Report on Insurance and Pensions 2007 - Central Bank of Trinidad ...

Report on Insurance and Pensions 2007 - Central Bank of Trinidad ... Report on Insurance and Pensions 2007 - Central Bank of Trinidad ...

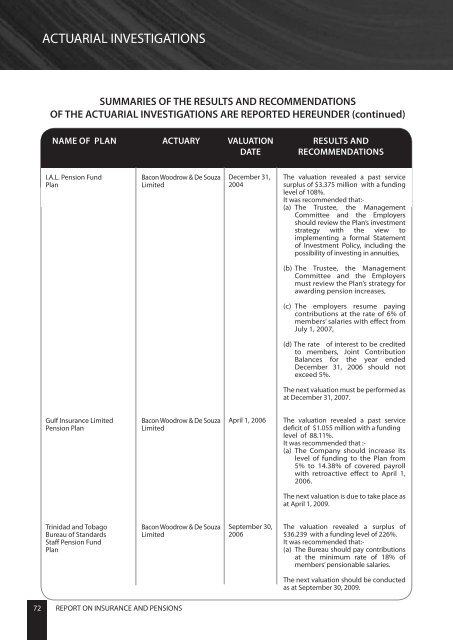

ACTUARIAL INVESTIGATIONS SUMMARIES OF THE RESULTS AND RECOMMENDATIONS OF THE ACTUARIAL INVESTIGATIONS ARE REPORTED HEREUNDER (continued) NAME OF PLAN ACTUARY VALUATION DATE RESULTS AND RECOMMENDATIONS I.A.L. Pension Fund Plan Bacon Woodrow & De Souza Limited 89.087 10.910 0.003 December 31, 2004 89.763 10.192 0.045 90.908 9.058 0.034 The valuation revealed a past service 91.868 93.004 surplus of $3.375 million with a funding level of 108%. 8.100 6.963 It was recommended that:- (a) The Trustee, 0.032 the 0.033 Management Committee and the Employers should review the Plan’s investment strategy with the view to implementing a formal Statement of Investment Policy, including the possibility of investing in annuities, (b) The Trustee, the Management Committee and the Employers must review the Plan’s strategy for awarding pension increases, (c) The employers resume paying contributions at the rate of 6% of members’ salaries with effect from July 1, 2007, (d) The rate of interest to be credited to members, Joint Contribution Balances for the year ended December 31, 2006 should not exceed 5%. The next valuation must be performed as at December 31, 2007. Gulf Insurance Limited Pension Plan Bacon Woodrow & De Souza Limited April 1, 2006 The valuation revealed a past service deficit of $1.055 million with a funding level of 88.11%. It was recommended that :- (a) The Company should increase its level of funding to the Plan from 5% to 14.38% of covered payroll with retroactive effect to April 1, 2006. The next valuation is due to take place as at April 1, 2009. Trinidad and Tobago Bureau of Standards Staff Pension Fund Plan Bacon Woodrow & De Souza Limited September 30, 2006 The valuation revealed a surplus of $36.239 with a funding level of 226%. It was recommended that:- (a) The Bureau should pay contributions at the minimum rate of 18% of members’ pensionable salaries. The next valuation should be conducted as at September 30, 2009. 72 REPORT ON INSURANCE AND PENSIONS

ACTUARIAL INVESTIGATIONS SUMMARIES OF THE RESULTS AND RECOMMENDATIONS OF THE ACTUARIAL INVESTIGATIONS ARE REPORTED HEREUNDER (continued) NAME OF PLAN ACTUARY VALUATION DATE RESULTS AND RECOMMENDATIONS The Pheonix Park Gas Processors Limited Pension Fund Plan 89.087 Apex Consulting Ltd 10.910 0.003 January 1, 2006 90.908 9.058 0.034 91.868 8.100 0.032 93.004 The valuation revealed a past service surplus of $1.411 million with 6.963 a funding level of 105%. It was recommended that:-0.033 (a) The gains arising from interest earned but not credited due to the inclusion of investment management expenses as part of the administration expenses of the fund, be used to uplift members’ accounts as at December 31, 2006, (b) The residue of the contingency reserve should be carried forward to finance administrative expenses of the Plan. The next valuation is due to take place as at January 1, 2009. National Flour Mills Limited Pension Plan Bacon Woodrow & De Souza Limited December 31, 2005 The valuation revealed a surplus of $3.787 million with a funding level of 104%. It was recommended that:- (a) The Company should continue to contribute at a rate of 12.5% of members’ salaries until reviewed on the next actuarial valuation, (b) The Trustees should review the Plan’s investment strategy with the Management Committee and the Company to take into account the effect of the change in membership profile following the separation exercise in 2006. The next valuation should be conducted no later than December 31, 2008. REPORT ON INSURANCE AND PENSIONS 73

