong>from</strong> the left; must not<br />

contain a delimiter<br />

1. numeric field<br />

2. modulo 11<br />

3. is not 0<br />

4. access rights<br />

5. must not be equal to the contra-account, if it<br />

is within <strong>KB</strong><br />

6. the account must be of the A status<br />

The value will be replaced with beneficiary’s VS<br />

field.<br />

The value will be replaced with beneficiary’s SS<br />

field.<br />

not <strong>valid</strong>ated<br />

Included in the library of banks<br />

If contra-account currency is FC, the bank must<br />

be 0100<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

9/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

18. Ben. 16 416 9(16) CALAC<br />

account<br />

C<br />

no.<br />

(CAFA<br />

CC)<br />

19. Beneficia<br />

ry's VS<br />

20. Beneficia<br />

ry's SS<br />

21. Beneficia<br />

ry's<br />

comment<br />

10 432 9(10) CACRP<br />

R<br />

(CADB<br />

PR)<br />

10 442 9(10) CACRA<br />

N<br />

(CADB<br />

AN)<br />

140 452 X(140) CACRI<br />

D1-4<br />

(CADBI<br />

D1-4)<br />

Ben. account<br />

no.<br />

Beneficiary's<br />

variable symbol<br />

the only VS symbol<br />

that can be<br />

currently entered<br />

according to ČNB<br />

the only SS symbol<br />

that can be<br />

currently entered<br />

according to ČNB<br />

Beneficiary's<br />

comment<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

Zeros must be added <strong>from</strong> the left; must not<br />

contain a delimiter<br />

1. numeric field<br />

2. modulo 11<br />

3. not 0<br />

1. numeric (excess positions must be zeroes)<br />

1. numeric<br />

If SS=”9999999999”, then the beneficiary’s name is<br />

not displayed in the transaction history EXPORTs<br />

not <strong>valid</strong>ated<br />

22. PRIORIT<br />

Y<br />

3 592 X(3) Priority 5 <strong>by</strong> default, otherwise 3 to 9 selected <strong>by</strong> <strong>client</strong>. Other =<br />

5.<br />

23. EXPRESS 1 595 X(1) CAEXP<br />

RE<br />

Express and<br />

Express with<br />

E=express<br />

A=express with SWIFT, other=standard<br />

advice<br />

24. FOREX 1 596 X(1) Only for FC with<br />

agreed rate<br />

“Y” in case of agreed rate, else according to<br />

exchange rate list<br />

(taken <strong>from</strong><br />

FRXIDENT<br />

(PAYMUL Z)<br />

25. Filler 1 597 X(1) not used<br />

26. File<br />

sentinel<br />

2 598 X(2) CRLF not <strong>valid</strong>ated<br />

List of rules for ensuring a single value for VS and SS symbols:<br />

Payer’s VS Beneficiary’s VS after Payer’s SS Beneficiary’s SS after<br />

VS<br />

<strong>valid</strong>ation<br />

SS<br />

<strong>valid</strong>ation<br />

zero X X Zero X X<br />

Y X X Y(not X<br />

X<br />

9999999999)<br />

Y zero Y Y zero Y<br />

9999999999 X 9999999999<br />

Note: VS and SS after <strong>valid</strong>ation means that the same value defined in that column will be included in both symbols in the<br />

DCS database at that particular payment.<br />

To ensure consistent contents of symbols during run-up of the change at the <strong>client</strong>’s side, the<br />

following rule applies for rewriting: in case no value is entered in the beneficiary’s symbol and the<br />

value in the payer’s symbol is <strong>valid</strong>, this value will remain. This means only beneficiary’s VS and SS<br />

value will be taken and copied into the payer’s VS and SS. Only in case when the beneficiary’s<br />

symbol is not entered, and the payer’s symbol is not zero, the payer’s symbol value will be taken<br />

over. The exceptional case is when payer’s SS is “9999999999”; in this case this value must be<br />

copied to the beneficiary’s SS regardless of the value of the beneficiary’s SS. Common <strong>valid</strong>ations<br />

for VS and SS remain. The “9999999999” symbol can be entered in case a <strong>client</strong> requires to<br />

suppress the beneficiary’s account name in the transaction history (available only for payments<br />

within <strong>KB</strong>).<br />

2.2 Foreign payments<br />

2.2.1 General in<strong>format</strong>ion<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

10/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

The file with payments contains one header, “n” payments and one footer. Record length - fixed 912<br />

