Asiaone 1-42

Asiaone 1-42

Asiaone 1-42

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

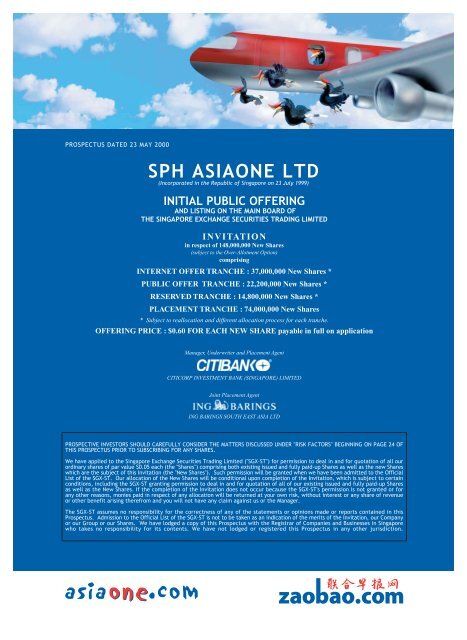

PROSPECTUS DATED 23 MAY 2000<br />

SPH ASIAONE LTD<br />

(Incorporated in the Republic of Singapore on 23 July 1999)<br />

INITIAL PUBLIC OFFERING<br />

AND LISTING ON THE MAIN BOARD OF<br />

THE SINGAPORE EXCHANGE SECURITIES TRADING LIMITED<br />

INVITATION<br />

in respect of 148,000,000 New Shares<br />

(subject to the Over-Allotment Option)<br />

comprising<br />

INTERNET OFFER TRANCHE : 37,000,000 New Shares *<br />

PUBLIC OFFER TRANCHE : 22,200,000 New Shares *<br />

RESERVED TRANCHE : 14,800,000 New Shares *<br />

PLACEMENT TRANCHE : 74,000,000 New Shares<br />

* Subject to reallocation and different allocation process for each tranche.<br />

OFFERING PRICE : $0.60 FOR EACH NEW SHARE payable in full on application<br />

Manager, Underwriter and Placement Agent<br />

CITICORP INVESTMENT BANK (SINGAPORE) LIMITED<br />

Joint Placement Agent<br />

ING BARINGS SOUTH EAST ASIA LTD<br />

PROSPECTIVE INVESTORS SHOULD CAREFULLY CONSIDER THE MATTERS DISCUSSED UNDER "RISK FACTORS" BEGINNING ON PAGE 24 OF<br />

THIS PROSPECTUS PRIOR TO SUBSCRIBING FOR ANY SHARES.<br />

We have applied to the Singapore Exchange Securities Trading Limited ("SGX-ST") for permission to deal in and for quotation of all our<br />

ordinary shares of par value $0.05 each (the "Shares") comprising both existing issued and fully paid-up Shares as well as the new Shares<br />

which are the subject of this Invitation (the "New Shares"). Such permission will be granted when we have been admitted to the Official<br />

List of the SGX-ST. Our allocation of the New Shares will be conditional upon completion of the Invitation, which is subject to certain<br />

conditions, including the SGX-ST granting permission to deal in and for quotation of all of our existing issued and fully paid-up Shares<br />

as well as the New Shares. If the completion of the Invitation does not occur because the SGX-ST's permission is not granted or for<br />

any other reasons, monies paid in respect of any allocation will be returned at your own risk, without interest or any share of revenue<br />

or other benefit arising therefrom and you will not have any claim against us or the Manager.<br />

The SGX-ST assumes no responsibility for the correctness of any of the statements or opinions made or reports contained in this<br />

Prospectus. Admission to the Official List of the SGX-ST is not to be taken as an indication of the merits of the Invitation, our Company<br />

or our Group or our Shares. We have lodged a copy of this Prospectus with the Registrar of Companies and Businesses in Singapore<br />

who takes no responsibility for its contents. We have not lodged or registered this Prospectus in any other jurisdiction.

CONTENTS<br />

CORPORATE INFORMATION...................................................................................................... 4<br />

DEFINITIONS ................................................................................................................................ 5<br />

GLOSSARY OF TECHNICAL TERMS ........................................................................................ 9<br />

DETAILS OF OUR INVITATION<br />

— Listing On The SGX-ST ....................................................................................................... 11<br />

— Structure Of Our Invitation ................................................................................................... 12<br />

— Results of Application And Distribution ............................................................................... 16<br />

— Indicative Timetable For Listing ........................................................................................... 17<br />

— Selling Restrictions ............................................................................................................... 18<br />

PROSPECTUS SUMMARY .......................................................................................................... 19<br />

FINANCIAL STATISTICS.............................................................................................................. 23<br />

RISK FACTORS ............................................................................................................................ 24<br />

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS ..................................... 33<br />

USE OF PROCEEDS ................................................................................................................... 34<br />

DIVIDEND POLICY ....................................................................................................................... 35<br />

SELECTED FINANCIAL DATA .................................................................................................... 36<br />

ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS......................... 37<br />

GENERAL INFORMATION ON OUR GROUP<br />

— History ................................................................................................................................... 43<br />

— Group Structure .................................................................................................................... 44<br />

— Share Capital ........................................................................................................................ 44<br />

— Description Of Our Ordinary Shares ................................................................................... 46<br />

— Shareholders ......................................................................................................................... 50<br />

— Moratorium ............................................................................................................................ 50<br />

— Dilution .................................................................................................................................. 50<br />

BUSINESS<br />

— Industry Overview ................................................................................................................. 52<br />

— Strategy ................................................................................................................................. 54<br />

— Business Model .................................................................................................................... 55<br />

— Core Business ...................................................................................................................... 58<br />

— Joint Ventures, Strategic Alliances And Investments ......................................................... 71<br />

1<br />

Page

— Customers And Suppliers .................................................................................................... 73<br />

— Competition ........................................................................................................................... 74<br />

— Competitive Strengths .......................................................................................................... 75<br />

— Expansion Plans ................................................................................................................... 77<br />

— Marketing And Branding Strategy ........................................................................................ 82<br />

— Product Development Initiatives .......................................................................................... 83<br />

— Intellectual Property .............................................................................................................. 84<br />

— Government Regulation ........................................................................................................ 84<br />

— Property, Plant And Equipment............................................................................................ 85<br />

— Insurance............................................................................................................................... 87<br />

DIRECTORS, SENIOR MANAGEMENT AND STAFF<br />

— Board Of Directors ............................................................................................................... 88<br />

— Committees Of The Board of Directors .............................................................................. 90<br />

— Directors’ Remuneration ....................................................................................................... 90<br />

— Executive Officers ................................................................................................................. 91<br />

— Service Agreements ............................................................................................................. 92<br />

— Directorships ......................................................................................................................... 93<br />

— Staff ....................................................................................................................................... 97<br />

— Share Option Schemes ........................................................................................................ 97<br />

INTERESTED PERSON TRANSACTIONS.................................................................................. 103<br />

SHAREHOLDERS’ MANDATE ..................................................................................................... 107<br />

POTENTIAL CONFLICTS OF INTEREST .................................................................................. 113<br />

DIRECTORS’ REPORT ................................................................................................................. 116<br />

REPORT OF THE INDEPENDENT PUBLIC ACCOUNTANTS.................................................. 117<br />

FINANCIAL STATEMENTS .......................................................................................................... 118<br />

GENERAL AND STATUTORY INFORMATION........................................................................... 1<strong>42</strong><br />

APPENDIX A<br />

CONTENTS<br />

— Terms And Conditions And Procedures For Application .................................................... 155<br />

— Additional Terms And Conditions For Applications Using Application Forms ................... 160<br />

— Additional Terms And Conditions For Electronic Applications ........................................... 163<br />

— Internet Offer Tranche: Registration with AsiaOne ............................................................. 170<br />

2<br />

Page

APPENDIX B<br />

— Rules Of The AsiaOne Pre-IPO Share Option Scheme .................................................... 172<br />

APPENDIX C<br />

CONTENTS<br />

— Rules Of The AsiaOne (2000) Post-IPO Share Option Scheme ...................................... 190<br />

