Osim International Ltd

Osim International Ltd

Osim International Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Osim</strong> <strong>International</strong> <strong>Ltd</strong><br />

“regional player...going global”<br />

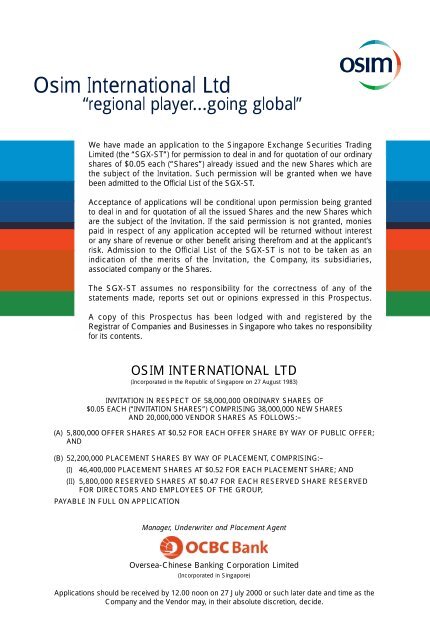

We have made an application to the Singapore Exchange Securities Trading<br />

Limited (the ‘‘SGX-ST’’) for permission to deal in and for quotation of our ordinary<br />

shares of $0.05 each (‘‘Shares’’) already issued and the new Shares which are<br />

the subject of the Invitation. Such permission will be granted when we have<br />

been admitted to the Official List of the SGX-ST.<br />

Acceptance of applications will be conditional upon permission being granted<br />

to deal in and for quotation of all the issued Shares and the new Shares which<br />

are the subject of the Invitation. If the said permission is not granted, monies<br />

paid in respect of any application accepted will be returned without interest<br />

or any share of revenue or other benefit arising therefrom and at the applicant’s<br />

risk. Admission to the Official List of the SGX-ST is not to be taken as an<br />

indication of the merits of the Invitation, the Company, its subsidiaries,<br />

associated company or the Shares.<br />

The SGX-ST assumes no responsibility for the correctness of any of the<br />

statements made, reports set out or opinions expressed in this Prospectus.<br />

A copy of this Prospectus has been lodged with and registered by the<br />

Registrar of Companies and Businesses in Singapore who takes no responsibility<br />

for its contents.<br />

OSIM INTERNATIONAL LTD<br />

(Incorporated in the Republic of Singapore on 27 August 1983)<br />

INVITATION IN RESPECT OF 58,000,000 ORDINARY SHARES OF<br />

$0.05 EACH (‘‘INVITATION SHARES’’) COMPRISING 38,000,000 NEW SHARES<br />

AND 20,000,000 VENDOR SHARES AS FOLLOWS:–<br />

(A) 5,800,000 OFFER SHARES AT $0.52 FOR EACH OFFER SHARE BY WAY OF PUBLIC OFFER;<br />

AND<br />

(B) 52,200,000 PLACEMENT SHARES BY WAY OF PLACEMENT, COMPRISING:–<br />

(I) 46,400,000 PLACEMENT SHARES AT $0.52 FOR EACH PLACEMENT SHARE; AND<br />

(II) 5,800,000 RESERVED SHARES AT $0.47 FOR EACH RESERVED SHARE RESERVED<br />

FOR DIRECTORS AND EMPLOYEES OF THE GROUP,<br />

PAYABLE IN FULL ON APPLICATION<br />

Manager, Underwriter and Placement Agent<br />

Oversea-Chinese Banking Corporation Limited<br />

(Incorporated in Singapore)<br />

Applications should be received by 12.00 noon on 27 July 2000 or such later date and time as the<br />

Company and the Vendor may, in their absolute discretion, decide.

our global presence (as of May 31, 2000)<br />

USA: 11<br />

Total Number of Outlets: 203<br />

A leading marketer, distributor and franchisor of home health-care, health-check and<br />

healthy lifestyle products in Asia, we have more than 200 point-of-sales outlets around<br />

the world.<br />

We aim to increase our point-of-sales outlets<br />

worldwide to 300 by 2001, 500 by 2003 and<br />

1,000 by 2008.<br />

2001E<br />

2003E<br />

2008E<br />

financial highlights<br />

1995<br />

1996<br />

1997<br />

1998<br />

1999<br />

103.1<br />

300<br />

No. of outlets<br />

69.7<br />

60.8<br />

500<br />

UAE: 1<br />

42.9<br />

31.4<br />

1000<br />

Hong Kong: 40 Taiwan: 30<br />

Thailand: 5<br />

Malaysia: 21<br />

Singapore: 37<br />

Indonesia: 14<br />

1.6<br />

PRC: 44<br />

3.2<br />

3.7<br />

4.4<br />

Turnover Profit Before Taxation<br />

(S$ million)<br />

10.8

Growth strategies<br />

our vision:<br />

to be a global leader in home health-care<br />

& healthy lifestyle products<br />

A) Expansion of Business<br />

Penetrate new geographical markets<br />

• Increase point-of-sales outlets<br />

• Appoint franchisees in Australia, the Philippines,<br />

United Kingdom, South Africa and Korea<br />

Introduce new product lines<br />

• Fitness equipment<br />

• Health supplements<br />

Expand wholesale distribution<br />

• Target hospitals, pharmacies, Chinese medical halls,<br />

health clubs, beauty centers and fitness centers<br />

Expand coverage of the consumer market<br />

• Develop our "NORO" brand<br />

• Lower-priced products to target<br />

different market segment<br />

B) Upgrading of IT Infrastructure<br />

• Enhance our Enterprise Resource Planning and<br />

Customer Relationship Management systems<br />

C) Venturing into E-Commerce Activities<br />

D) New Corporate Headquarters

Core business and products<br />

We provide a comprehensive range of home health-care<br />

products which are broadly categorised under:<br />

Healthy Lifestyle<br />

Millennium Chair Pro-Reflexologist eHuman Logic Blood<br />

Pressure Monitor<br />

Competitive strengths<br />

Operate & Control our Supply Chain<br />

• Design<br />

• Procurement<br />

• Distribution<br />

Established Brand Name<br />

• Well-known brand name in Singapore<br />

& Hong Kong<br />

Strong Marketing Capabilities<br />

• Strategic marketing focus<br />

• Niche business concept<br />

Extensive Distribution Network<br />

• More than 200 point-of-sales outlets covering<br />

Asia & USA<br />

• Stores are located in major departmental<br />

stores and suburban shopping malls<br />

• Ability to dictate what to sell & how to sell<br />

Experienced, Hands-on Management Team<br />

• Executive Directors have more than<br />

40 years of combined experience<br />

Health Care Health Check<br />

Management Team

CONTENTS<br />

CORPORATE INFORMATION .................................................................................................... 3<br />

DEFINITIONS .............................................................................................................................. 4<br />

DETAILS OF THE INVITATION<br />

Listing on the SGX-ST ................................................................................................................. 8<br />

Tentative Timetable for Listing ..................................................................................................... 9<br />

PROSPECTUS SUMMARY ......................................................................................................... 10<br />

RISK FACTORS .......................................................................................................................... 12<br />

INVITATION STATISTICS ............................................................................................................ 17<br />

SUMMARY OF FINANCIAL INFORMATION<br />

Results ......................................................................................................................................... 19<br />

Financial Position ......................................................................................................................... 20<br />

INFORMATION ON THE COMPANY AND THE GROUP<br />

Share Capital ............................................................................................................................... 22<br />

Our Shareholders ......................................................................................................................... 24<br />

Moratorium ................................................................................................................................... 25<br />

Restructuring Exercise ................................................................................................................. 25<br />

Group Structure ........................................................................................................................... 27<br />

History .......................................................................................................................................... 27<br />

Business ....................................................................................................................................... 29<br />

Franchise Model .......................................................................................................................... 35<br />

Intellectual Property Rights .......................................................................................................... 36<br />

Product And Service Quality Control ........................................................................................... 37<br />

New Products/Activities ............................................................................................................... 38<br />

Research and Development ........................................................................................................ 38<br />

Year 2000 Compliance ................................................................................................................. 38<br />

Insurance ..................................................................................................................................... 38<br />

Group Training Policy .................................................................................................................. 39<br />

Analysis of Turnover and Profits .................................................................................................. 39<br />

Review of Past Earnings Performance ........................................................................................ 41<br />

Prospects and Future Plans ........................................................................................................ 45<br />

Review of Financial Position ........................................................................................................ 47<br />

Dividends ..................................................................................................................................... 50<br />

Foreign Exchange Exposure ....................................................................................................... 50<br />

1<br />

Page

Competition .................................................................................................................................. 50<br />

