Planning approvals remain factory outlets - Value Retail News

Planning approvals remain factory outlets - Value Retail News

Planning approvals remain factory outlets - Value Retail News

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EuropEan FoC ChallEngEs & strEngths<br />

<strong>Planning</strong> <strong>approvals</strong> <strong>remain</strong><br />

<strong>factory</strong> <strong>outlets</strong>’ top challenge<br />

By Linda Humphers, Editor in Chief<br />

Obtaining planning <strong>approvals</strong>, generating<br />

footfall, and keeping up with consumers’<br />

whims are the top three challenges to<br />

the <strong>factory</strong> outlet industry’s ongoing success for<br />

the coming year, say European executives on the<br />

landlord side of the business (see chart on page 8).<br />

Among the other challenges cited by landlords<br />

in varying degrees of intensity are: meeting tenant<br />

leasing needs, government restrictions on<br />

trading hours and petrol prices. But it’s those<br />

pesky planning <strong>approvals</strong> that <strong>remain</strong> a thorn<br />

in the side of FOC landlords and developers.<br />

“Getting approval is impossible,” says J.W.<br />

Kaempfer, chairman of London-based McArthurGlen<br />

Designer Outlets, operator of 16<br />

outlet centres in the UK and Europe. “In Italy<br />

you can get the underlying basic consent in<br />

nine to 18 months but it always takes two years<br />

and then it’s still open to challenge. You just<br />

have to either be ahead of the game or fold.<br />

We’ve walked away from 25 or 30 sites over the years, and<br />

many times it was because of the <strong>approvals</strong> process.”<br />

McArthurGlen has just announced a site in Greece,<br />

which he hopes will be less daunting than usual. “It’s a<br />

magnificent site that was brought to me by one of my urban<br />

design students at harvard University. We’re hoping<br />

it goes forward smoothly.”<br />

Echoing Kaempfer is hans Dobke, president of London-based<br />

Outlet Centres International, developer of<br />

Designer Outlets Zweibrücken and the planned Designer<br />

Outlets Wolfsburg, both in Germany, known for its ferocious<br />

<strong>approvals</strong> procedures.<br />

“The development and management of outlet centres in Germany<br />

is extremely challenging,” Dobke says, “particularly regarding<br />

obtaining building consent. We’ve had to work extra hard to prove<br />

our reliability and profitability, not only to our tenants and our investors,<br />

but also to the cities and communities in which we develop.”<br />

One positive about developing FOCs in Germany, he says, is<br />

that “in comparison to most other European countries, Germany<br />

is still undersupplied with authentic outlet centres.”<br />

“<strong>Planning</strong> <strong>approvals</strong> are horrendous and getting worse,” says<br />

John Drummond, managing director of Edinburgh-based Guinea<br />

Group, operator of K Village in Kendal, England and Junction<br />

One in Antrim, N. Ireland. But having opened two centres,<br />

Drummond’s now mainly concerned with other challenges,<br />

such as keeping up with consumer preferences and the fact<br />

that manufacturing efficiency means fewer distressed goods are<br />

showing up in <strong>outlets</strong>. “Very little is produced for the <strong>outlets</strong>, so<br />

there is a problem with having enough stock,” he says.<br />

Also on Drummond’s headaches list: Few chains want to operate<br />

more than a handful of stores; generating footfall is an ongoing<br />

challenge, and the cost of petrol can be discouraging to the casual<br />

shopper. On the plus side, Drummond says, Junction One has a<br />

huge discount petrol station and a big, free car park.<br />

As managing director of London-based <strong>Value</strong> <strong>Retail</strong>, operator<br />

of nine outlet centres in the UK and Europe, Scott Malkin has<br />

seen his share of planning approval nightmares, but he shies<br />

InternatIonal outlet Journal u Fall 2006<br />

<strong>Planning</strong> <strong>approvals</strong> can cause costly delays, as Guinea Group discovered during<br />

the seven-year permission process on Junction One (above) in N. Ireland;<br />

McArthurGlen, which operates the Designer Outlets in Parndorf, Austria (below),<br />

sometimes walks away from schemes rather than wait for <strong>approvals</strong>.<br />

away from commenting on them. he focuses instead on what<br />

he considers his company’s biggest challenge: further upgrading<br />

his upscale centres, perfecting the outlet experience.<br />

“We want our brands and our customers to encounter something<br />

wholly satisfying and consistent with a fantastic urban setting, one<br />

of the great shopping venues of the world,” he says. “Our venues<br />

are young and have potential, but right now we’re building Ferraris<br />

while we’re still learning how to drive them. The raw material is<br />

there. Everytime I go to one of Bicester [<strong>Value</strong> <strong>Retail</strong>’s most successful<br />

scheme], I think of 35 things to improve. The whole company<br />

thinks this way. We’re all always trying to do things better.”<br />

Malkin is proud of his team at <strong>Value</strong> <strong>Retail</strong> and considers them<br />

essential to the company’s success. “Obviously every business<br />

has turnover,” he says, “but our team has grown together. We’re<br />

a multicultural company, a melting-pot culture. We’re not an<br />

English company doing <strong>outlets</strong>. As we expand country by country,<br />

we grow country by country. We feel totally European with<br />

strong local cultures. We’re decentralized with no dominant<br />

national culture, thus there’s no inclination to blame others.<br />

“And 90 percent of our senior team comes out of retail. We<br />

understand and serve our brands. We don’t dominate them.”<br />

So the list of challenges goes on and on, but one common theme<br />

among landlords is that they genuinely enjoy what they do and who<br />

they work with. As Kaempfer put it, “I’m having fun. I have a great<br />

crew. They’re all smart, hard-working and a lot of fun.”

EuropEan FoC ChallEngEs & strEngths<br />

What are they doing right?<br />

Outlet landlords talk<br />

about their strengths<br />

IOJ asked European <strong>factory</strong>-outlet executives what factors would be most important<br />

in their companies’ ongoing success in the coming year.<br />

Of more than 40 replies to this open-ended question, a wide variety of industry<br />

strengths jumped out, with most of the executives saying they rely on the high quality<br />

of their schemes and their portfolios to reach and exceed their goals. Portfolio<br />

branding and the ability to spread planning and operations across<br />

a group of FOCs is high on the list for the owners of multiple<br />

properties, and they and other FOC developers say their standing<br />

is enhanced by their good reputations for delivering on promises,<br />

particularly regarding growth and performance.<br />

Other positive factors include the ability to choose and obtain<br />

good sites. The clear positioning of each scheme, attractive centre<br />

designs, and adapting each centre to its customers and market were<br />

also seen as playing an important role in a well-run company.<br />

Mentioned almost as often as the quality of their schemes was<br />

the overall excellence of their staffs. Executives described their<br />

colleagues as “experienced,” “close-knit,” “efficient,” and “highly<br />

professional,” and as key players in their company’s decision-<br />

making process.<br />

A few praised their small staffs for their company’s ability to<br />

be nimble and make timely decisions or to react quickly to ten-<br />

ant needs. Others lauded their<br />

team’s understanding of the<br />

outlet industry, and others emphasized<br />

that having depth and<br />

quality at the senior management<br />

level is what leads to fruitfully<br />

defining and implementing their<br />

company’s strategies and objectives.<br />

Funding is fundamental to<br />

success, the respondents noted,<br />

citing strong financial backers<br />

and good JV partners (particularly<br />

in new countries) as one of<br />

the engines driving their business.<br />

Another positive force is<br />

centre marketing. Several<br />

respondents felt their company’s<br />

innovative marketing<br />

and understanding of<br />

the catchment make the<br />

difference between a centre<br />

that’s just doing okay<br />

and one that’s gloriously<br />

pumping money.<br />

Of course everyone real-<br />

Good site selection and a reputation for<br />

delivering on promises of growth and<br />

performance are seen as outlet-industry<br />

strengths; top photo, <strong>Value</strong> <strong>Retail</strong>’s Ingolstadt<br />

Village; above, aerial view of Outlet<br />

Centres International’s Designer Outlets<br />

Zweibrücken.<br />

izes that the FOC industry is retailer-driven, and much homage<br />

was paid by respondents to tenants and to the relationships<br />

that help centres flourish. Improving the tenant mix, bringing<br />

intelligence to brands’ concerns, and making sure that leasing<br />

teams and tenants are on excellent terms was cited often and<br />

embodied in this comment: “Our good communication among<br />

our network of investors, operators, tenants and consumers” is<br />

key to achieving success.<br />

Respondents are happy to see new tenants, hypermarkets,<br />

InternatIonal outlet Journal u Fall 2006<br />

discount petrol stations, and the growth surrounding<br />

centres because all of those create<br />

footfall.<br />

Finally, a number of respondents mentioned the obvious,<br />

that industry growth is a sure sign of success. Development<br />

of new centres and opening new phases is undeniably the<br />

hallmark of arrival in the world of FOCs – and the growing<br />

demand by retailers for outlet units in new markets is the<br />

industry standard for excitement.<br />

But all of those will happen only if that one, often-locked<br />

door has been successfully pried open – obtaining planning<br />

consents. Now that’s success.

