Provincial Tax Receipts - Finance Department - Government of Sindh

Provincial Tax Receipts - Finance Department - Government of Sindh

Provincial Tax Receipts - Finance Department - Government of Sindh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

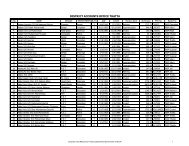

C O N T E N T S<br />

[ I ]<br />

S. No. Description Pages<br />

1 General Abstract <strong>of</strong> Revenue and Capital <strong>Receipts</strong>…………………………… 01 - 05<br />

2 <strong>Department</strong>-wise Breakup <strong>of</strong> Revenue,Capital and Other <strong>Receipts</strong>………. 06 - 10<br />

A<br />

SECTION-I- FEDERAL TRANSFERS<br />

3 Introduction <strong>of</strong> Federal Transfers…………………………………………………. 11 - 13<br />

4 <strong>Tax</strong>es on Income……………….......................................................... 14 - 15<br />

5 Customs........................................................................................ 16 - 17<br />

6 Sales <strong>Tax</strong>....................................................................................... 18 - 19<br />

7 Central Excise ……………………….................................................... 20 - 21<br />

8 Federal Excise on Natural Gas………………….................................. 22 - 23<br />

9 Gas Development Surcharge .......................................................... 24 - 25<br />

B<br />

SECTION-II- PROVINCIAL TAX RECEIPTS<br />

10 Introduction <strong>of</strong> <strong>Provincial</strong> <strong>Tax</strong> <strong>Receipts</strong>…………………………………… 26 - 28<br />

11 <strong>Tax</strong> on Agriculture Income.......................................................... 29 - 31<br />

12 Transfer <strong>of</strong> Property <strong>Tax</strong> (Registration)............................................ 32 - 35<br />

13 Other <strong>Receipts</strong> from Land............................................................ 36 - 38<br />

14 <strong>Tax</strong> on Pr<strong>of</strong>essions, Trades and Callings........................................... 39 - 41<br />

15 Capital Value <strong>Tax</strong>………………………………………………………. 41A-41B<br />

16 <strong>Sindh</strong> Sales <strong>Tax</strong> on Services………………………………………..... 42 - 46<br />

17 <strong>Provincial</strong> Excise............................................................................47 - 61<br />

18 Stamp Duties................................................................................. 62 - 70<br />

19 Motor Vehicles.............................................................................. 71 - 75<br />

20 <strong>Tax</strong> on Hotels……………………………………………………………………. 76- 78

C O N T E N T S<br />

[ II ]<br />

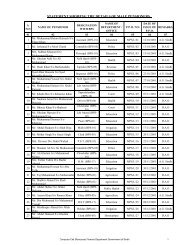

S. No. Description Pages<br />

21 Electricity Duty…………………………………………………………………. 79 - 83<br />

22 Cotton Fees………………………………………………………………………. 84 - 85<br />

23 <strong>Sindh</strong> Development Maintenance <strong>of</strong> Infrastructure <strong>Tax</strong>……………….. 86 - 87<br />

24 Others-Fees All Types………………………………………………………….. 88 - 89<br />

C<br />

SECTION-III- PROVINCIAL NON-TAX RECEIPTS<br />

25 Introduction <strong>of</strong> <strong>Provincial</strong> Non-<strong>Tax</strong> <strong>Receipts</strong>…………………… 89-A-90<br />

26 Interest......................................................................................... 91 - 95<br />

27 Dividends..................................................................................... 96 - 97<br />

28 Organs <strong>of</strong> State-Examination Fee.................................................... 98 - 101<br />

29 Fiscal Administration -Audit.......................................................... 102 - 105<br />

30 Fiscal Administration-<strong>Receipts</strong>-in-aid <strong>of</strong> Superannuation……………….. 106 - 108<br />

31 <strong>Receipts</strong> under Weights and Measures............................................ 109 - 111<br />

32 Justice.......................................................................................... 112 - 116<br />

33 Police........................................................................................... 117 - 123<br />

34 Jails.............................................................................................. 124 - 131<br />

35 Civil Defence................................................................................132 - 133<br />

36 Works.......................................................................................... 134 - 139<br />

37 Public Health................................................................................140 - 150<br />

38 Education......................................................................................151 - 165<br />

39 Health.......................................................................................... 166 - 171

[ III ]<br />

C O N T E N T S<br />

S. No. Description Pages<br />

40 Manpower Management................................................................. 172 - 174<br />

41 Social Security and Social Welfare Measures................................... 175 - 181<br />

42 Food............................................................................................. 182 - 184<br />

43 Agriculture................................................................................... 185 - 194<br />

44 Animal Husbandry.........................................................................195 - 198<br />

45 Forest........................................................................................... 199 - 210<br />

46 Cooperation..................................................................................211 - 213<br />

47 Irrigation...................................................................................... 214 - 224<br />

48 <strong>Receipts</strong> under Excise Duty on Mineral (Labour<br />

Welfare) Act, 1967........................................................................225 - 226<br />

49 Printing........................................................................................ 227 - 229<br />

50 Stationery.....................................................................................230 - 231<br />

51 Industries......................................................................................232 - 234<br />

52 Extra Ordinary <strong>Receipts</strong>................................................................235 - 238<br />

53 Mines and Mineral 239 - 240<br />

54 Sugarcane Development Cess……………………………………………….. 241 - 245<br />

55 Miscellaneous <strong>Receipts</strong> Others...................................................... 246 - 248<br />

56 Foreign Grants (Development)....................................................... 249 - 250<br />

57 Other Grants from Federal <strong>Government</strong>........................................ 251 - 259

[ IV ]<br />

C O N T E N T S<br />

S. No. Description Pages<br />

D<br />

SECTION-IV- CAPITAL RECEIPTS<br />

58 Introduction <strong>of</strong> Capital <strong>Receipts</strong>……………………………………………. 260<br />

59 Investment <strong>Receipts</strong>....................................................................... 261 - 262<br />

60<br />

Recoveries <strong>of</strong> Loans and Advances from Municipalities,<br />

Autonomous Bodies<br />

263 - 267<br />

61 Recoveries <strong>of</strong> Loans and Advances from <strong>Government</strong> Servants 268 ……… - 270<br />

62 Floating Debt (Account No. I)......................................................... 271 - 272<br />

63 Floating Debt (Account No. II)........................................................ 273 - 275<br />

64 Foreign Debt (Permanent).............................................................. 276 - 277<br />

E<br />

SECTION-V-RATES/FEES OF TAX RECEIPTS<br />

65 Rates / Fees <strong>of</strong> <strong>Tax</strong> <strong>Receipts</strong> ........................................................... 278 - 290<br />

F<br />

SECTION-VI- RATES/FEES OF NON-TAX RECEIPTS<br />

66 Rates / Fees <strong>of</strong> Non-<strong>Tax</strong> <strong>Receipts</strong> ……………….…………………………… 291 - 302

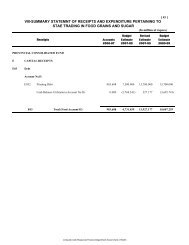

[ 1 ]<br />

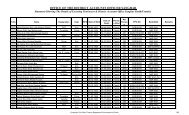

GENERAL ABSTRACT OF REVENUE AND CAPITAL RECEIPTS<br />

Accounts Budget Revised Budget<br />

2009-10 Estimates Estimates Estimates<br />

2010-11 2010-11 2011-12<br />

Rs. Rs. Rs. Rs.<br />

FEDERAL TRANSFERS<br />

B TAX REVENUE 0 212,299,695,000 207,402,960,000 262,286,254,000<br />

B01 DIRECT TAXES 0 85,064,797,000 80,956,189,000 98,416,478,000<br />

B011 <strong>Tax</strong> on Income 84,431,500,000 80,363,315,000 98,416,478,000<br />

B012 Wealth <strong>Tax</strong> 0 0 0<br />

B017 Capital Value <strong>Tax</strong> 633,297,000 592,874,000 0<br />

B02 INDIRECT TAXES 0 127,234,898,000 126,446,771,000 163,869,776,000<br />

B020 Customs Duties 23,818,723,000 22,721,906,000 27,172,601,000<br />

B023 Sales <strong>Tax</strong><br />

B02303 Share <strong>of</strong> net proceeds assigned to Provinces 78,676,704,000 79,144,940,000 105,528,892,000<br />

B02366<br />

B02367<br />

B024<br />

Sales <strong>Tax</strong> on Services Collected on Behalf <strong>of</strong> <strong>Provincial</strong><br />

<strong>Government</strong>s, FATA PATA, Islamabad Capital<br />

Territory, AJ&K and Northern Areas.<br />

Sales <strong>Tax</strong> on Services levied as Central Excise in the<br />

VAT Mode<br />

Federal Excise<br />

0 0 0<br />

0 0 0<br />

B02408 Shares <strong>of</strong> Net Proceeds assigned to Provinces. 19,714,416,000 16,212,685,000 20,743,043,000<br />

B025<br />

B02503<br />

Federal Excise on Natural Gas<br />

Net Proceeds on Excise Duty on Natural Gas Assigned to<br />

Provinces<br />

5,025,055,000 8,367,240,000 10,425,240,000<br />

C NON-TAX RECEIPTS 46,184,548,000 53,110,000,000 43,020,603,000<br />

C03907<br />

C03908<br />

C03904<br />

Net Proceeds <strong>of</strong> Royalty on Crude Oil Assigned to<br />

Provinces<br />

Net Proceeds <strong>of</strong> Royalty on Natural Gas etc. Transferred<br />

to Provinces<br />

Net Proceeds from Surcharge on Gas Assigned to<br />

Provinces<br />

7,756,061,000 8,556,000,000 7,109,885,000<br />

20,077,703,000 25,032,000,000 22,666,000,000<br />

18,350,784,000 19,522,000,000 13,244,718,000<br />

Total Federal Transfers (<strong>Tax</strong> Assignments and<br />

Straight Transfers)<br />

0 258,484,243,000 260,512,960,000 305,306,857,000<br />

PROVINCIAL REVENUE<br />

B TAX REVENUE<br />

B01 DIRECT TAXES 0 4,150,000,000 4,470,000,000 5,250,000,000<br />

B01176 <strong>Tax</strong>es on Agricultural Income in the <strong>Sindh</strong> 220,000,000 300,000,000 500,000,000<br />

