China: A case study of price control on electricity - the DBS Vickers ...

China: A case study of price control on electricity - the DBS Vickers ... China: A case study of price control on electricity - the DBS Vickers ...

CN: A

- Page 2 and 3: CN: A case <strong

- Page 4: CN: A case <strong

CN: A <str<strong>on</strong>g>case</str<strong>on</strong>g> <str<strong>on</strong>g>study</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>price</str<strong>on</strong>g> <str<strong>on</strong>g>c<strong>on</strong>trol</str<strong>on</strong>g> <strong>on</strong> <strong>electricity</strong> — May 20, 2011<br />

Ec<strong>on</strong>omics<br />

<str<strong>on</strong>g>China</str<strong>on</strong>g>: A <str<strong>on</strong>g>case</str<strong>on</strong>g> <str<strong>on</strong>g>study</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>price</str<strong>on</strong>g> <str<strong>on</strong>g>c<strong>on</strong>trol</str<strong>on</strong>g> <strong>on</strong><br />

<strong>electricity</strong><br />

<strong>DBS</strong> Group Research 20 May 2011<br />

Chart 2a: Coal <str<strong>on</strong>g>price</str<strong>on</strong>g>s rocketed up sharply<br />

USD/metric<br />

165<br />

145<br />

125<br />

105<br />

85<br />

65<br />

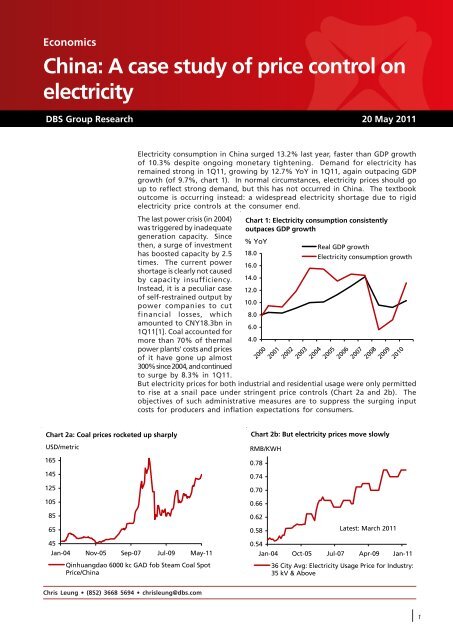

Electricity c<strong>on</strong>sumpti<strong>on</strong> in <str<strong>on</strong>g>China</str<strong>on</strong>g> surged 13.2% last year, faster than GDP growth<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> 10.3% despite <strong>on</strong>going m<strong>on</strong>etary tightening. Demand for <strong>electricity</strong> has<br />

remained str<strong>on</strong>g in 1Q11, growing by 12.7% YoY in 1Q11, again outpacing GDP<br />

growth (<str<strong>on</strong>g>of</str<strong>on</strong>g> 9.7%, chart 1). In normal circumstances, <strong>electricity</strong> <str<strong>on</strong>g>price</str<strong>on</strong>g>s should go<br />

up to reflect str<strong>on</strong>g demand, but this has not occurred in <str<strong>on</strong>g>China</str<strong>on</strong>g>. The textbook<br />

outcome is occurring instead: a widespread <strong>electricity</strong> shortage due to rigid<br />

<strong>electricity</strong> <str<strong>on</strong>g>price</str<strong>on</strong>g> <str<strong>on</strong>g>c<strong>on</strong>trol</str<strong>on</strong>g>s at <strong>the</strong> c<strong>on</strong>sumer end.<br />

The last power crisis (in 2004)<br />

was triggered by inadequate<br />

generati<strong>on</strong> capacity. Since<br />

<strong>the</strong>n, a surge <str<strong>on</strong>g>of</str<strong>on</strong>g> investment<br />

has boosted capacity by 2.5<br />

times. The current power<br />

shortage is clearly not caused<br />

by capacity insufficiency.<br />

Instead, it is a peculiar <str<strong>on</strong>g>case</str<strong>on</strong>g><br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> self-restrained output by<br />

power companies to cut<br />

financial losses, which<br />

amounted to CNY18.3bn in<br />

1Q11[1]. Coal accounted for<br />

more than 70% <str<strong>on</strong>g>of</str<strong>on</strong>g> <strong>the</strong>rmal<br />

power plants' costs and <str<strong>on</strong>g>price</str<strong>on</strong>g>s<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> it have g<strong>on</strong>e up almost<br />