EuropEan FoC ChallEngEs & strEngths<br />

Tenant challenges often come<br />

from within, affect landlords<br />

The challenges that landlords and <strong>factory</strong>-outlet chains<br />

say they face are often miles apart, with few overlapping<br />

concerns, according to IOJ’s anecdotal survey of retailer<br />

issues. But there are a few issues that landlords and tenants<br />

say they share, such as educating the consumer on<br />

<strong>factory</strong>-outlet brands and keeping up with ever-changing<br />

consumer trends. And, there are a few retailer-related issues<br />

that pose a challenge for landlords, such as poorly managed<br />

stores (due to tenants’ tough time finding qualified staff)<br />

plus competition from discounters and high street.<br />

When Brendon O’Reilly, partner of GVA Grimley<br />

Outlet Services, puts on his operator’s hat, he speaks to<br />

the kinds of tenant issues that faze landlords.<br />

“Currently the biggest challenge in Poland, the Czech<br />

Republic, hungary and the Ukraine is the varying representation<br />

in company stores,” he says, explaining that<br />

within the same country one brand will have both licensees<br />

and the corporate offices operating stores. “It shows up a mile<br />

in the consumer’s reaction. For instance, Nike Company Stores<br />

have much better selection and are much more organized than<br />

Nike distributors’ stores. The Company Stores’ inventory comes<br />

from everywhere, but the distributor gets inventory only from<br />

where he distributes, so those discounts aren’t as heavy. Almost<br />

every brand has two sets of distributors in every country, all<br />

trading under the same name. We’re convincing more to do<br />

Educating the consumer about FOCs is another challenge<br />

shared by tenants and landlords; above, Morley Fund/<br />

Aviva’s Premier Outlets Center in Budapest, Hungary.<br />

2006 European Factory Outlet Challenges Survey – Landlords<br />

Percentage of replies* Challenges to your company’s ongoing success in 2006<br />

19 percent Variations in planning/obtaining <strong>approvals</strong> in each country<br />

15 percent Generating footfall at outlet centers<br />

15 percent Keeping up with consumers’ preferences for brands and centre amenities<br />

10 percent Acquiring sites that meet tenants’ sensitivity requirements<br />

8 percent Creating efficiencies when operating centres in more than one country<br />

8 percent Government restrictions on trading (pricing and operating hours)<br />

8 percent Meeting tenants’ many leasing needs<br />

6 percent Educating consumers about branded tenants; consumer perception of outlet goods<br />

6 percent <strong>Retail</strong>ers’ diminishing need for space (unless capital premiums are paid)<br />

2 percent Funding my schemes<br />

2 percent Petrol prices<br />

* 48 replies received; survey conducted in August 2006<br />

Source: <strong>Value</strong> <strong>Retail</strong> <strong>News</strong>/International Outlet Journal<br />

InternatIonal outlet Journal u Fall 2006<br />

Keeping up with consumers’ changing preferences is a<br />

challenge shared by tenants and landlords; above, the<br />

Outlet Company’s Fashion House Sosnowiec in Poland.<br />

just company stores in the <strong>outlets</strong>.”<br />

Largely speaking, though, tenants and landlords often operate<br />

in parallel universes. here are a dozen challenges, in no particular<br />

order, that European outlet chains say are among their<br />

most critical:<br />

1. Availability of stock and the logistics of getting inventory into<br />

each store<br />

2. Sensitivity with wholesale accounts<br />

3. Cannibalization of my brand<br />

4. Company restrictions on participating in centre<br />

marketing<br />

5. Paperwork and hassle of local taxation and VAT<br />

6. Developer not keeping the tenant mix fresh<br />

7. Developer not creating tenant neighborhoods<br />

8. Footfall at centres<br />

9. Center operating hours<br />

10. Appropriate common area maintenance charges<br />

11. Lack of feedback on perfomance of existing centers and<br />

the potential of planned centers<br />

12. Center marketing strategies

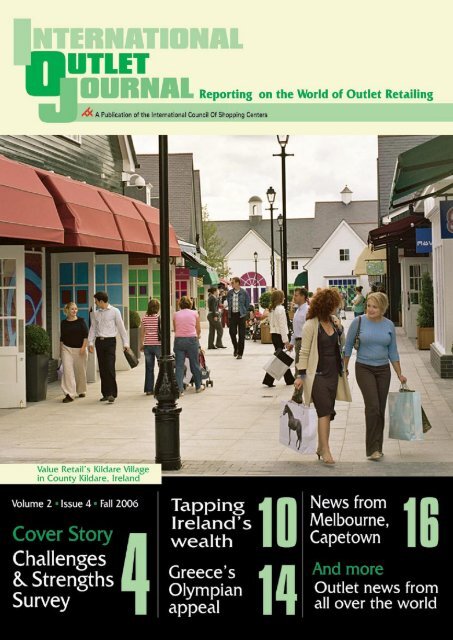

<strong>Value</strong> <strong>Retail</strong> stays in character<br />

with opening of Kildare Village<br />

By Linda Humphers, Editor in Chief<br />

By Linda Humphers, Editor in Chief<br />

K ildare<br />

Village, <strong>Value</strong><br />

<strong>Retail</strong>’s ninth up-<br />

scale outlet shop-<br />

ping centre, quietly<br />

opened its doors in<br />

early July in the heart of County<br />

Kildare, near Dublin, Ireland.<br />

Despite the no-frills opening<br />

– the grand opening won’t be<br />

until May 2007 – shoppers in the<br />

market were primed, and trading<br />

was two to three times higher<br />

than expected, exceeding opening-day<br />

sales of every other <strong>Value</strong><br />

<strong>Retail</strong> project in Europe.<br />

Furthermore, Kildare Village is<br />

currently trading third in terms<br />

of sales psm in the developer’s<br />

portfolio, behind only Bicester<br />

Village in England and La Vallee<br />

Village near Paris.<br />

Whether that’s a tribute to<br />

the affluent catchment in the<br />

Dublin market or to <strong>Value</strong> <strong>Retail</strong>’s<br />

particular expertise in siting and<br />

promotion doesn’t really matter.<br />

The fact is, Kildare Village has<br />

opened in one of the most interesting<br />

markets in the country<br />

with the fastest growing economy<br />

in Europe.<br />

The centre is 60 minutes southwest<br />

of central Dublin – 30<br />

minutes if the traffic’s light. It is<br />

adjacent to Junction 13 of the M7<br />

Motorway, which carries over 9.4 million cars and coaches past<br />

the Village each year and is the principal tourist route linking<br />

Dublin to the south, southwest and west.<br />

Kildare Village’s catchment draws from the 2.5 million people<br />

who live within a two-hour drive, the 3.6 million international<br />

tourists who visit Dublin annually and the 6.8 million international<br />

tourists who visit the Republic of Ireland each year.<br />

Kildare Village is a few minutes from the town of Kildare,<br />

one of Ireland’s wealthiest regions. Once the village is in full<br />

swing, it’s expected to attract 1.5 million shoppers in its first<br />

year, with possibly up to 400,000 of those customers traveling<br />

on the 35-minute direct rail service from Dublin.<br />

Music in their method<br />

Additionally, the site fits into <strong>Value</strong> <strong>Retail</strong>’s modus operandi:<br />

a visible location in a major, international city that shoppers<br />

are known to enjoy. Then add two portions of <strong>Value</strong> <strong>Retail</strong>’s<br />

formula: its collection of upmarket tenants and its ability to<br />

differentiate its centres from the rest of the pack.<br />

Scott Malkin, chairman of <strong>Value</strong> <strong>Retail</strong>, told IOJ that his<br />

company doesn’t pursue consumer advertising to get its mes-<br />

10 InternatIonal outlet Journal u Fall 2006<br />

Kildare Village was poised to bask in the glow of the Ryder Cup’s 225,000 spectators<br />

and 60 million TV viewers for the three-day golf event held in late September.<br />