B01310 Transfer <strong>of</strong> Property <strong>Tax</strong> (Registration) 900,000,000 900,000,000 1,300,000,000<br />

B014 Other <strong>Receipts</strong> from Land (Land Revenue) 250,000,000 400,000,000 450,000,000<br />

B016 <strong>Tax</strong>es on Pr<strong>of</strong>essions, Trades and Callings 280,000,000 370,000,000 300,000,000

[ 2 ]<br />

GENERAL ABSTRACT OF REVENUE AND CAPITAL RECEIPTS<br />

Accounts Budget Revised Budget<br />

2009-10 Estimates Estimates Estimates<br />

2010-11 2010-11 2011-12<br />

Rs. Rs. Rs. Rs.<br />

B017 Capital Value <strong>Tax</strong> 2,500,000,000 2,500,000,000 2,700,000,000<br />

B02 INDIRECT TAXES 0 52,350,000,000 45,643,453,000 54,794,029,000<br />

B023 <strong>Sindh</strong> Sales <strong>Tax</strong> on Services 0 25,000,000,000 17,365,479,000 25,000,000,000<br />

B026 <strong>Provincial</strong> Excise 2,900,000,000 2,900,000,000 3,000,000,000<br />

B027 Stamp Duties 6,600,000,000 5,000,000,000 6,000,000,000<br />

B028 Motor Vehicles 3,815,000,000 3,815,000,000 4,000,000,000<br />

B030 OTHER INDIRECT TAXES 0 14,035,000,000 16,562,974,000 16,794,029,000<br />

B030-4 <strong>Tax</strong>es on Hotels 160,000,000 160,000,000 170,000,000<br />

B03027<br />

Coal Development Cess<br />

B03030 Electricity Duty 600,000,000 3,102,974,000 1,314,029,000<br />

B03055 Cotton Fees 250,000,000 250,000,000 280,000,000<br />

B03078 <strong>Sindh</strong> Development Maintenance <strong>of</strong> Infrastructure <strong>Tax</strong> 13,000,000,000 13,000,000,000 15,000,000,000<br />

B03079 Others-Fees All Types 25,000,000 50,000,000 30,000,000<br />

Total <strong>Provincial</strong> <strong>Tax</strong> <strong>Receipts</strong> 0 56,500,000,000 50,113,453,000 60,044,029,000<br />

Total B- <strong>Tax</strong> Revenue 0 268,799,695,000 257,516,413,000 322,330,283,000<br />

C<br />

NON-TAX REVENUE<br />

C01 INCOME FROM PROPERTY AND ENTERPRISE 0 1,251,296,413 1,251,796,413 2,773,690,781<br />

C013 Interest on Loans to District <strong>Government</strong>s/TMAs 1,231,296,413 1,231,296,413 1,252,690,781<br />

C014<br />

C015<br />

Interest on Loans and Advances to Financial Institutions<br />

Interest on Loans and Advances to Non- Financial<br />

Institutions<br />

C016 Interest on Loans and Advances to <strong>Government</strong> Servants 2,000,000 2,000,000 2,500,000<br />

C017<br />

Interest on Loans and Advances- Other to Private Sector<br />

C019 Dividends 18,000,000 18,500,000 1,518,500,000<br />

C02 GENERAL ADMINISTRATION RECEIPTS 0 230,000,000 230,000,000 260,000,000<br />

C021 General Administration <strong>Receipts</strong>- Organisations <strong>of</strong> State 90,000,000 90,000,000 100,000,000<br />

C022 General Administration <strong>Receipts</strong>- Fiscal Adminstration 35,000,000 35,000,000 35,000,000<br />

C02240 <strong>Receipts</strong> in Aid <strong>of</strong> Superannuation 40,000,000 40,000,000 50,000,000<br />

C023 General Administration- <strong>Receipts</strong> Economics Regulation 65,000,000 65,000,000 75,000,000<br />

C026 LAW AND ORDER RECEIPTS 0 1,485,000,000 1,185,500,000 1,306,200,000

[ 3 ]<br />

GENERAL ABSTRACT OF REVENUE AND CAPITAL RECEIPTS<br />

Accounts Budget Revised Budget<br />

2009-10 Estimates Estimates Estimates<br />

2010-11 2010-11 2011-12<br />

Rs. Rs. Rs. Rs.<br />

C02600 Justice 80,000,000 180,000,000 100,000,000<br />

C02630 Police <strong>Department</strong> <strong>Receipts</strong> 1,400,000,000 1,000,000,000 1,200,000,000<br />

C02655 Jails 4,500,000 4,500,000 5,000,000<br />

C02665 Civil Defence 500,000 1,000,000 1,200,000<br />

C027 COMMUNITY SERVICES RECEIPTS 0 267,000,000 267,500,000 268,000,000<br />

C02700 Works- Building 175,840,000 175,840,000 175,840,000<br />

C02710 Works- Communications 84,160,000 84,160,000 84,160,000<br />

C02720 Public Health 7,000,000 7,500,000 8,000,000<br />

C028 SOCIAL SERVICES 0 412,000,000 406,000,000 443,500,000<br />

C02800 Education 320,000,000 320,000,000 350,000,000<br />

C02850 Health 75,000,000 75,000,000 78,000,000<br />

C02900 Manpower Management 8,000,000 4,000,000 8,000,000<br />

C02950 Social Security & Social Welfare Measures 9,000,000 7,000,000 7,500,000<br />

Total C02- Receipt from Civil Administration and<br />

Other Functions<br />

0 2,394,000,000 2,089,000,000 2,277,700,000<br />

C03 MISCELLANEOUS RECEIPTS<br />

C031<br />

ECONOMIC SERVICES RECEIPTS- FOOD AND<br />

AGRICULTURE<br />

0 115,000,000 70,392,600 75,000,000<br />

C03100 Food 15,000,000 392,600 0<br />

C03115 Agriculture 100,000,000 70,000,000 75,000,000<br />

C032<br />

ECONOMIC SERVICES RECEIPTS- FISHERIES<br />

AND ANIMAL HUSBANDRY<br />

0 20,000,000 12,000,000 15,000,000<br />

C03200 General Administartion- <strong>Receipts</strong> Economics Regulation 0<br />

C03220 Animal Husbandry 20,000,000 12,000,000 15,000,000<br />

C033 ECONOMIC SERVICES RECEIPTS FOREST<br />

C033 Economic Services <strong>Receipts</strong> Forest 130,000,000 80,000,000 100,000,000<br />

C034<br />

ECONOMIC SERVICES RECEIPTS,<br />

COOPERATION, IRRIGATION AND<br />

EMBANKMENT- DRAINAGE WORKS<br />

0 603,500,000 403,500,000 503,500,000<br />

C03400 Cooperation 3,500,000 3,500,000 3,500,000<br />

C03430 Irrigation works 600,000,000 400,000,000 500,000,000<br />

C035 ECONOMIC SERVICES RECEIPTS- OTHERS 0 216,000,000 216,000,000 303,000,000

[ 4 ]<br />

GENERAL ABSTRACT OF REVENUE AND CAPITAL RECEIPTS<br />

Accounts Budget Revised Budget<br />

2009-10 Estimates Estimates Estimates<br />

2010-11 2010-11 2011-12<br />

Rs. Rs. Rs. Rs.<br />

C03507<br />

<strong>Receipts</strong> under Excise Duty Minerals (Labour Welfare)<br />

Act, 1967<br />

160,000,000 160,000,000 210,000,000<br />

C03510 Printing 15,000,000 15,000,000 35,000,000<br />

C03525 Stationery 20,000,000 20,000,000 36,000,000<br />

C03540 Industries 21,000,000 21,000,000 22,000,000<br />

Total C-03- Miscellaneous <strong>Receipts</strong> 0 1,084,500,000 781,892,600 996,500,000<br />

C037 Extraordinary <strong>Receipts</strong> 9,000,000,000 3,000,000,000 6,000,000,000<br />

C038 Others 5,270,204,000 5,272,204,000 7,815,000,000<br />

C03808<br />

<strong>Receipts</strong> under the Mines and Oil Fields and Mineral<br />

Development Act<br />

600,000,000 600,000,000 650,000,000<br />

C03811 Sugarcane Development Cess 160,000,000 162,000,000 165,000,000<br />

C038 Miscellaneous <strong>Receipts</strong>-Others 4,510,204,000 4,510,204,000 7,000,000,000<br />

Total <strong>Provincial</strong> Non-<strong>Tax</strong> Revenue 0 19,000,000,413 12,394,893,013 19,862,890,781<br />

Total Federal Non-<strong>Tax</strong> <strong>Receipts</strong> 0 46,184,548,000 53,110,000,000 43,020,603,000<br />

Total Federal and <strong>Provincial</strong> Non-<strong>Tax</strong> Revenue 0 65,184,548,413 65,504,893,013 62,883,493,781<br />

Total <strong>Provincial</strong> <strong>Tax</strong> and Non-<strong>Tax</strong> Receitps 0 75,500,000,413 62,508,346,013 79,906,919,781<br />

