Pioneer Nickel Limited Prospectus - Pioneer Resources Limited

Pioneer Nickel Limited Prospectus - Pioneer Resources Limited

Pioneer Nickel Limited Prospectus - Pioneer Resources Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

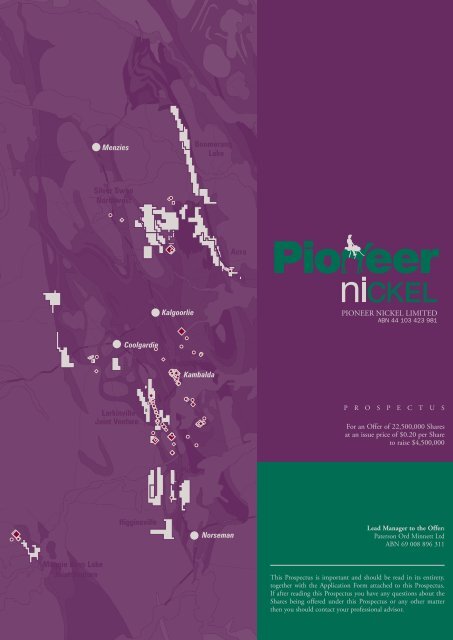

Menzies<br />

Boomerang<br />

Lake<br />

Silver Swan<br />

Northwest<br />

Acra<br />

Kalgoorlie<br />

PIONEER NICKEL LIMITED<br />

ABN 44 103 423 981<br />

Coolgardie<br />

Wattle Dam<br />

Kambalda<br />

Larkinville<br />

Joint Venture<br />

P R O S P E C T U S<br />

For an Offer of 22,500,000 Shares<br />

at an issue price of $0.20 per Share<br />

to raise $4,500,000<br />

<strong>Pioneer</strong><br />

Higginsville<br />

Norseman<br />

Lead Manager to the Offer:<br />

Paterson Ord Minnett Ltd<br />

ABN 69 008 896 311<br />

Maggie Hays Lake<br />

Joint Venture<br />

This <strong>Prospectus</strong> is important and should be read in its entirety,<br />

together with the Application Form attached to this <strong>Prospectus</strong>.<br />

If after reading this <strong>Prospectus</strong> you have any questions about the<br />

Shares being offered under this <strong>Prospectus</strong> or any other matter<br />

then you should contact your professional advisor.

Corporate Directory<br />

SECTION 7<br />

Directors<br />

Craig Leslie Readhead Chairman<br />

David John Crook<br />

Ian James Buchhorn<br />

Allan Trench<br />

Managing Director<br />

Non-Executive Director<br />

Non-Executive Director<br />

Company Secretary<br />

Julie Anne Wolseley<br />

Company Secretary<br />

1.1<br />

Registered and 21 Close Way<br />

Principal Office Kalgoorlie WA 6430<br />

Telephone: (08) 9091 6974<br />

Facsimile: (08) 9022 2294<br />

Email: pioneer@pioneernickel.com.au<br />

Website: http://www.pioneernickel.com.au<br />

Proposed ASX Code<br />

Lead Manager<br />

to the Offer<br />

PIO<br />

Paterson Ord Minnett Ltd<br />

Level 23 Exchange Plaza<br />

2 The Esplanade<br />

Perth WA 6000<br />

Telephone: (08) 9263 1111<br />

Facsimile: (08) 9325 5123<br />

Telephone: (08) 9021 1422 (Kalgoorlie Office)<br />

Facsimile: (08) 9021 8133 (Kalgoorlie Office)<br />

Email: paterson@patersonord.com.au<br />

Website: www.patersonord.com.au<br />

Corporate Adviser Pullinger Readhead Stewart<br />

& Solicitor to the Offer Level 1, Scott House<br />

46-50 Kings Park Road<br />

West Perth WA 6005<br />

Telephone: (08) 9321 2444<br />

Facsimile: (08) 9321 3411<br />

Email: prs@prslaw.com.au<br />

Investigating<br />

Accountant<br />

Auditor<br />

Butler Settineri Securities Pty <strong>Limited</strong><br />

35-37 Havelock Street<br />

West Perth WA 6005<br />

Telephone: (08) 9426 4444<br />

Facsimile: (08) 9321 5215<br />

Email: mail@butlersettineri.com.au<br />

Butler Settineri<br />

35-37 Havelock Street<br />

West Perth WA 6005<br />

Telephone: (08) 9426 4444<br />

Facsimile: (08) 9321 5215<br />

Email: mail@butlersettineri.com.au<br />

Independent Solicitor<br />

Mineral Titles<br />

Independent<br />

Consulting Geologist<br />

Share Registry<br />

McKenzie Lalor<br />

74 Egan Street<br />

Kalgoorlie WA 6430<br />

Telephone: (08) 9021 6699<br />

Facsimile: (08) 9021 4052<br />

Email: mckenzie@emerge.net.au<br />

Snowden Corporate Services Pty Ltd<br />

87 Colin Street<br />

West Perth WA 6005<br />

Telephone: (08) 9481 6690<br />

Facsimile: (08) 9322 2576<br />

Email: snowden@snowdenau.com<br />

Security Transfer Registrars Pty <strong>Limited</strong><br />

770 Canning Highway<br />

Applecross WA 6153<br />

Telephone: (08) 9315 0933<br />

Facsimile: (08) 9315 2233<br />

Email: registrar@securitytransfer.com.au<br />

Above, Mr Ferguson (Inspector of Artesian<br />

Bores), and right, Mr Max George Meth<br />

(Inspector of Bores), riding “Old Brownie”<br />

at Oodnadatta, South Australia, 1911<br />

PIONEER NICKEL LIMITED<br />

ABN 44 103 423 981

<strong>Pioneer</strong> <strong>Nickel</strong> <strong>Limited</strong> <strong>Prospectus</strong><br />

Indicative Timetable<br />

SECTION 7<br />

<strong>Prospectus</strong> lodgement with ASIC and ASX 17 October 2003<br />

Exposure Period ends 23 October 2003<br />

Opening Date 24 October 2003<br />

Record Date (for entitlement to <strong>Pioneer</strong> In Specie Shares and to receive a <strong>Prospectus</strong>) 28 October 2003<br />

Closing Date for Heron shareholders’ priority allocations 12 November 2003<br />

Closing Date for applications for shares 21 November 2003<br />

Holding Statements to be dispatched 28 November 2003<br />

Expected Date of Official Quotation of Shares on ASX 5 December 2003<br />

ontents<br />

The Directors, in consultation with the Lead Manager, reserve the right to vary the dates without notice.<br />

C1 IMPORTANT NOTES AND STATEMENTS<br />

6.4 NATIVE TITLE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .19<br />

1.1 CHAIRMAN’S LETTER . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3 6.5 RISKS SPECIFIC TO THE COMPANY . . . . . . . . . . . . . . . . .19<br />

1.2 PROSPECTUS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4 7 GEOLOGIST’S REPORT<br />

1.3 EXPOSURE PERIOD . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4 7.1 INTRODUCTION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .20<br />

2 MANAGEMENT PROFILES<br />

7.2 ACRA PROJECT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .23<br />

2.1 DIRECTORS & COMPANY SECRETARY . . . . . . . . . . . . . . . .5 7.3 PIONEER PROJECT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .26<br />

3 DETAILS OF THE OFFER<br />

7.4 HIGGINSVILLE PROJECT . . . . . . . . . . . . . . . . . . . . . . . . . .29<br />

3.1 THE OFFER . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6 7.5 WATTLE DAM PROJECT . . . . . . . . . . . . . . . . . . . . . . . . . . .30<br />

3.2 HOW TO APPLY FOR SHARES . . . . . . . . . . . . . . . . . . . . . . . .6 7.6 LARKINVILLE JOINT VENTURE PROJECT . . . . . . . . . . . .32<br />

3.3 HERON RESOURCES LIMITED SHAREHOLDERS . . . . . . .6 7.7 SILVER SWAN NORTHWEST PROJECT . . . . . . . . . . . . . . .33<br />

3.4 INDICATIVE TIMETABLE . . . . . . . . . . . . . . . . . . . . . . . . . . .7 7.8 MAGGIE HAYS LAKE JOINT VENTURE PROJECT . . . . . .34<br />

3.5 LEAD MANAGER TO THE OFFER . . . . . . . . . . . . . . . . . . . . .7 7.9 BOOMERANG LAKE PROJECT . . . . . . . . . . . . . . . . . . . . . .35<br />

3.6 APPLICATION MONEY HELD IN TRUST . . . . . . . . . . . . . . .7 7.10 HEAZLEWOOD PROJECT . . . . . . . . . . . . . . . . . . . . . . . . . .36<br />

3.7 ISSUE OF SHARES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7 7.11 REFERENCES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .38<br />

3.8 AUSTRALIAN STOCK EXCHANGE LISTING . . . . . . . . . . . .8 7.12 GLOSSARY OF TECHNICAL TERMS . . . . . . . . . . . . . . . . . .40<br />

3.9 CHESS SYSTEM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8 8 INDEPENDENT GEOLOGIST’S REPORT . . . . . . . . . . . . .42<br />

