(RARE) - Financial and Strategic Analysis Review - Mondobiotech

(RARE) - Financial and Strategic Analysis Review - Mondobiotech

(RARE) - Financial and Strategic Analysis Review - Mondobiotech

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong> <strong>Analysis</strong><br />

<strong>Review</strong><br />

Reference Code: GDPH135831FSA<br />

Company Snapshot<br />

Key Information<br />

<strong>Mondobiotech</strong> Holding AG, Key Information<br />

Web Address www.mondobiotech.com<br />

<strong>Financial</strong> year-end December<br />

No. of Employees 24<br />

Swiss Exchange <strong>RARE</strong><br />

Source: Annual Report, Company Website, Primary <strong>and</strong> Secondary<br />

Research, GlobalData<br />

Key Ratios<br />

<strong>Mondobiotech</strong> Holding AG, Key Ratios<br />

P/E<br />

Return on Equity (%)<br />

Debt/Equity (%)<br />

Operating Profit Margin (%)<br />

Dividend Yield<br />

Note: Above ratios are based on share price as of 09-Jun-2010<br />

Source: Annual Report, Company Website, Primary <strong>and</strong> Secondary<br />

Research, GlobalData<br />

Share Data<br />

<strong>Mondobiotech</strong> Holding AG, Share Data<br />

Price (CHF) as on 09-Jun-2010<br />

EPS (CHF)<br />

Market Cap (million CHF)<br />

Enterprise Value (million CHF)<br />

Shares Outst<strong>and</strong>ing (million)<br />

Source: Annual Report, Company Website, Primary <strong>and</strong> Secondary<br />

Research, GlobalData<br />

Performance Chart<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

NA<br />

-21.50<br />

0.60<br />

-88.10<br />

NA<br />

87.0<br />

-0.23<br />

4,708<br />

4,704<br />

<strong>Mondobiotech</strong> Holding AG, Performance Chart (2006 - 2009)<br />

Source: Company Annual Report<br />

GlobalData<br />

54<br />

Company Overview<br />

Publication Date: JUN 2010<br />

<strong>Mondobiotech</strong> Holding AG (<strong>Mondobiotech</strong>) is a<br />

Switzerl<strong>and</strong> based biotechnology company engaged in the<br />

discovery <strong>and</strong> development of product c<strong>and</strong>idates for the<br />

treatment of rare <strong>and</strong> ab<strong>and</strong>oned diseases. <strong>Mondobiotech</strong><br />

focuses mainly on discovering treatments for rare <strong>and</strong><br />

unmatched medical needs. With rights to more than 300<br />

medicinal product c<strong>and</strong>idates, the company focuses on<br />

advancing its portfolio of pipeline products either in-house<br />

or in collaboration with its business partners.<br />

<strong>Mondobiotech</strong> nurtures its collaboration with various<br />

pharmaceutical companies for the development <strong>and</strong><br />

commercialization of its product c<strong>and</strong>idates.<br />

SWOT <strong>Analysis</strong><br />

<strong>Mondobiotech</strong> Holding AG, SWOT <strong>Analysis</strong><br />

Strengths Weaknesses<br />

In-house Research Expertise<br />

Strong Intellectual Property<br />

Base<br />

Increasing Operating<br />

Expenses<br />

Opportunities Threats<br />

<strong>Strategic</strong> Agreements <strong>and</strong><br />

Collaborations<br />

Business Expansion<br />

Activities<br />

Uncertain R&D Outcomes<br />

Government Regulations<br />

Source: Annual Report, Company Website, Primary <strong>and</strong> Secondary<br />

Research, GlobalData<br />

<strong>Financial</strong> Performance<br />

The company reported revenues of (Swiss Francs) CHF<br />

13.74 million during the fiscal year ended December 2009,<br />

a decrease of 5.53% from 2008. The operating loss of the<br />

company was CHF 12.11 million during the fiscal year<br />

2009, as compared to an operating loss of CHF 9.17<br />

million during 2008. The net loss of the company was<br />

CHF 12.22 million during the fiscal year 2009, as<br />

compared to a net loss of CHF 9.40 million during 2008.<br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 1

Table of Contents<br />

Table of Contents............................................................................................................................................................................................................ 2<br />

List of Tables................................................................................................................................................................................................................... 3<br />

List of Figures.................................................................................................................................................................................................................. 3<br />

<strong>Mondobiotech</strong> Holding AG - Key Facts ........................................................................................................................................................................... 4<br />

<strong>Mondobiotech</strong> Holding AG - Business Description ......................................................................................................................................................... 4<br />

<strong>Mondobiotech</strong> Holding AG - Corporate Strategy............................................................................................................................................................. 5<br />

<strong>Mondobiotech</strong> Holding AG - Major Products <strong>and</strong> Services ............................................................................................................................................. 5<br />

<strong>Mondobiotech</strong> Holding AG - History................................................................................................................................................................................ 7<br />

<strong>Mondobiotech</strong> Holding AG - SWOT <strong>Analysis</strong>................................................................................................................................................................ 10<br />

SWOT <strong>Analysis</strong> - Overview .................................................................................................................................................................................... 10<br />

<strong>Mondobiotech</strong> Holding AG - Strengths ................................................................................................................................................................... 10<br />

Strength - In-house Research Expertise .......................................................................................................................................................... 10<br />

Strength - Strong Intellectual Property Base.................................................................................................................................................... 10<br />

<strong>Mondobiotech</strong> Holding AG - Weaknesses.............................................................................................................................................................. 10<br />

Weakness - Increasing Operating Expenses ................................................................................................................................................... 10<br />

<strong>Mondobiotech</strong> Holding AG - Opportunities ............................................................................................................................................................. 11<br />

Opportunity - <strong>Strategic</strong> Agreements <strong>and</strong> Collaborations.................................................................................................................................. 11<br />

Opportunity - Business Expansion Activities.................................................................................................................................................... 11<br />

Opportunity - Changing Demographics............................................................................................................................................................ 11<br />

<strong>Mondobiotech</strong> Holding AG - Threats ...................................................................................................................................................................... 11<br />

Threat - Uncertain R&D Outcomes .................................................................................................................................................................. 11<br />

Threat - Government Regulations.................................................................................................................................................................... 11<br />

Threat - Competitive Pressures ....................................................................................................................................................................... 12<br />

<strong>Mondobiotech</strong> Holding AG - Key Competitors .............................................................................................................................................................. 12<br />

<strong>Mondobiotech</strong> Holding AG - Key Employees ................................................................................................................................................................ 13<br />

<strong>Mondobiotech</strong> Holding AG - Key Employee Biographies.............................................................................................................................................. 14<br />

<strong>Mondobiotech</strong> Holding AG - Company Statement ........................................................................................................................................................ 15<br />

<strong>Mondobiotech</strong> Holding AG - Locations And Subsidiaries.............................................................................................................................................. 16<br />

Head Office............................................................................................................................................................................................................. 16<br />

Other Locations & Subsidiaries .............................................................................................................................................................................. 16<br />

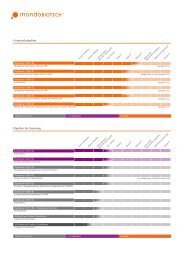

<strong>Mondobiotech</strong> Holding AG - <strong>Financial</strong> Ratios ............................................................................................................................................................... 18<br />

<strong>Financial</strong> Ratios - Capital Market Ratios................................................................................................................................................................. 18<br />

