Personal Deposit Account Fee Schedule

Personal Deposit Account Fee Schedule

Personal Deposit Account Fee Schedule

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

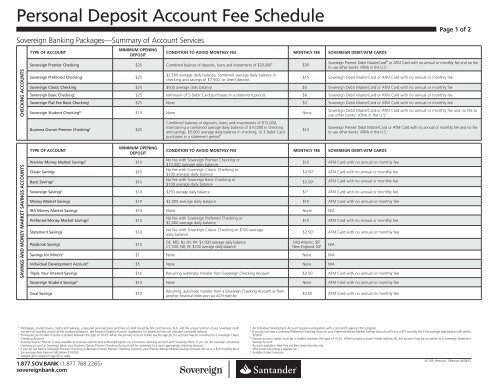

<strong>Personal</strong> <strong>Deposit</strong> <strong>Account</strong> <strong>Fee</strong> <strong>Schedule</strong><br />

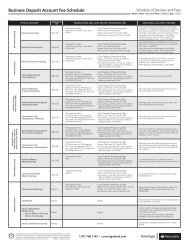

Sovereign Banking Packages—Summary of <strong>Account</strong> Services<br />

CHECKING ACCOUNTS<br />

SAVINGS AND MONEY MARKET SAVINGS ACCOUNTS<br />

TYPE OF ACCOUNT<br />

MINIMUM OPENING<br />

DEPOSIT<br />

Sovereign Premier Checking $25 Combined balance of deposits, loans and investments of $20,000 A<br />

Sovereign Preferred Checking $25<br />

CONDITION TO AVOID MONTHLY FEE MONTHLY FEE SOVEREIGN DEBIT/ATM CARDS<br />

$2,500 average daily balance, combined average daily balance in<br />

checking and savings of $7,500, or direct deposit<br />

$30<br />

Page 1 of 2<br />

Sovereign Premier Debit MasterCard ® or ATM Card with no annual or monthly fee and no fee<br />

to use other banks’ ATMs in the U.S. J<br />

$15 Sovereign Debit MasterCard or ATM Card with no annual or monthly fee<br />

Sovereign Classic Checking $25 $500 average daily balance $5 Sovereign Debit MasterCard or ATM Card with no annual or monthly fee<br />

Sovereign Basic Checking K $25 Minimum of 5 Debit Card purchases in a statement period $8 Sovereign Debit MasterCard or ATM Card with no annual or monthly fee<br />

Sovereign Flat <strong>Fee</strong> Basic Checking I $25 None $3 Sovereign Debit MasterCard or ATM Card with no annual or monthly fee<br />

Sovereign Student Checking B $10 None None<br />

Business Owner Premier Checking C $25<br />

TYPE OF ACCOUNT<br />

MINIMUM OPENING<br />

DEPOSIT<br />

Premier Money Market Savings D $10<br />

Classic Savings $10<br />

Basic Savings K $10<br />

Combined balance of deposits, loans and investments of $15,000,<br />

maintaining a combined average daily balance of $10,000 in checking<br />

and savings, $5,000 average daily balance in checking, or 3 Debit Card<br />

purchases in a statement period A<br />

CONDITION TO AVOID MONTHLY FEE MONTHLY FEE SOVEREIGN DEBIT/ATM CARDS<br />

No fee with Sovereign Premier Checking or<br />

$10,000 average daily balance<br />

No fee with Sovereign Classic Checking or<br />

$100 average daily balance<br />

No fee with Sovereign Basic Checking or<br />

$100 average daily balance<br />

$10<br />

Sovereign Debit MasterCard or ATM Card with no annual or monthly fee and no fee to<br />

use other banks’ ATMs in the U.S. J<br />

Sovereign Premier Debit MasterCard or ATM Card with no annual or monthly fee and no fee<br />

to use other banks’ ATMs in the U.S. J<br />

$10 ATM Card with no annual or monthly fee<br />

$3.50 E ATM Card with no annual or monthly fee<br />

E $3.50 ATM Card with no annual or monthly fee<br />

Sovereign Savings K $10 $250 average daily balance $1 E ATM Card with no annual or monthly fee<br />

Money Market Savings $10 $2,000 average daily balance $10 ATM Card with no annual or monthly fee<br />

