Green Banking Policy of IBBL - Islami Bank Bangladesh Limited

Green Banking Policy of IBBL - Islami Bank Bangladesh Limited

Green Banking Policy of IBBL - Islami Bank Bangladesh Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

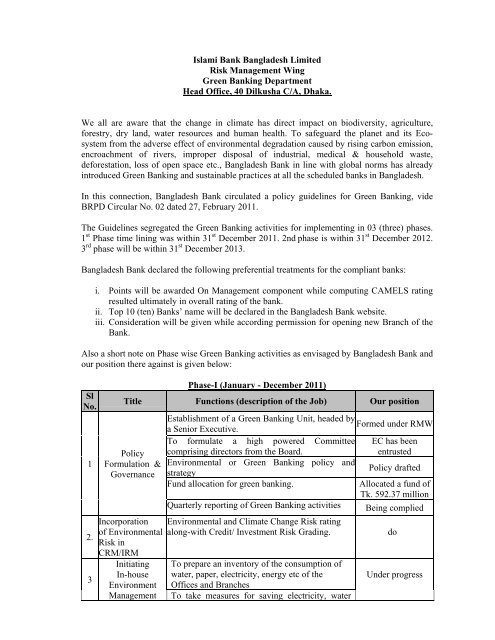

<strong>Islami</strong> <strong>Bank</strong> <strong>Bangladesh</strong> <strong>Limited</strong><br />

Risk Management Wing<br />

<strong>Green</strong> <strong><strong>Bank</strong>ing</strong> Department<br />

Head Office, 40 Dilkusha C/A, Dhaka.<br />

We all are aware that the change in climate has direct impact on biodiversity, agriculture,<br />

forestry, dry land, water resources and human health. To safeguard the planet and its Ecosystem<br />

from the adverse effect <strong>of</strong> environmental degradation caused by rising carbon emission,<br />

encroachment <strong>of</strong> rivers, improper disposal <strong>of</strong> industrial, medical & household waste,<br />

deforestation, loss <strong>of</strong> open space etc., <strong>Bangladesh</strong> <strong>Bank</strong> in line with global norms has already<br />

introduced <strong>Green</strong> <strong><strong>Bank</strong>ing</strong> and sustainable practices at all the scheduled banks in <strong>Bangladesh</strong>.<br />

In this connection, <strong>Bangladesh</strong> <strong>Bank</strong> circulated a policy guidelines for <strong>Green</strong> <strong><strong>Bank</strong>ing</strong>, vide<br />

BRPD Circular No. 02 dated 27, February 2011.<br />

The Guidelines segregated the <strong>Green</strong> <strong><strong>Bank</strong>ing</strong> activities for implementing in 03 (three) phases.<br />

1 st Phase time lining was within 31 st December 2011. 2nd phase is within 31 st December 2012.<br />

3 rd phase will be within 31 st December 2013.<br />

<strong>Bangladesh</strong> <strong>Bank</strong> declared the following preferential treatments for the compliant banks:<br />

i. Points will be awarded On Management component while computing CAMELS rating<br />

resulted ultimately in overall rating <strong>of</strong> the bank.<br />

ii. Top 10 (ten) <strong>Bank</strong>s’ name will be declared in the <strong>Bangladesh</strong> <strong>Bank</strong> website.<br />

iii. Consideration will be given while according permission for opening new Branch <strong>of</strong> the<br />

<strong>Bank</strong>.<br />

Also a short note on Phase wise <strong>Green</strong> <strong><strong>Bank</strong>ing</strong> activities as envisaged by <strong>Bangladesh</strong> <strong>Bank</strong> and<br />

our position there against is given below:<br />

Sl<br />

No.<br />

1<br />

2.<br />

3<br />

Phase-I (January - December 2011)<br />

Title Functions (description <strong>of</strong> the Job) Our position<br />

<strong>Policy</strong><br />

Formulation &<br />

Governance<br />

Incorporation<br />

<strong>of</strong> Environmental<br />

Risk in<br />

CRM/IRM<br />

Initiating<br />

In-house<br />

Environment<br />

Management<br />

Establishment <strong>of</strong> a <strong>Green</strong> <strong><strong>Bank</strong>ing</strong> Unit, headed by<br />