sage across. “We market to the travel trade, to luxury hotel<br />

groups, credit card companies, fashion magazines,” he says.<br />

“We don’t do signs on buses. That’s not our focus. That is not<br />

what we are about.”<br />

What <strong>Value</strong> <strong>Retail</strong> is about, Malkin says, simply cannot be<br />

copied by other developers.<br />

“There are other outlet centres across Europe, but not in<br />

the primary cities. Our villages are like a luxury hotel brand<br />

that attracts a certain shopper, a higher-end customer looking<br />

for an experience. We offer her a global, upscale shopping<br />

experience.”<br />

Not that <strong>Value</strong> <strong>Retail</strong> rushes into providing tenants for that<br />

global, upscale shopping experience.<br />

The 11,000-m² phase 1 of Kildare Village opened with 17<br />

of its planned 58 tenants. While a 30-percent occupancy rate<br />

might keep other developers from opening at all, <strong>Value</strong> <strong>Retail</strong><br />

is an old hand at this strategy, preferring to hold out space until<br />

the perfect tenant match for the centre comes along.<br />

“The opening was completely our style,” Malkin says casually.<br />

“We’ll have 45 stores open by the grand opening” in May.<br />

Also, <strong>Value</strong> <strong>Retail</strong> wanted Kildare Village open in time for

the prestigious world golf tournament, the 2006 Ryder Cup,<br />

which was played in late September at the nearby K Club. The<br />

event was expected to attract more than 225,000 well-heeled<br />

international spectators – many of whom live to shop – to<br />

County Kildare.<br />

Strategically secure<br />

Secure that his strategy is paying off, Malkin says sales at all<br />

nine <strong>Value</strong> <strong>Retail</strong> outlet villages are going well. “Touch wood,<br />

we’re having a very good year, with trading up 10 to 12 percent<br />

and the biggest gains in London and Paris. They’re each trading<br />

up in double digits – 15 percent at Bicester and 20 percent<br />

in Paris.”<br />

Malkin says that to some extent the increase in sales at La<br />

Vallee is due to the return of the tourist to France, but also, the<br />

centre has begun hitting its stride as a tourism destination.<br />

“It takes years to do that,” he says, adding that he hasn’t been<br />

especially troubled by the recent issues at international airports.<br />

“Recent events are more about introducing additional layers<br />

to prevent a calamity,” he says. “The world tends to adjust.<br />

Generally, people make their travel plans six to 18 months in<br />

advance, so when there’s a disruption, the shock factor is what<br />

throws people off. It’s more of an inconvenience.”<br />

The upticks in sales at Bicester and Paris nicely coincide with<br />

having received planning permission to expand both centres in<br />

2008. Twenty-five units will be added to Bicester and 16 to La<br />

Vallee. Expansions are also scheduled to open in 2007 in <strong>Value</strong><br />

<strong>Retail</strong>’s centres in Fidenza, Italy, which will add 15 units, and<br />

in Wertheim, Germany, which will add 16 units.<br />

Kildare Village is already benefiting from <strong>Value</strong> <strong>Retail</strong>’s<br />

editorial coverage in the travel and leisure media, including<br />

Condé Nast Traveller magazine and in-flight magazines of British<br />

Airways, Aer Lingus, BMI, Scandinavian Airlines, Delta, Lufthansa,<br />

and Ryan Air, as well as through established promotional<br />

partnerships with travel operators.<br />

In the Dublin market, Kildare Village has established crossmarketing<br />

partnerships with local attractions including The<br />

Curragh, the Irish National Stud, the Japanese Garden, Punch-<br />

Kildare Village<br />

tenants include:<br />

Möve<br />

Café Coton<br />

Calvin Klein Jeans<br />

Calvin Klein Underwear<br />

Clarks<br />

Coast<br />

Designers Guild*<br />

Karen Millen<br />

Kenneth Turner<br />

Le Creuset<br />

Levi’s<br />

L’Officina Dunne & Crescenzi<br />

Molton Brown<br />

Monsoon*<br />

Ireland’s economic miracle explored<br />

In an article entitled “The Risk Pool,” which ran in The<br />

New Yorker magazine on 28 August, 2006, journalist Malcom<br />

Gladwell is writing about the demise of pension funds in the<br />

U.S., but he incisively presents an analysis of Ireland’s economy<br />

as the best way to explain the issue.<br />

Here is what he said about Ireland:<br />

The key to understanding the pension business is something called<br />

the “dependency ratio,” and dependency ratios are best understood<br />

in the context of countries.<br />

In the past two decades, for instance, Ireland has gone from being<br />

one of the most economically backward countries in Western<br />

Europe to being one of the strongest: Its growth rate has been<br />

roughly double that of the rest of Europe. There is no shortage of<br />

conventional explanations. Ireland joined the European Union. It<br />

opened up its markets. It invested well in education and economic<br />

infrastructure. It’s a politically stable country with a sophisticated,<br />

mobile workforce.<br />

But, as the Harvard economists David Bloom and David Canning<br />

suggest in their study of the “Celtic Tiger,” of greater importance may<br />

have been a singular demographic fact. In 1979, restrictions on con-<br />

Myla<br />

Nike<br />

Petit Bateau<br />

Quiksilver<br />

Radley<br />

Reebok<br />

Starbucks Coffee<br />

Sunglass Time<br />

Tog 24<br />

TSE Cashmere*<br />

Villeroy & Boch*<br />

*Opening soon<br />

estown, Saint Fiachra’s Garden and Saint Brigid’s Cathedral, as<br />

well as with Irish Rail to promote “a great day out” in County<br />

Kildare. These attractions draw more than 335,000 international<br />

and domestic visitors annually.<br />

Architecturally Kildare Village is inspired by the region’s stud<br />

farms and world-renowned thoroughbred horse-breeding industry.<br />

Equestrian facades, varied roofscapes and rich landscaping<br />

complete the village feel.<br />

Tenants are required to discount prices for out-of-season or<br />

end-of-line merchandise by at least 33 percent. <strong>Value</strong> <strong>Retail</strong>’s<br />

Frank Blanchette told the Irish Times that goods generally will<br />

be available at discounts of around 50 per cent.<br />

“Our experience is that people shop in our Villages because<br />

of the good products, good pricing and a good experience,” he<br />

said. “Customers don’t come to us to save money, they come to<br />

spend twice as much.”<br />

Malkin says <strong>Value</strong> <strong>Retail</strong> is constantly looking for new sites<br />

that fit the company’s model, and lately he’s been looking<br />

beyond Europe. “We’ve been studying Moscow and Dubai,”<br />

he says, but not Asia, where Chelsea Property Group, a <strong>Value</strong><br />

<strong>Retail</strong> investor, has pioneered the FOC concept. “We defer to<br />

