SAILING THE SEAS OF SUCCESS - Swissco Holdings Limited

SAILING THE SEAS OF SUCCESS - Swissco Holdings Limited

SAILING THE SEAS OF SUCCESS - Swissco Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO <strong>THE</strong> FINANCIAL STATEMENTS<br />

FOR <strong>THE</strong> FINANCIAL YEAR ENDED 31 DECEMBER 2004<br />

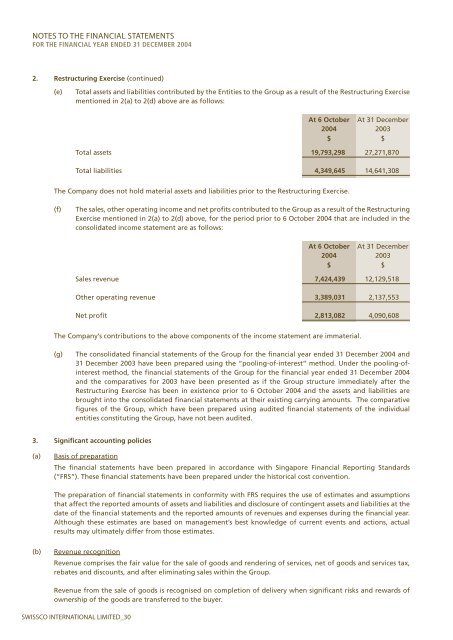

2. Restructuring Exercise (continued)<br />

(e)<br />

Total assets and liabilities contributed by the Entities to the Group as a result of the Restructuring Exercise<br />

mentioned in 2(a) to 2(d) above are as follows:<br />

At 6 October At 31 December<br />

2004<br />

2003<br />

$ $<br />

Total assets 19,793,298 27,271,870<br />

Total liabilities 4,349,645 14,641,308<br />

The Company does not hold material assets and liabilities prior to the Restructuring Exercise.<br />

(f)<br />

The sales, other operating income and net profits contributed to the Group as a result of the Restructuring<br />

Exercise mentioned in 2(a) to 2(d) above, for the period prior to 6 October 2004 that are included in the<br />

consolidated income statement are as follows:<br />

At 6 October<br />

2004<br />

At 31 December<br />

2003<br />

$ $<br />

Sales revenue 7,424,439 12,129,518<br />

Other operating revenue 3,389,031 2,137,553<br />

Net profit 2,813,082 4,090,608<br />

The Company’s contributions to the above components of the income statement are immaterial.<br />

(g)<br />

The consolidated financial statements of the Group for the financial year ended 31 December 2004 and<br />

31 December 2003 have been prepared using the “pooling-of-interest” method. Under the pooling-ofinterest<br />

method, the financial statements of the Group for the financial year ended 31 December 2004<br />

and the comparatives for 2003 have been presented as if the Group structure immediately after the<br />

Restructuring Exercise has been in existence prior to 6 October 2004 and the assets and liabilities are<br />

brought into the consolidated financial statements at their existing carrying amounts. The comparative<br />

figures of the Group, which have been prepared using audited financial statements of the individual<br />

entities constituting the Group, have not been audited.<br />

3. Significant accounting policies<br />

(a)<br />

Basis of preparation<br />

The financial statements have been prepared in accordance with Singapore Financial Reporting Standards<br />

(“FRS”). These financial statements have been prepared under the historical cost convention.<br />

The preparation of financial statements in conformity with FRS requires the use of estimates and assumptions<br />

that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the<br />

date of the financial statements and the reported amounts of revenues and expenses during the financial year.<br />

Although these estimates are based on management’s best knowledge of current events and actions, actual<br />

results may ultimately differ from those estimates.<br />

(b)<br />

Revenue recognition<br />

Revenue comprises the fair value for the sale of goods and rendering of services, net of goods and services tax,<br />

rebates and discounts, and after eliminating sales within the Group.<br />

Revenue from the sale of goods is recognised on completion of delivery when significant risks and rewards of<br />

ownership of the goods are transferred to the buyer.<br />

SWISSCO INTERNATIONAL LIMITED_30