3<br />

Page

CORPORATE INFORMATION<br />

Board of Directors : Wong Yuen Weng Ernest (Non-Executive Chairman)<br />

Low Huan Ping (Chief Executive Officer)<br />

Tan Teck Huat (Chief Financial Officer)<br />

Koh Boon Hwee<br />

Eddie Kuo Chen-Yu<br />

Soon Tit Koon<br />

Teo Ming Kian<br />

Tjong Yik Min<br />

Company Secretary : Ginney Lim May Ling, LLB (Hons)<br />

Assistant Company Secretary : Janice Wu Sung Sung, LLB (Hons)<br />

Registered Office : 82 Genting Lane<br />

News Centre<br />

Singapore 349567<br />

Share Registrar and Share : Lim Associates (Pte) Ltd<br />

Transfer Office 10 Collyer Quay #19-08<br />

Ocean Building<br />

Singapore 049315<br />

Manager, Underwriter and : Citicorp Investment Bank (Singapore) Limited<br />

Placement Agent 3 Temasek Avenue #17-00<br />

Centennial Tower<br />

Singapore 039190<br />

Joint Placement Agent : ING Barings South East Asia Ltd<br />

9 Raffles Place #19-02<br />

Republic Plaza<br />

Singapore 048619<br />

Auditors and Reporting : Ernst & Young<br />

Accountants Certified Public Accountants<br />

10 Collyer Quay #21-01<br />

Ocean Building<br />

Singapore 049315<br />

Solicitors to the Invitation : Wong Partnership<br />

80 Raffles Place #58-01<br />

UOB Plaza 1<br />

Singapore 048624<br />

Receiving Bank : Citibank, N.A.<br />

3 Temasek Avenue #17-00<br />

Centennial Tower<br />

Singapore 039190<br />

Principal Banker : Citibank, N.A.<br />

3 Temasek Avenue #17-00<br />

Centennial Tower<br />

Singapore 039190<br />

4

DEFINITIONS<br />

In this Prospectus and the accompanying Application Forms, the following definitions apply where<br />

the context so admits:-<br />

Group companies<br />

“AsiaOne” or the “Company” : SPH AsiaOne Ltd<br />

“Zaobao.com” : Zaobao.com Ltd<br />

Other companies<br />

“Asianbourses.com” : Asianbourses.com Pte Ltd<br />

“FantasticOne” : FantasticOne (Asia Pacific) Pte Ltd<br />

General<br />

“Application Forms” : The printed application forms to be used for the purpose of the<br />

Invitation and which form part of this Prospectus<br />

“Application List” : The list of applications for subscription of the New Shares<br />

“AsiaOne IPO website” or : www.asiaone.com/IPO<br />

“our IPO website”<br />

“ATM” : Automated teller machine of a Participating Bank<br />

“ATM Electronic Applications” : Applications for the New Shares made by way of ATMs<br />

“Capital Injection” : The injection of $40 million fresh capital by SPH in our Company<br />

on 15 March 2000<br />

“CATS” : The Straits Times Classified Ads<br />

“CDP” : The Central Depository (Pte) Limited<br />

“Citibank” : Citibank, N.A.<br />

“Citicorp” : Citicorp Investment Bank (Singapore) Limited<br />

“Companies Act” : Companies Act, Chapter 50, of Singapore, as amended,<br />

modified or supplemented from time to time<br />

“Company” : SPH AsiaOne Ltd. The terms “we”, “our”, “our Company” or<br />

“us” have correlative meanings<br />

“CPF” : The Central Provident Fund<br />

“Directors” : The directors of our Company as at the date of this Prospectus<br />

“EGM” : Extraordinary General Meeting<br />

“Electronic Applications” : ATM Electronic Applications and applications made through the<br />

Internet<br />

“Executive Officers” : The executive officers of our Company as at the date of this<br />

Prospectus<br />

5

“FY” : Financial year ended or ending 31 August<br />

“Group” : SPH AsiaOne Ltd and its subsidiary<br />

“IB” : Internet banking through the Internet Banks<br />

“IDA” : Infocomm Development Authority of Singapore<br />

“IDC” : International Data Corporation<br />

“ING Barings” or “Joint : ING Barings South East Asia Ltd, as agent for ING Bank N.V.<br />

Placement Agent”<br />

“Internet Banks” : Citibank, The Development Bank of Singapore Ltd (“DBS Bank”),<br />

Overseas Union Bank Limited (“OUB”) and United Overseas<br />

Bank Limited (“UOB”)<br />

“Internet IPO Website” : Any one of AsiaOne IPO website, IB websites of the Internet<br />

Banks, or Internet trading websites of the Internet Stockbrokers<br />

“Internet Offer” or “Internet : The offer of initially 37,000,000 New Shares at the Offering<br />

Offer Tranche” Price for applications through the Internet<br />

“Internet Offer Tranche : Applications by Qualifying Users for the New Shares<br />

Applications”<br />

“Internet Stockbrokers” : DMG & Partners Securities Pte Ltd, Fraser Securities Pte Ltd,<br />

G.K. Goh Stockbrokers Pte Ltd, J.M. Sassoon Co. (Pte) Ltd,<br />

Kay Hian Private Limited, Keppel Securities Pte Ltd, Lim & Tan<br />

Securities Pte Ltd, Lum Chang Securities Pte Ltd, OCBC<br />

Securities Private Limited, Ong & Company Private Limited, OUB<br />

Securities Pte Ltd, Phillip Securities Pte Ltd, UOB Securities<br />

Pte Ltd, Vickers Ballas & Co Pte Ltd and UBS Warburg &<br />

Associates (Singapore) Pte Ltd<br />

“Invitation” : The invitation by our Company to the public to subscribe for<br />

the New Shares, subject to and on the terms and conditions of<br />

this Prospectus<br />

“M1” : MobileOne (Asia) Pte Ltd<br />

“Manager”, “Placement Agent”, : Citicorp<br />

“Underwriter”<br />

DEFINITIONS<br />

“Market Day” : A day on which the SGX-ST is open for trading in securities<br />

“New Shares” : The new Shares for which our Company invites applications to<br />

subscribe for under the Invitation, including the new Shares<br />

pursuant to the Over-Allotment Option, subject to and on the<br />

terms and conditions of this Prospectus<br />

“NSTB” : National Science and Technology Board<br />

“NTU” : Nanyang Technological University, Singapore<br />

“Offer” : The invitation by our Company to the public in Singapore to<br />

subscribe for the Offer Shares at the Offering Price<br />

6

“Offer Shares” : 22,200,000 of the New Shares pursuant to the Public Offer<br />

Tranche<br />

“Offering Price” : $0.60 for each New Share<br />

“Over-Allotment Option” : The option granted to Citicorp, exercisable within 30 days from<br />

the date of this Prospectus, to subscribe for up to 22,200,000<br />

New Shares to cover over-allotments in the Invitation<br />

“Participating Banks” : DBS Bank, Keppel TatLee Bank Limited (“KTB”), Oversea-<br />

Chinese Banking Corporation Limited (“OCBC”) Group<br />

(comprising OCBC and Bank of Singapore Limited), OUB and<br />

UOB Group (comprising UOB, Far Eastern Bank Limited and<br />

Industrial & Commercial Bank Limited)<br />

“Placement” or “Placement : The placement by the Placement Agent and the Joint Placement<br />

Tranche” Agent on behalf of our Company of New Shares at the Offering<br />

Price, subject to and on the terms and conditions of this<br />

Prospectus and the Placement Agreement (as defined on page<br />

151 of this Prospectus)<br />

“Placement Shares” : 74,000,000 of the New Shares, which are the subject of the<br />

Placement<br />

“Public Offer” or “Public Offer : The offer of New Shares at the Offering Price to<br />

