BalanceSheet 2011 - maharashtra gramin bank

BalanceSheet 2011 - maharashtra gramin bank

BalanceSheet 2011 - maharashtra gramin bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

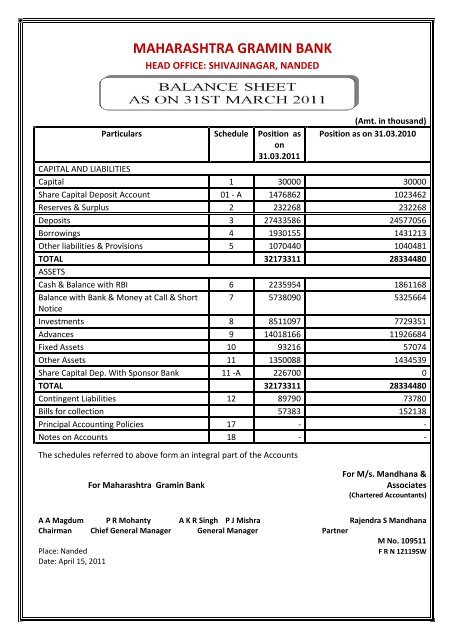

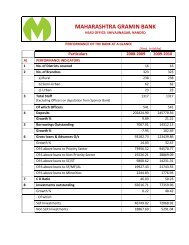

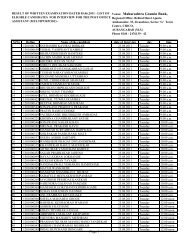

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

Particulars Schedule Position as<br />

on<br />

31.03.<strong>2011</strong><br />

(Amt. in thousand)<br />

Position as on 31.03.2010<br />

CAPITAL AND LIABILITIES<br />

Capital 1 30000 30000<br />

Share Capital Deposit Account 01 - A 1476862 1023462<br />

Reserves & Surplus 2 232268 232268<br />

Deposits 3 27433586 24577056<br />

Borrowings 4 1930155 1431213<br />

Other liabilities & Provisions 5 1070440 1040481<br />

TOTAL 32173311 28334480<br />

ASSETS<br />

Cash & Balance with RBI 6 2235954 1861168<br />

Balance with Bank & Money at Call & Short 7 5738090 5325664<br />

Notice<br />

Investments 8 8511097 7729351<br />

Advances 9 14018166 11926684<br />

Fixed Assets 10 93216 57074<br />

Other Assets 11 1350088 1434539<br />

Share Capital Dep. With Sponsor Bank 11 -A 226700 0<br />

TOTAL 32173311 28334480<br />

Contingent Liabilities 12 89790 73780<br />

Bills for collection 57383 152138<br />

Principal Accounting Policies 17 - -<br />

Notes on Accounts 18 - -<br />

The schedules referred to above form an integral part of the Accounts<br />

For Maharashtra Gramin Bank<br />

For M/s. Mandhana &<br />

Associates<br />

(Chartered Accountants)<br />

A A Magdum P R Mohanty A K R Singh P J Mishra Rajendra S Mandhana<br />

Chairman Chief General Manager General Manager Partner<br />

M No. 109511<br />

Place: Nanded<br />

F R N 121195W<br />

Date: April 15, <strong>2011</strong>

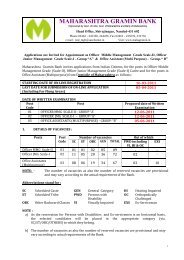

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

Particulars Schedule Current<br />

Year<br />

(Amt. in thousand)<br />

Previous Year<br />

INCOME<br />

Interest Earned 13 2256371 1750817<br />

Other Income 14 184383 170590<br />

TOTAL 2440754 1921407<br />

EXPENDITURE<br />

Interest Expended 15 1237416 991588<br />

Operating Expenses 16 969878 644798<br />

Provisions and contingencies - 111370 81423<br />

TOTAL 2318664 1717809<br />

PROFIT / LOSS -<br />

Net Loss ( - ) Profit (+) for the Year - 122090 203598<br />

Profit (+) /Loss (-) brought forward - 556463 682867<br />

TOTAL 434373 479270<br />

APPROPRIATION<br />

Transfer to Statutory Reserves - 8520<br />

Transfer to Special Reserves - 0 30000<br />

Transfer to Capital Reserves - 3798<br />

Transfer to Investment Fluctuation - 34876<br />

Balance carried over to Balance sheet - 434373 556463<br />

TOTAL 434373 479269<br />

For Maharashtra Gramin Bank<br />

For M/s. Mandhana &<br />

Associates<br />

(Chartered Accountants)<br />

A A Magdum P R Mohanty A K R Singh P J Mishra Rajendra S Mandhana<br />

Chairman Chief General Manager General Manager Partner<br />

M No. 109511<br />

Place: Nanded<br />

F R N 121195W<br />

Date: April 15, <strong>2011</strong>

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

Particulars<br />

As on<br />

31.03.<strong>2011</strong><br />

(Amt. in thousand)<br />

As on 31.03.2010<br />

Authorised Capital ( 5,00,000 Shares of Rs. 100 each ) 50000 30000<br />

Issued Capital ( 3,00,000 Shares of Rs. 100 each ) 30000 30000<br />

Subscribed Capital (3,00,000 Shares of Rs. 100 each ) 30000 30000<br />

Called up Capital ( 3,00,000 Shares of Rs. 100 each ) 30000 30000<br />

Less : Called Unpaid -- --<br />

Add : Forfeited Shares -- --<br />

TOTAL 30000 30000<br />

(Amt. in thousand)<br />

Particulars<br />

As on<br />

31.03.<strong>2011</strong><br />

As on 31.03.2010<br />

Share Capital Deposit Account 1476862 1023462<br />

Recapitalisation support received as under<br />

Central Government 738431 511731<br />

Sponsor Bank 516911 358211<br />

State Government 221519 153519<br />

Total 1476862 1023462

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

Particulars<br />

As on<br />

31.03.<strong>2011</strong><br />

(Amt. in thousand)<br />

As on 31.03.2010<br />

I Statutory Reserves 102911 102911<br />

Opening Balance 102911 94391<br />

Additions during the year 0 8520<br />

Deductions during the year 0 0<br />

II. Special Reserve 30000 30000<br />

Opening Balance 30000 0<br />

Additions during the year 0 30000<br />

Deduction during the year 0 0<br />

III Capital Reserves 21755 21755<br />

Opening Balance 21755 17957<br />

Additions during the year 0 3798<br />

Deductions during the year 0 0<br />

IV. Investment Fluctuation Resevre 77602 77602<br />

Opening Balance 77602 42726<br />

Additions during the year 0 34876<br />

Deductions during the year 0 0<br />

0 0<br />

V. Revenue and Other Reserves 0 0<br />

Opening Balance 0 0<br />

Additions during the year 0 0<br />

Deductions during the year<br />

0 0<br />

V. Balance in Profit & Loss Account 0 0<br />

Opening Balance 0 252246<br />

Additions during the year 0 0<br />

Deductions during the year 0 252246<br />

Grand Total 232268 232268

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

Particulars<br />

As on<br />

31.03.<strong>2011</strong><br />

(Amt. in thousand)<br />

As on 31.03.2010<br />

A<br />

I . Demand Deposits<br />

i. From Banks 0 0<br />

ii. From Others 1320621 1109266<br />

II. Savings Bank Deposits 17732770 15221479<br />