C036 GRANTS 0 21,034,403,000 9,170,471,816 16,554,743,000<br />

C03601<br />

Foreign Grants- Development Grants from Foreign<br />

Goverrnments<br />

22,500,000 22,500,000 22,500,000<br />

C03631 DERA Programme 320,000,000 20,605,000 0<br />

C03603<br />

C03604<br />

Other Grants from Federal <strong>Government</strong>- Development<br />

Grants from Federal <strong>Government</strong><br />

Other Grants from Federal <strong>Government</strong>- Non-<br />

Development Grants from Federal <strong>Government</strong><br />

14,431,971,000 3,091,669,816 9,761,234,000<br />

5,572,353,000 5,510,294,000 6,771,009,000<br />

C03883 Production Bonus deposited by Exploration 687,579,000 525,403,000 0<br />

Total General Revenue <strong>Receipts</strong> 0 355,018,646,413 332,191,777,829 401,768,519,781<br />

E CAPITAL RECEIPTS<br />

E01 Recoveries <strong>of</strong> Investment 105,000,000 105,000,000 105,000,000

[ 5 ]<br />

GENERAL ABSTRACT OF REVENUE AND CAPITAL RECEIPTS<br />

Accounts Budget Revised Budget<br />

2009-10 Estimates Estimates Estimates<br />

2010-11 2010-11 2011-12<br />

Rs. Rs. Rs. Rs.<br />

E02 RECOVERIES OF LOANS AND ADVANCES 0 6,626,978,286 619,878,286 6,776,744,918<br />

E022 From District <strong>Government</strong>/TMAs 507,318,804 507,318,804 659,034,246<br />

E023 From Financial Institutions<br />

E024 From Non-Financial Institutions 7,559,482 7,559,482 7,710,672<br />

E025 From <strong>Government</strong> Servants 110,000,000 105,000,000 110,000,000<br />

E026 From Private Sector 2,100,000 0 0<br />

E27 Domestic Loan (Over Payment <strong>of</strong> SCARP CDLs) 6,000,000,000 0 6,000,000,000<br />

E03 FLOATING DEBT 0 19,398,000,000 16,910,553,000 20,121,875,000<br />

E031 Permanent Debt- Domestic (Direct) 2,500,000,000<br />

E031 Permanent Debt- Recived from Federal <strong>Government</strong> 0<br />

E032 Floating Debt (Account No.I) 0<br />

E03301 Permanent Debt-Foreign -Direct 19,398,000,000 14,410,553,000 20,121,875,000<br />

Total Capital <strong>Receipts</strong> (Account No.I) 0 26,129,978,286 17,635,431,286 27,003,619,918<br />

E012<br />

STATE TRADING SCHEMES RECEIPTS<br />

E01202 Sale Proceeds <strong>of</strong> Wheat 0 0 33,800,000,000<br />

E01203 Other <strong>Receipts</strong> 0 0 1,540,000,000<br />

E03 DEBT (Account No.II)<br />

E032 Floating Debt<br />

E03202 Ways and Means Advances 30,000,000,000 35,000,000,000 31,000,000,000<br />

Total State Trading Schemes <strong>Receipts</strong> 0 30,000,000,000 35,000,000,000 66,340,000,000<br />

Total Capital <strong>Receipts</strong> (Account I+II) 0 56,129,978,286 52,635,431,286 93,343,619,918<br />

E03<br />

E033<br />

E03305<br />

DEBT<br />

PERMANENT DEBT- FOREIGN<br />

Foreign Debt (Permanennt) Received from the Federal<br />

<strong>Government</strong><br />

4,760,000,000 3,879,592,000 20,156,667,000<br />

Total E033- Permanent Debt- Foreign (Dev.) 0 4,760,000,000 3,879,592,000 20,156,667,000<br />

Total Capital <strong>Receipts</strong> (Current & Development) 0 60,889,978,286 56,515,023,286 113,500,286,918<br />

Total <strong>Provincial</strong> Consolidated Fund 0 415,908,624,699 388,706,801,115 515,268,806,699

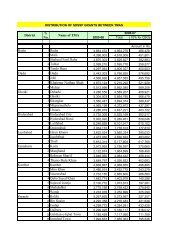

[ 6 ]<br />

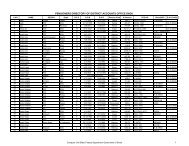

<strong>Department</strong>-wise Break-up <strong>of</strong> Revenue,Capital <strong>Receipts</strong><br />

Accounts<br />

2009-10<br />

Budget<br />

Estimates<br />

2010-11<br />

Revised<br />

Estimaes<br />

2010-11<br />

Rs. in million<br />

Budget<br />

Estimates<br />

2011-12<br />

A- RECEIPTS FROM FEDERAL<br />

GOVERNMENT<br />

1 <strong>Tax</strong>es on Income 0.000 84,431.500 80,363.315 98,416.478<br />

2 Wealth <strong>Tax</strong> 0.000<br />

3 Capital Value <strong>Tax</strong> 0.000 633.297 592.874 0.000<br />

4 Customs Duty 0.000 23,818.723 22,721.906 27,172.601<br />

5 Sales <strong>Tax</strong>- Share <strong>of</strong> net proceeds assignment to<br />

Provinces<br />

0.000 78,676.704 79,144.940 105,528.892<br />

6 Sales <strong>Tax</strong>- Sales <strong>Tax</strong> on Services Collected on Behalf<br />

<strong>of</strong> Provncial <strong>Government</strong>s, FATA PATA, Islamabad<br />

0.000 0.000 0.000 0.000<br />

CapitalTerrtory, AJ&K and Northern Areas.<br />

7 Sales <strong>Tax</strong>- Sales <strong>Tax</strong> on Services Levied as Central<br />

Excise in the VAT Mode.<br />

0.000 0.000 0.000 0.000<br />

8 Federal Excise- Shares <strong>of</strong> Net Proceeds assigned to<br />

Provinces.<br />

0.000 19,714.416 16,212.685 20,743.043<br />

9 Federal Excise- Net Proceeds <strong>of</strong> Royalty on Crude Oil<br />

Assigned to Provinces.<br />

0.000 7,756.061 8,556.000 7,109.885<br />

10 Federal Excise on Natural Gas- Net Proceeds on Excise<br />

Duty on Natural Gas Assigned to Provinces. 0.000 5,025.055 8,367.240 10,425.240<br />

11 Federal Excise on Natural Gas- Net Proceeds on Excise<br />

Duty on Natural Gas etc. Transferred to Provinces. 0.000 20,077.703 25,032.000 22,666.000<br />

12 Net Proceeds from Surcharge on Gas Assigned to<br />

Provinces<br />

13 Grant-in-Aid (0.66% <strong>of</strong> Shortfall/2.5% GST)<br />

0.000 18,350.784 19,522.000 13,244.718<br />

0.000 5,572.353 5,350.858 6,771.009<br />

Total <strong>Receipts</strong> from Federal <strong>Government</strong> (A) 0.000 264,056.596 265,863.818 312,077.866<br />

B- RECEIPTS FROM PROVINCIAL<br />

GOVERNMENT DEPARTMENTS<br />

AGRICULTURE DEPARTMENT<br />

1 <strong>Receipts</strong> under Weights & Measures 0.000 65.000 65.000 75.000<br />

2 Agriculture 0.000 100.000 70.000 75.000<br />

3 Paddy Husking <strong>Tax</strong><br />

4 Sugarcane Development Cess 0.000 160.000 162.000 165.000<br />

Total Agriculture 0.000 325.000 297.000 315.000<br />

FISHERIES AND LIVESTOCK<br />

1 Fisheries 0.000 0.000 0.000 0.000

[ 7 ]<br />

<strong>Department</strong>-wise Break-up <strong>of</strong> Revenue,Capital <strong>Receipts</strong><br />

Accounts<br />

2009-10<br />

Budget<br />

Estimates<br />

2010-11<br />

Revised<br />

Estimaes<br />

2010-11<br />

Rs. in million<br />

Budget<br />

Estimates<br />

2011-12<br />

2 Animal Husbandry 0.000 20.000 12.000 15.000<br />

Total Fisheries and Livestock 0.000 20.000 12.000 15.000<br />

BOARD OF REVENUE<br />

1 <strong>Tax</strong> on Agriculture Income 0.000 220.000 300.000 500.000<br />

2 Transfer <strong>of</strong> Property <strong>Tax</strong> (Registration) 0.000 900.000 900.000 1,300.000<br />

3 Other <strong>Receipts</strong> from Land 0.000 250.000 400.000 450.000<br />

4 Stamp Duty 0.000 6,600.000 5,000.000 6,000.000<br />

5 Capital Value <strong>Tax</strong> 2,500.000 2,500.000 2,700.000<br />

6 Extra Ordinary <strong>Receipts</strong> 0.000 9,000.000 3,000.000 6,000.000<br />

7 Miscellaneous <strong>Receipts</strong> (including various Deptt.) 0.000 4,510.204 4,510.204 7,000.000<br />

Total Board <strong>of</strong> Revenue 0.000 23,980.204 16,610.204 23,950.000<br />

COMMUNICATION & WORKS DEPARTMENT<br />

1 Works- Building 0.000 175.840 175.840 175.840<br />

2 Works- Communication 0.000 84.160 84.160 84.160<br />

Total Communication & Works<br />

0.000 260.000 260.000 260.000<br />

COOPERATION DEPARTMENT<br />

1 Cooperation 0.000 3.500 3.500 3.500<br />

Total Cooperation 0.000 3.500 3.500 3.500<br />

EDUCATION DEPARTMENT<br />

1 Education 0.000 320.000 320.000 350.000<br />

Total Education 0.000 320.000 320.000 350.000<br />

EXCISE & TAXATION DEPARTMENT<br />

1 <strong>Tax</strong>es on Pr<strong>of</strong>essions, Trades and Callings 0.000 280.000 370.000 300.000<br />

