Health Savings Account (HSA) Eligible Expenses

Health Savings Account (HSA) Eligible Expenses

Health Savings Account (HSA) Eligible Expenses

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

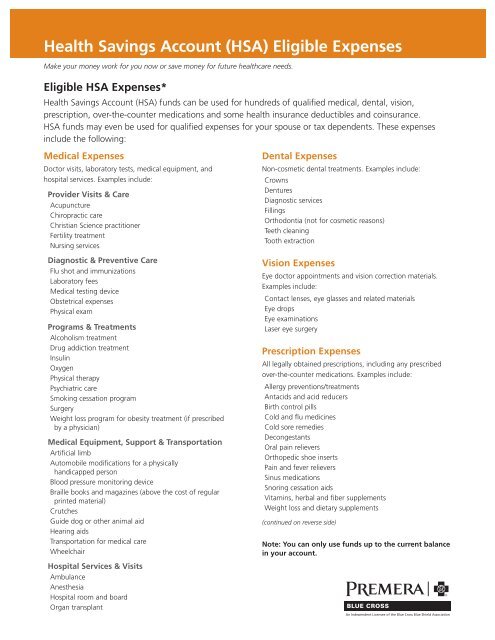

<strong>Health</strong> <strong>Savings</strong> <strong>Account</strong> (<strong>HSA</strong>) <strong>Eligible</strong> <strong>Expenses</strong><br />

Make your money work for you now or save money for future healthcare needs.<br />

<strong>Eligible</strong> <strong>HSA</strong> <strong>Expenses</strong>*<br />

<strong>Health</strong> <strong>Savings</strong> <strong>Account</strong> (<strong>HSA</strong>) funds can be used for hundreds of qualified medical, dental, vision,<br />

prescription, over-the-counter medications and some health insurance deductibles and coinsurance.<br />

<strong>HSA</strong> funds may even be used for qualified expenses for your spouse or tax dependents. These expenses<br />

include the following:<br />

Medical <strong>Expenses</strong><br />

Doctor visits, laboratory tests, medical equipment, and<br />

hospital services. Examples include:<br />

Provider Visits & Care<br />

Acupuncture<br />

Chiropractic care<br />

Christian Science practitioner<br />

Fertility treatment<br />

Nursing services<br />

Diagnostic & Preventive Care<br />

Flu shot and immunizations<br />

Laboratory fees<br />

Medical testing device<br />

Obstetrical expenses<br />

Physical exam<br />

Programs & Treatments<br />

Alcoholism treatment<br />

Drug addiction treatment<br />

Insulin<br />

Oxygen<br />

Physical therapy<br />

Psychiatric care<br />

Smoking cessation program<br />

Surgery<br />

Weight loss program for obesity treatment (if prescribed<br />

by a physician)<br />

Medical Equipment, Support & Transportation<br />

Artificial limb<br />

Automobile modifications for a physically<br />

handicapped person<br />

Blood pressure monitoring device<br />

Braille books and magazines (above the cost of regular<br />

printed material)<br />

Crutches<br />

Guide dog or other animal aid<br />

Hearing aids<br />

Transportation for medical care<br />

Wheelchair<br />

Hospital Services & Visits<br />

Ambulance<br />

Anesthesia<br />

Hospital room and board<br />

Organ transplant<br />

Dental <strong>Expenses</strong><br />

Non-cosmetic dental treatments. Examples include:<br />

Crowns<br />

Dentures<br />

Diagnostic services<br />

Fillings<br />

Orthodontia (not for cosmetic reasons)<br />

Teeth cleaning<br />

Tooth extraction<br />

Vision <strong>Expenses</strong><br />

Eye doctor appointments and vision correction materials.<br />

Examples include:<br />

Contact lenses, eye glasses and related materials<br />

Eye drops<br />

Eye examinations<br />

Laser eye surgery<br />

Prescription <strong>Expenses</strong><br />

All legally obtained prescriptions, including any prescribed<br />

over-the-counter medications. Examples include:<br />

Allergy preventions/treatments<br />

Antacids and acid reducers<br />

Birth control pills<br />

Cold and flu medicines<br />

Cold sore remedies<br />

Decongestants<br />

Oral pain relievers<br />

Orthopedic shoe inserts<br />

Pain and fever relievers<br />

Sinus medications<br />

Snoring cessation aids<br />

Vitamins, herbal and fiber supplements<br />

Weight loss and dietary supplements<br />

(continued on reverse side)<br />

Note: You can only use funds up to the current balance<br />

in your account.

Over-The-Counter Medications<br />

and Treatments<br />

The new healthcare reform law significantly changes your<br />

over-the-counter (OTC) benefits. Effective January 1, 2011,<br />

you may only use your healthcare payment card to purchase<br />

OTC drugs and medicines if you have a physician’s<br />

prescription at a retail establishment, such as a pharmacy,<br />

that meets IRS standards.<br />

Based on communications from a trade association of<br />

healthcare payment card companies, we believe that you<br />

may use your healthcare payment card at retail<br />

establishments that meet IRS standards for a limited number<br />

of purchases without a prescription. Examples include:<br />

Antiseptics and wound cleansers<br />

Bandages and dressings<br />

Contact lens solution and eye care related drops<br />

Contraceptives<br />

Denture adhesives, repair, pain relief and cleansers<br />

Diagnostic products (thermometer, blood pressure monitor,<br />

cholesterol testing)<br />

Ear care<br />

First aid burn remedies, dressings and supplies<br />

Foot care antifungal and treatments<br />

Hearing aid/medical batteries<br />

Home health care (limited segments)<br />

Incontinence protection and treatment products<br />

Insulin<br />

Reading glasses and maintenance accessories<br />

A Note about Insurance<br />

Premium <strong>Expenses</strong><br />

Some health insurance premiums are considered qualified<br />

expenses. Call 800-941-6121 for more information.<br />

Examples include:<br />

COBRA premiums<br />

Long term care insurance premiums<br />

Retiree medical insurance premiums<br />

Ineligible <strong>HSA</strong> <strong>Expenses</strong><br />

<strong>Expenses</strong> merely beneficial to general health or for<br />

cosmetic reasons are not qualified. Examples include:<br />

Cosmetic surgery<br />

Cosmetics<br />

Deodorant<br />

Exercise equipment<br />

Fitness programs<br />

Funeral expenses<br />

Hair transplants<br />

Household help<br />

Illegal operations and treatments<br />

Insurance premiums<br />

Maternity clothes<br />

Moisturizers and wrinkle creams<br />

Sun tan lotions<br />

Teeth whitening services and products<br />

Toothpaste, toothbrushes and mouth wash<br />

Vitamins taken to improve overall health<br />

Go to premera.com or call 800-941-6121 for more information about your<br />

<strong>Health</strong> <strong>Savings</strong> <strong>Account</strong> and qualified expenses.<br />

* For more detailed information, refer to IRS Publication 969, “<strong>Health</strong> <strong>Savings</strong> <strong>Account</strong>s and Other Tax-Favored <strong>Health</strong> Plans,” which you can<br />

download from the IRS Web site, www.irs.gov, or order by calling 1-800-TAX FORM. This material is not intended to be tax or legal advice. The<br />

reader should consult with his or her own tax advisor to determine the tax implications of participating in a personal funding account discussed<br />

herein. Advice, if any, included in this material was not intended or written by Premera to be used, and it cannot be used, by any taxpayer for the<br />

purpose of avoiding penalties that may be imposed on the taxpayer.<br />

022856 (12-2010)