3.10 RESTRICTED SECURITIES . . . . . . . . . . . . . . . . . . . . . . . . . . .8 9 INDEPENDENT SOLICITOR’S REPORT . . . . . . . . . . . . . .47<br />

3.11 NON-RESIDENT INVESTORS . . . . . . . . . . . . . . . . . . . . . . . .8 10 INVESTIGATING ACCOUNTANT’S REPORT . . . . . . . . . .52<br />

3.12 PRIVACY DISCLOSURE . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8 11 SUMMARY OF MATERIAL CONTRACTS . . . . . . . . . . . . .58<br />

4 INVESTMENT SUMMARY<br />

12 ADDITIONAL INFORMATION . . . . . . . . . . . . . . . . . . . . .62<br />

4.1 PIONEER NICKEL LIMITED . . . . . . . . . . . . . . . . . . . . . . . . .9 12.1 RIGHTS AND LIABILITIES ATTACHING TO SHARES . . . .62<br />

4.2 TENEMENTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9 12.2 RIGHTS AND LIABILITIES ATTACHING TO OPTIONS . .62<br />

4.3 COMPANY OBJECTIVES . . . . . . . . . . . . . . . . . . . . . . . . . . .10 12.3 COMPANY DETAILS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .63<br />

4.4 PURPOSE OF THE OFFER . . . . . . . . . . . . . . . . . . . . . . . . . .10 12.4 TAX CONSIDERATIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . .63<br />

4.5 USE OF FUNDS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10 12.5 CORPORATE GOVERNANCE . . . . . . . . . . . . . . . . . . . . . . .63<br />

4.6 WORKING CAPITAL ADEQUACY . . . . . . . . . . . . . . . . . . . .11 12.6 DIRECTOR & OFFICER PROTECTION DEEDS . . . . . . . . .63<br />

4.7 CAPITAL STRUCTURE . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11 12.7 INTERESTS OF DIRECTORS . . . . . . . . . . . . . . . . . . . . . . . .63<br />

4.8 RISK FACTORS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11 12.8 INTERESTS OF EXPERTS AND ADVISERS . . . . . . . . . . . . .64<br />

5 COMPANY AND PROJECT OVERVIEW<br />

12.9 CONSENTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .64<br />

5.1 COMPANY OVERVIEW & EXPLORATION STRATEGY . . .12 12.10 LITIGATION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .65<br />

5.2 PROJECT OVERVIEW . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .14 12.11 EXPENSES OF THE OFFER . . . . . . . . . . . . . . . . . . . . . . . . . .65<br />

5.3 PROPOSED BUDGET . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .15 12.12 ENQUIRIES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .65<br />

6 RISK FACTORS<br />

13 DIRECTORS’ STATEMENT . . . . . . . . . . . . . . . . . . . . . . . .65<br />

6.1 KEY PERSONNEL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .18 14 GLOSSARY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .66<br />

6.2 ECONOMIC AND GOVERNMENT RISKS . . . . . . . . . . . . .18 APPLICATION FORM<br />

6.3 EXPLORATION, DEVELOPMENT, MINING AND<br />

PROCESSING RISKS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .19<br />

-1-

SECTION 1<br />

To achieve this outcome, <strong>Pioneer</strong> has acquired:<br />

ACRA<br />

• A <strong>Nickel</strong> Sulphide-bearing ultramafic channel<br />

• previous drilling intercepts include<br />

21m at 0.5% Ni<br />

18m at 0.6% Ni<br />

and 0.27m at 4.36% Ni<br />

• Drilling targets based on DHTEM for immediate testing.<br />

PIONEER<br />

• ultramafic units that correlate with Widgiemooltha<br />

• a reported resource (non JORC) at JH of 32,000t at 1.1% Ni<br />

• previous drilling intercepts include<br />

3.2m at 3.2% Ni<br />

5.9m at 2.0% Ni<br />

WATTLE DAM<br />

• In excess of 15km of ultramafic units including the host to the<br />

Spargoville mines, which produced 16,500t of <strong>Nickel</strong>.<br />

<strong>Pioneer</strong> has other high quality Western Australian projects at Silver<br />

Swan Northwest and Higginsville; and the Heazlewood Complex<br />

in Tasmania, all with <strong>Nickel</strong> Sulphide targets identified.<br />

Following listing, drilling will commence immediately at Acra.<br />

Photograph: Managing Director David Crook onsite at Wattle Dam.<br />

-2-

<strong>Pioneer</strong> <strong>Nickel</strong> <strong>Limited</strong> <strong>Prospectus</strong><br />

C1.1<br />

hairman’s Letter<br />

Dear Investor,<br />

On behalf of the Directors it gives me great pleasure to introduce this <strong>Prospectus</strong> to you, and to invite you to invest in <strong>Pioneer</strong><br />

<strong>Nickel</strong> <strong>Limited</strong> ("<strong>Pioneer</strong>" or the "Company"). <strong>Pioneer</strong> is the result of Heron <strong>Resources</strong> <strong>Limited</strong> ("Heron") de-merging its<br />

<strong>Nickel</strong> Sulphide assets.<br />

The focus of <strong>Pioneer</strong> is the discovery and development of high grade <strong>Nickel</strong> Sulphide deposits. I believe<br />

<strong>Pioneer</strong> has three outstanding attributes favouring success:<br />

SECTION 1<br />

1. Excellent Project Locations<br />

The two key projects for initial drilling are Acra and <strong>Pioneer</strong> which are located in proven <strong>Nickel</strong> Sulphide geological provinces<br />

with operating nickel mines. These are advanced projects, and each has the potential to deliver a high value ore deposit.<br />

Heazlewood is a conceptual target with potential for Noril’sk-style mineralisation.<br />

• Acra project: The project is a 403km 2 contiguous holding covering the Acra <strong>Nickel</strong> Sulphide deposit which, with the<br />

adjoining Boomerang Lake Project, covers a total 135km strike of the host komatiite sequence. The focus for initial<br />

drilling will be the Acra deposit; and the prospects at Acra West and Jubilee Gossan. The exploration strategy on listing<br />

is to commence immediate drilling of previously defined down-hole ElectroMagnetic targets.<br />

• <strong>Pioneer</strong>-Wattle Dam-Higginsville project: <strong>Pioneer</strong> has acquired a major ground position of 677km 2 that covers a total<br />

of 59 kilometres of the Widgiemooltha Greenstone Belt between the Depot Dome and the Jimberlana Dyke. The<br />

Widgiemooltha Greenstone Belt is one of Australia’s most <strong>Nickel</strong> Sulphide-endowed mineral provinces, hosting the<br />

Widgiemooltha-Miitel-Redross <strong>Nickel</strong> Sulphide deposits. Substantial drilling is planned to test <strong>Nickel</strong> Sulphide<br />

intercepts and soil geochemical anomalies. The focus for initial drilling is the JH <strong>Nickel</strong> Deposit, a "<strong>Nickel</strong> Boom"<br />

discovery reported to contain 32,500t at 1.1% Ni, occurring as the secondary sulphides violarite and marcasite. The<br />

<strong>Pioneer</strong> exploration strategy is to complete detailed surface EM, prior to drilling below the secondary sulphides to test<br />

for primary <strong>Nickel</strong> Sulphides at depth.<br />

• Heazlewood project: The 147 km 2 project area covers an ultramafic complex which was a world-leading alluvial<br />

Platinum Group Metal producer a century ago. Reports of the era also document sulphide gossans and <strong>Nickel</strong> Sulphide<br />

production.<br />

There has been very little modern <strong>Nickel</strong> Sulphide exploration completed on the <strong>Pioneer</strong> tenement portfolio. <strong>Pioneer</strong>’s<br />

strategy is simple. It will be the first company to complete systematic surface ElectroMagnetic surveying with follow up<br />

drilling and down-hole ElectroMagnetic surveys on ground that has been virtually unexplored for nickel since the 1970s<br />

"<strong>Nickel</strong> Boom".<br />

2. The Proven <strong>Pioneer</strong> Team<br />

Sustained company performances reflect the quality of the team. The <strong>Pioneer</strong> team has an excellent industry track record for<br />

finding and developing ore bodies utilising:<br />

• The highest professional standards, maximising exploration expenditure into the ground;<br />

• A tightly run low cost operation, with project acquisition largely from aggressive pegging; and<br />

• Focus on discovering high value resources with the potential to develop into high margin operations.<br />

3. Favourable Commodity Outlook<br />

The <strong>Nickel</strong> Sulphide exploration strategy has been based on the Company’s view that world demand for nickel is increasing<br />

at 4-5% per annum (approximately 50,000 tonnes of increased nickel metal production per annum), driven by Chinese<br />

stainless steel demand. The limited availability of new sources of <strong>Nickel</strong> Sulphide supply is reflected in recent joint venture<br />

and off-take arrangements involving international nickel refiners. In this environment, any future exploration success will be<br />

very well rewarded.<br />

I urge you to read the <strong>Prospectus</strong> carefully before you make your investment decision, and where necessary, consult your<br />

professional adviser. The Directors would be pleased to welcome you as a Shareholder in the Company.<br />