2 <strong>Provincial</strong> Excise 0.000 2,900.000 2,900.000 3,000.000<br />

3 Motor Vehicles 3,548.300 3,548.300 3,659.000<br />

4 <strong>Tax</strong>es on Hotels 0.000 160.000 160.000 170.000<br />

5 Cotton Fees 0.000 250.000 250.000 280.000<br />

6 <strong>Sindh</strong> Development Maintenance <strong>of</strong> Infrastructure 0.000 13,000.000 13,000.000 15,000.000<br />

7 Others (Fees All Types) 0.000 25.000 50.000 30.000<br />

Total Excise and <strong>Tax</strong>ation 0.000 20,163.300 20,278.300 22,439.000

[ 8 ]<br />

<strong>Department</strong>-wise Break-up <strong>of</strong> Revenue,Capital <strong>Receipts</strong><br />

Accounts<br />

2009-10<br />

Budget<br />

Estimates<br />

2010-11<br />

Revised<br />

Estimaes<br />

2010-11<br />

Rs. in million<br />

Budget<br />

Estimates<br />

2011-12<br />

FOREST & WILD LIFE DEPARTMENT<br />

Forest<br />

0.000 130.000 80.000 100.000<br />

<strong>Receipts</strong> from Civil Administration, Social Security &<br />

Social Welfare Measures 0.000 9.000 7.000 7.500<br />

Total Forest 0.000 139.000 87.000 107.500<br />

FOOD DEPARTMENT<br />

1 Food 0.000 15.000 0.393 0.000<br />

Total Food <strong>Department</strong> 0.000 15.000 0.393 0.000<br />

FINANCE DEPARTMENT<br />

1 <strong>Sindh</strong> Sales <strong>Tax</strong> on Services (SRB-<strong>Finance</strong>) 0.000 25,000.000 17,365.479 25,000.000<br />

2 Fiscal Administration -Audit 0.000 35.000 35.000 35.000<br />

3 Fiscal Administration- <strong>Receipts</strong> in Aid <strong>of</strong><br />

Superannuation.<br />

0.000 40.000 40.000 50.000<br />

4 Interest 0.000 1,233.296 1,233.296 1,255.191<br />

5 Dividends 0.000 18.000 18.500 1,518.500<br />

Total <strong>Finance</strong> <strong>Department</strong> 0.000 26,326.296 18,692.275 27,858.691<br />

HOME DEPARTMENT<br />

1 Motor Vehicle Fitness (MVT) 66.700 66.700 106.000<br />

2 Traffic Fines (Police) 126.870 93.450 104.635<br />

3 Arms Licence Fee Arms Act (Police) 431.000 409.100 458.000<br />

4 Motor Driving Licences Fees (Police) Other Police 518.635 159.800 227.900<br />

5 Others (Police) 323.495 337.650 409.465<br />

6 Jails 0.000 4.500 4.500 5.000<br />

7 Civil Defence 0.000 0.500 1.000 1.200<br />

Total Home<br />

0.000 1,471.700 1,072.200 1,312.200<br />

HEALTH<br />

1 Health 0.000 75.000 75.000 78.000<br />

Total Health 0.000 75.000 75.000 78.000

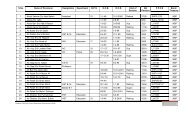

[ 9 ]<br />

<strong>Department</strong>-wise Break-up <strong>of</strong> Revenue,Capital <strong>Receipts</strong><br />

Accounts<br />

2009-10<br />

Budget<br />

Estimates<br />

2010-11<br />

Revised<br />

Estimaes<br />

2010-11<br />

Rs. in million<br />

Budget<br />

Estimates<br />

2011-12<br />

IRRIGATION & POWER<br />

1 Irrigation (Abiana) 0.000 600.000 400.000 500.000<br />

2 Electricity Duty 0.000 600.000 3,102.974 1,314.029<br />

Total Irrigation & Power 0.000 1,200.000 3,502.974 1,814.029<br />

LABOUR TRANSPORT & INDUSTRIES<br />

DEPARTMENT<br />

1 Printing 0.000 15.000 15.000 35.000<br />

2 Stationery 0.000 20.000 20.000 36.000<br />

3 Industries 0.000 21.000 21.000 22.000<br />

4 Manpower Management 0.000 8.000 4.000 8.000<br />

5 <strong>Provincial</strong> Transport Authority (Route Permit under<br />

Motor Vehicle <strong>Tax</strong><br />

200.000 200.000 235.000<br />

6 <strong>Receipts</strong> under Excise Duty on Mineral (Labour<br />

Welfare) Act<br />

160.000 160.000 210.000<br />

7 Coal Development Cess<br />

Total Labour, Transport & Industries 0.000 424.000 420.000 546.000<br />

MINES AND MINERAL DEPARTMENT<br />

1 <strong>Receipts</strong> under the Mines and Oil Fields and Mineral<br />

Development Act<br />

0.000 600.000 600.000 650.000<br />

Total Mines and Mineral <strong>Department</strong> 0.000 600.000 600.000 650.000<br />

LAW DEPARTMENT<br />

1 Justice 0.000 80.000 180.000 100.000<br />

Total Law 0.000 80.000 180.000 100.000<br />

PUBLIC HEALTH DEPARTMENT<br />

1 Public Health 0.000 7.000 7.500 8.000<br />

Total Public Health 0.000 7.000 7.500 8.000<br />

SERVICES GENERAL ADMINISTRATION &<br />

COORDINATION DEPARTMENT<br />

1 General Administration- Organisations <strong>of</strong> State<br />

0.000 90.000 90.000 100.000<br />

Sub-Total Public Service Commission 0.000 90.000 90.000 100.000<br />

Total <strong>Provincial</strong> <strong>Receipts</strong> (B) 0.000 75,500.000 62,508.346 79,906.920

[ 10 ]<br />

<strong>Department</strong>-wise Break-up <strong>of</strong> Revenue,Capital <strong>Receipts</strong><br />

Accounts<br />

2009-10<br />

Budget<br />

Estimates<br />

2010-11<br />

Revised<br />

Estimaes<br />

2010-11<br />

Rs. in million<br />

Budget<br />

Estimates<br />

2011-12<br />

C- GRANTS (Non-Development)<br />

1 Non-Development Grants 0.000 0.000 159.436 0.000<br />

Total Grants (Non-Development) (C) 0.000 0.000 159.436 0.000<br />

D<br />

GRANTS (Development)<br />

1 Foreign Grants-Development Grants from Foreign<br />

<strong>Government</strong>s<br />

0.000 22.500 22.500 22.500<br />

2 DERA Programme 0.000 320.000 20.605 0.000<br />

3 Other Grants from Federal <strong>Government</strong>- Development<br />

Grants from Federal <strong>Government</strong> 0.000 14,431.971 3,091.670 9,761.234<br />

4 Producation Bonous deposited by Exploration<br />

0.000 687.579 525.403 0.000<br />

Total Grants(Development) (D) 0.000 15,462.050 3,660.178 9,783.734<br />

Total General Revenue <strong>Receipts</strong> (A+B+C+D) 0.000 355,018.646 332,191.778 401,768.520<br />

E CAPITAL RECEIPTS<br />

1 Investment 0.000 105.000 105.000 105.000<br />

2 Recoveries <strong>of</strong> Loans and Advances 0.000 6,626.978 619.878 6,776.745<br />

3 Domestic Debt (Permanent) -Direct 0.000 0.000 2,500.000 0.000<br />

4 Domestic Debt (Permanent)-Received From F.G 0.000 0.000 0.000 0.000<br />

5 Floating Debt-Other (Account No.1) 0.000 0.000 0.000 0.000<br />

6 Debt (Account No.I) 0.000 19,398.000 14,410.553 20,121.875<br />

7 State Trading Schemes <strong>Receipts</strong> 0.000 30,000.000 35,000.000 66,340.000<br />

8 Foreign Debt (Permanent) Received from the Federal<br />

<strong>Government</strong><br />

0.000 4,760.000 3,879.592 20,156.667<br />

Total Capital <strong>Receipts</strong> (E) 0.000 60,889.978 56,515.023 113,500.287<br />

Grand Total (Current+Capital+Development)<br />

(A+B+C+D+E)<br />

0.000 415,908.625 388,706.801 515,268.807

[ A ]<br />

SECTION-I<br />

FEDERAL TRANSFERS

11<br />

Federal Transfers<br />

The federal receipts essentially comprise <strong>of</strong> divisible pool tax receipts, straight transfers received<br />

on account <strong>of</strong> various levies on natural resources such as royalty on natural gas and oil, excise on<br />

natural gas and surcharge on gas.<br />

Divisible Pool <strong>Tax</strong> Revenue<br />

The net divisible pool comprises <strong>of</strong> the net proceeds <strong>of</strong> various direct and indirect taxes<br />

collected by the CBR, and comprise <strong>of</strong> taxes on income, wealth tax, capital value tax, taxes on<br />

sales and purchases, sales tax on services, export duties on cotton, custom duties and federal<br />

excise duty.<br />

Distribution <strong>of</strong> Revenues. (1) The Divisible Pool taxes in each year shall consist <strong>of</strong> the levied and<br />

collected by the Federal <strong>Government</strong> in that year, namely:<br />

(a) <strong>Tax</strong>es on income;<br />

(b) Wealth tax;<br />

(c) Capital value tax;<br />

(d) Export duties on cotton;<br />

(e) Customs duties;<br />

(f) Any other tax which may be levied by the Federal <strong>Government</strong>.<br />

(2) One percent <strong>of</strong> the net proceeds <strong>of</strong> divisible pool taxes shall be assigned to <strong>Government</strong> <strong>of</strong><br />

