INCOME-TAX APPELLATE TRIBUNAL, MUMBAI BENCHES ... - ITAT

INCOME-TAX APPELLATE TRIBUNAL, MUMBAI BENCHES ... - ITAT

INCOME-TAX APPELLATE TRIBUNAL, MUMBAI BENCHES ... - ITAT

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

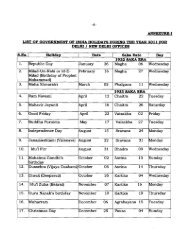

<strong>INCOME</strong>-<strong>TAX</strong> <strong>APPELLATE</strong> <strong>TRIBUNAL</strong>, <strong>MUMBAI</strong> <strong>BENCHES</strong>, <strong>MUMBAI</strong><br />

STATEMENT SHOWING THE LIST OF THIRD MEMBER CASES PENDING AS ON 06.02.2013<br />

Sr<br />

No<br />

Appeal No.<br />

Name of the<br />

Assessee<br />

Bench Points involved To whom<br />

assigned<br />

REMARKS<br />

<strong>MUMBAI</strong> BENCH<br />

1. ITA No.<br />

6987/Mum/2003<br />

ITA No. 5280 &<br />

5281/Mum/2004<br />

A.Y. 1996-97 to<br />

1998-99<br />

M/s Kaira Can<br />

Company Ltd.<br />

S/Shri.<br />

1. Sunil Kumar<br />

Yadav, J.M.<br />

2. V.K.Gupta,<br />

A.M.<br />

Reference dt. 25.11.2008 u/s<br />

255(4) of the Income Tax Act<br />

made afresh by S/Shri. Sunil<br />

Kumar Yadav, J.M. and V.K.<br />

Gupta, A.M. is as under.<br />

“1. Whether the impugned<br />

transactions of leasing out of<br />

assets to the assessee is a lease<br />

transaction or a financial lease<br />

Hon’ble Zonal<br />

Vice-President<br />

Adjourned Sine<br />

die<br />

2. Whether the assessee can be<br />

held to be the owner of the asset<br />

acquired under the above<br />

transactions and is entitled for<br />

depreciation over the said assets<br />

or assessee being a lessee is<br />

entitled to claim the lease rent<br />

paid to the lessor as a revenue<br />

expenditure”<br />

1

2. ITA Nos. 525 to<br />

530/Mum/2008,<br />

A.Ys.1999-2000 to<br />

2004-05<br />

Mrs. Sumanlata<br />

Bansal, Mumbai<br />

S/Shri.<br />

1. R.S.Padvekar,<br />

J.M.<br />

2.B.Ramakotaiah,<br />

A.M.<br />

1. “Whether, non-issuance of<br />

the notice as provided in Sub.-<br />

sec.(2) to Section 143 of the I.T.<br />

Act in the case of assessment<br />

framed u/sec.153A, in<br />

consequence of search under<br />

sec. 132, is merely an<br />

irregularity and the same is<br />

curable”<br />

Zonal Vice-<br />

President(MZ)<br />

Fixed on<br />

14.03.2013<br />

2. “Whether ,on the facts of the<br />

case, failure on the part of the<br />

Assessessing Officer (A.O.) to<br />

issue notice to the assessee as<br />

per provisions of Sub-sec.(2) to<br />

Section 143 shall have the<br />

effect of rendering the entire<br />

assessment framed u/sec. 153A<br />

of the Act as null and void”<br />

3. ITA 5229/M/2004<br />

& 5303/M/2004<br />

A.Y. 1996-97<br />

M/s. Standard<br />

Chartered Bank<br />

S/Shri.<br />

1.R.S.Padvekar,J.<br />

M.<br />

2.Rajendra<br />

Singh,A.M.<br />

“Whether on the facts and<br />

circumstances of the case<br />

interest income of<br />

Rs.73,92,16,611/-<br />

(Rs.39,23,71,781+Rs.34,68,44,<br />

830) is asseable to tax in the<br />

year under consideration”<br />

Shri.<br />

R.S.Syal,A.M.<br />

After the<br />

Disposal of MA<br />

PUNE BENCH<br />

1. ITA No.<br />

1712/PN/2007,<br />

for A.Y. 2004-05.<br />

M/s Audyogik<br />

Shikshan Mandal,<br />

Pune,<br />

S/Shri.<br />

1. Mukul Shrawat,<br />

J.M.<br />

2.D. Karunakara<br />

Rao, A.M.<br />

1. “In the facts and<br />

circumstances of the case,<br />

whether the property of the trust<br />

i.e. car, be held ‘made<br />

available’ for the use of the<br />

trustee, specified person u/s<br />

13(3) of the Income Tax Act<br />

1961”<br />

Zonal Vice-<br />

President(MZ)<br />

Ajd. Sine-die<br />

2

2. “In the facts and<br />

circumstances of the case,<br />

whether the expression ‘made<br />

available for the use of’ trustee<br />

ipso facto be understood to have<br />

been deemed used or applied<br />

for the benefit of the said<br />

trustee, with or without the<br />

actual use or application of the<br />

property of the trust i.e. car for<br />

personal benefit of the trustee in<br />

view of section 13(2) of the<br />

Income Tax Act 1961”<br />

3. “In the facts and<br />

circumstances of the case,<br />

whether the case of the assessee<br />

falls within the ambit of the<br />

provisions of clause (b) of<br />

section 13(2) of the Income tax<br />

Act 1961”<br />

4. “If the answers to above<br />

questions at sr. No. (1) to (3)<br />

are affirmative, whether the<br />

denial of benefits of section 11<br />

be restricted to such income of<br />

the trust used or<br />

applied directly or indirectly<br />

for the benefits of trustee or, in<br />

alternative, the total income of<br />

the trust is not entitled for the<br />

benefits of section 11 of the<br />

Act.”<br />

3

LUCKNOW<br />

<strong>BENCHES</strong><br />

1. ITA No.<br />

141,142,143 &<br />

144/LKW/2009<br />

C.O.No.06 to<br />

09/LKW/2009<br />

A.Y.2001-02,2002-<br />

03,2003-<br />

04 &2006-07<br />

Ms Rajya Krishi<br />

Utpadan mandi<br />

Parishad,<br />

Lucknow<br />

S/Shri<br />

1. I.S.Verma,J.M.<br />

2. N.K.Saini, A.M.<br />

1.”Whether” the CIT(A) has<br />

jurisdiction to decide the<br />

assessee’s petition for stay or<br />

recovery of demand during the<br />

pendency of assessee’s appeal<br />

furnished under section 246A of<br />

the Act”<br />

2. “If the CIT(A) has<br />

jurisdiction to decide the<br />

assessee’s petition for stay of<br />

recovery of demend , than<br />