Tranche” members of the public in Singapore as well as to institutional<br />

and professional investors<br />

“Qualifying Users” : Individuals in Singapore:<br />

“Receiving Bank” : Citibank<br />

DEFINITIONS<br />

(a) from whom we have received valid registrations as users<br />

at our website “www.asiaone.com/registration” during the<br />

period commencing on 17 May 2000 and ending at<br />

8.00 a.m. on 31 May 2000;<br />

(b) whom we have notified via e-mail to apply for New Shares<br />

under the Internet Offer Tranche through our IPO website<br />

“www.asiaone.com/IPO”; and<br />

(c) who are (i) not corporations, sole-proprietorships,<br />

partnerships, chops or any other business entities; (ii) over<br />

the age of 21 years; (iii) not undischarged bankrupts; (iv)<br />

applying for the New Shares in Singapore; (v) not applying<br />

for New Shares under the Public Offer Tranche or the<br />

Placement Tranche; and (vi) customers who maintain<br />

Internet banking accounts with the Internet Banks or<br />

Internet trading accounts with the Internet Stockbrokers<br />

“Reserved Shares” : 14,800,000 of the New Shares reserved for the directors,<br />

executive officers and employees of our group of companies,<br />

directors, officers and employees of our related corporations,<br />

and our business associates and their employees<br />

7

“Reserved Tranche” : The offer of New Shares reserved for subscription by the<br />

directors, executive officers and employees of our group of<br />

companies, directors, officers and employees of our related<br />

corporations, and our business associates and their employees<br />

at the Offering Price<br />

“SCCS” : Securities Clearing & Computer Services (Pte) Ltd<br />

“Securities Account” : Securities account maintained by a depositor with CDP<br />

“SGX-ST” or “Stock Exchange” : Singapore Exchange Securities Trading Limited<br />

“Share Registrars” : Lim Associates (Pte) Ltd<br />

“Shares” : Ordinary shares of par value $0.05 each in the capital of our<br />

Company<br />

“Share Split” : The sub-division of each of our ordinary shares of par value<br />

$0.10 each in our authorised and issued share capital into two<br />

ordinary shares of par value $0.05 each on 4 April 2000<br />

“SPH” : Singapore Press Holdings Limited<br />

“SPH Group” : The group of companies comprising SPH and its subsidiaries<br />

“SPHMM” : SPH Multimedia Private Limited<br />

“%” or “per cent.” : Per centum<br />

DEFINITIONS<br />

“S$” or “$” and “cents” : Singapore dollars and cents respectively<br />

Words importing the singular shall, where applicable, include the plural and vice versa and words<br />

importing the masculine gender shall, where applicable, include the feminine and neuter genders<br />

and vice versa. References to persons shall include corporations.<br />

Any reference in this Prospectus and the Application Forms to any statute or enactment is a reference<br />

to that statute or enactment for the time being amended or re-enacted, unless the context otherwise<br />

requires. Any word defined under the Companies Act or any statutory modification thereof or the<br />

SGX-ST Listing Manual and used in this Prospectus and the Application Forms shall have the meaning<br />

assigned to it under the Companies Act, or such statutory modification, or the SGX-ST Listing Manual,<br />

as the case may be.<br />

Any reference in this Prospectus and the Application Forms to shares being allotted to an applicant<br />

includes allotment to CDP for the account of that applicant.<br />

Any reference to a time of day in this Prospectus shall be a reference to Singapore time unless<br />

otherwise stated.<br />

8

GLOSSARY OF TECHNICAL TERMS<br />

The glossary contains explanations of certain terms used in this Prospectus in connection with our<br />

group of companies and our business. The terms and their meaning may not correspond to standard<br />

industry meaning or usage of these terms.<br />

“ADSL” : Asymmetric Digital Subscriber Line is a member of the digital subscriber<br />

line family of modulation and compression technologies, all of which allow<br />

copper phone lines to support higher data rates than those required for<br />

voice telephony. ADSL supports an asymmetric service that offers higher<br />

downstream data rates than upstream. ADSL allows a subscriber to<br />

download data at speeds far higher than traditional modems and ISDN and<br />

is capable of supporting video<br />

“B2B” : An e-commerce model whereby businesses transact online<br />

“B2C” : An e-commerce model whereby businesses transact with consumers online<br />

“banner” : A form of advertisement on the Internet, usually a narrow graphic or logo<br />

towards the edge or edges of the screen<br />

“C2B” : An e-commerce model whereby consumers aggregate their demands and<br />

collectively transact with businesses online<br />

“C2C” : An e-commerce model whereby consumers transact online with each other<br />

“channel” : Website features which provide users with an efficient and easy way to<br />

explore and utilise content on the Internet through a series of guides and<br />

directories<br />

“community” : An interacting population of various kinds of individuals in a common location<br />

“content” : Information contained in a website<br />

“CPM” : Cost per mille, being cost per thousand advertisement impressions<br />

“domain name” : The Internet name of a website which is registered with Network Solutions<br />

Inc.<br />

“e-commerce” : Commercial transactions based on the electronic transmission of data over<br />

communications network. These commercial transactions may take place<br />

between B2B or B2C<br />

“e-mail” : An application that allows a user to send and receive messages to or from<br />

any other user with an Internet address, commonly known as an e-mail<br />

address<br />

“hyperlink” : A method of instantly linking one website to another<br />

“impressions” : An advertisement’s appearance on an accessed webpage. Advertisers use<br />

impressions to measure the number of views their advertisements receive<br />

and publishers often sell advertisement space according to impressions.<br />

Impressions are tracked in a log maintained by a site server<br />

“Internet” : A global network of interconnected, separately administered public and<br />

private computer networks<br />

“ISP” : Internet service provider<br />

9

GLOSSARY OF TECHNICAL TERMS<br />

“online” : Being connected to other interconnected computers on the Internet<br />

“pageviews” : Statistics used to measure website activity. One pageview is recorded each<br />

time a single page on a website is viewed<br />

“PDA” : Personal Digital Assistant<br />

“portal” : A website that attracts visitors by offering free information or free services<br />

on a daily basis. The portal site can be used as a basis to explore the<br />

web. A portal is an entry point and gateway for surfing the Internet that<br />

provides useful web-related services and links<br />

“URL” : Uniform Resource Locater, being the address of a web page<br />

“WAP” : Wireless Access Protocol<br />

“web page” : A file written in programming language and readable by browsers over the<br />

Internet<br />

“website” : A group of files on the world wide web, written in programming language<br />

and readable by a browser over the Internet using a communications<br />

protocol. Each website is identifiable by its URL<br />

“world wide web” : A network of computer servers that uses a special communications protocol<br />

to link different servers throughout the Internet and permits communication<br />

of graphics, video and sound<br />

10

LISTING ON THE SGX-ST<br />

DETAILS OF OUR INVITATION<br />

We have applied to the SGX-ST for permission to deal in and for quotation of all our Shares,<br />

comprising both existing issued and fully-paid Shares, the New Shares which are the subject of our<br />

Invitation, as well as the new Shares arising from the exercise of options granted under our AsiaOne<br />

Pre-IPO Share Option Scheme (the rules of which are set out in Appendix B of this Prospectus) and<br />

our AsiaOne (2000) Post-IPO Share Option Scheme (the rules of which are set out in Appendix C of<br />

this Prospectus). Such permission will be granted when we have been admitted to the Official List of<br />

SGX-ST. Our acceptance of applications and allocation of the New Shares will be conditional upon<br />

completion of our Invitation, which is subject to certain conditions, including the SGX-ST granting<br />

permission to deal in and for quotation of all of the issued Shares as well as the New Shares. If the<br />

completion of our Invitation does not occur because the SGX-ST’s permission is not granted or for<br />

any other reasons, monies paid in respect of any application accepted will be returned at your own<br />

risk without interest or any share of revenue or other benefit arising therefrom and you will not have<br />

any claim against us or the Manager.<br />

The SGX-ST assumes no responsibility for the correctness of any of the statements made, opinions<br />

expressed or reports contained in this Prospectus. Admission to the Official List of SGX-ST or opinions<br />

expressed in this Prospectus is not to be taken as an indication of the merits of our Invitation, our<br />