<strong>by</strong>tes.<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

• Checking file integrity - number of payments (in the footer) = number of payments in the<br />

file,<br />

• Only simple payment orders can be entered<br />

• Payments in FC outside <strong>KB</strong><br />

• Payments in CZK outside the Czech Republic<br />

• In the Direct channel (DC) service, it is possible to transfer cancellation batches where only<br />

those orders that the <strong>client</strong> wants to cancel can be included in the batch. The in<strong>format</strong>ion<br />

specifying that cancellation is to be performed is contained in the batch header (CAN<br />

constant), where all records are considered cancelling ones regardless of the record type.<br />

A payment will be cancelled if it is not in the final status (rejected, booked, cancelled) and<br />

its Creation date and Payment sequential number are identical.<br />

2.2.2 Description of import fields<br />

IMPORT in <strong>EDI</strong>_<strong>BEST</strong> <strong>format</strong><br />

Type of record - HI<br />

HEADER<br />

Type of record - 02<br />

Type OF record – 03 for SEPA<br />

Type of record – 04 for SEPA<br />

Payment order 1<br />

Single payment orders<br />

Data file<br />

.<br />

.<br />

.<br />

Payment order n<br />

Type of record - TI<br />

FOOTER<br />

Definition of <strong>EDI</strong> <strong>BEST</strong> <strong>format</strong><br />

Header: foreign payments<br />

Se Name<br />

r.<br />

no.<br />

1. Type of<br />

message<br />

2. Type of<br />

<strong>format</strong><br />

3. Date of<br />

sending<br />

4. File<br />

identifica<br />

len<br />

gth<br />

offse<br />

t<br />

<strong>format</strong><br />

Item:<br />

PAYMUL/<br />

DIRDEB<br />

data content in<br />

the <strong>EDI</strong> <strong>BEST</strong><br />

service<br />

2 0 X(2) HI HI<br />

required checks<br />

9 2 X(9) „<strong>EDI</strong>_<strong>BEST</strong> „ a constant defining the type of <strong>format</strong><br />

6 11 yymmdd FDATCRS date of sending -<br />

refers to the check<br />

of duplicate data<br />

within the<br />

specified current<br />

date<br />

14 17 X(14) FUNIQN identification of<br />

the source file<br />

Date of creation of the file - YYMMDD <strong>format</strong>. If<br />

<strong>valid</strong>. type Creation date=current d. is activated, it<br />

must be identical with the current date<br />

Otherwise, only formal <strong>valid</strong>ation applied. (-31 to<br />

+364 days)<br />

Not <strong>valid</strong>ated; however, it is necessary to get back to the<br />

formal response to the REPORT <strong>valid</strong>ation in the Header<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

11/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

tion<br />

5. Identifica<br />

tion of<br />

the <strong>client</strong><br />

6 Cancellat<br />

ion sign<br />

for the<br />

whole file<br />

35 31 X(35) FAIDKLI DI ID -<br />

identification of<br />

the <strong>client</strong><br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

and to transfer to AS.<br />

It must be equal to the identification in DB (note - it is<br />

defined as item 8 (10) in DB).<br />

3 66 X(3) CANCODE Cancellation sign All that is not CAN is an order<br />

7. Filler 84 69 X(841) presently not used not <strong>valid</strong>ated<br />

1<br />

and not checked<br />

8. File<br />

sentinel<br />

2 910 X(2) CRLF not <strong>valid</strong>ated<br />

Footer: foreign payments<br />

Ser Name<br />

.<br />

no.<br />

1. Type of<br />

messa<br />

ge<br />

2. Type of<br />

<strong>format</strong><br />

3. Date of<br />

sendin<br />

g<br />

4. Numbe<br />

r of<br />

record<br />

s<br />

5. Checks<br />

um<br />

len<br />

gth<br />

off<br />

set<br />

<strong>format</strong><br />

Item:<br />

PAYMUL/<br />

DIRDEB<br />

data content in<br />

the <strong>EDI</strong> <strong>BEST</strong><br />

service<br />

2 0 X(2) TI TI<br />

required checks<br />

9 2 X(9) „<strong>EDI</strong>_<strong>BEST</strong> „ a constant defining the type of <strong>format</strong><br />