under which provisions of law<br />

the CIT(A) will pass such an<br />

order i.e. what will be the<br />

nature or status of such order<br />

passed by the CIT(A)”<br />

Hon’ble Zonal<br />

Vice-President<br />

(As per order<br />

dt.20.09.2011 of<br />

the Hon’ble<br />

President) Shri<br />

H.L.Karwa as<br />

Zonal Vice-<br />

President to hear<br />

as a Third<br />

Member.”<br />

Adjourned Sine<br />

die<br />

3. “Whether, such order (supra)<br />

passed by the CIT(A) is<br />

appealable before the Tribunal<br />

or not i.e. can such an order be<br />

appealed against before the<br />

Tribunal by way of an appeal<br />

under section 253 of the Act, or<br />

can be challenged only before<br />

the Hon’ble High Court by way<br />

of writ petition”<br />

4. “If such an order(Supra) is<br />

found to be appealable before<br />

the Tribunal, then can the<br />

Tribunal entertain such an<br />

appeal against such order<br />

without there being appeal<br />

before it against the order of<br />

CIT(A) in appeal against the<br />

4

2. ITA No.<br />

219/LKW/2009 and<br />

C.O.No.23/Lck/<br />

2009 A.Y.2005-06<br />

3. SPNo.03/Lkw/2012<br />

(A/o ITA<br />

188/Lkw/2010)<br />

A.Y. 2007-08<br />

SP.No.04/Lkw/201<br />

2<br />

(A/o ITA<br />

103/Lkw/2012)<br />

A.Y. 2007-08<br />

M/s Zazsons<br />

Exports Ltd.<br />

Kanpur<br />

Smt.Uma Pandey,<br />

M/s.State Urban<br />

Development<br />

Agency.<br />

S/Shri.<br />

1. I.S.Verma, J.M.<br />

2.N.K.Saini, A.M.<br />

S/Shri.<br />

Sunil Kumar<br />

Yadav,J.M.<br />

2.B.R.Jain,A.M.<br />

order of the Assessing Officer<br />

or other orders appealable under<br />

section 246A of the Act, as the<br />

case may be, for the reason that<br />

the CIT(A) has not preferred to<br />

decide the assessee’s appeal<br />

pending before him”<br />

“Whether, on the facts and the<br />

circumstances of the case as<br />

well as in law, the Revenue’s<br />

ground Nos.3 to 6 be allowed or<br />

not”<br />

SP No.03/Lkw/2012<br />

“Whether, the stay earlier<br />

granted by the Tribunal can be<br />

extended till disposal of the<br />

appeal in a case where the<br />

appeal has been heard by the<br />

Tribunal and is pending with<br />

the Members for order”<br />

Sd/-<br />

J.M.<br />

“Whether, on the peculiar facts,<br />

circumstances of this case and<br />

in law, there is any justification<br />

in extending the stay of the<br />

disputed demand that already<br />

had run beyond 365 days or the<br />

application so made by the<br />

assessee is liable to be<br />

rejected”<br />

Sd/-<br />

A.M.<br />

SP No.04/Lkw/2012<br />

“Whether, under the facts and<br />

circumstances of the case, the<br />

outstanding demand can be<br />

stayed outrightly or subject to<br />

Zonal Vice-<br />

President<br />

Hon’ble<br />

President,I.T.A.T.<br />

Adjourned Sine<br />

die<br />

Hearing is<br />

awaited.<br />

5

4. ITA No.<br />

188/Lkw/2010<br />

A.Y. 2007-08<br />

Smt. Uma Pandey S/Shri.<br />

1.Sunil Kumra<br />

Yadav,J.M.<br />

2.B.R.Jain,A.M.<br />

payment of part of demand in<br />

instalments as proposed”<br />

Sd/- Sd/-<br />

J.M. A.M<br />

“Whether, under the facts and<br />

circumstances of the case, the<br />

payments received by the<br />

assessee from M/s. Amit Poly<br />

Yarn Ltd. (now known as M/s<br />

Amitech Ind. Ltd) are receipt as<br />

an advance against sales made<br />

during the course of<br />

commercial transactions and<br />

therefore provisions of section<br />

2(22)(e) of the Income-tax Act,<br />

1961 are not attracted to these<br />

payments or the aforesaid<br />

payments are purely an<br />

advance/loan made to the<br />

assessee, attracting the<br />

provisions of section 2(22)(e) of<br />

the Act<br />

“Whether, the issue of<br />

allotment of shares for Rs.10<br />

lakhs can be restored to the<br />

Assessing Officer to investigate<br />

the fact as to whether the<br />

allotment of shares was<br />

unilateral act of the company i.e<br />

M/s. Amitech Ind. Ltd. or the<br />

allotment was done at the<br />

instance of the assessee in order<br />

determine the applicability of<br />

provisions of section 2(22)(e) of<br />

the Act to the benefit accrued to<br />

the assessee on allotment of<br />

shares or addition of Rs.10<br />

lakhs can be confirmed by<br />

holding that benefit accrued to<br />

Shri.G.D.Agarwal<br />

, Hon’ble Vice-<br />

President (LZ)<br />

Hearing is<br />

awaited.<br />

6

JABALPUR<br />

BENCH<br />

1. ITA No.<br />

327/Jab/2009<br />

A25/10-2004<br />

KOLKATA<br />

BENCH<br />

ITA Nos.<br />

65/Kol/2010, &<br />

655/Kol/2011.<br />

A.Y.2006-07 2007-<br />

08<br />

PATNA BENCH<br />

(Circuit Bench,<br />

Ranchi)<br />

1 MA No.<br />

11 (Pat) / 2007<br />

arising out in<br />

IT(SS)A No.<br />

45/Pat/05) A.Y. 86-<br />

87 to 97-98<br />

Shri. Anil<br />

Jaiswal, Jabalpur<br />

M/s Shyam Steel<br />

Industries Ltd.,<br />

Kolkata.<br />

Shri. Ghasi Ram<br />

Agarwal, Ranchi<br />

S/Shri<br />

1.I.S.Verma, J.M.<br />

2.B.R.Kaushik,<br />

A.M.<br />

S/Shri<br />

1.George Mathan,<br />

J.M.<br />

2.C.D.Rao,A.M.<br />

S/Shri.<br />

1. B. R. Mittal,<br />

J.M.<br />

2. B.K. Haldar,<br />

A.M.<br />

the assessee on allotment of<br />

shares attracts provisions of<br />

section 2(22)(e) of the Act on<br />

the basis of material available<br />