Craig Leslie Readhead<br />

Chairman<br />

-3-

SECTION 1<br />

P1.2<br />

rospectus<br />

This <strong>Prospectus</strong> is dated 17 October 2003 and was lodged with ASIC on that date. Neither ASIC nor ASX take any<br />

responsibility for the contents of this <strong>Prospectus</strong>. No securities will be allotted or issued pursuant to this <strong>Prospectus</strong> later<br />

than 13 months after the date of this <strong>Prospectus</strong>.<br />

The Company will apply to ASX within 7 days after the date of this <strong>Prospectus</strong> for admission to the Official List of ASX<br />

and for permission for the Shares offered pursuant to this <strong>Prospectus</strong> to be listed for quotation.<br />

Before deciding to invest in <strong>Pioneer</strong>, potential investors should read the entire <strong>Prospectus</strong>. The Shares offered under this<br />

<strong>Prospectus</strong> (“Offer”) should be considered speculative. The Company is at an early stage of its development, therefore the<br />

risks associated with investing in the Company are significant. Potential investors should carefully consider these factors in<br />

light of personal circumstances (including financial and taxation issues) and seek advice from their professional adviser before<br />

deciding whether to invest. The Shares offered under this <strong>Prospectus</strong> carry no guarantee in respect to the return on capital<br />

investment, payment of dividends or the future value of the Shares.<br />

No person and/or entity is authorised to give any information or to make any representation in connection with the Offer.<br />

Any information or representation in relation to the Offer not contained in this <strong>Prospectus</strong> may not be relied on as having<br />

been authorised by the Company in connection with the Offer.<br />

This <strong>Prospectus</strong> does not constitute an offer in any place in which, or to any person to whom, it would not be lawful to<br />

make such an offer. The distribution of this <strong>Prospectus</strong> in jurisdictions outside Australia may be restricted by law and persons<br />

who come into possession of this <strong>Prospectus</strong> should seek advice on, and observe any such restrictions. Any failure to comply<br />

with such restrictions may constitute a violation of applicable securities laws.<br />

There may be a number of persons and/or entities referred to elsewhere in this <strong>Prospectus</strong> who are not experts and who have<br />

not made statements included in this <strong>Prospectus</strong>. There are no statements made in this <strong>Prospectus</strong> on the basis of any<br />

statements made by those persons and/or entities. These persons and/or entities did not consent to being named in the<br />

<strong>Prospectus</strong> and did not authorise or cause the issue of the <strong>Prospectus</strong>.<br />

Certain terms and abbreviations used in this <strong>Prospectus</strong> have defined meanings that are explained in the Section 14 Glossary<br />

of this <strong>Prospectus</strong>.<br />

Geological sketch map showing the interior<br />

Region of Western Australia. <strong>Pioneer</strong>’s projects<br />

are in the Coolgardie & Dundas Areas.<br />

Western Australia Geological Survey<br />

(By S.Goczel) © Copyright sourced by GSWA<br />

xposure Period<br />

E1.3<br />

In accordance with Chapter 6D of the Corporations Act, this <strong>Prospectus</strong> is subject to an<br />

Exposure Period of 7 days from the date of lodgement with ASIC. The period may be<br />

extended by ASIC by a further period of up to 7 days.<br />

The purpose of the Exposure Period is to enable this <strong>Prospectus</strong> to be examined by market<br />

participants prior to the raising of funds. The examination may result in the identification<br />

of deficiencies in this <strong>Prospectus</strong>. If deficiencies are detected, any application that has been<br />

received may need to be dealt with in accordance with Section 724 of the Corporations Act.<br />

Applications received prior to the expiration of the Exposure Period will not be processed<br />

until after the Exposure Period. No preference will be conferred on applications received<br />

during the Exposure Period and all applications received during the Exposure Period will be<br />

treated as if they were simultaneously received on the Opening Date.<br />

The <strong>Prospectus</strong> may also be viewed online during the Exposure Period at<br />

www.patersonord.com.au and www.pioneernickel.com.au.<br />

A read-only version of this <strong>Prospectus</strong> is available at these sites however there is no facility<br />

for online applications.<br />

A paper copy of this <strong>Prospectus</strong> containing an Application Form will be made available<br />

upon request during the Exposure Period.<br />

To obtain your paper copy of this <strong>Prospectus</strong>:<br />

Paterson Ord Minnett (Perth) - Tel: (08) 9263 1111 Fax: (08) 9325 5123<br />

<strong>Pioneer</strong> <strong>Nickel</strong> <strong>Limited</strong> - Tel: (08) 9091 6974 Fax: (08) 9022 2294<br />

-4-

<strong>Pioneer</strong> <strong>Nickel</strong> <strong>Limited</strong> <strong>Prospectus</strong><br />

M2<br />

anagement Profiles<br />

2.1 Directors & Company Secretary<br />

The <strong>Pioneer</strong> Board comprises Mr Craig Readhead as the Non-Executive Chairman, Mr David Crook as the Managing<br />

Director, and Mr Ian Buchhorn and Dr Allan Trench as Non-Executive Directors. Brief profiles are set out below:<br />

SECTION 2<br />

Craig Leslie Readhead B.Juris. LL.B.<br />

CHAIRMAN (Non-Executive)<br />

Age 49 Appointed 17 January 2003<br />

Craig Readhead is a lawyer with 25 years legal and corporate advisory experience, with specialisation in the<br />

resources sector. Mr Readhead is a partner of the law firm Pullinger Readhead Stewart and is a director of a<br />

number of listed and unlisted public companies involved in mining and exploration in Australia. Mr<br />

Readhead is the past vice president of the Association of Mining and Exploration Companies (AMEC), and<br />

past president of the Australian Mining and Petroleum Law Association (AMPLA).<br />

David John Crook B.Sc.<br />

MANAGING DIRECTOR (Executive)<br />

Age 46 Appointed 11 August 2003<br />

David Crook is a geologist with 24 years experience in relevant exploration, mining and management,<br />

predominantly within Western Australia. Mr Crook has investigated nickel sulphide, nickel laterite, gold,<br />

and other commodity resources and has an excellent discovery record. He has held senior exploration and<br />

mining operations roles, including contract negotiation and management; and corporate evaluations. Mr<br />

Crook has been the exploration manager for Heron <strong>Resources</strong> <strong>Limited</strong> for the past 7 years.<br />

Ian James Buchhorn B.Sc.(Hons) Dipl.Geosci.(Min.Econ.)<br />

DIRECTOR (Non-Executive)<br />

Age 51 Appointed 17 January 2003<br />

Ian Buchhorn is a mineral economist and geologist. Mr Buchhorn has worked on nickel, bauxite and<br />

industrial mineral mining and exploration, gold and base metal project generation, gold mine operation and<br />

in corporate evaluations. He has 30 years experience as an economic geologist, has commissioned several<br />

open cut gold mines, and has operated as a Registered Mine Manager. Mr Buchhorn, as Managing Director<br />

of Heron <strong>Resources</strong> <strong>Limited</strong>, has been actively involved with the development of <strong>Pioneer</strong>.<br />

Allan Trench B.Sc. (Hons) Ph.D. M.Sc. (Min.Econ.) M.B.A. (Oxon.)<br />

DIRECTOR (Non-Executive)<br />

Age 40 Appointed 8 September 2003<br />

Allan Trench is a mineral economist, geophysicist and business management consultant with minerals<br />

experience including nickel, gold, vanadium and mineral sands. Dr Trench led nickel sulphide exploration<br />

teams for WMC <strong>Resources</strong> in the Widgiemooltha-<strong>Pioneer</strong> and Leinster-Mt Keith regions of WA in the mid-<br />

1990s. He subsequently joined McKinsey and Company serving a number of major minerals companies with<br />

corporate strategy development and operations improvement. Dr Trench is Adjunct Associate Professor in<br />

Mineral Economics at the Western Australian School of Mines.<br />

Julie Anne Wolseley B.Comm. C.A.<br />

COMPANY SECRETARY<br />

Age 37 Appointed 11 August 2003<br />

Julie Wolseley acts as company secretary to a number of listed public companies operating in the resources<br />

sector. She has over 9 years experience as a financial controller and company secretary. Previously, Ms<br />

Wolseley was an audit manager in Australia and overseas for an international accountancy firm. Her fields<br />

of expertise include financial and management reporting in the mining industry, gold hedging portfolio<br />

management, cash flow modelling and corporate governance.<br />

-5-

SECTION 3<br />

D3<br />

etails of the Offer<br />

3.1 The Offer<br />

Pursuant to this <strong>Prospectus</strong>, the Company is offering for subscription 22.5 million Shares at an Issue Price of $0.20 per<br />

Share, to raise $4.5 million. All Shares offered under this <strong>Prospectus</strong> will rank equally with existing Shares. The rights<br />

attaching to Shares are further described in Section 12.1 of this <strong>Prospectus</strong>.<br />

The issue of 22.5 million Shares is not underwritten. However, Paterson Ord Minnett Ltd has agreed to act as Lead Manager<br />

to the Offer on the terms set out in the Mandate Agreement referred to in Section 11. The minimum subscription for this<br />

