Shelf Prospectus - Srei Infrastructure Finance Limited

Shelf Prospectus - Srei Infrastructure Finance Limited Shelf Prospectus - Srei Infrastructure Finance Limited

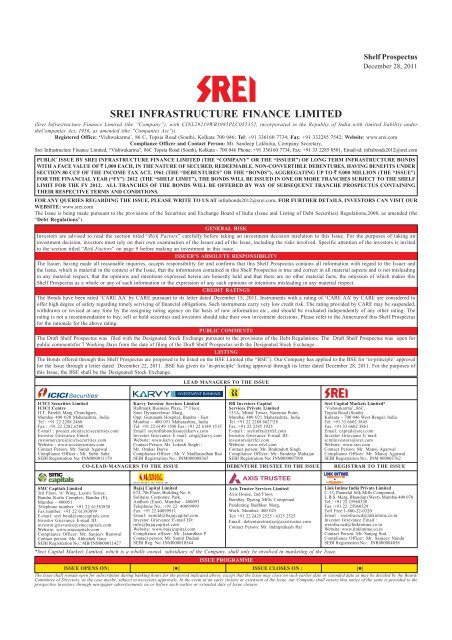

Shelf Prospectus December 28, 2011 SREI INFRASTRUCTURE FINANCE LIMITED (Srei Infrastructure Finance Limited (the “Company”), with CINL29219WB1985PLC055352, incorporated in the Republic of India with limited liability under theCompanies Act, 1956, as amended (the “Companies Act”)) Registered Office: ‘Vishwakarma’, 86 C, Topsia Road (South), Kolkata 700 046; Tel: +91 336160 7734; Fax: +91 332285 7542; Website: www.srei.com Compliance Officer and Contact Person: Mr. Sandeep Lakhotia, Company Secretary, Srei Infrastructure Finance Limited, “Vishwakarma”, 86C Topsia Road (South), Kolkata - 700 046 Phone: +91 336160 7734, Fax: +91 33 2285 8501, Email-id: infrabonds2012@srei.com PUBLIC ISSUE BY SREI INFRASTRUCTURE FINANCE LIMITED (THE “COMPANY” OR THE “ISSUER”) OF LONG TERM INFRASTRUCTURE BONDS WITH A FACE VALUE OF ` 1,000 EACH, IN THE NATURE OF SECURED, REDEEMABLE, NON-CONVERTIBLE DEBENTURES, HAVING BENEFITS UNDER SECTION 80 CCF OF THE INCOME TAX ACT, 1961 (THE “DEBENTURES” OR THE “BONDS”), AGGREGATING UP TO ` 5,000 MILLION (THE “ISSUE”) FOR THE FINANCIAL YEAR (“FY”) 2012 (THE “SHELF LIMIT”). THE BONDS WILL BE ISSUED IN ONE OR MORE TRANCHES SUBJECT TO THE SHELF LIMIT FOR THE FY 2012. ALL TRANCHES OF THE BONDS WILL BE OFFERED BY WAY OF SUBSEQUENT TRANCHE PROSPECTUS CONTAINING THEIR RESPECTIVE TERMS AND CONDITIONS. FOR ANY QUERIES REGARDING THE ISSUE, PLEASE WRITE TO US AT infrabonds2012@srei.com. FOR FURTHER DETAILS, INVESTORS CAN VISIT OUR WEBSITE: www.srei.com The Issue is being made pursuant to the provisions of the Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations,2008, as amended (the “Debt Regulations”). GENERAL RISK Investors are advised to read the section titled “Risk Factors” carefully before taking an investment decision inrelation to this Issue. For the purposes of taking an investment decision, investors must rely on their own examination of the Issuer and of the Issue, including the risks involved. Specific attention of the investors is invited to the section titled “Risk Factors” on page 9 before making an investment in this issue. ISSUER’S ABSOLUTE RESPONSIBILITY The Issuer, having made all reasonable inquiries, accepts responsibility for and confirms that this Shelf Prospectus contains all information with regard to the Issuer and the Issue, which is material in the context of the Issue, that the information contained in this Shelf Prospectus is true and correct in all material aspects and is not misleading in any material respect, that the opinions and intentions expressed herein are honestly held and that there are no other material facts, the omission of which makes this Shelf Prospectus as a whole or any of such information or the expression of any such opinions or intentions misleading in any material respect. CREDIT RATINGS The Bonds have been rated ‘CARE AA’ by CARE pursuant to its letter dated December 15, 2011. Instruments with a rating of ‘CARE AA’ by CARE are considered to offer high degree of safety regarding timely servicing of financial obligations. Such instruments carry very low credit risk. The rating provided by CARE may be suspended, withdrawn or revised at any time by the assigning rating agency on the basis of new information etc., and should be evaluated independently of any other rating. The rating is not a recommendation to buy, sell or hold securities and investors should take their own investment decisions. Please refer to the Annexureof this Shelf Prospectus for the rationale for the above rating. PUBLIC COMMENTS The Draft Shelf Prospectus was filed with the Designated Stock Exchange pursuant to the provisions of the Debt Regulations. The Draft Shelf Prospectus was open for public commentsfor 7 Working Days from the date of filing of the Draft Shelf Prospectus with the Designated Stock Exchange.. LISTING The Bonds offered through this Shelf Prospectus are proposed to be listed on the BSE Limited (the “BSE”). Our Company has applied to the BSE for ‘in-principle’ approval for the Issue through a letter dated December 22, 2011. .BSE has given its ‘in-principle’ listing approval through its letter dated December 28, 2011. For the purposes of this Issue, the BSE shall be the Designated Stock Exchange. LEAD MANAGERS TO THE ISSUE ICICI Securities Limited ICICI Centre H.T. Parekh Marg Churchgate, Mumbai 400 020 Maharashtra, India Tel : +91 22 2288 2460 Fax : +91 22 2282 6580 E-mail : project.srei@icicisecurities.com Investor Grievance Email: customercare@icicisecurities.com Website : www.icicisecurities.com Contact Person: Mr. Sumit Agarwal Compliance Officer : Mr. Subir Saha SEBI Registration No: INM000011179 Karvy Investor Services Limited Hallmark Business Plaza, 7 th Floor, Sant Dynaneshwar Marg, Opp: Gurunank Hospital, Bandra - East Mumbai – 400 051 Maharashtra, India Tel: +91 22 6149 1500 Fax: +91 22 6149 1515 Email: sreiinfrabondissue@karvy.com Investor Grievance E mail: cmg@karvy.com Website: www.karvy.com Contact Person: Mr. Lokesh Singhi / Mr. Omkar Barve Compliance Officer : Mr. V. Madhusudhan Rao SEBI Registration No.: INM000008365 RR Investors Capital Services Private Limited 133A, Mittal Tower, Nariman Point, Mumbai 400 021 Maharashtra, India Tel :+91 22 2288 6627/28 Fax :+91 22 2285 1925 E-mail : sreiinfra@rrfcl.com Investor Grievance E-mail ID: investors@rrfcl.com Website: www.rrfcl.com Contact person: Mr. Brahmdutt Singh Compliance Officer: Mr. Sandeep Mahajan SEBI Registration No: INM000007508 Srei Capital Markets Limited* ‘Vishwakarma’, 86C, Topsia Road (South) Kolkata – 700 046 West Bengal, India Tel: +91 33 6602 3845 Fax: +91 33 6602 3861 Email: capital@srei.com Investor Grievance E mail: scmlinvestors@srei.com Website: www.srei.com Contact Person: Mr. Manoj Agarwal Compliance Officer: Mr. Manoj Agarwal SEBI Registration No.: INM 000003762 CO-LEAD-MANAGERS TO THE ISSUE DEBENTURE TRUSTEE TO THE ISSUE REGISTRAR TO THE ISSUE SMC Capitals Limited 3rd Floor, 'A' Wing, Laxmi Tower, Bandra Kurla Complex, Bandra (E), Mumbai - 400051 Telephone number: +91 22 61383838 Fax number: +91 22 61383899 E-mail: srei.bond@smccapitals.com Investor Grievance E-mail ID: investor.grievance@smccapitals.com Website: www.smccapitals.com Compliance Officer: Mr. Sanjeev Barnwal Contact person: Mr. Abhishek Gaur SEBI Registration No.: MB/INM000011427 always acting in your interest (%) Bajaj Capital Limited 672, 7th Floor, Building No. 6, Solitaire Corporate Park, Andheri (East), Mumbai - 400093 Telephone No.: +91 22 40099999 Fax: +91 22 40099911 Email: sumitd@bajajcapital.com Investor Grievance E-mail ID: info@bajajcapital.com Website: www.bajajcapital.com Compliance officer: Mr. Janardhan P Contact person: Mr. Sumit Dudani SEBI Reg. No. INM000010544 Axis Trustee Services Limited Axis House, 2nd Floor, Bombay Dyeing Mills Compound Pandurang Budhkar Marg, Worli, Mumbai: 400 025 Tel: +91 22 2425 2525 / 4325 2525 Email: debenturetrustee@axistrustee.com Contact Person: Mr. Indraprakash Rai Link Intime India Private Limited C-13, Pannalal Silk Mills Compound, L.B.S. Marg, Bhandup (West), Mumbai 400 078 Tel.: +91 22 25960320 Fax :+91 22 25960329 Toll Free:1-800-22-0320 Email : sreinfra.ncd@linkintime.co.in Investor Grievance Email : sreinfra.ncd@linkintime.co.in Website: www.linkintime.co.in Contact Person: Mr. Sanjog Sud Compliance Officer: Mr. Sanjeev Nandu SEBI Registration No.: INR000004058 *Srei Capital Markets Limited, which is a wholly owned subsidiary of the Company, shall only be involved in marketing of the Issue. ISSUE PROGRAMME ISSUE OPENS ON: [] ISSUE CLOSES ON : [] The Issue shall remain open for subscription during banking hours for the period indicated above, except that the Issue may close on such earlier date or extended date as may be decided by the Board/ Committee of Directors, as the case maybe, subject to necessary approvals. In the event of an early closure or extension of the Issue, our Company shall ensure that notice of the same is provided to the prospective investors through newspaper advertisements on or before such earlier or extended date of Issue closure.

