here - City of Reedley

here - City of Reedley

here - City of Reedley

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MEASURE G PUBLIC SAFETY SALES TAX<br />

The Public Safety Sales Tax, (Measure G) was passed by the voting public in February, 2008.<br />

Upon passage, Ordinance 2007-05, as adopted by the <strong>City</strong> Council in November, 2007, added<br />

Chapter 11 to Title 5 <strong>of</strong> the <strong>Reedley</strong> Municipal Code. The Ordinance imposes a transactions and<br />

use tax <strong>of</strong> which ½ <strong>of</strong> 1% is collected from gross sales receipts and collected for permissible<br />

uses as identified in Title 5, Chapter 11, Section 2 <strong>of</strong> the aforementioned municipal code. Of<br />

these tax revenues collected, 70% shall be used for Police services and 30% shall be used for<br />

Fire services.<br />

Permissible uses for Police services are defined in the Ordinance as:<br />

(a) Police patrol services<br />

(b) Police traffic control services<br />

(c) Gang enforcement, school resource services, and bicycle patrol<br />

(d) Police support services, including facilities and equipment and the financing t<strong>here</strong><strong>of</strong><br />

(e) Competitive salary, retention and benefit compensation for Police personnel<br />

(f) Funding new Police department personnel<br />

Permissible uses for Fire services are defined in the Ordinance as:<br />

(a) Construction and relocation (including, but not limited to, land acquisition, facilities<br />

design, and the use <strong>of</strong> temporary facilities) <strong>of</strong> fire stations and the financing t<strong>here</strong><strong>of</strong><br />

(b) Purchase <strong>of</strong> specialized equipment for Fire Department<br />

(c) Competitive salary, retention and benefit compensation for Fire personnel<br />

(d) Comprehensive Fire Prevention Program<br />

(e) Funding new Fire Department personnel<br />

Approval for FY 2013-14<br />

The Measure G Oversight Committee met on May 22, 2013 to review and approve the Public<br />

Safety Sales Tax Expenditure Plan for FY 2013-14, which was then incorporated into the FY 2013-<br />

14 Proposed Budget, and then ultimately into the Adopted Budget.<br />

Financial Overview<br />

FY 2012-13 Public Safety Sales Tax (PSST) receipts are expected to come in 11.43% above FY<br />

2011-12 receipts. The primary reason why the percentage is at this level is that PSST is usually<br />

collected on large purchases <strong>Reedley</strong> residents make outside <strong>of</strong> city limits, such as autos or<br />

agricultural equipment; and these industries are currently performing well. The FY 2013-14<br />

Adopted Budget assumes a 1.50% target growth rate over the FY 2012-13 year end estimates for<br />

PSST. Although the revenue stream has performed well above this target this year, Staff did not<br />

feel confident in assuming that growth rate would continue at its current pace.<br />

The PSST fund balance was $660,010 as <strong>of</strong> June 30, 2012, and is projected to be $805,302 as <strong>of</strong><br />

June 30, 2013 due in large part to the year over year increase to PSST revenue. The PSST fund<br />

has a projected fund balance <strong>of</strong> June 30, 2014 <strong>of</strong> $661,588.<br />

Page 146<br />

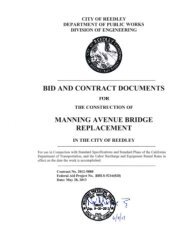

CITY OF REEDLEY<br />

ADOPTED BUDGET 2013-2014