Khyber Pakhtunkhwa to meet the expenses on War on Terror.<br />

(3) After deducting the amounts as prescribed in clause (2), <strong>of</strong> the balance amount <strong>of</strong> the net<br />

proceeds <strong>of</strong> divisible pool taxes, fifty-six percent shall be assigned to provinces during the<br />

financial year 2010-11 and fifty-seven and half percent from the financial year 2011-12 onwards.<br />

The share <strong>of</strong> the Federal <strong>Government</strong> in the net proceeds <strong>of</strong> divisible pool shall be forty-four<br />

percent during the financial year 2010-11 and forty-two and half percent from the financial year<br />

2011-12 onwards.<br />

The size <strong>of</strong> the Divisible Pool has been increased in the interest <strong>of</strong> national solidarity and<br />

provincial harmony. Federal government committed to make efforts to boost tax revenue. In<br />

addition the Divisible Pool will be increased by reducing the collection charges from 5% to 1%.<br />

The <strong>Provincial</strong> Share <strong>of</strong> the Divisible Pool will increase from the present 47.5% to 56% in the<br />

first year <strong>of</strong> NFC and 57.5% in the remaining years <strong>of</strong> the Award. This is an increase <strong>of</strong> over 21%<br />

in <strong>Provincial</strong> Share<br />

The multiple indicators and their respective weights as agreed upon are:-<br />

a Population 82.0%<br />

b Poverty / backwardness 10.3%<br />

c Revenue collection / generation 5.0%<br />

d Inverse Population Density (IPD) 2.7%

12<br />

After giving effect to the special needs <strong>of</strong> Baluchistan and application <strong>of</strong> the aforesaid multiple<br />

a Punjab 51.74%<br />

b <strong>Sindh</strong> 24.55%<br />

c Khyber Pakhtoonkhawa 14.62%<br />

d Balochistan 9.09%<br />

<strong>Sindh</strong> would receive an additional transfer <strong>of</strong> Rs.6 billion from the Federal <strong>Government</strong><br />

equivalent to 0.66% <strong>of</strong> the provincial pool.<br />

Straight Transfers<br />

Straight transfers generally refer to the incomes received on account <strong>of</strong> royalty on oil, royalty on<br />

gas, excise duty and surcharge on gas. The provincial governments are entitled to receive the<br />

royalty on the production <strong>of</strong> gas and excise duty on gas in accordance with the provisions <strong>of</strong><br />

Article 161 (1) <strong>of</strong> 1973 Constitution <strong>of</strong> Islamic Republic <strong>of</strong> Pakistan. In keeping with the spirit <strong>of</strong><br />

the above provision, the 4 th NFC (1990) Award recommended transfer <strong>of</strong> gas development<br />

surcharge (GDS) and royalty on oil to the provinces and subsequently the 1996-97 Award as well<br />

as the new Revenue Distribution Order provided for transfer <strong>of</strong> GDS and royalty on oil to the<br />

provinces. For GDS, the recommendation is that the net proceeds <strong>of</strong> Development Surcharge on<br />

natural gas would be transferred to the provinces and shall be distributed on production basis at<br />

wellheads after deducting the collection charges <strong>of</strong> 2%.<br />

Each <strong>of</strong> the provinces shall be paid in each financial year as a share in the net proceeds <strong>of</strong> the total<br />

royalties on crude oil an amount which bears to the total net proceeds the same proportion as the<br />

production <strong>of</strong> crude oil in the Province in that year bears to the total production <strong>of</strong> crude oil.<br />

Each <strong>of</strong> the Provinces shall be paid in each financial year as a share in the net proceeds to per<br />

MMBTU <strong>of</strong> the respective province. The average rate per MMBTU shall be derived by notionally<br />

clubbing both the royalty on natural gas and development surcharge on gas. Royalty on natural<br />

gas shall be distributed in accordance with clause (1) <strong>of</strong> Article 161 <strong>of</strong> the Constitution whereas<br />

the development surcharge on natural gas would be distributed by making adjustments based on<br />

this average rate.

13<br />

GST on Services (<strong>Provincial</strong>)<br />

The GST on services is a provincial levy and has been levied through <strong>Sindh</strong> Sales <strong>Tax</strong> Ordinance-<br />

2000, promulgated with effect from July 2000. The sales tax on services is charged @ 17% <strong>of</strong><br />

value <strong>of</strong> taxable services which amongst other include services rendered by hotels, marriage halls,<br />

lawns, clubs, caterers etc. It is also levied on advertisements, services rendered by custom agents,<br />

stevedores, courier services etc. The procedure adopted for collection <strong>of</strong> tax is same as prescribed<br />

in Sales <strong>Tax</strong> Act 1990.<br />

Sales <strong>Tax</strong> on Services has been devolved to provinces. NFC recognized that Sales <strong>Tax</strong> on Services is a<br />

provincial subject under the Constitution <strong>of</strong> Pakistan. It has been iterated that Provinces may collect the<br />

GST on Services if they so desire. <strong>Government</strong> <strong>of</strong> Pakistan would remove GST on Services under Central<br />

Excise Mode to enable provinces to levy this <strong>Tax</strong>.<br />

This by far is the greatest achievement as it empowers fiscal base <strong>of</strong> provinces. It is a big step towards<br />

fiscal autonomy <strong>of</strong> Provinces as it reduces level <strong>of</strong> dependency on the Federation.

TAXES ON INCOME<br />

____________________________________________________________________________<br />

Total Receipt: 98,416,478,000<br />

____________________________________________________________________________<br />

Head <strong>of</strong> <strong>Department</strong>s:<br />

1 Secretary to <strong>Government</strong> <strong>of</strong> <strong>Sindh</strong>, <strong>Finance</strong> <strong>Department</strong><br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

14<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Summary<br />

B-TAX REVENUE<br />

B01 Direct <strong>Tax</strong>es 85,064,797,000 80,956,189,000 98,416,478,000<br />

B011 <strong>Tax</strong>es on Income 84,431,500,000 80,363,315,000 98,416,478,000<br />

B017 Capital Value <strong>Tax</strong> on Immoveable Property 633,297,000 592,874,000

TAXES ON INCOME<br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

15<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Detail<br />

B-TAX REVENUE<br />

B01 Direct <strong>Tax</strong>es 85,064,797,000 80,956,189,000 98,416,478,000<br />

B011 <strong>Tax</strong>es on Income 84,431,500,000 80,363,315,000 98,416,478,000<br />

B01108 Share <strong>of</strong> net proceeds assigned to 84,431,500,000 80,363,315,000 98,416,478,000<br />

Provinces<br />

B017 Capital Value <strong>Tax</strong> on Immoveable Property 633,297,000 592,874,000<br />

B01770 Others 633,297,000 592,874,000

CUSTOMS<br />

____________________________________________________________________________<br />

Total Receipt: 27,172,601,000<br />

____________________________________________________________________________<br />

Head <strong>of</strong> <strong>Department</strong>s:<br />

1 Secretary to <strong>Government</strong> <strong>of</strong> <strong>Sindh</strong>, <strong>Finance</strong> <strong>Department</strong><br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

16<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Summary<br />

B-TAX REVENUE<br />

B02 Indirect <strong>Tax</strong>es 23,818,723,000 22,721,906,000 27,172,601,000<br />

B020 Sea Customs 23,818,723,000 22,721,906,000 27,172,601,000

CUSTOMS<br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

17<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Detail<br />

B-TAX REVENUE<br />

B02 Indirect <strong>Tax</strong>es 23,818,723,000 22,721,906,000 27,172,601,000<br />

B020 Sea Customs 23,818,723,000 22,721,906,000 27,172,601,000<br />

B02070 Share <strong>of</strong> net proceeds assigned to 23,818,723,000 22,721,906,000 27,172,601,000<br />

Provinces

SALES TAX<br />

____________________________________________________________________________<br />

Total Receipt: 105,528,892,000<br />

____________________________________________________________________________<br />

Head <strong>of</strong> <strong>Department</strong>s:<br />

1 Secretary to <strong>Government</strong> <strong>of</strong> <strong>Sindh</strong>, <strong>Finance</strong> <strong>Department</strong><br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

18<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Summary<br />

B-TAX REVENUE<br />

B02 Indirect <strong>Tax</strong>es 78,676,704,000 79,144,940,000 105,528,892,000<br />

B023 Sales <strong>Tax</strong> 78,676,704,000 79,144,940,000 105,528,892,000

SALES TAX<br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

19<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Detail<br />

B-TAX REVENUE<br />

B02 Indirect <strong>Tax</strong>es 78,676,704,000 79,144,940,000 105,528,892,000<br />

B023 Sales <strong>Tax</strong> 78,676,704,000 79,144,940,000 105,528,892,000<br />

B02303 Share <strong>of</strong> net proceeds assigned to 78,676,704,000 79,144,940,000 105,528,892,000<br />

Provinces

CENTRAL EXCISE<br />

____________________________________________________________________________<br />

Total Receipt: 31,168,283,000<br />

____________________________________________________________________________<br />

Head <strong>of</strong> <strong>Department</strong>s:<br />

1 Secretary to <strong>Government</strong> <strong>of</strong> <strong>Sindh</strong>, <strong>Finance</strong> <strong>Department</strong><br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

20<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Summary<br />

B-TAX REVENUE<br />

B02 Indirect <strong>Tax</strong>es 24,739,471,000 24,579,925,000 31,168,283,000<br />

B024 Federal Excise 19,714,416,000 16,212,685,000 20,743,043,000<br />

B025 Federal Excise on Natural Gas 5,025,055,000 8,367,240,000 10,425,240,000

CENTRAL EXCISE<br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

21<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Detail<br />

B-TAX REVENUE<br />

B02 Indirect <strong>Tax</strong>es 24,739,471,000 24,579,925,000 31,168,283,000<br />