Chelsea in the Asian markets.” n<br />

traception that had been in place since Ireland’s founding were lifted,<br />

and the birth rate began to fall. In 1970, the average Irishwoman had<br />

3.9 children. By the mid-nineteen-nineties, that number was less than<br />

two. As a result, when the Irish children born in the nineteen-sixties<br />

hit the workforce, there weren’t a lot of children in the generation<br />

just behind them. Ireland was suddenly free of the enormous social<br />

cost of supporting and educating and caring for a large dependent<br />

population. It was like a family of four in which, all of a sudden,<br />

the elder child is old enough to take care of her little brother and the<br />

mother can rejoin the workforce. Overnight, that family doubles its<br />

number of breadwinners and becomes much better off.<br />

This relation between the number of people who aren’t of working<br />

age and the number of people who are is captured in the dependency<br />

ratio. In Ireland during the sixties, when contraception was illegal,<br />

there were ten people who were too old or too young to work for every<br />

fourteen people in a position to earn a paycheck. That meant that the<br />

country was spending a large percentage of its resources on caring<br />

for the young and the old. Last year, Ireland’s dependency ratio hit<br />

an all-time low: For every ten dependents, it had twenty-two people<br />

of working age. That change coincides precisely with the country’s<br />

extraordinary economic surge.<br />

Fall 2006 u InternatIonal outlet Journal 11

Dundalk, Banbridge wage a market skirmish<br />

In the shopping-center business, good economic times<br />

are often heralded by hard-fought battles to be the<br />

first to open in a market. The two planned centres<br />

for Ireland – GML Estate’s The Outlet at Bridgewater<br />

Park in Banbridge, Northern Ireland and ING’s Ballymac<br />

Shopping Outlet in Dundalk, Ireland – have been slugging<br />

it out for the last couple of years.<br />

The Outlet@ Bridgewater Park<br />

The OUTLET is the first phase of Bridgewater Park, a<br />

mixed-use retail, leisure and business park on 100 acres<br />

with a 400-metre frontage to the A1. The FOC will provide<br />

19,220 m² of GLA, including 80 shops, several cafes, coffee<br />

shops and restaurants, and a satellite tourist-information<br />

bureau. It will be built in a contemporary style, laid out<br />

as a single curved pedestrian street with all shops facing<br />

inward; 1,500 parking spaces will be provided within the<br />

semi-circular design.<br />

According to Phil Cottingham, portfolio director of Land<br />

Securities, which is also involved in Gunwharf Quays, The<br />

Galleria at hatfield and Livingston Factory Outlet, more<br />

than 50 percent of the property has been either leased or<br />

reserved and the scheme is well on target for completion in<br />

Easter 2007. he adds that 70 percent of the space will be<br />

under signed leases by Christmas and 90 percent of the units<br />

will be occupied at the opening next year.<br />

Also, construction is running about four weeks ahead of<br />

schedule, as the steelwork has been completed and storefronts<br />

are taking shape.<br />

Signed Tenants at The Outlet include<br />

Armani<br />

Claire’s Accessories<br />

Clockwork Orange<br />

Designer Studio<br />

ex- Z<br />

Ghost<br />

Joseph<br />

Marks and Spencer<br />

Mexx<br />

Mountain Warehouse<br />

Nitya<br />

Oasis<br />

Olsen<br />

Pilot<br />

Ravel<br />

Regatta<br />

Tog 24<br />

12 InternatIonal outlet Journal u Fall 2006<br />

Ballymac Shopping Outlet<br />

Ballymac Shopping Outlet in Dundalk arrived on the<br />

scene with the backing of investment powerhouse ING<br />

and a site ready to encompass 1.75 million people within 60<br />

minutes, rising to 2.9 million within 90 minutes.<br />

Then construction on the planned 15,479-m² scheme<br />

slammed into slow gear when an early summer judicial review<br />

halted construction until 1 September. According to<br />

a story in August in The Argus newspaper, this ruling gave<br />

The Outlet a head-start.<br />

Billy McKinney, managing director of RJ McKinney<br />

Ltd, acting for Coverfield Developments and ING, told<br />

The Argus, “At the moment I am still confident that it will<br />

go ahead…September 1st was the earliest date we could<br />

move on site, otherwise we would have been in contempt<br />

of court.”<br />

he also told The Argus that although the two projects<br />

are in competition for the same tenants, “ING have already<br />

invested e16 million to e19 million in the project, and it if<br />

was a boxing match, there would be no contest.”<br />

Ballymac’s Web site says construction on the e60 million<br />

scheme is scheduled to start any time from now. Some<br />

40 percent of the space has been let and negotiations with<br />

retailers continue.<br />

Factory Outlet Centres in Ireland<br />

TRADING<br />

Center Location Developer GLA sm GLA sf Opening date<br />

Killarney Outlet Centre Killarney, Ireland Green Property plc 8,357 90,000 July 1999<br />

Linen Green Moygashel, N. Ireland<br />

Moygashel Community<br />

Dev. Assoc.<br />

Both are on the new A1 Euroroute, with GML’s<br />

scheme 26 miles south of Belfast and ING’s scheme 22<br />

miles further south, 48 miles equidistant from Belfast<br />

and Dublin. Both have impressive catchments and<br />

both have been successful in their preleasing efforts,<br />

although they want the same tenants. An update on<br />

each follows.<br />

Signed tenants at Ballymac include:<br />

Antler<br />

Basile<br />

Book Depot<br />

Mandarian Duck<br />

Next<br />

Papermill<br />

4,643 50,000 November 1999<br />

Rathdowney Designer Outlet Rathdowney, Ireland AWG Outlets 9,285 100,000 2001<br />

Junction 1 Antrim, N.Ireland Junction One Ltd 28,346 305,000 2004<br />

Kildare Village Kildare, Ireland <strong>Value</strong> <strong>Retail</strong> Plc 9,285 100,000 Summer 2006<br />

Total GLA of open FOCs<br />

PLANNED<br />

59,916 m² 645,000 sf<br />

The Outlet, Bridgewater Park Banbridge, N.Ireland GML Estates Ltd/Land Sec 19,220 207,000 Easter 2007<br />

Ballymac Shopping Outlet Dundalk, Ireland ING/ Orana/ Land Securities 15,479 166,705 2008<br />

Total GLA of planned FOCs 34,699 m² 373,705 sf<br />

Source: VRN/IOJ

Junction One thrives as Ireland booms<br />

By Linda Humphers, Editor in Chief<br />

It seems as though Junction One, the outlet centre in Antrim,<br />

Northern Ireland, has been around for nearly a decade, and<br />

in a way it has: seven years getting <strong>approvals</strong> and close to<br />

three years actually open and operating.<br />

“Approvals take a very long time in Europe,” says John<br />

Drummond, managing director of The Guinea Group, which is<br />

partners on Junction One (as well as K Village <strong>outlets</strong> in Kendal)<br />

with CUSP, The Kennedy Group and Dunalastair Estates.<br />

“It took a long time to get people used to the idea of an outlet<br />

centre in Northern Ireland, and then it took a fair bit of time<br />

to get the retailers interested because most didn’t have many<br />

– or any – retail units of any kind.”<br />

When the centre opened fully leased in May 2004, he says,<br />

many of the 55 tenants were there by virtue of opening their<br />

first retail units.<br />

Booming beginnings<br />

While Junction One wasn’t the first to open in Ireland (see chart<br />

page 12), the centre has made a mark since opening when shoppers<br />

desperate for branded bargains created 10-mile traffic jams.<br />

Since then, more than 7 million people have visited the<br />

23,000-m² centre that will soon expand to more than 28,000<br />

m², with 90 to 100 stores. When that 5,600-m² expansion opens<br />

in October, Junction One will be the second-largest <strong>factory</strong><br />

outlet centre in the UK, behind McArthurGlen’s 35,000-m²<br />

Cheshire Oaks and more than 50 percent larger than either of<br />

the planned Irish outlet centres at Banbridge, County Down<br />

and at Ballymac near Dundalk in the Republic of Ireland.<br />

Work has already started on yet another Junction One expansion,<br />

comprising 3,000 m² and 30 units that will open in 2007.<br />

REALM, Rohleder Lumby and OKT are assisting the Guinea<br />

Group with leasing. Drummond says that 80 percent of Junction<br />

One’s tenants are company owned, but only a relatively small<br />

number are domestic. “Ireland hasn’t produced a huge retail<br />

portfolio,” he says. “Less than 10 percent are Irish and most of<br />

those are textiles. Most of our fashion tenants are UK or universal<br />

brands,” such as the 836-m² Nike that opened a year ago.<br />

In addition to the <strong>factory</strong> outlet offer, a retail and leisure park is<br />

being developed on the site with restaurants, hotel, multiplex cinema<br />

and a range of supermarkets. Already operating are discount<br />

supermarket Lidl, Burger<br />

King, a petrol station with<br />

a Costercutter retail store,<br />

plus a 3,500-m² homebase<br />

with garden centre<br />

store, a state-of-the-art<br />

car wash and a Red Panda<br />

restaurant. UK restaurant<br />

chain Brewer’s Fayre and<br />

British grocery chain Asda<br />

have signed leases, and<br />

construction has begun on<br />

the 90-room holiday Inn<br />

Express hotel, which will<br />

open by summer 2007.<br />

Thanks to the strong<br />

economy and a population<br />

that, although<br />

comparatively small,<br />

loves shopping, sales at<br />

Junction One are look-<br />

ing rosy.<br />

“We’re in our third year of trading and we’re doing very well,”<br />

Drummond says. “Our comps have increased over 20 percent<br />

every year.”<br />

Drummond acknowledges that marketing is a big job, particularly<br />

with today’s public having such a keen understanding<br />

of the value equation.<br />

Equal opportunity marketing<br />

So to attract shoppers, Junction One markets to everyone.<br />

“There are only so many people in our market,” Drummond says,<br />

noting that the centre is off the M2 Motorway 20 minutes west of<br />

Belfast city centre. “Northern Ireland has just 2 million people, but<br />

compare that population for a whole country to Cheshire Oaks,<br />

which has a catchment of 6 million within a 20-minute drive.<br />

“Because of our limited population, we go for everybody except<br />

the most hard-pressed,” he says. “Over 40 percent of our shoppers<br />

are wealthy achievers with household incomes of e120,000 and up.<br />

Over 60 percent are a combination of wealthy achiever, comfortably<br />

off and flourishing families – those are the middle management and<br />

above people, who have kids in private schools and the wife doesn’t<br />

work; she goes shopping and to the gym. The <strong>remain</strong>der are the<br />