Company, our Group or our Shares.<br />

Our Directors individually and collectively accept full responsibility for the accuracy of the information<br />

given in this Prospectus and confirm, having made all reasonable enquiries, that to the best of their<br />

knowledge and belief, the facts stated and the opinions expressed in this Prospectus are fair and<br />

accurate in all material respects as at the date of this Prospectus and there are no other material<br />

facts the omission of which would make any statement in this Prospectus misleading.<br />

We have not authorised any person to give any information or to make any representation not<br />

contained in this Prospectus in connection with our Invitation. If such information or representation is<br />

made, it must not be relied upon as having been authorised by ourselves or the Manager. Neither<br />

the delivery of this Prospectus and the Application Forms nor our Invitation shall, under any<br />

circumstances, constitute a continuing representation or create any suggestion or implication that<br />

there has been no change in our affairs or any statement of fact or information contained in this<br />

Prospectus since the date of this Prospectus. Where such changes occur, we may make an<br />

announcement on the same to the SGX-ST. You should take note of any such announcement and,<br />

upon the release of such announcement, you shall be deemed to have notice of such changes.<br />

Save as expressly stated in this Prospectus, nothing herein is, or may be relied upon as, a promise<br />

or representation as to our future performance or policies.<br />

This Prospectus has been prepared solely for the purpose of our Invitation and may not be relied<br />

upon by any persons, other than the applicants in connection with their application for the New<br />

Shares, or for any other purpose. This Prospectus does not constitute an offer, invitation or solicitation<br />

to subscribe for the New Shares in any jurisdiction in which such offer, invitation or solicitation is<br />

unauthorised or unlawful, nor does it constitute an offer, invitation or solicitation to any person to<br />

whom it is unlawful to make such offer, invitation or solicitation.<br />

Copies of this Prospectus and the Application Forms may be obtained on request during business<br />

hours from the date of this Prospectus to the closing date for applications for the New Shares,<br />

subject to availability, from:-<br />

CITICORP INVESTMENT BANK (SINGAPORE) LIMITED<br />

3 Temasek Avenue #17-00<br />

Centennial Tower<br />

Singapore 039190<br />

and branches of Citibank, members of the Association of Banks in Singapore, members of the SGX-<br />

ST and merchant banks in Singapore.<br />

11

The Application List will open at 6.00 a.m. on 1 June 2000 and will remain open until 8.00 a.m.<br />

on 1 June 2000 or for such further period or periods as we and the Manager may decide.<br />

STRUCTURE OF OUR INVITATION<br />

Offering Price<br />

The Offering Price, determined by us and Citicorp based on the estimated market valuation of our<br />

Company and the market demand for our Shares, is $0.60 for each New Share offered in our<br />

Invitation. The Offering Price is the same for all New Shares offered in the various tranches of our<br />

Invitation and is payable in full on application.<br />

Our Invitation<br />

The Invitation comprises the following tranches:-<br />

INVITATION<br />

148,000,000 New Shares<br />

(subject to the<br />

Over-Allotment Option)<br />

* Subject to reallocation and<br />

different allocation process<br />

for each tranche<br />

Applications for New Shares under the Internet Offer Tranche will be processed separately<br />

from applications for New Shares under the Public Offer Tranche as the allocation process<br />

for each of these tranches will be different.<br />

Although the initial number of New Shares allocated to the Internet Offer Tranche and the Public<br />

Offer Tranche are 37,000,000 New Shares and 22,200,000 New Shares respectively, we reserve the<br />

right to reallocate these number of New Shares between the Internet Offer Tranche and the Public<br />

Offer Tranche depending on the number of applications received for each of these two tranches.<br />

To ensure a reasonable spread of shareholders:-<br />

DETAILS OF OUR INVITATION<br />

▲ ▲ ▲ ▲<br />

(a) we may decide to allocate to a successful applicant under the Internet Offer Tranche or the<br />

Public Offer Tranche such number of New Shares which is less than the number applied for by<br />

that applicant, in any of the following events:-<br />

(aa) an over-subscription for both the Internet Offer Tranche and the Public Offer Tranche; or<br />

(bb) an under-subscription for the Internet Offer Tranche and over-subscription for the Public<br />

Offer Tranche; or<br />

(cc) an under-subscription for the Public Offer Tranche and over-subscription for the Internet<br />

Offer Tranche; and<br />

(b) in such event, we will allocate no less than 14,800,000 New Shares to the Internet Offer Tranche<br />

and no less than 14,800,000 New Shares to the Public Offer Tranche.<br />

12<br />

INTERNET OFFER TRANCHE<br />

37,000,000 New Shares*<br />

PUBLIC OFFER TRANCHE<br />

22,200,000 New Shares*<br />

RESERVED TRANCHE<br />

14,800,000 New Shares*<br />

PLACEMENT TRANCHE<br />

74,000,000 New Shares

In any event, we reserve the right to reallocate such number of New Shares as we deem<br />

appropriate amongst the different tranches.<br />

Investors may subscribe for any number of New Shares in integral multiples of 1,000 New<br />

Shares. However, in the event that both the Internet Offer Tranche and the Public Offer Tranche<br />

are substantially over-subscribed, to ensure a reasonable spread of shareholders, we may<br />

limit the number of New Shares allocated to any single investor subscribing for New Shares<br />

under the Internet Offer Tranche or the Public Offer Tranche to not more than 20,000 New<br />

Shares or such other number of New Shares as we may prescribe. We have full discretion to<br />

decide to allocate above or under this limit if we deem it appropriate to do so.<br />

We have granted Citicorp the Over-Allotment Option, exercisable within 30 days from the date of this<br />

Prospectus, to subscribe for up to 22,200,000 additional New Shares to cover over-allotments in our<br />

Invitation.<br />

(i) Internet Offer Tranche<br />

DETAILS OF OUR INVITATION<br />

Individuals in Singapore from whom we have received valid registrations as users at our website<br />

“www.asiaone.com/registration” during the period commencing on 17 May 2000 and ending at<br />

8.00 a.m. on 31 May 2000, will be notified by us via e-mail to apply for New Shares under the<br />

Internet Offer Tranche through our IPO website “www.asiaone.com/IPO”. Individuals whose<br />

registrations are received by us prior to or on 23 May 2000 will receive our e-mail notification<br />

on 23 May 2000. In respect of individuals whose registrations are received by us after 23 May<br />

2000, to the extent possible, we will acknowledge receipt of such registration within one hour<br />

by way of return e-mail.<br />

Such individuals must (a) not be corporations, sole-proprietorships, partnerships, chops or any<br />

other business entities; (b) be over the age of 21 years; (c) not be undischarged bankrupts; (d)<br />

apply for the New Shares in Singapore; (e) not apply for New Shares under the Public Offer<br />

Tranche or the Placement Tranche; and (f) be customers who maintain Internet banking accounts<br />

with the Internet Banks or Internet trading accounts with the Internet Stockbrokers.<br />

Each Qualifying User may only submit one application for New Shares under the Internet<br />

Offer Tranche. An investor who subscribes for New Shares under the Internet Offer<br />

Tranche shall not make any separate application for New Shares under the Public Offer<br />

Tranche or the Placement Tranche. Such separate applications will be deemed to be<br />

multiple applications and shall be rejected.<br />

The procedures for Internet Offer Tranche Application through our IPO website<br />

“www.asiaone.com/IPO” are set out on pages 169 to 171 in Appendix A of this Prospectus.<br />

The Internet Offer Tranche of initially 37,000,000 New Shares at the Offering Price represents<br />

25% of the total number of New Shares initially available under the Invitation (before any exercise<br />

of the Over-Allotment Option) and 3.2% of our post-IPO issued and paid-up share capital (before<br />

any exercise of the Over-Allotment Option).<br />

An applicant for New Shares under the Internet Offer Tranche must choose his preferred<br />

Internet Bank or Internet Stockbroker in order to complete his application. As the Internet<br />

IPO gateway of an Internet Bank or Internet Stockbroker may close before 8.00 a.m. on 1<br />

June 2000, an applicant is requested to liaise with his preferred Internet Bank or Internet<br />