300% since 2004, and c<strong>on</strong>tinued<br />

to surge by 8.3% in 1Q11.<br />

Chart 1: Electricity c<strong>on</strong>sumpti<strong>on</strong> c<strong>on</strong>sistently<br />

outpaces GDP growth<br />

% YoY<br />

Real GDP growth<br />

18.0<br />

Electricity c<strong>on</strong>sumpti<strong>on</strong> growth<br />

16.0<br />

14.0<br />

12.0<br />

10.0<br />

8.0<br />

6.0<br />

4.0<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

But <strong>electricity</strong> <str<strong>on</strong>g>price</str<strong>on</strong>g>s for both industrial and residential usage were <strong>on</strong>ly permitted<br />

to rise at a snail pace under stringent <str<strong>on</strong>g>price</str<strong>on</strong>g> <str<strong>on</strong>g>c<strong>on</strong>trol</str<strong>on</strong>g>s (Chart 2a and 2b). The<br />

objectives <str<strong>on</strong>g>of</str<strong>on</strong>g> such administrative measures are to suppress <strong>the</strong> surging input<br />

costs for producers and inflati<strong>on</strong> expectati<strong>on</strong>s for c<strong>on</strong>sumers.<br />

Chart 2b: But <strong>electricity</strong> <str<strong>on</strong>g>price</str<strong>on</strong>g>s move slowly<br />

RMB/KWH<br />

0.78<br />

0.74<br />

0.70<br />

0.66<br />

0.62<br />

0.58<br />

Latest: March 2011<br />

45<br />

Jan-04 Nov-05 Sep-07 Jul-09 May-11<br />

Qinhuangdao 6000 kc GAD fob Steam Coal Spot<br />

Price/<str<strong>on</strong>g>China</str<strong>on</strong>g><br />

0.54<br />

Jan-04 Oct-05 Jul-07 Apr-09 Jan-11<br />

36 City Avg: Electricity Usage Price for Industry:<br />

35 kV & Above<br />

Chris Leung • (852) 3668 5694 • chrisleung@dbs.com<br />

1

CN: A <str<strong>on</strong>g>case</str<strong>on</strong>g> <str<strong>on</strong>g>study</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>price</str<strong>on</strong>g> <str<strong>on</strong>g>c<strong>on</strong>trol</str<strong>on</strong>g> <strong>on</strong> <strong>electricity</strong> — May 20, 2011<br />

As a result, power companies have to scale back <strong>electricity</strong> generati<strong>on</strong>. The<br />

problem has called for Nati<strong>on</strong>al Development Reform Commissi<strong>on</strong> (NDRC) to<br />

provide guidance for power rati<strong>on</strong>ing. Measures so far have already negatively<br />

impacted <strong>the</strong> normal operati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> factories in 20 provinces and aut<strong>on</strong>omous<br />

regi<strong>on</strong>s. Guangd<strong>on</strong>g, Jiangsu and Zhejiang, which toge<strong>the</strong>r accounted for 30.8%<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> industrial producti<strong>on</strong>[2] have also been affected. One township in Zhejiang,<br />

which produces about <strong>on</strong>e-third <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>China</str<strong>on</strong>g>'s umbrellas, was badly hit. Umbrellas<br />

<str<strong>on</strong>g>price</str<strong>on</strong>g>s are now rising, illustrating how <strong>the</strong> effort to suppress inflati<strong>on</strong> upstream<br />

is actually creating inflati<strong>on</strong> downstream.<br />

During <strong>the</strong> last episode <str<strong>on</strong>g>of</str<strong>on</strong>g> power shortage in 2004, industrial producti<strong>on</strong> growth<br />

fell from 19.4% in Mar04 to 14.4% in Dec04 (Chart 3) despite <strong>the</strong> buoyancy <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