III. Term Deposits<br />

i. From Banks 0 0<br />

ii. From Others 8380195 8246311<br />

Total ( I+II+III) 27433586 24577056<br />

B<br />

I . Deposits of Branches in India 27433586 24577056<br />

II. Deposits of Branches outside India 0 0<br />

Total ( I+II) 27433586 24577056

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

I. Borrowings In India<br />

Particulars<br />

As on<br />

31.03.<strong>2011</strong><br />

(Amt. in thousand)<br />

As on 31.03.2010<br />

i. Reserve Bank of India<br />

ii Other Banks 253591 200054<br />

iii.. Other Institutions & Agencies 1676564 1231159<br />

II. Borrowings outside India -- --<br />

Total (I + II )<br />

1930155 1431213

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

(Amt. in thousand)<br />

Particulars As on 31.03.<strong>2011</strong> As on 31.03.2010<br />

i. Bills payable 334646 177160<br />

ii.<br />

iii.<br />

iv<br />

Inter office adjustments<br />

(Net)<br />

Interest accrued but not<br />

due<br />

Others (Including<br />

provisions)<br />

0 104370<br />

11679 47563<br />

724115 711389<br />

Total (i+ii+iii+iv) 1070440 1040481

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

Particulars<br />

As on<br />

31.03.<strong>2011</strong><br />

(Amt. in thousands)<br />

As on 31.03.2010<br />

1 Cash in Hand 521430 499344<br />

2 Balance with Reserve Bank of India<br />

In current Account 1714524 1361824<br />

In other Accounts<br />

Total (1 + 2 ) 2235954 1861168

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

Particulars<br />

As on<br />

31.03.<strong>2011</strong><br />

(Amt. in thousand)<br />

As on 31.03.2010<br />

1) In India<br />

i. Balance with Banks<br />

a) In current Accounts 382741 729037<br />

b) In other Deposit Accounts 5355349 4596627<br />

Sub - Total 5738090 5325664<br />

ii.<br />

Money at call & short Notice<br />

a) With Banks<br />

b) With Other institutions<br />

Sub - Total 0 0<br />

Total 1 ( i + ii ) 5738090 5325664<br />

2)<br />

Outside India Balance with Banks<br />

a) In current Account<br />

b) In other Deposit Account<br />

c) Money at call & Short Notice<br />

Total 2 ( a+b+c)<br />

Grand Total (1 + 2) 5738090 5325664

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

I. Investments in India in<br />

(Amt. in thousand)<br />

Particulars As on 31.03.<strong>2011</strong> As on 31.03.2010<br />

i. Government securities & Treasury bills 7941517 7206892<br />

ii. Other approved securities 0 0<br />

iii. Shares 12285 12735<br />

iv. Debentures and Bonds 326840 443500<br />

v. Subsidiaries and / or Joint ventures 0 0<br />

vi. Others (Units) 242400 72869<br />

Grant Total (i+ii+iii+iv+v+vi) 8523042 7735997<br />

Less : Depreciation / Provision 11945 6645<br />

Total 8511097 7729351<br />

II.<br />

Investments outside India in<br />

i. Government securities (Including local<br />

authorities)<br />

0 0<br />

ii. Subsidiaries and / or Joint ventures abroad 0 0<br />

iii. Other Investments ( to be specified) 0 0<br />

Total 0 0<br />

Grand Total( I + II ) 8511097 7729351

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

Particulars<br />

As on<br />

31.03.<strong>2011</strong><br />

(Amt. in thousand)<br />

As on 31.03.2010<br />

A I Bills purchased and discounted 41972 935249<br />

II<br />

Cash Credits, overdrafts & loans repayable on<br />

demand 6085791 4768345<br />

III TERM LOANS 8297954 6211807<br />

IV Debt Amt. Receivable from Govt. 28456 428585<br />

V Net effect of MOC 0 0<br />

Sub Total 14454173 12343986<br />

LESS : BAD & DOUBTFUL DEBTS PROVISIONS<br />

436007 417302<br />

GRAND TOTAL 14018166 11926684<br />

B I Standard 13697184 11644731<br />

II Sub Standard 307480 253756<br />

III Doubtful 410891 373638<br />

IV Loss of Assets 38618 71861<br />

SUB TOTAL 14454173 12343986<br />

Less : Bad & Doubtful debts Provisions 436007 417302<br />

GRAND TOTAL 14018166 11926684<br />

1 Advances in India<br />

I Priority sector 12427242 9470499<br />

II<br />

III<br />

Public sector<br />

Banks<br />

IV Others 2026931 2873487<br />

Total 1 14454173 12343986<br />

2 Advances outside India 0 0<br />

Less : Bad & Doubtful debts Provisions 436007 417302<br />

GRAND TOTAL 14018166 11926684

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

Particulars<br />

As on<br />

31.03.<strong>2011</strong><br />

(Amt. in thousand)<br />

As on 31.03.2010<br />

I. Premises:<br />

At cost as on 31 st March of the preceding year 657 692<br />

Addition during the year 0 0<br />

Deduction during the year 0 0<br />

Depreciation to date 33 35<br />

Sub Total (I) 624 657<br />

II.<br />

Other Fixed Assets<br />

(Including furniture and fixtures ) At cost as on 31 st<br />

56417 43126<br />

March of the preceding year<br />

Addition during the year 76913 36497<br />

Deduction during the year 773 276<br />

Depreciation to date 39964 22930<br />

Sub Total (II) 92592 56417<br />

Grand Total 93216 57074

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

Particulars<br />

As on<br />

31.03.<strong>2011</strong><br />

(Amt. in thousand)<br />

As on 31.03.2010<br />

i. Inter-Office adjustment (net) 15087 0<br />

ii. Interest accrued 663265 509375<br />

iii. Tax paid in advance / tax deducted at source 11127 6603<br />

iv. Stationery and stamps 5747 5502<br />

v. Non <strong>bank</strong>ing assets acquired in satisfaction of claims 0 0<br />

