IN THE INCOME TAX APPELLATE TRIBUNAL MUMBAI âDâ BENCH ...

IN THE INCOME TAX APPELLATE TRIBUNAL MUMBAI âDâ BENCH ... IN THE INCOME TAX APPELLATE TRIBUNAL MUMBAI âDâ BENCH ...

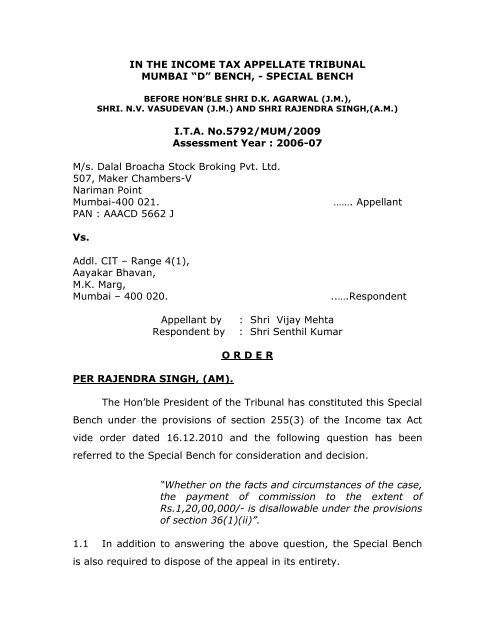

IN THE INCOME TAX APPELLATE TRIBUNAL MUMBAI “D” BENCH, - SPECIAL BENCH BEFORE HON’BLE SHRI D.K. AGARWAL (J.M.), SHRI. N.V. VASUDEVAN (J.M.) AND SHRI RAJENDRA SINGH,(A.M.) I.T.A. No.5792/MUM/2009 Assessment Year : 2006-07 M/s. Dalal Broacha Stock Broking Pvt. Ltd. 507, Maker Chambers-V Nariman Point Mumbai-400 021. PAN : AAACD 5662 J ……. Appellant Vs. Addl. CIT – Range 4(1), Aayakar Bhavan, M.K. Marg, Mumbai – 400 020. Appellant by Respondent by : Shri Vijay Mehta : Shri Senthil Kumar ..….Respondent O R D E R PER RAJENDRA SINGH, (AM). The Hon’ble President of the Tribunal has constituted this Special Bench under the provisions of section 255(3) of the Income tax Act vide order dated 16.12.2010 and the following question has been referred to the Special Bench for consideration and decision. “Whether on the facts and circumstances of the case, the payment of commission to the extent of Rs.1,20,00,000/- is disallowable under the provisions of section 36(1)(ii)”. 1.1 In addition to answering the above question, the Special Bench is also required to dispose of the appeal in its entirety.

- Page 2 and 3: 2 5792/Mum/09 Assessment Year:06-07

- Page 4 and 5: 4 5792/Mum/09 Assessment Year:06-07

- Page 6 and 7: 6 5792/Mum/09 Assessment Year:06-07

- Page 8 and 9: 8 5792/Mum/09 Assessment Year:06-07

- Page 10 and 11: 10 5792/Mum/09 Assessment Year:06-0

- Page 12 and 13: 12 5792/Mum/09 Assessment Year:06-0

- Page 14 and 15: 14 5792/Mum/09 Assessment Year:06-0

- Page 16 and 17: 16 5792/Mum/09 Assessment Year:06-0

- Page 18 and 19: 18 5792/Mum/09 Assessment Year:06-0

- Page 20 and 21: 20 5792/Mum/09 Assessment Year:06-0

- Page 22 and 23: 22 5792/Mum/09 Assessment Year:06-0

- Page 24 and 25: 24 5792/Mum/09 Assessment Year:06-0

- Page 26 and 27: 26 5792/Mum/09 Assessment Year:06-0

- Page 28 and 29: 28 5792/Mum/09 Assessment Year:06-0

- Page 30 and 31: 30 5792/Mum/09 Assessment Year:06-0

- Page 32 and 33: 32 5792/Mum/09 Assessment Year:06-0

<strong>IN</strong> <strong>THE</strong> <strong>IN</strong>COME <strong>TAX</strong> <strong>APPELLATE</strong> <strong>TRIBUNAL</strong><br />

<strong>MUMBAI</strong> “D” <strong>BENCH</strong>, - SPECIAL <strong>BENCH</strong><br />

BEFORE HON’BLE SHRI D.K. AGARWAL (J.M.),<br />

SHRI. N.V. VASUDEVAN (J.M.) AND SHRI RAJENDRA S<strong>IN</strong>GH,(A.M.)<br />

I.T.A. No.5792/MUM/2009<br />

Assessment Year : 2006-07<br />

M/s. Dalal Broacha Stock Broking Pvt. Ltd.<br />

507, Maker Chambers-V<br />

Nariman Point<br />

Mumbai-400 021.<br />

PAN : AAACD 5662 J<br />

……. Appellant<br />

Vs.<br />

Addl. CIT – Range 4(1),<br />

Aayakar Bhavan,<br />

M.K. Marg,<br />

Mumbai – 400 020.<br />

Appellant by<br />

Respondent by<br />

: Shri Vijay Mehta<br />

: Shri Senthil Kumar<br />

..….Respondent<br />

O R D E R<br />

PER RAJENDRA S<strong>IN</strong>GH, (AM).<br />

The Hon’ble President of the Tribunal has constituted this Special<br />

Bench under the provisions of section 255(3) of the Income tax Act<br />

vide order dated 16.12.2010 and the following question has been<br />

referred to the Special Bench for consideration and decision.<br />

“Whether on the facts and circumstances of the case,<br />

the payment of commission to the extent of<br />

Rs.1,20,00,000/- is disallowable under the provisions<br />

of section 36(1)(ii)”.<br />

1.1 In addition to answering the above question, the Special Bench<br />

is also required to dispose of the appeal in its entirety.