on record”<br />

Sd/- Sd/-<br />

J.M. A.M<br />

“Whether on the facts and the<br />

circumstances of the case as<br />

well as in law, the CIT(A) was<br />

justified in deleting the addition<br />

made, while making assessment<br />

under section 153A read with<br />

section 143(3) of the Act on<br />

protective basis”<br />

“Whether in the facts and<br />

circumstances of the case the<br />

power subsidy received by the<br />

assessee is capital in nature or<br />

revenue in nature ”<br />

“Whether, on the facts and in<br />

the circumstances of the case,<br />

the application of the<br />

department for recall of the<br />

order of the Tribunal dt. 21 st<br />

June, 2006 passed in IT(ss)A<br />

No. 91(Pat)/05 to delete the<br />

amount of Rs.45,823/- is to be<br />

allowed as held by the learned<br />

Accountant Member or is to be<br />

rejected as held by the learned<br />

Judicial Member.”<br />

Hon’ble<br />

President,<br />

I.T.A.T.<br />

Hon’ble Vice-<br />

President<br />

Chennai/Kolkata<br />

Zone.<br />

Hon’ble Zonal<br />

Vice President<br />

(KZ)<br />

----<br />

Not yet fixed<br />

Pending for<br />

hearing.<br />

7

2 Int. Tax Appeal<br />

Nos. 06 to<br />

08/Pat/06<br />

A.Ys.1997-98 to<br />

1999-2000<br />

GUWAHATI<br />

<strong>BENCHES</strong><br />

1 ITA 47, 48 and<br />

49(Gau)/2004<br />

A.Y.1996-97, 1997-<br />

98 &<br />

1998-99<br />

M/s Coalsesce<br />

Investment (P)<br />

Ltd., Ranchi<br />

M/s Purbanchal<br />

Safety Glassess<br />

(P) Ltd.,<br />

Guwahati.<br />

S/Shri.<br />

1. B. R. Mittal,<br />

J.M.<br />

2. B.K. Haldar,<br />

A.M.<br />

S/Shri.<br />

1.Hemant<br />

Sausarkar, J.M.<br />

2.B.R.Kaushik,<br />

A.M.<br />

“Whether, in the facts and<br />

circumstances of the case, the<br />

assessee was liable under the<br />

Interest Tax Act to pay interest<br />

tax on the gross interest<br />

received on the loans and<br />

advances granted by it during<br />

the impugned assessment<br />

years.”<br />

1. “Whether, on the facts and<br />

circumstances of the case the<br />

Ld. CIT(A) was justified in<br />

deleting the additions made by<br />

the A.O. under section 69 of the<br />

Act as undisclosed investment<br />

amounting to Rs. 9,21,461/-,<br />

Rs.2,20,990 and Rs.3,66,526/-<br />

for the assessment years 1996-<br />

97, 1997-98 and 1998-99<br />

respectively on the ground that<br />

the reassessments made by the<br />

A.O. for the assessment years in<br />

question were based on the<br />

information received from<br />

Bureau of Investigation<br />

(Economic<br />

Offence)<br />

(Guwahati) and that the<br />

information was based on<br />

material and documentary<br />

evidence to substantiate the<br />

assessments”<br />

Hon’ble Zonal<br />

Vice-President<br />

Hon’ble<br />

President,<br />

I.T.A.T.<br />

Pending for<br />

hearing.<br />

Not yet fixed.<br />

2. ”Whether on the facts and<br />

in the circumstances of the case<br />

the order of the Ld.CIT(A) is<br />

required to be set aside with the<br />

direction to decide the issue<br />

8

afresh after giving proper<br />

opportunity to the assessee on<br />

the relevant information<br />

received by the A.O. on<br />

25.02.2003 from the Bureau of<br />

Investigation (Economic<br />

Offence)”<br />

2. ITA Nos. 96, 97 &<br />

98(Gau)/2002<br />

A.Y.1990-91, 1991-<br />

92, 1992-93<br />

Brooke Bond<br />

India Ltd.,<br />

Calcutta.<br />

S/Shri.<br />

1.Hemant<br />

Sausarkar, J.M.<br />

2.B.R.Kaushik,<br />

A.M.<br />

3. “Whether, on the facts and<br />

in the circumstances of the<br />

case, the Ld. Judicial Member<br />

was justified in holding that<br />

the issuance of notice u/s 148<br />

cannot hold good and,<br />

therefore, the assessment u/s<br />

143(3) r.w.s. 147 of the Act is<br />

illegal, unjustified and void or<br />

the Ld. Accountant Member<br />

was justified in holding that<br />

the reopening of assessment<br />

and subsequent assessment<br />

made by the A.O. is<br />

justified”<br />

As per the order<br />

dt.16.04.2008 of the Hon’ble<br />

President<br />

“All the three questions would<br />

be considered u/s 255(4) by the<br />

President.”<br />

1.” Whether, the learned<br />

CIT(A) has erred in law and in<br />

facts in directing the A.O. to<br />

consider the income from<br />

interest and dividend as<br />

business income for the purpose<br />

of eligible deduction u/s 32AB<br />

of the Act, in view of the<br />

decision in the case of CIT Vs.<br />

Dinjoy Tea Estate (P) Ltd.<br />

Shri.Pramod<br />

Kumar,A.M.<br />

Adjourned Sine<br />

-die<br />

9

(1997) 224 ITR 263 (Gau), 271<br />

ITR 123 (Cal), 273 ITR 470<br />

(Mad) and 224 ITR 263<br />

(Gau)”<br />

2. “Whether, this Bench of the<br />

Tribunal working under the<br />

jurisdiction of the Hon’ble<br />

Guawahati High Court can<br />

allow the claim of the assessee<br />

that income from interest and<br />

dividend is to be taken as<br />

business income for the purpose<br />

of eligible deduction u/s 32 AB<br />

of the Act in view of the<br />

decisions in the cases of (i)<br />

Britania Industries Ltd. Vs.<br />

JCIT (2004) 271 ITR 123 (Cal)<br />

and (ii) DCIT Vs.United<br />

Nilgiris Tea Estate Co.<br />

Ltd.(2005) 273 ITR 470<br />

(Mad)”<br />

3. “Whether, on the facts and<br />

circumstances of the case the<br />