6 11 yymmdd FDATCRS date of sending<br />

the medium<br />

6 17 9(6) FSUMLI Number of<br />

payments in the<br />

file<br />

18 23 9(16)V9(2<br />

)<br />

FSUMAM<br />

the sum of the<br />

Amount field for<br />

all payments<br />

YYMMDD <strong>format</strong>; it should equal the 12th to 17th<br />

positions in the header and should equal the current<br />

date<br />

number of records of types 02, 03 and 04<br />

transferred in the file<br />

sum total of all payments<br />

It will not be <strong>valid</strong>ated<br />

6. Filler 869 41 X(869) presently not not <strong>valid</strong>ated<br />

used and not<br />

checked<br />

7. File<br />

sentine<br />

l<br />

2 910 X(2) CRLF not <strong>valid</strong>ated<br />

Data record Foreign payment<br />

Ser. Name leng offs <strong>format</strong><br />

data content in required checks<br />

no.<br />

th et<br />

the <strong>EDI</strong> service<br />

1. Type of 2 0 X(2) 02 02 - foreign payment<br />

record<br />

(required<br />

field)<br />

2. Filler 6 2 X(6) not used<br />

3. Seq. No<br />

(required<br />

field)<br />

4. Creation<br />

date<br />

(required<br />

field)<br />

5. Due date<br />

(required<br />

field)<br />

35 8 X(35) FASERQ Item sequential<br />

number - must be<br />

unique for specific<br />

subject on specific<br />

creation date.<br />

Alphanumeric<br />

field. It must not<br />

be empty.<br />

8 43 yyyymmd<br />

d<br />

8 51 yyyymmd<br />

d<br />

FDATCRS<br />

Date of creating<br />

the item<br />

Item sequential number - must be unique for<br />

the specific subject on the specific creation<br />

date. Alphanumeric field. Must not be in<strong>valid</strong><br />

(in<strong>valid</strong> characters, empty (spaces),<br />

duplicate)<br />

Only SWIFT set characters are allowed.<br />

1. <strong>valid</strong> date YYYYMMDD<br />

2. If <strong>valid</strong>. type Creation date=current d. is<br />

activated, it must be identical with the<br />

current date<br />

Otherwise, only formal <strong>valid</strong>ation applied (-<br />

31 to +364 days).<br />

FAVALD Required due date 1. <strong>valid</strong> date YYYYMMDD<br />

2. not older than the current date<br />

3. equal to the current date or up to + 364<br />

days<br />

4. must not be a holiday or calendar day<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

12/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

6. Payment<br />

currency<br />

code<br />

(required<br />

field)<br />

7. Amount of<br />

payment<br />

(required<br />

field)<br />

8. Payer of<br />

charges<br />

(default: SHA<br />

- optional<br />

field)<br />

9. Number of<br />

account for<br />

charges<br />

(optional<br />

field)<br />

10. ISO currency<br />

code of<br />

account for<br />

charges<br />

(optional<br />

field)<br />

11. Express<br />

payment<br />

(default E -<br />

optional field)<br />

3 59 X(3) FACCYC ISO code of the<br />

currency<br />

15 62 9(13)V9(2<br />

)<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

off<br />

5. Urgent payments <strong>by</strong> 12:00, Express<br />

payments <strong>by</strong> 15:00.<br />

1. ISO code of the currency <strong>banka</strong>ble<br />

(marketable) in <strong>KB</strong><br />

2. IN currencies must not be used after 31<br />

December 2001<br />

3. Only in EUR for SEPA.<br />

FAAMNT amount 1. must be numeric data<br />

2.. must not be zero<br />

3. the last positions must be 00 for weak<br />

currencies<br />

3 77 X(3) FABENO OUR, BEN, SHA,<br />

STD, SLV<br />

16 80 9(16) FACDRO Number of<br />

account for<br />

charges<br />

3 96 X(3) FACCCH Currency code for<br />

charges<br />

Applicable: OUR (paid <strong>by</strong> the payer), SHA<br />

(paid <strong>by</strong> both), BEN (paid <strong>by</strong> beneficiary). STD<br />

(both pay; SHA shall be entered in DB), SLV<br />

(in case of SEPA payment). If the abbreviation<br />

is not <strong>valid</strong> or the field is not filled in, SHA will<br />

be substituted.<br />

From 1 November 2009 to 20 November<br />

2009, the BEN charge cannot be used<br />

under the following conditions:<br />

• the beneficiary’s bank country<br />

belonging to EES<br />

• all currencies<br />

From 21 November 2009, the BEN charge<br />

cannot be used under the following<br />

conditions:<br />

• the beneficiary’s bank country<br />

belonging to EES<br />

• the currency of a country<br />

belonging to EES<br />

1. Must be aligned to the right; must not<br />

contain a delimiter.<br />

If not filled in, the payer’s account number<br />

will be used.<br />

2. modulo 11<br />

3. access rights<br />

4. Account status must be A; the type of<br />

account must be CK<br />

If not specified elsewhere, it is <strong>valid</strong>ated for<br />

data in the DB; otherwise, the currency<br />

registered in the DB will be taken.<br />

.<br />

1 99 X(1) FASWPC EXPRESS request differentiation of "U"=urgent payments, all<br />