- Page 2 and 3: TABLE OF CONTENTS SECTION I: GENERA

- Page 4 and 5: Term Description N.I. Act Negotiabl

- Page 6 and 7: Term Description Issue Public issue

- Page 8 and 9: Term Board / Board of Directors CC&

- Page 10 and 11: PRESENTATION OF FINANCIALS & USE OF

- Page 12 and 13: Our lending activities are exposed

- Page 14 and 15: interest rate or currency exchange

- Page 16 and 17: Given the extensive regulation of t

- Page 18 and 19: As on March 31, 2009, 2010, and 201

- Page 20 and 21: financial loss, disruption of our b

- Page 22 and 23: central government policy, taxation

- Page 24 and 25: There can be no assurance that an a

- Page 26 and 27: 133A, Mittal Tower, Nariman Point,

- Page 28 and 29: Tel: +91 33 2249 3310 Fax: +91 33 2

- Page 30 and 31: ISSUE OPENS ON ISSUE CLOSES ON [●

- Page 32 and 33: Day Count Conversion particularly s

- Page 34 and 35: THE ABOVE MENTIONED FIGURES. THE FI

- Page 36 and 37: Srei Infrastructure Finance Ltd. (S

- Page 38 and 39: Issue of Equity Warrants (Net) - -

- Page 40 and 41: Srei Infrastructure Finance Ltd. (C

- Page 42 and 43: Srei Infrastructure Finance Ltd. (C

- Page 44 and 45: CAPITAL STRUCTURE Details of Share

- Page 46 and 47: Date Allotment of Number of Equity

- Page 48 and 49: ight was exercised on June 1, 1999.

- Page 50 and 51: Categor y Code Category of Sharehol

<strong>Shelf</strong> <strong>Prospectus</strong><br />

December 28, 2011<br />

SREI INFRASTRUCTURE FINANCE LIMITED<br />

(<strong>Srei</strong> <strong>Infrastructure</strong> <strong>Finance</strong> <strong>Limited</strong> (the “Company”), with CINL29219WB1985PLC055352, incorporated in the Republic of India with limited liability under<br />

theCompanies Act, 1956, as amended (the “Companies Act”))<br />

Registered Office: ‘Vishwakarma’, 86 C, Topsia Road (South), Kolkata 700 046; Tel: +91 336160 7734; Fax: +91 332285 7542; Website: www.srei.com<br />

Compliance Officer and Contact Person: Mr. Sandeep Lakhotia, Company Secretary,<br />

<strong>Srei</strong> <strong>Infrastructure</strong> <strong>Finance</strong> <strong>Limited</strong>, “Vishwakarma”, 86C Topsia Road (South), Kolkata - 700 046 Phone: +91 336160 7734, Fax: +91 33 2285 8501, Email-id: infrabonds2012@srei.com<br />

PUBLIC ISSUE BY SREI INFRASTRUCTURE FINANCE LIMITED (THE “COMPANY” OR THE “ISSUER”) OF LONG TERM INFRASTRUCTURE BONDS<br />

WITH A FACE VALUE OF ` 1,000 EACH, IN THE NATURE OF SECURED, REDEEMABLE, NON-CONVERTIBLE DEBENTURES, HAVING BENEFITS UNDER<br />

SECTION 80 CCF OF THE INCOME TAX ACT, 1961 (THE “DEBENTURES” OR THE “BONDS”), AGGREGATING UP TO ` 5,000 MILLION (THE “ISSUE”)<br />

FOR THE FINANCIAL YEAR (“FY”) 2012 (THE “SHELF LIMIT”). THE BONDS WILL BE ISSUED IN ONE OR MORE TRANCHES SUBJECT TO THE SHELF<br />

LIMIT FOR THE FY 2012. ALL TRANCHES OF THE BONDS WILL BE OFFERED BY WAY OF SUBSEQUENT TRANCHE PROSPECTUS CONTAINING<br />

THEIR RESPECTIVE TERMS AND CONDITIONS.<br />

FOR ANY QUERIES REGARDING THE ISSUE, PLEASE WRITE TO US AT infrabonds2012@srei.com. FOR FURTHER DETAILS, INVESTORS CAN VISIT OUR<br />

WEBSITE: www.srei.com<br />

The Issue is being made pursuant to the provisions of the Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations,2008, as amended (the<br />

“Debt Regulations”).<br />

GENERAL RISK<br />

Investors are advised to read the section titled “Risk Factors” carefully before taking an investment decision inrelation to this Issue. For the purposes of taking an<br />

investment decision, investors must rely on their own examination of the Issuer and of the Issue, including the risks involved. Specific attention of the investors is invited<br />

to the section titled “Risk Factors” on page 9 before making an investment in this issue.<br />

ISSUER’S ABSOLUTE RESPONSIBILITY<br />

The Issuer, having made all reasonable inquiries, accepts responsibility for and confirms that this <strong>Shelf</strong> <strong>Prospectus</strong> contains all information with regard to the Issuer and<br />

the Issue, which is material in the context of the Issue, that the information contained in this <strong>Shelf</strong> <strong>Prospectus</strong> is true and correct in all material aspects and is not misleading<br />

in any material respect, that the opinions and intentions expressed herein are honestly held and that there are no other material facts, the omission of which makes this<br />

<strong>Shelf</strong> <strong>Prospectus</strong> as a whole or any of such information or the expression of any such opinions or intentions misleading in any material respect.<br />

CREDIT RATINGS<br />

The Bonds have been rated ‘CARE AA’ by CARE pursuant to its letter dated December 15, 2011. Instruments with a rating of ‘CARE AA’ by CARE are considered to<br />

offer high degree of safety regarding timely servicing of financial obligations. Such instruments carry very low credit risk. The rating provided by CARE may be suspended,<br />

withdrawn or revised at any time by the assigning rating agency on the basis of new information etc., and should be evaluated independently of any other rating. The<br />

rating is not a recommendation to buy, sell or hold securities and investors should take their own investment decisions. Please refer to the Annexureof this <strong>Shelf</strong> <strong>Prospectus</strong><br />

for the rationale for the above rating.<br />

PUBLIC COMMENTS<br />

The Draft <strong>Shelf</strong> <strong>Prospectus</strong> was filed with the Designated Stock Exchange pursuant to the provisions of the Debt Regulations. The Draft <strong>Shelf</strong> <strong>Prospectus</strong> was open for<br />

public commentsfor 7 Working Days from the date of filing of the Draft <strong>Shelf</strong> <strong>Prospectus</strong> with the Designated Stock Exchange..<br />