B024 Federal Excise 19,714,416,000 16,212,685,000 20,743,043,000<br />

B02408 Share <strong>of</strong> net proceeds assigned to 19,714,416,000 16,212,685,000 20,743,043,000<br />

Provinces<br />

B025 Federal Excise on Natural Gas 5,025,055,000 8,367,240,000 10,425,240,000<br />

B02503 Net proceeds on Excise Duty on Natural 5,025,055,000 8,367,240,000 10,425,240,000<br />

Gas Assigned to Provinces

FEDERAL EXCISE ON NATURAL GAS<br />

____________________________________________________________________________<br />

Total Receipt: 29,775,885,000<br />

____________________________________________________________________________<br />

Head <strong>of</strong> <strong>Department</strong>s:<br />

1 Secretary to <strong>Government</strong> <strong>of</strong> <strong>Sindh</strong>, <strong>Finance</strong> <strong>Department</strong><br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

22<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Summary<br />

C-NON-TAX REVENUE<br />

C03 Miscellaneous <strong>Receipts</strong> 27,833,764,000 33,588,000,000 29,775,885,000<br />

C039 Development Surcharge and Royalties 27,833,764,000 33,588,000,000 29,775,885,000

FEDERAL EXCISE ON NATURAL GAS<br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

23<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Detail<br />

C-NON-TAX REVENUE<br />

C03 Miscellaneous <strong>Receipts</strong> 27,833,764,000 33,588,000,000 29,775,885,000<br />

C039 Development Surcharge and Royalties 27,833,764,000 33,588,000,000 29,775,885,000<br />

C03907 Net proceeds Royalty On Crude Oil 7,756,061,000 8,556,000,000 7,109,885,000<br />

Assigned to Provinces<br />

C03908 Net proceeds Royalty On Natural Gas 20,077,703,000 25,032,000,000 22,666,000,000<br />

Assigned to Provinces

GAS DEVELOPMENT SURCHARGE<br />

____________________________________________________________________________<br />

Total Receipt: 13,244,718,000<br />

____________________________________________________________________________<br />

Head <strong>of</strong> <strong>Department</strong>s:<br />

1 Secretary to <strong>Government</strong> <strong>of</strong> <strong>Sindh</strong>, <strong>Finance</strong> <strong>Department</strong><br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

24<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Summary<br />

C-NON-TAX REVENUE<br />

C03 Miscellaneous <strong>Receipts</strong> 18,350,784,000 19,522,000,000 13,244,718,000<br />

C039 Development Surcharge and Royalties 18,350,784,000 19,522,000,000 13,244,718,000

GAS DEVELOPMENT SURCHARGE<br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

25<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Detail<br />

C-NON-TAX REVENUE<br />

C03 Miscellaneous <strong>Receipts</strong> 18,350,784,000 19,522,000,000 13,244,718,000<br />

C039 Development Surcharge and Royalties 18,350,784,000 19,522,000,000 13,244,718,000<br />

C03904 Net Proceeds from Development Surcharge 18,350,784,000 19,522,000,000 13,244,718,000<br />

on Gas Assigned to Provinces

[ B ]<br />

SECTION-II<br />

PROVINCIAL TAX<br />

RECEIPTS

26<br />

<strong>Provincial</strong> <strong>Tax</strong> <strong>Receipts</strong><br />

<strong>Provincial</strong> Direct <strong>Tax</strong>es<br />

The direct taxes comprise <strong>of</strong> only three major taxes namely the agriculture income tax (AIT), the<br />

tax on transfer <strong>of</strong> property (registration) and the tax on pr<strong>of</strong>essions, trades and callings. The<br />

receipts from land revenue only include some past arrears or some revenue on account <strong>of</strong> local<br />

cess and drainage Cess etc. The overall ratio <strong>of</strong> direct taxes in tax receipts has declined in last five<br />

years. The basic decrease occurred after the devolution <strong>of</strong> the property tax to the Local<br />

<strong>Government</strong>s.<br />

Agriculture Income <strong>Tax</strong><br />

Pursuant to the recommendations <strong>of</strong> an expert committee under the Chairmanship <strong>of</strong> Dr.Tariq<br />

Siddiqui, the then Vice Chancellor, Quaid-e-Azam University, the <strong>Government</strong> <strong>of</strong> <strong>Sindh</strong>, like the<br />

other provincial governments, promulgated <strong>Sindh</strong> Land <strong>Tax</strong> and Agricultural Income <strong>Tax</strong><br />

Ordinance 2000, requiring land owners to file AIT returns having net agriculture income exceeding<br />

Rs. 80,000/- or having cultivated land upto 50 acres irrigated and 100 acres un-irrigated. The<br />

agriculture land upto 4 acres irrigated and 8 acres un-irrigated was exempted from AIT.<br />

<strong>Tax</strong> on Trade, Pr<strong>of</strong>essions, Calling and Employment<br />

The tax on trade, pr<strong>of</strong>ession, calling and employment was levied under section-11 <strong>of</strong> the West<br />

Pakistan <strong>Finance</strong> Act, 1964. This Act was adopted by the <strong>Government</strong> <strong>of</strong> <strong>Sindh</strong> as <strong>Sindh</strong> <strong>Finance</strong><br />

Act, 1964, whereby all income tax payers were made liable to pay pr<strong>of</strong>essional tax in accordance<br />

with the specified rates. Presently, the tax is being charged on the following:<br />

‣ All person assessed to income tax<br />

‣ All Limited Companies with paid up capital and reserves<br />

‣ All Establishments other than Limited Companies with annual turn-over<br />

‣ Establishments not assessed to income tax<br />

‣ All Petrol Pumps with commission earned<br />

The <strong>Government</strong> <strong>of</strong> <strong>Sindh</strong> through <strong>Sindh</strong> <strong>Finance</strong> Act, No. XIII <strong>of</strong> 1994 made amendment in the<br />

seventh schedule under which all Limited Companies, Modarbas, Mutual Funds and any other<br />

body corporate with “paid up capital ”or“paid up share capital and reserves ” in the preceding<br />

year are liable to pay this tax. Under this the minimum prescribed rate is Rs. 5000 while the<br />

maximum rate is Rs. 500,000.

27<br />

Indirect <strong>Tax</strong>es<br />

The major sources <strong>of</strong> indirect taxes are stamp duties, provincial excise, motor vehicle tax (MVT);<br />

tax on hotels; cotton tax; electricity duty and the <strong>Sindh</strong> Development & Maintenance <strong>of</strong><br />

Infrastructure Cess (SDMIC).<br />

<strong>Provincial</strong> Excise<br />

The main sources <strong>of</strong> income under the provincial excise are duties on medicinal and toilet<br />

preparation materials including beer and liquor sold to non-Muslims and fee on sale <strong>of</strong> commercial<br />

spirits including denatured spirits. The provincial excise is regulated by the Prohibition<br />

(Enforcement <strong>of</strong> Hudd) Order 1979 and <strong>Sindh</strong> Abkari Act, 1878 and Rules made therein.<br />

Stamp Duty<br />

Stamp duty is a voluntary tax which legalizes various transactions. It confirms an act as lawful,<br />

legal and with full force <strong>of</strong> the law. It also confirms the rights <strong>of</strong> both the parties involved in the<br />

said transaction. The stamp duty is regulated through Stamp Act, 1899 and it is mainly recovered<br />

through sale <strong>of</strong> judicial and non judicial stamps. The non judicial stamps are used for revenue<br />

recovery from bill <strong>of</strong> exchange, g, commercial documents, sale <strong>of</strong> propertyp and many other<br />

transactions enlisted under law. The judicial stamp paper is used for many legal transactions<br />

including court fees, property sale, etc.<br />

Motor Vehicle <strong>Tax</strong><br />

The MVT is regulated through <strong>Sindh</strong> Motor Vehicle Ordinance, 1965 and the Motor Vehicles<br />

Rules, 1969. The revenue comprises <strong>of</strong> annual MVT levied on different categories <strong>of</strong> vehicles<br />

registered in the province, motor registration fee which is charged at the time <strong>of</strong> registration <strong>of</strong> a<br />

new vehicle, and motor vehicle fitness certificate, route permit, etc.<br />

Cotton Fee<br />

Cotton fee is levied on the quantity <strong>of</strong> cotton brought in the ginning factories for ginning. It is<br />

regulated through <strong>Sindh</strong> Cotton Control Ordinance, 1966 and rules made thereunder. The overall<br />

revenue under this levy is dependent on cotton production in the country.

28<br />

The <strong>Sindh</strong> Development & Maintenance <strong>of</strong> Infrastructure Cess<br />

The SDMI Cess was first levied and collected under Section 9 <strong>of</strong> <strong>Sindh</strong> <strong>Finance</strong> Act 1994 & the<br />

rules made there under, which have been amended from time to time. At present, this Cess is<br />

levied and collected under the <strong>Sindh</strong> <strong>Finance</strong> Ordinance, 2001 on C&F value <strong>of</strong> the goods upon<br />

their entering or before leaving the province, through Air or Sea, in the manner as may be<br />

prescribed. The Cess at present is charged only on the imported goods entering in the province<br />

from outside the country. Although law provides levy <strong>of</strong> Cess on exports as well but it is remained<br />

exempted for providing incentive to exports. The rate <strong>of</strong> the Cess on imports into <strong>Sindh</strong> was raised<br />

from 0.80% to 0.85% in 2008.<br />

This Cess was levied for facilitating adequate maintenance <strong>of</strong> the infrastructure, which is likely to<br />

depreciate and be adversely affected on account <strong>of</strong> a constant flow <strong>of</strong> trade traffic and related<br />

activities. Here infrastructure refers to a wide range <strong>of</strong> infrastructure and services such as the<br />

social; economic; physical infrastructure as well the overall environment and health hazards which<br />

are created by a constant flow <strong>of</strong> trade related movement from all over the country into and out <strong>of</strong><br />

Port.

