SAILING THE SEAS OF SUCCESS - Swissco Holdings Limited

SAILING THE SEAS OF SUCCESS - Swissco Holdings Limited SAILING THE SEAS OF SUCCESS - Swissco Holdings Limited

NOTES TO THE FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2004 19. Borrowings (continued) (b) Non-current The Group 2004 2003 $ $ Finance lease liabilities (note 20) 370,286 315,176 Bank term loans (ii) 543,214 1,538,990 913,500 1,854,166 Total borrowings 1,385,700 6,018,835 (i) (ii) The bank overdrafts and facilities are secured by the mortgage of the Group’s leasehold buildings, certain executive directors’ properties and guaranteed jointly and severally by certain executive directors and their family members. The unutilised banking facilities as at 31 December 2004 amounted to $3 million (2003: fully utilised). The bank term loans comprise a 4-year term loan, a 5-year term loan and a 10-year term loan. The 4-year term loan with a balance of $1,100,000 at 31 December 2003 was secured by one of the Group’s offshore vessels and guaranteed jointly and severally by certain executive directors. Interest on the loan is at 3.75% per annum flat and is repayable over 4 years by monthly installments commencing from 1 September 2003. The term loan has been fully settled during the financial year. The 5-year term loan with a balance of $121,491 (2003: $392,973) at balance sheet date was secured by the Group’s leasehold buildings, properties owned or co-owned by certain executive directors and guaranteed jointly and severally by certain executive directors and their family members. Interest on the loan is at 1% above bank’s prevailing prime rate subject to variation and is repayable over 5 years by monthly instalments commencing from 25 June 2000. The 10-year term loan with a balance of $673,450 (2003: $763,928) at balance sheet date was secured by the Group’s leasehold buildings, properties owned or co-owned by certain executive directors and guaranteed jointly and severally by certain executive directors and their family members. Interest on the loan is at 0.5% above the bank’s prevailing prime rate subject to variation and is repayable over 10 years by monthly instalments commencing from 11 February 2001. (c) Interest rate risk The weighted average effective interest rates at the balance sheet date were as follows: The Group 2004 2003 $ $ Finance lease liabilities 2.62 3.31 Bank loans 5.58 4.73 Bank overdrafts – 6.25 SWISSCO INTERNATIONAL LIMITED_44

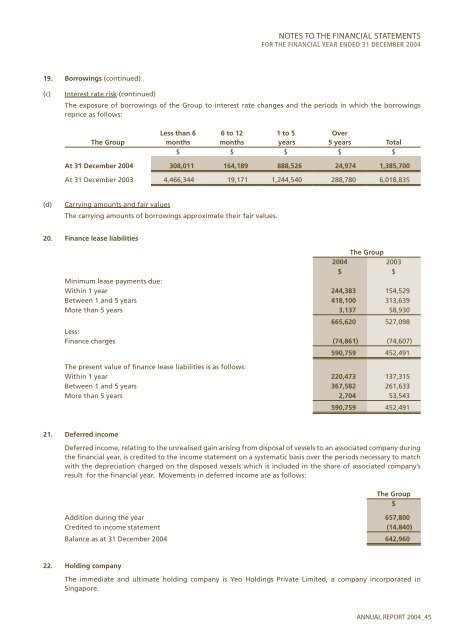

NOTES TO THE FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2004 19. Borrowings (continued) (c) Interest rate risk (continued) The exposure of borrowings of the Group to interest rate changes and the periods in which the borrowings reprice as follows: The Group Less than 6 months 6 to 12 months 1 to 5 years Over 5 years Total $ $ $ $ $ At 31 December 2004 308,011 164,189 888,526 24,974 1,385,700 At 31 December 2003 4,466,344 19,171 1,244,540 288,780 6,018,835 (d) Carrying amounts and fair values The carrying amounts of borrowings approximate their fair values. 20. Finance lease liabilities The Group 2004 2003 $ $ Minimum lease payments due: Within 1 year 244,383 154,529 Between 1 and 5 years 418,100 313,639 More than 5 years 3,137 58,930 665,620 527,098 Less: Finance charges (74,861) (74,607) 590,759 452,491 The present value of finance lease liabilities is as follows: Within 1 year 220,473 137,315 Between 1 and 5 years 367,582 261,633 More than 5 years 2,704 53,543 590,759 452,491 21. Deferred income Deferred income, relating to the unrealised gain arising from disposal of vessels to an associated company during the financial year, is credited to the income statement on a systematic basis over the periods necessary to match with the depreciation charged on the disposed vessels which is included in the share of associated company’s result for the financial year. Movements in deferred income are as follows: The Group $ Addition during the year 657,800 Credited to income statement (14,840) Balance as at 31 December 2004 642,960 22. Holding company The immediate and ultimate holding company is Yeo Holdings Private Limited, a company incorporated in Singapore. ANNUAL REPORT 2004_45