LISTING<br />

The Bonds offered through this <strong>Shelf</strong> <strong>Prospectus</strong> are proposed to be listed on the BSE <strong>Limited</strong> (the “BSE”). Our Company has applied to the BSE for ‘in-principle’ approval<br />

for the Issue through a letter dated December 22, 2011. .BSE has given its ‘in-principle’ listing approval through its letter dated December 28, 2011. For the purposes of<br />

this Issue, the BSE shall be the Designated Stock Exchange.<br />

LEAD MANAGERS TO THE ISSUE<br />

ICICI Securities <strong>Limited</strong><br />

ICICI Centre<br />

H.T. Parekh Marg Churchgate,<br />

Mumbai 400 020 Maharashtra, India<br />

Tel : +91 22 2288 2460<br />

Fax : +91 22 2282 6580<br />

E-mail : project.srei@icicisecurities.com<br />

Investor Grievance Email:<br />

customercare@icicisecurities.com<br />

Website : www.icicisecurities.com<br />

Contact Person: Mr. Sumit Agarwal<br />

Compliance Officer : Mr. Subir Saha<br />

SEBI Registration No: INM000011179<br />

Karvy Investor Services <strong>Limited</strong><br />

Hallmark Business Plaza, 7 th Floor,<br />

Sant Dynaneshwar Marg,<br />

Opp: Gurunank Hospital, Bandra - East<br />

Mumbai – 400 051 Maharashtra, India<br />

Tel: +91 22 6149 1500 Fax: +91 22 6149 1515<br />

Email: sreiinfrabondissue@karvy.com<br />

Investor Grievance E mail: cmg@karvy.com<br />

Website: www.karvy.com<br />

Contact Person: Mr. Lokesh Singhi /<br />

Mr. Omkar Barve<br />

Compliance Officer : Mr. V. Madhusudhan Rao<br />

SEBI Registration No.: INM000008365<br />

RR Investors Capital<br />

Services Private <strong>Limited</strong><br />

133A, Mittal Tower, Nariman Point,<br />

Mumbai 400 021 Maharashtra, India<br />

Tel :+91 22 2288 6627/28<br />

Fax :+91 22 2285 1925<br />

E-mail : sreiinfra@rrfcl.com<br />

Investor Grievance E-mail ID:<br />

investors@rrfcl.com<br />

Website: www.rrfcl.com<br />

Contact person: Mr. Brahmdutt Singh<br />

Compliance Officer: Mr. Sandeep Mahajan<br />

SEBI Registration No: INM000007508<br />

<strong>Srei</strong> Capital Markets <strong>Limited</strong>*<br />

‘Vishwakarma’, 86C,<br />

Topsia Road (South)<br />

Kolkata – 700 046 West Bengal, India<br />

Tel: +91 33 6602 3845<br />

Fax: +91 33 6602 3861<br />

Email: capital@srei.com<br />

Investor Grievance E mail:<br />

scmlinvestors@srei.com<br />

Website: www.srei.com<br />

Contact Person: Mr. Manoj Agarwal<br />

Compliance Officer: Mr. Manoj Agarwal<br />

SEBI Registration No.: INM 000003762<br />

CO-LEAD-MANAGERS TO THE ISSUE DEBENTURE TRUSTEE TO THE ISSUE REGISTRAR TO THE ISSUE<br />

SMC Capitals <strong>Limited</strong><br />

3rd Floor, 'A' Wing, Laxmi Tower,<br />

Bandra Kurla Complex, Bandra (E),<br />

Mumbai - 400051<br />

Telephone number: +91 22 61383838<br />

Fax number: +91 22 61383899<br />

E-mail: srei.bond@smccapitals.com<br />

Investor Grievance E-mail ID:<br />

investor.grievance@smccapitals.com<br />

Website: www.smccapitals.com<br />

Compliance Officer: Mr. Sanjeev Barnwal<br />

Contact person: Mr. Abhishek Gaur<br />

SEBI Registration No.: MB/INM000011427<br />

always acting in your interest (%)<br />

Bajaj Capital <strong>Limited</strong><br />

672, 7th Floor, Building No. 6,<br />

Solitaire Corporate Park,<br />

Andheri (East), Mumbai - 400093<br />

Telephone No.: +91 22 40099999<br />

Fax: +91 22 40099911<br />

Email: sumitd@bajajcapital.com<br />

Investor Grievance E-mail ID:<br />

info@bajajcapital.com<br />

Website: www.bajajcapital.com<br />

Compliance officer: Mr. Janardhan P<br />

Contact person: Mr. Sumit Dudani<br />

SEBI Reg. No. INM000010544<br />

Axis Trustee Services <strong>Limited</strong><br />

Axis House, 2nd Floor,<br />

Bombay Dyeing Mills Compound<br />

Pandurang Budhkar Marg,<br />

Worli, Mumbai: 400 025<br />

Tel: +91 22 2425 2525 / 4325 2525<br />

Email: debenturetrustee@axistrustee.com<br />

Contact Person: Mr. Indraprakash Rai<br />

Link Intime India Private <strong>Limited</strong><br />

C-13, Pannalal Silk Mills Compound,<br />

L.B.S. Marg, Bhandup (West), Mumbai 400 078<br />

Tel.: +91 22 25960320<br />

Fax :+91 22 25960329<br />

Toll Free:1-800-22-0320<br />

Email : sreinfra.ncd@linkintime.co.in<br />

Investor Grievance Email :<br />

sreinfra.ncd@linkintime.co.in<br />

Website: www.linkintime.co.in<br />

Contact Person: Mr. Sanjog Sud<br />

Compliance Officer: Mr. Sanjeev Nandu<br />

SEBI Registration No.: INR000004058<br />

*<strong>Srei</strong> Capital Markets <strong>Limited</strong>, which is a wholly owned subsidiary of the Company, shall only be involved in marketing of the Issue.<br />

ISSUE PROGRAMME<br />

ISSUE OPENS ON: [] ISSUE CLOSES ON : []<br />

The Issue shall remain open for subscription during banking hours for the period indicated above, except that the Issue may close on such earlier date or extended date as may be decided by the Board/<br />

Committee of Directors, as the case maybe, subject to necessary approvals. In the event of an early closure or extension of the Issue, our Company shall ensure that notice of the same is provided to the<br />

prospective investors through newspaper advertisements on or before such earlier or extended date of Issue closure.

TABLE OF CONTENTS<br />

SECTION I: GENERAL .........................................................................................................1<br />

DEFINITIONS & ABBREVIATIONS ........................................................................................................... 1<br />

FORWARD-LOOKING STATEMENTS ...................................................................................................... 7<br />

PRESENTATION OF FINANCIALS & USE OF MARKET DATA .......................................................... 8<br />

SECTION II: RISK FACTORS .............................................................................................9<br />

SECTION III: INTRODUCTION........................................................................................23<br />

GENERAL INFORMATION........................................................................................................................ 23<br />

THE ISSUE ..................................................................................................................................................... 29<br />

SUMMARY FINANCIAL INFORMATION .............................................................................................. 33<br />

CAPITAL STRUCTURE .............................................................................................................................. 42<br />

OBJECTS OF THE ISSUE ........................................................................................................................... 51<br />

STATEMENT OF TAX BENEFITS ............................................................................................................ 52<br />

SECTION IV: ABOUT THE ISSUER AND THE INDUSTRY ........................................56<br />

INDUSTRY ..................................................................................................................................................... 56<br />

BUSINESS ...................................................................................................................................................... 66<br />

HISTORY AND MAIN OBJECTS ............................................................................................................... 78<br />

OUR MANAGEMENT .................................................................................................................................. 82<br />

STOCK MARKET DATA FOR OUR EQUITY SHARES/DEBENTURES ............................................ 90<br />

OUR PROMOTER ........................................................................................................................................ 92<br />

SECTION V: FINANCIAL INFORMATION ....................................................................93<br />

DISCLOSURES ON EXISTING FINANCIAL INDEBTEDNESS ........................................................... 94<br />

SECTION VI: ISSUE RELATED INFORMATION .........................................................99<br />

ISSUE STRUCTURE ..................................................................................................................................... 99<br />

TERMS OF THE ISSUE ............................................................................................................................. 102<br />

ISSUE PROCEDURE .................................................................................................................................. 115<br />

SECTION VII: LEGAL AND OTHER INFORMATION ..............................................122<br />

OUTSTANDING LITIGATION AND STATUTORY DEFAULTS ....................................................... 122<br />

OTHER REGULATORY AND STATUTORY DISCLOSURES ............................................................ 123<br />

REGULATIONS AND POLICIES ............................................................................................................. 128<br />

SUMMARY OF KEY PROVISIONS OF ARTICLES OF ASSOCIATION .......................................... 136<br />

MATERIAL CONTRACTS AND DOCUMENTS FOR INSPECTION................................................. 141<br />

DECLARATION .......................................................................................................................................... 143

SECTION I: GENERAL<br />

DEFINITIONS & ABBREVIATIONS<br />

CONVENTIONAL / GENERAL TERMS AND ABBREVIATIONS<br />

This <strong>Shelf</strong> <strong>Prospectus</strong> uses certain definitions and abbreviations which, unless the context indicates or implies<br />

otherwise, have the meaning as provided below. References to any legislation, act or regulation shall be to such<br />

term as amended from time to time.<br />

Term<br />

Description<br />

Companies Act / Act The Companies Act, 1956<br />

AGM<br />

AS<br />

CAGR<br />

CDSL<br />

Annual General Meeting<br />

Accounting Standard<br />

Compounded Annual Growth Rate<br />

Central Depository Services (India) <strong>Limited</strong><br />

Competition Act Competition Act, 2002<br />

CPC Civil Procedure Code, 1908<br />

CrPC Code of Criminal Procedure, 1973<br />

Debt Regulations SEBI (Issue and Listing of Debt Securities) Regulations, 2008<br />

