A Burden - American Business Media

A Burden - American Business Media

A Burden - American Business Media

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

HEAVY<br />

<<br />

A <strong>Burden</strong><br />

A remnant of a simpler time, the generous<br />

pension plans at many Am Law 100 firms place<br />

an increasing weight on younger partners.<br />

Is a generational battle looming<br />

By Julie Triedman<br />

P h o t o g r a p h By Fr e d r i k Br o d e n<br />

photo credit feet in<br />

It’s a safe betthat<br />

partners at Simpson Thacher & Bartlett aren’t lying awake<br />

at night worrying about their 401(k)s. No matter what happens to the stock market, they’re guaranteed<br />

to retire rich, thanks to the firm’s pension plan.<br />

The plan—the most generous among 21 Am Law 100 pension plans we analyzed for this article—promises<br />

retired partners a quarter of the compensation they received during their highestearning<br />

years. For life. On top of that, retirees receive an additional payout of 130 percent of<br />

that highest-compensation average, spread out over seven years. Currently, 30 retired Simpson<br />

partners are receiving these pension benefits.<br />

Benefits under Simpson’s plan, like those of other Am Law 100 firms with traditional unfunded<br />

pension programs, are paid for out of current income. And because Simpson, like other Am<br />

Law 100 firms, has steadily expanded the size of its partnership since the plan was created, we<br />

wondered how much it will cost the firm over the next decade or so, as a glut of those it elevated<br />

to partner in the seventies and eighties retire.<br />

The answer: a lot. Our hypothetical, back-of-the-envelope calculation of Simpson’s future<br />

liability—which we believe can stand in for at least a dozen similarly situated firms—indicates<br />

that it will be paying out of its annual income a minimum of roughly $65 million a year by 2022,<br />

double the estimated current annual payout. (We asked Simpson chairman Philip “Pete” Ruegger<br />

III to correct or comment on our numbers. He declined.)<br />

A scan of the firm’s 194 partners reveals that approximately a quarter could be expected to<br />

