Consolidated Financial Statements - L. Possehl & Co. mbH

Consolidated Financial Statements - L. Possehl & Co. mbH

Consolidated Financial Statements - L. Possehl & Co. mbH

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Possehl</strong> Inc. Group: American trading activities turn<br />

out to be very successful<br />

In fi scal year 2005, the <strong>Possehl</strong> Inc. Group was again able to achieve the<br />

high sales level of the previous year. The earnings that were achieved<br />

from these sales were equally positive. Expanding the range of products<br />

by adding chemicals together with the good market position in<br />

Central and South America guaranteed the success of our American<br />

trading activities.<br />

At the beginning of the year 2006 we handed over our products from<br />

the non-fi reproof division to our previous American partner. The trade<br />

in industrial raw materials for the steel and foundry industry for North<br />

America that remained with <strong>Possehl</strong> Inc. enabled a closer tie to the<br />

Erzkontor Group, which was operating primarily in Europe.<br />

EARNINGS POSITION IN THE SERVICES<br />

BUSINESS SEGMENT<br />

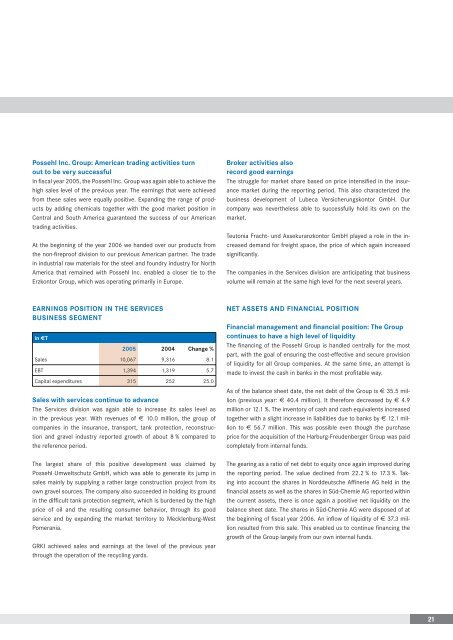

in €T<br />

2005 2004 Change %<br />

Sales 10,067 9,316 8.1<br />

EBT 1,394 1,319 5.7<br />

Capital expenditures 315 252 25.0<br />

Sales with services continue to advance<br />

The Services division was again able to increase its sales level as<br />

in the previous year. With revenues of € 10.0 million, the group of<br />

companies in the insurance, transport, tank protection, reconstruction<br />

and gravel industry reported growth of about 8 % compared to<br />

the reference period.<br />

The largest share of this positive development was claimed by<br />

<strong>Possehl</strong> Umweltschutz G<strong>mbH</strong>, which was able to generate its jump in<br />

sales mainly by supplying a rather large construction project from its<br />

own gravel sources. The company also succeeded in holding its ground<br />

in the diffi cult tank protection segment, which is burdened by the high<br />

price of oil and the resulting consumer behavior, through its good<br />

service and by expanding the market territory to Mecklenburg-West<br />

Pomerania.<br />

GRKI achieved sales and earnings at the level of the previous year<br />

through the operation of the recycling yards.<br />

Broker activities also<br />

record good earnings<br />

The struggle for market share based on price intensifi ed in the insurance<br />

market during the reporting period. This also characterized the<br />

business development of Lubeca Versicherungskontor G<strong>mbH</strong>. Our<br />

company was nevertheless able to successfully hold its own on the<br />

market.<br />

Teutonia Fracht- und Assekuranzkontor G<strong>mbH</strong> played a role in the increased<br />

demand for freight space, the price of which again increased<br />

signifi cantly.<br />

The companies in the Services division are anticipating that business<br />

volume will remain at the same high level for the next several years.<br />

NET ASSETS AND FINANCIAL POSITION<br />

<strong>Financial</strong> management and fi nancial position: The Group<br />

continues to have a high level of liquidity<br />

The fi nancing of the <strong>Possehl</strong> Group is handled centrally for the most<br />

part, with the goal of ensuring the cost-effective and secure provision<br />

of liquidity for all Group companies. At the same time, an attempt is<br />

made to invest the cash in banks in the most profi table way.<br />

As of the balance sheet date, the net debt of the Group is € 35.5 million<br />

(previous year: € 40.4 million). It therefore decreased by € 4.9<br />

million or 12.1 %. The inventory of cash and cash equivalents increased<br />

together with a slight increase in liabilities due to banks by € 12.1 million<br />

to € 56.7 million. This was possible even though the purchase<br />

price for the acquisition of the Harburg-Freudenberger Group was paid<br />

completely from internal funds.<br />

The gearing as a ratio of net debt to equity once again improved during<br />

the reporting period. The value declined from 22.2 % to 17.3 %. Taking<br />

into account the shares in Norddeutsche Affi nerie AG held in the<br />

fi nancial assets as well as the shares in Süd-Chemie AG reported within<br />

the current assets, there is once again a positive net liquidity on the<br />

balance sheet date. The shares in Süd-Chemie AG were disposed of at<br />

the beginning of fi scal year 2006. An infl ow of liquidity of € 37.3 million<br />

resulted from this sale. This enabled us to continue fi nancing the<br />

growth of the Group largely from our own internal funds.<br />

21