Competitive Strengths .................................................................................................................. 51<br />

Major Suppliers and Customers .................................................................................................. 52<br />

Properties and Fixed Assets ........................................................................................................ 53<br />

Directors, Management and Staff ................................................................................................ 53<br />

<strong>Osim</strong> Share Option Scheme ........................................................................................................ 59<br />

Corporate Governance ................................................................................................................ 61<br />

Interest of Management and Others in Certain Transactions ..................................................... 62<br />

Potential Conflicts of Interest ....................................................................................................... 70<br />

DIRECTORS’ REPORT ............................................................................................................... 71<br />

ACCOUNTANTS’ REPORT ......................................................................................................... 72<br />

GENERAL AND STATUTORY INFORMATION .......................................................................... 95<br />

Page<br />

APPENDIX A — SUMMARY OF THE PRINCIPAL TERMS OF OSIM SHARE OPTION<br />

SCHEME (THE ‘‘SCHEME’’) .................................................................... 113<br />

— RULES OF THE OSIM SHARE OPTION SCHEME ................................... 118<br />

APPENDIX B — TERMS AND CONDITIONS AND PROCEDURES FOR APPLICATIONS . 136<br />

2

CORPORATE INFORMATION<br />

Board of Directors : Dr Ron Sim Chye Hock (Chairman & Chief Executive Officer)<br />

Teo Chay Lee (Chief Operating Officer)<br />

Leow Lian Soon (Regional General Manager)<br />

Teo Sway Heong (Non-executive Director)<br />

Khor Peng Soon (Non-executive Director)<br />

Michael Kan Yuet Yun, PBM (Independent Director)<br />

Ong Kian Min (Independent Director)<br />

Company Secretary : Juliet Ang, LLB (Hons)<br />

Registered Office and<br />

Principal Office<br />

Registrar and Share Transfer<br />

Office<br />

Manager, Underwriter and<br />

Placement Agent<br />

Auditors and Reporting<br />

Accountants<br />

: 57 Genting Lane<br />

<strong>Osim</strong> Industrial Building<br />

Singapore 349564<br />

: B.A.C.S. Private Limited<br />

63 Cantonment Road<br />

Singapore 089758<br />

: Oversea-Chinese Banking Corporation Limited<br />

65 Chulia Street #29-02/04<br />

OCBC Centre<br />

Singapore 049513<br />

: Arthur Andersen<br />

Certified Public Accountants<br />

10 Hoe Chiang Road #18-00<br />

Keppel Towers<br />

Singapore 089315<br />

Solicitors to the Invitation : Wong Partnership<br />

80 Raffles Place #58-01<br />

UOB Plaza 1<br />

Singapore 048624<br />

Principal Bankers : Oversea-Chinese Banking Corporation Limited<br />

65 Chulia Street #29-02/04<br />

OCBC Centre<br />

Singapore 049513<br />

The Development Bank of Singapore <strong>Ltd</strong><br />

6 Shenton Way<br />

DBS Building Tower One<br />

Singapore 068809<br />

3

DEFINITIONS<br />

In this Prospectus, the accompanying Application Forms and in relation to Electronic Applications, the<br />

instructions appearing on the screens of the ATMs of Participating Banks, the following definitions apply<br />

throughout where the context so admits:–<br />

‘‘Act’’ : Companies Act, Chapter 50 of Singapore<br />

‘‘Application Forms’’ : Official printed application forms for the Invitation Shares<br />

which are the subject of the Invitation and which form part of<br />

this Prospectus<br />

‘‘Application List’’ : List for the application to subscribe for the Invitation Shares<br />

‘‘ATM’’ : Automated teller machine<br />

‘‘CDP’’ : The Central Depository (Pte) Limited<br />

‘‘Company’’ or ‘‘<strong>Osim</strong> (S)’’ : <strong>Osim</strong> <strong>International</strong> <strong>Ltd</strong><br />

‘‘Controlling Shareholder’’ : A Shareholder exercising control over the Company and<br />

unless rebutted, a person who controls directly or indirectly<br />

a shareholding of fifteen (15) per cent. or more of our issued<br />

share capital shall be presumed to be a Controlling<br />

Shareholder of the Company<br />

‘‘Directors’’ : The Directors of the Company as at the date of this<br />

Prospectus<br />

‘‘Electronic Applications’’ : Applications for the Invitation Shares made through an ATM<br />

of one of the Participating Banks in accordance with the<br />

terms and conditions of this Prospectus<br />

‘‘EPS’’ : Earnings per Share<br />

‘‘e-commerce’’ : Electronic commerce<br />

‘‘FY’’ : Financial year ended or ending 31 December<br />

‘‘Investor’’ : Century Private Equity Holdings (S) Pte <strong>Ltd</strong>, a wholly-owned<br />

subsidiary of Temasek Holdings (Private) Limited<br />

‘‘Invitation’’ : Invitation in respect of the Invitation Shares, subject to and<br />

on the terms and conditions of this Prospectus<br />

‘‘Invitation Shares’’ : 58,000,000 Shares comprising 38,000,000 New Shares and<br />

20,000,000 Vendor Shares<br />

‘‘Market Day’’ : A day on which the SGX-ST is open for trading in securities<br />

‘‘New Shares’’ : 38,000,000 new Shares for which the Company invites<br />

applications to subscribe pursuant to the Invitation, subject<br />

to and on the terms and conditions of this Prospectus<br />

‘‘NTA’’ : Net tangible assets<br />

‘‘OCBC Bank’’, ‘‘Manager’’,<br />

‘‘Underwriter’’ or ‘‘Placement<br />

Agent’’<br />

: Oversea-Chinese Banking Corporation Limited<br />

4

‘‘Offer’’ : Invitation in respect of the Offer Shares to the public at the<br />

Offer Price, subject to and on the terms and conditions of this<br />

Prospectus<br />

‘‘Offer Price’’ : $0.52 for each Offer Share<br />

‘‘Offer Shares’’ : 5,800,000 Invitation Shares which are the subject of the<br />

Offer<br />

‘‘Participating Banks’’ : OCBC Bank group (comprising OCBC Bank and Bank of<br />

Singapore Limited), The Development Bank of Singapore<br />

<strong>Ltd</strong> (‘‘DBS Bank’’) including its POSBank Services division,<br />

Keppel TatLee Bank Limited (‘‘KTB’’), Overseas Union Bank<br />

Limited, and United Overseas Bank Limited (‘‘UOB’’) group<br />

(comprising UOB, Far Eastern Bank <strong>Ltd</strong> and Industrial &<br />

Commercial Bank Limited)<br />

‘‘PER’’ : Price earnings ratio<br />

‘‘PRC’’ : People’s Republic of China<br />

‘‘Placement’’ : Placement of the Placement Shares at the Placement Price,<br />

subject to and on the terms and conditions of this<br />

Prospectus<br />

‘‘Placement Agent’’ : OCBC Bank as placement agent who shall subscribe for<br />

and/or purchase, or procure subscription for and/or<br />

purchase of, the Placement Shares<br />

‘‘Placement Price’’ : $0.52 for each Placement Share and $0.47 for each<br />

Reserved Share<br />

‘‘Placement Shares’’ : 52,200,000 Invitation Shares which are the subject of the<br />

Placement (including the Reserved Shares)<br />

‘‘Proforma Group’’ or ‘‘Group’’ : The Company and its subsidiaries assuming that the group<br />

structure had been in place since 1 January 1995<br />

‘‘Reserved Shares’’ : 5,800,000 Placement Shares reserved for the Directors and<br />

employees of the Group at the price of $0.47 for each<br />

Reserved Share<br />

‘‘Restructuring Exercise’’ : The restructuring exercise of the Group undertaken in<br />

connection with the Invitation as described on pages 25 and<br />

26 of this Prospectus<br />

‘‘Securities Account’’ : Securities account maintained by a Depositor with CDP<br />

‘‘SGX-ST’’ : Singapore Exchange Securities Trading Limited<br />

‘‘Shares’’ : Ordinary shares of $0.05 each in the capital of the Company<br />

‘‘Shareholder’’ : Shareholder holding shares in the capital of the Company<br />

‘‘Subscription Agreement’’ : Agreement dated 17 July 2000 between Investor, Dr Ron<br />

