kontinuita - Komunálna Poisťovňa

kontinuita - Komunálna Poisťovňa

kontinuita - Komunálna Poisťovňa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO<br />

THE FINANCIAL<br />

STATEMENTS<br />

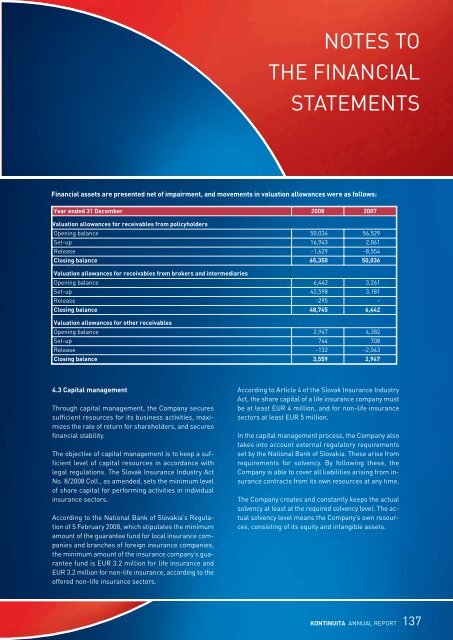

Financial assets are presented net of impairment, and movements in valuation allowances were as follows:<br />

Year ended 31 December 2008 2007<br />

Valuation allowances for receivables from policyholders<br />

Opening balance 50,036 56,529<br />

Set-up 16,943 2,061<br />

Release -1,629 -8,554<br />

Closing balance 65,350 50,036<br />

Valuation allowances for receivables from brokers and intermediaries<br />

Opening balance 6,442 3,261<br />

Set-up 42,598 3,181<br />

Release -295 –<br />

Closing balance 48,745 6,442<br />

Valuation allowances for other receivables<br />

Opening balance 2,947 4,282<br />

Set-up 744 708<br />

Release -132 -2,043<br />

Closing balance 3,559 2,947<br />

4.3 Capital management<br />

Through capital management, the Company secures<br />

sufficient resources for its business activities, maximizes<br />

the rate of return for shareholders, and secures<br />

financial stability.<br />

The objective of capital management is to keep a sufficient<br />

level of capital resources in accordance with<br />

legal regulations. The Slovak Insurance Industry Act<br />

No. 8/2008 Coll., as amended, sets the minimum level<br />

of share capital for performing activities in individual<br />

insurance sectors.<br />

According to the National Bank of Slovakia’s Regulation<br />

of 5 February 2008, which stipulates the minimum<br />

amount of the guarantee fund for local insurance companies<br />

and branches of foreign insurance companies,<br />

the minimum amount of the insurance company’s guarantee<br />

fund is EUR 3.2 million for life insurance and<br />

EUR 3.2 million for non-life insurance, according to the<br />

offered non-life insurance sectors.<br />

According to Article 4 of the Slovak Insurance Industry<br />

Act, the share capital of a life insurance company must<br />

be at least EUR 4 million, and for non-life insurance<br />

sectors at least EUR 5 million.<br />

In the capital management process, the Company also<br />

takes into account external regulatory requirements<br />

set by the National Bank of Slovakia. These arise from<br />

requirements for solvency. By following these, the<br />

Company is able to cover all liabilities arising from insurance<br />

contracts from its own resources at any time.<br />

The Company creates and constantly keeps the actual<br />

solvency at least at the required solvency level. The actual<br />

solvency level means the Company’s own resources,<br />

consisting of its equity and intangible assets.<br />

KONTINUITA ANNUAL REPORT 137