Download - Glenmark

Download - Glenmark Download - Glenmark

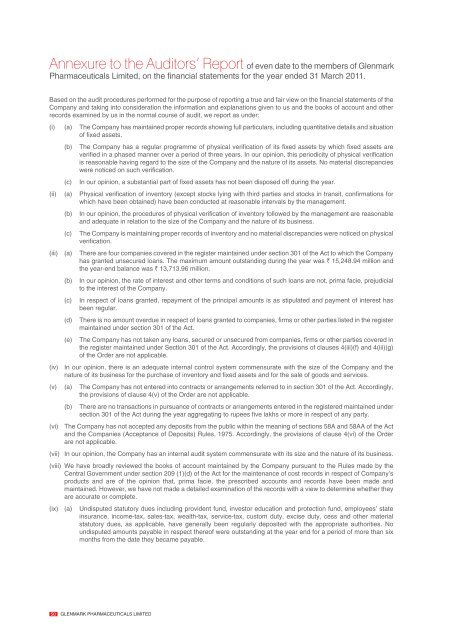

Annexure to the Auditors’ Report of even date to the members of Glenmark Pharmaceuticals Limited, on the financial statements for the year ended 31 March 2011. Based on the audit procedures performed for the purpose of reporting a true and fair view on the financial statements of the Company and taking into consideration the information and explanations given to us and the books of account and other records examined by us in the normal course of audit, we report as under: (i) (a) The Company has maintained proper records showing full particulars, including quantitative details and situation of fixed assets. (b) The Company has a regular programme of physical verification of its fixed assets by which fixed assets are verified in a phased manner over a period of three years. In our opinion, this periodicity of physical verification is reasonable having regard to the size of the Company and the nature of its assets. No material discrepancies were noticed on such verification. (c) In our opinion, a substantial part of fixed assets has not been disposed off during the year. (ii) (a) Physical verification of inventory (except stocks lying with third parties and stocks in transit, confirmations for which have been obtained) have been conducted at reasonable intervals by the management. (b) In our opinion, the procedures of physical verification of inventory followed by the management are reasonable and adequate in relation to the size of the Company and the nature of its business. (c) The Company is maintaining proper records of inventory and no material discrepancies were noticed on physical verification. (iii) (a) There are four companies covered in the register maintained under section 301 of the Act to which the Company has granted unsecured loans. The maximum amount outstanding during the year was ` 15,248.94 million and the year-end balance was ` 13,713.96 million. (b) In our opinion, the rate of interest and other terms and conditions of such loans are not, prima facie, prejudicial to the interest of the Company. (c) In respect of loans granted, repayment of the principal amounts is as stipulated and payment of interest has been regular. (d) There is no amount overdue in respect of loans granted to companies, firms or other parties listed in the register maintained under section 301 of the Act. (e) The Company has not taken any loans, secured or unsecured from companies, firms or other parties covered in the register maintained under Section 301 of the Act. Accordingly, the provisions of clauses 4(iii)(f) and 4(iii)(g) of the Order are not applicable. (iv) In our opinion, there is an adequate internal control system commensurate with the size of the Company and the nature of its business for the purchase of inventory and fixed assets and for the sale of goods and services. (v) (a) The Company has not entered into contracts or arrangements referred to in section 301 of the Act. Accordingly, the provisions of clause 4(v) of the Order are not applicable. (b) There are no transactions in pursuance of contracts or arrangements entered in the registered maintained under section 301 of the Act during the year aggregating to rupees five lakhs or more in respect of any party. (vi) The Company has not accepted any deposits from the public within the meaning of sections 58A and 58AA of the Act and the Companies (Acceptance of Deposits) Rules, 1975. Accordingly, the provisions of clause 4(vi) of the Order are not applicable. (vii) In our opinion, the Company has an internal audit system commensurate with its size and the nature of its business. (viii) We have broadly reviewed the books of account maintained by the Company pursuant to the Rules made by the Central Government under section 209 (1)(d) of the Act for the maintenance of cost records in respect of Company’s products and are of the opinion that, prima facie, the prescribed accounts and records have been made and maintained. However, we have not made a detailed examination of the records with a view to determine whether they are accurate or complete. (ix) (a) Undisputed statutory dues including provident fund, investor education and protection fund, employees’ state insurance, income-tax, sales-tax, wealth-tax, service-tax, custom duty, excise duty, cess and other material statutory dues, as applicable, have generally been regularly deposited with the appropriate authorities. No undisputed amounts payable in respect thereof were outstanding at the year end for a period of more than six months from the date they became payable. 50 GLENMARK PHARMACEUTICALS LIMITED