remaining are to be considered "E"=express<br />

(Urgent must be delivered until 12.00,<br />

Express until 15:00 of the specified day).<br />

For SEPA, “U” is not available.<br />

12. Filler 10 100 9(10) FAPMTT payment title not used<br />

13. Filler 10 110 9(10) not transferred for <strong>KB</strong> purposes<br />

14. Filler 10 120 9(10) not transferred not <strong>valid</strong>ated<br />

(DS3/SS)<br />

assigned <strong>by</strong><br />

system<br />

15. FOREX 1 130 X(1) FRXIDENT Y in case of agreed Y = FOREX<br />

FOREX<br />

16. Filler (FOREX 16 131 X(16) Presently, FOREX Presently not in operation without <strong>valid</strong>ation<br />

ID)<br />

identification is not<br />

necessary in <strong>KB</strong>.<br />

The FOREX<br />

marking in the<br />

previous field is<br />

enough.<br />

17. Code of 7 147 9(7) FABKID always 0000100 0000100<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

13/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

payer’s bank<br />

(required<br />

field)<br />

18.. Payer’s 16 154 9(16) FADACC Account number 1. must be numeric field<br />

account<br />

2. must comply with modulo 11<br />

number<br />

3. is not 0<br />

(required<br />

4. the user has access rights<br />

field)<br />

5. it is either CA (current acc.) in the "A"<br />

(active) status or TA (term acc.) in the "A"<br />

status.<br />

19. Payer’s<br />

currency<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

3 170 X(3) FACCDA account currency If not specified elsewhere, it is <strong>valid</strong>ated for<br />

data in the DB; otherwise, the currency<br />

registered in the DB will be taken<br />

.<br />

20. Filler 105 173 X(105) reserve<br />

21. SWIFT code of<br />

beneficiary's<br />

bank (optional)<br />

35 278 X(35) FAACB presently, the<br />

SWIFT code of<br />

beneficiary’s bank<br />

Optional field; if filled in, the code must be in<br />

the library of bank SWIFT codes<br />

Required for SEPA payments.<br />

22.. Payer’s<br />

address<br />

23. Details of<br />

payment<br />

35 x<br />

4<br />

35 x<br />

4<br />

313 X(140) FAORA1 - 4 presently not<br />

transferred; the<br />

address <strong>valid</strong> for<br />

the account is taken<br />

453 X(140) FAINC1-3 all 140 characters<br />

are transferred<br />

24. Filler 1 593 X(1) assumption “/”, no<br />

<strong>valid</strong>ations<br />

25. Beneficiary’s 34 594 X(34) FACAC Ben. account<br />

account<br />

no.<br />

(required<br />

unless the<br />

Payment <strong>by</strong><br />

cheque sign<br />

is used)<br />

26. Beneficiary's<br />

name<br />

27. Beneficiary's<br />

street<br />

28. Beneficiary's<br />

town<br />

29. Beneficiary's<br />

country<br />

the address related to the account in the DB is<br />

taken over, not this one. Not <strong>valid</strong>ated<br />

All 140 characters are transferred (in TH -<br />

contained in the AV field)<br />

If the /VS/nnn string is found, nnn characters<br />

(up to 10 digits) will be considered a variable<br />

symbol and will be used (in this form) in<br />

transaction history and in the VS field of the<br />

payment, too.<br />

Similarly, the constant symbol will be<br />

detected in this field. It should start with the<br />

/CS/nnn string, where nnn (up to 7 digits)<br />

will be considered a constant symbol. CS<br />

must not contain in<strong>valid</strong> CSs. A <strong>valid</strong> CS will<br />

also be found in TH and in the CS field of the<br />

payment.<br />

assumption “/”, no <strong>valid</strong>ations<br />

it will be <strong>valid</strong>ated for payments within<br />

EU, where it is recommended to enter it<br />

in IBAN <strong>format</strong> according to<br />

requirements of the target country. If not<br />

observed, the beneficiary’s bank may<br />

increase charges for manual processing<br />

and the <strong>client</strong> will receive a notification.<br />

(the <strong>client</strong> types in the account number or<br />

the "PAYMENT BY CHEQUE" string. If the<br />

payment is to a name, he/she will leave the<br />

field empty). The beneficiary’s address<br />

must be filled in when paying <strong>by</strong> cheque.<br />

Only IBAN for SEPA.<br />

35 628 35 FACNAM name considered as the name - a required field. In<br />

case the address block of the SEPA payment<br />

has been transferred in record 03, only the<br />

values of record 03 will be transferred.<br />

35 663 35 FACAD1 beneficiary's<br />

street<br />

35 698 35 FACAD2 Beneficiary's<br />

Town and<br />

Postcode<br />

35 733 35 CTRYBE ISO code of<br />

beneficiary's<br />

regarded as the street – optional for SEPA<br />

In case the address block of SEPA payment<br />

has been transferred to record 03, only values<br />

of record 03 will be transferred to the<br />

partner.<br />

regarded as the town – optional for SEPA<br />

In case the address block of SEPA payment<br />

has been transferred to record 03, only values<br />

of record 03 will be transferred to the<br />

partner.<br />

Beneficiary's country is compulsory.<br />

In case the address block of SEPA payment<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

