Connect - Schneider Electric

Connect - Schneider Electric Connect - Schneider Electric

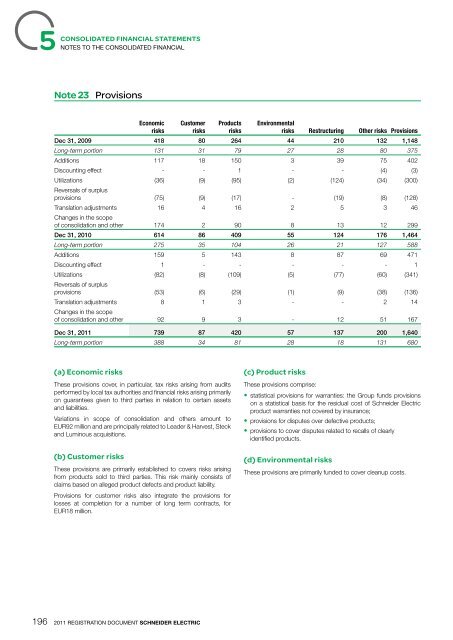

5 CONSOLIDATED FINANCIAL STATEMENTS NOTES TO THE CONSOLIDATED FINANCIAL Note 23 Provisions Economic risks Customer risks 196 2011 REGISTRATION DOCUMENT SCHNEIDER ELECTRIC Products risks Environmental risks Restructuring Other risks Provisions Dec 31, 2009 418 80 264 44 210 132 1,148 Long-term portion 131 31 79 27 28 80 375 Additions 117 18 150 3 39 75 402 Discounting effect - - 1 - - (4) (3) Utilizations Reversals of surplus (36) (9) (95) (2) (124) (34) (300) provisions (75) (9) (17) - (19) (8) (128) Translation adjustments Changes in the scope 16 4 16 2 5 3 46 of consolidation and other 174 2 90 8 13 12 299 Dec 31, 2010 614 86 409 55 124 176 1,464 Long-term portion 275 35 104 26 21 127 588 Additions 159 5 143 8 87 69 471 Discounting effect 1 - - - - - 1 Utilizations Reversals of surplus (82) (8) (109) (5) (77) (60) (341) provisions (53) (6) (29) (1) (9) (38) (136) Translation adjustments Changes in the scope 8 1 3 - - 2 14 of consolidation and other 92 9 3 - 12 51 167 Dec 31, 2011 739 87 420 57 137 200 1,640 Long-term portion 388 34 81 28 18 131 680 (a) Economic risks These provisions cover, in particular, tax risks arising from audits performed by local tax authorities and fi nancial risks arising primarily on guarantees given to third parties in relation to certain assets and liabilities. Variations in scope of consolidation and others amount to EUR92 million and are principally related to Leader & Harvest, Steck and Luminous acquisitions . (b) Customer risks These provisions are primarily established to covers risks arising from products sold to third parties. This risk mainly consists of claims based on alleged product defects and product liability. Provisions for customer risks also integrate the provisions for losses at completion for a number of long term contracts, for EUR18 million. (c) Product risks These provisions comprise: • statistical provisions for warranties: the Group funds provisions on a statistical basis for the residual cost of Schneider Electric product warranties not covered by insurance; • provisions for disputes over defective products; • provisions to cover disputes related to recalls of clearly identifi ed products. (d) Environmental risks These provisions are primarily funded to cover cleanup costs.

Note 24 Total (current and non-current) financial liabilities Non-current fi nancial liabilities break down as follows: CONSOLIDATED FINANCIAL STATEMENTS NOTES TO THE CONSOLIDATED FINANCIAL Dec. 31, 2011 Dec. 31, 2010 Bonds 5,540 4,348 Bank and other borrowings 1,464 1,379 Lease liabilities 7 15 Employees profi t sharing 12 10 Short-term portion of convertible and non-convertible bonds - (503) Short-term portion of long-term debt (96) (239) NON-CURRENT FINANCIAL LIABILITIES 6,927 5,010 Current fi nancial liabilities break down as follows: Dec. 31, 2011 Dec. 31, 2010 Commercial paper 190 - Accrued interest 132 110 Other short-term borrowings 475 170 Drawdown of funds from lines of credit - - Bank overdrafts 217 93 Short-term portion of convertible and non-convertible bonds - 503 Short-term portion of long-term debt 96 239 Short-term debt 1,110 1,115 TOTAL CURRENT AND NON-CURRENT FINANCIAL LIABILITIES 8,037 6,125 24.1 – Breakdown by maturity Dec.31, 2011 Dec.31, 2010 Nominal Interests Swaps Nominal 2011 1,115 2012 1,110 285 46 104 2013 1,181 256 27 1,085 2014 1,158 187 5 767 2015 998 133 7 980 2016 792 120 - 546 2017 and beyond 2,798 171 - 1,528 TOTAL 8,037 1,152 85 6,125 2011 REGISTRATION DOCUMENT SCHNEIDER ELECTRIC 197 5