<strong>Financial</strong> Ratios - Annual Ratios............................................................................................................................................................................. 18<br />

<strong>Financial</strong> Ratios - Interim Ratios............................................................................................................................................................................. 19<br />

<strong>Financial</strong> Ratios - Ratio Charts ............................................................................................................................................................................... 20<br />

Appendix ....................................................................................................................................................................................................................... 21<br />

Methodology ........................................................................................................................................................................................................... 21<br />

Ratio Definitions...................................................................................................................................................................................................... 21<br />

About GlobalData ................................................................................................................................................................................................... 26<br />

Contact Us .............................................................................................................................................................................................................. 26<br />

Disclaimer............................................................................................................................................................................................................... 26<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 2

List of Tables<br />

<strong>Mondobiotech</strong> Holding AG, Key Information .................................................................................................................................................................. 1<br />

<strong>Mondobiotech</strong> Holding AG, Key Ratios.......................................................................................................................................................................... 1<br />

<strong>Mondobiotech</strong> Holding AG, Share Data ......................................................................................................................................................................... 1<br />

<strong>Mondobiotech</strong> Holding AG, SWOT <strong>Analysis</strong> .................................................................................................................................................................. 1<br />

<strong>Mondobiotech</strong> Holding AG, Key Facts ........................................................................................................................................................................... 4<br />

<strong>Mondobiotech</strong> Holding AG, Major Products <strong>and</strong> Services ............................................................................................................................................. 6<br />

<strong>Mondobiotech</strong> Holding AG, History ................................................................................................................................................................................ 7<br />

<strong>Mondobiotech</strong> Holding AG, Key Employees ................................................................................................................................................................ 13<br />

<strong>Mondobiotech</strong> Holding AG, Key Employee Biographies .............................................................................................................................................. 14<br />

<strong>Mondobiotech</strong> Holding AG, Other Locations................................................................................................................................................................ 16<br />

<strong>Mondobiotech</strong> Holding AG, Subsidiaries...................................................................................................................................................................... 16<br />

<strong>Mondobiotech</strong> Holding AG, Ratios based on current share price ................................................................................................................................18<br />

<strong>Mondobiotech</strong> Holding AG, Annual Ratios................................................................................................................................................................... 18<br />

<strong>Mondobiotech</strong> Holding AG, Interim Ratios ................................................................................................................................................................... 19<br />

Currency Codes ........................................................................................................................................................................................................... 21<br />

Capital Market Ratios................................................................................................................................................................................................... 21<br />

Equity Ratios ................................................................................................................................................................................................................ 22<br />

Profitability Ratios......................................................................................................................................................................................................... 22<br />

Cost Ratios................................................................................................................................................................................................................... 23<br />

Liquidity Ratios ............................................................................................................................................................................................................. 24<br />

Leverage Ratios ........................................................................................................................................................................................................... 24<br />

Efficiency Ratios........................................................................................................................................................................................................... 25<br />

List of Figures<br />

<strong>Mondobiotech</strong> Holding AG, Performance Chart (2006 - 2009) ...................................................................................................................................... 1<br />

<strong>Mondobiotech</strong> Holding AG, Ratio Charts ..................................................................................................................................................................... 20<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 3

<strong>Mondobiotech</strong> Holding AG - Key Facts<br />

<strong>Mondobiotech</strong> Holding AG, Key Facts<br />

Corporate Address<br />

Das Kloster, Muergstrasse<br />

18, Stans, 6370, Switzerl<strong>and</strong><br />

Ticker Symbol, Exchange<br />

Telephone<br />

+41 840 200043<br />

No. of Employees<br />

Fax<br />

+41 840 200044<br />

Fiscal Year End<br />

URL<br />

www.mondobiotech.com<br />

Revenue (in USD Million)<br />

Industry<br />

Pharmaceuticals <strong>and</strong><br />

Healthcare<br />

Revenue (in CHF Million)<br />

Locations<br />

Switzerl<strong>and</strong><br />

Source: Annual Report, Company Website, Primary <strong>and</strong> Secondary Research<br />

GlobalData<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

<strong>RARE</strong> [Swiss Exchange]<br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 4<br />

24<br />

December<br />

<strong>Mondobiotech</strong> Holding AG - Business Description<br />

<strong>Mondobiotech</strong> focuses on the research <strong>and</strong> development of product c<strong>and</strong>idates by using known peptides <strong>and</strong><br />

other immuno-modulating substances for use in the treatment of rare <strong>and</strong> neglected diseases. The company's<br />

pipeline products target indications such as Idiopathic Pulmonary Fibrosis, Pulmonary Arterial Hypertension,<br />

Sarcoidosis, Acute Respiratory Distress Syndrome, Methicillin-Resistant Staphylococcus Aureus in Cystic<br />

Fibrosis, Chronic Thromboembolic Pulmonary Hypertension, Chronic Beryllium Disease, Pseudomonas<br />

Aeruginosa in Cystic Fibrosis <strong>and</strong> Drug-Resistant Tuberculosis. <strong>Mondobiotech</strong> operates through two reportable<br />

business segments, Projects <strong>and</strong> Development Services.<br />

Through its Projects segment, the company licenses out different stages of development projects related to<br />

biological therapeutics for the treatment of rare <strong>and</strong> neglected diseases. This segment reported revenues of<br />

CHF 0.75 million for fiscal year 2009, which is 5.5% of the total revenue.<br />

<strong>Mondobiotech</strong>’s Development Services provides additional clinical development services to partners who<br />

specifically request the services in close connection with a licensing-out agreement. This segment reported<br />

revenue of CHF 13.13 million for fiscal year 2009, which is about 94.5% of the total revenue.<br />

During fiscal year 2009, the company spent CHF 20.14 million on its research <strong>and</strong> development activities, which<br />

is about 146.5% of the total revenue, compared to CHF 20.17 million spent in 2008. With no manufacturing<br />

capabilities, the company relies on third party manufacturers that offer contract manufacturing services.<br />

The company has entered into collaborations <strong>and</strong> partnerships with companies such as 23<strong>and</strong>Me, Inc., Biogen<br />

Idec, Intermune, Lung Rx, for the development <strong>and</strong> commercialization of its various products under<br />

development.<br />

Additionally, the company operates eight subsidiaries across Switzerl<strong>and</strong>, Liechtenstein <strong>and</strong> the US. These<br />

include mondoBIOTECH AG, mondoGEN AG, Interferon Medical Use SA, Fast Take-off AG, Alps Air AG in<br />

Switzerl<strong>and</strong>; mondoBIOTECH Laboratories AG in Liechtenstein; <strong>and</strong> also www.mondobiotech.com Inc <strong>and</strong><br />

mondoBIOTECH US, Inc. in the US.<br />

Recently, the company entered into an exclusive agreement with WR Hambrecht + Co., a Silicon Valley<br />

financial services firm, under which Hambrecht acts as the exclusive placement agent for <strong>Mondobiotech</strong>’s<br />

securities. The company had a global strategic partnership agreement with Lung Rx LLC, a subsidiary of United<br />

Therapeutics Corporation, for the development of Aviptadil platform. The company started the development of<br />

its first medical product c<strong>and</strong>idate against Extensively Drug-Resistant Tuberculosis (XDR-TB).<br />