Offer is 13.5 million Shares raising $2.7 million before expenses of the Offer.<br />

The Directors reserve the right to accept oversubscriptions for up to an additional $1.0 million by issuing an additional 5.0<br />

million Shares at an Issue Price of $0.20 per Share.<br />

In accordance with the Corporations Act, no Shares will be allotted by the Company until the minimum subscription has<br />

been subscribed.<br />

3.2 How to Apply for Shares<br />

If you wish to participate in the Offer, you must complete the Application Form contained at the back of this <strong>Prospectus</strong> in<br />

accordance with the instructions set out therein.<br />

Applications must be for a minimum of 10,000 Shares representing a minimum investment of $2,000 and thereafter in<br />

multiples of 1,000 Shares.<br />

Application Forms must not be circulated to prospective investors unless accompanied by a copy of this <strong>Prospectus</strong>. A duly<br />

completed and lodged Application Form will constitute an offer by the Applicant to subscribe for the number of Shares<br />

applied for pursuant to the Application Form.<br />

The Company, in consultation with the Lead Manager, reserves the right to accept any application in whole or in part, or<br />

to reject any application.<br />

Completed application forms and cheques made payable to “<strong>Pioneer</strong> <strong>Nickel</strong> <strong>Limited</strong> – Share Offer A/C” should be lodged<br />

at the offices of Paterson Ord Minnett at:<br />

Level 23 Exchange Plaza, 2 The Esplanade, PERTH WA 6000 or 63 Hannan Street, KALGOORLIE WA 6430<br />

Or by mail to: Paterson Ord Minnett, GPO BOX W2024, PERTH WA 6846<br />

3.3 Heron <strong>Resources</strong> <strong>Limited</strong> Shareholders<br />

Through a de-merger process Heron has agreed to transfer certain assets to <strong>Pioneer</strong>. The transfer will allow the required<br />

financial resources and dedicated management to be applied to adding value to these properties.<br />

Heron will retain <strong>Nickel</strong> Laterite rights or otherwise a pre-emptive right to purchase <strong>Nickel</strong> Laterite on these properties (as<br />

summarised in Material Contracts, Section 11 of this <strong>Prospectus</strong>).<br />

Heron has received 15 million Shares in <strong>Pioneer</strong> as part consideration for transferring the <strong>Nickel</strong> Sulphide assets to <strong>Pioneer</strong>.<br />

Heron will distribute these Shares on an approximate 1 for 8 basis, at no cost, to its shareholders registered on the 28 October<br />

2003. The distribution will proceed between 6 and 24 months following the listing of <strong>Pioneer</strong> on ASX.<br />

Heron Shareholders, as at 28 October, will have a priority right to apply for <strong>Pioneer</strong> Shares at an issue price of $0.20 per<br />

<strong>Pioneer</strong> Share on a 1 for 5 entitlements basis, provided that the minimum number of shares applied for equals or exceeds<br />

10,000 Shares. To satisfy this obligation, 22.5 million shares have been set aside as a priority pool for Heron Shareholders.<br />

(“Priority Pool”).<br />

Heron shareholders registered on 28 October 2003 will be mailed a <strong>Pioneer</strong> <strong>Prospectus</strong> with a personalised pink Application<br />

Form. Heron shareholders will also receive a letter detailing their entitlement under the Heron distribution.<br />

Heron shareholders should lodge their completed pink Application Forms and cheques payable to “<strong>Pioneer</strong> <strong>Nickel</strong> <strong>Limited</strong><br />

- Share Offer A/C” with the share registry:<br />

Security Transfer Registrars Pty <strong>Limited</strong>, 770 Canning Highway, APPLECROSS WA 6153<br />

Or by mail to: Security Transfer Registrars Pty <strong>Limited</strong>, PO Box 535, APPLECROSS WA 6953<br />

The right to access the Priority Pool requires Heron shareholders to lodge their completed pink Application Forms and<br />

cheques with the share registry on or before 5.00pm WST 12 November 2003. In the event that Heron Shareholders’<br />

applications for Shares from the Priority Pool exceeds 22.5 million Shares, the Directors reserve the right to scale applications<br />

that have been made for more than 10,000 Shares and otherwise deal with the applications in their absolute discretion.<br />

-6-

<strong>Pioneer</strong> <strong>Nickel</strong> <strong>Limited</strong> <strong>Prospectus</strong><br />

3.4 Indicative Timetable<br />

<strong>Prospectus</strong> lodgement with ASIC and ASX 17 October 2003<br />

Exposure Period ends 23 October 2003<br />

Opening Date 24 October 2003<br />

Record Date (for entitlement to <strong>Pioneer</strong> In Specie Shares and to receive a <strong>Prospectus</strong>) 28 October 2003<br />

Closing Date for Heron shareholders’ priority allocations 12 November 2003<br />

Closing Date for applications for shares 21 November 2003<br />

Holding Statements to be dispatched 28 November 2003<br />

Expected Date of Official Quotation of Shares on ASX 5 December 2003<br />

SECTION 3<br />

The Offer opens at 9:00am WST on the Opening Date and closes at 5:00pm WST on the Closing Date.<br />

The above dates are indicative only and may vary. The Company, in consultation with the Lead Manager to the Offer,<br />

reserves the right to vary the dates and times of the Offer under this <strong>Prospectus</strong>, including the Closing Date, without prior<br />

notice. This may impact on the other dates as shown.<br />

3.5 Lead Manager to the Offer<br />

The Offer of $4.5 million is facilitated by Paterson Ord Minnett Ltd (“Lead Manager”), a participating organisation of the<br />

ASX, who will perform the role of Lead Manager to the Offer subject to certain conditions and termination events. A<br />

summary of the Mandate Agreement including the circumstances in which the agreement can be terminated, is contained<br />

in Section 11 of this <strong>Prospectus</strong>. Under the terms of the Mandate Agreement, the Company will, in consultation with the<br />

Lead Manager, nominate subscribers for the Shares.<br />

The Lead Manager will receive a fee and a commission on the amount raised, including any oversubscriptions, as specified<br />

in the Mandate Agreement.<br />

If, for any reason the minimum amount has not been raised within 4 months after the date of this <strong>Prospectus</strong>, all application<br />

monies will be refunded in accordance with the Corporations Act.<br />

Applications received and accepted which bear the identification mark of an entity that is a member of ASX, or holds a<br />

Security Dealer’s Licence by ASIC, will entitle the entity to receive a 4% handling fee payable by the Company.<br />

3.6 Application Money held in Trust<br />

Application money will be held in trust in a separate bank account on behalf of Applicants until the Shares are issued. If<br />

any application is rejected in whole or in part, the amount tendered in respect of those Shares that have not been issued will<br />

be repaid to the unsuccessful Applicant without interest.<br />

3.7 Issue of Shares<br />

The issue of Shares to successful Applicants will occur as soon as practicable<br />

after applications and application monies have been received for all the Shares<br />

being offered (subject to the minimum subscription being raised and ASX<br />

granting the Company conditional approval to be admitted to the Official<br />

List), following which holding statements will be dispatched. It is the<br />

responsibility of Applicants to determine their allocation prior to trading in<br />

the Shares. Applicants who sell the Shares before they receive their holding<br />

statement will do so at their own risk.<br />

David Crook mapping ultramafic rock, which helped develop<br />

the exploration model to be used in <strong>Pioneer</strong>’s followup drilling.<br />

Komatiite is a form of ultramafic rock often associated<br />

with <strong>Nickel</strong> Sulphide deposits.<br />

-7-

SECTION 3<br />

3.8 Australian Stock Exchange Listing<br />

The Company will apply to ASX within 7 days from the date of this <strong>Prospectus</strong> for the Company to be admitted to the Official<br />

List and for Official Quotation of:<br />

a) the Shares issued under this <strong>Prospectus</strong>; and<br />

b) existing Shares other than those existing Shares that are, or that ASX is likely to treat as, restricted securities as defined in<br />

ASX Listing Rules.<br />

If granted, Official Quotation of the Shares will commence as soon as practicable after the allotment of the Shares.<br />

ASX takes no responsibility for the contents of this <strong>Prospectus</strong>. The fact that ASX may admit the Company to the Official List is<br />

not to be taken in any way as an indication by ASX of the merits of the Company or the Shares offered under this <strong>Prospectus</strong>.<br />

If the Company is not admitted to the Official List within 3 months after the date of this <strong>Prospectus</strong>, none of the Shares offered<br />

under this <strong>Prospectus</strong> will be allotted and all application monies will be refunded without interest as soon as practicable.<br />

3.9 CHESS System<br />

Upon the Company being admitted to the Official List, it will be admitted to participate in CHESS in accordance with ASX<br />

Listing Rules and the SCH Business Rules. On admission to CHESS, the Company will operate an electronic issuer sponsored<br />

sub-register and an electronic CHESS sub-register. The two sub-registers together will make up the Company’s principal register<br />

of securities.<br />

The Company will not issue certificates to Shareholders. Instead, Shareholders who elect to hold their Shares on the issuersponsored<br />

sub-register will be provided with a holding statement (similar to a bank account statement), which sets out the number<br />

of Shares allotted to them under this <strong>Prospectus</strong>. For Shareholders who elect to hold their Shares on the CHESS sub-register, the<br />