Sim Chye Hock and the Company under which Investor<br />

agreed to subscribe for 11,600,000 new Shares,<br />

representing approximately 5 per cent. of the post-Invitation<br />

enlarged share capital of the Company, at $0.47 per Share<br />

(‘‘Investor Subscription’’)<br />

‘‘Vendor’’ : Dr Ron Sim Chye Hock<br />

5

‘‘Vendor Shares’’ : 20,000,000 issued and fully-paid Shares for which the<br />

Vendor invites applications to purchase pursuant to the<br />

Invitation<br />

‘‘USA’’ or ‘‘United States’’ : United States of America<br />

‘‘sq m’’ : Square metres<br />

‘‘$’’ or ‘‘S$’’ and ‘‘cents’’ : Singapore dollars and cents, respectively, unless otherwise<br />

stated<br />

‘‘HK$’’ : Hong Kong dollars<br />

‘‘NT$’’ : New Taiwan dollars<br />

‘‘RM’’ : Malaysian Ringgit<br />

‘‘RMB’’ : Renminbi, the lawful currency of the People’s Republic of<br />

China<br />

‘‘US$’’ : United States dollars<br />

‘‘Yen’’ : Japanese Yen<br />

Group Companies<br />

<strong>Osim</strong> (M’sia) : <strong>Osim</strong> (M) Sdn Bhd<br />

<strong>Osim</strong> (HK) : <strong>Osim</strong> (HK) Company Limited<br />

<strong>Osim</strong> (Shanghai) : <strong>Osim</strong> <strong>International</strong> Trading (Shanghai) Co., <strong>Ltd</strong>.<br />

<strong>Osim</strong> (Taiwan) : <strong>Osim</strong> GHC (Taiwan) Co., <strong>Ltd</strong><br />

Daito-<strong>Osim</strong> (Suzhou) : Daito-<strong>Osim</strong> Healthcare Appliance (Suzhou) Co., <strong>Ltd</strong>.<br />

Non-Group Companies<br />

HCC (Langfang) : Health Check and Care (Langfang) Co., <strong>Ltd</strong> (has since<br />

12 May 2000 been renamed as <strong>Osim</strong> GHC (Langfang) Co.,<br />

<strong>Ltd</strong>)<br />

ODCPL : <strong>Osim</strong> Distribution Centre (S) Pte <strong>Ltd</strong><br />

<strong>Osim</strong> (Beijing) : <strong>Osim</strong> (Beijing) Co., <strong>Ltd</strong><br />

<strong>Osim</strong> GHC (SH) : <strong>Osim</strong> GHC (Shanghai) Co., <strong>Ltd</strong><br />

<strong>Osim</strong> (Thai) : <strong>Osim</strong> GHC (Thailand) Co., <strong>Ltd</strong><br />

<strong>Osim</strong> (USA) : <strong>Osim</strong> (USA) Inc.<br />

PT Sharon : PT Sharon Samaru<br />

RSH : R.S.H. (Middle East) L.L.C.<br />

6

The exchange rates used to translate the accounts of foreign subsidiaries, as applied in this Prospectus<br />

are as follows:–<br />

Profit and Loss<br />

FY1995 FY1996 FY1997 FY1998 FY1999<br />

RM1 : S$ 0.564 0.558 0.528 0.428 0.447<br />

HK$1 : S$ 0.183 0.182 0.193 0.215 0.219<br />

NT$1 : S$ 0.054 0.052 0.053 0.050 0.052<br />

RMB1 : S$ — 0.170 0.184 0.202 0.205<br />

Balance Sheet<br />

RM1 : S$ 0.555 0.552 0.431 0.436 0.439<br />

HK$1 : S$ 0.182 0.180 0.216 0.214 0.215<br />

NT$1 : S$ 0.052 0.051 0.053 0.051 0.052<br />

RMB1 : S$ — 0.168 0.206 0.200 0.201<br />

The terms ‘‘Depositor’’, ‘‘Depository Agent’’ and ‘‘Depository Register’’ shall have the meanings ascribed<br />

to them respectively in Section 130A of the Act.<br />

The term ‘‘associate’’ shall have the meaning ascribed to it by the Singapore Exchange Securities<br />

Trading Limited’s Listing Manual, which is defined to include an immediate family member (that is, the<br />

spouse, child, adopted child, step-child, sibling or parent) of such director, chief executive officer or<br />

substantial shareholder, the trustees, acting in their capacity as such trustees, of any trust of which the<br />

director, chief executive officer or substantial shareholder or his immediate family is a beneficiary or, in<br />

the case of a discretionary trust, is a discretionary subject and any company in which the director/his<br />

immediate family, the chief executive officer/his immediate family or substantial shareholder/his<br />

immediate family has an aggregate interest (directly or indirectly) of 25 per cent. or more, and, where a<br />

substantial shareholder is a corporation, its subsidiary or holding company or fellow subsidiary or a<br />

company in which it and/or they have (directly or indirectly) an interest of 25 per cent. or more.<br />

Words importing the singular shall, where applicable, include the plural and vice versa and words<br />

importing the masculine gender shall, where applicable, include the feminine and neuter genders.<br />

Any reference in this Prospectus and the Application Forms to any enactment is a reference to that<br />

enactment as for the time being amended or re-enacted. Any word defined in the Act, or any statutory<br />

modification thereof and used in this Prospectus and the Application Forms shall have the meaning<br />

assigned to it in the Act, or such statutory modification, as the case may be.<br />

A reference to a time of day in this Prospectus shall be a reference to Singapore time unless otherwise<br />

stated.<br />

7

DETAILS OF THE INVITATION<br />

1. LISTING ON THE SGX-ST<br />

We have applied to the SGX-ST for permission to deal in and for quotation of all our Shares already<br />

issued (including Vendor Shares) and the New Shares. Such permission will be granted when the<br />

Company has been admitted to the Official List of the SGX-ST. Acceptance of applications will be<br />

conditional upon permission being granted to deal in and for quotation of all the issued Shares<br />

(including Vendor Shares) and the New Shares. If the said permission is not granted, moneys paid<br />

in respect of any application accepted will be returned without interest or any share of revenue or<br />

other benefit arising therefrom and at the applicant’s risk.<br />

The SGX-ST assumes no responsibility for the correctness of any statements made, reports set out<br />

or opinions expressed or reports contained in this Prospectus. Admission to the Official List of the<br />

SGX-ST is not to be taken as an indication of the merits of the Invitation, the Company, its<br />

subsidiaries, associated company or the Shares.<br />

Our Directors and the Vendor collectively and individually accept full responsibility for the accuracy<br />

of the information given in this Prospectus and confirm, having made all reasonable enquiries, that<br />

to the best of their knowledge and belief, the facts stated and opinions expressed in this Prospectus<br />

are fair and accurate in all material respects as at the date of this Prospectus and that there are no<br />

other material facts the omission of which would make any statement in this Prospectus misleading.<br />

No person is authorised to give any information or to make any representation not contained in this<br />

Prospectus in connection with the Invitation and, if given or made, such information or representation<br />

must not be relied upon as having been authorised by us, the Vendor or OCBC Bank. Neither the<br />

delivery of this Prospectus and the Application Forms nor the Invitation shall, under any<br />

circumstances, constitute a continuing representation or create any suggestion or implication that<br />

there has been no change in our affairs or any statement of fact or information contained in this<br />

Prospectus since the date of this Prospectus. Where such changes occur, we may make an<br />

announcement of the same to the SGX-ST. All applicants should take note of any such<br />

announcement and, upon release of such an announcement, shall be deemed to have notice of such<br />

changes. Save as expressly stated in this Prospectus, nothing herein is, or may be relied upon as,<br />

a promise or representation as to our future performance or policies. This Prospectus has been<br />

prepared solely for the purpose of the Invitation and may not be relied upon by any persons other<br />

than the applicants in connection with their application for Invitation Shares or for any other purpose.<br />

This Prospectus does not constitute an offer of, or invitation to subscribe for, the Invitation Shares<br />

in any jurisdiction in which such offer or invitation is unauthorised or unlawful or to any person to<br />

whom it is unlawful to make such offer or invitation.<br />

Copies of this Prospectus and the Application Forms may be obtained on request, subject to<br />

availability, during office hours from:–<br />

Oversea-Chinese Banking Corporation Limited<br />

65 Chulia Street<br />

OCBC Centre<br />

Singapore 049513<br />

and from selected branches of OCBC Bank, members of the Association of Banks in Singapore,<br />

merchant banks in Singapore and members of the SGX-ST.<br />

The Application List will open at 10.00 a.m. on 27 July 2000 and will remain open until 12.00<br />

noon on 27 July 2000, or such later date and time as the Company and the Vendor may, in<br />

their absolute discretion, decide.<br />

8

2. TENTATIVE TIMETABLE FOR LISTING<br />

In accordance with the SGX-ST’s News Release of 28 May 1993 on the trading of initial public<br />

offering shares on a ‘‘when issued’’ basis, an indicative timetable is set out below for the reference<br />

of applicants:–<br />

Indicative Time and Date Event<br />

27 July 2000, 12.00 noon Close of Application List<br />

28 July 2000 Balloting of applications, if necessary<br />

31 July 2000, 9.00 a.m. Commence trading on a ‘‘when issued’’ basis<br />

10 August 2000 Last day for trading on a ‘‘when issued’’ basis<br />

11 August 2000, 9.00 a.m. Commence trading on a ‘‘ready’’ basis<br />

16 August 2000 Settlement date for all trades done on a ‘‘when issued’’ basis<br />

and for all trades done on a ‘‘ready’’ basis on 11 August 2000<br />

The above timetable is only indicative and is subject to the closing date for the Invitation being 27<br />

