xz0n7

xz0n7 xz0n7

BUILDING SOCIETIES Your money and the financial system Page 16 The Bank of England’s Financial Policy Committee (FPC) The objective of the FPC is to spot and fix threats to the financial system as a whole. There are two key policy levers in the FPC tool kit. These are its powers of Direction and Recommendation. Recommendations to anyone FINANCIAL POLICY FPC Directions are binding instructions on the Prudential Regulation Authority and Financial Conduct Authority. COMMITTEE The FPC can issue a Direction to the Prudential Regulation Authority to make banks, building societies and large investment firms: • raise or lower the total amount of capital on their balance sheets; • adjust the amount of capital for unexpected losses on specific types of loans – say to the property market. Directions to PRA & FCA HEDGE FUNDS PENSION FUNDS CREDIT UNIONS INSURERS

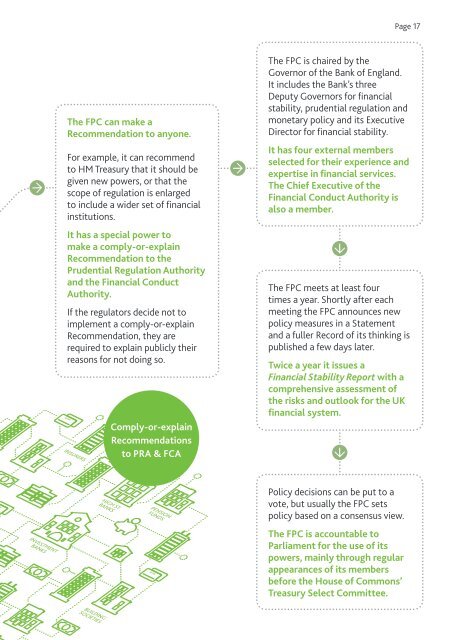

BUILDING SOCIETIES Page 17 The FPC can make a Recommendation to anyone. For example, it can recommend to HM Treasury that it should be given new powers, or that the scope of regulation is enlarged to include a wider set of financial institutions. It has a special power to make a comply-or-explain Recommendation to the Prudential Regulation Authority and the Financial Conduct Authority. If the regulators decide not to implement a comply-or-explain Recommendation, they are required to explain publicly their reasons for not doing so. INSURERS Comply-or-explain Recommendations to PRA & FCA The FPC is chaired by the Governor of the Bank of England. It includes the Bank’s three Deputy Governors for financial stability, prudential regulation and monetary policy and its Executive Director for financial stability. It has four external members selected for their experience and expertise in financial services. The Chief Executive of the Financial Conduct Authority is also a member. The FPC meets at least four times a year. Shortly after each meeting the FPC announces new policy measures in a Statement and a fuller Record of its thinking is published a few days later. Twice a year it issues a Financial Stability Report with a comprehensive assessment of the risks and outlook for the UK financial system. INVESTMENT BANKS HIGH ST BANKS PENSION FUNDS Policy decisions can be put to a vote, but usually the FPC sets policy based on a consensus view. The FPC is accountable to Parliament for the use of its powers, mainly through regular appearances of its members before the House of Commons’ Treasury Select Committee.

- Page 1 and 2: Your money and the financial system

- Page 3 and 4: Page 3 The Bank of England is able

- Page 5 and 6: Page 5 In the UK, the high-street b

- Page 7 and 8: Page 7 Each day the financial syste

- Page 9 and 10: Page 9 ASSETS A bank uses its capit

- Page 11 and 12: Page 11 A bank is insolvent if its

- Page 13 and 14: Page 13 A bank is insolvent if with

- Page 15: Page 15 The Financial Policy Commit

- Page 19 and 20: Page 19 The PRA uses judgement to f

- Page 21 and 22: Page 21 Only banks and building soc

- Page 23 and 24: Page 23 YOUR MONEY AND THE FINANCIA

BUILDING<br />

SOCIETIES<br />

Page 17<br />

The FPC can make a<br />

Recommendation to anyone.<br />

For example, it can recommend<br />

to HM Treasury that it should be<br />

given new powers, or that the<br />

scope of regulation is enlarged<br />

to include a wider set of financial<br />

institutions.<br />

It has a special power to<br />

make a comply-or-explain<br />

Recommendation to the<br />

Prudential Regulation Authority<br />

and the Financial Conduct<br />

Authority.<br />

If the regulators decide not to<br />

implement a comply-or-explain<br />

Recommendation, they are<br />

required to explain publicly their<br />

reasons for not doing so.<br />

INSURERS<br />

Comply-or-explain<br />

Recommendations<br />

to PRA & FCA<br />

The FPC is chaired by the<br />

Governor of the Bank of England.<br />

It includes the Bank’s three<br />

Deputy Governors for financial<br />

stability, prudential regulation and<br />

monetary policy and its Executive<br />

Director for financial stability.<br />

It has four external members<br />

selected for their experience and<br />

expertise in financial services.<br />

The Chief Executive of the<br />

Financial Conduct Authority is<br />

also a member.<br />

The FPC meets at least four<br />

times a year. Shortly after each<br />

meeting the FPC announces new<br />

policy measures in a Statement<br />

and a fuller Record of its thinking is<br />

published a few days later.<br />

Twice a year it issues a<br />

Financial Stability Report with a<br />

comprehensive assessment of<br />

the risks and outlook for the UK<br />

financial system.<br />

INVESTMENT<br />

BANKS<br />

HIGH ST<br />

BANKS<br />

PENSION<br />

FUNDS<br />

Policy decisions can be put to a<br />

vote, but usually the FPC sets<br />

policy based on a consensus view.<br />

The FPC is accountable to<br />

Parliament for the use of its<br />

powers, mainly through regular<br />

appearances of its members<br />

before the House of Commons’<br />

Treasury Select Committee.