2<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

2. We first deal with the specific question referred to the Special<br />

Bench which is regarding allowability of claim of deduction on account<br />

of payment of commission to the tune of Rs.1.20 crores to the three<br />

employee directors under provisions of section 36(1)(ii). The clause<br />

(ii) of sub section (1) of section 36 of the income tax Act, 1961 allows<br />

deduction of any sum paid to an employee as bonus or commission for<br />

services rendered, where such sum would not have been payable to<br />

him as profits or dividend if it had not been paid as bonus or<br />

commission.<br />

2.1 The facts of case, in brief, are that the assessee company during<br />

the relevant year had paid commission to the tune of Rs.40.00 lacs<br />

each to the three working directors. The three employee directors<br />

were the only shareholders of the company and owned the entire<br />

share capital of Rs.6.5 crores of the company. The details of salary,<br />

commission and the share holding of the three directors were as under<br />

:-<br />

S.No. Name of director Nature of<br />

Payment<br />

Amount(Rs.)<br />

Share holding<br />

1. Mr. P.K. M. Dalal<br />

2. Mr. Nilesh P. Dalal<br />

3. Mr.Vipul P. Dalal<br />

Salary- 6,00,000<br />

Commission- 40,00,000<br />

Salary 12,00,000<br />

Commission 40,00,000<br />

Salary 12,00,000<br />

Commission 40,00,000<br />

50%<br />

25%<br />

25%<br />

2.2 During the assessment proceedings, the Assessing Officer (AO)<br />

after examining the legal provisions regarding the allowability of bonus<br />

or commission observed that, in case of the assessee, provisions of

3<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

section 36(1)(ii) which specifically dealt with allowability of<br />

expenditure on account of bonus or commission were applicable and<br />

not the provisions of section 40A(2)(b) which provides for disallowance<br />

of expenditure incurred on account of related persons to the extent<br />

found excessive compared to the market value. He, therefore, asked<br />

the assessee to explain as to why the claim of the expenditure on<br />

account of commission should not be disallowed as the assessee had<br />

earned substantial profits and the said amount could have been<br />

distributed as dividend. The assessee submitted that the payment of<br />

commission was not in lieu of profit or dividend as payment had been<br />

made to the directors for the hard work they had put in improving the<br />

profits of the company. The assessee had not paid any commission<br />

during Assessment Years 2001-02 to 2003-04 and commission was<br />

paid in the Assessment Year 2000-01 and again from Assessment Year<br />

2004-05 onwards when the efforts made by the directors had resulted<br />

into substantial profits. It was also submitted that the assessee<br />

company was not bound to declare dividend compulsorily and<br />

therefore, the directors / share holders could not force the assessee to<br />

declare dividend. The assessee was not declaring dividend because it<br />

wanted to improve its net worth to attract FIIs. It was also pointed<br />

out that the three directors were holding shares at 50%, 25% and<br />

25% and therefore in case the amount of commission had been<br />

distributed as dividend, they would not have got the same amount as<br />

dividend. Therefore it could not be said that the commission paid was<br />

in lieu of dividend.<br />

2.3 The assessee further argued that while applying the provisions<br />

of 36(1)(ii), it was required to be seen whether the remuneration paid<br />

to directors was more than the amount payable to other persons in

4<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

open market having similar experience in the same business. It was<br />

pointed out that all three directors had vast experience. It was also<br />

pointed out that in assessee’s own case, Mr. Milind Karmakar, C.A.<br />

who was head of the research department had been paid remuneration<br />

of Rs.46,61,860/-. Therefore, the remuneration including commission<br />

paid to the three directors having manifold experience in the business<br />

compared to Mr. Milind Karmakar could not be said to be excessive<br />

compared to market vale of services. Further the assessee had paid<br />

the same amount of commission for Assessment Years 2004-05 to<br />

2006-07 when the profits had increased substantially in subsequent<br />

years which also showed that the assessee wanted to increase the net<br />

worth for improving the business. The assessee also pointed out that<br />

in Assessment Year 2004-05, 50% of the commission had been<br />

disallowed by the Assessing Officer under the provisions of section<br />

40A(2)(b) holding the same as excessive but the same was deleted by<br />

the CIT(A). In Assessment Year 2005-06 the Assessing Officer had<br />

disallowed the claim under provisions of section 36(1)(ii) which was<br />

also not upheld in appeal.<br />

2.4 The Assessing Officer, however, did not accept the contentions<br />

raised by the assessee. It was observed by him that in the profit &<br />

loss account of the relevant year, there was net profit of<br />

Rs.15.55(before tax) crores after claiming deduction on account of<br />

commission of Rs.1.20 crores, which had been carried forward in the<br />

balance sheet as reserve and surplus. The directors however did not<br />

declare any dividend and no reasons were given for not declaring the<br />

dividend. It was thus, clear that the directors had distributed dividend<br />

in the form of commission and therefore, payment was covered by the<br />

exceptions provided in section 36(1)(ii).<br />

The Assessing Officer also

5<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

observed that the provisions of section 36(1)(ii) were intended to<br />

prevent an escape from taxation by describing a payment as bonus or<br />

commission when, in fact ordinarily it should have reached the<br />

shareholders as profit or dividend as held by the Hon’ble High Court of<br />

Bombay in Loyal Motor Services Company Ltd. vs. CIT (14 ITR 647).<br />

It was pointed out, that had the assessee paid dividend, the income of<br />

the company would have gone up by Rs.1.20 crores on which tax at<br />

the rate of 30% would have been payable which came to Rs.36.00<br />

lacs. In addition, the company would also have to pay dividend<br />

distribution tax at the rate of 12.5% on the entire amount of dividend<br />

which came to Rs.15.00 lacs. Thus total outgoings in the form of tax<br />

in case assessee had paid dividend and not commission was Rs.51.00<br />

lacs. On the contrary, by showing payment as commission, the<br />

directors would have paid tax of only Rs.36.00 lacs on the commission<br />

income. Thus there was tax avoidance of Rs.15.00 lacs. The<br />

Assessing Officer also pointed out that, in this case, the three<br />

employee directors were the only share holders and they were also the<br />

decision making authorities. Therefore, it was clear that commission<br />

payment was a device for tax evasion. As regards the argument of the<br />

assessee that the commission had been paid for services rendered<br />

which was comparable to the market rate, the Assessing Officer<br />

observed that, even if the commission had been paid for any extra<br />

services rendered, the assessee could not escape the provisions of<br />

section 36(1)(ii) in case it was found that commission payment was in<br />

lieu of dividend. The Assessing Officer accordingly held that the<br />

payment of commission by the assessee to the directors was in lieu of<br />

dividend and was not eligible for deduction u/s.36(1)(ii). He therefore,<br />

disallowed the sum and added the same to the total income.