July 2000, the date of our admission to the Official List of the SGX-ST being 11 August 2000, the<br />

SGX-ST’s shareholding spread requirement being complied with and the New Shares being issued<br />

and fully paid up prior to 11 August 2000. The actual date on which the Shares will commence trading<br />

on a ‘‘when issued’’ basis will be announced when it is confirmed by the SGX-ST.<br />

The above timetable and procedure may be subject to such modifications as the SGX-ST may in its<br />

discretion decide, including the decision to permit trading on a ‘‘when issued’’ basis and the<br />

commencement date of such trading. All persons trading in the Shares on a ‘‘when issued’’ basis, if<br />

implemented, do so at their own risk. In particular, persons trading in the Shares before their<br />

Securities Accounts with CDP are credited with the relevant number of Shares do so at the<br />

risk of selling Shares which neither they nor their nominees have been allotted and/or<br />

allocated or are otherwise beneficially entitled to. Such persons are exposed to the risk of<br />

having to cover their net sell positions earlier if trading on a ‘‘when issued’’ basis ends<br />

sooner than the indicative date set out above. Persons who have net sell positions traded on<br />

a ‘‘when issued’’ basis should close their positions on or before the first day of trading on a<br />

‘‘ready’’ basis.<br />

Investors should consult the SGX-ST announcement on ‘‘ready’’ trading date on the Internet (at<br />

SGX-ST website http://www.singaporeexchange.com), INTV or the newspapers or enquire from their<br />

brokers the date on which trading on a ‘‘ready’’ basis will commence.<br />

9

PROSPECTUS SUMMARY<br />

The information contained in this summary is derived from and should be read in conjunction with the full<br />

text of this Prospectus. In addition to this summary, we urge you to read the entire Prospectus carefully,<br />

especially the discussion on ‘‘Risk Factors’’, before buying our Shares. References in this Prospectus to<br />

‘‘<strong>Osim</strong> (S)’’, ‘‘Company’’, ‘‘we’’, ‘‘our’’ and ‘‘us’’ refer to <strong>Osim</strong> <strong>International</strong> <strong>Ltd</strong> or, where the context admits,<br />

the Group.<br />

The Company<br />

We were incorporated in the Republic of Singapore on 27 August 1983 as a limited exempt private<br />

company under the name of R. Sim Trading Co. Pte <strong>Ltd</strong>. Subsequently, we changed our name firstly, to<br />

R. Sim & Company Pte <strong>Ltd</strong> and then, to <strong>Osim</strong> <strong>International</strong> (S) Pte <strong>Ltd</strong> on 24 November 1988 and 2<br />

September 1996 respectively. On 4 July 2000, we were converted to a public limited company, and the<br />

name of the Company was changed to <strong>Osim</strong> <strong>International</strong> <strong>Ltd</strong>.<br />

We are in the business of marketing, distributing and franchising of a comprehensive range of home<br />

health care, health check and healthy lifestyle products. Other than Daito-<strong>Osim</strong> (Suzhou), all the Group’s<br />

production needs are out-sourced to contract manufacturers in Japan and Taiwan as we believe in<br />

focusing on our strengths in marketing and brand management.<br />

As at 31 May 2000, our Group had 128 point-of-sales outlets in Singapore, Malaysia, Hong Kong and<br />

Taiwan, and through our franchisees, another 75 point-of-sales outlets in Thailand, Indonesia, PRC,<br />

United Arab Emirates and the United States. Barring unforeseen circumstances, we aim to increase the<br />

number of point-of-sales outlets worldwide to 300 by 2001, 500 by 2003 and 1,000 by 2008. In order for<br />

us to achieve this rate of growth, we will be gradually moving away from being a retailer and are<br />

beginning to position ourselves as a franchisor of our OSIM products. We believe that over time this will<br />

lower the capital risk in penetrating new geographical markets and enable our management to<br />

concentrate on strategic marketing and brand cultivation which are our main strengths.<br />

In the next phase of our future growth, we intend to expand our business by marketing and distributing<br />

other related home health-care products like health food and supplements, and fitness equipment. We<br />

also intend to increase our wholesale distribution sales by looking into, inter alia, wholesale distribution<br />

to hospitals, pharmacies, Chinese medical halls, health clubs, beauty centres and fitness centres.<br />

The Invitation<br />

Size : 58,000,000 Shares comprising 38,000,000 New Shares and<br />

20,000,000 Vendor Shares. The Vendor Shares and the<br />

New Shares, will, upon issue, rank pari passu in all respects<br />

with the then existing issued Shares.<br />

Offer Price and Placement Price : $0.52 for each Offer Share and Placement Share and $0.47<br />

for each Reserved Share.<br />

Purpose of the Invitation : We consider that the listing and quotation of the Shares on<br />

the SGX-ST will enhance the public image of the Group and<br />

will enable us to tap the capital markets for the expansion of<br />

our business. It will also give the general public, employees,<br />

Directors and business associates of the Group an<br />

opportunity to participate in the equity of the Company. The<br />

Invitation will enlarge our capital base for continued<br />

expansion of our businesses.<br />

10

Use of Proceeds : The net proceeds of the issue of New Shares will amount to<br />

approximately $18 million. We propose to utilise the net<br />

proceeds of the Invitation as follows:–<br />

(i) approximately $1.5 million to enhance and upgrade<br />

our Group’s information technology systems in order to<br />

facilitate our enterprise resource planning (‘‘ERP’’) and<br />

customer relationship management (‘‘CRM’’) (as more<br />

particularly described under ‘‘PROSPECTS AND<br />

FUTURE PLANS — Upgrading of IT Infrastructure’’ on<br />

pages 46 and 47 of this Prospectus);<br />

(ii) approximately $6 million for the expansion of our<br />

point-of-sales outlets in existing and new geographic<br />

markets, the development of new product lines and for<br />

strategic investments in e-commerce initiatives (as<br />

more particularly described under ‘‘PROSPECTS<br />

AND FUTURE PLANS — Expansion of Business and<br />

E-Commerce’’ on pages 45, 46 and 47 of this<br />

Prospectus respectively);<br />

(iii) approximately $8 million to partially finance the<br />

acquisition of land and construction costs of a new<br />

corporate headquarters in Singapore at Ubi Avenue 1<br />

(as more particularly described under ‘‘PROSPECTS<br />

AND FUTURE PLANS — New Corporate<br />

Headquarters’’ on page 45 of this Prospectus); and<br />

(iv) the balance of approximately $2.5 million for additional<br />

working capital for our Group.<br />

Pending the deployment of the net proceeds from the New<br />

Shares for the above purposes, we may place the net<br />

proceeds in deposits with financial institutions, invest them<br />

in short-term money market instruments, and/or add to our<br />

working capital as our Directors, may in their absolute<br />

discretion, deem appropriate.<br />

Reserved Shares : Of the Placement Shares, 5,800,000 Shares will be reserved<br />

for our Directors and employees of the Group. In the event<br />

that any of the Reserved Shares are not taken up, they will<br />

be made available to satisfy applications made for the<br />

Placement Shares or, in the event of an under-subscription<br />

for the Placement Shares, to satisfy applications made by<br />

members of the public for the Offer Shares.<br />

Listing Status : The Shares will, on admission of the Company to the Official<br />