(b) The dues outstanding in respect of sales-tax, excise duty, on account of any dispute, are as follows: Name of the statute The Central Excise Act, 1944 Finance Act, 1994 The Gujarat Sales Tax Act, 1969 The Central Sales Tax Act, 1956 The Central Sales Tax Act, 1956 Nature of dues Amount (` million) Period to which the amount relates Excise Duty 10.00 April 2003 to September 2007 Service Tax 9.71 FY 2004-05 and FY 2005-06 Forum where dispute is pending The Central Excise and Service Tax Appellate Tribunal The Central Excise and Service Tax Appellate Tribunal Sales Tax 0.2 F.Y 2004-05 Deputy Commissioner (CT) Appeals Sales Tax 1.87 FY 2004-05 Deputy Commissioner (CT) Appeals Sales Tax 5.59 FY 2006-07 Deputy Commissioner (CT) Appeals (x) In our opinion, the Company has no accumulated losses at the end of the financial year and it has not incurred cash losses in the current and the immediately preceding financial year. (xi) In our opinion, the Company has not defaulted in repayment of dues to a financial institution or a bank during the year. (xii) The Company has not granted any loans and advances on the basis of security by way of pledge of shares, debentures and other securities. Accordingly, the provisions of clause 4(xii) of the Order are not applicable. (xiii) In our opinion, the Company is not a chit fund or a nidhi/mutual benefit fund/society. Accordingly, the provisions of clause 4(xiii) of the Order are not applicable. (xiv) In our opinion, the Company is not dealing in or trading in shares, securities, debentures and other investments. Accordingly, the provisions of clause 4(xiv) of the Order are not applicable. (xv) In our opinion, the terms and conditions on which the Company has given guarantee for loans taken by others from banks or financial institutions are not, prima facie, prejudicial to the interest of the Company. (xvi) In our opinion, the Company has applied the term loans for the purpose for which the loans were obtained. (xvii) In our opinion, no funds raised on short-term basis have been used for long-term investment. (xviii) The Company has not made any preferential allotment of shares to parties or companies covered in the register maintained under section 301 of the Act. Accordingly, the provisions of clause 4(xviii) of the Order are not applicable. (xix) The Company has neither issued nor had any outstanding debentures during the year. Accordingly, the provisions of clause 4(xix) of the Order are not applicable. (xx) The Company has not raised any money by public issues during the year. Accordingly, the provisions of clause 4(xx) of the Order are not applicable. (xxi) According to the information and explanations given to us, no fraud on or by the Company has been noticed or reported during the period covered by our audit except a case of theft in transit of some inventories aggregating to ` 2.27 million. As further informed to us, the Company has taken adequate follow up action, including recovering the complete amount by way of insurance claims. For Walker, Chandiok & Co. Chartered Accountants Firm Registration No: 001076N Per Khushroo B. Panthaky Partner Membership No: F – 42423 Place: Mumbai Date: 10 May 2011 Annual Report 2010-2011 51

- Page 35 and 36: Profiles of Directors Mr. Gracias S

- Page 37 and 38: DIRECTORS Mr. D. R. Mehta, Mrs. B.

- Page 39 and 40: 3. Metformin ER Tablets 1000 mg 4.

- Page 41 and 42: ANNEXURE - B Disc losure in the Dir

- Page 43 and 44: Report on Corporate Governance Purs

- Page 45 and 46: 5. Shareholders’/Investors’ Gri

- Page 47 and 48: Distribution Schedule as on 31 Marc

- Page 49 and 50: Market Price Data: High, low during

- Page 51 and 52: Certification by the Chief Executiv

- Page 53: Auditors’ Report To, The Members

- Page 57 and 58: Profit and Loss Account (All amount

- Page 59 and 60: Cash Flow Statement (All amounts in

- Page 61 and 62: Schedules annexed to and forming pa

- Page 63 and 64: Schedules annexed to and forming pa

- Page 65 and 66: Schedules annexed to and forming pa

- Page 67 and 68: Schedules annexed to and forming pa

- Page 69 and 70: Schedules annexed to and forming pa

- Page 71 and 72: Schedules annexed to and forming pa

- Page 73 and 74: Schedules annexed to and forming pa

- Page 75 and 76: Schedules annexed to and forming pa

- Page 77 and 78: Schedules annexed to and forming pa

- Page 79 and 80: Schedules annexed to and forming pa

- Page 81 and 82: Additional information as required

- Page 83 and 84: Consolidated Statement of Financial

- Page 85 and 86: Consolidated Statement of Comprehen

- Page 87 and 88: Notes to Consolidated Financial Sta

- Page 89 and 90: the foreign entity and translated i

- Page 91 and 92: The Group’s internal drug develop

- Page 93 and 94: Financial liabilities are recognise

- Page 95 and 96: In those cases where the possible o

- Page 97 and 98: NOTE B - BASIS OF CONSOLIDATION The

- Page 99 and 100: NOTE H - PROPERTY, PLANT AND EQUIPM

- Page 101 and 102: Working Capital Facilities is secur

- Page 103 and 104: NOTE R - MATERIALS CONSUMED Materia

Annexure to the Auditors’ Report of even date to the members of <strong>Glenmark</strong><br />