12.7<br />

13.7

<strong>Mondobiotech</strong> Holding AG - Corporate Strategy<br />

<strong>Mondobiotech</strong>’s continuing success <strong>and</strong> growth is based upon its underlying business strategy. The company<br />

focuses on growing long-term shareholder value. Its strategic intent is to become the leading global company<br />

focused on discovering, developing <strong>and</strong> commercializing therapies for the treatment of rare <strong>and</strong> ab<strong>and</strong>oned<br />

diseases. Its operating model focuses on exp<strong>and</strong>ing its product portfolio while maintaining strong financial<br />

discipline. Its policy is to first dedicate a share of the annual revenues toward growing operating income <strong>and</strong><br />

then use the remainder to grow the business, mainly through R&D. Additionally; <strong>Mondobiotech</strong> nourishes<br />

collaborations with third parties as a critical part of its business strategy. The company also focuses on<br />

attracting, retaining, <strong>and</strong> motivating its employees to drive its operational excellence <strong>and</strong> scope of business<br />

operations.<br />

<strong>Mondobiotech</strong> Holding AG - Major Products <strong>and</strong> Services<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 5

<strong>Mondobiotech</strong> provides therapies for rare <strong>and</strong> neglected diseases by modifying previously known peptides. The<br />

company's pipeline products include the following:<br />

<strong>Mondobiotech</strong> Holding AG, Major Products <strong>and</strong> Services<br />

Pipeline Products:<br />

DasKloster 1001-01-Idiopathic Pulmonary Fibrosis<br />

DasKloster 1001-01-Pulmonary Arterial Hypertension<br />

DasKloster 1001-02-Sarcoidosis<br />

DasKloster 1001-03-Idiopathic Pulmonary Fibrosis<br />

DasKloster 1001-04-Acute Respiratory Distress Syndrome<br />

DasKloster 0247-01-Chronic Thromboembolic Pulmonary Hypertension<br />

DasKloster 0182-01-Sarcoidosis<br />

DasKloster 0381-01-Methicillin-Resistant Staphylocaccus Aureus in Cystic fibrosis<br />

DasKloster 0210-01-Chronic Beryllium Disease<br />

DasKloster 0249-01-Drug Resistant Tuberculosis<br />

DasKloster 0274-01-Pseudomonas Aeruginosta in Cystic Fibrosis<br />

Br<strong>and</strong>s:<br />

mondoBIOTECH<br />

Source: Annual Report, Company Website, Primary <strong>and</strong> Secondary Research<br />

GlobalData<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 6

<strong>Mondobiotech</strong> Holding AG - History<br />

<strong>Mondobiotech</strong> Holding AG, History<br />

2009 Contracts/Agreements<br />

2009 Management Changes<br />

2009 Contracts/Agreements<br />

2009 Corporate Changes/Expansions<br />

2009 Management Changes<br />

2009 Management Changes<br />

2008 Official Trials/Tests<br />

2008 Corporate Awards<br />

2007 Corporate Awards<br />

2007 Research <strong>and</strong> Development<br />

2007 Research <strong>and</strong> Development<br />

2007 Commercial Operation<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

In January 2009, <strong>Mondobiotech</strong> AG <strong>and</strong> 23<strong>and</strong>Me, Inc. entered<br />

into a collaboration agreement for the advancement of research on<br />

rare diseases.<br />

In March 2009, the company joins Mr. Michael A. Keller <strong>and</strong> Mr.<br />

Thomas Cerny to its Board.<br />

In September 2009, the company concluded a long-term<br />

cooperation with Bachem AG.<br />

In November 2009, the company exp<strong>and</strong>ed its operations in<br />

Silicon Valley.<br />

In November 2009, the company appointed Ms. S<strong>and</strong>ra Senti as<br />

its first Chief Information Officer<br />

In December 2009, the company appointed Mr. Evelyn Strauss,<br />

Ph.D. as a Director of Health Information Services.<br />

In May 2008, mondoBIOTECH announced the data from the<br />

clinical trials of “AVICUTE - Aviptadil in Pulmonary Hypertension”<br />

In December 2008, <strong>Mondobiotech</strong> AG was awarded "The Swiss<br />

Innovation Award 2008,” by the Central Swiss Chamber of<br />

Commerce in the monastery dasKloster in Stans.<br />

In June 2007, the company has been awarded as the Best<br />

Innovator 2007 in Switzerl<strong>and</strong> for its innovative business model.<br />

In October 2007, the company's subsidiary, mondoBIOTECH,<br />

announced that its product, Aviptadil, for the treatment of<br />

Sarcoidosis has been granted an Orphan Medicinal Product<br />

Designation (OMPD) by the European Commission.<br />

In November 2007, mondoBIOTECH was selected as the<br />

Technology Pioneer 2008 by the World Economic Forum.<br />

In December 2007, mondoBIOTECH signed a transatlantic<br />

strategic partnership agreement with Lung Rx, a wholly-owned<br />

subsidiary of United Therapeutics Corporation, for the<br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 7

2007 Contracts/Agreements<br />

2006 Contracts/Agreements<br />

2006 Contracts/Agreements<br />

2006 Contracts/Agreements<br />

2006 Contracts/Agreements<br />

2006 Research <strong>and</strong> Development<br />

2005 Research <strong>and</strong> Development<br />

2005 Contracts/Agreements<br />

2005 Corporate Awards<br />

2004 Contracts/Agreements<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

development of drugs for patients with rare diseases.<br />

In December 2007, the company's subsidiary, mondoBIOTECH<br />

AG entered into a new business alliance with IFE Europe GmbH,<br />

for clinical study management of trials emerging from<br />

mondoBIOTECH's product pipeline.<br />

In March 2006, the company signed a new collaboration<br />

agreement with Bachem AG for the development of new projects<br />

deriving from the Bachem Peptide Library.<br />

In April 2006, the company had a business alliance with Quintiles,<br />

a pharmaceutical services organization, for clinical study<br />

management of trials emerging from the company's product<br />

pipeline.<br />

In July 2006, the company signed a collaborative development<br />

<strong>and</strong> manufacturing agreement with Nebu-Tec GmbH for the<br />

development <strong>and</strong> patient support of mondoBIOTECH´s products<br />

used for the treatment of fatal <strong>and</strong> rare lung diseases.<br />

In September 2006, the company's subsidiary, mondoBIOTECH<br />

AG entered into an exclusive collaboration <strong>and</strong> license agreement<br />

with Biogen Idec for the development, manufacture <strong>and</strong><br />

commercialization of its product, Aviptadil, a clinical compound for<br />

the treatment of Pulmonary Arterial Hypertension (PAH).<br />

In September 2006, the company's subsidiary, mondoBIOTECH<br />

AG, announced that its product, Aviptadil, for the treatment of<br />

Acute Lung Injury (ALI) has been granted an Orphan Medicinal<br />

Product Designation (OMPD) by the European Commission.<br />

In April 2005, the company's product Aviptadil, for the treatment of<br />

Pulmonary Arterial Hypertension, was granted Orphan Drug<br />

Designation by the United States FDA.<br />

In April 2005, the company signed a collaboration agreement with<br />

Bachem AG for the development <strong>and</strong> production of the company's<br />

Thymopentin project.<br />

In October 2005, the company received the Swiss Life Sciences<br />

Prize for the year 2005.<br />

In July 2004, the company had a collaboration agreement with<br />

Bachem AG, for production <strong>and</strong> supply of the company's lead<br />

compound, Aviptadil.<br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 8

2003 Contracts/Agreements<br />

2000 Incorporation/Establishment<br />

Source: Annual Report, Company Website, Primary <strong>and</strong> Secondary Research<br />

