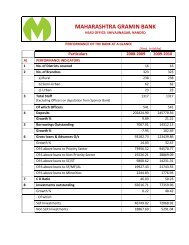

BalanceSheet 2011 - maharashtra gramin bank

BalanceSheet 2011 - maharashtra gramin bank

BalanceSheet 2011 - maharashtra gramin bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

23) Details of Loans Assets subject to Restructuring<br />

i<br />

ii<br />

iii<br />

iv<br />

Particulars<br />

Current<br />

Year<br />

Previous Year<br />

Total amount of loan assets subject to restructuring, rescheduling,<br />

renegotiation Nil Nil<br />

The amount of Standard assets subjected to restructuring,<br />

rescheduling, renegotiation Nil Nil<br />

The amount of Sub-Standard assets subjected to restructuring,<br />

rescheduling, renegotiation Nil Nil<br />

The amount of Doubtful assets subjected to restructuring,<br />

rescheduling, renegotiation Nil Nil<br />

Note [ (i) = (ii) + (iii) + (iv)] Nil Nil<br />

24) Exposure to Real Estate Sector<br />

(Rs. in lakhs)<br />

Sr. Category Current Year Previous<br />

Year<br />

a Direct exposure<br />

i) Residential Mortgages<br />

15885.44 6896.10<br />

Lending fully secured by mortgages on residential property<br />

that is or will be occupied by the borrower or that is rented<br />

(individual housing loan upto Rs. 15 lakh may be shown<br />

separately)<br />

ii) Commercial Real Estate<br />

Lending secured by mortgages on commercial real estates<br />

(office buildings, retail space, multi-purpose commercial<br />

premises, multi-family residential building, multi-tenanted 2037.50 560.25<br />

commercial premises, industrial or warehouse space, hotels,<br />

land acquisition, development and construction, etc.)<br />

Exposure would also include non-fund based (NFB) limits;<br />

iii) Investments in Mortgage Backed Securities (MBS) and other<br />

-- --<br />

securitized exposures<br />

a. Residential -- --<br />

b. Commercial Real Estate -- --<br />

b) Indirect Exposure<br />

Fund-based and non-fund based exposures on National<br />

Housing Bank (NHB) and Housing Finance Companies (HFCs)<br />

-- --<br />

25) Details of Single Borrower (SGL), Group Borrower Limit (GBL) exceeded by the Bank:<br />

- - N I L - -

![FORM NO. 31 [See rule 42] Application for a certificate under section ...](https://img.yumpu.com/49987957/1/184x260/form-no-31-see-rule-42-application-for-a-certificate-under-section-.jpg?quality=85)

![FORM NO. 15H [See rule 29C(3)] Declaration under section 197A ...](https://img.yumpu.com/45395081/1/184x260/form-no-15h-see-rule-29c3-declaration-under-section-197a-.jpg?quality=85)