claim of expenditure of<br />

Rs.94,363/- and Rs.1,26,718/-<br />

attributable to the foreign tour<br />

of Mrs. R. Sen, wife of the<br />

director, Mr. D. Sen, was not<br />

wholly and exclusively for the<br />

purpose of business”<br />

4. “Whether, in view of change<br />

of stand by the assessee<br />

regarding nature and purpose of<br />

expenditure taken before the<br />

Ld.CIT(A) for the first time the<br />

issue was required to be<br />

restored to the A.O. for fresh<br />

adjudication after enquiring into<br />

the claim of the assessee”<br />

10

3. ITA No.<br />

09/Gau/2006<br />

A.Y.2002-2003<br />

Shri. Shyam<br />

Sunder Malpani,<br />

Jorhat<br />

S/Shri.<br />

Hemant Sausarkar,<br />

J.M.<br />

B.R.Kaushik,<br />

A.M.<br />

(1) “Whether, on the basis of<br />

facts and in the circumstances<br />

of the case, the assessee is<br />

entitled to deduction u/s 80IB”<br />

(2) “Whether, in view of the<br />

decision in the case of CIT Vs<br />

Down Town Hospital Ltd. 251<br />

ITR 683 (Gau), the issue was<br />

required to be restored to the<br />

learned CIT(A) for fresh<br />

adjudication after ascertaining<br />

whether all the conditions u/s<br />

80 IB are fulfilled”<br />

Hon’ble<br />

President,<br />

I.T.A.T.<br />

Not yet fixed.<br />

4. ITA 161/Gau/2003<br />

Block period f<br />

1989-90 to 1998-99<br />

& 1999-2000.<br />

ITA 162/Gau/2004<br />

Block period 1989-<br />

90 to 1998-99 &<br />

1999-2000<br />

M/s 3R,<br />

Gauwahati.<br />

M/s Panbazar<br />

Diagnostic<br />

Centre, Guwahati.<br />

S/Shri<br />

1. Hement<br />

Sausarkar, J.M.<br />

2. B.R.Kaushik,<br />

A.M.<br />

1. “Whether in the facts and<br />

circumstances of these cases the<br />

block assessments can be<br />

considered invalid”<br />

2. “Whether, in the facts and<br />

circumstances of these cases it<br />

can be held that the A.O. did<br />

not bring on record the prima<br />

facie evidence for invoking<br />

jurisdiction and initiation of<br />

proceedings u/s 158 BD of the<br />

Act”<br />

Shri.<br />

D.K.Tyagi,J.M.<br />

------ do -------<br />

Not yet fixed<br />

CHENNAI<br />

BENCH<br />

1. 67/Mds/2012 Shri C.<br />

Srikanth,Chennai.<br />

& M/s Atlus<br />

Securities<br />

Trading (P) Ltd.<br />

S/Shri<br />

1.N.S.Saini,A.M.<br />

2.V.Durga Rao,<br />

J.M.<br />

“Whether keeping in view the<br />

findings of the CIT(A), there<br />

was any mistake apparent from<br />

the records rectifiable u/s<br />

254(2) of the Act in the order<br />

dated 10.2.2012 passed by the<br />

Tribunal wherein the Tribunal<br />

proceeded on the assumption<br />

that the facts of the case as<br />

brought out by the Assessing<br />

Dr. O. K.<br />

Narayanan, Vice<br />

President, (CZ).<br />

Fixed on<br />

18/02/2013<br />

11

BANGALORE<br />

BENCH<br />

1. MP.No<br />

41/Bang/2010<br />

(ITA 773/B/10)<br />

Shri Mahesh<br />

Hasmukh Boriya,<br />

S/Shri/Smt.<br />

1.P.Madhavi Devi,<br />

J.M.<br />

2. A.Mohan<br />

Alankamony A.M.<br />

Officer in the assessment order<br />

were undisputed facts of the case <br />

Sd/-<br />

A.M.<br />

“Whether, on the facts and in<br />

the circumstances of the case,<br />

the Miscellaneous Applications filed<br />

by the assesses do come within the<br />

purview of Section 254(2) of the<br />

Income Tax Act, 1961 or not”<br />

Sd/-<br />

J.M.<br />

1.”Whether, on the facts and in<br />

the circumstances of the case,<br />

there is any mistake apparent<br />

from record rectifiable u/s<br />

254(2) of the IT Act, when the<br />

Tribunal adjudicated the<br />

Revenue’s appeal on the sole<br />

ground of limitation in favour<br />

of the Revenue, but not remitted<br />

back the issue to CIT(A) for<br />

adjudication on merits when<br />

such an issue of<br />

remission/merits was not before<br />

the Tribunal either by a prayer<br />

submission or cross objection<br />

by the Assessee/AR other than<br />

the only argument to defend his<br />

ground on technicality”<br />

Hon’ble Vice-<br />

President (BZ)<br />

Fixed on<br />

15/03/2013<br />

2.”Whether, the inclusion of a<br />

copy of a favourable judgment<br />

to the assessee on the issue of<br />

merits in the paperbook<br />

produced before the <strong>ITAT</strong><br />

would amount to be a ground or<br />

12

CHANDIGARH<br />

BENCH<br />

1. ITA No.<br />

142/CHD/1999<br />

A.Y.97-98<br />

ITA 550, 489, 586,<br />

587 & 588/CHD/99<br />

A.Y.87-88, 90-91,<br />

98-99, 1999-2000 &<br />

2000-2001<br />

ITA No.<br />

143/CHD/1999<br />

A.Y.97-98<br />

ITA Nos. 589, 590<br />

& 591/CHD/2002<br />

A.Y. 1998-99,<br />

1999-2000,<br />

2000-2001<br />

ITA 503/CHD/2002<br />

A.Y. 1997-98<br />

Shri . R.K.Garg<br />

Smt. Sunaina<br />

Garg<br />

Shri . R.K.Garg,<br />

& Sons(HUF)<br />

S/Shri .<br />

1.M.A.Bakshi, VP<br />

2. N.K.Saini. A.M.<br />

submission enabling the<br />

assessee to invoke the<br />

rectification jurisdiction of the<br />

Tribunal, when during the<br />

course of the hearing there were<br />

no such arguments or<br />

submission on merits/remission<br />

before the Tribunal by the<br />

Assessee/AR”<br />

Per J.M.<br />

1. “Whether, on the facts and in<br />

the circumstances of this case,<br />

the guarantee commission<br />

received by the assessees is a<br />

revenue receipt or a capital<br />

receipt”<br />

2. “Whether, the decision of the<br />