- Page 24 and 25: INSURANCE COMPANIES Local Assets Ra

- Page 26 and 27: INSURANCE COMPANIES 3.17 Net Premiu

- Page 28 and 29: INSURANCE COMPANIES FIGURE 7 Long-T

- Page 30 and 31: INSURANCE COMPANIES REINSURANCE 3.1

- Page 32 and 33: GENERAL INSURANCE BUSINESS 4. GENER

- Page 34 and 35: INSURANCE COMPANIES Statutory Depos

- Page 36 and 37: INSURANCE COMPANIES DEPOSITS RETAIN

- Page 38 and 39: INSURANCE COMPANIES GENERAL INSURAN

- Page 40 and 41: INSURANCE COMPANIES SCHEDULE SHOWIN

- Page 42 and 43: INSURANCE COMPANIES Underwriting Re

- Page 44 and 45: INSURANCE COMPANIES REINSURANCE - M

- Page 46 and 47: INSURANCE COMPANIES SCHEDULE SHOWIN

- Page 48 and 49: INSURANCE COMPANIES FIGURE 10 OTHER

- Page 50 and 51: INSURANCE COMPANIES REINSURANCE - P

- Page 52 and 53: INSURANCE COMPANIES REINSURANCE - O

- Page 54 and 55: INSURANCE COMPANIES MARGIN OF SOLVE

- Page 56 and 57: INSURANCE COMPANIES 5. ASSOCIATION

- Page 58 and 59: INSURANCE INTERMEDIARIES Examinatio

- Page 60 and 61: PENSION FUND PLANS 7.09 The followi

- Page 62 and 63: PENSION FUND PLANS Balance Sheets 7

- Page 64 and 65: PENSION FUND PLANS FIGURE 12 PENSIO

- Page 66 and 67: ACTUARIAL INVESTIGATIONS SUMMARIES

- Page 68 and 69: ACTUARIAL INVESTIGATIONS SUMMARIES

- Page 70 and 71: ACTUARIAL INVESTIGATIONS SUMMARIES

- Page 72 and 73: ACTUARIAL INVESTIGATIONS SUMMARIES

- Page 76 and 77: ACTUARIAL INVESTIGATIONS SUMMARIES

- Page 78 and 79: ACTUARIAL INVESTIGATIONS SUMMARIES

- Page 80 and 81: ACTUARIAL INVESTIGATIONS SUMMARIES

- Page 82 and 83: APPENDIX A Directors: Secretary: Au

- Page 84 and 85: APPENDIX A Directors: Secretary: Au

- Page 86 and 87: APPENDIX A CARIBBEAN INSURANCE COMP

- Page 88 and 89: APPENDIX A COLONIAL FIRE AND GENERA

- Page 90 and 91: APPENDIX A CUNA CARIBBEAN INSURANCE

- Page 92 and 93: APPENDIX A FURNESS ANCHORAGE GENERA

- Page 94 and 95: APPENDIX A GUARDIAN GENERAL INSURAN

- Page 96 and 97: APPENDIX A GULF INSURANCE LIMITED I

- Page 98 and 99: APPENDIX A MARITIME LIFE (CARIBBEAN

- Page 100 and 101: APPENDIX A MOTOR ONE INSURANCE COMP

- Page 102 and 103: APPENDIX A THE REINSURANCE COMPANY

- Page 104 and 105: APPENDIX A SAGICOR GENERAL INSURANC

- Page 106 and 107: APPENDIX A SCOTIALIFE INSURANCE LIM

- Page 108 and 109: APPENDIX A TATIL LIFE ASSURANCE LIM

- Page 110 and 111: APPENDIX A THE GREAT NORTHERN INSUR

- Page 112 and 113: APPENDIX A THE PRESIDENTIAL INSURAN

- Page 114 and 115: APPENDIX A UNITED INSURANCE COMPANY

- Page 116 and 117: APPENDIX B LIST OF REGISTERED AGENT

- Page 118 and 119: List of Registered Agents List of A

- Page 120 and 121: List of Registered Agents List of A

- Page 122 and 123: List of Registered Agents List of A

ACTUARIAL INVESTIGATIONS<br />

SUMMARIES OF THE RESULTS AND RECOMMENDATIONS<br />

OF THE ACTUARIAL INVESTIGATIONS ARE REPORTED HEREUNDER (c<strong>on</strong>tinued)<br />

NAME OF PLAN<br />

ACTUARY<br />

VALUATION<br />

DATE<br />

RESULTS AND<br />

RECOMMENDATIONS<br />

I.A.L. Pensi<strong>on</strong> Fund<br />

Plan<br />