Depositories Act Depositories Act, 1996<br />

DRR<br />

EGM<br />

EPS<br />

FDI<br />

Debenture Redemption Reserve<br />

Extraordinary General Meeting<br />

Earnings Per Share<br />

Foreign Direct Investment<br />

FEMA Foreign Exchange Management Act, 1999<br />

FERA Foreign Exchange Regulation Act, 1973<br />

FII (s)<br />

Foreign Institutional Investor(s)<br />

Financial Year / FY/ Fiscal Year Financial Year ending March 31<br />

GDP<br />

GIR<br />

G-Sec<br />

HUF<br />

Indian GAAP<br />

Gross Domestic Product<br />

General Index Registration Number<br />

Government Securities<br />

Hindu Undivided Family<br />

IPC Indian Penal Code, 1860<br />

IRDA<br />

I.T. Act / Income Tax Act Income Tax Act, 1961<br />

MCA<br />

MNC<br />

NAV<br />

NECS<br />

NEFT<br />

Generally Accepted Accounting Principles in India<br />

Insurance Regulatory and Development Authority<br />

Ministry of Corporate Affairs, Government of India<br />

Multi-National Corporation / Company<br />

Net Asset Value<br />

National Electronic Clearing System<br />

National Electronic Fund Transfer<br />

1

Term<br />

Description<br />

N.I. Act Negotiable Instruments Act, 1881<br />

NII(s)<br />

Non-Institutional Investor(s)<br />

NSDL<br />

National Securities Depository <strong>Limited</strong><br />

PAN<br />

Permanent Account Number<br />

RBI<br />

Reserve Bank of India<br />

RBI Act Reserve Bank of India Act, 1934<br />

ROC<br />

Registrar of Companies, West Bengal<br />

Rs. /` / INR / Rupees<br />

The lawful currency of the Republic of India<br />

RTGS<br />

Real Time Gross Settlement<br />

SCRA Securities Contracts (Regulation) Act, 1956<br />

SCRR The Securities Contracts (Regulation) Rules, 1957<br />

SEBI<br />

Securities and Exchange Board of India constituted under the SEBI Act<br />

SEBI Act Securities and Exchange Board of India Act, 1992<br />

TDS<br />

Tax Deducted at Source<br />

ISSUE RELATED TERMS<br />

Term<br />

Allotment / Allotted/ Allot<br />

Allottee(s)<br />

Applicant(s)<br />

Application Amount<br />

Application Form<br />

Bajaj Capital / Bajaj Cap<br />

Basis of Allotment<br />

Bankers to the Issue<br />

<strong>Srei</strong> Tax Saving Infra Bonds<br />

Bondholder(s) / Debenture Holder(s)<br />

Description<br />

Unless the context otherwise requires, allotment of Bonds to the<br />

successful Applicants pursuant to this Issue<br />

A successful Applicant to whom the Bonds are being / have been<br />

Allotted<br />

Resident Individual or an HUF who applies for allotment of the Bonds<br />

in the Issue<br />

The total amount to be paid by an Applicant along with the Application<br />

Form, which is the total value of the Bonds being applied for<br />

The form (including revisions thereof) in terms of which the Applicant<br />

shall make an offer to subscribe to the Bonds and which will be<br />

considered as the application for Allotment of Bonds in terms of which<br />

this <strong>Shelf</strong> <strong>Prospectus</strong> and the respective Tranche <strong>Prospectus</strong>.<br />

Bajaj Capitals <strong>Limited</strong><br />

The basis on which Bonds will be Allotted to Successful Applicant(s)<br />

under the Issue and is described in the section titled “Issue Procedure –<br />

Basis of Allotment” on page 120 of this <strong>Shelf</strong> <strong>Prospectus</strong><br />

Collectively the Escrow Collection Banks, Public Issue Account Banks<br />

and the Refund Banks<br />

Long term infrastructure bonds, in the nature of secured, redeemable,<br />

non-convertible debentures of our Company of face value of ` 1,000<br />

each, having benefits under section 80 CCF of the Income Tax Act,<br />

issued at par, in one or more tranches in terms of this <strong>Shelf</strong> <strong>Prospectus</strong><br />

and the respective Tranche <strong>Prospectus</strong>.<br />

Any person holding the Bonds, and whose name appears on the<br />

beneficial owners list provided by the Depositories or whose name<br />

appears in the Register of Bondholders maintained by our Company<br />

2

Term<br />

Buyback Amount<br />

Buyback Date<br />

Buyback Intimation Period<br />

Buyback Intimation Request<br />

BSE<br />

CARE<br />

Co- Lead Managers<br />

Consolidated Bond Certificate<br />

Deemed Date of Allotment<br />

Debenture Trust Deed<br />

Debenture Trustee/ Trustee<br />

Depository(ies)<br />

Designated Date<br />

DP / Depository Participant<br />

Draft <strong>Shelf</strong> <strong>Prospectus</strong><br />

Escrow Accounts<br />

Escrow Agreement<br />

Escrow Collection Bank(s)<br />

ICICI Securities / I-Sec<br />

Description<br />

The amount that will be specified as the buyback amount for various<br />

series of the Bonds, as more specifically set out in the respective<br />

Tranche <strong>Prospectus</strong> in the section entitled “The Issue” on page 29 of this<br />

<strong>Shelf</strong> <strong>Prospectus</strong><br />

The date on which the buyback of the Bonds shall be made by our<br />

Company, and more particularly set out in the respective Tranche<br />

<strong>Prospectus</strong>, subject to a minimum lock-in period of 5 years from the<br />

Deemed Date of Allotment of the Bonds.<br />

The period beginning not more than 9 months prior to the Buyback Date<br />

and ending not later than 6 months prior to the Buyback Date and that<br />

will be more specifically set out in the respective Tranche <strong>Prospectus</strong>.<br />

The letter to be sent by our Company to the Bondholders intimating<br />

them about the buyback of the Bonds.<br />

BSE <strong>Limited</strong><br />

Credit Analysis & Research <strong>Limited</strong><br />

SMC Capitals <strong>Limited</strong> and Bajaj Capital <strong>Limited</strong><br />

In case of Bonds held in physical form, the certificate issued by the<br />

Issuer to the Bondholder for the aggregate amount of the Bonds that are<br />

held by such Bondholder<br />

The Deemed Date of Allotment, in case of issue of each tranche of<br />

Bonds, shall be the date as may be determined by the Board/Committee<br />

of our Company and notified to the Stock Exchange, and that will be<br />

more specifically set out in the respective Tranche <strong>Prospectus</strong>.<br />

Trust deed to be entered into between the Debenture Trustee and our<br />

Company<br />

Trustee for the Bondholders, in this case being Axis Trustee Services<br />

<strong>Limited</strong><br />

National Securities Depository <strong>Limited</strong> (NSDL) and / or Central<br />

Depository Services (India) <strong>Limited</strong> (CDSL)<br />

The date on which funds are transferred from the Escrow Account to the<br />

Public Issue Account or the Refund Account, as appropriate, subsequent<br />

to the execution of documents for the creation of security, following<br />

which the Board of Directors/Committee of Directors shall Allot the<br />

Bonds to the successful Applicants<br />

A depository participant as defined under the Depositories Act<br />

The Draft <strong>Shelf</strong> <strong>Prospectus</strong> dated December 19, 2011 filed by our<br />

Company with the Designated Stock Exchange for receiving public<br />

comments, in accordance with provision of Debt Regulations.<br />

Accounts opened with the Escrow Collection Bank(s) and in whose<br />

favour the Applicants can issue cheques or bank drafts in respect of the<br />

Application Amount while submitting the Application<br />

Agreement to be entered into amongst our Company, the Registrar, the<br />

Escrow Collection Bank(s), the Lead Managers and the Co Lead<br />

Managers for collection of the Application Amounts<br />

The banks which are clearing members and registered with SEBI under<br />

the SEBI (Bankers to an Issue) Regulations, 1994 with whom the<br />

Escrow Accounts will be opened, comprising [●]<br />

ICICI Securities <strong>Limited</strong><br />

3

Term<br />

Description<br />

Issue Public issue of long term infrastructure bonds of face value of ` 1,000<br />

each, in the nature of secured, redeemable, non-convertible debentures,<br />

having benefit under section 80CCF of the Income Tax Act, 1961, not<br />

exceeding the <strong>Shelf</strong> Limit.<br />

Issue Closing Date<br />

Issue Opening Date<br />

Issue Period<br />

Karvy<br />

KYC Documents<br />

Lead Brokers<br />

Lead Managers<br />

Lock-in Period<br />

Market/ Trading Lot<br />

Maturity Amount<br />

Maturity Date<br />

Notification<br />

NSE<br />

<strong>Prospectus</strong> – Tranche 1<br />

Public Issue Account<br />

Public Issue Account Bank<br />

Registrar / Registrar to the Issue<br />

Refund Account<br />

The date on which the issue of a particular tranche of Bonds will close<br />

for subscription and as more particularly set out in the respective<br />

Tranche <strong>Prospectus</strong>.<br />

The date on which the issue of a particular tranche of Bonds will open<br />

for subscriptions and as more particularly set out in the respective<br />

Tranche <strong>Prospectus</strong>.<br />

The period between the Issue Opening Date and the Issue Closing Date,<br />

both dates inclusive, as specifically set out in the respective Tranche<br />

<strong>Prospectus</strong>, during which Applicants can submit their Application<br />