vi.<br />

Other (includes Accumulated losses, Sundry Debtors,<br />

Inland remittance, Other Receivables )<br />

654862 913058<br />

Total 1350088 1434539<br />

Particulars<br />

As on<br />

31.03.<strong>2011</strong><br />

(Amt. in<br />

thousand)<br />

As on<br />

31.03.2010<br />

Share Capital Deposit with<br />

Sponsor Bank<br />

Recapitalisation support received and deposit with Sponsor Bank as under<br />

Central Government 226700 0<br />

Sponsor Bank 0 0<br />

State Government 0 0<br />

Total 226700 0

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

i.<br />

Particulars<br />

Claims against the <strong>bank</strong> not acknowledged as<br />

debts.<br />

As on<br />

31.03.<strong>2011</strong><br />

(Amt. in thousand)<br />

As on 31.03.2010<br />

0 442<br />

ii. Liability for partly paid investments 0 0<br />

iii.<br />

Liability on account of outstanding forward<br />

exchange contracts<br />

0 0<br />

iv. Guarantees given on behalf of constituents 0 0<br />

a) India 0 0<br />

b) Outside India 0 0<br />

v. Acceptances, endorsements and other obligations 89326 73338<br />

vi.<br />

Other items for which the <strong>bank</strong> is contingently<br />

liable.<br />

464 0<br />

Total 89790 73780<br />

Particulars<br />

As on<br />

31.03.<strong>2011</strong><br />

(Amt. in thousand)<br />

As on 31.03.2010<br />

1 OBC 41223 150887<br />

2 IBC 550 1251<br />

3 LBC<br />

15611 0<br />

4 INLAND LETTERS 0 0<br />

Total 57383 152138

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

Particulars<br />

Current<br />

Year<br />

(Amt. in thousand)<br />

Previous Year<br />

i. Interest / discount on advances / bills 1358526 1001757<br />

ii. Income on Investments 897845 749061<br />

iii.<br />

Interest on balance with Reserve Bank of India & other<br />

<strong>bank</strong> funds<br />

0 0<br />

iv. Others 0 0<br />

TOTAL 2256371 1750817

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

Particulars<br />

Current<br />

Year<br />

(Amt. in thousand)<br />

Previous Year<br />

i. Commission, Exchange & Brokerage 54311 76918<br />

ii. Profit on sale of investments 26870 27935<br />

Less : Loss on sale of investments 0 30<br />

iii. Profit on revaluation of investments 0 27532<br />

Less: Loss on revaluation of 0 0<br />

investments 0 0<br />

iv. Profit on sale of land, buildings and other Assets 115 28<br />

Less: Loss on sale of land, buildings and other assets. 0 0<br />

v. Profit on exchange transactions 0 0<br />

Less: Loss on exchange transaction 0 0<br />

vi.<br />

Income earned by way of dividend etc. from<br />

subsidiaries / companies and / or joint ventures<br />

abroad / in India.<br />

0 0<br />

vii. Miscellaneous Income 103087 38206<br />

TOTAL 184383 170590

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

Particulars<br />

Current<br />

Year<br />

(Amt. in thousand)<br />

Previous Year<br />

I. Interest on Deposits 1115386 943204<br />

II.<br />

Interest on Reserve Bank of India / Inter Bank<br />

borrowings 0 0<br />

III. Others Interest on Refinance :<br />

a) NABARD 122029 48384<br />

b) Sponsor Bank 0 0<br />

Total 1237416 991588

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

(Amt. in thousand)<br />

Current Previous Year<br />

Particulars<br />

Year<br />

i. Payments to and provisions for employees 788273 524854<br />

ii. Rent, taxes and lighting 23057 18679<br />

iii. Printing and stationery 8127 6895<br />

iv. Advertisement and publicity 1825 1569<br />

v. Depreciation on Bank's property 40305 22965<br />

vi Directors fees, allowances and expenses on Board<br />

136 79<br />

Meeting<br />

vii. Auditors fees and expenses 2472 2867<br />

(Including Branch Auditors & Revenue Auditors)<br />

viii. Law Charges 1505 2812<br />

ix. Postage, Telegrams, Telephones etc. 3865 4190<br />

x. Repairs and maintenance 4628 3915<br />

xi.<br />

Insurance on deposits to DICGC<br />

on Fixed Assets 24620 19668<br />

xii. Other expenditure 71065 36305<br />

Total 969878 644798

SCHEDULE - 17 SIGNIFICANT ACCOUNTING POLICIES 2010-11<br />

01) ACCOUNTING CONVENTION (AS - 1):<br />

The financial statements have been prepared by following the going concern concept<br />

on historical cost basis except as otherwise stated and conform to the statutory<br />

provisions and practices prevailing in the country.<br />

02) FOREIGN EXCHANGE TRANSACTIONS (AS - 11):<br />

There are no transactions involving foreign exchange.<br />

03) INVESTMENTS (AS - 13) :<br />

I. Investments are grouped & shown in Balance-Sheet under the following six groups:<br />

i. Government Securities<br />

ii. Other Approved securities<br />

iii. Shares<br />

iv. Debentures and Bonds<br />

v. Investments in Subsidiaries/ Joint Ventures<br />

vi. Others (Commercial Paper, Units of Mutual Fund etc,)<br />

II.<br />

The Investment portfolio of the Bank is classified into the following three<br />

categories:<br />

i. Held to Maturity<br />

ii. Available for Sale<br />

iii. Held for Trading<br />

Bank decides the category of each investment at the time of acquisition and<br />

classifies the same accordingly. Transfer of securities from one category to another is<br />

done at the least of the acquisition cost/book value/ market value on the date of<br />

transfer.<br />

Valuation of Investments:<br />

a) Government Securities (Central & State) and Treasury Bills:<br />

i) Investments under this category forms part of SLR Investments of the <strong>bank</strong> as per<br />

