Managing Synthetic CDO Tranches using Base Correlations

Managing Synthetic CDO Tranches using Base Correlations

Managing Synthetic CDO Tranches using Base Correlations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

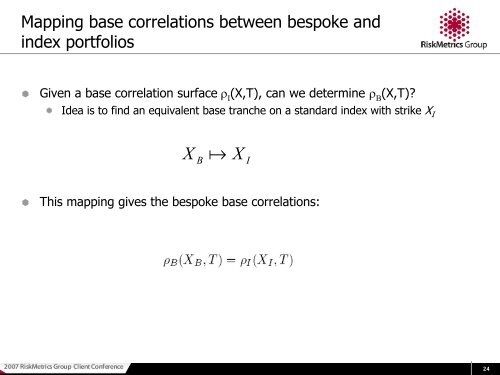

Mapping base correlations between bespoke and<br />

index portfolios<br />

<br />

Given a base correlation surface ρ Ι<br />

(X,T), can we determine ρ Β<br />

(X,T)<br />

Idea is to find an equivalent base tranche on a standard index with strike X I<br />

X<br />

a<br />

B<br />

X I<br />

<br />

This mapping gives the bespoke base correlations:<br />

24