14/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

has been transferred to record 03, only values<br />

of record 03 will be transferred to the<br />

partner.<br />

30. Bank name 35 768 35 FABAN name name (compulsory unless SWIFT code is<br />

filled in). For SEPA payments, SWIFT code<br />

is compulsory.<br />

31. Bank street 35 803 35 FABAA1 1st address row street (optional even if SWIFT code is not<br />

filled in). For SEPA payments, SWIFT code<br />

is compulsory.<br />

32. Bank town 35 838 35 FABAA2 2nd address row town (compulsory unless SWIFT code is<br />

filled in). For SEPA payments, SWIFT code<br />

33. country,<br />

bank NCC<br />

34. Payment <strong>by</strong><br />

cheque sign<br />

(optional)<br />

country<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

is compulsory.<br />

35 873 35 FACTRY 3rd address row country (compulsory unless SWIFT code is<br />

filled in). For SEPA payments, SWIFT code<br />

is compulsory.<br />

1 908 X(1) FACAC ”Y” = payment <strong>by</strong><br />

cheque, other to<br />

the account<br />

35. SEPA sign 1 909 X(1) “Y” - SEPA<br />

payment<br />

36. File sentinel 2 910 X(2) CRLF<br />

<strong>EDI</strong> Inhouse - if the “PAYMENT BY<br />

CHEQUE” string is in the beneficiary’s<br />

account number, then the sign = “Y”.<br />

“Y” not allowed for SEPA.<br />

A payment marked this way is transferred to<br />

the partner under SEPA conditions and it<br />

can contain other optional data contained in<br />

types of record “03” or “04” *<br />

* note - record 04 containing in<strong>format</strong>ion defined in Rule book 3 is ready and the bank will<br />

transfer this in<strong>format</strong>ion only after the book has been approved. The <strong>client</strong> will be informed <strong>by</strong><br />

means of WWW.<strong>KB</strong>.CZ.<br />

Beneficiary’s bank - address - fields 31 - 34<br />

Bank Bank name<br />

name<br />

Bank street Street<br />

Bank town<br />

Country,<br />

NCC code<br />

Postcode, Town<br />

Country - ISO code + optional NCC bank code<br />

Positions 1-3: Country ISO code of the beneficiary’s bank, either in 9(3) <strong>format</strong> or X(2)<br />

<strong>format</strong> with an additional space.<br />

Position 4: space<br />

Positions 5-35: optional NCC code in the ”//xx” <strong>format</strong>. If chars at positions 5-8 match this<br />

<strong>format</strong>, the chars at positions 7-35 will be imported (”/” chars are not imported).<br />

Excess spaces will be ignored.<br />

Record 03 - if non-accounting data are transferred for SEPA payment; record 02 - “Y” stands in the<br />

position 909.<br />

The <strong>client</strong> transfers this record in order to transfer any of the fields 5 to 12 in the full extent to the<br />

partner.<br />

Type of record 03 - Data record Foreign payment - optional data of the beneficiary and payer<br />

Ser. Name leng offset <strong>format</strong> mapping in data content in required checks<br />

no.<br />

th<br />

<strong>EDI</strong>/MCB the <strong>EDI</strong> service<br />

1. Type of<br />

record<br />

2 0 X(2) 03 “03” - SEPA addition - the record will be<br />

created only if at least one SEPA field is<br />

non-zero - paired with record 02 according<br />

to the sequential number of the item.<br />

Records 03 and 04 must follow the<br />

appropriate record 02 (sequential number of<br />

the item is identical).<br />

2. Filler 6 2 X(6) not used<br />

3. Seq. No.<br />

Client<br />

sequential<br />

35 8 X(35) The item sequential<br />

number to which<br />

this SEPA addition<br />

The item sequential number is unique for the<br />

parental record and located in the file of type of<br />

record 02.<br />

number<br />

belongs.<br />

4. Payment type 2 43 X(2) Credit Transfer - CT <strong>by</strong> default; only if DD is necessary, then<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