GlobalData<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

In March 2003, the company entered into an agreement with<br />

InterMune, for distribution of the company's product, AMPHOTEC<br />

in Switzerl<strong>and</strong>.<br />

The company was incorporated in the year 2000.<br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 9

<strong>Mondobiotech</strong> Holding AG - SWOT <strong>Analysis</strong><br />

SWOT <strong>Analysis</strong> - Overview<br />

<strong>Mondobiotech</strong> holding AG (<strong>Mondobiotech</strong>) is engaged in the discovery of medical product c<strong>and</strong>idates for the<br />

treatment of rare <strong>and</strong> neglected diseases. The company focuses on developing its products under development<br />

either in-house or in collaboration with its business partners. The company leverages its in-house research<br />

expertise to advance its portfolio of pipeline products. However, increasing competitive pressures <strong>and</strong> stringent<br />

government regulations can be a major setback for the company’s growth <strong>and</strong> profitability in the future.<br />

<strong>Mondobiotech</strong> Holding AG - Strengths<br />

Strength - In-house Research Expertise<br />

<strong>Mondobiotech</strong>’s expertise in research activities has provided it a growing pipeline of medicinal product<br />

c<strong>and</strong>idates for rare <strong>and</strong> neglected diseases. Recognized as one of the leading, independent, Internet-based<br />

biotech research companies in Switzerl<strong>and</strong>, <strong>Mondobiotech</strong>’s research activities focus on discovering drugs for<br />

patients suffering from some of the major <strong>and</strong> debilitating diseases. Its pipeline comprises multi-dimensional<br />

projects targeting diseases such as Idiopathic Pulmonary Fibrosis (IPF), Pulmonary Arterial Hypertension<br />

(PAH), Sarcoidosis, Acute Respiratory Distress Syndrome (ARDS), <strong>and</strong> Chronic Thromboembolic Pulmonary<br />

Hypertension, among others. The strong in-house research expertise has provided the company with a global<br />

top ranking position in patent inventions for the year 2009, demonstrating the ability of its innovative, Internet<br />

<strong>and</strong> scientific community based research approach. The company’s commitment to research activities is evident<br />

from its R&D investment pattern. During fiscal year 2009, the company spent CHF 20.15 million on its research<br />

activities, which is about 146.65% of the total revenue, compared to CHF 20.17 million spent during 2008.<br />

Additionally, the company nurtures collaboration with its various business partners including, 23<strong>and</strong>Me, Inc.,<br />

Biogen Idec, InterMune <strong>and</strong> Lung Rx, to accelerate the development of its various product c<strong>and</strong>idates.<br />

Strength - Strong Intellectual Property Base<br />

Securing patent rights is important for the development of the company’s product portfolio. Strong patent<br />

portfolio creates market exclusivity for the proprietary drug c<strong>and</strong>idates giving the company a competitive edge<br />

over its competitors. Its patents, patent applications, <strong>and</strong> licensed patent rights cover several compounds,<br />

pharmaceutical formulations <strong>and</strong> methods of use. <strong>Mondobiotech</strong> owns rights to more than 300 medicinal<br />

product c<strong>and</strong>idates that can either be developed in-house or licensed to its business partners for further<br />

development. Additionally, as per the Derwent World Patents Index (DWPI) database, that consolidates 41<br />

major patent issuing authorities worldwide; <strong>Mondobiotech</strong> was recognized as inventions patent champion in<br />

2009 in the pharmaceutical industry.<br />

<strong>Mondobiotech</strong> Holding AG - Weaknesses<br />

Weakness - Increasing Operating Expenses<br />

The company's increasing operating expenses can be attributed to its high cost operating model.<br />

<strong>Mondobiotech</strong>’s operating expenses increased during 2006-2009 at a compound annual growth rate (CAGR) of<br />

44.21%. In fiscal 2009, the company's operating expenses increased 9.03% to CHF 25.85 million, compared to<br />

CHF 23.71 million in fiscal 2008. The increasing operating expenses had adverse impact on the company's<br />

profits, as well as bottom line. The company's operating loss was CHF 12.11 million in fiscal 2009, compared to<br />

CHF 9.17 million in 2008. It recorded a net loss of CHF 12.22 million in fiscal 2009, as against a net loss of CHF<br />

9.4 million in 2008. <strong>Mondobiotech</strong>’s operating margin was -88.13% for fiscal year 2009. This was below the<br />

Pharmaceuticals & Healthcare sector average* of 4.09%. A lower than sector average* operating margin<br />

indicates the inefficient cost management <strong>and</strong> weak pricing strategy by the company. Moreover, the significant<br />

decline in the company's cash levels had adversely impacted its liquidity position. In fiscal 2009, the company's<br />

cash level drastically decreased to CHF 4.63 million, compared to CHF 14.09 million in 2009. The company's<br />

current ratio was 1.07 at the end of fiscal year 2009. This was below the Pharmaceuticals & Healthcare sector<br />

average* of 3.62. A lower than sector average* current ratio indicates that the company is in a weaker financial<br />

position than other companies in the sector. Additionally, the company's return on equity (ROE) was -21.5% at<br />

the end of fiscal year 2009. This was below the Pharmaceuticals & Healthcare sector average* of 5.9%. A lower<br />

than sector average* ROE indicate that the company has not been using the shareholders' money as efficiently<br />

as other companies in the sector <strong>and</strong> that it is generating low returns for its shareholders compared to other<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 10

companies in the sector. Under these situations, the company's increasing operating expenses, if not curtailed,<br />

can have adverse impact on its business operations <strong>and</strong> financial position in the future.<br />

<strong>Mondobiotech</strong> Holding AG - Opportunities<br />

Opportunity - <strong>Strategic</strong> Agreements <strong>and</strong> Collaborations<br />

As a part of business strategy, the company establishes collaborations <strong>and</strong> agreements with other companies to<br />

enhance its product portfolio <strong>and</strong> bring non-dilutive capital into the company. During fiscal year 2009 <strong>and</strong> early<br />

2010, the company entered into various collaborations, to sustain its inorganic growth. In April 2010, the<br />

company entered into an exclusive agreement with the financial services firm WR Hambrecht + Co.,<br />

establishing Hambrecht as the exclusive placement agent for its securities. Leveraging the significant<br />

experience of WR Hambrecht in Silicon Valley financing, the company focuses on the material expansion of its<br />

therapeutic pipelines, to discover <strong>and</strong> develop treatment for people suffering from rare diseases. In February<br />

2010, <strong>Mondobiotech</strong> formed a global strategic partnership agreement with Lung Rx LLC, a subsidiary of United<br />

Therapeutics Corporation, to develop Aviptadil platform for a range of indications, including, PAH, Sarcoidosis,<br />

Idiopathic Pulmonary Fibrosis (IPF) <strong>and</strong> Acute Respiratory Distress Syndrome (ARDS). Other significant<br />

agreements include, a long-term cooperation agreement with Bachem (September 2009), to develop peptides<br />

to fight rare diseases. According to the terms of the agreement, Bachem received access to the comprehensive<br />

<strong>and</strong> growing portfolio of <strong>Mondobiotech</strong>’s development projects for the treatment of rare diseases. Additionally, in<br />

January 2009, the company formed collaboration with 23<strong>and</strong>Me, Inc., to advance research in rare diseases.<br />