secure families and the struggling guys. We don’t have a lot of yuppies.<br />

The predominate age level of our shopper is 35 to 44 years old,<br />

and they’re willing to spend 20 percent or more of their income on<br />

fashion and footwear. They’re pretty brand conscious.”<br />

Drummond heartily believes in customer research, having<br />

conducted five exit surveys and three focus groups that have<br />

told him all sorts of things about his shoppers, from their average<br />

stay (84 minutes) to their postal codes, and which stores they<br />

shop in and where they spend their money. And he’s pleased<br />

that 80 percent of Junction One shoppers are repeat customers,<br />

which shows high customer satisfaction.<br />

“We do get shoppers from southern Ireland and overseas, as<br />

well,” he says, “as we’re on the route for The Giants Causeway,<br />

Bushmills Distillery and the North West Coast – 20 percent of<br />

our customers are new, and that’s healthy.”<br />

What works well in the search for new customers for Junction<br />

One, he says, is TV advertising. “Ulster TV covers all of Northern<br />

Ireland and great chunks of the South, so there’s no waste,”<br />

he says. “A heavy campaign week on Ulster TV is e30,000<br />

– that would buy half a<br />

day in London and most<br />

of it would be wasted. On<br />

Ulster TV, we can afford to<br />

communicate often.”<br />

Print advertising includes<br />

Chinese publications,<br />

mainly to target the charter<br />

coaches filled with tourists<br />

who love to see outlet stores<br />

stocked with footwear and<br />

apparel made in China. For<br />

instance, Drummond says,<br />

“At Kendal we get coaches<br />

full of Chinese people shopping<br />

at the Clarks shoe<br />

store. The shoes are made<br />

in China and these visitors<br />

Because many brands had no retail offering in Ireland, Junction<br />

One incubated new outlet chains by helping their companies open<br />

their first stores.<br />

bring in outlines of their<br />

friends’ feet. They can<br />

empty a store.” n<br />

Fall 2006 u InternatIonal outlet Journal 13

McArthurGlen heads to Greece<br />

Shopping and innovative ideas in high demand in Attike<br />

By Linda Humphers, Editor in Chief<br />

Having made its mark with 16 outlet<br />

centres across Europe, including<br />

seven in the UK, two in France,<br />

three in Italy, two in Austria, two in Germany,<br />

along with projects planned in Austria,<br />

Germany and Italy, McArthurGlen has come<br />

up with a real surprise for its next serving: a<br />

future project on a fast track in Greece.<br />

This summer, McArthurGlen signed an<br />

e80 million development deal to open<br />

its 17th location at Yalou, 25 km east of<br />

central Athens. The centre is scheduled<br />

to open in autumn 2008, covering 25,000<br />

m² and accommodating approximately 125<br />

stores. The Yalou outlet centre is part of a<br />

23-hectare site that includes big box retail<br />

and a hypermarket anchor.<br />

Yalou has a catchment of 4.5 million<br />

people within a 60-minute drive. That was<br />

the crux of the reason to look to Greece<br />

for FOC expansion.<br />

Outlet retailers have long wanted to<br />

tap into the cosmopolitan Athens market,<br />

and the city’s performance during the recent<br />

Olympic Games proved its value as<br />

an international-brands market. A new<br />

ring road around Athens and a massive<br />

transportation infrastructure were built<br />

for the games, opening up accessible land<br />

for development.<br />

Prior to the vastly improved transportation<br />

system, Athens was considered to be a<br />

fully built-out city. Now, new projects are<br />

popping up everywhere – and even last year<br />

Greece had the lowest shopping center provision<br />

per capita in the European Union.<br />

Store brand interest<br />

“Yalou represents an excellent opportunity<br />

to establish a solid platform in Greece<br />

that will add value to the brands we bring<br />

into the project,” J.W. Kaempfer, chairman,<br />

McArthurGlen, said in a press release.<br />

“There has already been significant interest<br />

from some of the more illustrious names in<br />

our portfolio and I am confident that with<br />

the location and proximity of Yalou to Athens,<br />

this project will fill the needs of even<br />

more brands that have long championed<br />

the economic growth and readiness of the<br />

Greek market. We intend to bring the<br />

same awarding-winning presentation and<br />

performance that constitutes our success<br />

throughout Europe.”<br />

McArthurGlen, which has noted that<br />

it has no shortage of investors interested<br />

in the Yalou scheme, has joined forces<br />

with Bluehouse Development as its joint-<br />

1 InternatIonal outlet Journal u Fall 2006<br />

venture partner. Yannis Delikanakis,<br />

chairman, said, “We intended to do this<br />

deal with a world-class partner with a<br />

proven management team. This deal<br />

not only fulfills that aim, it also delivers<br />

considerable economic benefits to the<br />

community. New jobs and revenues will<br />

be generated in the community as a result<br />

of this experience. We are especially<br />

pleased to be able to introduce this project<br />

to the Greek market under the aegis of a<br />

partner as performance-oriented and quality-driven<br />

as McArthurGlen, who has a<br />

track record for making such contributions<br />

to the communities they enter.”<br />

Elmec Sport’s concept<br />

While McArthurGlen’s project will be<br />

the first purpose-built outlet centre in<br />

Greece, the concept has had something of<br />

a forerunner since 1999 when Elmec Sport<br />

S.A., the exclusive distributor of Nike apparel<br />

and shoes in Greece, Cyprus, Bulgaria<br />

and Romania (and a seasoned apparel retailer),<br />

opened a discount department store<br />

in Athens. Factory Outlet S.A. operates in<br />

a 13,000-m² building on Pireos street, Neo<br />

Faliro, clearing out-of-season goods.<br />

In September 2004 Elmec formed Athens<br />

International Airport SA to develop<br />

a new-construction, 13,000-m² discount<br />

department store in the Commercial Park<br />

of Eleftherios Venizelos Airport. Its opera-<br />

McArthurGlen’s only competition<br />

thus far in the Athens<br />

market are Elmec Sport’s concepts,<br />

which are positioned as<br />

discount department stores<br />

selling out-of-season goods.<br />

tions will mirror Factory Outlet on Pireos<br />

street, offering a variety of branded apparel<br />

and footwear products at prices at least 30<br />

percent lower than the original.<br />

Elmec Sport also represents the legendary<br />

American motorcycle company harley-<br />

Davidson and Italian fitness-equipment<br />

manufacturer Technogym.<br />

With new ideas sprouting everywhere and<br />

the demand for retail so high there, McArthurGlen<br />

sees Greece as a logical market<br />

for its aggressive and continued expansion<br />

plans. This year, the company has opened<br />

Barberino Designer Outlet near Florence,<br />

Italy, and has taken over management of<br />

the B5 outlet centre, Berlin, Germany and<br />

BIGG outlet, in Parndorf, Austria (see page<br />

20 for related story). Furthermore, the London-based<br />

developer will open a centre in<br />

Salzburg, Austria, and one in Naples, Italy,<br />

within the next 18 months. McArthurGlen<br />

is also evaluating other possible third party<br />

management and leasing opportunities.<br />

Bluehouse Development, McArthur-<br />

Glen’s partner in Greece, was established in<br />

2005 and is a real estate investment advisory<br />

firm based in Athens. It is an advisor to<br />

Bluehouse Capital Partners I, a property<br />

fund launched in 2005 targeting investments<br />

in Southeast European property<br />

markets. The fund has invested in 16 assets<br />

in Romania, Bulgaria and Greece covering<br />

the office, residential and retail sectors.