Forms<br />

Karvy Investor Services <strong>Limited</strong><br />

Documents required for fulfilling the know your customer requirements<br />

prescribed by RBI as prescribed in "KYC Documents" on page 118 of<br />

this <strong>Shelf</strong> <strong>Prospectus</strong><br />

[●]<br />

ICICI Securities <strong>Limited</strong>, Karvy Investor Services <strong>Limited</strong>, RR<br />

Investors Capital Services Private <strong>Limited</strong> and <strong>Srei</strong> Capital Markets<br />

<strong>Limited</strong><br />

5 years from the Deemed Date of Allotment to be more specifically set<br />

out in the Tranche <strong>Prospectus</strong><br />

One Bond<br />

The principal amount and the accrued interest (if any) or the cumulative<br />

interest payments which are due, till the Maturity Date, more<br />

particularly specified in the section titled “The Issue” at page 29 of this<br />

<strong>Shelf</strong> <strong>Prospectus</strong><br />

120 months for Series 1 & 2 Bonds from the Deemed Date of Allotment<br />

to be more specifically set out in the Tranche <strong>Prospectus</strong>; or<br />

180 months for Series 3 & 4 Bonds from the Deemed Date of Allotment<br />

to be more specifically set out in the Tranche <strong>Prospectus</strong>.<br />

Notification No. 50 / 2011 . F . No . 178 / 43 / 2011 - SO (ITA.1) dated<br />

September 9, 2011 issued by the Central Board of Direct Taxes<br />

National Stock Exchange of India <strong>Limited</strong><br />

The prospectus to be filed with the RoC pursuant to provisions of the<br />

Act and Debt Regulations for issue of the first tranche of the Bonds for<br />

an amount not exceeding ` 3,000 million<br />

An account opened with the Banker(s) to the Issue to receive monies<br />

from the Escrow Accounts on the Designated Date<br />

The banks which are clearing members and registered with SEBI under<br />

the SEBI (Bankers to an Issue) Regulations, 1994 with whom the Public<br />

Issue Accounts will be opened, comprising [●].<br />

Link Intime India Private <strong>Limited</strong>, being the Registrar to the Issue and<br />

the transfer agent to our Company<br />

The account opened with the Refund Bank, from which refunds, if any,<br />

of the whole or part of the Application Amount shall be made<br />

4

Term<br />

Refund Bank<br />

Resident Individual<br />

RR Capital / RR<br />

Simple Mortgage Deed / Debenture<br />

Trust-cum–Hypothecation Deed<br />

<strong>Shelf</strong> Limit<br />

<strong>Shelf</strong> <strong>Prospectus</strong><br />

SMC Capitals / SMC Cap<br />

<strong>Srei</strong> Capital / <strong>Srei</strong> Cap<br />

<strong>Srei</strong> Group<br />

Stock Exchange<br />

Tranche <strong>Prospectus</strong><br />

Description<br />

The bank which is a clearing member and registered with SEBI under<br />

the SEBI (Bankers to an Issue) Regulations, 1994 with whom the<br />

Refund Account(s) will be opened, comprising [●].<br />

An individual who is a “person resident in India” as defined in the<br />

Income Tax Act<br />

RR Investors Capital Services Private <strong>Limited</strong><br />

The simple mortgage deed / debenture trust-cum-hypothecation deed, as<br />

the case may be, to be executed between our Company and the<br />

Debenture Trustee in relation to this Issue<br />

The limit up to which the Bonds can be issued for the FY 2012 being `<br />

5,000 million.<br />

This shelf prospectus dated December 28, 2011 filed by our Company<br />

with the RoC in accordance with the provisions of the Debt Regulations.<br />

SMC Capitals <strong>Limited</strong><br />

<strong>Srei</strong> Capital Markets <strong>Limited</strong><br />

<strong>Srei</strong> <strong>Infrastructure</strong> <strong>Finance</strong> <strong>Limited</strong> and its subsidiaries, step down<br />

subsidiaries, its joint ventures and associate companies and subsidiaries<br />

and step down subsidiaries of such subsidiaries, joint ventures and<br />

associate companies<br />

BSE <strong>Limited</strong><br />

Every prospectus that will be filed with the RoC in connection with the<br />

issue of any tranche of Bonds within the <strong>Shelf</strong> Limit, and each such<br />

prospectus will be called a Tranche <strong>Prospectus</strong><br />

Tranche I Bonds The Bonds that will be issued and allotted pursuant to the <strong>Prospectus</strong> –<br />

Tranche 1<br />

Tripartite Agreements<br />

WDM<br />

YTM<br />

Working Days<br />

Agreements entered into between the Issuer, Registrar and each of the<br />

Depositories under the terms of which the Depositories have agreed to<br />

act as depositories for the bonds issued by the Issuer.<br />

Wholesale Debt Market<br />

Yield to Maturity<br />

COMPANY / INDUSTRY RELATED TERMS<br />

All days excluding Saturdays, Sundays and public holidays in Kolkata<br />

or at any other payment centre notified in terms of the Negotiable<br />

Instruments Act, 1881<br />

Term<br />

“<strong>Srei</strong> Infra”, “Issuer”, “the<br />

Company”, “we”, “us”, and “our<br />

Company”<br />

ALCO<br />

ALM<br />

Articles / Articles of Association /<br />

AOA<br />

Auditors / Statutory Auditors<br />

Description<br />

<strong>Srei</strong> <strong>Infrastructure</strong> <strong>Finance</strong> <strong>Limited</strong>, a public limited company<br />

incorporated under the Act having its registered office at<br />

“Vishwakarma” , 86C Topsia Road (South), Kolkata - 700 046<br />

Asset Liability Management Committee<br />

Asset Liability Management<br />

Articles of Association of the Issuer, as amended<br />

M/s. Haribhakti & Co., Chartered Accountants, the statutory auditors<br />

of our Company<br />

5

Term<br />

Board / Board of Directors<br />

CC&IC<br />

Committee of Directors<br />

CAR<br />

CP<br />

CRAR<br />

Exposure<br />

FIMMDA<br />

IFC<br />

Memorandum / MOA<br />

Mezzanine Debt<br />

NBFC<br />

NBFC-ND-SI<br />

NPA<br />

Portfolio<br />

PFI<br />

Promoters / our Promoters<br />

Description<br />

The Board of Directors of the Issuer<br />

Central Credit and Investment Committee<br />

The Committee of Directors of the Issuer<br />

Capital Adequacy Ratio<br />

Commercial Paper<br />

Capital-to-Risk-Weighted Assets Ratio<br />

Exposure includes credit exposure (funded and non-funded credit limits)<br />

and investment exposure. The sanctioned limit or outstanding,<br />

whichever is higher, is our exposure as at that date. In the case of fully<br />

drawn term loans, where there is no scope for further drawl of any<br />

portion of the sanctioned amount, the committed/outstanding amount, as<br />

may be applicable, is equivalent to our exposure.<br />

Fixed Income, Money Markets and Derivatives Association<br />

‘<strong>Infrastructure</strong> <strong>Finance</strong> Company’, as defined under applicable RBI<br />

guidelines<br />

Memorandum of Association of the Issuer, as amended<br />

Subordinated debt instruments secured by a charge other than an<br />

exclusive charge or a first charge<br />

Non-Banking Financial Company as defined under Section 45-I(f) of<br />

the RBI Act<br />

Systemically Important Non-Deposit Taking NBFC<br />

Non Performing Asset<br />

Aggregate outstanding loans and advances including Senior Debt,<br />

Mezzanine Debt, debentures, unsecured loans, and investments by way<br />

of equity and preference shares<br />

Public financial institution as defined under Section 4A of the<br />

Companies Act<br />

The promoter of our Company being Mr. Hemant Kanoria<br />

Registered Office Registered office of our Company situate at “Vishwakarma”, 86C<br />

Topsia Road (South), Kolkata - 700 046<br />

Senior Debt/ Senior Loans<br />

USD<br />

Debt secured by exclusive charge or first charge<br />

United States Dollar, the official currency of the United States of<br />

America<br />

6

FORWARD-LOOKING STATEMENTS<br />

This <strong>Shelf</strong> <strong>Prospectus</strong> contains certain forward-looking statements such as “aim”, “anticipate”, “shall”, “will”,<br />