Company will, on allotment, issue an advice to Shareholders that sets out the number of Shares allotted to the Shareholder and,<br />

at the end of the month following the allotment, CHESS (acting on behalf of the Company) will provide Shareholders with a<br />

holding statement that confirms the number of Shares allotted.<br />

A holding statement (whether issued by CHESS or the Company) will also provide details of a Shareholder’s Holder Identification<br />

Number (in the case of the holding on the CHESS sub-register) or Shareholder Reference Number (in the case of a holding on<br />

the issuer sponsored sub-register). Following distribution of these initial holding statements, a holding statement will only<br />

routinely be provided at the end of any subsequent month during which the balance of the Shareholder’s holding of Shares changes.<br />

3.10 Restricted Securities<br />

Securities on issue as at the date of this <strong>Prospectus</strong> may be subject to the restricted securities provisions of the ASX Listing Rules.<br />

These may include:<br />

• 400,000 Shares subscribed to by the Managing Director, D Crook.<br />

• 1,000,000 Vendor Shares issued to Kurana Pty Ltd as vendor consideration for sale of the Wattle Dam project.<br />

• In Specie Shares initially held in trust by Heron and those in Specie Shares to be distributed to the related parties, being<br />

C Readhead, I Buchhorn, D Crook and A Trench and/or their spouses, children and parents and controlled entities, all of<br />

whom may hold Heron shares at the In Specie Share Record Date.<br />

• 3,500,000 unlisted options issued to Heron (Refer Section 11).<br />

• 2,400,000 unlisted options issued to Directors of <strong>Pioneer</strong> and/or Heron.<br />

Accordingly, such securities may be required to be held in escrow for up to 24 months and may not be transferred, assigned or<br />

otherwise disposed of during that period. These agreements will be entered into in accordance with the ASX Listing Rules. The<br />

ASX has provided in principle advice that once the <strong>Pioneer</strong> In-Specie Shares are distributed to Heron shareholders, these will be<br />

freely tradeable upon issue (other than the restrictions mentioned above).<br />

3.11 Non-Resident Investors<br />

This <strong>Prospectus</strong> does not constitute an offer or invitation in any place in which, or to any person to whom, it would not be lawful<br />

to make such an offer or extend such an invitation.<br />

No action has been taken to register or qualify the Shares or the Offer or otherwise to permit a public offering of the Shares in any<br />

jurisdiction outside Australia. It is the responsibility of non-Australian resident investors to obtain all necessary approvals for the<br />

issue to them of Shares under this <strong>Prospectus</strong>.<br />

3.12 Privacy Disclosure<br />

The Company collects information in relation to each Applicant as provided on the Application Form for the purpose of processing<br />

the Application Form, and should the application be successful, to administer the Applicant’s security holding in the Company.<br />

The Company may use such information for the purpose of administering the applicant’s security holding and the Company may<br />

disclose such information to the Lead Manager, share registry, the Company’s related bodies, corporate agents, contractors and<br />

third party service providers, and to ASX, ASIC, and other regulatory authorities.<br />

-8-

<strong>Pioneer</strong> <strong>Nickel</strong> <strong>Limited</strong> <strong>Prospectus</strong><br />

4<br />

nvestment Summary<br />

IThe information set out in this Section is not intended to be comprehensive and should be read in conjunction with the<br />

more detailed information appearing elsewhere in this <strong>Prospectus</strong>.<br />

4.1 <strong>Pioneer</strong> <strong>Nickel</strong> <strong>Limited</strong><br />

<strong>Pioneer</strong> plans to issue 22.5 million Shares at $0.20 each to raise $4.5 million, with a right to accept oversubscriptions of up<br />

to $1.0 million. With 16 million Vendor Shares and 0.4 million Shares subscribed by the Managing Director already on<br />

issue, the total issued capital of <strong>Pioneer</strong> on listing will be approximately 38.9 million Shares (excluding any<br />

oversubscriptions), with a nominal market capitalisation of $7.8 million.<br />

<strong>Pioneer</strong>’s corporate base is Kalgoorlie, Western Australia.<br />

SECTION 4<br />

4.2 Tenements<br />

The Directors of <strong>Pioneer</strong> believe that the discovery potential for the Company’s Eastern Goldfields nickel projects is very<br />

strong, occurring as they do within mineralised Archaean komatiites that support operating <strong>Nickel</strong> Suphide mines in close<br />

proximity. The Eastern Goldfields has been recognised as a world-class nickel province since the 1966 Kambalda discovery,<br />

with individual mines typically ranging in size between 10,000 to 100,000 tonne of contained nickel metal.<br />

The Directors will also seek exposure to geological provinces with the potential to host a world-class nickel mine with<br />

potential for 1,000,000 tonne of contained nickel metal. These tend to be hosted by post-Archaean layered mafic complexes,<br />

with the great world examples including the Proterozoic Voiseys Bay and Triassic Noril’sk deposits. This strategy for larger<br />

discoveries has led the Company to the Heazlewood project in Northwest Tasmania.<br />

Eastern Goldfields Province, Western Australia<br />

The <strong>Pioneer</strong> tenement portfolio provides a large landholding of 2,433km 2 , predominantly over one of the best documented<br />

Eastern Goldfields komatiite <strong>Nickel</strong> Sulphide provinces, the <strong>Pioneer</strong> - Widgiemooltha - Depot Domes. These structures are<br />

easily accessed and are associated with excellent infrastructure.<br />

The area is considered by the Independent Geologist to be very prospective and to have production potential for nickel and<br />

copper, with existing drill targets defined through the application of detailed Transient ElectroMagnetic (“TEM”) and<br />

magnetic surveys in conjunction with innovative low detection limit surface geochemistry. This exploration methodology<br />

will continue as the strategy for future discoveries.<br />

The area is also considered to be prospective for gold and Platinum Group Metals (“PGM”).<br />

Northwest Tasmania<br />

The Heazlewood project geological setting is considered analogous with the Noril’sk copper-nickel-PGM mining centre of<br />

Siberia, the world’s largest nickel producer. Both mineralised districts occur at intra-cratonic rift “triple junction” flexures,<br />

respectively at the northwestern craton margin of the Siberian Platform for Noril’sk, and Tyennan Platform for Heazlewood.<br />

The Company has lodged a tenement application covering known nickel-copper-PGM mineralisation associated with the<br />

Heazlewood ultramafic to mafic intrusive complex, including the Brassey Creek and Fentons Knob <strong>Nickel</strong> Sulphide<br />

workings.<br />

Although Heazlewood is a conceptual target, the Directors are keen to support the management team in testing such low<br />

financial risk-potentially high reward targets.<br />

The Tynan Family, ca 1890<br />

The Tynan Family was typical of Australia’s nineteenth century<br />

mining pioneers. Patriach Daniel Tynan (standing, back row<br />

right) as a young man was a labourer on a silver mine near<br />

Gumeracha, South Australia. The family variously lived at<br />

Moonta, then Broken Hill and finally Kalgoorlie-Boulder, as new<br />

mining centres were opened up. Matriach Elizabeth Tynan<br />

(seated, centre) is buried in Boulder Cemetry.<br />

-9-

SECTION 4<br />

4.3 Company Objectives<br />

The Company’s aim is to discover and develop high value nickel resources within the Eastern Goldfields region of Western<br />

Australia, northwest Tasmania and elsewhere.<br />

<strong>Pioneer</strong>’s management strategy and corporate plan is to:<br />

Rapidly build shareholder wealth<br />

• Capital growth potential from the discovery of, and production from, <strong>Nickel</strong> Sulphide mines. With its 100%-owned<br />

tenements on the <strong>Pioneer</strong>-Widgiemooltha-Depot Domes, <strong>Pioneer</strong> is extremely well positioned in a world-class nickel<br />

province to generate an early cash flow through exploration success from advanced stage targets.<br />

• Undertake best practice exploration emphasising an expeditious and cost-effective campaign on those targets most likely<br />

to generate mineable resources.<br />

Maximise project values<br />

• Use economic evaluations to ensure that the targets being sought can deliver a low cost position on the nickel industry<br />

production cost curve. For a company at <strong>Pioneer</strong>’s stage of development, this means targeting high-grade deposits with<br />

high contained nickel tonnes per vertical metre, as seen in the Kambalda district.<br />

• Maintain an evolving list of projects from grass-roots exploration through to advanced resource drilling. Emerging<br />

projects will continually compete against more mature projects already in the <strong>Pioneer</strong> portfolio.<br />

Create high-reward opportunities at limited risk<br />

• Build up large, continuous tenement holdings overlying endowed geological structures which will be attractive as<br />

development projects for furture partners or project funders.<br />

• Manage the risk of its large tenement holding by continuing to enter into joint ventures. <strong>Pioneer</strong> will usually seek<br />

provision to be free-carried to the commencement of mining and a royalty option.<br />

Operate as a responsible corporate citizen<br />

• Adhere to the highest standards of corporate governance.<br />

• Conduct operations in a safe and environmentally responsible manner.<br />

• Offer employment opportunities to those who live in the exploration project areas.<br />