ING plans Melbourne outlet scheme<br />

Around the world neglected docklands are turning into lively<br />

districts offering a mix of commercial and public facilities.<br />

By TOM KIRWAN, Senior Editor<br />

ING Real Estate Development is aiming<br />

to make an outlet centre the retail<br />

star of its AUD $1.3-billion (e780<br />

million) waterfront development – Waterfront<br />

City – that is currently under<br />

construction in Melbourne, Australia.<br />

A harbour Town Brand Direct Outlet<br />

centre will be a big part of Waterfront<br />

City, a massive redevelopment that one<br />

ING exec told a local paper is “all about<br />

intimacy, community and atmosphere, not<br />

oversized apartments and office towers.”<br />

The site is the Melbourne Docklands,<br />

where an urban redevelopment is under<br />

way that covers more than 19 hectares<br />

(47 acres) and offers 7 km (23,000 feet)<br />

of waterfront.<br />

The Waterfront City project will nearly<br />

double the size of the city’s central business<br />

district. Upon completion, about 20,000<br />

people will live there, and 25,000 people<br />

will be employed in the Docklands.<br />

ING and Queensland retail and<br />

residential developer Lewis Land are old<br />

hands at outlet-centre development in<br />

Australia, having together developed<br />

three outlet projects there since 1999.<br />

Now they are hoping to capture the<br />

Melbourne market with their harbour<br />

Town outlet-centre formula.<br />

“harbour Town is currently under<br />

construction, with completion due prior<br />

to the end of 2008,” says Barry Stockton,<br />

leasing director for ING Real Estate Development<br />

Australia.<br />

The outlet centre will have plenty of visitors<br />

to draw from: Waterfront City, when<br />

completed, is anticipated to draw up to 12<br />

1 InternatIonal outlet Journal u Fall 2006<br />

million visitors per year, ING officials say.<br />

That’s because there will be so much to<br />

do there: Waterfront City will be home to<br />

200 stores, 18 restaurants, 500 homes and<br />

some commercial office space, plus other<br />

venues, including a wide variety of bars and<br />

nightspots. ING is promoting much of the<br />

area as Melbourne’s new waterfront playground,<br />

a destination replete with a public<br />

piazza, the outlet centre, many restaurants<br />

and a 120-metre (402-foot) ferris wheel.<br />

85 tenants expected<br />

ING expects to have about 85 stores<br />

in the outlet centre, which will be about<br />

19,251 m2 (207,200 sf). Each store will be<br />

about 226 m2 (2,400 sf). While the developers<br />

aren’t releasing tenant names, they<br />

say they expect mostly domestic brands,<br />

plus a healthy dose of international tenants.<br />

Several brands that are well-known<br />

in the U.S. outlet business that have entered<br />

one or more of the ING/ Lewis Land<br />

outlet properties in Australia include Nike,<br />

Polo Ralph Lauren, Fila, Esprit, Mikasa<br />

and Levi.<br />

“The anticipated number of international<br />

retailers is 27, and 46 will be Australian<br />

retailers,” says ING’s Stockton,<br />

adding that the balance will be made<br />

up of local businesses and fast-food restaurants.<br />

Tenants are being recruited from<br />

among the 400 stores that lease space in<br />

the three Australian outlet centres ING<br />

co-owns with Lewis Land. “ING Real<br />

Estate is also a global property group<br />

that owns and manages a number of<br />

outlet centres in Europe and the United<br />

Harbour Town Brand Direct Outlet centre will be a big part of the 19-hectare,<br />

massive redevelopment project, which features 7 kilometres of waterfront.<br />

A 120-metre-tall Southern Star Observation<br />

Wheel will be a chief attraction.<br />

Kingdom,” according to Stockton. “The<br />

organization will be working closely with<br />

its international network to entice new<br />

outlet operators to Australia. There will<br />

be no anchor tenants as such: Brand<br />

Direct is the anchor in and of itself.”<br />

The design for the retail portion of<br />

the Waterfront City project is based on<br />

the simple concept of two streets linking<br />

festival retail on the waterfront to an entertainment<br />

area deep inside the site.<br />

“Australian outlet centres are generally<br />

not as up-market as the European model,”<br />

Stockton says, “as they are more leisureoriented<br />

and apart from the men’s and<br />

women’s fashion, tend to feature a large<br />

component of housewares.”<br />

In some ways, the centre is taking<br />

its cues from the three-year-old Perth<br />

harbour Town outlet centre that attracts<br />

about 1 million visitors a month. That<br />

centre, says Stockton, “is also a two-level,<br />

outdoor centre that comprises 110 shops<br />

and is located on the fringe of the central<br />

business district. The centre is performing<br />

particularly strong, with traffic flow<br />

and turnover up 20 percent this current<br />

year, reflecting the attractiveness of this<br />

style of retailing within a new market.<br />

We see Waterfront City mirroring this<br />

success formula.”<br />

There are two other Brand Direct outlet<br />

centres, in Adelaide and Gold Coast (in<br />

Biggera Waters, 15 minutes north of Surfers<br />

Paradise), both open since 1999. n

Outlet retailing comes to Africa<br />

By MARY JO MELONE, Contributing Writer<br />

R<br />

ock bands. Clowns. Fire eaters.<br />

Live radio broadcasts. Throw<br />

in personal shoppers who gave<br />

makeovers to some lucky customers, and<br />

you’ll get a feel for the hoopla associated<br />

with the opening of Africa’s first outlet centre.<br />

Sable Square – Outlet Shopping Village<br />

was to open in a suburb of Cape Town,<br />

South Africa, at the end of September.<br />

Sable Square is not just the first outlet<br />

centre in South Africa, but the first on<br />

the continent of Africa.<br />

“There’s nothing like it,” says Caroline<br />

Coates, assistant marketing manager for<br />

Spearhead Property Group, which is the<br />

developer. “We’ll be the first one.”<br />

The e30 million centre, which will eventually<br />

total 22,000 m², is a 15- minute drive<br />

from Cape Town’s city centre and is sited<br />

in one of the area’s hottest neighborhoods,<br />

Century City, which includes a full-price<br />

retail project, Canal Walk. An estimated<br />

40,000 cars pass by the location daily.<br />

Being first in the outlet business in Africa<br />

has put Sable Square in the peculiar<br />

marketing situation of both promoting<br />

itself as well as educating the public on<br />

what an outlet centre is and is not. Now,<br />

Coates says, the centre is in a “heavy,<br />

heavy communications phase. People<br />

don’t automatically know what a retail<br />

outlet village is.”<br />

Consumers have to learn the difference<br />

between outlet stores and <strong>factory</strong> stores,<br />

which are commonplace in South Africa.<br />

Clothing manufacturers sell seconds in<br />

<strong>factory</strong> stores, chiefly in a development<br />

called Access Park, also in Cape Town.<br />

“Access Park caters to the lower end of<br />

the market,” Coates says. By comparison,<br />

Sable Square’s stores will sell first-quality<br />

fashions, from previous seasons, at a 30<br />

to 50 percent discount.<br />

The outlet centre has noticeably upset<br />

South Africa’s full-price retailers, Coates<br />

says. “They’ve been making a fuss,” she<br />

says. “I think they’re concerned that<br />

people will suddenly stop coming to<br />

Canal Walk.”<br />

But she argues that Sable Square will<br />

complement Canal Walk. A consumer<br />

can shop the latter if she’s searching for<br />

this year’s fashions, while Sable Square<br />

will carry stock from previous seasons for<br />

those who are not so cutting-edge.<br />

The 12,000-m² first phase of the centre<br />

was fully leased at opening. Tenants<br />

include well-known brands made by<br />

South African licensees, such as Adidas,<br />

Levi (the South African licensee of Levi<br />

Strauss), Reebok and Skechers. Spearhead<br />

predicts that as many as 50 stores<br />

will tenant Sable Square’s 10,000-m²<br />

phase 2, set to open in 2007.<br />

But even then, South African retailers<br />

will have to be taught about the advantages<br />

of <strong>outlets</strong>. “<strong>Retail</strong>ers in South<br />

Africa still have to be educated about the<br />

concept,” says Alf hartzenberg, a major<br />

retailer. “Our group relies heavily on outlet<br />

retail to maintain a balance between<br />

new and excess stock sales.”<br />

All Sable Square tenants have to agree<br />

not to sell knock-offs. According to Mike<br />

Flax, CEO of Spearhead, Sable Square<br />

leases will have a zero-tolerance clause<br />

and centre management will immediately<br />

dispose of fakes from stores. If counterfeiting<br />

persists, the stores will be evicted.<br />

The source of the concern, Caroline<br />

Coates says, is that so many Nigerians sell<br />

counterfeit designer goods and might view<br />

Sable Square as another venue to sell their<br />

knock-offs. “The point must be, loud and<br />

clear, that Sable Square is offering ‘high<br />

quality, protected brands,’” Coates says.<br />

All Sable<br />

Square<br />

tenants<br />

must sign<br />

a “ No<br />

Counterfeit<br />

Goods ”<br />

agreement.<br />

Even during construction – the above photo was taken in March – Sable Square<br />

was preparing consumers for the first outlet centre on the African continent<br />