Stockbroker on the last date and time the Internet Bank or Internet Stockbroker is<br />

accepting applications through the Internet IPO gateway.<br />

13

Allocation of New Shares under the Internet Offer Tranche will be based on the level of valid<br />

applications received. In the event that the Internet Offer Tranche and/or the Invitation on the<br />

whole are substantially over-subscribed, there may be balloting and applicants who are not<br />

successful in the ballot will not receive any New Shares under the Internet Offer Tranche while<br />

successful applicants in the ballot may receive less than the number of New Shares they<br />

applied for under the Internet Offer Tranche. Applications for New Shares under the Internet<br />

Offer Tranche will be processed separately from applications for New Shares under the<br />

Public Offer Tranche as the allocation process for each of these tranches will be different.<br />

(ii) Public Offer Tranche<br />

DETAILS OF OUR INVITATION<br />

The Public Offer is open to members of the public in Singapore as well as to institutional and<br />

professional investors. Investors may apply for New Shares under the Public Offer Tranche by<br />

way of printed Offer Shares Application Forms or ATMs belonging to the Participating Banks.<br />

Applications for New Shares through any Internet IPO Website by investors who are not<br />

Qualifying Users shall be treated as applications under the Public Offer Tranche.<br />

The terms and conditions and the procedures for application of New Shares under the Public<br />

Offer Tranche are set out on pages 155 to 169 in Appendix A of this Prospectus.<br />

Only one application may be made for the benefit of a person for New Shares under the<br />

Public Offer Tranche. A person submitting an application for New Shares in the Public<br />

Offer Tranche by way of a printed Offer Shares Application Form may not submit separate<br />

application of New Shares by way of ATMs and vice versa. An investor who subscribes<br />

for New Shares under the Public Offer Tranche shall not make any separate application<br />

for New Shares either through the Internet Offer Tranche or the Placement Tranche. Such<br />

separate applications shall be deemed to be multiple applications and shall be rejected.<br />

The Public Offer Tranche of initially 22,200,000 New Shares at the Offering Price represents<br />

15% of the total number of New Shares initially available under the Invitation (before any exercise<br />

of the Over-Allotment Option) and 1.9% of our post-IPO issued and paid-up share capital (before<br />

any exercise of the Over-Allotment Option).<br />

Allocation of New Shares under the Public Offer Tranche will be based on the level of valid<br />

applications received. In the event that the Public Offer Tranche and the Invitation on the whole<br />

are substantially over-subscribed, there will be balloting and applicants who are not successful<br />

in the ballot will not receive any New Shares under the Public Offer Tranche while successful<br />

applicants in the ballot may receive less than the number of New Shares they applied for under<br />

the Public Offer Tranche. Applications for New Shares under the Public Offer Tranche will<br />

be processed separately from applications for New Shares under the Internet Offer Tranche<br />

as the allocation process for each of these tranches will be different.<br />

14

(iii) Reserved Tranche<br />

14,800,000 New Shares under our Invitation are subject to priority allocation to persons in the<br />

following categories who have contributed to our success: (a) the directors, executive officers<br />

and employees of our Group, (b) directors, officers and employees of our related corporations,<br />

and (c) our business associates and their employees. More than 90% of the Reserved Shares<br />

will be offered to directors, officers and employees of the SPH Group.<br />

Application for New Shares under the Reserved Tranche may only be made by way of printed<br />

Reserved Shares Application Forms. The terms and conditions and the procedures for application<br />

of Reserved Shares under the Reserved Tranche are set out on pages 155 to 162 in Appendix<br />

A of this Prospectus.<br />

An investor who has agreed to subscribe for Reserved Shares shall not make or procure<br />

to be made any separate application for New Shares through the Placement Tranche.<br />

Such separate applications will be deemed to be multiple applications and shall be<br />

rejected.<br />

The Reserved Tranche of 14,800,000 New Shares at the Offering Price represents 10% of the<br />

total number of New Shares initially available under the Invitation (before any exercise of the<br />

Over-Allotment Option) and 1.3% of our post-IPO issued and paid-up share capital (before any<br />

exercise of the Over-Allotment Option).<br />

(iv) Placement Tranche<br />

DETAILS OF OUR INVITATION<br />

The Placement will involve selective marketing of New Shares to institutional and professional<br />

investors and other investors expected to have a sizeable demand for the New Shares.<br />

Professional investors generally include brokers, dealers, companies (including fund managers)<br />

whose ordinary business involves dealing in shares and other securities and corporate entities<br />

which regularly invest in shares and other securities. Application for New Shares under the<br />

Placement Tranche may only be made by way of printed Placement Shares Application Forms.<br />

The terms and conditions and the procedures for application of Placement Shares under the<br />

Placement Tranche are set out on pages 155 to 162 in Appendix A of this Prospectus.<br />

An investor who has agreed to subscribe for Placement Shares or who otherwise<br />

subscribes for Placement Shares shall not make or procure to be made any separate<br />

application for New Shares either through the Internet Offer Tranche or the Public Offer<br />

Tranche or the Reserved Tranche. Such separate applications will be deemed to be multiple<br />

applications and shall be rejected.<br />

The Placement Tranche of initially 74,000,000 New Shares at the Offering Price represents<br />

50% of the total number of New Shares initially available under the Invitation (before any exercise<br />

of the Over-Allotment Option) and 6.4% of our post-IPO issued and paid-up share capital (before<br />

any exercise of the Over-Allotment Option).<br />

15

RESULTS OF APPLICATION AND DISTRIBUTION<br />

We will publicly announce the level of subscription for the New Shares and the basis of allocation of<br />

the New Shares pursuant to the Invitation, as soon as it is practicable after the closing date for<br />

applications:-<br />

(i) through a MASNET announcement to be posted on the Internet at the SGX-ST website<br />

http://www.singaporeexchange.com;<br />

(ii) on our AsiaOne.com website; and<br />

DETAILS OF OUR INVITATION<br />

(iii) in the local English newspapers, namely, The Straits Times and The Business Times.<br />

We will inform the Qualifying Users who applied for New Shares under the Internet Offer Tranche<br />

the results of their application by way of an e-mail notification on the evening of the balloting day.<br />

Applicants who make ATM Electronic Applications through the ATMs of the following banks may<br />

check the provisional results of their Electronic Applications as follows:-<br />

Bank Telephone Available at Operating Hours Service expected from<br />

DBS Bank 1800-222 2222 Internet Banking or 24 hours a day Evening of the balloting day<br />

327 4767 Internet Kiosk<br />

www.dbs.com.sg*<br />

KTB 222 8228 ATM ATM - 24 hours a day ATM-Evening of the balloting day<br />

Phone Banking: Phone Banking:<br />

Mon-Fri: 0800-2200 8.00 a.m. on the day<br />

Sat: 0800-1500 after the balloting day<br />

OCBC 1800-363 3333 ATM 24 hours a day Evening of the balloting day<br />

OUB 1800-224 2000 OUB Personal<br />

Banking<br />

www.oub2000.com.sg<br />

OUB Mobile Buzz**<br />

24 hours a day Evening of the balloting day<br />

UOB 1800 533 5533*** ATM (Other<br />

Transactions-“IPO<br />

24 hours a day Evening of the balloting day<br />

1800-222 2121*** enquiry”)<br />

* Applicants who made Internet Offer Tranche Applications through the IB website of DBS Bank or OUB may also check<br />

the result through same channels listed in the table above in relation to ATM Electronic Applications made at ATMs of<br />

DBS Bank or OUB.<br />

** Applicants who made Electronic Applications through the ATMs of OUB and who activated their OUB Mobile Buzz<br />

services will be notified of the results of their Electronic Application, via their mobile phones.<br />

*** UOB customers with PhoneBanking service can check the results of their IPO applications via the two toll-free 24 hours<br />

hotline numbers after successful verification of their Access Code and Personal Identification Number. Transaction code<br />

is “12#”. The information will be kept in the system for 7 days after closure of the IPO.<br />

If the applicant’s ATM Electronic Application is made through the ATMs of KTB or UOB Group and<br />

is unsuccessful, it is expected that a computer-generated notice will be sent to the applicant by the<br />

relevant Participating Bank (at the address of the applicant as stated in the records of the relevant<br />