Pharmaceuticals Limited, on the financial statements for the year ended 31 March 2011.<br />

Based on the audit procedures performed for the purpose of reporting a true and fair view on the financial statements of the<br />

Company and taking into consideration the information and explanations given to us and the books of account and other<br />

records examined by us in the normal course of audit, we report as under:<br />

(i) (a) The Company has maintained proper records showing full particulars, including quantitative details and situation<br />

of fixed assets.<br />

(b) The Company has a regular programme of physical verification of its fixed assets by which fixed assets are<br />

verified in a phased manner over a period of three years. In our opinion, this periodicity of physical verification<br />

is reasonable having regard to the size of the Company and the nature of its assets. No material discrepancies<br />

were noticed on such verification.<br />

(c) In our opinion, a substantial part of fixed assets has not been disposed off during the year.<br />

(ii) (a) Physical verification of inventory (except stocks lying with third parties and stocks in transit, confirmations for<br />

which have been obtained) have been conducted at reasonable intervals by the management.<br />

(b) In our opinion, the procedures of physical verification of inventory followed by the management are reasonable<br />

and adequate in relation to the size of the Company and the nature of its business.<br />

(c) The Company is maintaining proper records of inventory and no material discrepancies were noticed on physical<br />

verification.<br />

(iii) (a) There are four companies covered in the register maintained under section 301 of the Act to which the Company<br />

has granted unsecured loans. The maximum amount outstanding during the year was ` 15,248.94 million and<br />

the year-end balance was ` 13,713.96 million.<br />

(b) In our opinion, the rate of interest and other terms and conditions of such loans are not, prima facie, prejudicial<br />

to the interest of the Company.<br />

(c) In respect of loans granted, repayment of the principal amounts is as stipulated and payment of interest has<br />

been regular.<br />

(d) There is no amount overdue in respect of loans granted to companies, firms or other parties listed in the register<br />

maintained under section 301 of the Act.<br />

(e) The Company has not taken any loans, secured or unsecured from companies, firms or other parties covered in<br />

the register maintained under Section 301 of the Act. Accordingly, the provisions of clauses 4(iii)(f) and 4(iii)(g)<br />

of the Order are not applicable.<br />

(iv) In our opinion, there is an adequate internal control system commensurate with the size of the Company and the<br />

nature of its business for the purchase of inventory and fixed assets and for the sale of goods and services.<br />

(v) (a) The Company has not entered into contracts or arrangements referred to in section 301 of the Act. Accordingly,<br />

the provisions of clause 4(v) of the Order are not applicable.<br />

(b) There are no transactions in pursuance of contracts or arrangements entered in the registered maintained under<br />

section 301 of the Act during the year aggregating to rupees five lakhs or more in respect of any party.<br />

(vi) The Company has not accepted any deposits from the public within the meaning of sections 58A and 58AA of the Act<br />

and the Companies (Acceptance of Deposits) Rules, 1975. Accordingly, the provisions of clause 4(vi) of the Order<br />

are not applicable.<br />

(vii) In our opinion, the Company has an internal audit system commensurate with its size and the nature of its business.<br />

(viii) We have broadly reviewed the books of account maintained by the Company pursuant to the Rules made by the<br />

Central Government under section 209 (1)(d) of the Act for the maintenance of cost records in respect of Company’s<br />

products and are of the opinion that, prima facie, the prescribed accounts and records have been made and<br />

maintained. However, we have not made a detailed examination of the records with a view to determine whether they<br />

are accurate or complete.<br />

(ix) (a)<br />

Undisputed statutory dues including provident fund, investor education and protection fund, employees’ state<br />

insurance, income-tax, sales-tax, wealth-tax, service-tax, custom duty, excise duty, cess and other material<br />

statutory dues, as applicable, have generally been regularly deposited with the appropriate authorities. No<br />

undisputed amounts payable in respect thereof were outstanding at the year end for a period of more than six<br />

months from the date they became payable.<br />

50<br />

GLENMARK PHARMACEUTICALS LIMITED