6<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

3. In appeal the assessee reiterated the same submissions before<br />

the CIT(A) who was also not satisfied with the arguments advanced<br />

and confirmed the disallowance made by the Assessing Officer. The<br />

assessee had also raised an additional ground before the CIT(A) that<br />

commission payment should be allowed u/s.37(1) of the Income tax<br />

Act. The CIT(A) however rejected the additional ground also after<br />

observing that there being specific provision under section 36(1)(ii)<br />

regarding allowability of bonus or commission, the claim will be<br />

governed by the said section and not by the provisions of sec.37(1).<br />

4. Before us, the ld. AR for the assessee argued that the intention<br />

of the legislature was always to make allowances for bonafide<br />

expenditure incurred on account of payment of bonus or commission.<br />

However, since the Hon’ble Madras High Court in case of R.E.<br />

Mahomed Kassim Rowther of R.E. Mahomed Kassim Rowther & Co. (2<br />

ITC 482) had held that such expenditure calculated on the basis of<br />

profits was not allowable as profit could be computed only after<br />

deducting all expenditure. Thereafter section 10(2) of the Income tax<br />

Act, 1922 was amended and clause viii(a) was inserted in section<br />

10(2) making provision for allowability of expenditure on account of<br />

bonus or commission. The said clause viii(a), was later renumbered as<br />

clause (x) of section 10(2) which corresponds to the present section<br />

36(1)(ii) of the Income tax Act, 1961. It was also argued that section<br />

36(1)(ii) was an enabling provision to allow expenditure on account of<br />

bonus or commission. It was submitted that head of expenditure was<br />

different from nature of expenditure. It was argued that not all<br />

expenditure incurred under the head ‘bonus or commission’ would be<br />

covered by the section 36(1)(ii). It was submitted that the said

7<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

section covered only commission paid to non-share holder employees<br />

as there was no possibility of paying dividend to such employees.<br />

Therefore, it was further argued that commission paid to share holder<br />

employees will be covered under the provisions of sec.37(1) under<br />

which expenditure incurred wholly and exclusively for the purpose of<br />

business is allowable. It was submitted that there was no dispute in<br />

the present case that the expenditure incurred was wholly and<br />

exclusively for the purpose of business and, therefore, the same<br />

should be allowed u/s.37(1).<br />

4.1 The ld. AR for the assessee also submitted that even if the<br />

expenditure was covered by the provisions of section 36(1)(ii), the<br />

said provisions could be applied only when the commission if not paid,<br />

would not have been payable as dividend. It was pointed out that the<br />

payment of bonus under the Companies Act was discretionary, to be<br />

decided by the management of the company. Therefore, it could not<br />

be said that the commission if it had not been paid, the same would<br />

have been payable as dividend. It was also submitted that the plain<br />

reading of the provisions made it clear that for disallowance of the<br />

claim of commission, the same amount should have been payable as<br />

dividend as held by Hon’ble High Court of Bombay in the case of Loyal<br />

Motor Services Company Ltd. (supra). In this case, it was pointed out,<br />

that the commission had been paid amounting to Rs.40.00 lacs in each<br />

case. But in case, the entire commission of Rs.1.20 crores had been<br />

paid as dividend, the share of each director in the dividend would not<br />

have been the same, as the shareholdings of the directors were not<br />

the same. Therefore, it was argued that the expenditure incurred by<br />

the assessee was not hit by the provisions of section 36(1)(ii). As<br />

regards the finding of the Assessing Officer that the claim of deduction

8<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

on account of commission was for tax avoidance, the ld. AR submitted<br />

that the tax rate applicable in case of directors was 33% whereas the<br />

rate in the case of company was 35.75%. The dividend distribution<br />

tax, it was submitted, could not be taken into account unless it was<br />

established that the assessee would have declared dividend.<br />

Therefore, there was hardly any difference in tax. In any case, it was<br />

submitted that the argument based on tax avoidance was irrelevant<br />

because legitimate and bonafide expenditure incurred for the purpose<br />

of business could not be disallowed on the ground that the assessee<br />

was saving in taxes. The ld. AR also referred to the following<br />

decisions of the Tribunal in support of the case of the assessee.<br />

i) 36 SOT 456 (Delhi) in case of ACIT vs. Bony Polymers (P)<br />

Ltd. dated 23.11.2009,<br />

ii) ITA No.4747/M/10 in the case of DCIT vs. M/s. Celsieus<br />

Refrigeration (P) Ltd. dated 31.12.2010,<br />

iii) ITA No.631/Bang/2010 in the case of ACIT vs. Mandavi<br />

Motors (P) Ltd. dated 12.11.2010 and<br />

iv)<br />

ITA No.4924 & 4925/Raj./09 in the case of M/s. Career<br />

launcher Pvt. Ltd. vs. ACIT dated 27.12.2010<br />

4.2 It was also argued that there was no dispute regarding the<br />

rendering of services by the directors and the reasonableness of<br />

payment made to them. It was pointed out that in Assessment Year<br />

2004-05, disallowance had been made by the Assessing Officer under<br />

section 40A(2)(b) holding the commission payment excessive<br />

compared to market value but the addition had been deleted by the<br />

Tribunal. Therefore, in case the interpretation adopted by the<br />

department was accepted, an expenditure could be disallowed u/s.<br />

36(1)(ii) even if the commission was paid for commensurate services

9<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

rendered by the directors which would lead to absurdity as it could<br />

not be the intention of the legislature. He referred to the judgment of<br />

Hon’ble Supreme Court in the case of K.P. Varghese (131 ITR 597) in<br />

which it was held that statutory provisions should be so interpreted to<br />

avoid absurdity. Further while interpreting statutory provisions, the<br />

scope and object of the provisions must be seen as held by the Hon’ble<br />

Supreme Court in case of Assam Co. Ltd. vs. State of Assam (248 ITR<br />

567). It was submitted that the intention of the legislature was to<br />

allow expenditure on account of commission for services rendered<br />

under the provisions of section 37(1). He referred to the chart, placed<br />

on record, showing turnover and profit of the assessee for Assessment<br />

Years 1999-00 to 2008-09 to point out that there was substantial<br />

improvement in the financial results of the assessee company which<br />

was due to the efforts made by the working directors. It was<br />

accordingly urged that the payment of commission which was for<br />

services rendered by the Directors should be allowed under the<br />

provisions of sec.37(1) and that, in such cases, the provisions of<br />

sec.36(1)(ii) had no application.<br />

4.3 The ld. AR further argued that, both in the prior years and in the<br />

subsequent orders, the claim has been allowed either by the Assessing<br />

Officer himself or in appeal by the Tribunal. It was pointed out that in<br />

the Assessment Year 2004-05, the Assessing Officer had not applied<br />

the provisions of sec.36(1)(ii) and had made disallowance under<br />

sec.40A(2)(b) holding that the claim of expenditure was exclusive<br />

compared to the market value. The addition made was, however, not<br />

upheld by the Tribunal in the order dated 31.3.2010 for Assessment<br />

Year 2004-05 in ITA No.2461/Mum/08 and no further dispute was<br />

raised on this issue by the department before the High Court.<br />

In

10<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

Assessment Year 2005-06, the Assessing Officer had made the<br />

disallowance of commission applying the provisions of sec.36(1)(ii)<br />

and disallowance had been confirmed by CIT(A) but the Tribunal vide<br />

order dated 31.3.2010 in ITA No.7194/M/08 deleted the addition<br />

holding that the provisions of sec.36(1)(ii) were not applicable and no<br />

appeal was filed by the department before the High Court. In<br />

Assessment Year 2007-08, the Assessing Officer had made<br />

disallowance in the assessment order dated 19.11.2009 u/s.143(3) but<br />

the addition was deleted by CIT(A) vide order dated 23.11.2010<br />

following the decision of the Tribunal in Assessment Year 2004-05 and<br />

2005-06 (supra) and in Assessment Year 2008-09, the Assessing<br />

Officer himself did not make any disallowance out of commission in the<br />

order dated 1.12.2010 passed u/s.143(3). Thus, the claim of<br />

commission had been allowed in the earlier years and subsequent<br />

years. It was argued that the principle of consistency demanded that<br />

no disallowance should be made in the assessment year under<br />

consideration. Reliance was placed on the judgment of Hon’ble<br />

Supreme Court in the case of Radha Saomi Satsang vs. CIT (193 ITR<br />

321).<br />

5. On the other hand the ld. DR strongly supported the orders of<br />

authorities below. It was argued that there being substantial profits<br />