72 May 2009 | americanlawyer.com<br />

The <strong>American</strong> Lawyer | March 2012 73

etire by 2022, providing that most do so around the firm’s<br />

normal retirement age of 62. Assuming a handful die early,<br />

the firm may see 43 new full-freight retirees within the<br />

decade. Assuming that this batch of senior partners have<br />

been earning $3.5 million during their highest-compensated<br />

years—a conservative estimate, consultants say, at a<br />

firm that posted average profits per partner of $2.6 million<br />

in 2010—a soon-to-retire partner can expect roughly<br />

$875,000 a year in benefits, plus roughly $650,000 in each<br />

of the first seven years from the additional distribution<br />

(subtracting roughly $50,000 offset by another defined<br />

benefit plan funded by the firm). Over the decade, the<br />

firm’s annual liability gradually creeps up to roughly $65<br />

million for the new retirees by 2022, not including benefits<br />

for those already in retirement. But as long as the firm<br />

increases its net by about 3–4 percent a year (since 2000,<br />

PPP has grown an average of 4.68 percent annually), the<br />

drag on profits will remain just about what it is now.<br />

At Simpson and many other Am Law 200 firms, pensions<br />

are the elephant in the room. Several firms continue to guarantee<br />

their equity partners far richer pension plans than they<br />

probably should. And that future pension liability is growing<br />

at a time when it is looking less than certain that profits and<br />

partner head count will grow in step with them.<br />

The recession, with its double whammy of retirement<br />

investment portfolio declines and firm revenue slowdowns,<br />

was a broad wake-up call for firms that fund pensions out<br />

of current income, as well as for the broader swath of firms<br />

a pensions primer<br />

The fine print about how firm retirement plans work.<br />

Until 1987, the Internal Revenue Service<br />

didn’t allow firms to put more than<br />

$7,500 per partner into tax-advantaged<br />

pension plans each year. In 2000 and<br />

2002 the IRS sharply increased the<br />

amounts that firms could set aside in<br />

defined benefit programs, and many law<br />

firms adopted the new plans as an alternative<br />

to their then common unfunded<br />

plans. Currently the maximum retiree<br />

benefit permitted under the tax-advantaged<br />

plans is $200,000; it rises yearly<br />

with the cost of living. (Non-tax-advantaged<br />

plans continue to have no benefit<br />

or contribution limits.)<br />

Here is a guide to what many firms<br />

now offer:<br />

Defined benefit plan This is an<br />

umbrella term for any plan where the<br />

annual retirement benefit is determined<br />

by a set formula, including traditional<br />

plans and the newer-generation cash<br />

balance and variable-annuity plans. The<br />

formula establishing the benefit may<br />

incorporate past compensation, years<br />

of employment, age at retirement, and<br />

other factors.<br />

Cash balance plan Sometimes<br />

called a “partner parity” plan, this is<br />

a defined benefit plan that looks like a<br />

bank account. Traditionally, each partner<br />

has a notional retirement account where<br />

interest is credited on the basis of an<br />

external index, such as a Treasury rate.<br />

The firm pays a contribution annually,<br />

charged back to the current partners,<br />

to fund the plan up to a defined target<br />

or level of “pay credit” (usually based on<br />

deferred compensation). If the investment<br />

gains do not meet the external<br />

interest rate returns credited to each<br />

partner’s account, the firm—and indirectly,<br />

the current partners—must make<br />

an additional contribution to top up the<br />

investment pool.<br />

Market-rate cash balance plan<br />

This IRS–approved plan, which is permitted<br />

as of October 2010, allows retirement<br />

annuity levels to fluctuate along<br />

with the actual return on a firm’s investment<br />

portfolio, thus reducing the possibility<br />

of a shortfall. A similar plan that<br />

allows payouts to fluctuate is known as<br />

a “variable annuity.”<br />

—J.T.<br />

that fund benefits out of firm-run investment portfolios.<br />

Many in the latter category had to dig into earnings to<br />

cover shortfalls in guaranteed benefits funded by firm investments.<br />

But the problems created by the sagging economy<br />

brought into relief a bigger, looming issue: The ranks<br />

of retired partners is swelling just as the number of equity<br />

partners—who are ultimately responsible for funding the<br />

pension plans—is leveling off. “This is an issue that cuts<br />