Participating Bank as at the date of his ATM Electronic Application) by ordinary post at the applicant’s<br />

own risk within three Market Days after the close of the Application List. If the applicant’s ATM<br />

Electronic Application is made through the ATMs of OCBC Group, OUB or DBS Bank (including its<br />

POSBank Services division) and is unsuccessful, no notification will be sent by the relevant<br />

Participating Bank.<br />

16

INDICATIVE TIMETABLE FOR LISTING<br />

An indicative timetable is set out below for the reference of applicants:-<br />

Indicative Date/Time Event<br />

8.00 a.m. on 1 June 2000 Close of Application List<br />

2 June 2000 Balloting of applications, if necessary<br />

9.00 a.m. on 5 June 2000 Admission of our Company to the Official List of the SGX-ST<br />

Commence trading of our Shares on the SGX-ST on a “when<br />

issued” basis<br />

12 June 2000 Last day for trading on a “when issued” basis<br />

9.00 a.m. on 13 June 2000 Commence trading on a “ready” basis<br />

16 June 2000 Settlement date for all trades done on a “when issued” basis<br />

and for trades done on a “ready” basis on 13 June 2000<br />

The above timetable is only indicative as it assumes that the closing of the Application List is 1 June<br />

2000, the date of admission of our Company to the Official List of SGX-ST will be 5 June 2000, the<br />

SGX-ST’s shareholding spread requirement will be complied with and the New Shares will be issued<br />

and fully paid-up prior to 5 June 2000.<br />

In the event of an early closure of the Application List or the shortening of the time period during<br />

which the Invitation is open, we will publicly announce the same:-<br />

(i) through a MASNET announcement to be posted on the Internet at the SGX-ST website<br />

http://www.singaporeexchange.com;<br />

(ii) on our AsiaOne.com website; and<br />

DETAILS OF OUR INVITATION<br />

(iii) in the local English newspapers, namely, The Straits Times and The Business Times.<br />

The actual date on which the Shares will commence trading on a “when issued” basis will be<br />

announced when it is confirmed by the SGX-ST.<br />

The above timetable and procedure may be subject to such modifications as the SGX-ST may<br />

in its absolute discretion decide, including the decision to permit trading on a “when issued”<br />

basis and the commencement date of such trading.<br />

All persons trading in the Shares on a “when issued” basis do so at their own risk. In particular,<br />

persons trading in the Shares before their Securities Accounts with CDP are credited with the<br />

relevant number of Shares do so at the risk of selling Shares which neither they nor their<br />

nominees, as the case may be, have been allotted or are otherwise beneficially entitled to.<br />

Such persons are also exposed to the risk of having to cover their net sell positions earlier<br />

if “when issued” trading ends sooner than the indicative date mentioned above. Persons who<br />

have a net sell position traded on a “when issued” basis should close their position on or<br />

before the first day of “ready” basis trading.<br />

Investors should consult the SGX-ST announcement of the “ready” listing date on the Internet (at<br />

SGX-ST website http://www.singaporeexchange.com), INTV or newspapers, or check with their brokers<br />

on the date on which trading on a “ready” basis will commence.<br />

17

SELLING RESTRICTIONS<br />

DETAILS OF OUR INVITATION<br />

This Prospectus does not constitute an offer, solicitation or invitation to subscribe for the New Shares<br />

in any jurisdiction in which such offer, solicitation or invitation is unlawful or is not authorised or to<br />

any person to whom it is unlawful to make such offer, solicitation or invitation. No action has been or<br />

will be taken under the requirements of the legislation or regulations of, or of the legal or regulatory<br />

authorities of, any jurisdiction, except for the registration of this Prospectus in Singapore in order to<br />

permit a public offering of the New Shares and the public distribution of this Prospectus in Singapore.<br />

The distribution of this Prospectus and the offering of the New Shares in certain jurisdictions may be<br />

restricted by the relevant laws in such jurisdictions. Persons who may come into possession of this<br />

Prospectus are required by our Company and the Manager to inform themselves about, and to<br />

observe and comply with, any such restrictions.<br />

18

This summary highlights certain information found in greater detail elsewhere in this Prospectus. In<br />

addition to this summary, we urge you to read the entire Prospectus carefully, especially the discussion<br />

of risk of investing in our Shares under “Risk Factors”, before deciding to buy our Shares. References<br />

in this Prospectus to “AsiaOne”, “Group”, “we”, “our” and “us” refer to AsiaOne and its subsidiary.<br />

OVERVIEW OF THE GROUP<br />

PROSPECTUS SUMMARY<br />

We started our operations in 1995 as the Multimedia division of SPH. We were incorporated on 23<br />

July 1999 under the Companies Act as a separate private limited company in Singapore, under the<br />

name of “SPH.com Pte Ltd” with an issued share capital of $2.00 comprising two ordinary shares of<br />

$1.00 each. We changed our name on 25 August 1999 to “AsiaOne Internet Pte Ltd” and on 16<br />

December 1999 to “SPH AsiaOne Pte Ltd”. We became a public limited company on 8 February<br />

2000 and changed our name to “SPH AsiaOne Ltd”. Our issued share capital as at the date of this<br />

Prospectus is $50 million comprising 1,000,000,000 ordinary shares of $0.05 each. Changes in our<br />

share capital from the date of our incorporation and the date of this Prospectus are set out in the<br />

“General Information on Our Group – Share Capital” section of this Prospectus.<br />

Our website was launched in June 1995 as the Internet version of SPH’s publications. The Business<br />

Times was the first to go online, followed by The Shipping Times, Lianhe Zaobao and The Straits<br />

Times. By late 1995, our website registered approximately 60,000 pageviews each week, of which<br />

approximately 60% was from outside Asia.<br />

In 1996, we included other publications, namely, The New Paper and Berita Harian as well as other<br />

regional newspapers and magazines on our website. The range of services was expanded to include<br />

Business Centre and Entertainment. AsiaOne.com gained good reception and the number of times<br />

our website was accessed increased to approximately 4 million pageviews a month.<br />

Keeping abreast of the virtual shopping trend, our e-commerce infrastructure was launched in October<br />

1997. We also launched other new services such as SingaporeConnect and REALink in 1997.<br />

By late 1998, our virtual shopping mall had 60 shops. Pageviews continued to grow, increasing to<br />

approximately 25 million pageviews a month by end 1998.<br />

At the start of the new millennium, we re-positioned ourselves to be the premier Internet player in<br />

Asia, targeting the English speaking audience with our English language portal, AsiaOne.com, and<br />

the Chinese language market with our Chinese language portal, Zaobao.com. Our objective is to be<br />

a dynamic, multifaceted news, information, lifestyle and e-commerce site. We want to reach English<br />

and Chinese speaking Internet users around the world with our focus on Asian products and services,<br />

and businesses and consumers looking for total solutions in Asia. We aim to be the premier Asian<br />

gateway/portal.<br />

Our Group currently operates as an Internet portal under the domain names of “www.asiaone.com”<br />

and “www.zaobao.com”, which are based on the fundamental concepts of content, community and<br />

commerce. We had approximately 58 million pageviews per month as at April 2000. Through our<br />

parent company, SPH, and in cooperation with other content providers, we offer a broad range of<br />

content, a directory of websites, e-commerce and auction capabilities, and value-added personal<br />

services such as free e-mail accounts and a homepage builder. We are dependent on our parent<br />

company, SPH, for news content.<br />

Prior to 1 March 2000, SPH did not charge us for the news content and neither did we charge SPH<br />

for hosting its online newspapers. However, with effect from 1 March 2000, SPH charges us royalty<br />

and licensing fees for its English, Malay and Tamil news content while we charge SPH a hosting fee<br />

for hosting its online English, Malay and Tamil newspapers on our websites. Our wholly-owned<br />

subsidiary Zaobao.com, has a similar arrangement with SPH in respect of its Chinese content with<br />

effect from 1 May 2000. The nature of our dealings with SPH is described in greater detail in the<br />