IRA Money Market Savings $10 None None N/A<br />

Preferred Money Market Savings G $10<br />

Statement Savings $10<br />

Passbook Savings $10<br />

No fee with Sovereign Preferred Checking or<br />

$2,000 average daily balance<br />

No fee with Sovereign Classic Checking or $100 average<br />

daily balance<br />

DE, MD, NJ, NY, PA: $1,500 average daily balance<br />

CT, MA, NH, RI: $100 average daily balance<br />

$10 ATM Card with no annual or monthly fee<br />

$3.50 E<br />

Mid-Atlantic: $5 E<br />

New England: $3 E<br />

Savings for Minors K $1 None None N/A<br />

Individual Development <strong>Account</strong> F $5 None None N/A<br />

ATM Card with no annual or monthly fee<br />

Triple Your Interest Savings $10 Recurring automatic transfer from Sovereign Checking <strong>Account</strong> $3.50 ATM Card with no annual or monthly fee<br />

Sovereign Student Savings H $10 None None ATM Card with no annual or monthly fee<br />

Goal Savings $10<br />

Recurring, automatic transfer from a Sovereign Checking <strong>Account</strong> or from<br />

another financial institution via ACH transfer<br />

A Mortgages, student loans, credit card balances, unsecured personal loans and lines of credit issued by FIA Card Services, N.A. and the unused portion of any Sovereign credit<br />

line are not counted as part of the combined balance. See <strong>Personal</strong> <strong>Deposit</strong> <strong>Account</strong> Agreement for details on how we calculate combined balance.<br />

B Primary account holder must be a student between the ages of 16-25. When the primary account holder reaches age 26, the account may be converted to a Sovereign Classic<br />

Checking <strong>Account</strong>.<br />

C Business Owner Premier is only available to business owners and authorized signers on a business checking account with Sovereign Bank. If you do not maintain a business<br />

checking account at Sovereign Bank, your Business Owner Premier Checking <strong>Account</strong> will be converted to a more appropriate checking account.<br />

D If you do not have a Sovereign Premier Checking or Business Owner Premier Checking <strong>Account</strong>, your Premier Money Market Savings <strong>Account</strong> will incur a $10 monthly fee if<br />

the average daily balance falls below $10,000.<br />

E Waived upon request if age 60 or older.<br />

1.877.SOV.BANK (1.877.768.2265)<br />

sovereignbank.com<br />

N/A<br />

$3.50 ATM Card with no annual or monthly fee<br />

F An Individual Development <strong>Account</strong> requires participation with a non-profit agency’s IDA program.<br />

G If you do not have a Sovereign Preferred Checking <strong>Account</strong>, your Preferred Money Market Savings <strong>Account</strong> will incur a $10 monthly fee if the average daily balance falls below<br />

$2,000.<br />

H Primary account holder must be a student between the ages of 16-25. When primary account holder reaches 26, the account may be converted to a Sovereign Statement<br />

Savings <strong>Account</strong>.<br />

I <strong>Account</strong>s available in New York and New Jersey branches only<br />

J ATM owner may charge a seperate fee.<br />

K Available at select branches.<br />

N1109_<strong>Personal</strong> Effective 04/09/12

<strong>Personal</strong> <strong>Deposit</strong> <strong>Account</strong> <strong>Fee</strong> <strong>Schedule</strong><br />

<strong>Schedule</strong> of Services and <strong>Fee</strong>s<br />

ACCOUNT RELATED SERVICES<br />

<strong>Account</strong> History $4.00<br />

Check Orders 1 Varies<br />

Collections (per item)<br />

Domestic $10.00<br />

International $30.00<br />

Copy of Canceled Check (12 free copies per year) 7 $5.00<br />

Date of Death Balance $20.00<br />

Duplicate Statement Copy $6.00<br />

Early <strong>Account</strong> Closing (if closed within 90 days of account opening) 10 $25.00<br />

Escheat $50.00<br />

Garnishment/Levy/Legal Processing $100.00<br />

Inactive <strong>Account</strong> (per month) $16.00<br />

(applies to checking and money market savings accounts<br />

inactive for more than one year with balances less than $250)<br />

Insufficient Funds <strong>Fee</strong> 9 $35.00<br />

Insufficient Funds (Item Returned) 9 $35.00<br />

IRA Trustee Transfer $25.00<br />

Lost Passbook $10.00<br />

Online Banking with BillPay No <strong>Fee</strong><br />

Overdraft Transfer (per transfer) 2 $12.00<br />

Research, Balance Reconciliation $20.00<br />

and/or Letter Writing Services (per hour, one hour minimum)<br />

Return <strong>Deposit</strong>ed Item 8<br />

Domestic $15.00<br />

International $25.00<br />

Savings/Money Market Savings Excess Activity (per item) $5.00<br />

Stop Payment 2 $30.00<br />

(personal check, official check, money order or ACH transaction)<br />

Sustained Overdraft 2,9 $35.00<br />

Checking<br />

Charged on the 6th consecutive business day account is overdrawn<br />

Savings and Money Market Savings $5.00 (per day)<br />

Charge of $5 per day beginning on the 6th consecutive business day account is<br />