and cumulative reserves and surplus, the decision of the directors who<br />

were the only share holders and were also related to each other<br />

(father and sons ) to not declare dividend was not reasonable. The<br />

decision of the share holder directors to pay commission instead of<br />

declaring dividend was obviously with the intention to reduce profits<br />

for avoiding payment of taxes as the assessee company had derived<br />

tax advantage as pointed out by the authorities below.<br />

It was

11<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

submitted that the directors had not given any reasons for not paying<br />

dividend although there were substantial profits. The argument that<br />

the dividend was not paid to improve the net worth to attract FII’s was<br />

not supported by any evidence. It was pointed out that<br />

reasonableness of payment or rendering of extra services by directors<br />

were not relevant factors while considering allowability of claim of<br />

deduction on account of payment/commission to the employees under<br />

the provisions of sec.36(1)(ii). It was submitted that the provisions of<br />

section 36(1)(ii) were applicable even when no extra services were<br />

rendered for payment of commission. Reliance was placed on the<br />

judgment of the Hon’ble Supreme Court in the case of Shahzada Nand<br />

& Sons vs. CIT (108 ITR 358). There was also no evidence of any<br />

extra services rendered by the directors. Further the assessee had not<br />

made any payment of commission to any other employee. The<br />

commission had been paid only to the directors who were also the<br />

share holders which clearly showed that the payment of commission<br />

was in lieu of dividend as there were substantial profits and surplus. It<br />

was further argued that there being specific provision in section<br />

36(1)(ii), any expenditure incurred on account of payment of bonus or<br />

commission to employee should be covered by the said section and not<br />

under section 37(1). Reliance was placed on the following judgments<br />

in support of the case :<br />

i) 24 ITR 566 (Bom.) in case of Subodh Chandra Popatlal vs.<br />

CIT<br />

ii)<br />

iii)<br />

54 ITR 763 (Guj.) in case of Laxmandas Sejram vs. CIT<br />

26 ITR 265 (Mad.) in case of N.M. Rayloo Iyer & Sons vs. CIT

12<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

5.1 The ld. DR further argued that provisions of sec.36(1)(ii) were<br />

applicable in case of payment of bonus or commission to all employees<br />

which was clear from the plain reading of the provision and not to only<br />

non share holder employees as argued by the ld. AR of the assessee.<br />

As regards the principle of consistency, the ld.DR argued that no doubt<br />

it was true that in the earlier years and in the subsequent years, the<br />

deduction in respect of commission to the same director employees<br />

had been allowed but the decision was based on the decision of the<br />

Tribunal. Since the issue has now been referred to the Special Bench<br />

which is a Larger Bench, the decision of the Special Bench shall be<br />

binding and the principle of consistency shall not be applicable in such<br />

cases.<br />

6. In reply the ld. AR for the assessee submitted that the<br />

judgments relied upon by the ld.DR were distinguishable as in those<br />

cases, payment of bonus or commission had been made to employees<br />

and not to partner or shareholders. The case of the assessee was<br />

covered by the judgment of Hon’ble High Court of Bombay in the case<br />

of Loyal Motors Service Company. Ltd. vs. CIT (supra).<br />

7. We have perused the records and considered the rival<br />

contentions carefully. The issue raised before us is regarding<br />

allowability of deduction on account of payment of commission of<br />

Rs.1.20 crores to the three employee directors under section 36(1)(ii).<br />

There is no dispute that the three directors were share holder<br />

employees who held the entire share capital of the company and were<br />

also related(father and sons). There is also no dispute that the<br />

commission had been paid to the three director employees only and<br />

not to any other employee. The issue is whether on the facts of the

13<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

case, expenditure on account of commission can be allowed under the<br />

provisions of section 36(1)(ii).<br />

7.1 For answering the question referred, we have to first deal with<br />

the object and scope<br />

of the provisions of section 36(1)(ii) which<br />

allows deduction on account of expenditure on payment of bonus or<br />

commission to employees subject to certain conditions while<br />

computing the income under the head “profits and gains of business or<br />

profession”.<br />

These provisions were first incorporated under the<br />

Income tax Act 1922 (hereinafter referred to as the old Act).<br />

The<br />

provisions were inserted subsequent to the judgment of Hon’ble<br />

Madras High Court in the case of R.E. Mahomed Kassim Rowther of<br />

R.E. Mahomed Kassim Rowther & Co. (2 ITC 482).<br />

The Hon’ble<br />

Madras High Court in the said case had held that payment of any<br />

amount which was directly or indirectly dependent upon the earnings<br />

or the profits of the business, could not be allowed as business<br />

expenditure. The reasoning was that profit is computed only after<br />

deducting all expenses and, therefore, any payment made out of profit<br />

could not be considered as expenditure incurred for the purpose of<br />

earning of the profit. The old Act was amended by Income tax (3 rd<br />

Amendment) Act 1930 and a new clause (viiia) was inserted in section<br />

10(2) to allow expenditure on account of payment of bonus or<br />

commission to an employee and later, the said clause was renumbered<br />

as clause (x) of section 10(2).<br />

The said provisions of<br />

section 10(2)(x) are reproduced below as a ready reference :<br />

(x) Any sum paid to an employee as bonus<br />

or commission for services rendered, where such<br />

sum would not have been payable to him as profits<br />

or dividend if it had not been paid as bonus or<br />

commission

14<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

Provided that the amount of bonus or commission is<br />

of reasonable amount with respect to :<br />

a) pay of the employee and conditions of his<br />

service.<br />

b) the profits of the business or profession for the<br />

year in question and<br />

c) the general practice in similar business or<br />

profession<br />

7.2 The above provisions of section 10(2)(x) of the old Act were<br />

incorporated in the Income tax Act, 1961 also without any changes as<br />

clause (ii) to section 36(1). Subsequently, the clause was amended<br />

and a new proviso was inserted as the first proviso and the existing<br />

proviso with some modifications was substituted as second proviso<br />

w.e.f. Assessment Year 1976-77.<br />

1976-77 read as under :-<br />

The amended provisions w.e.f.<br />

36(i)(ii) any sum paid to employee as bonus or<br />

commission for services rendered where such sum would<br />

not have been payable to him as profits or dividend if it<br />

had not been paid a bonus or commission<br />

Provided that the deduction in respect of bonus paid<br />

to employee employed in factory or other<br />

establishment to which provisions of payment of<br />

Bonus Act (521 of 1965) apply, shall not exceed<br />

the amount of bonus payable under the Act.<br />

Provide further that the amount of bonus (not being<br />

bonus referred to in the first proviso ) or commission<br />

is reasonable with respect to:<br />

a) pay of the employee and conditions of his<br />

service.<br />

b) the profits of the business or profession for the<br />

year in question and

15<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

c) the general practice in similar business or<br />

profession<br />

7.3 The provisions of section 36(1)(ii) were again amended by the<br />

Direct Tax Laws (Amendment) Act, 1987 from Assessment Year 1988-<br />

89 and the two provisos were deleted. Thus, the provisions of section<br />

36(1)(ii) applicable from 1988-89 which remained in force during the<br />

relevant year under consideration were as under :-<br />

36(1)(ii) Any sum paid to the employee as bonus<br />

or commission for services rendered, where such<br />

sum would not have been payable to him as profits<br />

or dividend if it had not been paid as bonus or<br />

commission<br />

7.4 The object behind the provisions of section 36(1)(ii) is to allow<br />

deduction on account of any expenditure on account of payment of<br />

bonus or commission to an employee even if the said payment is made<br />

out of profits of the assessee subject to the conditions mentioned in<br />

the section. This is an enabling provision which allows deduction on<br />

account of bonus or commission to employees. The reasonableness of<br />

payment or adequacy of services rendered by the employees are not<br />

relevant factors in deciding the allowability of deduction. The section<br />

allows deduction if the expenditure is:<br />

i) on account of bonus or commission;<br />

ii) is paid to an employee;<br />

iii) for services rendered and<br />

iv) is not in lieu of payment of dividend.<br />

7.5 The provisions of section 36(1)(ii) cover only the case of<br />

expenditure on account of bonus or commission paid to an employee.

