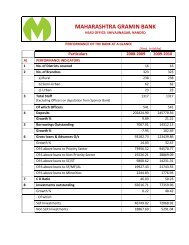

BalanceSheet 2011 - maharashtra gramin bank

BalanceSheet 2011 - maharashtra gramin bank

BalanceSheet 2011 - maharashtra gramin bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6) REVENUE RECOGNITION (AS - 9) :<br />

i. Income/ Expenditure is accounted on accrual basis except in the following cases:<br />

In the case of Non Performing Assets, income is recognized on cash basis, in<br />

terms of guidelines of the Reserve Bank of India. Where recovery is not adequate<br />

to upgrade the Non Performing Assets accounts by way of regularization, such<br />

recovery is being appropriated towards the principal/ book balance in the first<br />

instance and towards interest dues thereafter. In respect of Non Performing<br />

Investments, the same accounting treatment as above is followed except other<br />

wise agreed.<br />

ii. Interest on securities, which is due and not paid for a period of more than 90<br />

days is recognized on realization basis as per R.B.I. guidelines.<br />

iii.<br />

iv.<br />

Income from sale of Mutual fund products, locker rent etc., are accounted on<br />

cash/ realization basis.<br />

In the case of overdue Term Deposits, interest is provided for @ 3.50% on GL<br />

Products. Many Branches has not provided interest on Over Due Deposits. Hence<br />

effect on profit can not be quantified.<br />

v. In the case of suit filed accounts legal expenses are charged to the profit and loss<br />

account. Similarly at the time of recovery of legal expenses in respect of such suit<br />

filed accounts the amount recovered is accounted as income.<br />

vi.<br />

Commission/ exchange are normally recognized on the date of receipts although<br />

income may relate to transaction period extending beyond the accounting<br />

period.<br />

7) SEGMENT REPORTING (AS - 17):<br />

The Bank has treated the entire operations as a single reportable segment and<br />

secondary segment is not considered necessary due to operations in only one State and<br />

hence no disclosure is required.<br />

8) RELATED PARTY DISCLOSURES (AS - 18) :<br />

In compliance with AS - 18 issued by ICAI and the RBI guidelines details of related<br />

party transactions are disclosed below;<br />

The Bank has considered the following as the related parties for disclosure under<br />

AS- 18 issued by the ICAI.<br />

The key personnel of the Bank and the remuneration paid to them as under –

![FORM NO. 31 [See rule 42] Application for a certificate under section ...](https://img.yumpu.com/49987957/1/184x260/form-no-31-see-rule-42-application-for-a-certificate-under-section-.jpg?quality=85)

![FORM NO. 15H [See rule 29C(3)] Declaration under section 197A ...](https://img.yumpu.com/45395081/1/184x260/form-no-15h-see-rule-29c3-declaration-under-section-197a-.jpg?quality=85)