across all regions and all sizes of firms,” says Dan DiPietro,<br />

chair of the Law Firm Group of Citi Private Bank. “It’s a<br />

generational issue: As firms face the bubble of baby-boomer<br />

partner retirement, the problem will only get bigger.”<br />

The firms facing the largest future liability are the Am<br />

Law 100 firms with rich guaranteed benefits paid out of current<br />

income. We independently obtained information about<br />

the plans currently or recently active at 15 of the top 50<br />

Am Law 100 firms [see “Retiring in Style,” page 77]. All but<br />

two—Sullivan & Cromwell and Weil, Gotshal & Manges—<br />

offered unfunded pension plans. We shared our information<br />

with each firm and offered them the chance to update it;<br />

only five chose to do so. For the rest, we corroborated the<br />

information independently to the extent possible.<br />

Many partners we interviewed told us they had little<br />

knowledge or understanding of their benefit plans or<br />

their firms’ financial liabilities. But it’s not surprising<br />

that some firms aren’t being open with their partnership:<br />

Unfunded plans, in particular, tend to divide partnerships<br />

along generational lines. “Younger partners<br />

are saying, ‘I’m never going to see the money; I’m paying<br />

to guys who were here when I was in high school,’ ”<br />

says Bradford Hildebrandt, president of Hildebrandt Consulting<br />

LLC. “Then you have guys who are about to retire<br />

who are saying, ‘Are you kidding me You owe it to me.’ ”<br />

It’s a division that will only intensify with time. Simple<br />

demographics dictate that payouts to retired partners will<br />

be an increasing weight on profits for at least the next decade,<br />

and maybe two. “The 45-year-old types are enormously<br />

productive and are diverting money to satisfy 68-<br />

year-olds,” says Peter Kalis, chair of K&L Gates, a firm<br />

that phased out its unfunded plan in the late 1980s. “When<br />

those [younger partners] are attracted to go to firms without<br />

that overhang, that business model [of the firm with<br />

the pension] fails. That day may never come, but it’s important<br />

to consider.”<br />

Historically, In 1997<br />

many firms set up unfunded<br />

plans. Many of these plans are still in place, though<br />

often current partners are no longer accruing benefits under<br />

them. “The theory was that these partners built the<br />

firm, and we owe it to them,” says Hildebrandt. There is<br />

no mechanism for funding; retired partners’ pension benefits<br />

are scooped out of the firm’s current profits—in much<br />

the way that Social Security payouts are funded by payroll<br />

contributions from current workers.<br />

Generally, it is the lockstep or modified lockstep firms<br />

that still embrace unfunded plans. At these firms the benefit<br />

is usually calculated as a percentage of compensation,<br />

typically 20–30 percent of the average of a retiring partner’s<br />

highest-compensation years. Partners vest in the plans<br />

after 20–30 years of equity partnership, though in some<br />

cases partners can partially vest in as few as ten.<br />

Firm leaders describe these unfunded plans as golden<br />

handcuffs. Noncompete clauses built into nearly all the unfunded<br />

plans mean that partners lose their pensions if they<br />

join another firm [see “Taking It with You,” right]. As a partner<br />

approaches the age of 48 or 49, with vesting just around<br />

the corner, it becomes hard to leave. “Those of us who have<br />

been seeing our net income get hit every year are looking<br />

forward to receiving [the pension],” says one senior partner.<br />

Because benefit levels are linked to a partner’s highestearning<br />

years, payouts have ballooned, as the Simpson example<br />

shows. In the early to mid-nineties, senior partners<br />

at the most profitable firms earned around $1 million; a 30<br />

percent annual benefit of $300,000 might have been typical.<br />

But these days, senior partners at the most profitable<br />

Wall Street firms may take home $3–4.5 million a year,<br />

generating an entitlement of $1 million or more for life.<br />

“They’re making a fortune in their retirements,” says consultant<br />

Peter Zeughauser, chair of the Zeughauser Group.<br />

“There are many who are making more in retirement than<br />

they ever imagined.”<br />

Such plans assume a level of confidence in future financial<br />

performance. “Our plan works as long as the firm<br />

continues to grow profitably,” says Thomas Reid, managing<br />

partner of Davis Polk & Wardwell, which guarantees<br />

partners 30 percent of their highest compensation years<br />

for life. “We have a handle on our demographic in terms<br />

