SOL MELIA ANNUAL REPORT 00 COMP

SOL MELIA ANNUAL REPORT 00 COMP

SOL MELIA ANNUAL REPORT 00 COMP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

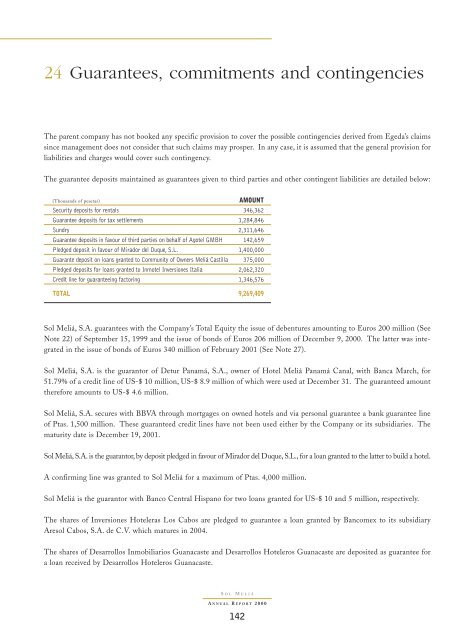

24 Guarantees, commitments and contingencies<br />

The parent company has not booked any specific provision to cover the possible contingencies derived from Egeda’s claims<br />

since management does not consider that such claims may prosper. In any case, it is assumed that the general provision for<br />

liabilities and charges would cover such contingency.<br />

The guarantee deposits maintained as guarantees given to third parties and other contingent liabilities are detailed below:<br />

(Thousands of pesetas)<br />

AMOUNT<br />

Security deposits for rentals 346,362<br />

Guarantee deposits for tax settlements 1,284,846<br />

Sundry 2,311,646<br />

Guarantee deposits in favour of third parties on behalf of Agotel GMBH 142,659<br />

Pledged deposit in favour of Mirador del Duque, S.L. 1,4<strong>00</strong>,<strong>00</strong>0<br />

Guarante deposit on loans granted to Community of Owners Meliá Castilla 375,<strong>00</strong>0<br />

Pledged deposits for loans granted to Inmotel Inversiones Italia 2,062,320<br />

Credit line for guaranteeing factoring 1,346,576<br />

TOTAL 9,269,409<br />

Sol Meliá, S.A. guarantees with the Company’s Total Equity the issue of debentures amounting to Euros 2<strong>00</strong> million (See<br />

Note 22) of September 15, 1999 and the issue of bonds of Euros 206 million of December 9, 2<strong>00</strong>0. The latter was integrated<br />

in the issue of bonds of Euros 340 million of February 2<strong>00</strong>1 (See Note 27).<br />

Sol Meliá, S.A. is the guarantor of Detur Panamá, S.A., owner of Hotel Meliá Panamá Canal, with Banca March, for<br />

51.79% of a credit line of US-$ 10 million, US-$ 8.9 million of which were used at December 31. The guaranteed amount<br />

therefore amounts to US-$ 4.6 million.<br />

Sol Meliá, S.A. secures with BBVA through mortgages on owned hotels and via personal guarantee a bank guarantee line<br />

of Ptas. 1,5<strong>00</strong> million. These guaranteed credit lines have not been used either by the Company or its subsidiaries. The<br />

maturity date is December 19, 2<strong>00</strong>1.<br />

Sol Meliá, S.A. is the guarantor, by deposit pledged in favour of Mirador del Duque, S.L., for a loan granted to the latter to build a hotel.<br />

A confirming line was granted to Sol Meliá for a maximum of Ptas. 4,<strong>00</strong>0 million.<br />

Sol Meliá is the guarantor with Banco Central Hispano for two loans granted for US-$ 10 and 5 million, respectively.<br />

The shares of Inversiones Hoteleras Los Cabos are pledged to guarantee a loan granted by Bancomex to its subsidiary<br />

Aresol Cabos, S.A. de C.V. which matures in 2<strong>00</strong>4.<br />

The shares of Desarrollos Inmobiliarios Guanacaste and Desarrollos Hoteleros Guanacaste are deposited as guarantee for<br />

a loan received by Desarrollos Hoteleros Guanacaste.<br />

S OL<br />

M ELIÁ<br />

A NNUAL R EPORT 2<strong>00</strong>0<br />

142