Formed under RMW<br />

a Senior Executive.<br />

To formulate a high powered Committee EC has been<br />

comprising directors from the Board.<br />

entrusted<br />

Environmental or <strong>Green</strong> <strong><strong>Bank</strong>ing</strong> policy and<br />

strategy<br />

<strong>Policy</strong> drafted<br />

Fund allocation for green banking.<br />

Allocated a fund <strong>of</strong><br />

Tk. 592.37 million<br />

Quarterly reporting <strong>of</strong> <strong>Green</strong> <strong><strong>Bank</strong>ing</strong> activities Being complied<br />

Environmental and Climate Change Risk rating<br />

along-with Credit/ Investment Risk Grading.<br />

To prepare an inventory <strong>of</strong> the consumption <strong>of</strong><br />

water, paper, electricity, energy etc <strong>of</strong> the<br />

Offices and Branches<br />

To take measures for saving electricity, water<br />

do<br />

Under progress

Sl<br />

No.<br />

4<br />

5<br />

6<br />

Title Functions (description <strong>of</strong> the Job) Our position<br />

Introducing<br />

<strong>Green</strong> finance<br />

Creation <strong>of</strong><br />

Climate Risk<br />

Fund<br />

Introducing<br />

<strong>Green</strong><br />

Marketing<br />

and paper consumption.<br />

To circulate a set <strong>of</strong> general instructions (<strong>Green</strong><br />

Office Guide) to the employees for efficient use<br />

<strong>of</strong> electricity, water, paper and reuse <strong>of</strong><br />

equipments.<br />

To use scrap papers as notepads and to avoid<br />

disposable cups/ glasses to become more Ec<strong>of</strong>riendly.<br />

To install energy efficient electronic equipments.<br />

To use energy saving bulbs in place <strong>of</strong> normal<br />

bulbs in branches/ <strong>of</strong>fices <strong>of</strong> the bank.<br />

To make plan to use solar energy at premises to<br />

save electricity.<br />

To encourage employees to purchase energy<br />

efficient cars (that consume less fuel) for<br />

reducing gas and petroleum consumption.<br />

Arrangement <strong>of</strong> automatic shutdown <strong>of</strong><br />

equipments<br />

Use <strong>of</strong> extensively online communication<br />

Double –side printing.<br />

To apply Eco-font in printing to reduce use <strong>of</strong><br />

ink.<br />

To prefer financing in the Eco friendly<br />

business activities and energy efficient<br />

industries such as:<br />

Renewable energy project<br />

Clean water supply project<br />

Waste water treatment plant<br />

Solid & hazardous waste disposal plant, Bio-gas<br />

plant<br />

Bio-fertilizer plant etc.<br />

To promote environmental practices applying<br />

consumer finance program.<br />

Finance in economic activities <strong>of</strong> the flood,<br />

cyclone and drought prone areas without<br />

charging additional risk premium.<br />

Creation <strong>of</strong> Climate Change Risk Fund<br />

To use environmental causes for marketing i.e.<br />

financial services to the customer for awareness<br />

development among the common people.<br />

To advise the clients for modifying the product,<br />

changing the production & packaging process<br />

and modifying advertisement for environmental<br />

cause.<br />

do<br />

do<br />

do<br />

do<br />

do<br />

do<br />

Allocated a fund<br />

<strong>of</strong> Tk. 50 million<br />

Partially<br />

implemented<br />

Implemented and<br />

being practiced<br />

7 Online <strong><strong>Bank</strong>ing</strong> To allow the customers online banking Implemented<br />

Supporting Arrangement <strong>of</strong> employee awareness More intensive<br />