List of SGX-ST and permission for dealing in and for<br />

quotation of the Shares being granted by the SGX-ST, be<br />

quoted on the SGX-ST.<br />

11

RISK FACTORS<br />

Investing in our Shares involves certain risks and you should consider carefully all the information<br />

contained in this Prospectus, especially the following, in evaluating whether to purchase our Shares. To<br />

the best of our belief and knowledge, all risk factors that are material to investors in making an informed<br />

judgement on our Group are set out below. Any of the following factors, depending upon the severity and<br />

circumstances of a particular occurrence, could result in a material adverse effect on our business,<br />

prospects, financial condition and results of operations.<br />

Industry Specific Risks<br />

(a) Changes in Consumer Tastes<br />

As with all other consumer products, sales of our products are dependent on consumers’ demand<br />

for our products and are susceptible to changes in consumer tastes. There is no assurance that in<br />

the future we will continue to be successful in keeping ourselves ahead of, and being up-to-date<br />

with, the latest health-care trends through constant market research and sourcing of feed-back from<br />

our customers. We can give no assurance that our intensive efforts in strategic marketing and<br />

product innovation will continue to enable us to satisfy the evolving consumer tastes. If we are not<br />

able to do so, our sales to consumers would be reduced and this will have a material adverse impact<br />

on our Group’s turnover and profitability.<br />

(b) Health Regulations in New Markets<br />

We do not consider ourselves to be in the medical or para-medical field. While our business is<br />

currently not subject to any governmental health regulations in our major geographical markets, the<br />

regulatory environment in new geographical markets may pose an obstacle to our plans to expand<br />

our geographical presence (our expansion plans are more particularly described under the section<br />

on ‘‘PROSPECTS AND FUTURE PLANS — Expansion of Business’’ on pages 45 and 46 of this<br />

Prospectus). Furthermore, we cannot discount the possibility that new health regulations that apply<br />

to our products may come into force in our existing major markets. If we are unable to comply with<br />

any such health regulations in any particular country, we may be prevented from effectively<br />

marketing our products in that country. This will have a material adverse impact on our overall<br />

turnover and profitability.<br />

(c) Exposure to Product Liability Laws<br />

As with other consumer product manufacturers, we are exposed to product liability laws in the<br />

countries where our products are marketed and may face lawsuits arising from alleged injuries to<br />

users caused by any alleged defects in our products. We may have to do substantial product recalls<br />

in respect of a product if there are allegations of that product being found to be unsafe in the future.<br />

We are also exposed to the product liability laws of the United States which, we believe, may<br />

impose much higher quantum of damages, whether compensatory or punitive, compared to the<br />

laws on product liability in other countries where we market our products. To mitigate this risk, we<br />

have obtained product liability insurance in the United States and Canada. The details of the<br />

insurance coverage are more particularly described under the section on ‘‘INSURANCE’’ on<br />

page 38 of this Prospectus. As we are not insured for product liability in any other jurisdictions, if we<br />

are ever unsuccessful in defending a product liability suit in one of these jurisdictions, we may have<br />

to pay substantial monetary damages which would have an adverse impact on our reputation and<br />

profitability.<br />

We have begun marketing our products in the United States since late 1997. To date, we have not<br />

encountered any legal suit, or threat of a legal suit, involving product liability in the United States or<br />

any other jurisdictions.<br />

(d) High Susceptibility to Downturns in Economic Cycles<br />

The nature of our home health-care products make us more susceptible to reduced demand in<br />

times of economic downturn than other kinds of businesses because our products may not be<br />

considered as essential medical or health products. Our profitability will therefore be adversely<br />

affected by downturns in economic cycles in any of our significant markets.<br />

12

(e) Prohibitive National Laws on Foreign Ownership<br />

Under the franchise business model which we have adopted (as more particularly described under<br />

the section on ‘‘FRANCHISE MODEL’’ on pages 35 and 36 of this Prospectus), it is not our business<br />

strategy to acquire equity interests in our franchisees. Nevertheless, where having an equity<br />

interest in a certain franchisee would enable us to have a share in their profits, we may decide to<br />

acquire ownership of that franchisee. However, this may be difficult, if not impossible, in certain<br />

jurisdictions. Currently we face prohibitive or restrictive laws in PRC, Indonesia and Thailand which<br />

do not permit us to have ownership or full ownership of our franchisees. As we expand our franchise<br />

network to more countries in the future, we may face similar prohibitive national laws that would<br />

affect our ability to acquire equity interests in our franchisees.<br />

In Malaysia, under the ‘‘Guidelines for the Regulation of Acquisition of Assets, Mergers and<br />

Take-overs’’ (the ‘‘Guidelines’’) established by The Foreign Investment Committee of Malaysia<br />

(‘‘FIC’’), the approval of the FIC is required for a foreign company to own more than a 15 per cent.<br />

interest in a Malaysian company. Foreign involvement in Malaysian companies engaging in the<br />

business of specialty stores is also subject to ‘‘Guidelines on Wholesale and Retail Trade’’ (the<br />

‘‘GWRT’’). The GWRT stipulates that the foreign ownership of such Malaysian company should be<br />

restricted to 30 per cent., with another 30 per cent. of the equity to be held by bumiputeras. The<br />

GWRT also requires the capitalisation of such Malaysian company to be at least RM1,000,000.<br />

We are of the view that the Guidelines and GWRT are not established under any statutory laws in<br />

Malaysia and non-compliance with the Guidelines and GWRT does not have any statutory<br />

implications. Therefore, we have not made any application to the FIC or the Committee of<br />

Wholesale and Retail Trade (the ‘‘Committee’’) for us to hold our 60 per cent. interest in the equity<br />

of <strong>Osim</strong> (M’sia). In the future, we may face the possibility of being directed by the FIC and/or the<br />

Committee to comply with the Guidelines and GWRT respectively. If so directed, we will seek<br />

consultations with the FIC and/or the Committee, as the case may be, for the appropriate<br />

compliance. Our non-compliance with the Guidelines and GWRT may lead to the non-renewal of<br />

our business premise licences in Malaysia which would result in a disruption or cessation of our<br />

operations. In such event, we would have to either dilute our shareholdings to comply with the<br />

Guidelines and/or the GWRT, or appoint a franchisee who is qualified to undertake the business in<br />

Malaysia.<br />

If the operations of <strong>Osim</strong> (M’sia) are not taken into account in preparing our financial statements,<br />

our Group’s profit after taxation and minority interests for FY1997, FY1998 and FY1999 would have<br />

been increased by 4.1 per cent. and reduced by 1.0 per cent. and 5.9 per cent. respectively, and<br />

our Group’s NTA as at 31 December 1997, 31 December 1998 and 31 December 1999 would have<br />

been reduced by 0.8 per cent., 1.1 per cent. and 5.9 per cent. respectively.<br />

Company Specific Risks<br />

(a) Dependence on Key Personnel<br />

Our continued success is dependent to a very large extent on our ability to retain key management<br />

personnel. The loss of the services of a substantial number of our key management personnel<br />

without adequate replacements, or the inability to attract or retain qualified personnel would have<br />

an unfavourable and material impact on our business. Furthermore, in connection with our future<br />

plans (as more particularly described under the section on ‘‘PROSPECTS AND FUTURE PLANS<br />

— Future Plans’’ on pages 45 to 47 of this Prospectus), we may need to recruit a greater number<br />

of experienced personnel in the future.<br />

Dr Ron Sim Chye Hock, our founder, has been the main contributor to our success and provides<br />

strategic leadership and vision for our Group. He will also hold, as direct and deemed interests, 69.0<br />

per cent. of our share capital after the Invitation. The loss of Dr Ron Sim Chye Hock’s services as<br />

our Chairman and Chief Executive Officer would adversely affect our business and future plans.<br />

13

(b) Reliance on Key Suppliers<br />

We are highly dependent on 3 suppliers (as disclosed in the section on ‘‘MAJOR SUPPLIERS AND<br />

CUSTOMERS — Major Suppliers’’ on pages 52 and 53 of this Prospectus) who are our suppliers<br />

or contract manufacturers for products contributing 75.5 per cent., 60.4 per cent. and 78.7 per cent.<br />

of our purchases for FY1997, FY1998 and FY1999 respectively. The involuntary or unexpected loss<br />

of any of our key suppliers/contract manufacturers will temporarily disrupt our supplies and have a<br />

material adverse impact on our Group’s turnover and profitability.<br />

Furthermore, there can be no assurance that the 3 key suppliers/contract manufacturers will<br />

continue to fulfil our needs and expectations in terms of cost and product quality although to date,<br />

we have not experienced any significant problems with our 3 key suppliers/contract manufacturers<br />

in these areas since we began our business relationship. In the event that the 3 key suppliers/<br />

contract manufacturers are not able to fulfil our requirements, we will incur costs in switching to new<br />

suppliers which would result in disruption to our business and profitability in the short term.<br />