<strong>the</strong> external trade sector. This time, industrial producti<strong>on</strong> growth has already<br />

fallen two m<strong>on</strong>ths in a row, and <strong>the</strong> power shortage has <strong>on</strong>ly just begun to<br />

unfold. There is every reas<strong>on</strong> to believe industrial activities will decelerate<br />

notably in <strong>the</strong> m<strong>on</strong>ths ahead. Power rati<strong>on</strong>ing will likely remain in place even<br />

after summer, unless financial losses are c<strong>on</strong>tained by <str<strong>on</strong>g>price</str<strong>on</strong>g> hikes.<br />

Looking ahead, <strong>the</strong> <str<strong>on</strong>g>China</str<strong>on</strong>g> Electricity Council warned that <strong>the</strong> country may face<br />

an <strong>electricity</strong> shortage <str<strong>on</strong>g>of</str<strong>on</strong>g> 30 milli<strong>on</strong> kWh in <strong>the</strong> summer, equivalent to three<br />

times <strong>the</strong> <strong>electricity</strong> c<strong>on</strong>sumpti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> Ch<strong>on</strong>gqing. Elsewhere, regi<strong>on</strong>al power<br />

Chart 3: IP notably fell despite buoyancy <str<strong>on</strong>g>of</str<strong>on</strong>g> external trade in 04<br />

% YoY, 3mma<br />

21.0<br />

20.0<br />

19.0<br />

18.0<br />

Latest: April 2011<br />

% YoY, 3mma<br />

33.0<br />

32.0<br />

31.0<br />

17.0<br />

16.0<br />

15.0<br />

14.0<br />

Industrial producti<strong>on</strong> (LHS)<br />

Exports (RHS)<br />

Mar-04 Apr-04 May-04 Jun-04<br />

Jul-04 Aug-04 Sep-04 Oct-04 Nov-04 Dec-04<br />

30.0<br />

29.0<br />

28.0<br />

Chart 4: Relati<strong>on</strong>ship between IP and <strong>electricity</strong> producti<strong>on</strong> is tightly correlated<br />

% YoY<br />

45.0<br />

35.0<br />

Electricity Producti<strong>on</strong><br />

Industrial producti<strong>on</strong><br />

25.0<br />

15.0<br />

5.0<br />

-5.0<br />

Latest: April 2011<br />

-15.0<br />

Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11<br />

2

CN: A <str<strong>on</strong>g>case</str<strong>on</strong>g> <str<strong>on</strong>g>study</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>price</str<strong>on</strong>g> <str<strong>on</strong>g>c<strong>on</strong>trol</str<strong>on</strong>g> <strong>on</strong> <strong>electricity</strong> — May 20, 2011<br />

distributor East <str<strong>on</strong>g>China</str<strong>on</strong>g> Grid Co Ltd estimated that Jiangsu will likely be <strong>the</strong><br />

hardest hit this summer with a deficit <str<strong>on</strong>g>of</str<strong>on</strong>g> 11 milli<strong>on</strong> kWh, about 16% <str<strong>on</strong>g>of</str<strong>on</strong>g> what<br />

<strong>the</strong> province c<strong>on</strong>sumes in normal circumstances.<br />

Policy implicati<strong>on</strong>s<br />

Suppressing inflati<strong>on</strong> by administrative <str<strong>on</strong>g>price</str<strong>on</strong>g> <str<strong>on</strong>g>c<strong>on</strong>trol</str<strong>on</strong>g>s results in unintended<br />

c<strong>on</strong>sequences. Solving this problem requires ei<strong>the</strong>r raising <strong>electricity</strong> <str<strong>on</strong>g>price</str<strong>on</strong>g>s to<br />

reflect true demand and/or to slow down <strong>electricity</strong> demand to a level c<strong>on</strong>sistent<br />

with prevailing <str<strong>on</strong>g>price</str<strong>on</strong>g>s. Authority are clearly caught in a policy dilemma. Headline<br />

CPI inflati<strong>on</strong> does not reflect <strong>the</strong> true extent <str<strong>on</strong>g>of</str<strong>on</strong>g> <strong>the</strong> inflati<strong>on</strong>ary force driven by<br />

energy <str<strong>on</strong>g>price</str<strong>on</strong>g>s. Never<strong>the</strong>less, inflati<strong>on</strong> manifests itself in o<strong>the</strong>r forms <str<strong>on</strong>g>of</str<strong>on</strong>g> ec<strong>on</strong>omic<br />

woes as shown by this <str<strong>on</strong>g>case</str<strong>on</strong>g> <str<strong>on</strong>g>study</str<strong>on</strong>g>.<br />