This collaboration not only complements its genetics <strong>and</strong> bioinformatics expertise, but also helps accelerate its<br />

various projects under development.<br />

Opportunity - Business Expansion Activities<br />

The company’s various business expansion initiatives not only complement its geographical presence, but also<br />

drive its organic growth. In November 2009, <strong>Mondobiotech</strong> established its new subsidiary in Silicon Valley, Palo<br />

Alto. Operating through this new facility, the company will oversee its health information <strong>and</strong> information<br />

technology services. Business expansions such as these enable the company to further accelerate its product<br />

development activities.<br />

Opportunity - Changing Demographics<br />

The increasing number of people aged above 65, who consume disproportionately more medicines <strong>and</strong> are<br />

more prone to chronic diseases, holds significant market potential for the company. People above 65 are the<br />

single largest group of customers for pharmaceutical companies as they consume three times more prescription<br />

drugs per head than those aged below 65. According to the United Nations Population Division, people aged 60<br />

were projected to account for 22% of the total world population by 2050, up from 11% in 2007. Globally, people<br />

aged 80 years <strong>and</strong> older, are projected to increase by 233% between 2008 <strong>and</strong> 2040. In the US, the Census<br />

Department projected that the 65 <strong>and</strong> older segment of the population will grow from 38.7 million in 2008 to 72.1<br />

million by 2030, when all of the baby boomers (Americans born from 1946 through 1964) will be 65 <strong>and</strong> older.<br />

<strong>Mondobiotech</strong> Holding AG - Threats<br />

Threat - Uncertain R&D Outcomes<br />

Adverse or inconclusive results from preclinical testing or clinical trials may substantially delay, or halt the<br />

development of the company's various product c<strong>and</strong>idates, consequently affecting its timeliness for profitability.<br />

The outcome of clinical trials is always a subject of uncertainty. It also requires a huge amount of investment<br />

<strong>and</strong> a great deal of time to successfully launch a new product after the discovery of a new compound.<br />

Moreover, it may be necessary to discontinue clinical development if the effectiveness of a drug is not proven as<br />

initially expected, or if serious adverse effects arise. In addition, pharmaceuticals are subject to legal restrictions<br />

in each country, <strong>and</strong> authorization from local regulatory authorities is a prerequisite for a product launch in each<br />

country. It is difficult to accurately foresee when approvals for a new product can be obtained.<br />

Threat - Government Regulations<br />

The company operates in a highly regulated industry, where a variety of statutes <strong>and</strong> regulations are in place for<br />

the testing, manufacture <strong>and</strong> sale of therapeutic products. The company has to obtain regulatory approvals from<br />

regulatory authorities in the respective countries before commercializing the products. Failure to comply with the<br />

present or future regulations related to clinical, laboratory <strong>and</strong> manufacturing practices may result in delayed<br />

approval of drugs, product recalls, <strong>and</strong> cancellation of permission to produce or sell the drugs. With products<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 11

still under development, the company faces a potential threat from its competitors, which have obtained<br />

regulatory approvals for marketing. The company’s financial position can also be adversely affected due to its<br />

inability to obtain or retain regulatory approvals on a timely basis, as this will delay the commercialization of its<br />

products.<br />

Threat - Competitive Pressures<br />

The company’s markets are characterized by intense competition, evolving industry st<strong>and</strong>ards <strong>and</strong> business<br />

models. The company’s products face competition from new <strong>and</strong> innovative products of its competitors.<br />

Competitors’ products may make the company’s products obsolete <strong>and</strong> non-competitive, even before the<br />

company is able to recover the costs associated with any such product’s research, development <strong>and</strong><br />

commercialization efforts. The company’s competitors include major pharmaceutical, <strong>and</strong> biotechnology<br />

companies, whose financial, technical, <strong>and</strong> marketing resources are significantly greater than those of the<br />

company.<br />

NOTE:<br />

* Sector average represents top companies within the specified sector<br />

The above strategic analysis is based on in-house research <strong>and</strong> reflects the publishers opinion only<br />

<strong>Mondobiotech</strong> Holding AG - Key Competitors<br />

The following companies are the major competitors of <strong>Mondobiotech</strong> Holding AG:<br />

Amdipharm Plc<br />

Aeirtec Limited<br />

Immundiagnostik AG<br />

LaborMed Pharma SA<br />

ORION Clinical Services Limited<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 12

<strong>Mondobiotech</strong> Holding AG - Key Employees<br />

<strong>Mondobiotech</strong> Holding AG, Key Employees<br />

Name Job Title Board Level Since Age<br />

Fabio Cavalli Chief Executive Officer,<br />

Director, Chief Business<br />

Architect, Founder<br />

Executive Board<br />

2007 55<br />

Vera Cavalli Director, Chief Pharmacy<br />

Officer, Founder<br />

Executive Board<br />

42<br />

Prinz Michael von und zu<br />

Liechtenstein<br />

Chairman, Founder Executive Board<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

2007 59<br />

Dr. Robert Huber Director Non Executive Board 2008 73<br />

Giovanni Cusmano Vice Chairman Non Executive Board 2008 48<br />

Cristoph Rentsch Director Non Executive Board 2007 51<br />

Hans Rudolf Schnieper Director Non Executive Board 2007 56<br />

Michael Alan Keller Director Non Executive Board 2009 65<br />

Dr. med. Thomas Cerny Director Non Executive Board 2009 58<br />

Dr. habil. Dorian Bevec, Chief Scientific Officer, Co- Senior Management<br />

53<br />

Ph.D.<br />

Founder<br />

Patrick Pozzorini Chief <strong>Financial</strong> Officer, Founder Senior Management<br />

S<strong>and</strong>ra Senti Chief Information Officer Senior Management 2009<br />

Dr. Evelyn Strauss, Ph.D. Director, Health Information<br />

Services<br />

Senior Management<br />

2009<br />

Source: Annual Report, Company Website, Primary <strong>and</strong> Secondary Research<br />

GlobalData<br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 13<br />

43

<strong>Mondobiotech</strong> Holding AG - Key Employee Biographies<br />

<strong>Mondobiotech</strong> Holding AG, Key Employee Biographies<br />

Fabio Cavalli<br />

Job Title: Chief Executive Officer, Director, Chief<br />

Business Architect, Founder<br />

Board Level: Executive Board<br />

Since: 2007<br />

Age: 55<br />

Vera Cavalli<br />

Job Title: Director, Chief Pharmacy Officer,<br />

Founder<br />

Board Level: Executive Board<br />

Age: 42<br />

Prinz Michael von und zu Liechtenstein<br />

Job Title: Chairman, Founder<br />

Board Level: Executive Board<br />

Since: 2007<br />

Age: 59<br />

Dr. habil. Dorian Bevec, Ph.D.<br />

Job Title: Chief Scientific Officer, Co-Founder<br />

Board Level: Senior Management<br />

Age: 53<br />

Patrick Pozzorini<br />

Job Title: Chief <strong>Financial</strong> Officer, Founder<br />

Board Level: Senior Management<br />

Age: 43<br />

Source: Annual Report, Company Website, Primary <strong>and</strong> Secondary Research<br />