RBI Circular no. RPCD/RRB no. BC 37A/ 03.05.34 / 2000-01 / 601 dated December<br />

4, 2000 and are classified as held to maturity. The SLR Investments have been<br />

exempted from marked to market norms for FY 2010-11, <strong>2011</strong>-12 & 2012-13 as<br />

per RBI Circular no. RPCD/CO/RRB/BC no. 59/ 03.05.34 / 2010-11 dated April

11, <strong>2011</strong>. Accordingly, these SLR investments consisting of investments in<br />

Government Securities (central and state) are classified as held to maturity and<br />

are valued at cost. The excess of acquisition cost if any, over the face value is<br />

amortized over the remaining period of maturity. During the year, <strong>bank</strong> has<br />

amortized premium of Rs. 5,56,53,837/- . Till FY 2009-10, shortfall of acquisition<br />

cost, if any, to the face value i.e. discount of face value was capitalized over the<br />

remaining period of maturity by credit to Profit and Loss a/c. This was done as<br />

per RBI Circular no. RPCD No. RF.BC.17/A-4-92/93 dated September 4, 1992.<br />

However, during the year under audit, <strong>bank</strong> has cited circular no. BC<br />

154/07.02.08/94-95 dated May 23, 1995 addressed to all SCBs, CCBs and RRBs<br />

and based on these circular, <strong>bank</strong> has decided to ignore discount on Government<br />

Securities i.e. it will not be accrued as income over remaining life of the maturity.<br />

Accordingly, an amount of Rs, 1,11,62,709/- (proportionate discount for current<br />

year) is ignored and not booked as income and not capitalized to book value of<br />

relevant G-sec.<br />

ii) Interest paid on purchases / received on sales for broken period is debited /<br />

credited to Interest received on Investments.<br />

iii)<br />

Treasury Bills are valued at cost of acquisition, since they do not carry any<br />

interest coupons and will mature at face value.<br />

iv) Provision is made for interest receivable from the date of last interest payment to<br />

March 31, <strong>2011</strong>.<br />

v) Net Profit on sale of investments under HTM Category (i.e. investments classified<br />

as HTM on last balance sheet date and sold during the year) is first taken to Profit<br />

& Loss Account and thereafter appropriated to capital reserve account. Net loss<br />

on sale is recognized in Profit & Loss Account. Profit / Loss on sale of securities<br />

purchased during the year is recognized in Profit & Loss a/c. It has been<br />

explained that entire profit earned during the year is from sale of securities<br />

purchased during the year and hence no transfer to capital reserve a/c is<br />

required.<br />

b) Valuation of Non SLR Investments::<br />

As per RBI Circular no. RPCD/RRB no. BC 37A/ 03.05.34 / 2000-01 / 601 dated<br />

December 4, 2000, non SLR investments includes investments in Shares,<br />

Debentures and Bonds, Investments in Subsidiaries and Joint Ventures, Others<br />

like mutual funds etc. Valuation is as follows:<br />

a) Investment in shares is marked to market. Net Depreciation is charged to profit<br />

and loss account and net appreciation is ignored. During the year, provision for<br />

depreciation on investment in shares is made at Rs. 36,72,519.30 by debit to<br />

Profit and Loss a/c.<br />

b) Investments in units of mutual funds marked to market. Net Depreciation is<br />

charged to profit and loss account and net appreciation is ignored. During the<br />

year, provision for depreciation on investment in mutual funds is made at Rs.<br />

82,72,516 by debit to Profit and Loss a/c.

c) In case of Debentures and bonds, Bank take approximate YTM on Government<br />

security having maturity date equal to or nearby date of maturity of instruments<br />

under consideration. These YTM rates are taken as published by FIMMDAI. Rtes<br />

used for YTM are 50 basis points above rates applicable to Government<br />

Securities. Based on these rates, market values are calculated. Net Depreciation<br />

is charged to profit and loss account and net appreciation is ignored. Net<br />

appreciation of Rs. 9,35,187/- is ignored.<br />

d) Provision is made for interest receivable from the date of last interest payment<br />

to March 31, <strong>2011</strong>. Dividends are recognized on cash basis.<br />

e) Profit/ loss on sale of these investments is credited/ debited to Profit & Loss a/c.<br />

4} FIXED ASSETS/ DEPRECIATION (AS - 6) & ( AS - 10) :<br />

i. Fixed assets are accounted for on historical cost basis.<br />

ii.<br />

Depreciation is provided for on Written Down Value method except on<br />

Computers & UPS. Computers are depreciated on Straight Line Method at the<br />

rate of 33.33% p.a. Depreciation on additions made during the year is charged at<br />

full rates. No depreciation is provided in the year of sale/ disposal on all fixed<br />

assets.<br />

5} ADVANCES:<br />

i. In terms of guidelines of Reserve Bank of India, advances are classified<br />

"performing" and "non-performing assets" based on recovery of principal/<br />

interest. Non Performing Advances (NPAs) are categorized as sub-standard,<br />

doubtful and loss assets for the purpose of provision.<br />

ii.<br />

iii.<br />

Advances shown in the Balance Sheet are net of provisions in respect of Nonperforming<br />

Advances and claims settled.<br />

Provisions on Standard Advances are shown under "Other Liabilities and<br />

Provisions".<br />

iv. Provision on advances is made as per RBI prudential norms and provisions held<br />

are as follows-:<br />

a) Standard Assets :<br />

0.40% of outstanding balance.<br />

b) Sub standard assets: 15% of outstanding balance secured by tangible assets<br />

and 100% on unsecured portion<br />

c) Doubtful assets:<br />

i) Assets classified in D-1 Category: - 50% of outstanding balance secured by<br />

tangible assets and 100% on unsecured portion<br />

ii) Assets classified in D-2, D-3 and Loss Category: 100% of outstanding balance.