15/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

5. Address<br />

block<br />

Beneficiary's<br />

name<br />

-<br />

6. Address<br />

block<br />

Beneficiary’s<br />

address<br />

-<br />

7. Address<br />

block<br />

Beneficiary's<br />

country<br />

-<br />

8. Type of<br />

beneficiary<br />

-<br />

9. Beneficiary’s<br />

identification<br />

code<br />

-<br />

10. Type of<br />

payer<br />

-<br />

11. Payer’s<br />

identification<br />

code<br />

-<br />

“CT“<br />

Direct Debit -<br />

„DD“<br />

70 45 X(70) SEPA field 21 - the<br />

name of the<br />

Beneficiary<br />

140 115 X(140) SEPA field 22 - the<br />

address of the<br />

Beneficiary<br />

2 255 X(2) alphanumeric ISO<br />

code of the<br />

partner’s country<br />

1 257 X(1) “O” = business<br />

“S” - nonbusiness<br />

105 258 X(105) SEPA field 24 -<br />

The beneficiary’s<br />

identification<br />

code, nonstructured<br />

form<br />

1 363 X(1) “O” = business<br />

“S” - nonbusiness<br />

105 364 X(105) SEPA field 10 -<br />

The payer’s<br />

identification<br />

code, nonstructured<br />

form<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

Direct Debit (in SEPA 1, only CT will be<br />

resolved and DD will be rejected)<br />

only SWIFT characters - in the receipt of<br />

conversion<br />

SEPA name can be larger than in a<br />

standard FPO; if specified in record 03, the<br />

longer record is used.<br />

2 x 70 characters - only SWIFT characters<br />

in the receipt of conversion<br />

SEPA address can be larger than in a<br />

standard FPO; if specified in the record 03,<br />

the longer record is used.<br />

ISO code of beneficiary's country<br />

This type determines data of the Identification<br />

code, where 2 x 35 characters are used for “O”<br />

and 3 x 35 characters are used for “S” - see the<br />

description of the next field.<br />

“O” is default - if the character is in<strong>valid</strong>,<br />

default is used.<br />

Used in receipt of conversion to permitted<br />

character set for SWIFT. Other <strong>valid</strong>ations are<br />

not required.<br />

In non-structured form, the „;“ separator is used<br />

and the following form is recommended for<br />

filling in:<br />

„name-identification1= text; nameidentification2=text;<br />

nameidentificationN=text;“,<br />

where the actual values<br />

are in the text and the name of the selected<br />

identification is in the name-identification<br />

(names are defined <strong>by</strong> the <strong>client</strong> himself).<br />

In structured form transfer:<br />

For business persons:<br />

1. line - value of identification with “ID=”<br />

prefix (such as „ID=file index AZ 1689“<br />

2. line: Issuer with “IS=” prefix (such as<br />

“IS=Register court in Prague”<br />

3. line empty<br />

For non-business persons:<br />

1. line: Identification type with “TI” prefix<br />

(such as “TI=driving license number”<br />

2. line: value of identification with “ID=” prefix<br />

(such as „ID=AM 801386“<br />

3. line: Issuer with “IS=” prefix (such as<br />

“IS=Licensing authority in Prague”<br />

This type determines data of the Identification<br />

code, where 2 x 35 characters are used for “O”<br />

and 3 x 35 characters are used for “S” - see the<br />

description of the next field.<br />

“O” is default - if the character is in<strong>valid</strong>,<br />

default is used.<br />

Used in receipt of conversion to permitted<br />

character set for SWIFT. Other <strong>valid</strong>ations are<br />

not required.<br />

In non-structured form, the „;“ separator is used<br />

and the following form is recommended for<br />

filling in:<br />

„name-identification1= text; nameidentification2=text;<br />

nameidentificationN=text;“,<br />

where the actual values<br />

are in the text and the name of the selected<br />

identification is in the name-identification<br />

(names are defined <strong>by</strong> the <strong>client</strong> himself).<br />

In structured form transfer:<br />

16/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

12. Payer's<br />

reference<br />

-<br />

35 469 X(35) SEPA field 41 -<br />

The payer’s<br />

reference of the<br />

Credit transfer<br />

transaction<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

For business persons:<br />

1. line - value of identification with “ID=”<br />

prefix (such as „ID=file index AZ 1689“<br />

2. line: Issuer with “IS=” prefix (such as<br />

“IS=Register court in Prague”<br />

3. line empty<br />

For non-business persons:<br />

1. line: Identification type with “TI” prefix<br />

(such as “TI=driving license number”<br />

2. line: value of identification with “ID=” prefix<br />

(such as „ID=AM 801386“<br />

3. line: Issuer with “IS=” prefix (such as<br />

“IS=Licensing authority in Prague”<br />

If not filled in, the Item sequential<br />

number field is transferred to the<br />

partner.<br />

13. Filler 70 504 X(70) Payer's name<br />

-<br />

SEPA 02 field - The name of the payer - now<br />

taken <strong>from</strong> the DB and not transferred <strong>from</strong> the<br />

