Managing Synthetic CDO Tranches using Base Correlations

Managing Synthetic CDO Tranches using Base Correlations Managing Synthetic CDO Tranches using Base Correlations

Consider linear interpolation iTraxx 18-Sep-2007 1 0.9 0.8 0.7 1200 1000 800 Fair spreads of tranchlets Base Correlation 0.6 0.5 0.4 Fair spread (bp) 600 400 Arbitrage Negative spreads 0.3 0.2 200 0.1 0 0 0 0.05 0.1 0.15 0.2 0.25 0.3 0.35 Strike 0 0.05 0.1 0.15 0.2 0.25 0.3 0.35 Strike Increase X, fair spread decreases Low gradient, fair spread increases 34

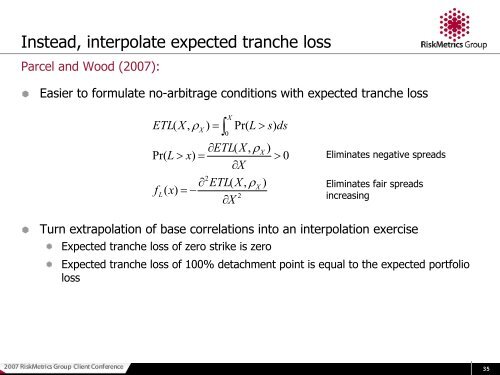

Instead, interpolate expected tranche loss Parcel and Wood (2007): Easier to formulate no-arbitrage conditions with expected tranche loss ETL( X, ρX ) = ∫ Pr( L > s) ds 0 ∂ETL( X, ρX ) Pr( L > x) = > 0 ∂X 2 ∂ ETL( X, ρX ) fL( x) = − 2 ∂X X Eliminates negative spreads Eliminates fair spreads increasing Turn extrapolation of base correlations into an interpolation exercise Expected tranche loss of zero strike is zero Expected tranche loss of 100% detachment point is equal to the expected portfolio loss 35

- Page 2 and 3: Managing synthetic CDO tranches usi

- Page 4 and 5: Synthetic CDO mechanics losses Pro

- Page 6 and 7: Protection buyer can hedge by selli

- Page 8 and 9: Agenda Synthetic CDO mechanics Ba

- Page 10 and 11: Gaussian Copula Model (con’t) S

- Page 12 and 13: Base correlation framework Each tr

- Page 14 and 15: Stress tests Base correlations c

- Page 16 and 17: Subprime crisis has spread to … L

- Page 18 and 19: Stress Test Example for CDX.NA.IG S

- Page 20 and 21: So which stress test makes sense I

- Page 22 and 23: Agenda Synthetic CDO mechanics Ba

- Page 24 and 25: Mapping base correlations between b

- Page 26 and 27: Base correlation mapping methods Fi

- Page 28 and 29: Method 4: Expected Tranche Loss Pro

- Page 30 and 31: Comparison of mappings for iTraxx S

- Page 32 and 33: Heterogeneous portfolios Can we fin

- Page 36: Summary Base correlation are usef

Instead, interpolate expected tranche loss<br />

Parcel and Wood (2007):<br />

<br />

Easier to formulate no-arbitrage conditions with expected tranche loss<br />

ETL(<br />

X,<br />

ρX<br />

) = ∫ Pr( L > s)<br />

ds<br />

0<br />

∂ETL(<br />

X,<br />

ρX<br />

)<br />

Pr( L > x)<br />

=<br />

> 0<br />

∂X<br />

2<br />

∂ ETL(<br />

X,<br />

ρX<br />

)<br />

fL(<br />

x)<br />

= −<br />

2<br />

∂X<br />

X<br />

Eliminates negative spreads<br />

Eliminates fair spreads<br />

increasing<br />

<br />

Turn extrapolation of base correlations into an interpolation exercise<br />

Expected tranche loss of zero strike is zero<br />

Expected tranche loss of 100% detachment point is equal to the expected portfolio<br />

loss<br />

35