with a sign that reads, “Where great value is always in fashion.”<br />

The first phase of Sable Square will not<br />

include any of the high-end brands such<br />

as Gucci, Versace and Louis Vuitton as<br />

those are found only in the South African<br />

capital of Johannesburg. Once Sable<br />

Square has established a track record of<br />

solid performance, Coates says Spearhead<br />

will approach them. “I think that in our<br />

second phase, we will be able to approach<br />

those guys with confidence.”<br />

The centre was designed by retail<br />

expert Bentel Associates International<br />

with an ultramodern look surrounding a<br />

main square. Small cafes complement the<br />

shops. The centre will have 1,095 parking<br />

spaces on two levels, and the centre’s<br />

second story will house an international<br />

hotel school and room for 30 hospitality<br />

industry students to live there. n<br />

For more information contact Anthony<br />

Wolpert, Development Manager,<br />

Spearhead Group, 42 Hans Strijdom<br />

Avenue, Foreshore, Cape Town, South Africa<br />

8001; +99 27 21 – 425 1000; email<br />

awolpert@spearheadprop.com.<br />

Fall 2006 u InternatIonal outlet Journal 17

Leoville Premium Outlet keeps a low profile<br />

By Stephanie Kramer, Berlin Correspondent<br />

In May 2005 Leoville Premium Outlet<br />

opened its doors to shoppers just<br />

outside Vienna, arriving on the outlet<br />

scene as “the first and only premium outlet<br />

centre in Austria.”<br />

Developed and run by European Outlets<br />

(EO), the scheme seems to be following<br />

the low-profile lead of London-based<br />

outlet-centre developer <strong>Value</strong> <strong>Retail</strong>,<br />

which has become renowned for quietly<br />

opening a centre that’s only partially<br />

leased in order to save room for the most<br />

cautious, yet desirable, tenants.<br />

Indeed, Michael herscovici, formerly<br />

of <strong>Value</strong> <strong>Retail</strong> and now one of EO’s two<br />

managing directors (the other is Michael<br />

Griesmayr), explained to the local Badener<br />

Zeitung newspaper that the nature of premium<br />

outlet centres is that one has to be<br />

selective when choosing tenants.<br />

And so it goes that in May 2005, the centre<br />

held a soft opening of 16 of its planned<br />

60 stores. By October 2005 an estimated<br />

400,000 shoppers had already visited the<br />

centre, and by the end of this summer, 32<br />

tenants were up and running, just slightly<br />

over half of the centre’s occupancy.<br />

Soft openings are generally held to give<br />

stores time to get their retail acts together,<br />

to hone selling and merchandising skills,<br />

and to gauge inventory levels. All of<br />

those things are better done with practice,<br />

and smooth operations are the aim of a<br />

premium outlet centre.<br />

According to Bettina Schuckert of<br />

European Outlets, a premium outlet is<br />

defined by premium location, premium<br />

architecture and premium brands. Only<br />

if these three criteria are met, she says,<br />

can brand names be discounted without<br />

risking their image. Equally as important<br />

is ensuring that “brand-aware bargainhunters<br />

[can] hunt for bargains without<br />

losing their image...without a rummage<br />

sale atmosphere.”<br />

This is achieved by promising both shoppers<br />

and tenants something to which only a<br />

select elite have access: Leoville describes<br />

itself as offering “exclusive stores” in an<br />

“exclusive atmosphere” with “exclusive<br />

walkways” and even “exclusive food.”<br />

Right down to having an “exclusive fountain,”<br />

Leoville promises a unique shopping<br />

experience. There is also a “Leo-VIP Club”<br />

with a bi-weekly newsletter for members<br />

announcing special offers, invitations to<br />

special events and other goodies.<br />

Shoppers will find clothes and other<br />

items at discounted 30 percent to 70<br />

percent off the retail price, though the<br />

price structuring at Leoville varies slightly<br />

1 InternatIonal outlet Journal u Fall 2006<br />

Leoville Premium Outlet is less than 30 minutes from central Vienna in Leobersdorf,<br />

one of the wealthiest areas in the region; 5.6 million live within a three-hour<br />

drive of the centre.<br />

from that of a traditional FOC. Not all<br />

items are discounted up front, but may be<br />

offered for example, as “10 percent off any<br />

two shirts not already discounted.”<br />

Leoville’s target shopper is a high-<br />

income woman over 25, with or without<br />

children, who visits the centre by car,<br />

perhaps with friends or family.<br />

Located on a major highway, the A2,<br />

which runs through Austria to Italy<br />

to the south, Leoville is accessible to<br />

shoppers from the region (Vienna is a<br />

mere 30 minutes away) and tourists<br />

alike. Situated in Leobersdorf, Leoville<br />

is within a three-hour drive of hungary,<br />

the Czech Republic, or Slovakia.<br />

A total of 5.6 million people live<br />

within the catchment area. There is<br />

shuttle service from Vienna, but most<br />

shoppers are expected to arrive by car,<br />

and there are 880 parking spaces to<br />

accommodate them.<br />

Leoville is currently 11,000 m² but<br />

there are plans to expand to 19,000 m².<br />

As elsewhere in Europe, initial resistance<br />

on the part of local retail was tough and<br />

herscovici spent seven years trying to<br />

convince local communities of the benefits<br />

of the centre.<br />

European Outlets plans to forge ahead<br />

with another two or three more centres<br />

over the next five to seven years in neighboring<br />

countries. n<br />

Leoville tenants include:<br />

Airfield<br />

Alizé<br />

MaxCompany<br />

Baldinini<br />

Eno Town<br />

L’Occitane<br />

Heindl<br />

EX10<br />

Frottana<br />

Goldix<br />

G.G.SUN (Sonnenbrillen)<br />

G.K.Mayer Shoes<br />

Linea A<br />

HumanicOutlet<br />

Interspiel<br />

Käthe Kruse<br />

La Rossi Gold (Uhren)<br />

Marc Picard (Taschen)<br />

Mila Schön<br />

Milano Italy<br />

Morawa Preis-Bestseller<br />

Salamander<br />

Salewa<br />

Shirt House<br />

S-Line<br />

Triumph<br />

Palmers<br />

Walk Safari<br />

Wesley<br />

Wexmann London<br />

European Outlets is taking the slow-and-steady approach to leasing at its Austrian<br />

centre, intending to hold out for the most upscale brands.

