xz0n7

xz0n7

xz0n7

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

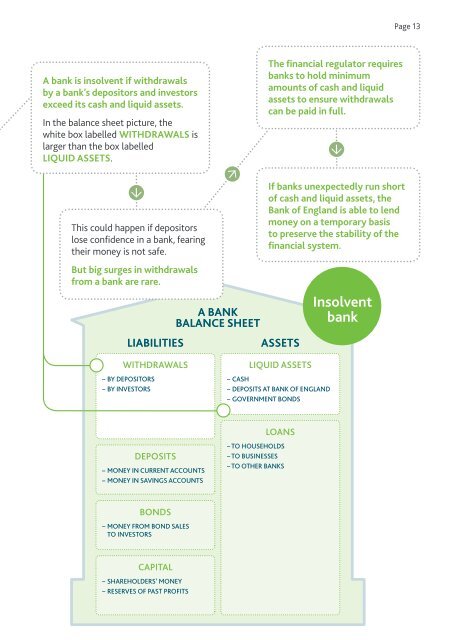

Page 13<br />

A bank is insolvent if withdrawals<br />

by a bank’s depositors and investors<br />

exceed its cash and liquid assets.<br />

In the balance sheet picture, the<br />

white box labelled WITHDRAWALS is<br />

larger than the box labelled<br />

LIQUID ASSETS.<br />

The financial regulator requires<br />

banks to hold minimum<br />

amounts of cash and liquid<br />

assets to ensure withdrawals<br />

can be paid in full.<br />

This could happen if depositors<br />

lose confidence in a bank, fearing<br />

their money is not safe.<br />

But big surges in withdrawals<br />

from a bank are rare.<br />

A BANK<br />

BALANCE SHEET<br />

LIABILITIES<br />

ASSETS<br />

If banks unexpectedly run short<br />

of cash and liquid assets, the<br />

Bank of England is able to lend<br />

money on a temporary basis<br />

to preserve the stability of the<br />

financial system.<br />

Insolvent<br />

bank<br />

WITHDRAWALS<br />

– BY DEPOSITORS<br />

– BY INVESTORS<br />

LIQUID ASSETS<br />

– CASH<br />

– DEPOSITS AT BANK OF ENGLAND<br />

– GOVERNMENT BONDS<br />

DEPOSITS<br />

– MONEY IN CURRENT ACCOUNTS<br />

– MONEY IN SAVINGS ACCOUNTS<br />

LOANS<br />

– TO HOUSEHOLDS<br />

– TO BUSINESSES<br />

– TO OTHER BANKS<br />

BONDS<br />

– MONEY FROM BOND SALES<br />

TO INVESTORS<br />

CAPITAL<br />

– SHAREHOLDERS’ MONEY<br />

– RESERVES OF PAST PROFITS