“will continue”, “would pursue”, “will likely result”, “expected to”, “contemplate”, “seek to”, “target”, “propose<br />

to”, “future”, “goal”, “project”, “could”, “may”, “in management’s judgment”, “objective”, “plan”, “is likely”,<br />

“intends”, “believes”, “expects” and other similar expressions or variations of such expressions. These<br />

statements are primarily meant to give the investor an overview of our Company’s future plans, as they<br />

currently stand. Our Company operates in a highly competitive, dynamic and regulated business environment,<br />

and a change in any of these variables may necessitate an alteration of our Company’s plans. Further, these<br />

plans are not static, but are subject to continuous internal review and policies, and may be altered, if the altered<br />

plans suit our Company’s needs better.<br />

Further, many of the plans may be based on one or more underlying assumptions (all of which may not be<br />

contained in this <strong>Shelf</strong> <strong>Prospectus</strong>) which may not come to fruition. Thus, actual results may differ materially<br />

from those suggested by the forward-looking statements. Our Company and all intermediaries associated with<br />

this <strong>Shelf</strong> <strong>Prospectus</strong> do not undertake to inform the investor of any change in any matter in respect of which<br />

any forward-looking statements are made.<br />

All statements contained in this <strong>Shelf</strong> <strong>Prospectus</strong> that are not statements of historical fact constitute “forwardlooking<br />

statements” and are not forecasts or projections relating to our Company’s financial performance. All<br />

forward-looking statements are subject to risks, uncertainties and assumptions that may cause actual results to<br />

differ materially from those contemplated by the relevant forward-looking statement. Important factors that may<br />

cause actual results to differ materially from our Company’s expectations include, amongst others:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

General economic and business environment in India;<br />

Our Company’s ability to successfully implement its strategy and growth plans;<br />

Our Company’s ability to compete effectively and access funds at competitive cost;<br />

Effectiveness and accuracy of internal controls and procedures;<br />

Changes in domestic or international interest rates and liquidity conditions;<br />

Defaults by end customers resulting in an increase in the level of non-performing assets in its portfolio;<br />

Rate of growth of its loan assets and ability to maintain concomitant level of capital;<br />

Downward revision in credit rating(s);<br />

Performance of the Indian debt and equity markets;<br />

Potential mergers, acquisitions or restructurings and increased competition;<br />

Changes in tax benefits and incentives and other applicable regulations, including various tax laws;<br />

Our Company’s ability to retain its management team and skilled personnel;<br />

Changes in laws and regulations that apply to NBFCs and PFIs in India, including laws that impact its<br />

lending rates and its ability to enforce the assets financed/secured to it; and<br />

Changes in political conditions in India.<br />

By their nature, certain market risk disclosures are only estimates and could be materially different from what<br />

actually occurs in the future. As a result, actual future gains or losses could materially differ from those that<br />

have been estimated. Neither our Company nor any of its Directors have any obligation, or intent to update or<br />

otherwise revise any statements reflecting circumstances arising after the date hereof or to reflect the occurrence<br />

of underlying events, even if the underlying assumptions do not come to fruition. For further discussion of the<br />

factors that could affect our Company’s future financial performance, see the section titled “Risk Factors”<br />

beginning on page 9 of this <strong>Shelf</strong> <strong>Prospectus</strong>.<br />

7

PRESENTATION OF FINANCIALS & USE OF MARKET DATA<br />

Unless stated otherwise, the financial information used in this <strong>Shelf</strong> <strong>Prospectus</strong> is derived from our Company’s<br />

audited financial statements as at March 31, 2007, March 31, 2008, March 31, 2009, March 31, 2010 and March<br />

31, 2011 and the 6 month period ending September 30, 2011 prepared in accordance with Indian GAAP and the<br />

Act and are in accordance with Paragraph B, Part – II of Schedule II to the Act, the Debt Regulations, as stated<br />

in the report of our Company’s Statutory Auditors, M/s. Haribhakti & Co., Chartered Accountants, included in<br />

this <strong>Shelf</strong> <strong>Prospectus</strong>.<br />

In this <strong>Shelf</strong> <strong>Prospectus</strong>, any discrepancies in any table between the total and the sum of the amounts listed are<br />

due to rounding-off.<br />

Except as specifically disclosed, all financial / capital ratios and disclosures regarding NPAs in this <strong>Shelf</strong><br />

<strong>Prospectus</strong> are in accordance with the applicable RBI norms.<br />

Unless stated otherwise, macroeconomic, growth rates, industry data and information regarding market position<br />

contained in this <strong>Shelf</strong> <strong>Prospectus</strong> have been obtained from publications prepared / compiled by professional<br />

organisations and analysts, data from other external sources, our knowledge of the markets in which we<br />

compete, providers of industry information, government sources and multilateral institutions, with their consent,<br />

wherever necessary. Such publications generally state that the information contained therein has been obtained<br />

from sources believed to be reliable but that their accuracy and completeness are not guaranteed and their<br />

reliability cannot be assured.<br />

The extent to which the market and industry data used in this <strong>Shelf</strong> <strong>Prospectus</strong> is meaningful depends on the<br />

reader’s familiarity with and understanding of the methodologies used in compiling such data. The<br />

methodologies and assumptions may vary widely among different industry sources.<br />

While we have compiled, extracted and reproduced data from external sources, including third parties, trade,<br />

industry or general publications, we accept responsibility for accurately reproducing such data. However,<br />

neither we nor the Lead Managers have independently verified this data and neither we nor the Lead Managers<br />

make any representation regarding the accuracy of such data. Similarly, while we believe our internal estimates<br />

to be reasonable, such estimates have not been verified by any independent sources and neither we nor the Lead<br />

Managers can assure potential investors as to their accuracy.<br />

Currency and units of Presentation<br />

In this <strong>Prospectus</strong>, all references to ‘Rupees’/ ‘`’ / ‘INR’ are to Indian Rupees, the official currency of the<br />

Republic of India and to ‘U.S. Dollar’/ ‘USD’ are to the United States dollar, the official currency of the United<br />

States.<br />

Except where stated otherwise in this <strong>Prospectus</strong>, all figures have been expressed in ‘Millions’. All references to<br />

‘million/Million/Mn’ refer to one million, which is equivalent to ‘ten lakhs’ or ‘ten lacs’, the word<br />

‘Lakhs/Lacs/Lac’ means ‘one hundred thousand’ and ‘Crore’ means ‘ten million’ and ‘billion/bn./Billions’<br />

means ‘one hundred crores’.<br />

Certain of our funding is by way of US Dollar loans. Amounts set out in this <strong>Prospectus</strong>, and particularly in the<br />

section “Disclosure on Existing Financial Indebtedness”, in relation to such U. S. Dollar loans have been<br />

converted into Indian Rupees for the purposes of the presentation.<br />

8

SECTION II: RISK FACTORS<br />

Prospective investors should carefully consider the risks and uncertainties described below, in addition to the other<br />

information contained in this <strong>Shelf</strong> <strong>Prospectus</strong> before making any investment decision relating to the Issue. If any of<br />

the following risks or other risks that are not currently known or are deemed immaterial at this time, actually occur,<br />

our business, financial condition and results of operation could suffer, the trading price of the Bonds could decline<br />

and you may lose all or part of your redemption amounts and / or interest amounts. Unless otherwise stated in the<br />

relevant risk factors set forth below, we are not in a position to specify or quantify the financial or other<br />

implications of any of the risks mentioned herein. The order of the risk factors appearing hereunder is intended to<br />

facilitate ease of reading and reference and does not in any manner indicate the importance of one risk factor over<br />

another. Unless the context requires otherwise, the risk factors described below apply to us / our operations only.<br />

This <strong>Shelf</strong> <strong>Prospectus</strong> also contains forward-looking statements that involve risks and uncertainties. Our Company’s<br />

actual results could differ materially from those anticipated in these forward-looking statements as a result of<br />

certain factors, including the considerations described below and elsewhere in this <strong>Shelf</strong> <strong>Prospectus</strong>.<br />

Investors are advised to read the following risk factors carefully before making an investment in this Issue. You must<br />

rely on your own examination of our Company and this Issue, including the risks and uncertainties involved.<br />

INTERNAL RISKS<br />

1. There are outstanding material legal proceedings involving our Company. Any adverse outcome in such<br />

legal proceedings may affect our business, results of operations and financial condition.<br />

There are outstanding legal proceedings involving our Company and one of our Non Executive &<br />