<strong>client</strong>.<br />

14. Filler 140 574 X(140) Payer’s address - 2 x 70 characters, only<br />

SWIFT chars in the receipt of SEPA<br />

conversion field 03 The address of the<br />

payer.<br />

now taken <strong>from</strong> the DB and not transferred<br />

<strong>from</strong> the <strong>client</strong>.<br />

15. Filler 2 714 X(2) Payer’s country - alphanumeric ISO code<br />

of the payer’s country - checking its<br />

<strong>valid</strong>ity; if not <strong>valid</strong>, no transfer is carried<br />

out.<br />

now taken <strong>from</strong> the DB and not transferred<br />

<strong>from</strong> the <strong>client</strong>.<br />

16. Filler 194 716 X(194) reserve<br />

17.. File sentinel 2 910 X(2) CRLF record end character<br />

Record 04 - if non-accounting data are transferred for SEPA payment; record 02 - “Y” stands in<br />

position 909.<br />

The <strong>client</strong> transfers this record in order to transfer any of the fields 5 to 10 in the full extent to the<br />

partner. These fields will be transferred to the partner only after Rule Book 3 has been approved.<br />

Clients will be informed <strong>by</strong> means of WWW.<strong>KB</strong>.CZ<br />

Type of record 04 - Data record Foreign payment SEPA part - optional data of the Final<br />

beneficiary and the Original payer (ignored for the time being and not transferred to the<br />

partner; ready for later use)<br />

Ser. Name leng offset <strong>format</strong> mapping in data content in required checks<br />

no.<br />

th<br />

<strong>EDI</strong>/MCB the <strong>EDI</strong> service<br />

1. Type of<br />

record<br />

2 0 X(2) 04 “04” - SEPA addition - the record will be<br />

created only if at least one SEPA field is<br />

non-zero - paired with record 02 according<br />

to the sequential number of the item.<br />

Records 03 and 04 must follow the<br />

appropriate record 02 (sequential number of<br />

the item is identical).<br />

2. Filler 6 2 X(6) not used<br />

3. Seq. No.<br />

Client<br />

sequential<br />

number<br />

35 8 X(35) The item sequential<br />

number to which<br />

this SEPA addition<br />

belongs.<br />

The item sequential number is unique for the<br />

parental record and located in the file of type of<br />

record 02.<br />

4. Payment type 2 43 X(2) Credit Transfer -<br />

“CT“ or<br />

Direct Debit -<br />

„DD“<br />

CT <strong>by</strong> default; only if DD is necessary, then<br />

Direct Debit (in SEPA 1, only CT will be<br />

resolved).<br />

(In SEPA 1, only CT will be resolved and<br />

DD will be rejected.)<br />

17/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

5. Final 70 45 X(70) SEPA field 28 -<br />

beneficiary’s<br />

the name of the<br />

name<br />

Beneficiary’s<br />

-<br />

reference<br />

6. Type of final<br />

beneficiary<br />

-<br />

7. Final<br />

beneficiary’s<br />

identification<br />

code<br />

-<br />

8. Original<br />

payer’s<br />

name<br />

-<br />

9. Type of<br />

original<br />

payer<br />

-<br />

10. Original<br />

payer’s<br />

identification<br />

code<br />

-<br />

1 115 X(1) “O” = business<br />

“S” - nonbusiness<br />

105 116 X(105) SEPA field 29 -<br />

the code of the<br />

Beneficiary’s<br />

reference<br />

non-structured<br />

form of the<br />

identification<br />

code<br />

70 221 X(70) SEPA field 08 -<br />

the name of the<br />

original payer’s<br />

reference<br />

1 291 X(1) “O” = business<br />

“S” - nonbusiness<br />

105 292 X(105) SEPA field 09 -<br />

the code of the<br />

original payer’s<br />

reference<br />

non-structured<br />

form of the<br />

identification<br />

code<br />

<strong>Komerční</strong> <strong>banka</strong>, a.s., registered office:<br />

Praha 1, Na Příkopě 33, 969, Postcode 114 07, IČ (Company<br />

ID): 45317054<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

only SWIFT characters - in the receipt of<br />

conversion<br />

This type determines data of the Identification<br />

code, where 2 x 35 characters are used for “O”<br />

and 3 x 35 characters are used for “S” - see the<br />

description of the next field.<br />

“O” is default - if the character is in<strong>valid</strong>,<br />

default is used.<br />

Used in receipt of conversion to permitted<br />

character set for SWIFT. Other <strong>valid</strong>ations are<br />

not required.<br />

In non-structured form, the „;“ separator is used<br />

and the following form is recommended for<br />

filling in:<br />

„name-identification1= text; nameidentification2=text;<br />

nameidentificationN=text;“,<br />

where the actual values<br />

are in the text and the name of the selected<br />

identification is in the name-identification<br />

(names are defined <strong>by</strong> the <strong>client</strong> himself).<br />