TAX ON AGRICULTURE INCOME<br />

____________________________________________________________________________<br />

Total Receipt: 500,000,000<br />

____________________________________________________________________________<br />

Head <strong>of</strong> <strong>Department</strong>s:<br />

1 Secretary to <strong>Government</strong> <strong>of</strong> <strong>Sindh</strong>, Board <strong>of</strong> Revenue, <strong>Sindh</strong><br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

29<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Summary<br />

B-TAX REVENUE<br />

B01 Direct <strong>Tax</strong>es 220,000,000 300,000,000 500,000,000<br />

B011 <strong>Tax</strong>es on Income 220,000,000 300,000,000 500,000,000

TAX ON AGRICULTURE INCOME<br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

30<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Detail<br />

B-TAX REVENUE<br />

B01 Direct <strong>Tax</strong>es 220,000,000 300,000,000 500,000,000<br />

B011 <strong>Tax</strong>es on Income 220,000,000 300,000,000 500,000,000<br />

B01176 <strong>Tax</strong> on Agricultural Income in the SINDH 201,600,000 280,600,000 427,518,000<br />

01 Karachi 5,300,000 11,613,000 16,502,000<br />

02 Hyderabad 7,500,000 13,943,000 19,204,000<br />

03 Dadu 5,200,000 11,507,000 16,382,000<br />

04 Jamshoro 7,500,000 13,943,000 19,204,000<br />

05 Thatta 5,300,000 11,613,000 16,504,000<br />

06 Badin 6,200,000 7,566,000 7,609,000<br />

07 Sukkur 6,000,000 7,354,000 7,363,000<br />

08 Khairpur 10,500,000 21,120,000 22,886,000<br />

09 Naushero Feroze 10,500,000 21,120,000 22,886,000<br />

10 Nawabshah 11,000,000 11,650,000 23,500,000<br />

11 Ghotki 11,000,000 11,650,000 23,500,000<br />

12 Larkana 11,000,000 11,650,000 23,500,000<br />

13 Qamber 11,000,000 11,650,000 23,500,000<br />

14 Shikarpur 11,000,000 11,650,000 23,500,000<br />

15 Jacobabad 11,500,000 12,179,000 24,113,000<br />

16 Kashmore @ Kandhkot 10,000,000 10,590,000 22,272,000<br />

17 Mirpurkhas 11,000,000 11,650,000 23,500,000<br />

18 Umerkot 7,400,000 7,931,000 9,190,000<br />

19 Sanghar 11,000,000 11,650,000 23,500,000<br />

20 Thar at Mithi 5,200,000 5,507,000 6,382,000<br />

21 Matiari 10,000,000 20,590,000 22,272,000<br />

22 Tando Muhamamd Khan 10,500,000 16,120,000 22,886,000<br />

23 Tando Allah Yar 6,000,000 6,354,000 7,363,000<br />

B01184 Recoveries <strong>of</strong> overpayments 17,800,000 18,860,000 71,856,000<br />

01 Karachi 1,600,000 1,694,000 11,963,000<br />

02 Hyderabad 1,800,000 1,925,000 12,231,000<br />

03 Dadu 520,000 555,000 643,000<br />

04 Jamshoro 520,000 550,000 637,000<br />

05 Thatta 530,000 561,000 650,000<br />

06 Badin 220,000 233,000 270,000<br />

07 Sukkur 540,000 571,000 662,000<br />

08 Khairpur 750,000 793,000 919,000<br />

09 Naushero Feroze 120,000 127,000 147,000<br />

10 Nawabshah 330,000 349,000 404,000<br />

11 Ghotki 440,000 466,000 540,000<br />

12 Larkana 770,000 815,000 944,000<br />

13 Qamber 760,000 804,000 932,000<br />

14 Shikarpur 860,000 910,000 11,055,000

TAX ON AGRICULTURE INCOME<br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

31<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Detail<br />

B-TAX REVENUE<br />

15 Jacobabad 800,000 847,000 982,000<br />

16 Kashmore @ Kandhkot 230,000 243,000 282,000<br />

17 Mirpurkhas 3,300,000 3,495,000 14,050,000<br />

18 Umerkot 2,200,000 2,330,000 12,700,000<br />

19 Sanghar 420,000 440,000 510,000<br />

20 Thar at Mithi 110,000 116,000 134,000<br />

21 Matiari 400,000 423,000 490,000<br />

22 Tando Muhamamd Khan 320,000 338,000 392,000<br />

23 Tando Allah Yar 260,000 275,000 319,000<br />

B01189 Deduct-Refunds /Rebate 600,000 540,000 626,000<br />

01 Karachi 160,000 74,000 86,000<br />

02 Hyderabad 80,000 85,000 98,000<br />

03 Dadu 20,000 21,000 24,000<br />

04 Jamshoro 20,000 21,000 24,000<br />

05 Thatta 20,000 21,000 24,000<br />

06 Badin 15,000 16,000 19,000<br />

07 Sukkur 20,000 21,000 24,000<br />

08 Khairpur 20,000 21,000 24,000<br />

09 Naushero Feroze 15,000 16,000 19,000<br />

10 Nawabshah 20,000 21,000 24,000<br />

11 Ghotki 15,000 16,000 19,000<br />

12 Larkana 20,000 21,000 24,000<br />

13 Qamber 10,000 11,000 13,000<br />

14 Shikarpur 20,000 21,000 24,000<br />

15 Jacobabad 20,000 21,000 24,000<br />

16 Kashmore @ Kandhkot 10,000 11,000 13,000<br />

17 Mirpurkhas 15,000 16,000 19,000<br />

18 Umerkot 10,000 11,000 13,000<br />

19 Sanghar 15,000 16,000 19,000<br />

20 Thar at Mithi 10,000 11,000 13,000<br />

21 Matiari 25,000 26,000 30,000<br />

22 Tando Muhamamd Khan 15,000 16,000 19,000<br />

23 Tando Allah Yar 25,000 26,000 30,000

TRANSFER OF PROPERTY TAX (REGISTRATION)<br />

____________________________________________________________________________<br />

Total Receipt: 1,300,000,000<br />

____________________________________________________________________________<br />

Head <strong>of</strong> <strong>Department</strong>s:<br />

1 Senior Member, Board <strong>of</strong> Revenue <strong>Sindh</strong>.<br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

32<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Summary<br />

B-TAX REVENUE<br />

B01 Direct <strong>Tax</strong>es 900,000,000 900,000,000 1,300,000,000<br />

B013 Property <strong>Tax</strong> 900,000,000 900,000,000 1,300,000,000

TRANSFER OF PROPERTY TAX (REGISTRATION)<br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

33<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Detail<br />

B-TAX REVENUE<br />

B01 Direct <strong>Tax</strong>es 900,000,000 900,000,000 1,300,000,000<br />

B013 Property <strong>Tax</strong> 900,000,000 900,000,000 1,300,000,000<br />

B01311 Fees for Registering Documents 771,100,000 771,100,000 856,028,750<br />

01 Karachi 540,000,000 540,000,000 610,000,000<br />

02 Hyderabad 55,000,000 55,000,000 60,000,000<br />

03 Dadu 16,000,000 16,000,000 15,000,000<br />

04 Jamshoro 3,800,000 3,800,000 4,800,000<br />

05 Thatta 15,000,000 15,000,000 18,000,000<br />

06 Badin 10,000,000 10,000,000 10,000,000<br />

07 Sukkur 12,000,000 12,000,000 13,000,000<br />

08 Khairpur 12,000,000 12,000,000 15,000,000<br />

09 Naushero Feroze 9,800,000 9,800,000 6,500,000<br />

10 Nawabshah 11,000,000 11,000,000 11,000,000<br />

11 Ghotki 15,000,000 15,000,000 13,000,000<br />

12 Larkana 12,000,000 12,000,000 8,000,000<br />

13 Qamber 2,000,000 2,000,000 2,200,000<br />

14 Shikarpur 8,000,000 8,000,000 6,000,000<br />

15 Jacobabad 4,000,000 4,000,000 3,000,000<br />

16 Kashmore @ Kandhkot 1,000,000 1,000,000 2,000,000<br />

17 Mirpurkhas 17,000,000 17,000,000 17,028,750<br />

18 Umerkot 2,500,000 2,500,000 6,500,000<br />

19 Sanghar 15,000,000 15,000,000 15,000,000<br />

20 Thar at Mithi 2,000,000 2,000,000 5,000,000<br />

21 Matiari 2,500,000 2,500,000 3,000,000<br />

22 Tando Muhammad Khan 2,500,000 2,500,000 4,000,000<br />

23 Tando Allah Yar 3,000,000 3,000,000 8,000,000<br />

B01312 Copying Registered Documents 2,500,000 2,500,000 101,352,750<br />

01 Karachi 2,000,000 2,000,000 2,500,000<br />

02 Hyderabad 320,000 320,000 5,409,750<br />

03 Dadu 10,000 10,000 5,176,000<br />

04 Jamshoro 10,000 10,000 5,201,000<br />

05 Thatta 10,000 10,000 5,171,000<br />

06 Badin 10,000 10,000 5,191,000<br />

07 Sukkur 10,000 10,000 5,231,000<br />

08 Khairpur 10,000 10,000 5,241,000<br />

09 Naushero Feroze 10,000 10,000 5,181,000<br />

10 Nawabshah 10,000 10,000 5,211,000<br />

11 Ghotki 10,000 10,000 5,176,000<br />

12 Larkana 10,000 10,000 5,226,000<br />

13 Qamber 10,000 10,000 5,171,000<br />

14 Shikarpur 10,000 10,000 5,171,000

TRANSFER OF PROPERTY TAX (REGISTRATION)<br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