- Page 1 and 2: SWISSCO SAILING THE SEAS OF SUCCESS

- Page 3 and 4: GROUP STRUCTURE 100% 100% Swissc

- Page 5 and 6: CHAIRMAN’S STATEMENT “Our Group

- Page 7 and 8: CORPORATE PROFILE Out Port Limit (O

- Page 9 and 10: OUR HISTORY our business to support

- Page 11 and 12: BOARD OF DIRECTORS Mr Yeo Chong Lin

- Page 13 and 14: CORPORATE INFORMATION BOARD OF DIRE

- Page 15 and 16: OPERATIONS REVIEW Our Group’s two

- Page 17 and 18: our vessels OUT PORT LIMIT (OPL) BO

- Page 19 and 20: CORPORATE GOVERNANCE REPORT Swissco

- Page 21 and 22: CORPORATE GOVERNANCE REPORT Interna

- Page 23 and 24: DIRECTORS’ REPORT Directors’ co

- Page 25 and 26: STATEMENT BY DIRECTORS In the opini

- Page 27 and 28: CONSOLIDATED INCOME STATEMENT FOR T

- Page 29 and 30: CONSOLIDATED STATEMENT OF CHANGES I

- Page 31 and 32: NOTES TO THE FINANCIAL STATEMENTS F

- Page 33 and 34: NOTES TO THE FINANCIAL STATEMENTS F

- Page 35 and 36: NOTES TO THE FINANCIAL STATEMENTS F

- Page 37 and 38: NOTES TO THE FINANCIAL STATEMENTS F

- Page 39 and 40: NOTES TO THE FINANCIAL STATEMENTS F

- Page 41 and 42: NOTES TO THE FINANCIAL STATEMENTS F

- Page 43 and 44: NOTES TO THE FINANCIAL STATEMENTS F

- Page 45: NOTES TO THE FINANCIAL STATEMENTS F

- Page 49 and 50: NOTES TO THE FINANCIAL STATEMENTS F

- Page 51 and 52: NOTES TO THE FINANCIAL STATEMENTS F

- Page 53 and 54: NOTES TO THE FINANCIAL STATEMENTS F

- Page 55 and 56: STATISTICS OF SHAREHOLDINGS AS AT 1

- Page 57 and 58: NOTICE OF FIRST ANNUAL GENERAL MEET

- Page 59 and 60: NOTICE OF FIRST ANNUAL GENERAL MEET

- Page 61 and 62: SWISSCO INTERNATIONAL LIMITED (Inco

- Page 63: SWISSCO Swissco International Limit

NOTES TO <strong>THE</strong> FINANCIAL STATEMENTS<br />

FOR <strong>THE</strong> FINANCIAL YEAR ENDED 31 DECEMBER 2004<br />

19. Borrowings (continued)<br />

(c)<br />

Interest rate risk (continued)<br />

The exposure of borrowings of the Group to interest rate changes and the periods in which the borrowings<br />

reprice as follows:<br />

The Group<br />

Less than 6<br />

months<br />

6 to 12<br />

months<br />

1 to 5<br />

years<br />

Over<br />

5 years Total<br />

$ $ $ $ $<br />

At 31 December 2004 308,011 164,189 888,526 24,974 1,385,700<br />

At 31 December 2003 4,466,344 19,171 1,244,540 288,780 6,018,835<br />

(d)<br />

Carrying amounts and fair values<br />

The carrying amounts of borrowings approximate their fair values.<br />

20. Finance lease liabilities<br />

The Group<br />

2004 2003<br />

$ $<br />

Minimum lease payments due:<br />

Within 1 year 244,383 154,529<br />

Between 1 and 5 years 418,100 313,639<br />

More than 5 years 3,137 58,930<br />

665,620 527,098<br />

Less:<br />

Finance charges (74,861) (74,607)<br />

590,759 452,491<br />

The present value of finance lease liabilities is as follows:<br />

Within 1 year 220,473 137,315<br />

Between 1 and 5 years 367,582 261,633<br />

More than 5 years 2,704 53,543<br />

590,759 452,491<br />

21. Deferred income<br />

Deferred income, relating to the unrealised gain arising from disposal of vessels to an associated company during<br />

the financial year, is credited to the income statement on a systematic basis over the periods necessary to match<br />

with the depreciation charged on the disposed vessels which is included in the share of associated company’s<br />

result for the financial year. Movements in deferred income are as follows:<br />

The Group<br />

$<br />

Addition during the year 657,800<br />

Credited to income statement (14,840)<br />

Balance as at 31 December 2004 642,960<br />

22. Holding company<br />

The immediate and ultimate holding company is Yeo <strong>Holdings</strong> Private <strong>Limited</strong>, a company incorporated in<br />

Singapore.<br />

ANNUAL REPORT 2004_45