16<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

Any expenditure incurred on account of payment of commission to a<br />

person who is not an employee is not covered by the said provision.<br />

Such cases of expenditure on account of commission to non employees<br />

will be governed by the provisions of section 37(1) which allow<br />

deduction on account of any expenditure which is incurred wholly and<br />

exclusively for the purpose of business subject to certain conditions.<br />

The criteria of “wholly and exclusively” is not relevant while<br />

considering deduction under section 36(1)(ii). The payment may be<br />

made out of commercial expediency which should be judged in the<br />

light of current socio economic thinking which encourages employers<br />

to share a part of the profits with the employees as held by Hon'ble<br />

Supreme Court in the case of Shazada Nand & Sons (108 ITR 358)<br />

while dealing with the provisions of section 36(1)(ii).<br />

portion of the judgment is reproduced below:<br />

The relevant<br />

“….What is the requirement of commercial expediency<br />

must be judged, not in the light of the 19th century<br />

laissez faire doctrine which regarded man as an economic<br />

being concerned only to protect and advance his selfinterest,<br />

but in the context of current socio-economic<br />

thinking which places the general interest of the<br />

community above the personal interest of the individual<br />

and believes that a business or undertaking is the product<br />

of the combined efforts of the employer and the<br />

employees and where there is sufficiently large profit,<br />

after providing for the salary or remuneration of the<br />

employer and the employees and other prior charges such<br />

as interest on capital, depreciation, reserves, etc., a part<br />

of it should in all fairness go to the employees…”<br />

7.6 The ld. Authorised Representative for the assessee argued that<br />

provisions of section 36(1)(ii) are applicable only in the case of<br />

employees who are not share holders. His argument was that the<br />

provision is not applicable when the payment of commission is in lieu<br />

of dividend and since dividend is payable only in the case of share<br />

holders, the provisions will not be applicable in case of share holder

17<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

employees. We are unable to accept such argument which can be<br />

relevant only when the payment of dividend to shareholders is<br />

compulsory. It is an undisputed fact that payment of dividend by a<br />

company is not compulsory and it is dependent upon the profitability<br />

and other conditions of the business. Therefore, in cases where<br />

dividend is not payable, the payment of bonus or commission can be<br />

allowed as deduction in case of employee share holders also under<br />

section 36(1)(ii) as in that case it could not be said that payment of<br />

bonus or commission is in lieu of dividend. Thus the provisions of<br />

section 36(1)(ii) are also applicable to share holder employees subject<br />

to the condition that payment is not made in lieu of dividend. The<br />

provisions of section 36(1)(ii) can be split into two parts. The first part<br />