GlobalData<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

Mr. Cavalli has been the Chief Executive Officer, the Chief<br />

Business Architect, a Director <strong>and</strong> one of the Founders of<br />

<strong>Mondobiotech</strong> Holding AG since 2007. In the past, he has founded<br />

several successful start-ups in Information Technology, consumer<br />

services <strong>and</strong> sports goods fields.<br />

Ms. Cavalli is the Chief Pharmacy Officer, a Director <strong>and</strong> one of<br />

the founders of <strong>Mondobiotech</strong> Holding AG. She has five years of<br />

pharmacy business experience in various pharmacies. She<br />

worked in the sales department for the Swiss market of the<br />

pharmaceutical company Searle SA (Monsanto group), from 1999<br />

to 2000.<br />

Mr. Liechtenstein is the Chairman <strong>and</strong> one of the founders of<br />

<strong>Mondobiotech</strong> Holding AG. He served as the Chairman of<br />

INDUSTRIE- UND FINANZKONTOR ETABLISSEMENT from<br />

1987. He also serves as the Chairman of BIOPHARMAinvest<br />

AKTIENGESELLSCHAFT.<br />

Mr. Dorian Bevec is the Chief Scientific Officer <strong>and</strong> Co-Founder of<br />

<strong>Mondobiotech</strong> Holding AG. Prior to this, he worked as the Head of<br />

Molecular Biology <strong>and</strong> also project team leader at the S<strong>and</strong>oz<br />

Research Institute in Vienna for ten years <strong>and</strong> at Axxima AG in<br />

Martinsried, Germany, for two years.<br />

Mr. Pozzorini is the Chief <strong>Financial</strong> Officer <strong>and</strong> one of the founders<br />

of <strong>Mondobiotech</strong> Holding AG. Prior to this, he worked as the Chief<br />

<strong>Financial</strong> Officer for a start-up company active in the field of the<br />

web based enterprise management. From 1995 to 2000, he<br />

worked for PricewaterhouseCoopers AG, <strong>and</strong> from 1992 to 1995<br />

for Fidinam Group.<br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 14

<strong>Mondobiotech</strong> Holding AG - Company Statement<br />

A joint statement by Mr. Prinz Michael von und zu Liechtenstein, the Chairman <strong>and</strong> Mr. Fabio Cavalli, the Chief<br />

Executive Officer of <strong>Mondobiotech</strong> Holding AG is given below. The statement has been taken from the<br />

company's 2009 Annual Report.<br />

Since inception, the goal of the Company was to change the world of medicine for patients suffering from rare<br />

<strong>and</strong> neglected diseases. It is this goal that continues to motivate our progress in research, marketing <strong>and</strong><br />

unique business opportunities.<br />

It can be difficult to visualize the timeline of a company, though we have made great strides in our field, it has<br />

been a relatively short period of time <strong>and</strong> we are still a young company. Our growth <strong>and</strong> “education”, if you will,<br />

is still in its early stages. We have completed much, but we have much work ahead of us. mondoBIOTECH has<br />

visions that extend beyond short-term growth; our goal is to change the world of medicine for rare <strong>and</strong><br />

neglected diseases. It is a significant goal that will take long-term dedication to complete.<br />

Though 2009 was a difficult year economically, we were still able to make great strides for our long-term<br />

business plan. We improved our search-<strong>and</strong>-match tool, a key instrument that is integral to our research <strong>and</strong><br />

discovery method. Through improvements in our research process we were able to exp<strong>and</strong> our field of defined<br />

diseases, further exploring the possibilities for future innovation in medicinal c<strong>and</strong>idates. In 2009 we patented<br />

the corpus of our work from the last nine years, ensuring the profitability of our future medicinal pipeline.<br />

Additionally we made a huge step forward in our financial growth when we went public <strong>and</strong> became a listed<br />

company on the SIX Swiss Exchange. This step is only one rung on a long ladder to our ultimate goals,<br />

however it is crucial to our enduring financial growth <strong>and</strong> stability. We are very pleased with the advancements<br />

of mondoBIOTECH in 2009, <strong>and</strong> especially pleased with the hard work of investors, partners, management <strong>and</strong><br />

staff. A particularly pleasing development of 2009 was the relationship mondoBIOTECH cultivated with<br />

Professor Michael A. Keller of Stanford University. Prof. Keller is an expert, innovator <strong>and</strong> pioneer in the field of<br />

internet publishing <strong>and</strong> original research methods. His expertise is a valuable asset to mondoBIOTECH, as we<br />

are constantly seeking to improve our search-<strong>and</strong>-match research model to find new medicinal c<strong>and</strong>idates. The<br />

future of mondoBIOTECH will be greatly enhanced by a continuously improving system of informatics analysis.<br />

With the achievements of 2009 propelling us, we are pleased to enter 2010 with an even greater focus on our<br />

final goals <strong>and</strong> constantly improving tools <strong>and</strong> partnerships to reach them. Thus far in 2010 we have had the<br />

opportunity to establish an important relationship, in conjunction with our existing partnership with Biogen Idec,<br />

with Lung Rx, a wholly owned subsidiary of United Therapeutics. Experts in the field of pulmonary medicine, our<br />

partnership with LungRX brings us much closer to having one of our promising medicinal product c<strong>and</strong>idates on<br />

the market where it can benefit patients suffering from pulmonary arterial hypertension <strong>and</strong> other devastating<br />

lung diseases. With Biogen Idec taking the helm of its financial progress <strong>and</strong> United Therapeutics leading the<br />

development process, we have the best team available to introduce our product to the market. We are looking<br />

forward to working towards this goal with our partners.<br />

2010 will be driven by an increase in our qualitative search capacity, the expansion of our international<br />

community of physicians <strong>and</strong> researchers committed to treating rare diseases, the increase of our licensing<br />

agreements, our continued commitment to our licensing partners to move forward on our joint development<br />

goals, <strong>and</strong> our search to find an international financial partner to facilitate the growth of the Company. We are<br />

convinced that continuing to implement our strategy in a coherent manner will generate profitable growth <strong>and</strong>, in<br />

so doing, will sustainably enhance mondoBIOTECH’s value. We will work <strong>and</strong> do our utmost to achieve this<br />

goal.<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 15

<strong>Mondobiotech</strong> Holding AG - Locations And Subsidiaries<br />

Head Office<br />

<strong>Mondobiotech</strong> Holding AG<br />

Das Kloster<br />

Muergstrasse 18<br />

Stans<br />

ZIP: 6370<br />

Switzerl<strong>and</strong><br />

Tel: +41 840 200043<br />

Fax: +41 840 200044<br />

Other Locations & Subsidiaries<br />

<strong>Mondobiotech</strong> Holding AG, Other Locations<br />

<strong>Mondobiotech</strong> Holding AG<br />

Campus Lugano<br />

Via Pasquee 23<br />

Gentilino<br />

Zip: CH-6925<br />

Switzerl<strong>and</strong><br />

Tel: +41 840 200010<br />

Fax: +41 840 200011<br />

Source: Annual Report, Company Website, Primary <strong>and</strong> Secondary Research<br />

GlobalData<br />

<strong>Mondobiotech</strong> Holding AG, Subsidiaries<br />

mondoBIOTECH AG<br />

Clinical Department<br />

Mürgstrasse 18<br />

Zip: CH 6370<br />

Switzerl<strong>and</strong><br />

Url: www.mondobiotech.com<br />

Interferon Medical Use SA<br />

Via Pasquei<br />

Collina d'Oro<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

<strong>Mondobiotech</strong> Holding AG<br />

Campus Basel, Hardhof Basel<br />

Hardstrasse 52<br />

Basel<br />

Zip: CH-4052<br />

Switzerl<strong>and</strong><br />

Tel: +41 840 200027<br />

Fax: +41 840 200028<br />

mondoGEN AG<br />

Clinical Department<br />

Mürgstrasse 18<br />

Stans<br />

Zip: CH 6370<br />

Switzerl<strong>and</strong><br />

Tel: +41 840 200043<br />

Fax: +41 840 200044<br />

www.mondobiotech.com Inc<br />

P.O. Box 60698<br />

Palo Alto<br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 16

Stans<br />

Zip: 6925<br />

Switzerl<strong>and</strong><br />

Fast Take-off AG<br />

Stans<br />

Switzerl<strong>and</strong><br />

mondoBIOTECH Laboratories AG<br />

Vaduz<br />

Liechtenstein<br />

Source: Annual Report, Company Website, Primary <strong>and</strong> Secondary Research<br />