6) REVENUE RECOGNITION (AS - 9) :<br />

i. Income/ Expenditure is accounted on accrual basis except in the following cases:<br />

In the case of Non Performing Assets, income is recognized on cash basis, in<br />

terms of guidelines of the Reserve Bank of India. Where recovery is not adequate<br />

to upgrade the Non Performing Assets accounts by way of regularization, such<br />

recovery is being appropriated towards the principal/ book balance in the first<br />

instance and towards interest dues thereafter. In respect of Non Performing<br />

Investments, the same accounting treatment as above is followed except other<br />

wise agreed.<br />

ii. Interest on securities, which is due and not paid for a period of more than 90<br />

days is recognized on realization basis as per R.B.I. guidelines.<br />

iii.<br />

iv.<br />

Income from sale of Mutual fund products, locker rent etc., are accounted on<br />

cash/ realization basis.<br />

In the case of overdue Term Deposits, interest is provided for @ 3.50% on GL<br />

Products. Many Branches has not provided interest on Over Due Deposits. Hence<br />

effect on profit can not be quantified.<br />

v. In the case of suit filed accounts legal expenses are charged to the profit and loss<br />

account. Similarly at the time of recovery of legal expenses in respect of such suit<br />

filed accounts the amount recovered is accounted as income.<br />

vi.<br />

Commission/ exchange are normally recognized on the date of receipts although<br />

income may relate to transaction period extending beyond the accounting<br />

period.<br />

7) SEGMENT REPORTING (AS - 17):<br />

The Bank has treated the entire operations as a single reportable segment and<br />

secondary segment is not considered necessary due to operations in only one State and<br />

hence no disclosure is required.<br />

8) RELATED PARTY DISCLOSURES (AS - 18) :<br />

In compliance with AS - 18 issued by ICAI and the RBI guidelines details of related<br />

party transactions are disclosed below;<br />

The Bank has considered the following as the related parties for disclosure under<br />

AS- 18 issued by the ICAI.<br />

The key personnel of the Bank and the remuneration paid to them as under –

Sr.<br />

No.<br />

Name<br />

Period<br />

1 A A Magdum, Chairman 01.04.2010 to 31.03.<strong>2011</strong><br />

2 M.C.Kulkarni, Chief General Manager 01.04.2010 to 30.06.2010<br />

3 P. R. Mohanty, Chief General Manager 01.07.2010 to 31.03.<strong>2011</strong><br />

4 A K R Singh, General Manager 01.04.2010 to 31.03.<strong>2011</strong><br />

5 D C Sthul, General Manager 01.04.2010 to 30.06.2010<br />

6 P K Mishra, General Manager 01.04.2010 to 31.03.<strong>2011</strong><br />

7 G Srikrishna, Senior Manager, Accounts 01.04.2010 to 30.11.2010<br />

8 H L Mote, Senior Manager, Inspection 01.04.2010 to 30.11.2010<br />

9 U K Kurwalkar, Regional Manager, Jalna 01.04.2010 to 31.03.<strong>2011</strong><br />

Officers on deputation for CBS<br />

10 L.K. Joshi 01.12.2010 to 31.03.<strong>2011</strong><br />

11 K.G. Iyer 01.12.2010 to 31.03.<strong>2011</strong><br />

12 Sachin Dharam 01.12.2010 to 31.03.<strong>2011</strong><br />

13 S.V.Pathak 01.12.2010 to 31.03.<strong>2011</strong><br />

14 R.S.Gaitonde 01.12.2010 to 31.03.<strong>2011</strong><br />

15 C.R.Kadu 01.12.2010 to 31.03.<strong>2011</strong><br />

16 H.M.Godse 01.12.2010 to 31.03.<strong>2011</strong><br />

17 C.A.Joshi 01.12.2010 to 31.03.<strong>2011</strong><br />

The Bank has paid Rs. 66.84 lacs towards remuneration during financial year to the staff on<br />

deputation from the Sponsor Bank.<br />

9) STAFF BENEFITS (AS - 15):<br />

1. In respect of employees who have opted for Provident Fund scheme,<br />

contribution as permitted by EPF act is made and debited to the Profit & Loss<br />

Account.<br />

2. Bank has provided for Gratuity liability in the books & the amount has been<br />

debited to the Profit & Loss Account. Amount of Gratuity has been worked out as<br />

per Actuarial valuation at the year-end.<br />

3. Liability towards leave encashment is provided for & debited to Profit & Loss<br />

Account based on valuation made by LIC.<br />

4 Bank has opted for contribution to Group Gratuity Trust Scheme and Group<br />

Leave Encashment Trust Scheme of LIC.

10) PROVISION FOR TAXATION:<br />

Sr.<br />

No.<br />

Particulars<br />

Current Previous<br />

Year Year<br />

Provision for Income Tax - - - -<br />

11) PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS<br />

(AS - 29):<br />

a) Provision of Rs. 4,64,366 is made in respect of suits filed against the <strong>bank</strong> by<br />

customers and first appellate authority has decided the case against the <strong>bank</strong>.<br />

Provision is made for amount ordered to be made by the first appellate authority.<br />

b) Employees union of the <strong>bank</strong> had filed case against the <strong>bank</strong> raising demand for<br />

payment of matching contribution to the Provident fund. Case has been decided in<br />

favor of the <strong>bank</strong> by High Court and SLP by union is filed at Supreme Court. The matter<br />

has been heard and is closed for judgement. This, in the opinion of the management,<br />

does not require any provision.<br />

-----*****-----

SCHEDULE - 18 NOTES ON ACCOUNTS - FINANCIAL YEAR 20910-11<br />

1) During the year, <strong>bank</strong> has migrated its entire 327 branches to Core Banking in last 4<br />

months of FY. It has not yet conducted migration audit. Hence there are likely to be<br />

un-detected migration errors. Our audit opinion is subject to migration audit.<br />

2) Report of the branch auditors and observations given therein form integral part of<br />

audit report and our audit opinion is subject to comments / observation of branch<br />

auditors.<br />

3) Reconciliation of entries as on 30.09.2010 in the Branch Adjustment account and<br />

other accounts have been drawn. All the branches of the Bank have been reconciled<br />

with the Head Office as on 30.09.2010. Debit entries pending over 6 months as on<br />