Tribunal in assessee’s own case<br />

for the assessment year 88-89 to<br />

the effect that the guarantee<br />

commission is a revenue receipt<br />

is inapplicable in view the<br />

decision of the Hon’ble Madras<br />

High Court in the case of CIT v.<br />

Pondicherry Industrial<br />

Promotion Development &<br />

Investment Corporation Ltd.<br />

(supra), and the decision of<br />

Delhi High Court in the case of<br />

Suessen Textile Bearings Ltd.<br />

etc. v. Union of India etc.<br />

(supra)”<br />

Hon’ble Vice<br />

President<br />

(Chandigarh)<br />

Adjourned<br />

sine-dia<br />

3. “Whether, on the facts and in<br />

the circumstances of the case,<br />

the additional ground raised by<br />

the revenue for the assessment<br />

13

year 90-91 only deserves to be<br />

admitted and matter for all the<br />

assessment years remitted to the<br />

CIT(A) for giving an<br />

opportunity to the AO to<br />

distinguish the two High Courts<br />

cases, referred to above<br />

notwithstanding the fact that<br />

both the Members of the Bench<br />

have decided the issue relating<br />

to assessability of the guarantee<br />

commission on merits”<br />

Per A.M.<br />

1. “Whether, on the facts and in<br />

the circumstances of the case, it<br />

could be held that the guarantee<br />

commission received by the<br />

assessees against their personal<br />

assets was a capital receipt”<br />

2. “Whether, on the facts and in<br />

the circumstances of the case<br />

and also in law, the Ld. CIT(A)<br />

should have provided and<br />

opportunity of being heard to<br />

the Assessing Officer when<br />

there was a specific direction by<br />

the Tribunal to do so, before<br />

arriving at a conclusion on the<br />

basis of judgment of Hon’ble<br />

Delhi High Court in the case of<br />

Suessen Textile bearing Ltd.<br />

and others V Union of India,<br />

CC2 JJX 0082 and Hon’ble<br />

Madras High Court in the case<br />

of CIT V. Pondicherry Indl<br />

Promotion Development and<br />

Investment Corp. Ltd. (2000)<br />

245 ITR 859, that the amount<br />

14

eceived by assessees<br />

was a capital receipt.”<br />

AMRITSAR<br />

BENCH<br />

1. IT(SS)A No.<br />

14/ASR/2005.<br />

IT(SS)A<br />

No.13/ASR/2005.<br />

IT(SS)A<br />

No.12/ASR/2005<br />

Sh.Vinod Goel<br />

M/s Sidhant<br />

Deposits &<br />

Advances(P) Ltd.<br />

M/s Trimurti<br />

Deposits &<br />

Advances (P) Ltd.<br />

S/Shri<br />

1. H.S. Sidhu,<br />

J.M.<br />

2.Mehar<br />

Singh,A.M.<br />

Shri H.S.Sidhu.<br />

1. “Whether, on the facts<br />

and in the circumstances of<br />

present case, the issues in the<br />

present appeals are covered by<br />

the decision of the Hon’ble<br />

Supreme Court in the case of<br />

Manish Maheshwary Vs. ACIT<br />

(2007) 289 ITR 341 (SC) and<br />

the decision of the Hon’ble<br />

jurisdictional High Court in<br />

Income tax Appeal No.519 of<br />

2009 decided on 20-7-2010 in<br />

the case of CIT-I, Ludhiana Vs.<br />

Mridula Prop. Dhruv fabics,<br />

Ludhiana”<br />

2. “Whether, on the facts<br />

and in the circumstances of the<br />

present case, non-production of<br />

records by the revenue in spite<br />

of various opportunities given<br />

to them, benefit should go to the<br />

revenue or the asessee”<br />

3. “Whether, on the facts<br />

and in the circumstances of the<br />

present case, it is mandatory a<br />

pre-requisite that the<br />

satisfaction to be recorded in<br />

the cases of persons searched<br />

before issuance of notice under<br />

section 158 BD of the Income<br />

tax Act. 1961 to the assesse i.e.<br />

Zonal Vice<br />

President(CZ)<br />

Pending for<br />

fixation<br />

15

other person”<br />

Shri. Mehar Singh,AM.<br />

1. “Whether on the<br />

facts and on law, valid Block<br />

Assessments can be cancelled,<br />

on the ground of assumed nonproduction<br />

of record indicating<br />

recording of satisfaction u/s<br />

158BD, in a case where such<br />

satisfaction is duly evidenced by<br />

documents available in the paper<br />

book filed by the Deptt. and<br />

reproduced verbatim in the order<br />

dated 06.12.2006 passed by the<br />

Bench and subsequent M.A.dated<br />

21.01.2009, dismissed by the<br />

Bench, without even considering<br />

such satisfaction’<br />

2. “ Whether, on the facts<br />

and on law Block Assessments<br />

can be cancelled by applying<br />

the decision of jurisdictional<br />

High Court, relied upon by the<br />

assessee, which lays down the<br />

law that satisfaction under<br />

section 158BD be recorded<br />

before the conclusion of the<br />

Block Assessments under<br />

section 158BC of the Act, in the<br />

absence of vital details of dates<br />

of completion of such block<br />

assessment being determinative<br />

factor, in determining the<br />

applicability of the said<br />

decision, where the parties to<br />

the disputes failed to furnish<br />

such dates”<br />

16

JAIPUR BENCH<br />

1. ITA No.<br />

937/Jp/2011<br />

M/s. Mahaveer<br />

Exports, Jaipur.<br />

S/Shri<br />

1.R.K.Gupta, JM.<br />

2.Sanjay<br />

Arora,A.M.<br />

Shri R.K. Gupta, JM.<br />

1. “Whether, in the facts and<br />

circumstance, the addition of<br />

Rs.3,58,455/- made by one of<br />

the partners S mt.Kanta<br />

Nowlkha is liable to be deleted<br />

or to be confirmed”<br />