In structured form transfer:<br />

For business persons:<br />

1. line - value of identification with “ID=”<br />

prefix (such as „ID=file index AZ 1689“<br />

2. line: Issuer with “IS=” prefix (such as<br />

“IS=Register court in Prague”<br />

3. line empty<br />

For non-business persons:<br />

1. line: Identification type with “TI” prefix<br />

(such as “TI=driving license number”<br />

2. line: value of identification with “ID=” prefix<br />

(such as „ID=AM 801386“<br />

3. line: Issuer with “IS=” prefix (such as<br />

“IS=Licensing authority in Prague”<br />

only SWIFT characters - in the receipt of<br />

conversion<br />

This type determines data of the Identification<br />

code, where 2 x 35 characters are used for “O”<br />

and 3 x 35 characters are used for “S” - see the<br />

description of the next field.<br />

“O” is default - if the character is in<strong>valid</strong>,<br />

default is used.<br />

Used in receipt of conversion to permitted<br />

character set for SWIFT. Other <strong>valid</strong>ations are<br />

not required.<br />

In non-structured form, the „;“ separator is used<br />

and the following form is recommended for<br />

filling in:<br />

„name-identification1= text; nameidentification2=text;<br />

nameidentificationN=text;“,<br />

where the actual values<br />

are in the text and the name of the selected<br />

identification is in the name-identification<br />

(names are defined <strong>by</strong> the <strong>client</strong> himself).<br />

In structured form transfer:<br />

For business persons:<br />

1. line - value of identification with “ID=”<br />

prefix (such as „ID=file index AZ 1689“<br />

2. line: Issuer with “IS=” prefix (such as<br />

“IS=Register court in Prague”<br />

3. line empty<br />

For non-business persons:<br />

1. line: Identification type with “TI” prefix<br />

(such as “TI=driving license number”<br />

2. line: value of identification with “ID=” prefix<br />

(such as „ID=AM 801386“<br />

18/46<br />

<strong>valid</strong> <strong>from</strong> 12th June 2010

k<br />

3. line: Issuer with “IS=” prefix (such as<br />

“IS=Licensing authority in Prague”<br />

11. Filler 513 397 X(513) reserve<br />

12. File sentinel 2 910 X(2) CRLF record end character<br />

<strong>EDI</strong> <strong>BEST</strong> <strong>client</strong> <strong>format</strong><br />

2.2.3 Difference between standard Foreign payment and SEPA payment<br />

In both cases they represent foreign payment system and arrangement of transferal of the<br />

payment generated <strong>by</strong> the <strong>client</strong> to the partner, and receipt of the foreign partner plus transferal<br />

to his <strong>client</strong>.<br />

If the <strong>client</strong>’s partner is located in the EU zone and the <strong>client</strong> is paying in EUR, he can use a<br />

favourable type of SEPA (Single European Payment Area) payment and inter-banking<br />

agreements between banks adopting this type of payment.<br />

For both payment types, only SWIFT characters are permitted (if another character is<br />

transferred, it will be converted).<br />

• Standard foreign payment<br />

o<br />

Record 02 with standard payment data - no changes. (The<br />

“Y” character is not located in the offset. Of course, this form<br />

can still be used for payments even if the partner is based in<br />

the EU zone.<br />

• SEPA payment<br />

o Record 02 with standard payment data of FPO and marked<br />

with the SEPA sign. If the record is marked, it is a SEPA<br />

payment that must conform to the following requirements:<br />

Field of offset Required <strong>valid</strong>ation (if not conforming, the payment is<br />

SEPA<br />

rejected)<br />

payment<br />

Payment 59 Only EUR<br />

currency code<br />

Payer of 77 Only SLV<br />

charges<br />

ISO currency 96 With no <strong>valid</strong>ation, the currency downloaded in the DB is taken<br />

code of<br />

account for<br />

charges<br />

Express<br />

payment<br />

99 The payment cannot be entered as Urgent. Everything else is<br />

projected as normal, i.e. Express.<br />

Payer’s 170 With no <strong>valid</strong>ation, the currency downloaded in the DB is taken<br />

currency<br />

SWIFT code 278 If 8 characters are transferred, “XXX” is added <strong>from</strong> the right and<br />

of<br />