• Respect the indigenous culture of the exploration provinces.<br />

• Promote social and economic development for the traditional custodians of <strong>Pioneer</strong>’s exploration projects.<br />

4.4 Purpose of the Offer<br />

The purpose of this Offer is to raise funds to:<br />

• Explore and develop the Company’s tenements and projects described in this <strong>Prospectus</strong>, with early focus on the <strong>Pioneer</strong>-<br />

Widgiemooltha-Depot Domes and Acra project.<br />

• Provide funds to implement the planned exploration programs on the tenements and, where appropriate, acquire further<br />

strategic interests.<br />

• Ensure <strong>Pioneer</strong> is in a competitive position to tender for <strong>Nickel</strong> Sulphide resources and production opportunities as and<br />

when they may arise.<br />

• Meet the administrative costs of the Company and the expenses of the Offer, in addition to repaying an unsecured interestfree<br />

loan from Heron (representing management fees, initial tenement acquisition costs as well as establishing and preparing<br />

the Company for the IPO).<br />

4.5 Use of Funds<br />

The net funds raised by this Offer (after paying all costs of the Offer and start-up costs paid by Heron) are expected to provide the<br />

Company with a minimum of $3.7 million in working capital.<br />

The application of funds raised under the Offer will be as follows:<br />

$ million<br />

IPO funds 4.5<br />

Offer costs (Lead Manager and Brokers) (0.3)<br />

Repayment of loan and management fee to Heron (0.2)<br />

Other Offer costs (stamp duty, independent experts and creditors) (0.3)<br />

Exploration programs, administration and working capital for two years 3.7<br />

If only the minimum subscription is raised, funds available for exploration, administration and working capital will be reduced to<br />

$2.01 million.<br />

-10-

<strong>Pioneer</strong> <strong>Nickel</strong> <strong>Limited</strong> <strong>Prospectus</strong><br />

4.6 Working Capital Adequacy<br />

The Directors are satisfied that upon completion of the Offer through meeting the minimum subscription of $2.7 million,<br />

the Company will have sufficient working capital to meet its stated objectives.<br />

4.7 Capital Structure<br />

The capital structure of the Company following completion of the Offer is summarised below:<br />

SECTION 4<br />

Shareholders<br />

Shares<br />

Heron Subscriber Shares 10<br />

Managing Director Shares 1 400,000<br />

Vendor Shares for later In Specie Share Distribution to Heron shareholders 2 15,000,000<br />

Vendor Shares to Kurana 3 1,000,000<br />

Initial Public Offer ($4.5 million) 4 22,500,000<br />

Sub Total 38,900,010<br />

Oversubscriptions 5,000,000<br />

Total Issued Shares (including oversubscriptions) 43,900,010<br />

Optionholders 5<br />

Unlisted Options<br />

<strong>Pioneer</strong> Directors, management and Heron employees 3,500,000<br />

Vendor Options issued to Heron 3,500,000<br />

Total 7,000,000<br />

1 Shares subscribed for by D Crook at an issue price of $0.07 per Share.<br />

2 Distribution basis to be approximately 1 for 8 entitlement to be distributed between 6 and 24 months after ASX listing.<br />

3 Shares issued to Kurana Pty Ltd at an issue price of $0.03 per share (see Summary of Material Contracts Section 11).<br />

4 If the minimum subscription of $2,700,000 is raised then 13,500,000 Shares will be issued and the total issued shares will be<br />

reduced to 29,900,010.<br />

5 The terms of the Options appear in Section 12.2 of the <strong>Prospectus</strong>.<br />

4.8 Risk Factors<br />

Prospective investors in the Company should be aware that subscribing for Shares<br />

in the Company involves a number of risks. The key risk factors of which investors<br />

should be aware are described in Section 6 of this <strong>Prospectus</strong>. Investors are urged<br />

to consider these risks carefully before deciding whether to invest in the Company.<br />

<strong>Pioneer</strong>’s planned exploration programs<br />

have a strong emphasis on drilling.<br />

Drilling will commence at Acra immediately<br />

after <strong>Pioneer</strong> lists on the ASX.<br />

-11-

SECTION 5<br />

C5<br />

ompany and Project Overview<br />

5.1 Company Overview & Exploration Strategy<br />

Corporate Strategy<br />

<strong>Pioneer</strong> <strong>Nickel</strong> <strong>Limited</strong> is a specialist nickel exploration company seeking to develop <strong>Nickel</strong> Sulphide deposits in the region of the<br />

<strong>Pioneer</strong>-Widgiemooltha-Depot Domes south and west of Kambalda, and the Acra-Silver Swan region northeast of Kalgoorlie, Western<br />

Australia.<br />

<strong>Pioneer</strong>’s aim is to leverage off its expertise in nickel project acquisition, by employing a modern, well funded exploration strategy<br />

involving systematic TEM and drill exploration of the acquired projects, to explore for <strong>Nickel</strong> Sulphides.<br />

In addition, <strong>Pioneer</strong> will seek to develop strategic relationships with established nickel industry participants.<br />

Total world nickel demand is approximately 1,200,000 tonnes per annum, with the annual rate of demand forecast to increase at 4-<br />

5% per annum. This will require nickel industry production growth of some 50,000 tonnes of new metal each year. <strong>Nickel</strong>, as a<br />

commodity, therefore has an excellent short to medium term outlook, being particularly driven by ever-increasing nickel demand in<br />

the Chinese stainless steel market.<br />

In Western Australia, the nickel industry commenced with the 1966 Kambalda <strong>Nickel</strong> Sulphide discovery. The West Australian<br />

industry is now a top four leader in the world market, with a fully integrated industry.<br />

<strong>Pioneer</strong> has acquired the JH and BB <strong>Nickel</strong> Sulphide deposits from WMC <strong>Resources</strong> <strong>Limited</strong>, and as part of the acquisition,<br />

granted to WMC <strong>Resources</strong> <strong>Limited</strong> a first right to negotiate an ore purchase agreement.<br />

Geochemical Exploration<br />

<strong>Pioneer</strong>’s exploration will target <strong>Nickel</strong> Sulphide deposits and utilise appropriate geochemical techniques to detect soil and bedrock<br />

anomalies that can generate TEM and drill targets.<br />

-12-

<strong>Pioneer</strong> <strong>Nickel</strong> <strong>Limited</strong> <strong>Prospectus</strong><br />

Acra TMI Image with TEM Interpretation<br />

SECTION 5<br />

Figure 2. TEM Survey traverse showing conductor locations<br />

Transient ElectroMagnetic Exploration<br />

<strong>Nickel</strong> Sulphide mineralisation is a conductor, which is the mineralisation property<br />

detected in TEM surveys.<br />

Surface TEM<br />

The Emily Ann, Cosmos, Waterloo, and other <strong>Nickel</strong> Sulphide mines and deposits were<br />

all discovered in the past five years predominantly using surface ElectroMagnetic<br />

methods.<br />

Surface TEM techniques include:<br />

• Fixed Loop TEM (“FLTEM”); and<br />

• Moving Loop TEM (“MLTEM”).<br />

These are used in conjunction, to locate conductors including massive <strong>Nickel</strong> Sulphide.<br />

TEM surveys are planned at Acra, <strong>Pioneer</strong> and Wattle Dam immediately following<br />

<strong>Pioneer</strong> listing.<br />

Off-end of drill hole conductor<br />

Down Hole TEM<br />

Komatiite-hosted <strong>Nickel</strong> Sulphide mineralisation commonly has a “pipe-like” or “cigar”<br />

shaped geometry, with a spectacular down plunge continuity often in the order of 1,000m. High grade <strong>Nickel</strong> Sulphide shoots<br />

may have a limited horizontal extent, particularly when the plunge is steep. Silver Swan is the classic example of this ore style. When<br />

drilling <strong>Nickel</strong> Sulphide targets it is essential that Down Hole Transient ElectroMagnetic (“DHTEM”) surveys be completed to test<br />

for EM conductors not actually intersected by the drill hole. DHTEM can detect conductors within 100m of the drill hole.<br />

Director Allan Trench is an industry-acknowledged expert in this field. <strong>Pioneer</strong> is most fortunate to be able to draw on the expertise<br />

of Dr Trench in this highly specialised area of exploration.<br />

Drilling<br />

Conventional Reverse Circulation (“RC”) and diamond drilling will be undertaken as necessary to test for high grade <strong>Nickel</strong><br />