viz., “any sum paid to an employee as bonus or commission for<br />

services rendered” is an enabling provision. This part applies to all<br />

employees. The second part is a disabling provision which provides<br />

that “if the sum so paid is in lieu of profit or dividend,” it cannot be<br />

allowed as deduction. This part applies only to employees who are<br />

partners or shareholders. Thus, in so far allowability of expenditure<br />

on account of bonus or commission under section 36(1)(ii) is<br />

concerned, it applies to all employees including shareholder<br />

employees. The disallowability is restricted to only partners and<br />

shareholders as only in those cases, payment could be in lieu of profit<br />

or dividend. We therefore, reject the arguments advanced by the ld.<br />

AR that the provisions of section 36(1)(ii) apply only to nonshareholder<br />

employees.<br />

7.7 As regards the rendering of services by the employees for<br />

payment of bonus/commission, the only requirement of section<br />

36(1)(ii) is that some services should have been rendered. Adequacy

18<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

of services is not a relevant consideration. It is not necessary that<br />

payment should be made commensurate to the rendering of services<br />

or there should be some extra services rendered for payment on<br />

account of bonus or commission. This proposition is supported by the<br />

judgment of Hon’ble Supreme Court in case of Shazada Nand & Sons<br />

(108 ITR 358). Relevant portion of the judgment is reproduced for<br />

ready reference:<br />

“Section 36(1)(ii) of the Income tax Act, 1961 does<br />

not postulate that there should be any extra services<br />

rendered by an employee before payment of<br />

commission to him can be justified as allowable<br />

expenditure. If services were in fact rendered by the<br />

employee, it is immaterial that the services rendered<br />

by the employee was in no way greater or more<br />

onerous than the services rendered by him in the<br />

earlier years. Of course, the circumstances that no<br />

additional services were rendered by the employee,<br />

would undoubtedly be of some relevance in<br />

determining the reasonableness of the amount of<br />

commission but it would have to be considered<br />

along with other circumstances.”<br />

7.8 Thus any expenditure on account of payment of bonus or<br />

commission to an employee for some services rendered will be an<br />

allowable deduction subject to the condition that the payment of bonus<br />

or commission should not be in lieu of dividend. This condition, as<br />

pointed out earlier, is relevant only in case of share holder employees<br />

as dividend is payable only in case of share holders. Further,<br />

reasonableness of the payment is no longer a requirement as per the<br />

amended provisions of section 36(1)(ii) applicable from Assessment<br />

Year 1988-89. The ld. AR for the assessee has argued that the<br />

expression “payable” used in section 36(1)(ii) meant that the<br />

shareholder should have right to receive the dividend. It was<br />

submitted that payment of dividend was discretionary to be decided by

19<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

the management of the company and not compulsory. Therefore, it<br />

could not be said that the dividend was payable in case of the<br />

employee directors. Accordingly it was argued that since the dividend<br />

was not payable in case of the assessee company, the claim could not<br />

be disallowed under section 36(1)(ii). We are unable to accept the<br />

arguments advanced. In our view the word “payable” used in section<br />

36(1)(ii) does not mean statutorily payable or legally payable. Since<br />

payment of dividend is discretionary and not compulsory, any such<br />

construction will lead to absurd results. The word “payable” in our<br />

view means that dividend would have been declared by any reasonable<br />

management, on the facts and circumstances of the case considering<br />

the profitability and other relevant factors and become payable to<br />

shareholders. Therefore, after considering the entirety of the facts<br />

and circumstances of the case if a reasonable conclusion can be drawn<br />

that the dividend was payable by the company and if the assessee<br />

company instead of paying dividend had paid commission to their<br />

employee share holders, such payment of commission will be in lieu of<br />

dividend and the claim of deduction will not be allowable under section<br />

36(1)(ii).<br />

7.9 For deciding the issue whether dividend in case of the assessee<br />

would have been payable, we have to consider the profitability of the<br />

company and all other relevant factors. In this case, the position<br />

regarding the business turnover, the profit and payment of salary and<br />

commission to director employees from Assessment Year 1999-00 to<br />

Assessment Year 2008-09 which has been placed on record by the<br />

assessee was as under :-<br />

Assessment<br />

Year<br />

Turnover<br />

Income as per<br />

P&L A/c.<br />

Salary<br />

Directors<br />

to<br />

Commission<br />

to Directors

20<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

1999-00 4,97,93,940/- 2,69,77,012/- 30,00,000/-<br />

-<br />

2000-01 11,78,42,787/- 6,71,14,638/- 30,00,000/- 1,05,00,000/<br />

-<br />

2001-02 4,77,03,584/- 57,26,229/- 30,00,000/-<br />

-<br />

2002-03 5,95,29,967/- 2,44,95,962/- 30,00,000/-<br />

-<br />

2003-04 4,58,18,043/- 1,04,13,105/- 30,00,000/-<br />

-<br />

2004-05 10,51,26,344/- 4,55,44,868/- 30,00,000/- 1,20,00,000/<br />

-<br />

2005-06 12,74,11,457/- 6,69,78,205/- 30,00,000/- 1,20,00,000/<br />

-<br />

2006-07 17,86,29,800/- 10,57,96,305/- 30,00,000/- 1,20,00,000/-<br />

2007-08 18,86,71,578/- 10,81,16,140/- 30,00,000/- 1,50,00,000/-<br />

2008-09 32,21,66,934/- 22,42,87,992/- 30,00,000/- 1,50,00,000/-<br />

7.10 Referring to the financial performance mentioned above, it was<br />

argued on behalf of the assessee that from Assessment Year 2004-05<br />

onwards, the performance of the company had improved progressively<br />

and that it had been due to the extra efforts made by the directors.<br />

The Board, therefore, vide resolution dated 3.3.2003 allowed payment<br />

of commission to the directors @ 10% of profit before tax subject to a<br />

limit of Rs.40.00 lacs per year in each case for extra services. It was<br />

pointed out that the turnover of the business increased from Rs.10.51<br />

crores in 2004-05 to Rs.32.21 crores in Assessment Year 2008-09 and<br />

profit before tax after claiming deduction on account of commission,<br />

improved from Rs.4.55 crores in Assessment Year 2004-05 to 22.42<br />

crores in Assessment Year 2008-09. It has been submitted that<br />

payment of salary and commission was commensurate to market value<br />

of the services rendered by the director and therefore in such cases no<br />

disallowance could be made u/s.36(1)(ii). Comparison has been made

21<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

to the payment of remuneration of Rs.46,61,860/- to an employee of<br />

the assessee company namely Shri Milind Karmakar who was heading<br />

the research division. Reference has also been made to the case of<br />

M/s. Motilal Oswal Securities who was in the same business and in<br />

which case also commission aggregating to Rs.7.44 crores had been<br />

paid to directors in addition to the aggregate salary of Rs.2.54 crores.<br />

It has also been submitted that non-declaration of dividend by<br />

directors was to improve the net worth of the company so as to attract<br />

FIIs who select brokers based on their net worth.<br />

7.11 On careful consideration of various aspects of the matter, we are<br />

not convinced by the arguments advanced. The legal position as we<br />

have discussed earlier is that any expenditure on account of payment<br />

of commission to an employee will be allowable as deduction under the<br />

provisions of section 36(1)(ii) irrespective of the fact whether the<br />

employee is a shareholder or not or whether the commission has been<br />

paid for some extra services or for the some services subject to the<br />

condition that the payment is not in lieu of dividend. However, in case<br />

extra services have been rendered for payment of commission, it will<br />

be one of the relevant factors to consider while deciding whether the<br />

case is covered by the exception provided in the section 36(1)(ii) i.e.<br />

whether the payment of commission is in lieu of dividend. In the<br />

present case, no evidence is available on record to support the plea<br />

that the directors had rendered any extra services for payment of huge<br />

commission in addition to services rendered as an employee for which<br />

salary has been paid. No such evidence has been placed even before<br />

us nor even the details of any such extra services have been given.<br />

The ld. AR for the assessee has referred to the decision of the<br />

Tribunal in assessee’s own case in Assessment Year 2004-05 (supra),

22<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

in which disallowance made by the Assessing Officer of 50% of<br />

remuneration and commission under section 40A(2)(b) has been<br />

deleted to point out that the Tribunal accepted the case of the<br />

assessee that payment of salary and commission was comparable to<br />

market value of services. We have gone through the said decision of<br />

the Tribunal. The finding recorded by the Tribunal in para-9 on this<br />

issue is reproduced below as ready reference :-<br />

“9 We have heard the rival submissions and<br />

considered them carefully. After considering the<br />

submissions and perusing the relevant material on<br />

record, we do not find any infirmity in the findings of<br />

the ld CIT(A) in respect of the deletion of Rs. 75 lacs u/s<br />

40A(a)(b). It is seen that in earlier, the remuneration<br />

paid by the assessee has been allowed by the AO. It is<br />

further seen that the company has passed resolution<br />

that the Directors of the assessee company will be paid<br />

commission over and above the salary amount. In<br />

accordance with the resolution, the company has paid<br />

remuneration plus commission. It is further seen that<br />

the Directors of the company are assessed to tax and<br />

their taxable income is subject to payment of maximum<br />

marginal rate of tax which is 33% including surcharge.<br />

The company is liable to pay tax @ 35.75%; therefore, it<br />

cannot be said that the commission and remuneration<br />

aid to the Directors was on account of tax planning.<br />

9.1 The findings of the ld CIT(A) have been<br />

reproduced somewhere above in this order. In our view,<br />

the findings of the ld CIT(A) does not suffer from any<br />

infirmity. The decision relied upon by the ld counsel of<br />

the assessee are also in favour of the assessee.<br />

Therefore, keeping in view of these facts and<br />

circumstances and in view of the detailed findings given<br />

by the ld CIT(A), we hold that the ld CIT(A) was justified<br />

in deleting the addition of Rs. 75 lacs on account of<br />

remuneration paid to the Directors. Accordingly, we<br />

confirm the findings of the ld CIT(A) on this issue.”