Independent Directors, Mr. Sujitendra Krishna Deb. These proceedings are pending at different levels of<br />

adjudication before various courts, tribunals, enquiry officers, appellate tribunals and arbitrators If there are<br />

any rulings against us, we may face losses and may have to make provisions in our financial statements,<br />

which could increase our expenses and our liabilities. In addition, further liability may arise out of these<br />

claims. Brief details of such outstanding material litigation as of the date of the <strong>Shelf</strong> <strong>Prospectus</strong> are as<br />

follows:<br />

i. We are involved in a number of disputed income tax and interest tax demands amounting to ` 236.40<br />

Million as on September 30, 2011.<br />

ii.<br />

iii.<br />

iv.<br />

Our Company has challenged the constitutional validity of Fringe Benefit Tax (“FBT”) before the<br />

Hon’ble High Court at Calcutta. The Hon’ble Court has granted an interim stay on levy of such FBT on<br />

the Company. In view of this the Company has not provided for any liability against FBT since the<br />

inception of the levy up to the date of its abolition, i.e. March 31, 2009.<br />

M/s DHV India Private <strong>Limited</strong> (‘DHV’), has instituted arbitration proceeding against our Company<br />

claiming an amount of ` 69,189,451.00, along with an interest @ 18% . We have disputed the claim and<br />

the matter is still pending.<br />

Mr. Vijay Gopal Jindal, an ex-employee of <strong>Srei</strong> Venture Capital Ltd., has filed a suit for recovery and an<br />

application for mandatory and permanent injunction bearing C.S. (OS) no. 1575 of 2008 along with I.A.<br />

No. 9448 of 2008 before the Hon’ble High Court of Delhi, at New Delhi against our Company and <strong>Srei</strong><br />

Venture Capital <strong>Limited</strong> alleging that he was promised 500,000 equity shares at the rate of ` 100 per<br />

share of our Company. The objection to the injunction application has been filed by our Company and the<br />

written statement has also been filed by our Company. The matter is pending before the said Court for<br />

filing of the list of witnesses and evidence by Mr. Vijay Gopal Jindal. The amount involved is not<br />

ascertainable.<br />

v. Dr. Syed Sabahat Azim, ex-chief executive officer of <strong>Srei</strong> Sahaj E-village Ltd., has filed a company<br />

petition being No. 259 of 2011 before the Company Law Board, Eastern Region Bench, Kolkata against<br />

our Company, <strong>Srei</strong> Sahaj E-village Ltd. and others making various claims. The said Petition is currently<br />

pending. The amount involved in the matter is not ascertainable.<br />

For further details of these legal proceedings, see the section titled "Outstanding Litigation and Statutory<br />

Defaults" on page 122 of this <strong>Shelf</strong> <strong>Prospectus</strong>.<br />

2. As an NBFC, the risk of default and non-payment by borrowers and other counterparties may materially<br />

and adversely affect our profitability and asset quality. Any such defaults and non-payments would result<br />

in write-offs and/or provisions in our financial statements which may materially and adversely affect our<br />

profitability and asset quality.<br />

9

Our lending activities are exposed to credit risk arising from the risk of default and non-payment by<br />

borrowers and other counterparties. Our total outstanding loan (gross of provisions) was ` 64,797.70 million<br />

as at September 30, 2011. The size of our loan Portfolio is expected to grow as a result of our expansion<br />

strategy in existing as well as new products. Sustained growth may expose us to an increasing risk of defaults<br />

as our Portfolio expands. Our gross NPAs as a percentage of total outstanding loans were 0.15%, NIL%,<br />

NIL%, NIL% and NIL% as of September 30, 2011, March 31, 2011, 2010, 2009 and 2008, respectively,<br />

while the net NPAs as a percentage of net outstanding loans were 0.13%, NIL%, NIL%, NIL% and NIL% as<br />

of September 30, 2011, March 31, 2011, 2010, 2009 and 2008 respectively.<br />

The borrowers and/or guarantors and/or third parties may default in their repayment obligations due to<br />

various reasons including insolvency, lack of liquidity, and operational failure.<br />

We cannot be certain, and cannot assure you, that we will be able to improve our collections and recoveries in<br />

relation to the NPAs or otherwise adequately control our level of NPAs in the future. Moreover, as our loan<br />

Portfolio matures, we may experience greater defaults in principal and/or interest repayments. Thus, if we are<br />

not able to control or reduce our level of NPAs, the overall quality of our loan Portfolio may deteriorate and<br />

our results of operations may be adversely affected. Furthermore, our current provisions may not be<br />

comparable to those of other financial institutions.<br />

We have made provisions of ` 9.5 million in respect of gross NPAs as of September 30, 2011. In addition, we<br />

maintain a provision against standard assets, as per RBI Guidelines. As of September 30, 2011 and March 31,<br />

2011, we have made provisions of ` 41.60 million and ` 119.60 million respectively in respect of standard<br />

assets. There can be no assurance that there will be a decrease in our NPA provisions as a percentage of<br />

assets, or that the percentage of NPAs that we will be able to recover will be similar to our past experience of<br />

recoveries of NPAs. In the event of any further deterioration in our Portfolio, there could be a more<br />

significant and substantial material and adverse impact on our business, future financial performance and<br />

results of operations.<br />

3. Private sector infrastructure industry in India is still at a relatively early stage of development and is<br />

linked to the continued growth of the Indian economy, the sectors on which we focus and stable regulatory<br />

regimes. In the event that central and state government initiatives and regulations in the infrastructure<br />

industry do not proceed in the desired direction, or if there is any downturn in the macroeconomic<br />

environment in India or in specific sectors, our business, future financial performance and results of<br />

operations could be materially and adversely affected.<br />

We believe that further development of India's infrastructure is dependent on formulation and effective<br />

implementation of state and central government programs and policies that facilitate and encourage private<br />

sector investment in infrastructure projects in India. Many of these programs and policies are developing and<br />

evolving and their success will depend on whether they are properly designed to address the issues facing<br />

infrastructure development in India and are effectively implemented. Additionally, these programs will need<br />

continued support from stable and experienced regulatory regimes and tax deductions that not only encourage<br />

the continued movement of private capital into infrastructure projects but also lead to increased competition,<br />

appropriate allocation of risk, transparency, effective dispute resolution and more efficient and cost effective<br />

services to the end consumer.<br />

The availability of private capital and continued growth of the infrastructure industry are also linked to the<br />

continued growth of the Indian economy. Specific factors within each industry sector may also influence the<br />

success of the projects within those sectors, including changes in policies, regulatory frameworks and market<br />

structures. While there has been progress in sectors such as telecommunications, transportation, energy,<br />

tourism and industrial and commercial infrastructure, other sectors such as urban infrastructure and healthcare<br />

have not progressed to the same degree. Further, since infrastructure services in India have historically been<br />

provided by the central and state governments without charge or at a subsidized charge to consumers, the<br />

growth of the infrastructure industry will be impacted by consumers' income levels and the extent to which<br />

they would be willing to pay or can be induced to pay for infrastructure services. If the central and state<br />

governments' initiatives and regulations in the infrastructure industry do not proceed in the desired direction,<br />

or if there is any downturn in the macroeconomic environment in India or in specific sectors, our business,<br />

our future financial performance and results of operations could be materially and adversely affected.<br />

4. We may be exposed to potential losses due to a decline in value of assets secured in our favour, and due to<br />

delays in the enforcement of such security upon default by our borrowers<br />

Our total loan Portfolio is secured by a mix of movable and immovable assets and/or other collaterals. The<br />

value of certain types of assets may decline due to inherent operational risks, the nature of the asset secured in<br />

our favour and adverse market and economic conditions (both global and domestic).<br />

10

The value of the security or collateral, as the case may be, may also decline due to delays in insolvency,<br />

winding-up and foreclosure proceedings, defects in title, difficulty in locating movable assets, documentation<br />

relevant to the assets and the necessity of obtaining regulatory approvals for the enforcement of our collateral<br />

over those assets, and as such, we may not be able to recover the estimated value of the assets which would<br />

materially and adversely affect our business, future financial performance and results of operations.<br />

In the event of default by our borrowers, we cannot guarantee that we will be able to realize the full value of<br />

our collateral, due to, among other things, delays on our part in taking immediate action and in bankruptcy<br />

foreclosure proceedings, stock market downturns, defects in the perfection of collateral, litigation and<br />

fraudulent transfers by borrowers. In the event a specialized regulatory agency gains jurisdiction over the<br />

borrower, creditor actions can be further delayed.<br />

5. If we are unable to manage our rapid growth effectively, our business, future financial performance and<br />

results of operations could be materially and adversely affected.<br />

The business of our Company has grown rapidly since we began our operations. From March 31, 2009 to<br />

