SAILING THE SEAS OF SUCCESS - Swissco Holdings Limited

SAILING THE SEAS OF SUCCESS - Swissco Holdings Limited SAILING THE SEAS OF SUCCESS - Swissco Holdings Limited

NOTES TO THE FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2004 3. Significant accounting policies (continued) (m) Employee benefits (1) Defined contribution plans Defined contribution plans are post-employment benefit plans under which the Group pays fixed contributions into separate entities such as Central Provident Fund, and will have no legal or constructive obligation to pay further contributions if any of the funds does not hold sufficient assets to pay all employee benefits relating to employee service in the current and preceding financial years. The Group’s contribution to defined contribution plans are recognised in the financial year to which they relate. (2) Employee leave entitlement Employee entitlements to annual leave are recognised when they accrue to employees. A provision is made for the estimated liability for annual leave as a result of services rendered by employees up to the balance sheet date. (n) Impairment of assets Non-current assets, including property, plant and equipment and investments in subsidiaries and associated companies are reviewed for impairment losses whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss is recognised for the amount by which the asset’s carrying amount exceeds its recoverable amount, which is the higher of an asset’s net selling price and its value in use. (o) Foreign currency translation (1) Measurement currency Items included in the financial statements of each entity in the Group are measured using the currency that best reflects the economic substance of the underlying events and circumstances relevant to that entity (“the measurement currency”). The consolidated financial statements and balance sheet of the Company are presented in Singapore Dollars, which is the measurement currency of the Company. (2) Transactions and balances Foreign currency transactions are translated into the measurement currency using the exchange rates prevailing at the date of transactions. Foreign currency monetary assets and liabilities are translated into the measurement currency at the rates of exchange prevailing at the balance sheet date or at contracted rates where they are covered by forward exchange contracts. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation at financial year-end exchange rates of monetary assets and liabilities denominated in foreign currencies, are taken to the income statement. (3) Translation of Group entities’ financial statements The results and financial position of group entities (none of which has the currency of a hyperinflationary economy) that are in measurement currencies other than Singapore Dollars are translated into Singapore Dollars as follows: (i) (ii) (iii) Assets and liabilities for each balance sheet presented are translated at the closing rate at the date of that balance sheet; Income and expenses for each income statement are translated at average exchange rates (unless this average is not a reasonable approximation of the cumulative effect of the rates prevailing on the transaction dates, in which case income and expenses are translated at the dates of the transactions); and All resulting exchange differences are taken to the foreign currency translation reserve. SWISSCO INTERNATIONAL LIMITED_34

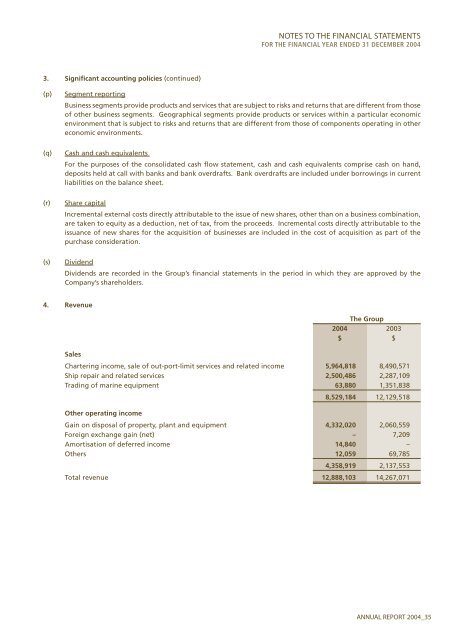

NOTES TO THE FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2004 3. Significant accounting policies (continued) (p) Segment reporting Business segments provide products and services that are subject to risks and returns that are different from those of other business segments. Geographical segments provide products or services within a particular economic environment that is subject to risks and returns that are different from those of components operating in other economic environments. (q) Cash and cash equivalents For the purposes of the consolidated cash flow statement, cash and cash equivalents comprise cash on hand, deposits held at call with banks and bank overdrafts. Bank overdrafts are included under borrowings in current liabilities on the balance sheet. (r) Share capital Incremental external costs directly attributable to the issue of new shares, other than on a business combination, are taken to equity as a deduction, net of tax, from the proceeds. Incremental costs directly attributable to the issuance of new shares for the acquisition of businesses are included in the cost of acquisition as part of the purchase consideration. (s) Dividend Dividends are recorded in the Group’s financial statements in the period in which they are approved by the Company’s shareholders. 4. Revenue The Group 2004 2003 $ $ Sales Chartering income, sale of out-port-limit services and related income 5,964,818 8,490,571 Ship repair and related services 2,500,486 2,287,109 Trading of marine equipment 63,880 1,351,838 8,529,184 12,129,518 Other operating income Gain on disposal of property, plant and equipment 4,332,020 2,060,559 Foreign exchange gain (net) – 7,209 Amortisation of deferred income 14,840 – Others 12,059 69,785 4,358,919 2,137,553 Total revenue 12,888,103 14,267,071 ANNUAL REPORT 2004_35