GlobalData<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

CA<br />

Zip: 94306<br />

United States<br />

Tel: +1 650 8570760<br />

Fax: +1 650 8570805<br />

Alps Air AG<br />

Stans<br />

Switzerl<strong>and</strong><br />

mondoBIOTECH US, Inc.<br />

NY<br />

United States<br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 17

<strong>Mondobiotech</strong> Holding AG - <strong>Financial</strong> Ratios<br />

<strong>Financial</strong> Ratios - Capital Market Ratios<br />

<strong>Mondobiotech</strong> Holding AG, Ratios based on current share price<br />

Key Ratios 09-Jun-2010<br />

Enterprise Value/Sales<br />

Enterprise Value/Total Assets<br />

Note: Above ratios are based on share price as of 09-Jun-2010, the above ratios are absolute numbers<br />

Source: Annual Report, Company Website, Primary <strong>and</strong> Secondary Research<br />

GlobalData<br />

<strong>Financial</strong> Ratios - Annual Ratios<br />

<strong>Mondobiotech</strong> Holding AG, Annual Ratios<br />

Key Ratios<br />

Equity Ratios<br />

Unit/Currency 2005 2006 2007 2008 2009<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

342.36<br />

72.13<br />

EPS (Earnings per Share) CHF -2.02 -0.15 -0.73 -0.23<br />

Book Value per Share CHF 1.22 1.19 1.27 1.05<br />

Cash Value per Share<br />

Profitability Ratios<br />

CHF 0.28 0.20 0.26 0.09<br />

Operating Margin % -247.70 -11.69 -63.04 -88.13<br />

Net Profit Margin % -291.29 -10.82 -64.63 -88.91<br />

PBT Margin (Profit Before Tax) % -282.70 -11.90 -64.63 -88.97<br />

Return on Equity % -10.92 -2.49 -13.64 -21.53<br />

Return on Capital Employed % -9.24 -2.55 -13.24 -21.28<br />

Return on Assets % -9.41 -2.03 -12.26 -18.73<br />

Return on Fixed Assets % -10.16 -2.81 -16.64 -21.50<br />

Return on Working Capital<br />

Growth Ratios<br />

% -102.71 -27.45 -64.68 -2,073.46<br />

Sales Growth % 497.86 -1.90 -5.53<br />

EBITDA Growth % -456.03<br />

Working Capital Growth<br />

Cost Ratios<br />

% 5.62 124.43 -95.88<br />

Operating Costs (% of Sales) % 347.70 111.69 163.04 188.13<br />

Administration Costs (% of Sales)<br />

Liquidity Ratios<br />

% 150.12 34.71 22.83 41.51<br />

Current Ratio Absolute 1.58 1.57 2.92 1.07<br />

Quick Ratio Absolute 1.58 1.57 2.92 1.07<br />

Cash Ratio<br />

Leverage Ratios<br />

Absolute 1.48 0.99 1.90 0.56<br />

Debt to Equity Ratio % 0.59 5.85 0.75 0.58<br />

Net Debt to Equity % -22.55 -11.22 -19.68 -7.58<br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 18

Debt to Capital Ratio % 0.59 5.55 0.74 0.58<br />

Efficiency Ratios<br />

Asset Turnover Absolute 0.03 0.19 0.19 0.21<br />

Fixed Asset Turnover Absolute 2.76 2.88 9.37 2.37<br />

Current Asset Turnover Absolute 0.15 0.85 0.67 1.54<br />

Capital Employed Turnover Absolute 0.04 0.23 0.21 0.24<br />

Working Capital Turnover Absolute 0.41 2.35 1.03 23.53<br />

Revenue per Employee CHF 572,500<br />

Net Income per Employee CHF -509,000<br />

Capex to Sales % 19.15 2.03 5.67 42.02<br />

R&D to Sales % 180.24 54.18 115.15 146.62<br />

Source: Annual Report, Company Website, Primary <strong>and</strong> Secondary Research<br />

GlobalData<br />

<strong>Financial</strong> Ratios - Interim Ratios<br />

<strong>Mondobiotech</strong> Holding AG, Interim Ratios<br />

Key Ratios Unit/Currency Dec-2008 Jun-2009 Sep-2009 Dec-2009<br />

Interim EPS (Earnings per Share) CHF -0.18 -0.08 -0.06 -0.08<br />

Book Value per Share CHF 1.20 1.14 1.05<br />

Operating Margin % -61.43 -48.89 -81.96 -304.27<br />

Net Profit Margin % -63.89 -49.45 -83.11 -305.10<br />

PBT Margin (Profit Before Tax) % -63.89 -49.45 -83.11 -305.61<br />

Operating Costs (% of Sales) % 161.43 148.89 181.96 404.27<br />

Administration Costs (% of Sales) % 26.50 32.58 28.06 122.74<br />

Current Ratio Absolute 1.59 1.49 0.70<br />

Quick Ratio Absolute 1.59 1.49 0.70<br />

Debt to Equity Ratio % 0.71 0.59 0.58<br />

Net Debt to Equity % -11.12 -11.07 -7.58<br />

Debt to Capital Ratio % 0.70 0.59 0.58<br />

Source: Annual Report, Company Website, Primary <strong>and</strong> Secondary Research<br />

GlobalData<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 19

<strong>Financial</strong> Ratios - Ratio Charts<br />

<strong>Mondobiotech</strong> Holding AG, Ratio Charts<br />

EPS Operating Margin<br />

Return on Equity Return on Assets<br />

Debt to Equity Ratio Current Ratio<br />

Source: Annual Report, Company Website, Primary <strong>and</strong> Secondary Research<br />

GlobalData<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 20

Appendix<br />

The data <strong>and</strong> analysis within this report is driven by Global Markets & Companies.<br />

Global Markets & Companies gives you key information to drive sales, investment <strong>and</strong> deal making activity in<br />

your business.<br />

Our coverage includes 130,000+ reports on 115,000+ companies (including 65,000+ private) across 200+<br />

countries <strong>and</strong> 29 industries. The key industries include Alternative Energy, Construction, Oil & Gas, Clean<br />

Technology, Technology <strong>and</strong> Telecommunication, Healthcare, Power, <strong>Financial</strong> Services, Retail & Consumer<br />

Packaged Goods <strong>and</strong> Transport.<br />

For more information or to receive a free demo of the services visit<br />

http://www.global-markets-companies.com/RequestforDemonstration.aspx<br />

Methodology<br />

GlobalData company reports are based on a core set of research techniques which ensure the best possible<br />

level of quality <strong>and</strong> accuracy of data. The key sources used include:<br />

