here - City of Reedley

here - City of Reedley

here - City of Reedley

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

VEHICLE IMPACT FEE (VIF) FUND 055<br />

Adopted in April 2013, by resolution 2013-028, authorized an annual refuse vehicle impact fee (VIF)<br />

for up to $285,000 annually to be utilized solely for the maintenance, repair, and related costs <strong>of</strong><br />

<strong>City</strong> streets caused by the impacts <strong>of</strong> the <strong>City</strong> refuse trucks. The amount available for the VIF for a<br />

given fiscal year shall be determined on an annual basis by the <strong>City</strong> Manager during the <strong>City</strong> budget<br />

build process and subject to appropriation approval by the <strong>City</strong> Council in the Adopted Budget.<br />

EQUIPMENT SHOP FUND 060<br />

Fund 060 is an internal service fund for the Equipment Shop. The budget document reflects<br />

working capital for the fund balance. This is an internal service fund, thus its primary source <strong>of</strong><br />

revenue comes from “fees” that are paid by all the other <strong>City</strong> funds that utilize the common<br />

expenses charged to the Equipment Shop, like gasoline, vehicular repairs, tires, etc.. As the total<br />

expenditures for the equipment shop rise, so do the individual “charges” to the various departments,<br />

like police, fire, streets, etc..<br />

COPS FUND 075<br />

Fund 075 was created by Assembly Bill 3229 and is authorized as part <strong>of</strong> the annual State budget<br />

allocation. Funds are allocated by population and are restricted for front line law enforcement use,<br />

which can include personnel services. Funding is subject to the State’s fiscal condition and passage<br />

<strong>of</strong> their budget.<br />

DEVELOPMENT IMPACT FEES FUND 100 THROUGH FUND 111<br />

Funds 100 through 111 represent the current Development Impact Fees. These fees are assessed<br />

and collected at the building permit level and are restricted for their respective use. Fund 100 is for<br />

Street and Thoroughfare Usage; Fund 101 is for Traffic Control Facilities; Fund 102 is for Law<br />

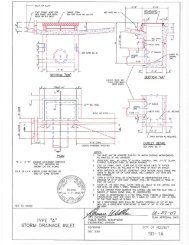

Enforcement Facilities; Fund 103 is for Fire Facilities; Fund 104 is Storm Drainage Facilities; Fund<br />

105 is for Wastewater Treatment Plant Facilities; Fund 106 is for Wastewater Collection Facilities;<br />

Fund 107 is for Water Supply and Holding Facilities; Fund 108 is for Parks and Recreational<br />

Facilities; Fund 109 is for Open Space Acquisition and Development; Fund 110 is for General<br />

Facilities; and Fund 111 is for Water Distribution Facilities.<br />

REDEVELOPMENT<br />

On February 1, 2012, all redevelopment agencies in California were dissolved and the process for<br />

unwinding their financial affairs began. Given the scope <strong>of</strong> the agencies’ funds, assets, and financial<br />

obligations, the unwinding process will take some time. Prior to dissolution, redevelopment<br />

agencies received tax increment in property tax revenues annually and had outstanding bonds,<br />

contracts, and loans. Over time, as these obligations are paid <strong>of</strong>f, schools and other local agencies<br />

will receive the property tax revenues formally distributed to RDAs.<br />

Funds 086 through 097 reflected the active financial information for the <strong>Reedley</strong> Redevelopment<br />

Agency. On February 1, 2012 all assets and liabilities were transferred to the successor agency, <strong>City</strong><br />

<strong>of</strong> <strong>Reedley</strong>, under the fund structure <strong>of</strong> 895, 896 and 897. Fund 895 accounts for bond proceeds<br />

from the February 2011 Tax Allocation Bond Issue in the amount <strong>of</strong> $8,825,000 uninsured with an<br />

A- rating. This issue defeased existing bonds and provided for unused bond proceeds <strong>of</strong><br />

approximately $5 million to be used for capital projects. Fund 896 accounts for all <strong>of</strong> the successor<br />

housing activities and Fund 897 is the retirement fund which handles the eventual close out <strong>of</strong><br />

operations for all non-housing redevelopment activities.<br />

Page 212<br />

CITY OF REEDLEY<br />

ADOPTED BUDGET 2013-2014