23<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

7.12. The Assessment Year 2004-05 was the first year when the<br />

assessee started paying commission of Rs.40.00 lacs to each working<br />

director in addition to salary. In the immediately preceding year, the<br />

directors had been paid only salary which was Rs.6.00 lacs per annum<br />

in case of Chairman and Rs.12.00 lacs per annum in case of the other<br />

two directors. The Tribunal in the said order has not given any finding<br />

whether substantial payment of Rs.40.00 lacs was for any extra<br />

services rendered. The Tribunal basically allowed the claim on the<br />

ground that in the immediate preceding year, salary expenditure had<br />

been allowed and payment of commission was supported by the Board<br />

Resolution and that there was no tax advantage to the assessee. The<br />

Tribunal confirmed the finding of the CIT(A) which had been<br />

reproduced in para-7 of the order of the Tribunal as per which the<br />

CIT(A) deleted the addition made by the Assessing Officer on the<br />

ground that the directors were competent to undertake the activities of<br />

the company which had yielded huge profits. The education of the<br />

directors was of not great significance. CIT(A) thus deleted the<br />

addition on account of estimated disallowance. Thus even CIT(A)<br />

whose finding has been confirmed by the Tribunal has not given any<br />

finding that huge payment of commission was linked to any extra<br />

services. The board resolution cannot be considered as an evidence of<br />

extra service particularly when the board is constituted by the director<br />

employees to whom payments have been made. There is also no<br />

finding by the Tribunal to the effect that payment of commission was<br />

commensurate to the market value of the services. Thus, the decision<br />

of the Tribunal in Assessment Year 2004-05 (supra), cannot be<br />

considered as precedent for the plea that huge commission had been<br />

paid for extra services or that payment was commensurate to market

24<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

value of services. As pointed out earlier, no evidence of any extra<br />

services to justify huge commission payments has been produced<br />

before the lower authorities or even before us.<br />

7.13 We have to evaluate the case on basis of material available on<br />

record. On careful perusal of financial performance statistics tabulated<br />

earlier, we note that both the turnover and the profit was exceptionally<br />

high in Assessment Year 2000-01 compared to the earlier year and<br />

subsequent three year period. But this was because of the reason that<br />

there was stock market boom which had peaked in Assessment Year<br />

2000-01 and the bubble had burst only towards the fag end of that<br />

year, which was the reason for exceptional performance in that year.<br />

The assessee is a share broker who gets commission on sale/purchase<br />

of shares by investors/traders. The income of the assessee is assured<br />

irrespective of the fact whether the investor/trader loses or gains in<br />

the transaction. The commission, will, however, depend upon the<br />

market conditions. In case of boom when the market is flooded with<br />

investors/traders, income will rise as volume increases but in case of<br />

slump when investors/traders desert the market, there will be fall in<br />

volume and income. After the Assessment Year 2000-01 when the<br />

stock market crashed, there was slump in the market for three years<br />

which resulted in sharp fall in both turnover and profit from<br />

Assessment Year 2001-02 to 2003-04. The turnover fell to 50% or<br />

even less and the profit declined more steeply.<br />

7.14 Therefore, the only reasonable conclusion which can be drawn is<br />

that the payment of Rs.1.05 crores shown as commission in<br />

Assessment Year 2000-01 when there was exceptional profit was<br />

nothing but dividend because had it been a genuine commission, the

25<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

assessee would have continued the payment of commission and even<br />

may have increased in the subsequent three year period to improve<br />

performance but no commission was paid in these years eventhough<br />

turnover and profit were both declining. Obviously, sharp fall in profits<br />

had forced the company management not to pay dividend in the garb<br />

of commission in the next three years. The stock market started<br />

recovery from Assessment Year 2004-05 and had steadily gained till<br />

Assessment Year 2008-09 which is reflected in steady increase in both<br />

turnover and profit. The assessee again started showing payment of<br />

commission from Assessment Year 2004-05. The profit before tax but<br />

after deduction on account of commission was Rs.4.55 crores in<br />

Assessment Year 2004-05 which steadily rose to Rs.22.42 crores in<br />

Assessment Year 2008-09. In our view the steady rise in performance<br />

was due to improved market conditions and not because of any extra<br />

service rendered by the directors as no evidence has been produced<br />

for rendering of extra services. The equity capital of the company<br />

which is entirely owned by the three directors was Rs.6.50 crores.<br />

Investors in equity shares expect a reasonable return on the share<br />

investment and in our view any reasonable management would have<br />

declared at least about 20% dividend in the above years to the share<br />

holders when there were substantial profits. No doubt it is true that<br />

dividend is not mandatory and is discretionary to be decided by the<br />

management after considering the profitability and other factors. The<br />

management may not declare dividend even when there are<br />

substantial profits because of business exigency such as requirement<br />

of fund for any expansion or diversification programme but no such<br />

exigencies have been shown. The assessee company is a share broker<br />

and only executes orders on behalf of investors on commission basis.<br />

No funds are therefore required for any expansion etc. nor any such

26<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

case has been made. The directors in the annual report have not<br />

given any reason for not declaring dividend. The reason given before<br />

us is that the assessee did not declare dividend to improve net worth<br />

to attract FIIs who do transactions only through high net worth<br />

brokers. This argument is not convincing at all because whether the<br />

assessee pays commission or dividend the net worth is reduced by the<br />

same amount. It is also to be noted that commission has been paid<br />

only to the director employees and commission has been paid as 10%<br />

of profits subject to a limit of Rs.40.00 lacs which also shows that the<br />

assessee company distributed part of the profits to the director<br />

employees who were the only shareholders. Therefore, on the facts<br />

and circumstances of the case as discussed above we have no<br />

hesitation in coming to the conclusion that dividend in case of the<br />

assessee company was payable and that the same has been paid in<br />

the garb of commission.<br />

7.15 The comparison made by the assessee to the high remuneration<br />

of Rs.46.61 lacs paid to a non share holder employee is not very<br />

relevant in our opinion. The three directors are the owners of the<br />

company. The owners of business if they are not technically qualified<br />

may have to engage highly qualified employees for doing specialized<br />

jobs and may have to pay high remuneration more than the salary<br />

payable to them for the services rendered. The stock market is a<br />

highly specialized field and requires adequate research to attract<br />

investors. The quality and reliability of research is back-bone of stock<br />

broking business. Therefore, obviously the assessee company had to<br />

engage a highly qualified CA to head research division on high<br />

remuneration which cannot be compared to the remuneration payable<br />

to the assessee. The Assessing Officer has also pointed out that the

27<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

assessee company had other B.Com employees who have been paid<br />

remuneration of only Rs.3.00 lacs per annum. Further, no commission<br />

is paid to any employee other than the three share holder directors.<br />

As regards, the case of Motilal Oswal Securities which has been quoted<br />

in comparison, no details such as qualifications of the directors,<br />

profitability and payment made to other employees has been placed on<br />

record. We are therefore not in a position to comment as to whether<br />

in that case it was a genuine payment of commission or payment in<br />

lieu of dividend. Moreover, merely because commission has been<br />

claimed and allowed in another case wrongly, cannot be the ground to<br />

allow a claim of deduction in case of the assessee. Each case has to<br />

be viewed on the facts of the case.<br />

7.16 The ld. AR for the assessee has also argued vehemently that the<br />

case of the assessee is supported by the judgment of Hon’ble high<br />

Court of Bombay in case of Loyal Motor Service Company.<br />

Ltd.(supra), in which case it has been held that for disallowance of<br />

bonus or commission under section 36(1)(ii), the same amount if not<br />

paid as commission should have been payable as dividend. In the<br />

present case, it has been pointed out that the directors had been paid<br />

commission of Rs.40.00 lacs each but in case the entire amount of<br />

commission of Rs.1.20 crores had been paid as dividend, the payment<br />

of dividend would not have come to Rs.40.00 lacs in each case<br />

because share holding of the three directors was not the same. The<br />

chairman held 50% of the shares whereas the other two directors held<br />

25% each.<br />

7.17 We have carefully gone through the said judgment. That was<br />

the case of a public limited company and the issue was allowability of

28<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

deduction on account of bonus under section 10(2)(x) which<br />

