FORM 10-K/A GAMCO Investors, Inc. - Gabelli

FORM 10-K/A GAMCO Investors, Inc. - Gabelli

FORM 10-K/A GAMCO Investors, Inc. - Gabelli

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

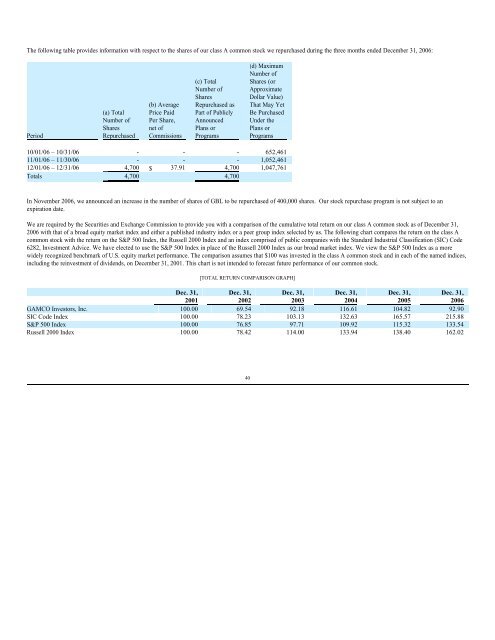

The following table provides information with respect to the shares of our class A common stock we repurchased during the three months ended December 31, 2006:<br />

Period<br />

(a) Total<br />

Number of<br />

Shares<br />

Repurchased<br />

(b) Average<br />

Price Paid<br />

Per Share,<br />

net of<br />

Commissions<br />

(c) Total<br />

Number of<br />

Shares<br />

Repurchased as<br />

Part of Publicly<br />

Announced<br />

Plans or<br />

Programs<br />

(d) Maximum<br />

Number of<br />

Shares (or<br />

Approximate<br />

Dollar Value)<br />

That May Yet<br />

Be Purchased<br />

Under the<br />

Plans or<br />

Programs<br />

<strong>10</strong>/01/06 – <strong>10</strong>/31/06 - - - 652,461<br />

11/01/06 – 11/30/06 - - - 1,052,461<br />

12/01/06 – 12/31/06 4,700 $ 37.91 4,700 1,047,761<br />

Totals 4,700 4,700<br />

In November 2006, we announced an increase in the number of shares of GBL to be repurchased of 400,000 shares. Our stock repurchase program is not subject to an<br />

expiration date.<br />

We are required by the Securities and Exchange Commission to provide you with a comparison of the cumulative total return on our class A common stock as of December 31,<br />

2006 with that of a broad equity market index and either a published industry index or a peer group index selected by us. The following chart compares the return on the class A<br />

common stock with the return on the S&P 500 Index, the Russell 2000 Index and an index comprised of public companies with the Standard Industrial Classification (SIC) Code<br />

6282, Investment Advice. We have elected to use the S&P 500 Index in place of the Russell 2000 Index as our broad market index. We view the S&P 500 Index as a more<br />

widely recognized benchmark of U.S. equity market performance. The comparison assumes that $<strong>10</strong>0 was invested in the class A common stock and in each of the named indices,<br />

including the reinvestment of dividends, on December 31, 2001. This chart is not intended to forecast future performance of our common stock.<br />

[TOTAL RETURN COMPARISON GRAPH]<br />

Dec. 31, Dec. 31, Dec. 31, Dec. 31, Dec. 31, Dec. 31,<br />

2001 2002 2003 2004 2005 2006<br />

<strong>GAMCO</strong> <strong>Investors</strong>, <strong>Inc</strong>. <strong>10</strong>0.00 69.54 92.18 116.61 <strong>10</strong>4.82 92.90<br />

SIC Code Index <strong>10</strong>0.00 78.23 <strong>10</strong>3.13 132.63 165.57 215.88<br />

S&P 500 Index <strong>10</strong>0.00 76.85 97.71 <strong>10</strong>9.92 115.32 133.54<br />

Russell 2000 Index <strong>10</strong>0.00 78.42 114.00 133.94 138.40 162.02<br />

40