“Interested Person Transactions” section of this Prospectus.<br />

19

Our present business model is based on the following revenue streams:-<br />

(i) content and other services<br />

(a) subscriptions;<br />

(b) archive database; and<br />

(c) e-commerce/auction;<br />

(ii) advertising services and classifieds; and<br />

(iii) audiotex services.<br />

PROSPECTUS SUMMARY<br />

A more detailed discussion of our business model can be found in the “Business – Business Model”<br />

section of this Prospectus.<br />

For FY1999, content and other services accounted for approximately <strong>42</strong>.3% of our revenue, whilst<br />

advertising services and audiotex services accounted for 26.2% and 31.5% of our revenue respectively.<br />

For the six months ended 29 February 2000, content and other services accounted for approximately<br />

36.5% of our revenue, whilst advertising services and audiotex services accounted for 24.2% and<br />

39.3% of our revenue respectively.<br />

We plan to expand our business horizontally, vertically and geographically. Our expansion plans are<br />

set out in detail in the “Business - Expansion Plans” section of this Prospectus. To support our<br />

expansion plans, we intend to invest in technology to build comprehensive websites to support mass<br />

transaction capabilities and website functionality to provide portal services which users find easy to<br />

use and will want to continue using.<br />

Horizontally, we intend to expand by broadening the range and depth of service and product offerings<br />

at our websites. We plan to integrate vertically by investing in businesses that offer content, technology,<br />

distribution capabilities as well as marketing, e-commerce, and cross-promotional opportunities through<br />

joint ventures, strategic alliances and investments. In addition, we plan to expand our presence<br />

geographically in the region, as well as to build our brand names internationally. To this end, we<br />

intend to enter into joint ventures with (i) established local partners in each of the various countries<br />

who have strong presence in their own countries and who have a good understanding of the<br />

indigenous social and cultural needs as well as consumption pattern in the respective countries, and<br />

(ii) partners with the content and/or proven know how and who are ready to penetrate the Asian<br />

market.<br />

Moving forward, we intend to serve our content, community and commerce products and services<br />

not only through the Internet but also through other platforms such as WAP, PDA and broadband<br />

networks.<br />

We believe our competitive strengths to be the following:-<br />

(i) Strong Parentage<br />

Our parent company, SPH, is a leading publishing and media group in Southeast Asia with 155<br />

years of publishing experience. SPH has injected $50 million equity monies into our Company<br />

to date. SPH, which owns approximately 87.1% (assuming that the Over-Allotment Option is<br />

not exercised) of our Company’s post-Invitation issued and paid-up share capital, has given an<br />

undertaking not to dispose of or transfer any of its shareholding in our Company for a period of<br />

six months after our admission to the Official List of the SGX-ST. SPH currently intends for<br />

AsiaOne to remain a subsidiary of SPH in the foreseeable future.<br />

20

PROSPECTUS SUMMARY<br />

In addition to the content creation and brand recognition of SPH, we also have access to and<br />

will be able to leverage on SPH’s large and successful advertising sales force, strong relationship<br />

with advertisers and extensive classified advertising operations.<br />

(ii) Quality Content<br />

We draw on the extensive content creating capabilities of SPH for quality news and information<br />

over a wide range of general and special interest areas. With the support of our parent company<br />

and other resources, we are able to harness a wealth of content to be offered to the users of<br />

our portal.<br />

(iii) Integrity and Trust<br />

The Internet is a vast global goldmine of information, but the sources and credibility of some of<br />

such information may be dubious and may not be verifiable. As a result, there is a lack of<br />

confidence in the integrity of content, product and services available on Internet. Given the<br />

credibility and integrity of the sources of our content, we believe that our users will have faith<br />

in the information provided at our websites. As we are a long term player in our business, we<br />

are of the view that our users have confidence and trust in engaging in e-commerce activities<br />

on our websites.<br />

(iv) Experienced Management<br />

We have an experienced management team which is well poised to bring our business to the<br />

next stage of success. We also have a team of seasoned content producers who know what it<br />

takes to break news and how to present news to capture attention, and a sales force which<br />

understands the online advertising and sales market.<br />

(v) Strategic Alliances<br />

Our Group has formed alliances with strategic Internet and technology companies that possess<br />

complementary expertise and know how. Such alliances enable us to provide high quality services<br />

to our users.<br />

(vi) Early Mover Advantage<br />

We have been in operation since mid 1995. We believe we have established ourselves as one<br />

of the most popular portals in Singapore. Zaobao Online has a very good reputation for its<br />

timely and high quality reporting of news and current affairs among Chinese-speaking users<br />

globally. Zaobao.com is currently ranked by www.cwrank.com as one of the top Chinese news<br />

website in the world. www.cwrank.com, owned by Canada’s Mandarin Media Inc, is a leading<br />

organization that ranks Chinese websites worldwide.<br />

To the best of our knowledge and belief, we are currently the only portal in Asia to provide up<br />

to date news and information throughout the day in four different languages – English, Chinese,<br />

Malay and Tamil.<br />

We believe that with the firm support of our shareholders, customers and business partners, and<br />

with our competitive strengths, we are well positioned to achieve our business plans and become<br />

the premier Asian gateway/portal.<br />

21

THE INVITATION<br />

PROSPECTUS SUMMARY<br />

Size : 148,000,000 New Shares which will, upon issue and allotment, rank<br />

pari passu in all respects with the existing issued Shares.<br />

Price : $0.60 for each New Share.<br />

Over-Allotment Option : We have granted Citicorp a 30-day option to purchase up to a total<br />

of 22,200,000 New Shares, solely to cover over-allotments, if any.<br />

Unless we indicate otherwise, all information in this Prospectus<br />

assumes that Citicorp has not exercised its Over-Allotment Option.<br />

Purpose of the Invitation : Our Directors believe that the listing of our Company and the<br />

quotation of our Shares on SGX-ST will enhance the public image<br />

of our Group and enable our Group to raise funds from the capital<br />

markets to finance our business expansion. It will also provide<br />

members of the public, employees and business associates of our<br />

Group, as well as others who have contributed to our success, with<br />

an opportunity to participate in the equity of our Company.<br />

Reserved Shares : 14,800,000 New Shares will be reserved for the directors, executive<br />

officers and employees of our group of companies, directors, officers<br />

and employees of our related corporations, and our business<br />

associates and their employees. More than 90% of the Reserved<br />

Shares will be offered to directors, officers and employees of the<br />

SPH Group. The Reserved Shares will be offered at the same price<br />

as the New Shares. In the event that any of the Reserved Shares<br />

are not taken up, they will be made available to satisfy applications<br />

made by members of the public for the New Shares.<br />

Listing Status : Our Shares will be quoted on SGX-ST, subject to admission of our<br />

Company to the Official List of SGX-ST and permission for dealing<br />

in and for quotation of our Shares being granted by the SGX-ST.<br />

22

SHARE CAPITAL<br />

Issued and paid-up share capital based on the balance sheet of our Group as at<br />

29 February 2000, and adjusting for the Capital Injection and the Share Split (as<br />

set out in the “General Information on Our Group – Share Capital” section of this<br />

Prospectus):-<br />

(a) based on the pre-floatation share capital of 1,000,000,000 Shares $50,000,000<br />

(b) based on the adjusted pre-floatation share capital of 1,071,820,000 Shares,<br />

assuming the 71,820,000 Pre-IPO Option granted prior to our Invitation (details<br />

of which are set out in the “Directors, Senior Management and Staff –<br />

Share Option Schemes” section of this Prospectus) were granted and were<br />

fully exercised on 31 August 1999 $53,591,000<br />

(c) based on the post-floatation enlarged share capital of 1,219,820,000 Shares,<br />

assuming the Over-Allotment Option is not exercised and the 71,820,000<br />

Pre-IPO Options were granted and were fully exercised on 31 August 1999 $60,991,000<br />

NET TANGIBLE ASSETS<br />

The net tangible assets per Share based on the balance sheet of the Group as at<br />