of who is approaching retirement. We have sufficient associates<br />

moving toward partnership, and we’re confident that<br />

retiring partners can be replaced without any adverse impact<br />

on profitability. I know there are some firms that have<br />

struggled with this, but it’s not an issue for us.”<br />

Some younger partners at the firms with unfunded<br />

plans, however, lament the drain on their current income,<br />

and many also worry that their firms’ business strategies<br />

are increasingly driven by the need to fund partner retirement.<br />

An unfunded plan “puts a huge onus on the firm,”<br />

says a partner at a firm with a generous plan who spoke on<br />

condition that he and his firm not be identified. “It forces<br />

you . . . to grow in order to pay the pension fund.”<br />

Younger partners also express skepticism about the future<br />

viability of unfunded plans. “Everyone understands<br />

it’s a crapshoot,” one such partner wrote in an anonymous<br />

flash survey we conducted in January on this topic. “It is, in<br />

effect, deferred compensation.”<br />

the Internal Revenue Service began<br />

allowing firms to establish prefunded, tax-advantaged defined<br />

benefit plans. Under these plans, firms invest a portion<br />

of current income in a firm-managed portfolio each<br />

year, with the contributions and investment proceeds<br />

dedicated to funding future retirement payouts. The plans<br />

looked more like 401(k) plans—partners were assigned notional<br />

“accounts” that are credited with a set growth rate—<br />

but just like pension plans, they guarantee a benefit [see “A<br />

Pensions Primer,” page 74].<br />

Additional IRS changes in 2000 and 2002 substantially<br />

increased the maximum individual annual benefit under<br />

these plans. (For 2012 the maximum per retiree under an<br />

IRS–approved defined benefit plan is $200,000 a year; the<br />

annual contribution limit under defined contribution plans<br />

like the Keogh or HR.10 plans is $50,000; and for 401(k)<br />

plans, $17,000.) Increasingly, a combination of IRS–qualified<br />

plans began to look like an attractive alternative to the<br />

unfunded plans, says Philip Deitch, a partner at PricewaterhouseCoopers<br />

LLP who specializes in law firm actuarial<br />

planning. Firms hoped to thereby eventually avoid having<br />

Taking It with You<br />

Lateral movement can complicate the pensions picture.<br />

Last year saw a strong increase<br />

in lateral movement among Am Law 200<br />

firms. It’s a trend that’s unlikely to slow.<br />

But what happens to a partner’s retirement<br />

benefits when he or she joins another<br />

firm<br />

Any vested money in IRS–approved<br />

plans, whether defined contribution plans<br />

like 401(k)s, Keoghs, or defined benefit<br />

plans like cash balance or variable annuity<br />

plans, is safe. A partner keeps those<br />

assets and can roll them over into an Individual<br />

Retirement Account.<br />

But for partners leaving or joining<br />

firms with unfunded plans, the situation<br />

is more complicated. Typically, laterals<br />

who join firms with active unfunded pension<br />

systems have the most to gain: They<br />

are folded into their new firm’s plan after<br />

achieving a specified amount of tenure.<br />

Conversely, partners who leave firms<br />

with the richest unfunded plans to join<br />

new ones risk leaving a lot of money on<br />

the table. While retiring early from those<br />

firms may be encouraged—some firms<br />

offer partners a reduced benefit beginning<br />

at around ten years’ service as a<br />

partner—firms with unfunded plans generally<br />

have the right to cut off all benefits<br />

if a partner joins a rival firm.<br />

If lost benefits are an issue, hiring<br />

firms often have ways to make a lateral<br />

partner whole. “It really depends on ‘how<br />

much does the firm want this partner’”<br />

says Jon Lindsey, managing partner at<br />

legal recruiting firm Major, Lindsey & Africa.<br />

“You have to be creative to find a<br />

way to make it work for both sides.”<br />

At one extreme, firms have offered a<br />

one-off payment to replace the net present<br />

value of benefits that were forfeited;<br />

LeBoeuf, Lamb, Greene & MacRae was<br />

said to have awarded prominent litigation<br />

partner Ralph Ferrera an $8 million<br />

special payment to replace the Debevoise<br />

& Plimpton pension he forfeited<br />

when he joined that firm (now Dewey &<br />

LeBoeuf) in 2005. (The firm declined to<br />

comment.) In other cases, “a firm may<br />

have to buy them an annuity that will<br />

make up the bulk of lost benefits,” Lindsey<br />

says. In some situations, he says, the<br />