overdrawn<br />

Unavailable Funds <strong>Fee</strong> 9 $35.00<br />

Unavailable Funds (Item Returned) 9 $35.00<br />

DEBIT/ATM CARD SERVICES<br />

Foreign Currency Exchange<br />

ATM Card 3% of transaction in U.S. dollars<br />

International Transaction<br />

Debit Card 4% of transaction in U.S. dollars<br />

Improperly Endorsed <strong>Deposit</strong> (per item) $2.00<br />

Replacement Card—Expedited $30.00<br />

Lost, Damaged, or Extra Debit Card $5.00 11<br />

Withdrawal at ATM not owned by Sovereign or one of its divisions 6<br />

Domestic–Classic Checking and Savings $3.00<br />

Domestic–Flat <strong>Fee</strong> Basic Checking, Basic Checking and Savings $3.50<br />

Domestic–Premier Checking, Business Owner Premier Checking, No <strong>Fee</strong><br />

Student Checking and Savings<br />

Domestic–All Other <strong>Account</strong>s $2.50<br />

International–All <strong>Account</strong>s $6.00<br />

SPECIAL SERVICES<br />

American Express ® Gift Card (per item) $5.00<br />

American Express Gift Cheque (per item) $2.50<br />

American Express Travelers Cheques<br />

Regular (per $100) 2 $2.00<br />

Cheques for Two ® (per $100)<br />

U.S. Currency $2.00<br />

Foreign Currency $1.00<br />

Bond Coupon (per envelope) $7.00<br />

Certified Check $15.00<br />

Copy of Official Check or Money Order (per item) $5.00<br />

International Draft $25.00<br />

Money Order $5.00<br />

Official Bank Check 2 $10.00<br />

Safe <strong>Deposit</strong> Box<br />

Annual Rental Varies4 10% discount with autopay per box5 Drilling $150.00<br />

Late Charge $15.00<br />

Lost Key $15.00<br />

Wire Transfer<br />

Domestic Incoming 3 $13.00<br />

Domestic Outgoing $25.00<br />

International Incoming 3<br />

U.S. Currency $13.00<br />

Foreign Currency No <strong>Fee</strong><br />

International Outgoing<br />

U.S. Currency $40.00<br />

Foreign Currency $31.00<br />

1 Free Graystone checks or $15 discount toward alternate designs with Sovereign Premier Checking or Business Owner<br />

Premier Checking. First order of 20 antique style checks free with Sovereign Student Checking. After first order, students<br />

purchase their checks. Graystone Checks are $14.95 per order with Sovereign Preferred Checking.<br />

2 Does not apply to Sovereign Premier Checking, Premier Partnership Checking or Business Owner Premier Checking.<br />

3 Does not apply to Sovereign Student Checking <strong>Account</strong>s.<br />

4 Sovereign Premier Checking and Business Owner Premier Checking <strong>Account</strong>s receive a free small box or a 50% discount<br />

on any size box rented for the life of the account. Additional boxes are eligible for a 10% discount with autopay.<br />

5 Cannot be combined with any other safe deposit box discounts.<br />

6 ATM owner may charge a separate fee.<br />

7 25 free copies for accounts opened in Maryland or Massachusetts.<br />

8 <strong>Fee</strong> for accounts opened in New York is $10.00 or in Massachusetts is $5.00.<br />

9 Always know your balance before you write a check or use your Sovereign Debit/ATM Card. If any payment request you<br />

make exceeds your available balance, we may approve your request at our discretion. However, you may be assessed the<br />

current Insufficient or Unavailable Funds <strong>Fee</strong> whether or not we honor your request.<br />

10 <strong>Fee</strong> only applies to checking accounts.<br />

11 No fee for Sovereign Premier or Business Owner Premier accounts even after February 1, 2012.<br />

Page 2 of 2<br />

Sovereign Bank, N.A. is a Member FDIC and a wholly owned subsidiary of Banco Santander,<br />

S.A. © 2012 Sovereign Bank, N.A. | Sovereign and Santander and its logo are registered<br />

trademarks of Sovereign Bank, N.A. and Banco Santander, S.A. respectively, or their<br />

affiliates or subsidiaries in the United States and other countries. MasterCard is a registered<br />

trademark of MasterCard International Incorporated.