29 February 2000 and after adjusting for the Capital Injection and the Share Split<br />

(as set out in the “General Information on Our Group – Share Capital” section of<br />

this Prospectus):-<br />

(a) based on the pre-floatation share capital of 1,000,000,000 Shares 4.77 cents<br />

(b) based on the pre-floatation share capital of 1,071,820,000 Shares, assuming<br />

the 71,820,000 Pre-IPO Options granted prior to our Invitation were granted<br />

and were fully exercised on 31 August 1999 6.46 cents<br />

(c) after adjusting for the estimated net proceeds of the Invitation and based on<br />

the post-floatation enlarged share capital of 1,219,820,000 Shares, assuming<br />

the Over-Allotment Option is not exercised, and the 71,820,000 Pre-IPO Options<br />

granted prior to our Invitation were granted and were fully exercised on<br />

31 August 1999 12.70 cents<br />

LOSS PER SHARE<br />

Proforma loss per Share of the Group for FY1999 based on the pre-floatation<br />

share capital of 1,000,000,000 Shares, assuming that the Capital Injection and<br />

the Share Spilt had been effected on 31 August 1999 0.05 cents<br />

Proforma loss per Share of the Group for FY1999 based on the pre-floatation<br />

share capital of 1,071,820,000 Shares, assuming that the Capital Injection and the<br />

Share Spilt had been effected on 31 August 1999, and the 71,820,000 Pre-IPO<br />

Options granted prior to our Invitation were granted and were fully exercised on<br />

31 August 1999 0.05 cents<br />

NET OPERATING CASH FLOW<br />

FINANCIAL STATISTICS<br />

Proforma net cash flow per Share used in operating activities of the Group for<br />

FY1999 based on the pre-floatation share capital of 1,000,000,000 Shares,<br />

assuming that the Capital Injection and the Share Split had been effected on<br />

31 August 1999 0.13 cents<br />

Proforma net cash flow per Share used in operating activities of the Group for<br />

FY1999 based on the pre-floatation share capital of 1,071,820,000 Shares, assuming<br />

that the Capital Injection and the Share Split had been effected on 31 August 1999,<br />

and the 71,820,000 Pre-IPO Options granted prior to our Invitation were granted<br />

and were fully exercised on 31 August 1999 0.12 cents<br />

23

An investment in our Shares involves a high degree of risk. You should carefully consider and<br />

evaluate the following information about these risks and all other information contained in this<br />

Prospectus before deciding to invest in our Shares. If any of the following risks and uncertainties<br />

develop into actual events, they would have a material adverse effect on our business and financial<br />

condition. In such cases, the trading price of our Shares could decline due to any of these<br />

considerations and uncertainties, and you may lose all or part of your investment in our Shares.<br />

RISKS RELATING TO OUR COMPANY<br />

RISK FACTORS<br />

We rely substantially on SPH to provide content and create traffic<br />

We rely substantially on SPH to provide content (classified listings inclusive) and create traffic in<br />

order to make our portal more attractive to advertisers and consumers. The arrangement is through<br />

Hosting Agreements and Licence Agreements, details of which can be found under the “Interested<br />

Person Transactions” section below. The agreements are non-exclusive and SPH may offer content<br />

through other portals whether owned by it or third parties. SPH may also raise the fee that they<br />

charge for their content to the extent that it becomes uneconomical for us to continue to license<br />

content from them. The availability of SPH content on other portals or Internet platforms, or the loss<br />

of access to SPH content, could adversely affect our business. Further, our profitability could also be<br />

affected by increase in the cost of content.<br />

We may not be able to rely on operating and financial resources provided by the SPH Group<br />

The SPH Group only recently reorganised its operations to establish the Company as a stand-alone<br />

company. Prior to that, as mentioned in the “Analysis of Financial Condition and Results of Operations<br />

– Liquidity and Capital Resources” section of this Prospectus, we relied on the SPH Group for<br />

substantially all of our resources and funding of expenses. Our need to acquire the necessary skills,<br />

staff and systems to operate as an independent public company is likely to substantially increase<br />

our operating expenses and occupy our senior management’s time. The financial information set out<br />

in the “Financial Statements” section of this Prospectus do not necessarily reflect our financial condition<br />

as though we had been a stand-alone entity throughout the relevant periods. Our future operating<br />

results and ability to meet our growth objectives will be substantially affected by how quickly we can<br />

operate as an independent public company and our ability to secure external financing when required.<br />

It is possible that our business and financial condition will be materially and adversely affected as a<br />

result of our inability to rely upon the financial support of the SPH Group in the future. While we will<br />

remain a subsidiary of SPH, we will have to comply with the rules and regulations of the SGX-ST<br />

once our shares are listed on the Official List of the SGX-ST and this may limit our ability to rely on<br />

the SPH Group as a source of capital in the future.<br />

The interests of SPH, our controlling shareholder, may be in conflict with our interests<br />

Immediately after the Invitation, SPH will control approximately 87.1% (assuming that the Over-<br />

Allotment Option is not exercised) of our outstanding share capital. SPH has undertaken not to<br />

compete with us or to license their content to any third party to allow such third party to compete<br />

with us by engaging in e-commerce development and content development in specified activities<br />

until 31 August 2001, subject to certain conditions as detailed in the “Interested Person Transactions”<br />

section of this Prospectus. In the future, SPH may be a competitor in some or all of our areas of<br />

business, as set out in greater details under the “Potential Conflicts of Interest” section of this<br />

Prospectus. SPH will, for the foreseeable future, exercise substantial influence over our operations<br />

and business strategy. In the event that there is a divergence of our strategic and other interests<br />

from those of SPH in the future, there can be no assurance that SPH will use its influence over our<br />

affairs in ways which would be in our best interests.<br />

24

RISK FACTORS<br />

We have a history of losses and anticipate to incur losses for the foreseeable future<br />

We have incurred net losses in our short operating history as a company as set out in the “Report<br />

of the Independent Public Accountants” section of this Prospectus. We anticipate that we will continue<br />

to incur substantial operating losses for the foreseeable future due to operating and capital expenditure,<br />

increased sales and marketing costs, additional personnel hires, greater levels of product development<br />

and our general growth objectives. We cannot assure you that our losses will not further increase in<br />

the future or that we will ever achieve or sustain profitability.<br />

We depend on advertising as a key source of our revenue<br />

We rely heavily on advertising as a source of revenue as disclosed in the “Selected Financial Data”<br />

and “Business – Business Model” sections of this Prospectus. Our business plan assumes that<br />

online advertising in Asia will expand and that revenues generated by advertising will increase. We<br />

anticipate that a substantial portion of our future revenues will be derived from our advertising network<br />

as online advertising becomes more broadly accepted in Asia. However, online advertising is still a<br />

relatively unproven business in Asia.<br />

Advertisers and advertising agencies typically purchase advertising under agreements that run for a<br />

limited time and can be terminated by the advertiser or advertising agency with little or no notice<br />

and no penalty. We cannot be certain that current advertisers and advertising agencies will continue<br />

to purchase advertising from us, that we will be able to attract additional advertisers and advertising<br />

agencies successfully or that advertisers and advertising agencies will make timely payments due to<br />

us.<br />

The growth of our advertising revenues will depend on many factors, including:<br />

• attractiveness of our advertising pricing schedules;<br />

• the pricing of advertising on other websites;<br />

• level of acceptance of Internet advertising;<br />

• volume of traffic at our websites; and<br />

• market recognition of our brand names.<br />

There is no guarantee that we can maintain constantly growing pageviews in line with our projected<br />

growth rate on advertising revenue. Any reduction in the pageviews of our websites may cause<br />

advertisers to withdraw from our advertising network.<br />

The development of web software that blocks Internet advertisements before they appear on a<br />

user’s screen may hinder the growth of online advertising. The expansion of advertisement blocking<br />

on the Internet may decrease our revenues because when an advertisement is blocked, it is not<br />

downloaded from our advertisement server, which means that such advertisements are not tracked<br />

as a delivered advertisement. Advertisers may choose not to advertise on the Internet and on our<br />

advertising network because of the use of Internet advertisement blocking software. The use of web<br />