3

CN: A <str<strong>on</strong>g>case</str<strong>on</strong>g> <str<strong>on</strong>g>study</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>price</str<strong>on</strong>g> <str<strong>on</strong>g>c<strong>on</strong>trol</str<strong>on</strong>g> <strong>on</strong> <strong>electricity</strong> — May 20, 2011<br />

Recent research<br />

CN: Good value in CNY forwards 18 May 11<br />

US: Interest Rate Outlook & Strategy 11 May 11<br />

CN: Latent risks facing <str<strong>on</strong>g>China</str<strong>on</strong>g> 9 May 11<br />

SG: Electi<strong>on</strong> effect <strong>on</strong> policy 9 May 11<br />

HK: Mild tightening at work 15 Apr 11<br />

KR: Interest Rate Outlook & Strategy 11 Apr 11<br />

ID: The balance <str<strong>on</strong>g>of</str<strong>on</strong>g> payments outlook 8 Apr 11<br />

FX: The CNH & its role in yuan reforms 7 Apr 11<br />

CN: The formati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> Chinese wealth 1 Apr 11<br />

CN: Interest Rate Outlook & Strategy 31 Mar 11<br />

CN: The roller coaster ride c<strong>on</strong>tinues 28 Mar 11<br />

CN: Offshore CNY progress check 24 Mar 11<br />

2Q11 Tactical Regi<strong>on</strong>al Asset Allocati<strong>on</strong> 23 Mar 11<br />

SG: A well-calibrated budget 21 Feb 11<br />

CN: Inflati<strong>on</strong> and labor productivity 21 Feb 11<br />

CN: CNY capital account liberalisati<strong>on</strong> -recent 8 Feb 11<br />

developments and implicati<strong>on</strong>s<br />

ID: Interest Rate Outlook & Strategy 2 Feb 11<br />

TW: Appreciati<strong>on</strong> impact 28 Jan 11<br />

IN: Food inflati<strong>on</strong> demand-driven 24 Jan 11<br />

SG: Budget to tackle <strong>the</strong> gap 17 Jan 11<br />

US: Interest Rate Outlook & Strategy 11 Jan 11<br />

SG: Singapore attempts <strong>the</strong> impossible 6 Dec 10<br />

SG: 2011: Above expectati<strong>on</strong>s 29 Nov 10<br />

KR: Interest Rate Outlook & Strategy 11 Nov 10<br />

EUR: One for <strong>the</strong> bulls 11 Nov 10<br />

KRW: Str<strong>on</strong>ger than c<strong>on</strong>sensus 3 Nov 10<br />

ID: 2011 budget preview 1 Nov 10<br />

Asia: Interest Rate Outlook & Strategy 28 Oct 10<br />

IN: Higher rates or higher inflati<strong>on</strong> 26 Oct 10<br />

Asia: The six ways to absorb capital inflow 26 Oct 10<br />

MY: A step towards Visi<strong>on</strong> 2020 18 Oct 10<br />

IN: Rising growth potential 13 Oct 10<br />

ID: Inflows & m<strong>on</strong>etary policy 13 Oct 10<br />

SG: It’s payback time 11 Oct 10<br />

ID: Inflows drown fundamentals 8 Oct 10<br />

Asia: Ano<strong>the</strong>r day, ano<strong>the</strong>r $2bn <str<strong>on</strong>g>of</str<strong>on</strong>g> inflow 7 Oct 10<br />

SGD: Higher with or without tightening 7 Oct 10<br />

HK’s inflecti<strong>on</strong> point as <str<strong>on</strong>g>of</str<strong>on</strong>g>fshore CNY center 28 Sep 10<br />

CN: Medium-term inflati<strong>on</strong> outlook 27 Aug 10<br />

IN: Interest Rate Outlook & Strategy 27 Aug 10<br />

SG: GDP c<strong>on</strong>tributi<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> <strong>the</strong> IRs 26 Aug 10<br />