31.03.<strong>2011</strong> are 256 involving amount of Rs. 843.51 lacs whereas credit entries<br />

pending over 6 months are 5659 amounting to Rs. 24019.02 lacs. Work of<br />

reconciliation of these entries is in progress.<br />

Bank is required to provide for at 100% on net debit balance on the entries<br />

remaining unadjusted beyond Six months in Branch Adjustments Accounts as at year<br />

end. No provision has been made by the Bank as there is net credit balance in Branch<br />

Adjustment Account.<br />

4) New DD account has been introduced in the Bank from 22.09.2009 and DD<br />

Transactions have been separated from Inter Branch Reconciliation. As on<br />

31.03.<strong>2011</strong>, 3185 debit entries pending involving amount of Rs. 4704 lacs and 5226<br />

pending credit entries amounting Rs. 4860 lacs are pending. Work of reconciliation<br />

of these entries is in progress.<br />

5) Fixed assets such as computers, UPS, furniture, inverter and batteries etc. are sent to<br />

branches by debit to Proceeds in Transit a/c. Entries worth Rs. 212.47 lacs are<br />

pending in proceeds in transit a/c towards assets sent to branches, since PoB<br />

realizations are not received from branches. A provision of Rs. 84,60,482/- is made<br />

by debit to P/L Provisions a/c towards depreciation on assets / write off of expenses<br />

involved in proceeds in transit a/c<br />

6) During the year, <strong>bank</strong> has migrated its entire 327 branches to Core Banking in last 4<br />

months of FY. Few instances of excess interest application or interest application to<br />

NPA accounts have been identified by branch auditors. Bank has yet to get migration<br />

audit completed. To cover up any such instance of excess interest application, <strong>bank</strong><br />

has made an ad-hoc provision of Rs. 3 crore by debit to P/L Provisions and Credit to<br />

G/L Interest Suspense a/c. The provision in our opinion is adequate.<br />

7) Amount lying to the credit of Interest Suspense a/c (towards interest applied to the<br />

Distressed Farmers a/c but not credited to Income a/c and held in Interest Suspense<br />

a/c) Rs. 1,73,18,482/- has been credited to Profit and Loss a/c, since in the opinion of<br />

the management, most of the accounts have been recovered in Debit waiver/relief<br />

scheme.

8) As per RBI Directives, <strong>bank</strong> had made provision for interest receivable on ADWDR-08<br />

at the rates applicable to 364 days T-Bill. Total provision so made was Rs.<br />

1,97,28,716 against which government has paid interest of only Rs. 34,45,000/-.<br />

Balance amount of Rs. 1,62,83,716/-is not expected to be recovered and has been<br />

debited to Profit and Loss a/c.<br />

9) REPO TRANSACTIONS:<br />

Securities sold under<br />

Repos<br />

Securities purchased<br />

under reserve Repos<br />

Minimum<br />

Outstanding<br />

during the year<br />

Maximum<br />

outstanding<br />

during the Year<br />

Daily average<br />

outstanding<br />

during the year<br />

As on 31 st<br />

March<br />

<strong>2011</strong><br />

- - - - - - - -<br />

- - - - - - - -<br />

10) No provision has been made for Interest payable on RD at all 9 branches audited by<br />

us. Amount and its impact on profit is not quantifiable.<br />

11) Details of Financial Assets sold to Secularization (SC) / Reconstruction Company (RC)<br />

for Assets Reconstruction:<br />

Sr.<br />

No.<br />

Particulars<br />

Current<br />

Year<br />

Previous<br />

Year<br />

1. No. of Accounts - - - -<br />

2. Aggregate value (net of provisions) of accounts sold to - - - -<br />

SC/ RC<br />

3. Aggregate consideration - - - -<br />

4. Additional consideration realized in respect of accounts - - - -<br />

transferred in earlier years<br />

5. Aggregate gain/ loss over net book value - - - -<br />

12) At many branches, physical cash balance and book cash balance does not tally.<br />

Difference amount is lying in system suspense a/c.<br />

13) Subvention claim receivable from Government under various schemes have been<br />

accounted for on the basis of calculations made by a) Old software Auto<strong>bank</strong> and b)<br />

programe designed by PMO for subvention calculation. As observed during the<br />

course of audit by all branch auditors, calculations provided by PMO software are<br />

entirely wrong. Bank has explained that they will rework the entire claim amount<br />

and based on it, claimed will be lodged with Government. Amount of claim booked<br />

as of now is not correct.<br />

14) Other notes enclosed herewith in Annexure I forms an integral part of our<br />

audit report.<br />

a) Details of Non-Performing Financial Assets purchased /sold is "Nil"

(Rs. Lakh)<br />

Sr. Particulars Current<br />

Year<br />

Previous<br />

Year<br />

1(a) No. of accounts purchased / sold during the year - - - -<br />

(b) Aggregate outstanding - - - -<br />

2(a) Of these, number of account restructured during the year - - - -<br />

(b) Aggregate outstanding - - - -<br />

b) Provision On Standard Asset (Rs. Lakh)<br />

Sr. Particulars Current Year Previous Year<br />

Provisions towards Standard Assets 566 566<br />

15) CAPITAL:<br />

NABARD vide letter no. NB.IDD/-/CRAR Committee/ 2010-11 dated June 25, 2010<br />

sanctioned recapitalization support of Rs. 104 crore to the <strong>bank</strong>, out of which Rs. 94<br />

crore were to be received in current year and Rs. 10 crore were to be received in next<br />

year. However, during the year <strong>bank</strong> has received Rs. 6.80 crore from State<br />

Government and Rs. 15.87 crore from sponsor <strong>bank</strong>.<br />

Department of Financial Services, Ministry of Finance, Government of India vide letter<br />

no. F.No. 3/8/2010-RRB (i) dated March 31, <strong>2011</strong> ordered to release Rs. 22.67 crore to<br />

the <strong>bank</strong>. Accordingly, cheque of Rs. 22.67 crore is said to have been deposited in RBI<br />

a/c of the <strong>bank</strong>. Based on order of the Central Government, <strong>bank</strong> has made provision<br />

for recapitalization support receivable by corresponding credit to Share Capital<br />