Bac<strong>on</strong> Woodrow & De Souza<br />

Limited<br />

89.087<br />

10.910<br />

0.003<br />

December 31,<br />

2004<br />

89.763<br />

10.192<br />

0.045<br />

90.908<br />

9.058<br />

0.034<br />

The valuati<strong>on</strong> revealed a past service<br />

91.868 93.004<br />

surplus <strong>of</strong> $3.375 milli<strong>on</strong> with a funding<br />

level <strong>of</strong> 108%. 8.100 6.963<br />

It was recommended that:-<br />

(a) The Trustee, 0.032 the 0.033 Management<br />

Committee <strong>and</strong> the Employers<br />

should review the Plan’s investment<br />

strategy with the view to<br />

implementing a formal Statement<br />

<strong>of</strong> Investment Policy, including the<br />

possibility <strong>of</strong> investing in annuities,<br />

(b) The Trustee, the Management<br />

Committee <strong>and</strong> the Employers<br />

must review the Plan’s strategy for<br />

awarding pensi<strong>on</strong> increases,<br />

(c) The employers resume paying<br />

c<strong>on</strong>tributi<strong>on</strong>s at the rate <strong>of</strong> 6% <strong>of</strong><br />

members’ salaries with effect from<br />

July 1, <strong>2007</strong>,<br />

(d) The rate <strong>of</strong> interest to be credited<br />

to members, Joint C<strong>on</strong>tributi<strong>on</strong><br />

Balances for the year ended<br />

December 31, 2006 should not<br />

exceed 5%.<br />

The next valuati<strong>on</strong> must be performed as<br />

at December 31, <strong>2007</strong>.<br />

Gulf <strong>Insurance</strong> Limited<br />

Pensi<strong>on</strong> Plan<br />

Bac<strong>on</strong> Woodrow & De Souza<br />

Limited<br />

April 1, 2006<br />

The valuati<strong>on</strong> revealed a past service<br />

deficit <strong>of</strong> $1.055 milli<strong>on</strong> with a funding<br />

level <strong>of</strong> 88.11%.<br />

It was recommended that :-<br />

(a) The Company should increase its<br />

level <strong>of</strong> funding to the Plan from<br />

5% to 14.38% <strong>of</strong> covered payroll<br />

with retroactive effect to April 1,<br />

2006.<br />

The next valuati<strong>on</strong> is due to take place as<br />

at April 1, 2009.<br />

<strong>Trinidad</strong> <strong>and</strong> Tobago<br />

Bureau <strong>of</strong> St<strong>and</strong>ards<br />

Staff Pensi<strong>on</strong> Fund<br />

Plan<br />

Bac<strong>on</strong> Woodrow & De Souza<br />

Limited<br />

September 30,<br />

2006<br />

The valuati<strong>on</strong> revealed a surplus <strong>of</strong><br />

$36.239 with a funding level <strong>of</strong> 226%.<br />

It was recommended that:-<br />

(a) The Bureau should pay c<strong>on</strong>tributi<strong>on</strong>s<br />

at the minimum rate <strong>of</strong> 18% <strong>of</strong><br />

members’ pensi<strong>on</strong>able salaries.<br />

The next valuati<strong>on</strong> should be c<strong>on</strong>ducted<br />

as at September 30, 2009.<br />

72<br />

REPORT ON INSURANCE AND PENSIONS