(c) Failure of Franchising as a Business Model<br />

We have only recently since the last quarter of 1999 begun to adopt franchising group-wide (except<br />

for our Singapore and PRC operations) as a business model. Therefore, the results of our franchise<br />

business model have not been time-tested for long. More details on our franchise business model<br />

are set out in the section on ‘‘FRANCHISE MODEL’’ on pages 35 and 36 of this Prospectus. Our<br />

franchise business model is dependent on the quality of our franchisees, their financial strength and<br />

ability to penetrate new markets. Presently, of our 7 franchisees, 3 are our subsidiaries, 3 are our<br />

affiliated companies controlled by our Controlling Shareholders and the remaining 1 is an unrelated<br />

company. We cannot give any assurance that we will be able to attract suitable non-related<br />

companies as our franchisees or that such franchisees will continue with our franchise. The loss of<br />

our franchisee in any particular market will result in a decrease of our revenues in that market while<br />

we seek alternative franchisee or undertake to carry on the business ourselves if the domestic<br />

regulations permit. The loss of our franchisee may also present an opportunity to competitors to<br />

increase their market share in that market at our expense. We have not experienced any loss of<br />

franchisee in any particular market since the implementation of our franchise business model.<br />

(d) Increased Competition<br />

Currently, in our major markets such as Hong Kong, Singapore and Taiwan, we do not consider<br />

ourselves to have a major competitor as most of the distributors and manufacturers of home<br />

health-care products do not have a comparable distribution network where the distributor or<br />

manufacturer directly controls the supply chain from the design of the products to the marketing of<br />

these products. However, we cannot give any assurance that no competitor will arise in the future<br />

who has the marketing expertise or a comparable distribution network to pose a significant<br />

competitive threat. As we expand into new geographical markets or new product lines (as more<br />

particularly described under the section on ‘‘PROSPECTS AND FUTURE PLANS — Expansion of<br />

Business’’ on pages 45 and 46 of this Prospectus), we may face significant competition in these new<br />

markets which will erode or eliminate our profit margins.<br />

We face competitive pressures from manufacturers of low-priced products, especially in PRC. To<br />

handle these competitive pressures, we have developed NORO as a secondary brand to sell<br />

lower-priced massage chairs and kneading massagers in PRC to the segment of the consumer<br />

market which is sensitive to pricing.<br />

Our Directors believe that e-commerce is emerging as a very major marketing and distribution<br />

channel for businesses although the extent of the impact of e-commerce cannot be conclusively<br />

assessed today. We have the intention of tapping into the vast potential of e-commerce and other<br />

health-care retailers may also follow. We cannot give any assurance that the expansion of<br />

e-commerce initiatives by other distributors or contract manufacturers will not result in us losing<br />

market share.<br />

14

(e) Difficulty of Expanding Distribution Network<br />

It is our business strategy to expand our network of ‘brick-and-mortar’ point-of-sales outlets in the<br />

region and eventually, the world. Our franchisees and we, in the event that we establish our own<br />

outlets to penetrate and/or establish ourselves in new markets, may face considerable difficulties or<br />

high costs in securing suitable retail locations to expand our distribution network. Rental is one of<br />

our major operating expenses and is subject to inflationary pressure if property prices increase. In<br />

the event that we are unable to improve our revenue per square foot on our rented premises, any<br />

increase in rentals will adversely affect our net operating profit margins.<br />

(f) Intellectual Property Rights Disputes<br />

Unauthorised use of our trademarks, brand names and other intellectual property may damage the<br />

brand and name recognition, and reputation of our Group. We have as at 31 May 2000, filed<br />

trademark applications for the registration of ‘‘OSIM’’ and ‘‘NORO’’ in 26 jurisdictions. The details of<br />

the trademark registrations are more particularly described in the section on ‘‘INTELLECTUAL<br />

PROPERTY RIGHTS’’ on pages 36 and 37 of this Prospectus.<br />

Although we have registered OSIM as a trademark in the countries where our products are<br />

marketed and where we intend to expand our business to, it may be possible for third parties to<br />

unlawfully pass-off their products as ours or to counterfeit our products. In certain jurisdictions which<br />

do not have clear laws protecting intellectual property rights or a consistent record of protecting<br />

intellectual property rights, we may face considerable difficulties and costly litigation in order to<br />

enforce our intellectual property rights. In the event that we are not able to protect our intellectual<br />

property rights, we cannot discount the possibility of our brand reputation or sales volume being<br />

adversely affected by passing-off or counterfeiting. This will have a material adverse impact on our<br />

turnover and profitability.<br />

(g) Exposure to the Emerging Markets of Malaysia, Thailand, Indonesia and PRC<br />

Our sales in the emerging markets of Malaysia, Thailand, Indonesia and PRC accounted for 18.4<br />

per cent. of our Group’s revenues in FY1997, 7.7 per cent. in FY1998 and 12.3 per cent. in FY1999.<br />

Our Directors expect the contribution from these 4 countries to our Group’s revenues to increase in<br />

the future. Therefore, to a certain extent, our business may be affected by economic conditions in<br />

these emerging markets. The economies of these emerging markets have only recently begun to<br />

recover from the Asian financial crisis and the recovery may not be sustainable. If the high interest<br />

rate environment and drastic devaluation of regional currencies seen in the Asian financial crisis<br />

were to recur in the future, this will have an adverse effect on the financial performance of our<br />

Group’s business in these countries. It will also greatly magnify the risk to us from our foreign<br />

exchange exposure (as described in paragraph (h) below).<br />

(h) Foreign Exchange Risks<br />

In line with the country of incorporation, the accounts of our overseas subsidiaries are prepared in<br />

the local currency (i.e. RM, HK$, RMB and NT$). This represents a translation risk in that any<br />

material fluctuation in the relevant currency rates against the S$ will have an effect on our<br />

consolidated financial statements which are presented in S$.<br />

While our sales are mainly denominated in the respective local currencies in which the sales arise,<br />

namely the S$, RM, HK$, RMB and NT$, our costs of procurement of products from our contract<br />

manufacturers are incurred mainly in US$ and Yen, which accounted for 33% and 64% of our total<br />

purchases respectively for FY1999.<br />

(i) Country Risks<br />

Our business is conducted in many countries outside Singapore, including Indonesia and PRC,<br />

through our franchise network and our foreign-based business activities are subject to the particular<br />

risks of the country in which they operate.<br />

15

Indonesia and PRC are countries which have experienced significant political, social and economic<br />

uncertainties in recent years. Our performance may be adversely affected by political, social,<br />

economic and regulatory uncertainties in these regions. For example, changes in policies by the<br />

respective government authorities of these regions may materially affect us through (i) changes in<br />

laws and regulations; (ii) changes in customs and import tariffs; (iii) restrictions on currency<br />

conversions and remittances; and (iv) instability of the banking system.<br />

Under current Indonesian and PRC laws, we are prohibited from owning companies that engage in<br />

retailing. As disclosed earlier under ‘‘Industry Specific Risks’’, this precludes us from acquiring our<br />

franchisees in these countries in order to have a share in their profits.<br />

In addition, in PRC, there can be no assurance that exchange rates of the RMB against the US$ or<br />

S$ will not become volatile or that the RMB will not be devalued against the US$ or S$. Our PRC<br />

licensees will be adversely affected by a RMB devaluation as their purchase costs are denominated<br />

in US$ while their sales are denominated in RMB. If the financial condition of any of our PRC<br />

licensees deteriorates, this would affect the level of their purchases from us and our business with<br />

our PRC licensees will be adversely affected.<br />

(j) Expansion of Business<br />

As described under the section on ‘‘PROSPECTS AND FUTURE PLANS — Expansion of<br />

Business’’ on pages 45 and 46 of this Prospectus, we intend to penetrate deeper into the consumer<br />

markets, expand to new geographical markets, diversify into new product lines and venture into<br />

wholesale distribution. If we are unsuccessful in the above business expansion, our long-term<br />

growth prospects will be adversely affected.<br />

(k) E-commerce<br />

Despite the enthusiasm among many merchants to embrace e-commerce, we cannot give any<br />

assurance that there will be a market for our home health-care products on the Internet. The Internet<br />

has yet to evolve as an important and widespread means of buying and selling products and<br />

services. Furthermore, e-commerce business models remain largely untested and yet to be proven<br />

to be profitable. Because on-line procurement of business products and services is still in its growth<br />

stage, it is difficult for us to estimate the size of the home health-care products market on the<br />

Internet and its growth rate, if any. By nature of the industry, any e-commerce venture that we may<br />

enter into would be highly capital intensive and would have a high ‘burn rate’ for capital in the early<br />

stages of the venture. We cannot give any assurance that the capital we invest in e-commerce<br />

which will come from the proceeds of the Invitation, would not be quickly used up without yielding<br />

any financial gain for us.<br />

(l) Conflicts of Interest Between Us and Our Controlling Shareholders<br />

Companies owned and/or controlled by our Controlling Shareholders (the ‘‘Controlled Companies’’)<br />

are our franchisees. These arrangements will give rise to situations where there are potential<br />

conflicts of interests between us and our Controlling Shareholders, which are set out in the sections<br />

on ‘‘INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS’’ and<br />

‘‘POTENTIAL CONFLICTS OF INTERESTS’’ on pages 62 to 69 of this Prospectus respectively. The<br />