2. “Whether, in the facts and<br />

circumstances, the addition of<br />

Rs. 1,00,000/- each in the name<br />

of Shri Nem Chand Nowalkha<br />

and Shri Pankaj Ghiya of the<br />

assessee firm made as capital<br />

contribution is liable to be<br />

deleted or liable to be set aside<br />

to the file of the Assessing<br />

Officer”<br />

3. “Whether, in view of the<br />

decision of Hon’ble<br />

Jurisdictional High Court in<br />

case of Kewal Krishan &<br />

Partners, 18 DTR 121 (Raj.) the<br />

entire capital contribution<br />

made/contributed prior to<br />

commencencement of business<br />

in liable to be deleted or to be<br />

confirmed in part and partly to<br />

be set aside to the file of<br />

Assessing Officer ”<br />

Shri Sanjay Arora,AM.<br />

Hon’ble Vice<br />

President<br />

(Chandigarh<br />

Zone)<br />

Pending<br />

1. “Whether, section 68 of the<br />

Income-tax Act, 1961 can be<br />

invoked where the assessee fails<br />

to satisfactorily explain the<br />

nature and source of a case<br />

credit found recorded by him in<br />

his books of account for the<br />

17

elevant year, or is the Revenue<br />

also required to establish that<br />

the assessee had in existence a<br />

source of income before the<br />

date on which such cash credit<br />

was recorded, i.e., in order to<br />

treat the same as unexplained<br />

u/s. 68”<br />

2. “Whether, the addition of the<br />

impugned sums as unexplained<br />

credits u/s.68 can be deleted on<br />

the sole ground that the assessee<br />

had no source of income prior<br />

to the date on which the same<br />

were found recorded in the<br />

assessee’s books of account,<br />

notwithstanding the fact that it<br />

has completely failed to<br />

discharge the burden of<br />

satisfactorily explaining the<br />

nature and source thereof”<br />

3. “Whether, the view that a<br />

cash credit recorded in the<br />

books of account of a<br />

partnership firm ostensibly as<br />

capital contributed by a partner<br />

cannot be treated as<br />

unexplained u/s.68 in the hands<br />

of the firm even if the<br />

assesseefirm fails to<br />

satisfactorily explain the nature<br />

and source thereof, and more<br />

particularly if its fails to adduce<br />

evidence to establish that the<br />

alleged capital was actually<br />

contributed by the partner, is<br />

18

sustainable in law in view of the<br />

decision by the Hon’ble<br />

jurisdictional high court in CIT<br />

v. Kishorilal Santoshilal<br />

(1995)216 ITR 9 (Raj.)”<br />

4.1 “Whether, can capital be<br />

contributed by a partner to a<br />

partnership-firm prior to the<br />

coming into existence of the<br />

said firm In any case, whether<br />

the claim of capital contribution<br />

by way of transfer of goods on<br />

June 1,2006 can be accepted in<br />

view of the fact that the<br />

assessee-firm itself came into<br />

existence only on July<br />

11,2006”<br />

“Is the remand in the case of<br />

two cash credits of Rs. 1 lac<br />

each in the name of two<br />

partners justified under the facts<br />

and circumstances of the case,<br />

even as contemplated by the<br />

Hon,ble jurisdictional high<br />

court in the case of Rajshree<br />

Synthetics (P) Ltd. v. CIT<br />

(2002) 256 ITR 331 (Raj.)”<br />

2. ITA No.363 &<br />

326/Jp/2011<br />

A.Y.2008-09.<br />

ITA<br />

No.1123/Jp/2011<br />

A.Y.2009-10.<br />

M/s Escorts Heart<br />

Institute &<br />

Research<br />

Centre,Jaipur.<br />

Escort Heart<br />

Super Speciality<br />

Hospital<br />

Ltd.,Jaipur.<br />

S/Shri<br />

1. R.K.Gupta,<br />

JM.<br />

2. SanjayArora,<br />

AM.<br />

Shri R.K.Gupta,J.M.<br />

1. Whether in the facts and<br />

circumstances of the case, the<br />

provisions of section 194J are<br />

applicable on the payments<br />

made to blood bank ”<br />

2. Whether in the facts and<br />

circumstances of the case, the<br />

provisions of section 192 or<br />

Hon’ble Vice<br />

President (Delhi<br />

Zone)<br />

Pending<br />

19

section 194J are applicable in<br />

case of retainer doctors <br />

3. Whether in the facts and<br />

circumstances of the case, on<br />

the mark up/profits earned by<br />

Fortis Health World Ltd.<br />

(FHWL) on sale of medicines to<br />

the assessee is a commission<br />

chargeable to tax under section<br />

194H or is a sale on which<br />

provisions of section194H are<br />

not applicable<br />

4. Whether in the facts and<br />

circumstances of the case, on<br />

the mark up/profits the<br />

provisions of section 194C can<br />

be invoked by the Tribunal<br />

where neither this is a case of<br />

department nor of the assessee <br />

Shri Sanjay Arora, AM.<br />

1.1 Whether the payments to<br />

the blood banks for carrying out<br />

investigation procedures, are, in<br />

the facts and circumstances of<br />

the case, made by the assesseehospital<br />

or by its patients<br />

1.2 Whether, while deciding an<br />

issue under appeal, the tribunal<br />

required to apply its<br />

independent mind thereon,<br />

without being influenced by the<br />

decision by the first appellate<br />

authority for a subsequent year,<br />

particularly when the same was<br />

not pressed during hearing and,<br />

accordingly, the parties not<br />

heard thereon<br />

2. I am in agreement with the<br />

20