Parndorf a Bigg deal<br />

McArthurGlen said in July that it has<br />

taken over management and leasing<br />

of its next-door neighbor in Parndorf,<br />

Austria, the BIGG Outlet Centre. The<br />

move is McArthurGlen’s second foray<br />

into third-party management, its first<br />

at the B5 outlet centre at Brandenburg<br />

near Berlin, Germany, that was announced<br />

in June.<br />

McArthurGlen CEO Julia Calabrese<br />

said, “Our success in managing the<br />

<strong>outlets</strong> we developed, as well as positive<br />

feedback from our brand partners, led<br />

us to look at third party management<br />

as an obvious and immediate expansion<br />

for our brands. We have an existing<br />

centre at Parndorf, McArthurGlen<br />

Designer Outlet Parndorf, and the offer<br />

at BIGG Outlet Centre is complementary<br />

to that. With the two <strong>outlets</strong> combined,<br />

we have created the biggest outlet<br />

A little more than two years ago the<br />

Miller Group was presented with the idea<br />

of partnering on an FOC in hungary. By<br />

all accounts, the developer spent a quick<br />

few weeks thinking it over and then<br />

plunged in full force, convinced that the<br />

strategy would pay off. Chief executive<br />

Phil Miller noted at the time that he<br />

especially enjoyed the entrepreneurial<br />

aspect of his family-owned company.<br />

And in early September, the two-yearold<br />

Premier Outlets Centre in Budapest<br />

sold for e70 million – a 6 percent initial<br />

yield – to Morley Fund Management,<br />

which acquired the centre on behalf of<br />

its Aviva Central European Property<br />

Fund (ACEPF). GVA Grimley Outlet<br />

Services will continue managing and<br />

leasing the 18,000-m² centre.<br />

The centre, which was a joint venture<br />

with Raiffeissen Ingatlan, was the first<br />

FOC to open in hungary, and its 82<br />

tenants include Calvin Klein, Columbia,<br />

Ecco Shoes, Fila, Levis/Dockers, Mango,<br />

Mexx, Nike, Pepe Jeans, Quiksilver,<br />

Roland/Tommy hilfiger, Russell Athletic,<br />

Sarar, Vans and Wilson/Mission.<br />

Julian Taylor, a fund manager at<br />

Morley, said “This is the first retail asset<br />

Morley has acquired for ACEPF and<br />

we are pleased to have acquired such a<br />

high quality property, particularly after<br />

the marketing attracted a significant<br />

number of interested parties. We believe<br />

it will deliver a good return for our<br />

investors over the long term.”<br />

20 InternatIonal outlet Journal u Fall 2006<br />

retailing space in Northern Europe.”<br />

Together, the two outlet centres total<br />

37,242 m² of GLA. The 11,760-m² BIGG<br />

Outlet Centre opened in 2005 and is fully<br />

leased with 29 tenants, including Gerry<br />

Weber, S’Oliver, Pierre Cardin/Otto Kern<br />

and Rosner. It was acquired in July for<br />

e30 million from Austrian developer<br />

Rene Benko by Warburg-henderson KAG<br />

Funds, a JV of Warburg and henderson<br />

Global Investors. The net yield was just<br />

under 7 percent.<br />

henderson operates the European<br />

Outlet Mall Fund, which owns seven<br />

assets: the B5 in Berlin, as well as<br />

projects developed by McArthurGlen<br />

in Troyes and Roubaix, France; Roermond,<br />

The Netherlands; Castel Romano<br />

and Serravalle in Italy, as well as<br />

the 25,482 m² centre in Parndorf. Despite<br />

its ownership of McArthurGlen’s<br />

Parndorf centre, the outlet fund passed<br />

on BIGG as it didn’t fit certain size and<br />

revenue criteria.<br />

In addition to the two centres in Parndorf,<br />

there is also the Leoville Outlet<br />

Mall, which opened in Leobersdorf in<br />

2005 (see page 18 for related story). Also,<br />

New owner for Premier Outlets Center in Budapest<br />

Miller Group opened Hungary’s only<br />

outlet centre just two years ago.<br />

Miller Developments has a second<br />

Premier Outlet Centre planned in Ringsted,<br />

Denmark, in joint venture with<br />

local partner TK Development. The<br />

Danish centre will be built on a 7 hectare<br />

site, close to Copenhagen, and will<br />

provide 12,000 m² of GLA.<br />

GVA Grimley partner Brendon O’Reilly<br />

said he thought the sale of the property to<br />

Morley Fund would open up the FOC acquisitions<br />

market. “I think we’ll now start<br />

seeing institutional investors looking at the<br />

Central European outlet market,” he said.<br />

Established more than 30 years ago,<br />

Miller Developments, a division of Miller<br />

Group, is one of the UK’s leading commercial<br />

property development companies.<br />

Through its national and European offices,<br />

Miller Developments manages large<br />

McArthurGlen is developing the e90<br />

million Salzburg Designer Outlet on the<br />

site of the Airport Centre, which had to<br />

be torn down to make room.<br />

Hermes sells Royal Quays<br />

hermes/REALM Ltd. said in early<br />

September that Royal Quays in Newcastle<br />

Upon Tyne, England, had sold to<br />

North Shields Investment Properties<br />

for e42 million, about e2.5 million<br />

less than hermes was hoping to attract.<br />

The selling price represents a yield of<br />

more than 6 percent. hermes put Royal<br />

Quays up for sale through London<br />

agent Cushman & Wakefield after a<br />

review of its portfolio found it was too<br />

heavily weighted towards retail properties<br />

after a surge in values.<br />

The property received 10 offers after<br />

it was put on the selling block in May.<br />

Peter Everest, managing director of<br />

WD Ltd., which will manage the property<br />

on behalf of the new owners, plans<br />

to spice up the tenancy of the 13,000m²<br />

centre by bringing in more fashionoriented<br />

retailers and by increasing its<br />

marketing.<br />

scale property development programmes<br />

throughout the UK and in Europe.<br />

UK-based Morley Fund Management<br />

is an independent asset management<br />

business of Aviva plc, which is one of<br />

the world’s largest financial services<br />

groups with over e432 billion of assets<br />

managed worldwide.

Leasing<br />

l Ghost, Ravel and Amanda Wakeley are the<br />

latest signings to Galleria Outlet Centre, the 29,729<br />

m² scheme in Hatfield, England. Galleria’s 90-store<br />

offer includes a number of top-name retailers including<br />

Marks & Spencer Outlet, Pringle, Oakley and<br />

Liz Claiborne. Purchased by Land Securities in late<br />

2005, it is the closest outlet centre to London with<br />

a catchment of nearly 7.3 million shoppers within a<br />

60-minute drive. All the leases run from one to five<br />

years, with rents at the higher of a minimum e45 psf<br />

or turnover basis.<br />

l Adidas has opened at the Ardennes Outlet Centre in Verviers,<br />

Belgium. The 11,000-m² centre, which lies equidistant between Brussels<br />

and Cologne, will<br />

soon be joined by Carven<br />

Menswear and by<br />

Italian coffee operator<br />

Illy. The centre’s tenant<br />

line-up includes Nike,<br />

Puma, Gerry Webber<br />

and Trespass. It is<br />

owned by the Comer<br />

Group and run by UK-<br />

Adidas joins other Ardennes Outlet Centre<br />

footwear retailers Nike and Puma.<br />

Marketing<br />

based strategic commercial<br />

development<br />

advisers BSB.<br />

l Dubai Outlet Mall<br />

will be the host venue for<br />

the Dubai Balloon Festival<br />

(DBF), scheduled to be a<br />

main attraction during the<br />

annual Dubai Shopping<br />

Festival in December. Mohamed<br />

Khammas, CEO<br />

of Dubai Outlet Mall, is<br />

also CEO of the Balloon<br />

Festival, which will mark<br />

the start of the Emirate’s<br />

annual shopping extravaganza. The balloon festival will feature events for the<br />

public on the two weekends between 21 and 30 December at Dubai Outlet City<br />

in Dubailand over two weekends. The 375,000-m² outlet mall is scheduled to<br />

open this autumn. Slated to become an annual event for the next 10 years, the<br />

DBF will include the participation of over 100 balloons from across the world, plus<br />

family entertainment, contests, events for the public, photo contests, music, food<br />

and other events. Organising the event will be a team of U.S. professionals from<br />

the Albuquerque International Balloon Fiesta Inc. Companies worldwide are<br />

sponsoring the event to gain balloon branding.<br />

l The farmer’s market held every Sunday at McArthurGlen Designer<br />

Outlet Centre in Swindon, England, has been nominated as one of Britain’s<br />

favourites. Country Life magazine and property specialists Strutt and Parker<br />

have launched a campaign to find the nation’s best farmer’s market, and the<br />

Swindon affair is one of three shortlisted in the Southwest. Michelin-starred<br />

chef John Burton Race said, “Swindon’s farmers’ market is a venue for local<br />

specialities, seasonal delights, and the best in local crafts. Produce includes<br />

traditionally reared meat and poultry, grass-fed lamb, free range eggs, olive and<br />

Mediterranean salads, farmhouse cheeses, pies and puddings, award-winning<br />

bread and cakes, Gloucester Old Spot sausages and homemade fudge.” Swindon’s<br />

entrant is up against two from Carruan in North Cornwall and Tavistock<br />

in Devon. The winners will be announced in November.<br />

New tenants at Land<br />

Securities’ Galleria<br />

Outlet Centre in<br />

Hatfield, England,<br />

include Amanda<br />

Wakely (left) and<br />

Ghost (below).<br />

Coxhead joins LMS Outlets<br />

Graham Coxhead, MRICS, joined LMS<br />

plc in June 2006 as director of LMS Outlets<br />

Ltd, a new division of TK Developments,<br />

concentrating on designer outlet<br />

shopping centre investments. Coxhead,<br />

who is an ICSC member, has some 20<br />

years experience in developing centres<br />

throughout the UK and in Europe. LMS<br />

Outlets are currently active in France,<br />

Germany, Turkey and the Czech Republic.<br />

LMS Outlets are co-owners with TK<br />

Developments of Prague Outlet Center,<br />

scheduled to open in summer 2007. Additionally,<br />

LMS is preparing the 22,000m²<br />

Tournus Fashion Village, a site midway<br />

between Lyon and Dijon, just north of<br />

Macon in the heart of France’s Burgundy<br />

region. This project, 100 percent owned<br />

by LMS Outlets, is scheduled to open<br />

summer 2008.<br />

LMS is also involved in First Fashion<br />

Village, Silivri, a seaside town near Istanbul.<br />

LMS has a JV with locally-based Real<br />

Estate Development (RED) for the 20,000m²<br />

centre, set to open in autumn 2008.<br />

Prior to joining LMS plc, Coxhead was<br />

managing director of development holdings<br />

of GVA Grimley Outlet Services.<br />

Correction<br />

Neil Thompson, associate partner with GVA<br />