Sulphide.<br />

Drilling will commence immediately upon listing at the Acra project, followed by <strong>Pioneer</strong>; and further drilling will be scheduled<br />

for Wattle Dam and Higginsville as TEM targets are generated.<br />

-13-<br />

Total Magnetic Intensity (TMI)<br />

imagery is used to identify the<br />

magnetic ultramafic units here at<br />

Acra, including locating the<br />

prospective basal contact. Ultramafic<br />

rocks have the red hues in the image.<br />

Surface TEM surveys located<br />

conductors, marked as various<br />

coloured dots (depending on the<br />

intensity of the conductor). <strong>Nickel</strong><br />

Sulphide mineralisation is an<br />

excellent conductor.<br />

Drill holes are sited to test<br />

resulting targets.<br />

LEGEND<br />

Proposed drill hole<br />

Possible conductor<br />

Weak conductor<br />

Low-Moderate conductor<br />

Moderate conductor<br />

Strong conductor

SECTION 5<br />

<strong>Pioneer</strong> Tenement Portfolio<br />

Acquisition Strategy<br />

Two strategies have guided the<br />

acquisition of the <strong>Pioneer</strong> <strong>Nickel</strong><br />

Sulphide project portfolio:<br />

1. For the Eastern Goldfields, the<br />

aim is to generate early cash<br />

flow through various production<br />

alliances, in what are essentially<br />

“brownfields” exploration<br />

settings.<br />

2. For Northwest Tasmania, the<br />

aim is to discover a world class<br />

<strong>Nickel</strong> Sulphide system in a<br />

“greenfields” exploration setting.<br />

LEGEND<br />

<strong>Nickel</strong> Deposits<br />

<strong>Nickel</strong> Mines (suspended)<br />

<strong>Nickel</strong> Mines (operational)<br />

Town<br />

-14-<br />

Figure 3

<strong>Pioneer</strong> <strong>Nickel</strong> <strong>Limited</strong> <strong>Prospectus</strong><br />

5.2 Project Overview<br />

ACRA PROJECT<br />

The sulphidated Acra komatiite channel has <strong>Nickel</strong> Sulphide mineralisation identified in drilling over a strike of 200 metres,<br />

which is open at depth. DHTEM has detected a very strong response in ARC-02, considered consistent with the presence of<br />

massive sulphides, located 100m along strike of drilling which intersected 74m of disseminated <strong>Nickel</strong> Sulphides.<br />

Better drill results from Acra include:<br />

• 21m at 0.5% Ni in AD-013;<br />

• 18m at 0.6% Ni in ARC-003; and<br />

• 0.27m of massive sulphide at 4.36% Ni in AD-004<br />

<strong>Pioneer</strong>’s independent geological review has confirmed the Acra project to be a very high priority <strong>Nickel</strong> Sulphide target.<br />

SECTION 5<br />

PIONEER PROJECT<br />

The <strong>Pioneer</strong> project contains ultramafic stratigraphy that correlates with the mine sequences at Miitel, Redross and Mt Edwards<br />

<strong>Nickel</strong> Sulphide mines.<br />

Better drill results from <strong>Pioneer</strong> include:<br />

• 0.6m at 3.9% Ni in JH4;<br />

• 3.2m at 3.2% Ni in JH8;<br />

The JH Deposit is reported to contain 32,500 tonne at 1.1% Ni (not JORC standard).<br />

In addition to testing for down plunge extensions to the JH and BB Deposits, aeromagnetic interpretation by <strong>Pioneer</strong> has<br />

located additional discrete zones of thickening within the ultramafic stratigraphy, consistent with the presence of further<br />

komatiite channels.<br />

WATTLE DAM PROJECT<br />

The Spargoville mine sequence komatiite unit at Wattle Dam includes the immediate strike extensions of the Spargoville 1A,<br />

5A, 5B, Andrews and Mt Edwards <strong>Nickel</strong> Sulphide mines.<br />

Soil geochemistry shows Wattle Dam to be highly anomalous, with coincident nickel and copper values over the Spargoville<br />

Mine sequence, providing immediate targets for surface TEM and drilling.<br />

HIGGINSVILLE PROJECT<br />

The Higginsville project targets the <strong>Pioneer</strong> ultramafic unit along the western and southern margin of the <strong>Pioneer</strong> Dome. The<br />

project includes the Spinifex <strong>Nickel</strong> Sulphide prospect, with excellent coincident Ni-Cu-PGM soil anomalism, and the 399<br />

Prospect, with high order Ni-Cu anomalism adjacent to the Jimberlana Dyke. Neither anomaly has previously been drill tested.<br />

Aeromagnetic interpretation by <strong>Pioneer</strong> indicates the presence of discrete komatiite channels associated with the soil anomalies,<br />

which will form the focus of <strong>Pioneer</strong>’s exploration.<br />

MAGGIE HAYS LAKE JOINT VENTURE PROJECT<br />

<strong>Pioneer</strong> has entered into a joint venture with LionOre Australia (<strong>Nickel</strong>) Pty Ltd to explore the Maggie Hays Lake prospect,<br />

whereby LionOre may earn a 70% interest in the project through expending $200,000.<br />

MLTEM and FLTEM surveys have identified a deep bedrock TEM anomaly, similar to the response that could be expected for<br />

<strong>Nickel</strong> Sulphide mineralisation. This occurs 5km SE along strike from the Maggie Hays <strong>Nickel</strong> Sulphide mine and remains<br />

undrilled.<br />

Shallow Rotary Air Blast (“RAB”) drilling confirms the prospectivity of the target with analyses up to 10m at 0.4% Ni, and<br />

with anomalous in Cu and PGM.<br />

SILVER SWAN NORTHWEST PROJECT<br />

Silver Swan Northwest project covers komatiite sequences on the east limb of the Scotia Kanowna Anticline, 6.5km NW along<br />

strike of the Silver Swan <strong>Nickel</strong> Sulphide mine. Regional aeromagnetic studies confirm the association of ultramafic channels<br />

to the known <strong>Nickel</strong> Sulphide deposits at Silver Swan and Scotia, respectively immediately South and West of the project area.<br />

BOOMERANG LAKE PROJECT<br />

The Boomerang Lake project covers 66km of strike of the Emu Fault, with associated ultramafic channel units.<br />

At Binti Binti immediately south of the project, previous drilling has been reported as returning 0.3m at 7.6% Ni and 1.0m at<br />

2.3% Ni. This confirms the <strong>Nickel</strong> Sulphide endowment of the Boomerang Lake Komatiite belt.<br />

-15-

SECTION 5<br />

5.3 Proposed Budget<br />

On full subscription (excluding oversubscriptions), the $4.5 million raised will provide available funds of approximately $3.7<br />

million (after payment of the issue costs, repayment of the loan to Heron and management fee detailed in Section 12.11 of<br />

this <strong>Prospectus</strong>).<br />

As detailed in Section 3.1 of this <strong>Prospectus</strong>, the minimum subscription to be raised under the Offer is $2.7 million.<br />

The Directors believe that the Company will have sufficient working capital to enable it to complete the exploration and<br />

evaluation programs described in Section 7 of this <strong>Prospectus</strong> and as detailed below:<br />

Of the available funds, $3.12 million (or 91% of funds raised net of loan repayments and issue costs) is allocated to project<br />

evaluation and associated exploration programs.<br />

The following table assumes that the full amount of $4.5 million is raised (from which the issue costs, repayment of the Heron<br />

loan and other costs as detailed in Section 4.5 of approximately $0.8 million will be paid), and that the Company will complete<br />

the evaluation and exploration programs detailed within Section 7 of this <strong>Prospectus</strong> within two years of listing:<br />

Applications of Funds from Raising $4.5 million (Net $3.72 million)<br />

Fully Subscribed<br />

Minimum<br />

$4.5 Million Raising Deductions $2.7 Million Raising Deductions<br />

(million) (million) (million) (million)<br />

Shares Issued 22,500,000 13,500,000<br />

Capital Raising $4.50 $2.70<br />

Repayment of loan to Heron ($0.11) ($0.11)<br />

Payment of Management fee to Heron ($0.10) ($0.10)<br />

Payment of creditors relating<br />

to issue costs of the Offer ($0.57) ($0.48)<br />

Available Post IPO $3.72 $2.01<br />

First Years’ Administration ($0.30) ($0.30)<br />

Available for exploration $3.42 $1.71<br />

Application of available Funds Year 1 Year 2 Total<br />

Full Subscription Model (million) (million) (million)<br />

Proposed Exploration Expenditure $ 1.43 $ 1.69 $ 3.12<br />

Corporate Administration $ 0.30 $ 0.30 $ 0.60<br />

Total Funds Available $ 1.73 $ 1.99 $ 3.72<br />

The Company may also accept oversubscriptions of up to 5.0 million Shares to raise a further $1.0 million.<br />

If oversubscriptions are received, the additional funds over and<br />

above the budget will be specifically directed towards additional<br />

drilling campaigns.<br />

<strong>Pioneer</strong> intends to actively review and pursue "Emerging Projects."<br />

The introduction and work on the emerging projects will facilitate<br />

testing of new exploration concepts and assessing new property<br />

offers. These new projects may ultimately displace established<br />

projects that no longer meet Company objectives. Projects that no<br />

longer fit the Company strategy or priority for funds will be offered<br />

for joint venture to other companies or otherwise divested.<br />

Detailed exploration budgets on all leading <strong>Pioneer</strong> projects are<br />

shown in Section 7 of this <strong>Prospectus</strong>.<br />

During the Great Depression of the 1930s, mining was the mainstay of<br />

regional Australia. Remote mining camps were supplied by camel trains.<br />

-16-

<strong>Pioneer</strong> <strong>Nickel</strong> <strong>Limited</strong> <strong>Prospectus</strong><br />