FX: JPY interventi<strong>on</strong> risk rising 18 Aug 10<br />

HK: How far can H<strong>on</strong>g K<strong>on</strong>g go as <str<strong>on</strong>g>China</str<strong>on</strong>g>'s 10 Aug 10<br />

major Renminbi <str<strong>on</strong>g>of</str<strong>on</strong>g>fshore center<br />

US Fed: Between a stock and b<strong>on</strong>d place 10 Aug 10<br />

<str<strong>on</strong>g>China</str<strong>on</strong>g> and US: Demand trumps supply 6 Aug 10<br />

CN: Implicati<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> rising wages 4 Aug 10<br />

(Part II)<br />

ID: Upgrade expectati<strong>on</strong>s 29 Jul 10<br />

Disclaimer:<br />

The informati<strong>on</strong> herein is published by <strong>DBS</strong> Bank Ltd (<strong>the</strong> “Company”). It is based <strong>on</strong> informati<strong>on</strong> obtained from sources believed to be<br />

reliable, but <strong>the</strong> Company does not make any representati<strong>on</strong> or warranty, express or implied, as to its accuracy, completeness, timeliness or<br />

correctness for any particular purpose. Opini<strong>on</strong>s expressed are subject to change without notice. Any recommendati<strong>on</strong> c<strong>on</strong>tained herein<br />

does not have regard to <strong>the</strong> specific investment objectives, financial situati<strong>on</strong> and <strong>the</strong> particular needs <str<strong>on</strong>g>of</str<strong>on</strong>g> any specific addressee. The<br />

informati<strong>on</strong> herein is published for <strong>the</strong> informati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> addressees <strong>on</strong>ly and is not to be taken in substituti<strong>on</strong> for <strong>the</strong> exercise <str<strong>on</strong>g>of</str<strong>on</strong>g> judgement<br />

by addressees, who should obtain separate legal or financial advice. The Company, or any <str<strong>on</strong>g>of</str<strong>on</strong>g> its related companies or any individuals<br />

c<strong>on</strong>nected with <strong>the</strong> group accepts no liability for any direct, special, indirect, c<strong>on</strong>sequential, incidental damages or any o<strong>the</strong>r loss or<br />

damages <str<strong>on</strong>g>of</str<strong>on</strong>g> any kind arising from any use <str<strong>on</strong>g>of</str<strong>on</strong>g> <strong>the</strong> informati<strong>on</strong> herein (including any error, omissi<strong>on</strong> or misstatement herein, negligent or<br />

o<strong>the</strong>rwise) or fur<strong>the</strong>r communicati<strong>on</strong> <strong>the</strong>re<str<strong>on</strong>g>of</str<strong>on</strong>g>, even if <strong>the</strong> Company or any o<strong>the</strong>r pers<strong>on</strong> has been advised <str<strong>on</strong>g>of</str<strong>on</strong>g> <strong>the</strong> possibility <strong>the</strong>re<str<strong>on</strong>g>of</str<strong>on</strong>g>. The<br />

informati<strong>on</strong> herein is not to be c<strong>on</strong>strued as an <str<strong>on</strong>g>of</str<strong>on</strong>g>fer or a solicitati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> an <str<strong>on</strong>g>of</str<strong>on</strong>g>fer to buy or sell any securities, futures, opti<strong>on</strong>s or o<strong>the</strong>r<br />

financial instruments or to provide any investment advice or services. The Company and its associates, <strong>the</strong>ir directors, <str<strong>on</strong>g>of</str<strong>on</strong>g>ficers and/or<br />

employees may have positi<strong>on</strong>s or o<strong>the</strong>r interests in, and may effect transacti<strong>on</strong>s in securities menti<strong>on</strong>ed herein and may also perform or<br />

seek to perform broking, investment banking and o<strong>the</strong>r banking or financial services for <strong>the</strong>se companies. The informati<strong>on</strong> herein is not<br />

intended for distributi<strong>on</strong> to, or use by, any pers<strong>on</strong> or entity in any jurisdicti<strong>on</strong> or country where such distributi<strong>on</strong> or use would be c<strong>on</strong>trary to<br />

law or regulati<strong>on</strong>.<br />

4