Deposit a/c.<br />

The Capital Adequacy Ratio calculated in terms of the guidelines issued by RBI is as under:<br />

Sr.No.<br />

Items<br />

31.03.<strong>2011</strong> 31.03.2010<br />

1 CRAR % 9.07% 6.78%<br />

2 CRAR - Tier I Capital % 8.62% 5.53%<br />

3 CRAR - Tier II Capital % 0.45% 1.25%<br />

4 % of the holding of the Government of<br />

India/ State Government / BoM<br />

5 Amount of subordinated debt raised as<br />

Tier II Capital<br />

50%, 15%, 35% 50%, 15%, 35%<br />

-- --

16) INVESTMENTS:<br />

Sr.<br />

No.<br />

1 Value of Investments<br />

Particulars<br />

Current Year<br />

31.03.<strong>2011</strong><br />

( Rs. lakhs)<br />

Previous Year<br />

31.03.2010<br />

i) Gross Value of Investments 85230.41 77359.97<br />

ii) Provisions for Depreciation 119.45 66.45<br />

iii) Net Value of Investments 85110.96 77293.51<br />

2 Movement of provisions held towards depreciation on<br />

investments<br />

i) Opening Balance 66.45 348.09<br />

ii) Add :Provisions made during the year 57.30 12.34<br />

iii) Less: Write Off/ Write back of excess provisions during<br />

the year<br />

4.30 293.98<br />

iv) Closing Balance 119.45 66.45<br />

Amount of investments referred to above does not includes investment in <strong>bank</strong> deposits,<br />

which is Rs.53553.49 lacs, shown under Balance with other <strong>bank</strong>s in balance sheet as per<br />

RBI Directives.<br />

17) Disclosure in respect of Non-SLR Investment portfolio as on 31st March <strong>2011</strong>.<br />

No.<br />

i) Issuer composition of Non SLR Investments (Rs. in Crore)<br />

Amount Extent of<br />

Issuer<br />

private<br />

placement<br />

Extent of 'below<br />

investment grade'<br />

Securities already<br />

invested<br />

Extent of<br />

'unrated'<br />

securities,<br />

already invested<br />

Extent of<br />

'unlisted'<br />

securities<br />

(1) (2) (3) (4) (5) (6) (7)<br />

1 P S Us 18.00 -- -- --<br />

2 F I s 10.50 -- -- --<br />

3 Banks 23.31 -- -- --<br />

4 Private corporate - -- -- --<br />

5 Others 6.34 -- -- --<br />

6 Provision held<br />

-- XXX XXX XXX<br />

towards depreciation<br />

TOTAL 58.15 -- -- - -

ii)<br />

Non- Performing Non- SLR Investments:<br />

Particulars<br />

Amount (Rs. Crore)<br />

Opening Balance - -<br />

Additions during the year since 1 st April - -<br />

Reductions during the above period - -<br />

Closing Balance - -<br />

Total Provisions Held - -<br />

18) Disclosure under Accounting Standard 5<br />

a)During the year Rs. 963.00 lacs debited to Profit and Loss account towards<br />

payment to LIC on account of provision for Gratuity and Rs. 5.00 lacs towards leave<br />

encashment.<br />

b)Other than one mentioned above, no material prior period expenditure has been<br />

debited to Profit and Loss Account.<br />

18-A) Disclosure of penalties imposed by RBI:<br />

RBI has not imposed any penalties to the Bank during the Current Financial Year.<br />

18-B) Floating Provisions: No such provisions held by the Bank.<br />

19) ASSET LIABILITY MANAGEMENT:<br />

Maturity pattern of certain Assets & Liabilities as under:<br />

Maturity pattern of Assets & Liabilities has been worked out by Bank and we rely<br />