Question No. 2 as proposed by<br />

my ld. Brother, JM.<br />

3.1 Whether, can on the<br />

admitted set of facts brought on<br />

record by the parties, the<br />

inferential finding/s by the<br />

Appellate Tribunal differ from<br />

that of either party before it, or<br />

is it to necessarily match<br />

therewith Further, is not the<br />

tribunal duty bound to, in<br />

deciding an issue before it,<br />

apply the law as applicable to<br />

the facts found by it, including<br />

such inferential finding/s<br />

3.2 Whether, in the facts and<br />

circumstances of the case, the<br />

supply of medicines by Fortis<br />

Health World Ltd.(FHWL) to<br />

the assessee-company for its<br />

IPD Pharmacy, constitutes an<br />

independent business being<br />

carried on by FHWL, or is the<br />

said supply only the result of<br />

the work carried out by its<br />

relevant manpower, whose<br />

services stand already<br />

contracted to the assessee<br />

company and subject to tax<br />

deduction u/s. 194C of the Act<br />

3. ITA No.<br />

110/JP/2012<br />

Smt. Asha<br />

Mandowra,Jaipur.<br />

S/Shri<br />

1.R.K.Gupra,<br />

JM.<br />

2.Sanjai Arora,<br />

AM.<br />

Whether in the facts and<br />

circumstances of the present<br />

case, the order of Ld. CIT(A) is<br />

liable to be confirmed or liable<br />

to be restored to his file to pass<br />

a fresh order <br />

Shri<br />

G.D.Agarwal,<br />

Vice-<br />

President(DZ)<br />

Pending<br />

21

4. MA. No.<br />

11/JP/2011<br />

(A.O.of ITA No.<br />

13/JP/10)<br />

Shri Deepak<br />

Delela,Jaipur.<br />

S/Shri<br />

1.R.K.Gupta,<br />

JM.<br />

2.Sanjai Arora,<br />

AM.<br />

Whether in the facts and<br />

circumstances of the present<br />

case, the order of Tribunal in<br />

Misc.<br />

Application<br />

No.11/JP/2011 arising out of<br />

the order of the Tribunal in ITA<br />

No.13/JP/2010 relating to<br />

Assessment Year 2006-07 is<br />

liable to be allowed by recalling<br />

the order of the Tribunal or to<br />

be dismissed.<br />

Shri<br />

G.D.Agarwal,<br />

Vice-<br />

President(DZ)<br />

Pending<br />

JODHPUR<br />

BENCH<br />

1. ITA No.362(JU)/10 Smt. Supriya<br />

Kanwar, Jodhpur.<br />

S/Shri<br />

1. JoginderSingh,<br />

J.M.<br />

2. K.G.Bansal,<br />

A.M.<br />

“Whether, on the facts and<br />

circumstances of the case,<br />

solitary transaction of purchase<br />

and sale of the same<br />

agricultural land with standing<br />

crops situated beyond the<br />

prescribed municipal limits,<br />

amounts to adventure in the<br />

nature of trade”<br />

Sd/-<br />

(Joginder Singh)<br />

J.M.<br />

“Whether, on the facts and in<br />

the circumstances of the case<br />

and sale of five pieces of<br />

agricultural land with standing<br />

crop, by way of separate<br />

conveyance deeds, beyond the<br />

prescribed distance from any<br />

municipal council, amount to<br />

transactions on capital account<br />

or adventure in the nature of<br />

trade” Sd/-<br />

(K.G.Bansal)<br />

A.M.<br />

Hon’ble Vice-<br />

President<br />

(Mumbai Zone)<br />

Adjourned<br />

sine-dia<br />

22

RAJKOT BENCH<br />

1. ITA<br />

No.921/Rjt/2010<br />

2. ITA No.<br />

342/Rjt/2012<br />

Atul Auto<br />

Ltd.Rajkot.<br />

Shri Shirish M.<br />

Ravani,<br />

Jamnagar.<br />

S/Shri<br />

1.T.K.Sharma,<br />

J.M.<br />

2.D.K.Srivastava,<br />

A.M.<br />

S/Shri<br />

1.T.K.Sharma, JM.<br />

2.D.K.Srivastava,<br />

AM.<br />

“Whether on the facts and<br />

circumstances of the case, the<br />

ld.CIT(A) is justified in directing<br />

the AO to grant the exemption<br />

of Rs.22,96,155/- u/s.10(34) of<br />

the I.T.Act, 1961 in respect of<br />

dividend received by the<br />

assessee in respect of shares<br />

held in subsidiary company and<br />

reflected in the balance-sheet<br />

under the head investments.<br />

Sd/-<br />

(T.K.Sharma, JM)<br />

“whether unreported judgment,<br />

which was never cited by the<br />

parties not otherwise brought to<br />

the notice of the Bench not to<br />

the notice of the Member<br />

proposing the order, can be<br />

used by another Member for<br />

passing dissenting order without<br />

giving any opportunity in this<br />

behalf to the parties<br />

Sd/-<br />

(D.K.Srivastava, AM)<br />

Whether on the facts and<br />

circumstances of the case, the ld.<br />

CIT(A) is justified in deleting the<br />

diaallowance of interest of Rs.<br />

3,22,091/- which was paid on<br />

loans taken from family members<br />

u/s 40A(2) of the Income Tax Act,<br />

1961”<br />

Hon’ble Vice<br />

President,<br />

(Ahmedabad<br />

Zone)<br />

Hon’ble Vice<br />

President,<br />

(Ahmedabad<br />

Zone)<br />

3. MA. Nos. 61 to<br />

66/Rjt/2010(A.O. of<br />

ITA Nos. 637 to<br />

639 & 707 to<br />

709/Rjt/2010)<br />

Shambhubhai<br />

Mahadev Ahir,<br />

Gandhidham.<br />

S/Shri<br />

1.T.K.Sharma, JM.<br />

2.D.K.Srivastava,<br />

AM.<br />

“Whether on the facts and<br />

circumstances of the case, all the<br />

six Miscellaneous Appelications<br />

filed by the Revenue should be<br />

dismissed or be allowed”<br />

Hon’ble Vice<br />

President,<br />

(Ahmedabad<br />

Zone)<br />

23

<strong>INCOME</strong> <strong>TAX</strong> <strong>APPELLATE</strong> <strong>TRIBUNAL</strong>, <strong>MUMBAI</strong> <strong>BENCHES</strong>, <strong>MUMBAI</strong><br />