• Company Websites<br />

• Company Annual Reports<br />

• SEC Filings<br />

• Press Releases<br />

• Proprietary Databases<br />

Currency Codes<br />

Currency Code Currency<br />

CHF Swiss Francs<br />

GlobalData<br />

Ratio Definitions<br />

Capital Market Ratios<br />

Capital Market Ratios measure investor response to owning a company's stock <strong>and</strong> also the cost of issuing<br />

stock.<br />

Price/Earnings Ratio<br />

(P/E)<br />

Enterprise<br />

Value/Earnings<br />

before Interest, Tax,<br />

Depreciation &<br />

Amortization<br />

(EV/EBITDA)<br />

Enterprise<br />

Value/Sales<br />

Price/Earnings (P/E) ratio is a measure of the price paid for a share relative to the annual<br />

income earned per share. It is a financial ratio used for valuation: a higher P/E ratio<br />

means that investors are paying more for each unit of income, so the stock is more<br />

expensive compared to one with lower P/E ratio. A high P/E suggests that investors are<br />

expecting higher earnings growth in the future compared to companies with a lower P/E.<br />

Price per share is as of previous business close, <strong>and</strong> EPS is from latest annual report.<br />

Calculation: Price per Share / Earnings per Share<br />

Enterprise Value/EBITDA (EV/EBITDA) is a valuation multiple that is often used in<br />

parallel with, or as an alternative to, the P/E ratio. The main advantage of EV/EBITDA<br />

over the PE ratio is that it is unaffected by a company's capital structure. It compares the<br />

value of a business, free of debt, to earnings before interest. Price per share is as of<br />

previous business close, <strong>and</strong> shares outst<strong>and</strong>ing last reported. Other items are from<br />

latest annual report.<br />

Calculation: (Market Cap + Debt + Preferred Stock - Cash & Cash Equivalents) / (Net<br />

Income + Interest + Tax + Depreciation + Amortization)<br />

Enterprise Value/Sales (EV/Sales) is a ratio that provides an idea of how much it costs to<br />

buy the company's sales. EV/Sales is seen as more accurate than Price/Sales because<br />

market capitalization does not take into account the amount of debt a company has,<br />

which needs to be paid back at some point. Price per share is as of previous business<br />

close, <strong>and</strong> shares outst<strong>and</strong>ing last reported. Other items are from latest annual report.<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 21

Enterprise<br />

Value/Operating<br />

Profit<br />

Enterprise<br />

Value/Total Assets<br />

Dividend Yield<br />

GlobalData<br />

Equity Ratios<br />

Calculation: (Market Cap + Debt + Preferred Stock - Cash & Cash Equivalents) / Sales<br />

Enterprise Value/Operating Profit measures the company's enterprise value to the<br />

operating profit. Price per share is as of previous business close, <strong>and</strong> shares outst<strong>and</strong>ing<br />

last reported. Other items are from latest annual report.<br />

Calculation: (Market Cap + Debt + Preferred Stock - Cash & Cash Equivalents) /<br />

Operating Income<br />

Enterprise Value/Total Assets measures the company's enterprise value to the total<br />

assets. Price per share is as of previous business close, <strong>and</strong> shares outst<strong>and</strong>ing last<br />

reported. Other items are from latest annual report.<br />

Calculation: (Market Cap + Debt + Preferred Stock - Cash & Cash Equivalents) / Total<br />

Assets<br />

These ratios are based on per share value.<br />

Earnings per Share<br />

(EPS)<br />

Dividend per Share<br />

Dividend Cover<br />

Book Value per Share<br />

Cash Value per Share<br />

GlobalData<br />

Profitability Ratios<br />

Dividend Yield shows how much a company pays out in dividends each year relative to<br />

its share price. In the absence of any capital gains, the dividend yield is the return on<br />

investment for a stock.<br />

Calculation: Annual Dividend per Share / Price per Share<br />

Earnings per share (EPS) is the portion of a company's profit allocated to each<br />

outst<strong>and</strong>ing share of common stock. EPS serves as an indicator of a company's<br />

profitability.<br />

Calculation: Net Income / Weighted Average Shares<br />

Dividend is the distribution of a portion of a company's earnings, decided by the board of<br />

directors, to a class of its shareholders.<br />

Dividend cover is the ratio of company's earnings (net income) over the dividend paid to<br />

shareholders.<br />

Calculation: Earnings per share / Dividend per share<br />

Book Value per Share measure used by owners of common shares in a firm to determine<br />

the level of safety associated with each individual share after all debts are paid<br />

accordingly.<br />

Calculation: (Shareholders Equity - Preferred Equity) / Outst<strong>and</strong>ing Shares<br />

Cash Value per Share is a measure of a company's cash (cash & equivalents on the<br />

balance sheet) that is determined by dividing cash & equivalents by the total shares<br />

outst<strong>and</strong>ing.<br />

Calculation: Cash & equivalents / Outst<strong>and</strong>ing Shares<br />

Profitability Ratios are used to assess a company's ability to generate earnings, based on revenues generated<br />

or resources used. For most of these ratios, having a higher value relative to a competitor's ratio or the same<br />

ratio from a previous period is indicative that the company is doing well.<br />

Gross Margin<br />

Gross margin is the amount of contribution to the business enterprise, after paying for<br />

direct-fixed <strong>and</strong> direct-variable unit costs.<br />

Calculation: {(Revenue-Cost of revenue) / Revenue}*100<br />

<strong>Mondobiotech</strong> Holding AG (<strong>RARE</strong>) - <strong>Financial</strong> <strong>and</strong> <strong>Strategic</strong><br />

<strong>Analysis</strong> <strong>Review</strong><br />

Reference Code: GDPH135831FSA<br />

Source : www.globalmarkets<strong>and</strong>companies.com Page 22

Operating Margin<br />

Net Profit Margin<br />

Profit Markup<br />

PBIT Margin (Profit<br />

Before Interest & Tax)<br />

PBT Margin (Profit<br />

Before Tax)<br />

Return on Equity<br />

Return on Capital<br />

Employed<br />

Return on Assets<br />

Return on Fixed<br />

Assets<br />

Return on Working<br />

Capital<br />

GlobalData<br />

Cost Ratios<br />

Operating Margin is a ratio used to measure a company's pricing strategy <strong>and</strong> operating<br />

efficiency.<br />

Calculation: (Operating Income / Revenues) *100<br />

Net Profit Margin is the ratio of net profits to revenues for a company or business<br />

segment - that shows how much of each dollar earned by the company is translated into<br />

profits.<br />

Calculation: (Net Profit / Revenues) *100<br />

Profit Markup measures the company's gross profitability, as compared to the cost of<br />

revenue.<br />

Calculation: Gross Income / Cost of Revenue<br />

Profit Before Interest & Tax Margin shows the profitability of the company before interest<br />

expense & taxation.<br />

Calculation: {(Net Profit+Interest+Tax) / Revenue} *100<br />

Profit Before Tax Margin measures the pre-tax income over revenues.<br />

Calculation: {Income Before Tax / Revenues} *100<br />

Return on Equity measures the rate of return on the ownership interest (shareholders'<br />

equity) of the common stock owners.<br />

Calculation: (Net Income / Shareholders Equity)*100<br />

Return on Capital Employed is a ratio that indicates the efficiency <strong>and</strong> profitability of a<br />

company's capital investments. ROCE should always be higher than the rate at<br />

which the company borrows; otherwise any increase in borrowing will reduce<br />

shareholders' earnings.<br />

Calculation: EBIT / (Total Assets – Current Liabilities)*100<br />