corresponds to section 36(1)(ii). In that case bonus had been paid not<br />

only to thirteen share holder employees but also to twenty-eight non<br />

share holder employees at the same rate and therefore, payment of<br />

bonus to the shareholder employee could not be said to be<br />

unreasonable. In case of public companies having large number of<br />

shareholders which are unrelated, it may not be possible to use a<br />

device. The present case involves a family business owned by the<br />

three directors who were not only shareholders but were also decision<br />

makers. They are also blood relations (father and sons). Therefore,<br />

they could easily show payment of dividend as commission and take<br />

the payment in such a manner that the same amount does not become<br />

payable as dividend though the total amount remains within the<br />

family. Therefore, in our view, the judgment cited above cannot be<br />

applied to a case where a device is adopted by closely held private<br />

companies to distribute dividend in the garb of commission in such a<br />

manner to take advantage of judgment in the case of Loyal Motor<br />

Service Company Ltd. (supra). We have already held earlier that,<br />

considering the facts and circumstances of the case, the commission<br />

payment in this case was in lieu of dividend and therefore, the claim<br />

cannot be allowed only on the ground that the payment taken by the<br />

directors is not in the share holding ratio. The device adopted by the<br />

assessee is obviously with the intention to avoid payment of full taxes.<br />

There is obvious tax avoidance. In case dividend is paid, the tax<br />

payable at the rate of 35.75% in case of a company on the amount of<br />

Rs.1.20 crores comes to Rs.42.90 lacs and in that case the company<br />

would have also to pay dividend distribution tax @12.5% which comes<br />

to Rs.15.00 lacs. The total tax payment in case of dividend payment<br />

would come to Rs.57.90 lacs whereas in case commission was paid,

29<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

the tax payable comes to Rs.39.60 lacs. There is thus tax avoidance<br />

of Rs. 18.30 lacs. The provisions of section 36(1)(ii) are intended to<br />

prevent an escape from taxation by describing the payment as bonus<br />

or commission when in fact ordinarily it should have reached the<br />

shareholders as profit or dividend as held by the Hon’ble High Court of<br />

Bombay in the case of Loyal Motor Service Company Ltd. (supra). In<br />

this case we are convinced in view of the discussion made earlier that<br />

it is a case of paying commission which was otherwise payable as<br />

dividend, to escape taxation.<br />

7.18 The ld. AR for the assessee has also relied on certain decisions<br />

of the Tribunal as mentioned earlier in para 4.1. These cases in our<br />

view are distinguishable. Moreover these are decisions of division<br />

Bench of the Tribunal which cannot act as binding precedent for the<br />

Special Bench which is a larger Bench. In case of ACIT vs. Bony<br />

Polymer Pvt. Ltd. (supra), two whole time working directors had been<br />

paid commission @ .5% of turnover. The divisional Bench of the<br />

Tribunal on facts of that case held that there was no material to<br />

support the proposition that had commission been not paid, it would<br />

have been payable as dividend. The case of DCIT vs. M/s. Celsius<br />

Refrigeration P. Ltd. (supra), was identical in which case, the decision<br />

in case of Bony Polymers (supra) was followed. In case of ACIT vs.<br />

Mandavi Motors Pvt. Ltd. (supra), the directors who had been paid<br />

bonus held only few shares and therefore, the dividend payable would<br />

have been negligible. In case of M/s. Carrier Launcher P. Ltd. (supra),<br />

there was a wide gap between the share holdings of the two directors<br />

which were 40.93% and 1.09%. Moreover the directors were also not<br />

related and therefore it could not have been a case of device. These

30<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

cases therefore are distinguishable and cannot come to the rescue of<br />

the assessee.<br />

7.19 Arguments have also been advanced by the ld. AR based on the<br />

principle of consistency. It has been submitted that in earlier years<br />

and subsequent years the claim has been allowed and therefore, it<br />

could not be disallowed in the present year. Reliance has been placed<br />

on the judgment of Hon'ble Supreme Court in the case of Radha Saomi<br />

Satsang (supra). No doubt, the revenue authorities are expected to<br />

adopt a consistent approach in allowing or disallowing a claim and if a<br />

claim has been allowed in an earlier year, any disallowance in<br />

subsequent year cannot be justified if factual and legal position<br />

remains the same. But in this case we note that the claim has been<br />

allowed in the earlier and subsequent year based on the decisions of<br />

divisional Bench of the Tribunal. The Bench which originally heard the<br />

appeal for this year had reservations regarding correctness of the<br />

decision of the divisional bench and accordingly matter was referred to<br />

a Larger Bench. The decision of the divisional Bench in earlier year<br />

cannot act as a binding precedent for the Special Bench which is a<br />

Larger Bench. Further in case the decision of the division Bench was<br />

to be followed, there was no need to refer the issue to a larger Bench.<br />

Therefore, in our view, on the facts of the case, the principle of<br />

consistency will be of no help and the argument raised has to be<br />

rejected. Even in case of Radha Saomi Satsang(supra), Hon’ble<br />

Supreme Court had held that the decision was confined to facts of that<br />

case only.

31<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

7.20 In view of the foregoing discussion and for the reasons given<br />

earlier, we are of the view that the payment of commission of Rs.1.20<br />

crores to the three working directors was in lieu of dividend and the<br />

same is not allowable as deduction under section 36(1)(ii). We answer<br />

the reference accordingly.<br />

8. We now take up the appeal of the assessee. In the appeal, the<br />

assessee has raised disputes on two grounds which are as under :-<br />

i) On the facts and circumstances of the case and in<br />

law the ld. Assessing Officer erred and ld. CIT(A)<br />

confirmed the disallowance of Rs.1,20,00,000/- under<br />

section 36(1)(ii) of the I.T. Act being commission paid to<br />

executive working directors.<br />

ii) Alternatively, on the facts and circumstances of the<br />

case and in law the ld. Assessing Officer and the ld. CIT(A)<br />

VIII did not consider the appellant’s claim of<br />

Rs.1,20,00,000/- being commission paid to three director<br />

as allowable under section 37(1).<br />

8.1 The dispute raised in ground No.1 is the same as the question<br />

referred before the Special Bench i.e. whether on the facts and<br />

circumstances of the case, payment of commission to the extent of<br />

Rs.1.20 crores is allowable under provisions of section 36(1)(ii). We<br />

have already answered the question vide para 7.20 of this order and<br />

held that the payment of commission of Rs.1.20 crores was in lieu of<br />

dividend and the same is not allowable under section 36(1)(ii). The<br />

ground is therefore, decided against the assessee.

32<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

8.2. The second ground is regarding alternate claim of allowability of<br />

deduction on account of commission of Rs.1.20 crores paid to the<br />

three director employees under provisions of section 37(1) of the I.T.<br />

Act. The ld. AR for the assessee argued that provisions of section<br />

36(1)(ii) were applicable only in the case of non-share holder<br />

employees. It was also argued that commission paid for any extra<br />

services rendered by the share holder employees will be covered by<br />

the provisions of section 37(1) which allows deduction on account of<br />

any expenditure incurred wholly and exclusively for the purpose of<br />

business subject to the conditions mentioned in the section. We have<br />

already considered these aspects while considering the question<br />

referred to the Special Bench and vide para 7.6 and 7.7 have held that<br />

the provisions of section 36(1)(ii) will apply in case of all employees<br />

including share holder employees irrespective of the fact whether any<br />

extra services have been rendered or not. The issue whether payment<br />

of bonus or commission to an employee will be covered by the<br />

provisions of section 36(1)(ii) or section 37(1) is also settled by the<br />

judgment of Hon’ble Jurisdictional High Court in case of Subodh<br />

Chandra Poppatlal vs. CIT (24 ITR 586) in which the Hon’ble High<br />

Court while dealing with similar provisions of the old Act held that<br />

when an expenditure fell under section 10(2)(x) [which corresponds to<br />

section 36(1)(ii)], in the sense that it is an expenditure in the nature<br />

of bonus or commission paid to an employee for services rendered<br />

then its validity can only be determined by the tests laid down in<br />

section 10(2)(x) and not by the tests laid down in section 10(2)(xv)<br />

which corresponds to section 37(1). Respectively following the said<br />

judgment, we hold that the payment of commission to the three<br />

director employees had been rightly considered by the authorities

33<br />

5792/Mum/09<br />

Assessment Year:06-07<br />

below under the provisions of section 36(1)(ii) and that the provisions<br />

of section 37(1) will not be applicable in such cases.<br />

8.3 In the result, the appeal of the assessee is dismissed.<br />

Order pronounced in open court on 22.6.2011.<br />

Sd/- Sd/- Sd/-<br />

(D.K. AGARWAL) (N.V. VASUDEVAN) (RAJENDRA S<strong>IN</strong>GH)<br />

JUDICIAL MEMBER JUDICIAL MEMBER ACCOUNTANT MEMBER<br />

Mumbai,<br />

Dated : 22.6.2011<br />

Jv.<br />

Copy to: The Appellant<br />

The Respondent<br />

The CIT, Concerned, Mumbai<br />

The CIT(A) Concerned, Mumbai<br />

The DR “ ” Bench<br />

True Copy<br />

By Order<br />

Dy/Asstt. Registrar, ITAT, Mumbai.