firm will make a loan, which is forgiven<br />

over time to net out an equivalent sum<br />

by the time a partner finally retires. Or<br />

the firm may increase current compensation<br />

enough for a partner to put aside<br />

enough money to offset some or all of<br />

the loss. Such arrangements are relatively<br />

rare, and older partners or those<br />

without a large and portable book of<br />

business seldom receive them.<br />

But disputes over terminated benefits<br />

are on the rise, according to Arthur<br />

Ciampi, a New York lawyer who represents<br />

partners in litigating such disputes.<br />

Many pension disputes arose during the<br />

recession, when some firms eased out<br />

partners who were on the cusp of vesting<br />

and then cut off benefits, arguing<br />

that those lawyers forfeited them when<br />

some inevitably joined other firms.<br />

Ciampi says his firm has handled<br />

a half-dozen cases recently involving<br />

breach of fiduciary duty and age-discrimination<br />

claims; most such disputes are<br />

settled. With the laws regarding age discrimination<br />

in partnerships still in flux,<br />

firms don’t want to risk a bad ruling.<br />

Another type of dispute concerns<br />

the validity of pension plan noncompete<br />

provisions. Ciampi says that, while firms<br />

are permitted to have such provisions<br />

in plans that are considered genuine retirement<br />

benefits, they sometimes are<br />

inconsistent about who gets to keep the<br />

benefits. In the course of reporting this<br />

story, we were told of several instances<br />

where firms permitted retired partners<br />

to join smaller firms that they don’t consider<br />

rivals without losing benefits; in<br />

one case, however, when the small firm<br />

was acquired by a larger firm, a retired<br />

partner had to leave the merged firm<br />

in order to retain the benefits from his<br />

original firm.<br />

“It can be a very scary time,” Ciampi<br />

says. “You anticipate a benefit will be<br />

there. You’re at a vulnerable time in your<br />

career. This has now been taken away<br />

from you. And when you try to replace<br />

it, the plans are not available.” —J.T.<br />

74 March 2012 | americanlawyer.com The <strong>American</strong> Lawyer | March 2012 75

Average number of equity partners<br />

current partners fund retired partners’ benefits, though<br />

they still have to pay for accrued benefits for many years.<br />

Deitch estimates that about eight in ten Am Law 100 firms<br />

now have some form of tax-qualified defined benefit plan.<br />

But the plans, while enormously popular, are not necessarily<br />

a panacea. “There are significant risks associated with<br />

certain types of defined benefit plans,” most notably traditional<br />

cash balance plans, says Deitch. Unlike in a 401(k),<br />

the payout to individual partners in a cash balance plan is<br />

not linked to the actual performance of the investments, but<br />

to an external interest rate, such as a Treasury index rate. If<br />

a firm’s investment portfolio underperforms that rate and<br />

falls short of the amount needed to fund the guaranteed<br />

level of benefits, partners have to make up the difference,<br />

either out of current income or in years to come. Unless<br />

firms adopt a stringent pay-as-you-go approach, “they risk<br />

creating subsidies between . . . generations of partners,” says<br />

Deitch.<br />

Firms learned this, to their dismay, in 2008 and 2009,<br />

when the balances in many firm-run retirement portfolios<br />

fell by 20 percent or more, Deitch says. The problem was<br />

especially acute at firms that had established non-tax-advantaged<br />

plans with much higher guaranteed benefits than<br />

the tax-advantaged plans. According to a senior partner<br />

at a New York law firm, some firms had invested retirement<br />

money in hedge funds, and these funds plummeted<br />

in 2008–09, just as overall firm profits slid. “Everyone got<br />

excited about hedge funds and their great returns” in the<br />

1990s, when their returns beat the equity markets, this<br />

partner says. “Well, that didn’t work out so well for us.”<br />

In the first quarter of 2011, as part of its annual Law<br />

Watch survey, Citi Private Bank asked its clients, a healthy<br />

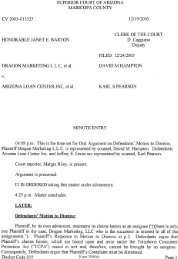

A Growing Obligation<br />

The average size of Am Law 100 equity partnerships<br />

has doubled since 1986, leaving some firms’ pension plans<br />

struggling to keep pace.<br />

200<br />

150<br />

100<br />

50<br />

0<br />

1986<br />

1991<br />

1996<br />

2001<br />

2006<br />

2010*<br />

*Most recent figure available. Includes worldwide equity partner counts for vereins.<br />