Audit Committee of our Board of Directors will review the implementation of the franchise<br />

agreements between us and the Controlled Companies to ensure that they are entered into on<br />

arms’ length basis and are on normal commercial terms. If the franchise agreements are not<br />

entered into on arms’ length basis and their terms are less favourable to us than what we would<br />

have offered to independent third party franchisees, we will suffer financial loss and this will have<br />

a significant adverse impact on our turnover and profitability.<br />

Had we been able to charge our affiliated companies the franchise fee, royalties (in the case of<br />

Controlled Companies which are our franchisees) or licensing fee (in the case of Controlled<br />

Companies which are our licensees) at rates similar to those charged to our subsidiaries and RSH<br />

(our unrelated franchisee), and had we been able to sell certain of our main products at prices<br />

similar to those sold to our subsidiaries and RSH, we would not have to suffer a reduction in income.<br />

For FY1999, the impact to our Group was a reduction in income of approximately $471,000 which<br />

represented 4.3 per cent. of our PBT.<br />

16

Offer Price (1)<br />

INVITATION STATISTICS<br />

: $0.52<br />

Placement Price for Placement Shares : $0.52<br />

Placement Price for Reserved Shares : $0.47<br />

NTA<br />

NTA per Share based on:–<br />

(a) the audited NTA of the Group as at 31 December 1999 before adjusting<br />

for the proceeds from the Investor Subscription and the estimated net<br />

proceeds of the New Shares and based on the pre-Investor<br />

Subscription and pre-Invitation issued share capital of 180,984,000<br />

Shares (the ‘‘Pre-Adjusted NTA per Share’’)<br />

(b) after adjusting for the proceeds from the Investor Subscription and the<br />

estimated net proceeds of the New Shares and based on the post-<br />

Investor Subscription and post-Invitation issued share capital of<br />

230,584,000 Shares (the ‘‘Adjusted NTA per Share’’)<br />

Premium of the Offer Price over:–<br />

: 5.67 cents<br />

: 14.57 cents<br />

(a) the Pre-Adjusted NTA per Share as at 31 December 1999 of 5.67 cents : 817 per cent.<br />

(b) the Adjusted NTA per Share of 14.57 cents : 257 per cent.<br />

Earnings<br />

Historical EPS based on the audited results of the Proforma Group for<br />

FY1999 and the pre-Investor Subscription and pre-Invitation issued share<br />

capital of 180,984,000 Shares<br />

Historical EPS had the Service Agreements as set out under the section on<br />

‘‘DIRECTORS, MANAGEMENT AND STAFF — Service Agreements’’ on<br />

pages 55 and 56 of this Prospectus been in effect for FY1999 and based on<br />

the pre-Investor Subscription and pre-Invitation issued share capital of<br />

180,984,000 Shares<br />

PER<br />

Historical PER based on the Offer Price and the historical EPS of 4.11 cents<br />

for FY1999<br />

Historical PER based on Offer Price and the historical EPS had the Service<br />

Agreements as set out under the section on ‘‘DIRECTORS, MANAGEMENT<br />

AND STAFF — Service Agreements’’ on pages 55 and 56 of this Prospectus<br />

been in effect for FY1999<br />

Net Operating Cash Flow (2)<br />

Historical net operating cash flow per Share for FY1999 based on the<br />

pre-Investor Subscription and pre-Invitation share capital of 180,984,000<br />

Shares<br />

17<br />

: 4.11 cents<br />

: 3.87 cents<br />

: 12.65 times<br />

: 13.44 times<br />

: 5.31 cents

Price to Net Operating Cash Flow Ratio<br />

Ratio of Offer Price to historical net operating cash flow per Share for FY1999<br />

based on the pre-Investor Subscription and pre-Invitation share capital of<br />

180,984,000 Shares<br />

Market Capitalisation<br />

Market capitalisation of our Company based on the Offer Price of $0.52 and<br />

based on the post-Investor Subscription and post-Invitation share capital of<br />

230,584,000 Shares<br />

: 9.79 times<br />

: $119.90 million<br />

Notes:–<br />

(1) The Offer Price of $0.52 has been used for the purpose of presenting the Invitation Statistics.<br />

(2) Net operating cash flow is defined as profit attributable to the members of the Company with depreciation added back.<br />

18

SUMMARY OF FINANCIAL INFORMATION<br />

The following selected financial information should be read in conjunction with the Accountants’ Report<br />

and the full text of this Prospectus.<br />

RESULTS<br />

The audited consolidated profit and loss statements of the Proforma Group for the past five financial<br />

years ended 31 December 1999, including EPS, are set out below:–<br />

——————— Year ended 31 December ———————<br />

1995 1996 1997 1998 1999<br />

$’000 $’000 $’000 $’000 $’000<br />

Turnover 31,432 42,897 60,837 69,747 103,138<br />

Other income (1)<br />

2 12 18 46 28<br />

Earnings before depreciation, interest expense<br />

and taxation 2,841 5,104 5,917 5,411 14,148<br />

Depreciation (313) (406) (569) (1,440) (4)<br />

(2,166) (4)<br />

Interest expense (896) (839) (929) (1,355) (1,468)<br />

Operating profit 1,632 3,859 4,419 2,616 10,514<br />

Share of (loss)/profit of associated company — (191) (17) 583 334<br />

Profit before taxation and minority interests 1,632 3,668 4,402 3,199 10,848<br />

Taxation (541) (1,177) (1,156) (912) (3,123)<br />

Profit after taxation 1,091 2,491 3,246 2,287 7,725<br />

Minority interests (49) (61) 84 (28) (284)<br />

Profit after taxation, minority interests but<br />

before extraordinary item 1,042 2,430 3,330 2,259 7,441<br />

Extraordinary item (2)<br />

— 1,759 (2)<br />

— — —<br />

Profit attributable to Shareholders 1,042 4,189 3,330 2,259 7,441 (5)<br />

Earnings per Share (3) (cents) 0.58 1.34 1.84 1.25 4.11<br />

Notes:–<br />

(1) Other income relates to interest income.<br />

(2) The extraordinary item relates to net gain on disposal of leasehold properties.<br />

(3) For comparative purposes, the historical EPS for FY1995 to FY1999 have been computed based on the profit after taxation<br />

and minority interests but before extraordinary item divided by the pre-Investor Subscription and pre-Invitation issued share<br />

capital of 180,984,000 Shares.<br />

(4) During FY1998, we had revised the estimated useful lives of certain fixed assets for depreciation purposes to more accurately<br />

reflect the economic useful lives of these fixed assets. The impact of the change in the accounting estimate is to decrease<br />

profit before taxation for FY1998 and FY1999 by approximately $182,000 and $68,000 respectively.<br />

During FY1999, a subsidiary, <strong>Osim</strong> (M’sia), had revised the estimated useful lives of certain fixed assets for depreciation<br />

purposes to be consistent with the Group’s accounting policy. The impact of the change in the accounting estimate is to<br />

decrease profit before taxation for FY1999 by approximately $105,000.<br />

(5) Had the Service Agreements referred to in the section on ‘‘DIRECTORS, MANAGEMENT AND STAFF — Service<br />

Agreements’’ on pages 55 and 56 of this Prospectus been in place for FY1999, the profit attributable to Shareholders for<br />

FY1999 would have been $7.0 million.<br />

19

FINANCIAL POSITION<br />

The audited consolidated balance sheets of the Proforma Group as at the end of each of the past five<br />

financial years ended 31 December 1999, including NTA per Share, are set out below:–<br />