LIST OF THIRD MEMBER CASES HEARD AND PENDING FOR ORDERS AS ON 06.02.2013.<br />

Sr.<br />

No<br />

Appeal No.<br />

GUWAHATI BENCH<br />

Name of the<br />

Assessee<br />

Bench Points involved To Whom<br />

assigned<br />

Remarks<br />

1.<br />

2.<br />

3.<br />

ITA No. 25/Gau/2005<br />

A.Y.1996-97<br />

ITA No. 20/Gau/2005<br />

A.Y.2001-2002<br />

C.O.No.02/Gau/2005<br />

ITA No.165/Gau/2004<br />

A.Y.2001-2002<br />

M/s Baid<br />

Commercial<br />

Enterprises Ltd.,<br />

Guwahati.<br />

M/s Shiva Sakti<br />

Floor Mills (P)<br />

Ltd., Tinsukia<br />

M/s Virgo<br />

Cements Ltd.,<br />

Gauwahati.<br />

S/Shri.<br />

1.Hemant Sausarkar,<br />

J.M.<br />

2.B.R.Kaushik, A.M.<br />

“Whether, on the facts and in the<br />

circumstances of the case the transport<br />

subsidy is to be treated as capital in nature in<br />

view of decisions in the following cases-<br />

i) CIT Vs Assam Asbestos Ltd. 215 ITR 847<br />

(Gau)<br />

ii) Sahney Steel & Press Works Ltd. And<br />

Others Vs CIT 228 ITR 253 (SC)<br />

iii) DCIT Vs Assam Asbestos Ltd. (2003)<br />

263 ITR 357 (Gau)<br />

iv) CIT Vs Rajaram Maize Products Ltd. 251<br />

ITR 427(SC) and<br />

v) Sdarda Plywood Industries Ltd. Vs.CIT<br />

238 ITR 354(Cal).<br />

Shri.Pramod<br />

Kumar,A.M.<br />

Heard on<br />

04.04.2012<br />

Heard on<br />

04.04.2012<br />

Heard on<br />

03.04.2012<br />

KOLKATA BENCH<br />

1. ITA 2004/Kol/09,<br />

1668, 1669/Kol/2011<br />

M/s. UAL<br />

Industries Ltd.,<br />

Kolkata<br />

S/Shri<br />

1.Pramod Kumar, A.M.<br />

2.George Mathan, J.M.<br />

Whether or not in the facts and<br />

circumstances of the case ‘Fly Ash Handling<br />

System’ is eligible to be treated as ‘Air<br />

Pollution Control Equipment’ for the purpose<br />

of granting depreciation at 100%”<br />

Dr.<br />

O.K.Narayanm<br />

Zonal Vice<br />

President<br />

Heard on<br />

17.12.2012<br />

24

COCHIN BENCH<br />

1. ITA 720/Coch/2010<br />

A.Y.2005-06 &<br />

ITA 721/Coch/2010<br />

A.Y.2006-07<br />

Al-Ameen<br />

Educational Trust<br />

S/Shri.<br />

1.N.Vijaykumaran,<br />

J.M.<br />

2.Sanjay Arora,A.M.<br />

“Whether levy of penalty under section<br />

271D is justified”<br />

Sd/-<br />

J.M.<br />

1”Whether, on facts, and in the<br />

circumstances of the case, penalty u/s.271D<br />

to the extent of Rs.79.40 lacs and Rs.15.25<br />

lacs for the two consecutive years, is liable to<br />

be levied, or not<br />

Hon’ble Vice<br />

President(BZ).<br />

Heard on<br />

14.12.2012<br />

2.”Whether, on facts and in the<br />

circumstances of the case, penalty levied<br />

u/s.271D to the extent of Rs.49.40 lacs (for<br />

A.Y. 2005-06), is liable to be deleted, or<br />

restored back to the file of the assessing<br />

authority for the necessary factual<br />

determi-nation,where upon only the law can<br />

be applied<br />

Sd/-<br />

A.M<br />

<strong>MUMBAI</strong> BENCH<br />

1. ITA 210/Kol/2008<br />

A.Y.2004-05<br />

M/s. Shaw<br />

Wallace Financial<br />

Services Ltd.<br />

S/Shri.<br />

1.R.K.Gupta,J.M.<br />

2.Rajendra Singh,A.M.<br />

“Whether, on the facts and in the<br />

circumstances of the case, the assessment in<br />

the case of assessee for A.Y. 2004-05 can be<br />

said to have been made on a non existent<br />

company and if so, whether the same can be<br />

quashed”<br />

Hon’ble Vice-<br />

President, (MZ)<br />

Heard on<br />

08.01.2013<br />

25

AGRA BENCH<br />

1. ITA No.<br />

92/Agr/2008 &<br />

93/Agr/2008<br />

A.Y.1998-99<br />

J.M.Agarwal<br />

Tabacco Co. &<br />

J.M.Agarwal<br />

Tabacco Co. (P)<br />

Ltd.<br />

S/Shri.<br />

1.Hari Om Maratha,<br />

J.M.<br />

2. Sanjay Arora,A.M.<br />

1. “Whether, in the given facts and<br />

circumstances of the case when disturbed.<br />

The AO has not the Trading results and the<br />

assessee has explained certain incriminating<br />

Evidences found by the Central Excise<br />

Department, particularly when the purchases<br />

and sales are found fully vouched and<br />

verifiable, the entire Investment can be<br />

treated as excess sale and be added to the<br />

total income of the assessee or not”<br />

2. “Whether, in a case of a Company the 3<br />

telephone and car running expenses can be<br />

disallowed and added in the hands of the<br />

company on account of personal user of<br />

telephone/car by its director (s) or not<br />

3. “Whether, when the assessee’s trading<br />

account has been accepted in toto, and the<br />

GRs were explained with reference to books<br />

of accounts, the non-production of copies of<br />

GRs can lead to addition, as has been done in<br />

this case or not”<br />

Shri.G.D.Agarw<br />

al, Hon’ble<br />

Vice-President<br />

(DZ)<br />

Heard on<br />

14/01/2013.<br />

26