The Company proposes to<br />

adopt the following budget<br />

in relation to carrying out<br />

the exploration program<br />

and the development of its<br />

tenements:<br />

Exploration Budget: Full Subscription Model Year 1 Year 2 Total<br />

(million) (million) (million)<br />

Data Acquisition/Interpretation $ 0.09 $ 0.04 $ 0.13<br />

Technical Support (Salaries/Wages/Consultants) $ 0.11 $ 0.11 $ 0.22<br />

Geochemical Surveys $ 0.07 $ 0.06 $ 0.13<br />

Ground Geophysical Surveys $ 0.12 $ 0.11 $ 0.23<br />

DHTEM Surveys $ 0.06 $ 0.14 $ 0.20<br />

Geochemical Drilling $ 0.18 $ 0.23 $ 0.41<br />

Reverse Circulation Drilling $ 0.43 $ 0.56 $ 1.00<br />

Diamond Core Drilling $ 0.05 $ 0.10 $ 0.15<br />

Vehicles/ Field Support $ 0.08 $ 0.10 $ 0.18<br />

General Overheads $ 0.24 $ 0.24 $ 0.48<br />

Subtotal $ 1.43 $ 1.69 $ 3.12<br />

Corporate Administration $ 0.30 $ 0.30 $ 0.60<br />

Total $ 1.73 $ 1.99 $ 3.72<br />

SECTION 5<br />

If the minimum subscription of $2.7 million<br />

is raised, and the net funds available for<br />

exploration programs is $1.41 million, the<br />

amended exploration programs will consist of<br />

the Year 1 and Year 2 budget as described in<br />

the following tables.<br />

Application of available Funds Year 1 Year 2 Total<br />

Minimum Subscription Model (million) (million) (million)<br />

Proposed Exploration Expenditure $ 0.76 $ 0.65 $ 1.41<br />

Corporate Administration $ 0.30 $ 0.30 $ 0.60<br />

Total Funds Available $ 1.06 $ 0.95 $ 2.01<br />

In this situation, first year expenditure would be directed toward drilling priority targets at the Acra and <strong>Pioneer</strong> projects. Data<br />

research and database compilation will be completed for the other <strong>Pioneer</strong> projects bearing in mind that some of the tenements<br />

are applications with no current expenditure requirement. Joint venture partners will be sought as a means of achieving<br />

expenditure on the granted tenements, with <strong>Pioneer</strong> seeking to retain an interest on a “free carried” basis until the commencement<br />

of mining.<br />

Exploration Budget: Minimum Subscription Model Year 1 Year 2 Total<br />

(million) (million) (million)<br />

Data Acquisition/Interpretation $ 0.08 $ 0.02 $ 0.10<br />

Technical Support (Salaries/Wages/Consultants) $ 0.16 $ 0.07 $ 0.23<br />

Geochemical Surveys $ 0.02 $ - $ 0.02<br />

Ground Geophysical Surveys $ 0.05 $ 0.05 $ 0.10<br />

DHTEM Surveys $ 0.03 $ 0.03 $ 0.06<br />

Geochemical Drilling $ 0.01 $ 0.01 $ 0.02<br />

Reverse Circulation Drilling $ 0.21 $ 0.27 $ 0.48<br />

Vehicles/ Field Support $ 0.03 $ 0.03 $ 0.06<br />

General Overheads $ 0.17 $ 0.17 $ 0.34<br />

Subtotal $ 0.76 $ 0.65 $ 1.41<br />

Corporate Administration $ 0.30 $ 0.30 $ 0.60<br />

Total Expenditure $ 1.06 $ 0.95 $ 2.01<br />

<strong>Pioneer</strong> intends to continually monitor its exploration program to ensure that it adopts the most efficient and cost-effective<br />

approach following ongoing review of the results of each stage of the program. This will involve prioritising mineralisation that<br />

has the potential to satisfy the Company’s objectives for profitable and long life mining projects. <strong>Pioneer</strong> also intends to review<br />

any acquisition opportunities that may further advance the Company’s objectives.<br />

The full subscription, two year exploration budget totals $3.7 million and is the best estimate available based upon the Company’s<br />

present knowledge of the projects and assumes that the projects will continue to show potential for economic ore deposits. Some<br />

budget needs of the Company are well established, such as the expenses of the Offer and the repayment of the Heron loan.<br />

However, it must be recognised that all exploration budgets are subject to change as the proposed programs may vary depending<br />

on the exploration success and as new opportunities are identified and evaluated. Budget outlays can be reduced by farming out<br />

exploration expenditure in return for equity in the project. As applications are granted within the program period <strong>Pioneer</strong> will<br />

adjust its expenditure to ensure the minimum statutory expenditure requirements are satisfied. To the extent that these<br />

requirements cannot be satisfied with existing funds, <strong>Pioneer</strong> is likely to selectively divest non-priority ground or will seek to raise<br />

additional funds.<br />

-17-

SECTION 6<br />

R6<br />

isk Factors<br />

The Shares offered under this <strong>Prospectus</strong> should be considered speculative because of the nature of the business activities of<br />

the Company. While the Directors commend the Offer, potential investors should consider whether the Shares offered are<br />

a suitable investment having regard to their own personal investment objectives, financial circumstances and the risk factors<br />

set out below. This list is not exhaustive and potential investors should read this <strong>Prospectus</strong> in its entirety and should in any<br />

event consult their professional adviser before deciding whether to participate in the Offer.<br />

6.1 Key Personnel<br />

The success of <strong>Pioneer</strong> is strongly dependent on the Company’s ability to attract high calibre personnel who are proficient<br />

in both technical and corporate fields. The future returns to Shareholders will be determined by the skill and enthusiasm of<br />

those managing <strong>Pioneer</strong>. The retention of, and as appropriate, additions to the <strong>Pioneer</strong> team is an important factor.<br />

6.2 Economic and Government Risks<br />

Share Market<br />

Share market conditions may affect the listed securities regardless of operating performance. Share market conditions are<br />

affected by many factors such as:<br />

a) general economic outlook;<br />

b) acts of hostility or terrorism, which impact on market confidence;<br />

c) movements in, or outlook on, interest rates and inflation rates;<br />

d) currency fluctuations;<br />

e) commodity prices;<br />

f) changes in investor sentiment towards particular market sectors; and<br />

g) the demand for, and supply of, capital.<br />

Investors should recognise that once the Shares are listed on ASX, the price of the Shares may fall as well as rise. Many factors<br />

will affect the price of the Shares including local and international stock markets, movements in interest rates, economic<br />

conditions and investor sentiment generally.<br />

Commodity<br />

Commodity prices are influenced by physical and investment demand for those commodities. The Company has a primary<br />

exposure to the world nickel price. Fluctuations in commodity prices may influence individual projects in which the<br />

Company has an interest. The Company has a limited multi-commodity strategy, including nickel, copper and the precious<br />

metals, gold, platinum and palladium. This may to a limited extent ameliorate commodity risk.<br />

Economic Factors<br />

Factors such as inflation, currency fluctuation, interest rates, commodity supply and demand, and industrial disruption have<br />

an impact on operating costs, commodity prices and stock market processes. The Company’s future possible revenues and<br />

Share price can be affected by these factors which are beyond the control of the Company and its Directors.<br />

Government<br />

Changes in government, monetary policies, taxation and other laws can have a significant influence on the outlook for<br />

companies and the returns to investors.<br />

6.3 Exploration, Development, Mining and Processing Risks<br />

Mineral exploration, project development and mining by their nature contain elements of significant risk. Ultimate and<br />

continuous success of these activities is dependent on many factors such as:<br />

a) maintenance of tenure and access;<br />

b) the discovery and/or acquisition of economically recoverable ore reserves;<br />

c) successful conclusions to bankable feasibility studies;<br />

d) access to adequate capital for project development;<br />

e) design and construction of efficient mining and processing facilities within capital expenditure budgets;<br />

f) obtaining consents and approvals necessary for the conduct of exploration and mining;<br />

g) prudent financial administration; and<br />

h) Native Title risks (see also below).<br />

Whether or not income will result from development of the tenements depends on the successful establishment of mining<br />

operations. Factors including costs, variability of mineralisation, consistency and reliability of ore grades and commodity<br />

prices affect successful project development and mining operations.<br />

-18-

<strong>Pioneer</strong> <strong>Nickel</strong> <strong>Limited</strong> <strong>Prospectus</strong><br />

6.4 Native Title<br />

The Native Title Act 1993 (Cth) recognises and protects the rights and interests in Australia of Aboriginal and Torres Strait Islander<br />

people in land and waters, according to their traditional laws and customs. There is significant uncertainty associated with Native<br />

Title in Australia and this may impact on the Company’s operations and future plans.<br />

Native Title can be extinguished by valid grants of land or waters to people other than the Native Title holders or by valid use of<br />

land or waters. It can also be extinguished if the indigenous group has lost their connection with the relevant land or waters. Native<br />

Title is not extinguished by the grant of mining licences, as they are not considered to be grants of exclusive possession. A valid<br />

mining lease prevails over Native Title to the extent of any inconsistency for the duration of the title.<br />

All tenements granted prior to 1 January 1994 are valid or validated by the Native Title Act.<br />