- Page 1 and 2: SWISSCO SAILING THE SEAS OF SUCCESS

- Page 3 and 4: GROUP STRUCTURE 100% 100% Swissc

- Page 5 and 6: CHAIRMAN’S STATEMENT “Our Group

- Page 7 and 8: CORPORATE PROFILE Out Port Limit (O

- Page 9 and 10: OUR HISTORY our business to support

- Page 11 and 12: BOARD OF DIRECTORS Mr Yeo Chong Lin

- Page 13 and 14: CORPORATE INFORMATION BOARD OF DIRE

- Page 15 and 16: OPERATIONS REVIEW Our Group’s two

- Page 17 and 18: our vessels OUT PORT LIMIT (OPL) BO

- Page 19 and 20: CORPORATE GOVERNANCE REPORT Swissco

- Page 21 and 22: CORPORATE GOVERNANCE REPORT Interna

- Page 23 and 24: DIRECTORS’ REPORT Directors’ co

- Page 25 and 26: STATEMENT BY DIRECTORS In the opini

- Page 27 and 28: CONSOLIDATED INCOME STATEMENT FOR T

- Page 29 and 30: CONSOLIDATED STATEMENT OF CHANGES I

- Page 31 and 32: NOTES TO THE FINANCIAL STATEMENTS F

- Page 33 and 34: NOTES TO THE FINANCIAL STATEMENTS F

- Page 35: NOTES TO THE FINANCIAL STATEMENTS F

- Page 39 and 40: NOTES TO THE FINANCIAL STATEMENTS F

- Page 41 and 42: NOTES TO THE FINANCIAL STATEMENTS F

- Page 43 and 44: NOTES TO THE FINANCIAL STATEMENTS F

- Page 45 and 46: NOTES TO THE FINANCIAL STATEMENTS F

- Page 47 and 48: NOTES TO THE FINANCIAL STATEMENTS F

- Page 49 and 50: NOTES TO THE FINANCIAL STATEMENTS F

- Page 51 and 52: NOTES TO THE FINANCIAL STATEMENTS F

- Page 53 and 54: NOTES TO THE FINANCIAL STATEMENTS F

- Page 55 and 56: STATISTICS OF SHAREHOLDINGS AS AT 1

- Page 57 and 58: NOTICE OF FIRST ANNUAL GENERAL MEET

- Page 59 and 60: NOTICE OF FIRST ANNUAL GENERAL MEET

- Page 61 and 62: SWISSCO INTERNATIONAL LIMITED (Inco

- Page 63: SWISSCO Swissco International Limit

NOTES TO <strong>THE</strong> FINANCIAL STATEMENTS<br />

FOR <strong>THE</strong> FINANCIAL YEAR ENDED 31 DECEMBER 2004<br />

3. Significant accounting policies (continued)<br />

(p)<br />

Segment reporting<br />

Business segments provide products and services that are subject to risks and returns that are different from those<br />

of other business segments. Geographical segments provide products or services within a particular economic<br />

environment that is subject to risks and returns that are different from those of components operating in other<br />

economic environments.<br />

(q)<br />

Cash and cash equivalents<br />

For the purposes of the consolidated cash flow statement, cash and cash equivalents comprise cash on hand,<br />

deposits held at call with banks and bank overdrafts. Bank overdrafts are included under borrowings in current<br />

liabilities on the balance sheet.<br />

(r)<br />

Share capital<br />

Incremental external costs directly attributable to the issue of new shares, other than on a business combination,<br />

are taken to equity as a deduction, net of tax, from the proceeds. Incremental costs directly attributable to the<br />

issuance of new shares for the acquisition of businesses are included in the cost of acquisition as part of the<br />

purchase consideration.<br />

(s)<br />

Dividend<br />

Dividends are recorded in the Group’s financial statements in the period in which they are approved by the<br />

Company’s shareholders.<br />

4. Revenue<br />

The Group<br />

2004 2003<br />

$ $<br />

Sales<br />

Chartering income, sale of out-port-limit services and related income 5,964,818 8,490,571<br />

Ship repair and related services 2,500,486 2,287,109<br />

Trading of marine equipment 63,880 1,351,838<br />

8,529,184 12,129,518<br />

Other operating income<br />

Gain on disposal of property, plant and equipment 4,332,020 2,060,559<br />

Foreign exchange gain (net) – 7,209<br />

Amortisation of deferred income 14,840 –<br />

Others 12,059 69,785<br />

4,358,919 2,137,553<br />

Total revenue 12,888,103 14,267,071<br />

ANNUAL REPORT 2004_35