————————— As at 31 December —————————<br />

1995 1996 1997 1998 1999<br />

$’000 $’000 $’000 $’000 $’000<br />

Fixed assets 17,272 12,349 13,455 16,607 18,276<br />

Investment in associated company — 303 333 905 1,068<br />

Current assets<br />

Stocks 3,750 5,808 7,706 5,452 12,089<br />

Trade debtors 2,168 3,204 6,094 5,818 8,846<br />

Other debtors, deposits and<br />

prepayments 1,140 2,126 3,893 2,360 2,574<br />

Due from affiliated companies<br />

— trade 3,236 3,300 7,039 4,634 8,587<br />

— non-trade 380 1,040 288 — 10 (2)<br />

Due from directors — 2,776 3,436 3,345 —<br />

Fixed deposits — 558 — — 236<br />

Cash and bank balances 227 2,311 5,668 3,080 4,265<br />

Current liabilities<br />

10,901 21,123 34,124 24,689 36,607<br />

Trade creditors 2,462 6,633 2,228 3,222 4,658<br />

Bills payable to banks (secured) 259 2,870 11,381 8,328 12,017<br />

Other creditors and accruals 1,399 1,585 5,046 1,967 8,925<br />

Due to an associated company<br />

— trade — — — 15 361<br />

Due to affiliated companies<br />

— trade — 4 321 260 —<br />

— non-trade — 559 — — 46 (2)<br />

Due to directors 2,112 — 2,361 830 1,600 (2)<br />

Term loans, current portion 1,279 2,123 537 660 646<br />

Short term bank loans 1,489 1,207 1,497 379 760<br />

Hire purchase liabilities, current<br />

portion — 36 118 112 115<br />

Proposed dividend — 370 370 370 75<br />

Provision for taxation 1,044 1,620 2,461 2,291 4,022<br />

Bank overdrafts (secured) 1,992 1,203 630 — 3,297<br />

(12,036) (18,210) (26,950) (18,434) (36,522)<br />

Net current (liabilities)/assets (1,135) 2,913 7,174 6,255 85<br />

20

Less:<br />

Non-current liabilities<br />

————————— As at 31 December —————————<br />

1995 1996 1997 1998 1999<br />

$’000 $’000 $’000 $’000 $’000<br />

Hire purchase liabilities, non-current<br />

portion — (80) (169) (145) (240)<br />

Term loans, non-current portion (8,837) (4,175) (6,886) (7,820) (7,255)<br />

Provision for pension benefits — — — — (157)<br />

Deferred taxation (102) (294) (147) (38) (369)<br />

Proforma shareholders’ equity<br />

(8,939) (4,549) (7,202) (8,003) (8,021)<br />

7,198 11,016 13,760 15,764 11,408<br />

Share capital 3,000 3,000 3,000 3,100 3,100<br />

Revenue reserves 3,571 7,343 9,508 11,157 6,375<br />

Enterprise expansion fund — 31 114 125 149<br />

Capital reserve — 16 91 347 466<br />

Translation reserves (154) (204) 294 208 179<br />

6,417 10,186 13,007 14,937 10,269<br />

Minority interests 781 830 753 827 1,139<br />

7,198 11,016 13,760 15,764 11,408<br />

NTA per Share (1) (cents) 3.55 5.63 7.19 8.25 5.67<br />

Notes:–<br />

(1) For comparative purposes, the historical NTA per Share as at 31 December 1995 to 1999 have been computed based on the<br />

pre-Investor Subscription and pre-Invitation issued share capital of 180,984,000 Shares.<br />

(2) Subsequent to the year ended 31 December 1999, these amounts have been repaid in June 2000.<br />

21

SHARE CAPITAL<br />

INFORMATION ON THE COMPANY AND THE GROUP<br />

We were incorporated on 27 August 1983 in the Republic of Singapore under the Act, as a limited exempt<br />

private company. We have only one class of shares. As at 31 December 1999, our authorised share<br />

capital was $5,000,000 divided into 5,000,000 ordinary shares of $1.00 each and our issued and paid-up<br />

share capital was $3,100,000 divided into 3,100,000 ordinary shares of $1.00 each.<br />

At the extraordinary general meeting held on 26 June 2000, our Shareholders approved, inter alia, the<br />

following:–<br />

(a) the increase of our authorised share capital from $5,000,000 divided into 5,000,000 ordinary shares<br />

of $1.00 each to $50,000,000 divided into 50,000,000 ordinary shares of $1.00 each;<br />

(b) the capitalisation of $5,921,000 from our revenue reserves for a bonus issue of 5,921,000 ordinary<br />

shares of $1.00 each in our capital, credited as fully paid, to the Shareholders of the Company on<br />

the basis of 1,910 new ordinary shares for every 1,000 ordinary shares held (the ‘‘Bonus Issue’’);<br />

(c) the subdivision of each of the existing ordinary shares of $1.00 each in the authorised share capital<br />

and issued and paid-up share capital of the Company into 20 shares of $0.05 each (the ‘‘Stock<br />

Split’’);<br />

(d) our conversion to a public limited company and the change of our name to <strong>Osim</strong> <strong>International</strong> <strong>Ltd</strong>;<br />

(e) the adoption of a set of new Articles of Association;<br />

(f) the issue of 564,000 new ordinary shares of $0.05 each to Mr Chen Chuan I and Ms Ho Jui Mei as<br />

consideration for the acquisition of their aggregate 10 per cent. equity in <strong>Osim</strong> (Taiwan) pursuant to<br />

the Restructuring Exercise;<br />

(g) the issue of 11,600,000 new ordinary shares of $0.05 each to Investor pursuant to the Subscription<br />

Agreement;<br />

(h) the issue of the New Shares which form part of the Invitation;<br />

(i) a shareholders’ mandate authorising <strong>Osim</strong> (S) to enter into recurrent transactions of a revenue<br />

and/or trading nature firstly, in the form of sales of our products to <strong>Osim</strong> (Thai), <strong>Osim</strong> (USA), PT<br />

Sharon, <strong>Osim</strong> (Beijing), <strong>Osim</strong> GHC (SH) and HCC (Langfang) and secondly, warehousing and<br />

freight forwarding contracts with ODCPL (these transactions are more particularly described on<br />

pages 62 to 69 of this Prospectus under ‘‘INTEREST OF MANAGEMENT AND OTHERS IN<br />

CERTAIN TRANSACTIONS’’);<br />

(j) the <strong>Osim</strong> Share Option Scheme (the ‘‘Scheme’’) (details of which are set out on pages 59 to 61 of<br />

this Prospectus and in Appendix A on pages 113 to 136 of this Prospectus) and the authorisation to<br />

our Board of Directors to implement and administer the Scheme, to modify and/or amend the<br />

Scheme, to offer and grant options and to allot and issue new Shares pursuant to the exercise of<br />

options granted pursuant to the Scheme subject to the rules of the Scheme; and<br />

(k) the authorisation of the Directors, pursuant to Section 161 of the Act and the provisions of the new<br />

Articles of Association becoming effective, to allot and issue such further shares in the Company at<br />

any time to such persons, upon such terms and conditions and for such purposes as the Directors<br />

may in their absolute discretion deem fit provided that the aggregate number of shares to be issued<br />

shall not exceed 50 per cent. of the issued share capital of the Company immediately prior to the<br />

proposed issue, provided that the aggregate number of shares to be issued other than on a pro-rata<br />

basis to the then existing Shareholders of the Company shall not exceed 20 per cent. of the issued<br />

share capital of the Company immediately prior to the proposed issue, and, unless revoked or<br />

varied by the Company in general meeting, such authority shall continue in force until the conclusion<br />

of the Annual General Meeting of the Company or the date by which the next Annual General<br />

Meeting of the Company is required by law to be held, whichever is the earlier.<br />

22

As at the date of this Prospectus, we have only one class of shares, being ordinary shares of $0.05 each.<br />

The rights and privileges of these Shares are stated in our Articles of Association. There are no founder,<br />

management or deferred shares reserved for issuance for any purpose.<br />

Our Company’s present and paid-up share capital is $9,629,200 comprising 192,584,000 Shares. Upon<br />

the allotment of the New Shares, our resultant issued and paid-up share capital will be increased to<br />

$11,529,200 comprising 230,584,000 Shares.<br />

The details of our Company’s issued and paid-up capital since 31 December 1999, being the date of our<br />

last audited accounts, and our issued and paid-up share capital immediately after the Invitation are as<br />

follows:–<br />

Number<br />

of Shares $<br />

Issued and fully paid ordinary shares of $1.00 each as at 31 December 1999 3,100,000 3,100,000<br />

Bonus Issue 5,921,000 5,921,000<br />

9,021,000 9,021,000<br />

Stock Split 180,420,000 9,021,000<br />

Shares issued pursuant to the Restructuring Exercise 564,000 28,200<br />

Shares issued pursuant to the Subscription Agreement 11,600,000 580,000<br />

Pre-Invitation issued share capital 192,584,000 9,629,200<br />

Issue of New Shares 38,000,000 1,900,000<br />

Post-Invitation issued share capital 230,584,000 11,529,200<br />

Our Company’s authorised share capital and shareholders’ funds as at 31 December 1999, before and<br />

after adjustments to reflect the increase in authorised share capital, the Bonus Issue, the Stock Split, the<br />

issue of Shares pursuant to the Restructuring Exercise and the Subscription Agreement, and the issue<br />

of the New Shares are set out below. This should be read in conjunction with the Accountants’ Report<br />