Employee development and training program on programs to be<br />

8<br />

Training, environmental and social risk<br />

taken<br />

Consumer Arrangement <strong>of</strong> customer awareness Steps to be taken

Sl<br />

No.<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

Title Functions (description <strong>of</strong> the Job) Our position<br />

Awareness and<br />

<strong>Green</strong> Even<br />

Reporting<br />

<strong>Green</strong> <strong><strong>Bank</strong>ing</strong><br />

Practices<br />

Sector Specific<br />

Environmental<br />

Policies<br />

<strong>Green</strong> Strategic<br />

Planning<br />

Setting up<br />

<strong>Green</strong> Branches<br />

Improved<br />

In-house<br />

Environme<br />

nt<br />

Manageme<br />

nt<br />

Formulation <strong>of</strong><br />

<strong>Bank</strong> Specific<br />

Environmental<br />

Risk<br />

Management<br />

Plan and<br />

Guidelines.<br />

Rigorous<br />

Programs to<br />

Educate Clients<br />

to be<br />

undertaken.<br />

development<br />

To take measure to report on the<br />

initiatives/practices to <strong>Bangladesh</strong> <strong>Bank</strong> and<br />

disclose in the <strong>Bank</strong>’s websites.<br />

To be designed<br />

Determine green targets<br />

To determine a set <strong>of</strong> achievable targets and<br />

strategies.<br />

To disclose these in the annual report and<br />

web-site for green financing and in-house<br />

management.<br />

Target areas for green financing:<br />

i. To reduce loans/investments for<br />

environmentally harmful<br />

activities.<br />

ii. To attain a particular percentage<br />

<strong>of</strong> environmental loans/<br />

investment.<br />

iii. To introduce Eco-friendly<br />

financial products.<br />

Features <strong>of</strong> <strong>Green</strong> Branches:<br />

• To use maximum natural light<br />

• To use renewable energy and energy<br />

saving bulbs and other equipments.<br />

• To reduce water and electricity use.<br />

• To use recycled water.<br />

• A green Branch will be entitled to display a special logo<br />

approved by BB.<br />

To take Strategy <strong>of</strong> reuse, recycling <strong>of</strong> materials<br />

& equipments, and source reduction and waste<br />

minimization.<br />

To rely increasingly on virtual meeting through<br />

the use <strong>of</strong> video conferencing in lieu <strong>of</strong> physical<br />

travel for saving cost and energy.<br />

Develop and follow an environmental risk<br />

management manual or guidelines for the<br />

assessment/ monitoring <strong>of</strong> project and working<br />

capital investments.<br />

To set internationally accepted higher<br />

environmental standards.<br />

Encourage the clients and business houses to<br />

comply environmental regulation.<br />

Introduce rigorous program to educate clients<br />

about environmental risk.<br />

Implemented<br />

Under process<br />

Steps to be taken<br />

do<br />

Partially<br />

implemented<br />

do<br />

Under process<br />

do<br />

Steps to be taken<br />

do

Sl<br />

No.<br />

16<br />

Title Functions (description <strong>of</strong> the Job) Our position<br />

Disclosure and<br />

Reporting <strong>of</strong><br />

<strong>Green</strong> <strong><strong>Bank</strong>ing</strong><br />

Activities.<br />

Publishing independent <strong>Green</strong> <strong><strong>Bank</strong>ing</strong>/<br />

Sustainability reports<br />

To disclose update and detail information about<br />

<strong>Bank</strong>’s environmental activities and<br />

performances <strong>of</strong> major clients.<br />

Phase-III (January - December 2013)<br />

To have a system <strong>of</strong> Environment Management before initiation <strong>of</strong> the activities <strong>of</strong> phase- III<br />

1. Designing and Introducing Innovative Products.<br />

• To introduce environment friendly innovative green products to address the core<br />

environmental challenges <strong>of</strong> the country.<br />

• To avoid negative impacts on environment through banking activities.<br />

2. Reporting in Standard Format with External Verification.<br />

• To publish independent <strong>Green</strong> Annual Report following internationally accepted<br />

format like Global Reporting Initiatives (GRI) targeting the stakeholders duly<br />

verified by an independent agency or acceptable third party.<br />

do<br />

do