34<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Detail<br />

B-TAX REVENUE<br />

15 Jacobabad 10,000 10,000 5,181,000<br />

16 Kashmore @ Kandhkot 10,000 10,000 5,171,000<br />

17 Mirpurkhas 10,000 10,000 5,181,000<br />

18 Umerkot 10,000 10,000 5,171,000<br />

19 Sanghar 10,000 10,000 5,176,000<br />

20 Thar at Mithi 15,000<br />

21 Matiari 20,000<br />

22 Tando Muhammad Khan 10,000 10,000 5,166,000<br />

23 Tando Allah Yar 15,000<br />

B01320 Others 126,400,000 126,400,000 342,618,500<br />

01 Fees for Micro Urgent 86,750,000 86,750,000 180,248,750<br />

01- Karachi 28,000,000 28,000,000 35,000,000<br />

02- Hyderabad 14,000,000 14,000,000 23,173,750<br />

03- Dadu 4,000,000 4,000,000 17,271,000<br />

04- Jamshoro 500,000 500,000 500,000<br />

05- Thatta 5,000,000 5,000,000 4,000,000<br />

06- Badin 1,000,000 1,000,000 1,200,000<br />

07- Sukkur 8,000,000 8,000,000 8,500,000<br />

08- Khairpur 3,000,000 3,000,000 3,000,000<br />

09- Nausher<strong>of</strong>eroze 15,000,000 15,000,000 18,671,000<br />

10- Benazirabad 1,000,000 1,000,000 2,000,000<br />

11- Ghotki 2,000,000 2,000,000 2,000,000<br />

12- Larkana 1,000,000 1,000,000 2,000,000<br />

13- Qamber 500,000 500,000 17,691,000<br />

14- Shikarpur 100,000 100,000 17,471,000<br />

15- Jacobabad 1,000,000 1,000,000 1,200,000<br />

16- Kandhkot 200,000 200,000 500,000<br />

17- Mirpurkhas 1,000,000 1,000,000 2,500,000<br />

18- Umerkot 200,000 200,000 250,000<br />

19- Sanghar 500,000 500,000 1,000,000<br />

20- Mithi 100,000 100,000 250,000<br />

21- Matiari 250,000 250,000 4,150,000<br />

22- Tando Muhammad Khan 200,000 200,000 17,271,000<br />

23- Tando Allahyar 200,000 200,000 650,000<br />

02 Fees for Micro Ordinary 39,650,000 39,650,000 162,369,750<br />

01- Karachi 19,700,000 19,700,000 30,000,000<br />

02- Hyderabad 4,000,000 4,000,000 19,673,750<br />

03- Dadu 1,000,000 1,000,000 17,721,000<br />

04- Jamshoro 250,000 250,000 17,371,000<br />

05- Thatta 1,300,000 1,300,000 17,971,000<br />

06- Badin 1,000,000 1,000,000 17,771,000<br />

07- Sukkur 3,000,000 3,000,000 17,721,000<br />

08- Khairpur 2,000,000

TRANSFER OF PROPERTY TAX (REGISTRATION)<br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

35<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Detail<br />

B-TAX REVENUE<br />

09- Nausher<strong>of</strong>eroze 500,000 500,000 650,000<br />

10- Benazirabad 1,000,000 1,000,000 850,000<br />

11- Ghotki 2,000,000 2,000,000 550,000<br />

12- Larkana 2,000,000 2,000,000 850,000<br />

13- Qamber 300,000 300,000 120,000<br />

14- Shikarpur 200,000 200,000 300,000<br />

15- Jacobabad 400,000 400,000 250,000<br />

16- Kashmore 150,000 150,000 7,300,000<br />

17- Mirpurkhas 1,000,000 1,000,000 1,000,000<br />

18- Umerkot 200,000 200,000 250,000<br />

19- Sanghar 800,000 800,000 1,000,000<br />

20- Mithi 200,000 200,000 7,260,000<br />

21- Matiari 150,000 150,000 260,000<br />

22- Tando Muhammad Khan 200,000 200,000 651,000<br />

23- Tando Allahyar 300,000 300,000 850,000

OTHER RECEIPTS FROM LAND<br />

____________________________________________________________________________<br />

Total Receipt: 450,000,000<br />

____________________________________________________________________________<br />

Head <strong>of</strong> <strong>Department</strong>s:<br />

1 Senior Member,Board <strong>of</strong> Revenue, <strong>Sindh</strong>.<br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

36<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Summary<br />

B-TAX REVENUE<br />

B01 Direct <strong>Tax</strong>es 250,000,000 400,000,000 450,000,000<br />

B014 Land Revenue 250,000,000 400,000,000 450,000,000

OTHER RECEIPTS FROM LAND<br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

37<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Detail<br />

B-TAX REVENUE<br />

B01 Direct <strong>Tax</strong>es 250,000,000 400,000,000 450,000,000<br />

B014 Land Revenue 250,000,000 400,000,000 450,000,000<br />

B01401 Ordinary Collection 67,000,000 136,100,000 155,100,000<br />

01 Karachi 35,000,000 87,700,000 99,000,000<br />

02 Hyderabad 8,000,000 13,700,000 17,800,000<br />

03 Dadu 1,500,000 2,000,000 2,100,000<br />

04 Jamshoro 1,500,000 2,000,000 2,100,000<br />

05 Thatta 1,500,000 2,000,000 2,100,000<br />

06 Badin 800,000 1,200,000 1,300,000<br />

07 Sukkur 3,000,000 3,500,000 3,600,000<br />

08 Khairpur 1,500,000 2,000,000 2,100,000<br />

09 Naushero Feroze 1,500,000 2,000,000 3,100,000<br />

10 Nawabshah 1,500,000 2,000,000 2,100,000<br />

11 Ghotki 800,000 2,000,000 2,100,000<br />

12 Larkana 1,500,000 2,000,000 2,100,000<br />

13 Qamber 800,000 1,200,000 1,400,000<br />

14 Shikarpur 1,500,000 2,000,000 2,100,000<br />

15 Jacobabad 1,500,000 2,000,000 2,100,000<br />

16 Kashmore @ Kandhkot 800,000 1,400,000 1,500,000<br />

17 Mirpurkhas 800,000 1,200,000 1,400,000<br />

18 Umerkot 600,000 1,000,000 1,100,000<br />

19 Sanghar 600,000 1,000,000 1,100,000<br />

20 Thar at Mithi 500,000 1,000,000 1,100,000<br />

21 Matiari 800,000 1,200,000 1,400,000<br />

22 Tando Muhamamd Khan 500,000 1,000,000 1,200,000<br />

23 Tando Allah Yar 500,000 1,000,000 1,200,000<br />

B01402 Development Cess 500,000 1,000,000 1,100,000<br />

20 Thar at Mithi 500,000 1,000,000 1,100,000<br />

B01403 Malkana 180,000,000 251,100,000 280,800,000<br />

01 Karachi 42,000,000 68,000,000 69,000,000<br />

02 Hyderabad 25,000,000 66,000,000 87,000,000<br />

03 Dadu 6,000,000 6,300,000 9,400,000<br />

04 Jamshoro 5,000,000 5,200,000 6,300,000<br />

05 Thatta 8,000,000 8,200,000 9,300,000<br />

06 Badin 8,000,000 8,200,000 8,300,000<br />

07 Sukkur 8,000,000 8,200,000 8,300,000<br />

08 Khairpur 8,000,000 8,300,000 8,500,000<br />

09 Naushero Feroze 6,000,000 6,200,000 6,400,000<br />

10 Nawabshah 6,000,000 6,100,000 6,200,000

OTHER RECEIPTS FROM LAND<br />

____________________________________________________________________________<br />

Accounts Budget Revised Budget<br />

38<br />

2009-2010 Estimates Estimates Estimates<br />

2010-2011 2010-2011 2011-2012<br />

____________________________________________________________________________<br />

Detail<br />

B-TAX REVENUE<br />

11 Ghotki 6,000,000 6,200,000 6,400,000<br />

12 Larkana 8,000,000 8,200,000 8,400,000<br />

13 Qamber 8,000,000 8,200,000 8,300,000<br />

14 Shikarpur 6,000,000 6,400,000 6,600,000<br />

15 Jacobabad 8,000,000 8,100,000 8,200,000<br />

16 7Kashmore @ Kandhkot 6,000,000 6,200,000 6,300,000<br />

17 Mirpurkhas 5,000,000 5,200,000 5,400,000<br />

18 Umerkot 4,000,000 4,500,000 4,800,000<br />

19 Sanghar 4,000,000 4,200,000 4,400,000<br />

20 Thar at Mithi 3,000,000 3,200,000 3,300,000<br />

B01411 Recovery on account <strong>of</strong> Survey & 100,000 800,000 1,100,000<br />

Settlement Charges<br />

03 Dadu 50,000 450,000 650,000<br />

10 Nawabshah 50,000 350,000 450,000<br />

B01417 Mutation Fee 2,300,000 9,850,000 10,400,000<br />

03 Dadu 2,250,000 9,450,000 9,850,000<br />

07 Sukkur 50,000 400,000 550,000<br />

B01421 Recoveries <strong>of</strong> Overpayments 50,000 650,000 850,000<br />

10 Nawabshah 50,000 650,000 850,000<br />

B01425 Land Revenue-Others 50,000 500,000 650,000<br />

10 Nawabshah 50,000 500,000 650,000

TAXES ON PROFESSIONS, TRADES AND CALLINGS<br />

____________________________________________________________________________<br />

Total Receipt: 300,000,000<br />