- Page 148 and 149: 4 BUSINESS REVIEW REVIEW OF THE CON

- Page 150 and 151: 4 BUSINESS REVIEW REVIEW OF THE CON

- Page 152 and 153: 4 BUSINESS REVIEW REVIEW OF THE PAR

- Page 154 and 155: 5 CONSOLIDATED CONSOLIDATED FINANCI

- Page 156 and 157: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 158 and 159: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 160 and 161: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 162 and 163: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 164 and 165: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 166 and 167: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 168 and 169: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 170 and 171: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 172 and 173: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 174 and 175: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 176 and 177: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 178 and 179: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 180 and 181: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 182 and 183: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 184 and 185: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 186 and 187: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 188 and 189: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 190 and 191: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 192 and 193: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 194 and 195: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 196 and 197: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 200 and 201: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 202 and 203: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 204 and 205: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 206 and 207: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 208 and 209: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 210 and 211: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 212 and 213: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 214 and 215: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 216 and 217: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 218 and 219: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 220 and 221: 5 CONSOLIDATED FINANCIAL STATEMENTS

- Page 222 and 223: 6 BALANCE 220 COMPANY FINANCIAL STA

- Page 224 and 225: 6 COMPANY FINANCIAL STATEMENTS STAT

- Page 226 and 227: 6 COMPANY FINANCIAL STATEMENTS NOTE

- Page 228 and 229: 6 COMPANY FINANCIAL STATEMENTS NOTE

- Page 230 and 231: 6 COMPANY FINANCIAL STATEMENTS NOTE

- Page 232 and 233: 6 COMPANY FINANCIAL STATEMENTS NOTE

- Page 234 and 235: 6 COMPANY FINANCIAL STATEMENTS NOTE

- Page 236 and 237: 6 COMPANY FINANCIAL STATEMENTS STAT

- Page 238 and 239: 6 COMPANY FINANCIAL STATEMENTS SUBS

- Page 240 and 241: 6 COMPANY FINANCIAL STATEMENTS THE

- Page 242 and 243: 7 GENERAL GENERAL PRESENTATION OF S

- Page 244 and 245: 7 GENERAL PRESENTATION OF SCHNEIDER

- Page 246 and 247: GENERAL PRESENTATION OF SCHNEIDER E

5 CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTES TO THE CONSOLIDATED FINANCIAL<br />

Note 23 Provisions<br />

Economic<br />

risks<br />

Customer<br />

risks<br />

196 2011 REGISTRATION DOCUMENT SCHNEIDER ELECTRIC<br />

Products<br />

risks<br />

Environmental<br />

risks Restructuring Other risks Provisions<br />

Dec 31, 2009 418 80 264 44 210 132 1,148<br />

Long-term portion 131 31 79 27 28 80 375<br />

Additions 117 18 150 3 39 75 402<br />

Discounting effect - - 1 - - (4) (3)<br />

Utilizations<br />

Reversals of surplus<br />

(36) (9) (95) (2) (124) (34) (300)<br />

provisions (75) (9) (17) - (19) (8) (128)<br />

Translation adjustments<br />

Changes in the scope<br />

16 4 16 2 5 3 46<br />

of consolidation and other 174 2 90 8 13 12 299<br />

Dec 31, 2010 614 86 409 55 124 176 1,464<br />

Long-term portion 275 35 104 26 21 127 588<br />

Additions 159 5 143 8 87 69 471<br />

Discounting effect 1 - - - - - 1<br />

Utilizations<br />

Reversals of surplus<br />

(82) (8) (109) (5) (77) (60) (341)<br />

provisions (53) (6) (29) (1) (9) (38) (136)<br />

Translation adjustments<br />

Changes in the scope<br />

8 1 3 - - 2 14<br />

of consolidation and other 92 9 3 - 12 51 167<br />

Dec 31, 2011 739 87 420 57 137 200 1,640<br />

Long-term portion 388 34 81 28 18 131 680<br />

(a) Economic risks<br />

These provisions cover, in particular, tax risks arising from audits<br />

performed by local tax authorities and fi nancial risks arising primarily<br />

on guarantees given to third parties in relation to certain assets<br />

and liabilities.<br />

Variations in scope of consolidation and others amount to<br />

EUR92 million and are principally related to Leader & Harvest, Steck<br />

and Luminous acquisitions .<br />

(b) Customer risks<br />

These provisions are primarily established to covers risks arising<br />

from products sold to third parties. This risk mainly consists of<br />

claims based on alleged product defects and product liability.<br />

Provisions for customer risks also integrate the provisions for<br />

losses at completion for a number of long term contracts, for<br />

EUR18 million.<br />

(c) Product risks<br />

These provisions comprise:<br />

• statistical provisions for warranties: the Group funds provisions<br />

on a statistical basis for the residual cost of <strong>Schneider</strong> <strong>Electric</strong><br />

product warranties not covered by insurance;<br />

• provisions for disputes over defective products;<br />

• provisions to cover disputes related to recalls of clearly<br />

identifi ed products.<br />

(d) Environmental risks<br />

These provisions are primarily funded to cover cleanup costs.