on that<br />

(Rs. in lakhs)<br />

Sr.<br />

No<br />

Maturity Pattern<br />

Loans &<br />

Advances<br />

ASSETS<br />

Investments &<br />

Bank Dep.<br />

LIABILITIES<br />

Deposits Borrowings<br />

1. 1 to 14 days 13477.26 1723.87 12262.75 0.00<br />

2. 15 to 28 days 7027.82 2100.00 2935.38 0.00<br />

3. 29 days to 3 months 9838.94 13070.00 4883.16 1926.81<br />

4. Over 3 months to 6 months 6929.43 12801.36 6830.94 8452.30<br />

5. Over 6 months to 12 months 10387.11 26418.29 14649.45 6132.92<br />

6. Over 1 year to 3 years 72586.30 12985.78 190747.12 2098.76<br />

7. Over 3 years to 5 years 17316.54 13556.59 29298.94 690.74<br />

8. Over 5 years 6706.64 56128.03 12729.13 0<br />

Total 144270.04 138783.92 274336.87 19301.55

20) Movement of NPA during the year:<br />

Particulars<br />

(Rs. in Lacs)<br />

31st March <strong>2011</strong> 31st March 2010<br />

Gross NPA as at the commencement of the year 6992.55 7002.80<br />

Additions during the year 2483.15 2882.28<br />

Less Reduction during the year<br />

i) Amounts recovered 1426.55 1847.16<br />

ii) Amounts Written Off 436.60 901.11<br />

iii) Upgradation 42.66 144.26<br />

Gross NPAs as at the close of the year 7569.89 6992.55<br />

Less Provisions 4360.06 4173.02<br />

Net NPA as at the close of the year 3209.83 2806.20<br />

21) Movement in provision for Non Performing Advances:<br />

(Rs. in Lacs)<br />

Particulars<br />

31st March<br />

<strong>2011</strong><br />

31st March<br />

2010<br />

Opening balance (excluding provisions on standard assets) 4173.02 5054.80<br />

Add: Provision made during the year 623.65 240.00<br />

Less: Write Off during the year 436.60 1121.78<br />

Closing Balance 4360.07 4173.02<br />

22) Disclosure of complaints:<br />

A. Customer Complaints -<br />

Sr. Particulars Details<br />

a No. of complaints pending at the beginning of the year 17<br />

b No. of complaints received during the year 63<br />

c No. of complaints redressed during the year 74<br />

d No. of complaints pending at the end of the year 06<br />

B. Award passed by the Banking Ombudsman -<br />

Sr. Particulars Details<br />

a No. of unimplemented Awards at the beginning of the year Nil<br />

b No. of Awards passed by the Banking Ombudsman during the year Nil<br />

c No. of Awards implemented during the year Nil<br />

d No. of unimplemented Awards at the end of the year Nil

23) Details of Loans Assets subject to Restructuring<br />

i<br />

ii<br />

iii<br />

iv<br />

Particulars<br />

Current<br />

Year<br />

Previous Year<br />

Total amount of loan assets subject to restructuring, rescheduling,<br />

renegotiation Nil Nil<br />

The amount of Standard assets subjected to restructuring,<br />

rescheduling, renegotiation Nil Nil<br />

The amount of Sub-Standard assets subjected to restructuring,<br />

rescheduling, renegotiation Nil Nil<br />

The amount of Doubtful assets subjected to restructuring,<br />

rescheduling, renegotiation Nil Nil<br />

Note [ (i) = (ii) + (iii) + (iv)] Nil Nil<br />

24) Exposure to Real Estate Sector<br />

(Rs. in lakhs)<br />

Sr. Category Current Year Previous<br />

Year<br />

a Direct exposure<br />

i) Residential Mortgages<br />

15885.44 6896.10<br />

Lending fully secured by mortgages on residential property<br />

that is or will be occupied by the borrower or that is rented<br />

(individual housing loan upto Rs. 15 lakh may be shown<br />

separately)<br />

ii) Commercial Real Estate<br />

Lending secured by mortgages on commercial real estates<br />

(office buildings, retail space, multi-purpose commercial<br />

premises, multi-family residential building, multi-tenanted 2037.50 560.25<br />

commercial premises, industrial or warehouse space, hotels,<br />

land acquisition, development and construction, etc.)<br />

Exposure would also include non-fund based (NFB) limits;<br />

iii) Investments in Mortgage Backed Securities (MBS) and other<br />

-- --<br />

securitized exposures<br />

a. Residential -- --<br />

b. Commercial Real Estate -- --<br />

b) Indirect Exposure<br />

Fund-based and non-fund based exposures on National<br />

Housing Bank (NHB) and Housing Finance Companies (HFCs)<br />

-- --<br />

25) Details of Single Borrower (SGL), Group Borrower Limit (GBL) exceeded by the Bank:<br />

- - N I L - -

26) Maintenance of CRR:<br />

During current financial year the Bank has maintained adequate average balance<br />

with RBI in compliance to the CRR requirement.<br />

27) Following ratios have been calculated as per NABARD guidelines:<br />

Particulars<br />

As on 31 st<br />

March,<br />

<strong>2011</strong><br />

(Rs in crores)<br />

As on 31 st<br />

March, 2010<br />

Percentage of Net NPAs to net Advances 1.97 2.36<br />

Interest income as a percentage to working funds 8.12 8.50<br />

Non interest income as a percentage to working funds 0.66 0.82<br />

Operating Profit as a percentage to working funds 0.84 1.38<br />

Return on Assets 0.38 0.72<br />

Business (Deposits + Advances) Per Employee 3.22 2.77<br />

Gross Profit Per Employee 0.018 0.02<br />

Net Profit Per Employee 0.009 0.015<br />

28) The Bank has maintained the Statutory Liquidity Ratio (SLR) @ 25% of Demand &<br />

Time Liabilities by investing with the NABARD & in Government Securities. Bank has<br />

also maintained Cash Reserve Ratio as per applicable rates (presently 6.00%) of<br />

Demand & Time Liabilities with Reserve Bank of India for financial year.<br />

29) The figures have been rounded off to the nearest thousands. Figures in bracket<br />

indicate negative amounts. Figures shown in the tables/ annexure/ charts are as<br />

given and certified by the management.<br />

30) Previous year's figures have been re-grouped / re-classified wherever necessary to<br />

confirm Current year's classification.<br />

FOR MANDHANA & ASSOCIATES<br />

CHARTERED ACCOUNTANTS<br />

FOR MAHARASHTRA GRAMIN BANK<br />

CA. RAJENDRA S MANDHANA<br />

PARTNER<br />

M. No. 109511 FRN.121195W<br />

ASHOK MAGDUM<br />

CHAIRMAN<br />

H N DHANURKAR<br />

DIRECTOR<br />

M K CHANDEKAR<br />

DIRECTOR<br />

V R GUPTA<br />

DIRECTOR<br />

A D DESHPANDE<br />

DIRECTOR<br />

EKNATHRAO DAWALE<br />

DIRECTOR<br />

SHRIKAR PARDESHI<br />

DIRECTOR

MAHARASHTRA GRAMIN BANK<br />

HEAD OFFICE: SHIVAJINAGAR, NANDED<br />

Provision for<br />

1 Bad & Doubtful debt<br />

2 Non Performing Investment<br />

Particulars<br />

3 Deprecation in Investment (Mark to Market valuation)<br />

4 Gratuity Payment<br />

5 Leave Balance (P/L)<br />

6 Fraud<br />

7 Inter Bank Reconcilation (Mahur Br)<br />

8 Cash theft (Shiradhon Br)<br />

9 FBT<br />

10 Debit Balance in S/B<br />

Total (1 + 8)<br />

Less : Write back provision<br />

investment<br />

Less : Write back provision<br />

investment<br />

Current<br />

Year<br />

(Amt. in<br />

thousand)<br />

Previous<br />

Year<br />

623<br />

65 24000<br />

0<br />

573<br />

0<br />

430<br />

0 57423<br />

0<br />

846<br />

0<br />

300<br />

00<br />

50<br />

464<br />

0<br />

111<br />

370<br />

Less : Write back provision of NPA 0<br />

Less : Write back provision of Non<br />

performing invest.<br />

Total Net Provisions<br />

0<br />

0<br />

0<br />

81423<br />

111<br />

370 81423

![FORM NO. 31 [See rule 42] Application for a certificate under section ...](https://img.yumpu.com/49987957/1/184x260/form-no-31-see-rule-42-application-for-a-certificate-under-section-.jpg?quality=85)

![FORM NO. 15H [See rule 29C(3)] Declaration under section 197A ...](https://img.yumpu.com/45395081/1/184x260/form-no-15h-see-rule-29c3-declaration-under-section-197a-.jpg?quality=85)