March 31, 2011, our total loans outstanding increased by a CAGR of 117.11%. We intend to continue to grow<br />

our businesses, which could place significant demands on our operational, credit, financial and other internal<br />

risk controls. It may also exert pressure on the adequacy of our capitalization, making management of asset<br />

quality increasingly important.<br />

Our future business plan is dependent on our ability to borrow at competitive rate to fund our growth. We<br />

may have difficulty obtaining funding on attractive terms. Adverse developments in the Indian credit markets,<br />

such as the significant increase in interest rates in the last 18 months, had increase our debt service costs and<br />

the overall cost of our funds. An inability to manage our growth effectively and failure to secure the required<br />

funding therefore on favourable terms, or at all, could have a material and adverse effect on our business,<br />

future financial performance and results of operations.<br />

6. We face increasing competition in our business which may result in declining margins if we are unable to<br />

compete effectively<br />

Our primary competitors are other NBFCs, public sector banks, private sector banks and other financial<br />

institution. Banks have access to low cost funds which enables them to enjoy higher margins and / or offer<br />

finance at lower rates. NBFCs do not have access to large quantities of low cost deposits, a factor which may<br />

render them less competitive.<br />

All of these factors have resulted in us facing increased competition from other lenders in each of our lines of<br />

businesses, including commercial banks and other NBFCs. Our ability to compete effectively will depend, to<br />

some extent, on our ability to raise funds at competitive rates or at all. Increasing competition may have an<br />

adverse effect on our net interest margin and other income, and, if we are unable to compete successfully, our<br />

market share may decline.<br />

7. <strong>Infrastructure</strong> projects carry certain risks which, to the extent they materialize, could adversely affect our<br />

business and result in defaults/ delays in repayment of our loans and investments declining in value which<br />

could have a material and adverse effect on our business, future financial performance and results of<br />

operations.<br />

Our Company’s product offerings include debt, equity and mezzanine financings, and financial advisory<br />

services related to infrastructure projects in India. As at September 30, 2011 our outstanding loans were `<br />

64,797.70 million. <strong>Infrastructure</strong> projects are characterized by project - specific risks as well as general risks.<br />

These risks are generally beyond our control, and include:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

political, regulatory and legal actions that may adversely affect project viability;<br />

interruptions or disruption in domestic or international financial markets, whether for equity or<br />

debt funds;<br />

changes in government and regulatory policies;<br />

delays in the construction and operation of infrastructure projects;<br />

adverse changes in market demand or prices for the products or services that the project, when<br />

completed, is expected to provide;<br />

the unwillingness or inability of consumers to pay for infrastructure services;<br />

shortages of, or adverse price developments in respect of raw materials and key project inputs such<br />

as oil and natural gas;<br />

potential defaults under financing arrangements with lenders and investors;<br />

failure of third parties to perform on their contractual obligations;<br />

adverse developments in the overall economic environment in India;<br />

11

interest rate or currency exchange rate fluctuations or changes in tax regulations;<br />

economic, political and social instability or occurrences such as natural disasters, armed conflict<br />

and terrorist attacks, particularly where projects are located or in the markets they are intended to<br />

serve; and<br />

the other risks discussed in the sub-section “External Risks — Risks Relating to India”, on page 19<br />

of this <strong>Shelf</strong> <strong>Prospectus</strong>.<br />

To the extent these or other risks relating to the projects we finance materialize, the quality of our asset<br />

Portfolio and our profitability may decline, which would have a material and adverse effect on our business,<br />

future financial performance and results of operations.<br />

8. Our Company has significant Exposure to certain sectors and to certain borrowers and if these Exposures<br />

become non-performing, such Exposure could increase the level of non-performing assets in our Portfolio<br />

and materially affect our business, future financial performance and results of operations and the quality<br />

of our asset Portfolio.<br />

As at September 30, 2011, our three largest single sector Exposures were in the Power, Telecommunication<br />

and Road sectors, which constituted 35.17%, 23.18%, 16.33%, (aggregating to total percentage Exposure of<br />

74.68%) respectively, of our total infrastructure loan. Out of exposure of 35.17% in the power sector,<br />

exposure of 11.30% consists of Renewable energy. For the foreseeable future, we expect to continue to have<br />

a significant concentration of loans in these three sectors. Any material negative trends or financial<br />

difficulties in the Power, Telecommunication and Road sectors, could increase the level of non-performing<br />

assets in our Portfolio and may adversely affect our business, future financial performance and results of<br />

operations.<br />

The customers of our Company may default on their obligations to us as a result of their bankruptcy, lack of<br />

liquidity, operational failure, breach of contract, government or other regulatory intervention and other<br />

reasons such as their inability to adapt to changes in the macro business environment. Historically,<br />

borrowers or borrower groups have been adversely affected by economic conditions in varying degrees.<br />

Such adverse impact may limit our ability to recover the dues from the borrowers and predictability of cash<br />

flows. Credit losses due to financial difficulties of these borrowers or borrower groups in the future could<br />

materially and adversely affect our business, future financial performance and results of operations.<br />

9. Our indebtedness and restrictive covenants imposed by our financing agreements could restrict our ability<br />

to conduct our business and operations.<br />

Our financing agreements require us to maintain certain security margins. Should we breach any financial or<br />

other covenants contained in any of our financing agreements, we may be required to immediately repay our<br />

borrowings either in whole or in part, together with any related costs. Under the terms of some of the loan<br />

agreements, our Company is required to obtain the prior written consent of the concerned lender prior to our<br />

Company entering into any scheme of expansion, merger, amalgamation, compromise or reconstruction or<br />

selling, leasing, transferring all or a substantial portion of its fixed and other assets; making any change in<br />

ownership or control or constitution of our Company, or in the shareholding or management or majority of<br />

directors, or in the nature of business of our Company; or making amendments in the Company’s<br />

Memorandum and Articles of Association. In the event that such lenders, in the future decline to consent or<br />

delay in granting the consent to our plans of expansion/modernization/diversification of our business, such<br />

declination or delay as the case may be may have adverse bearing on our future growth plan.<br />

10. We may experience delays in enforcing collateral when the borrowers who are customers of our Company<br />

default on their obligations to us, which may result in failure to recover the expected value of collateral<br />

and may materially and adversely affect our business and future financial performance.<br />

As at September 30, 2011, 99.70 % of the loans of our Company were secured by project assets and/or other<br />

collateral:<br />

Although we seek to maintain a collateral value to loan ratio of at least 100% for our secured loans, an<br />

economic downturn or the other project risks could result in a fall in collateral values. Additionally, the<br />

realizable value of our collateral in a liquidation may be lower than its book value.<br />

Moreover, foreclosure of such collateral may require court or tribunal intervention that may involve<br />

protracted proceedings and the process of enforcing security interests against collateral can be difficult.<br />

Additionally, the realizable value of our collateral in liquidation may be lower than its book value,<br />

particularly in relation to projects which are not completed when default occurs and lenders initiate action in<br />

12

espect of enforcement of security. In general, most project loans are provided on a limited recourse basis.<br />

With respect to disbursements made on a non-recourse basis, only the related project assets are available to<br />

repay the loan in the event the borrowers are unable to meet their obligations under the loan agreements due<br />

to lower than expected cash flows. With respect to disbursements made on a limited recourse basis, project<br />

sponsors generally give undertakings for funding shortfalls and cost overruns.<br />

We cannot guarantee that we will be able to realize the full value of our collateral, due to, among other<br />

things, defects in the perfection of collateral, delays on our part in taking immediate action in bankruptcy<br />

foreclosure proceedings, stock market downturns, claims of other lenders, legal or judicial restraint and<br />

fraudulent transfers by borrowers In the event a specialized regulatory agency gains jurisdiction over the<br />

borrower, creditor actions can be further delayed.<br />

11. Our investments can be particularly volatile and may not be recovered.<br />

As at September 30, 2011, our investments accounted for 25.68% of our total assets. The value of<br />

investments depends on the success and continued viability of these projects. In addition to the project<br />

specific risks described in the above risk factors, we have limited control over the operations or management<br />

of these projects. Therefore, our ability to realize expected gains as a result of our equity interest in a project<br />

is highly dependent on factors outside of our control. Decline in value of our equity Portfolio may materially<br />

and adversely affect our business, future financial performance and results of operations.<br />

12. As a consequence of being regulated as an NBFC and IFC, and a PFI, we have to adhere to certain<br />

individual and borrower group Exposure limits under the RBI regulations.<br />

Our Company is regulated by the RBI as an NBFC. In terms of the Non - Banking Financial (Non-Deposit<br />

Accepting or Holding) Companies Prudential Norms (Reserve Bank) Directions, 2007, as amended (the<br />

"Prudential Norms Directions") our Company is required to comply with the prescribed Exposure limits.<br />

Further, our Company has been classified as an IFC by the RBI, which classification is subject to certain<br />

conditions including a minimum 75% of the total assets of such NBFC being deployed in infrastructure loans<br />

(as defined under the Prudential Norms Directions), net owned funds of ` 3,000 million or more, a minimum<br />