Source: ALM Legal Intelligence (Am Law 100 Survey)<br />

proportion of Am Law 200 firms, about their obligations<br />

to retired partners. Roughly 40 percent of firms, including<br />

those with unfunded and underfunded pension liabilities,<br />

projected a shortfall between future obligations to retired<br />

partners and funds firms had allocated to pay for them;<br />

those indicating some shortfall included 21 of the Am Law<br />

50 firms that report to the bank, and 23 of the Am Law<br />

51–100 firms. Among firms that projected a shortfall, Citi<br />

determined that the gap between future funds available<br />

and projected aggregate payouts to retirees ranged widely—from<br />

less than $1 million for some firms to more than<br />

$100 million for others; Citi did not disclose the average<br />

amount of exposure.<br />

Firms with<br />

both unfunded pension<br />

plans and the newer defined benefit plans generally have<br />

moved to limit their annual liability by instituting caps on<br />

the percentage of firm income that can be used to fund retirement<br />

benefits in any single year. In researching this story<br />

we found that caps usually ranged from 3 to 5 percent.<br />

But for some firms with The Am Law 100’s highest profits<br />

per partner, caps ranged between 10 and 15 percent, and<br />

at one firm, Cahill Gordon & Reindel, the cap was 20 percent<br />

as recently as 2007. (The firm declined to confirm or<br />

update that information.)<br />

In recent years many firms reduced their caps, we<br />

learned. But the caps may lead to a false sense of security<br />

that the firm has its financial obligations under control; in<br />

reality, most plans bar firms from giving retired partners a<br />

pension haircut even if the cap is surpassed. The cap simply<br />

allows a firm to reduce pension payouts temporarily; it<br />

then has to pay out the shortfall as soon as it can meet its<br />

obligations without breaching the annual cap. Meanwhile,<br />

overall future liability remains unaffected.<br />

Though our reporting did not uncover any firm that<br />

had breached its cap, several law firm financial consultants<br />

and managing partners say that day is soon approaching<br />

for many firms, given the demographic realities: Through<br />

the nineties and well into the last decade, the size of equity<br />

partnerships at Am Law 100 firms expanded rapidly.<br />

But firms began applying the brakes in recent years [see “A<br />

Growing Obligation,” left]. Firms will also be paying retired<br />

partners longer: Average life expectancy is expected<br />

to rise from 78 today to a projected 80 by 2020, according<br />

to U.S. Census Bureau data. Never will so many retired<br />

partners be supported by so relatively few active ones.<br />

The future<br />

challenges and future liabilities<br />

for firms that have shifted to investment-funded<br />

defined benefit plans (including both tax-advantaged and<br />

non-tax-advantaged plans) are distinct from the firms with<br />

unfunded plans. Since the 2008 recession, these firms have<br />

been wrestling with how best to invest funds, and how<br />

much to ante up now, to ensure that they can cover future<br />

guaranteed benefits.<br />

For firms with tax-advantaged plans, relief may be on<br />

the way. In late 2010 the IRS approved a new kind of defined<br />

benefit plan, called a market-rate cash balance plan,<br />

that reduces investment risk. These plans for the first time<br />

link benefit levels to actual investment continued on page 91<br />

retiring in style<br />

Many Am Law 100 firms maintain generous pension plans. Here are details of a sampling. Some firms were not willing to share current information on<br />

their plans; in those cases, which are footnoted, we used the most recent available. Because it takes several years for any change in plans (such as a<br />

freeze at current accrued benefit levels) to make a dent in future annual benefit payouts, we view even outdated information as germane.<br />

Firm<br />

Funding<br />

mechanism<br />

Formula for determining annual benefit,<br />

duration of benefit, and years to vest<br />

Cahill 1 None Fixed amount ($245,000 as of 2007).<br />

For life. Vesting at 24 years.<br />

Cleary 1 None 12% of what the partner earned in his last year<br />

for first ten years of retirement, then 7.7% of the<br />

last-year earnings. For life. Vesting at 20 years.<br />

Cravath 2 None 25% of an average of the partner’s highestcompensation<br />

years. For life. Vesting at 30 years,<br />

including time as associate.<br />

Davis Polk None 30% of the average of a partner’s three highestcompensated<br />

years in the five years before<br />

retirement. For life. Vesting at 20 years.<br />

Debevoise 1 None 25% of average earnings in the ten years before<br />

retirement. For life. Vesting at 20 years.<br />

Foley & Lardner 1 None 25% of the average of the partner’s three<br />

highest-compensation years. Duration: N/A.<br />

Vesting at 30 years.<br />

Fried, Frank 1 None Three benefit levels; as of 2007, they ranged<br />

between $117,000–$175,000 a year.<br />

Duration: Ten years. Vesting at 20 years.<br />

Kaye Scholer 1 None Based on firm income; annual benefit was<br />

$200,000 in 2007. For life. Vesting at 15 years.<br />

Latham 3 None 36% of the average of the partner’s three<br />

highest-compensation years for first five years<br />

of retirement, then 24% of the same average.<br />

Duration: Ten years. Vesting at 20 years.<br />

Milbank 1 None 23% of the average of five of the highestcompensation<br />

years in the last ten years of<br />

service. Duration: N/A. Vesting at 20 years.<br />

Paul, Weiss<br />

Proskauer<br />

Simpson Thacher<br />

Sullivan & Cromwell<br />

Weil, Gotshal<br />

Partially offset<br />

by funded plans<br />

Partially offset<br />

by funded plans<br />

Partially offset<br />

by funded plans<br />

Funded through<br />

firm investments<br />

Partially funded<br />

by firm investments<br />

20% of the average of five of the highestcompensation<br />

years in the last ten years of<br />

service. For life. Vesting at 20 years.<br />

0.5% per year of service, up to a maximum of<br />

30 years. This service factor is multiplied by the<br />

average of the partner’s eight highestcompensated<br />

years, capped at $2 million as<br />

of 2010. For life. Vesting at 30 years.<br />

25% of the partner’s final-year compensation.<br />

For life. Vesting at 20 years. Retired partners get<br />

an additional equity payout of 130% of annual<br />

income, paid out over seven years.<br />

All retired partners receive the same amount<br />

annually, which depends on the firm’s<br />

contributions to its retirement fund and the<br />

returns on the firm’s investments. Duration: N/A.<br />

Based on a percentage of a partner’s highest<br />

compensation, subject to a maximum individual<br />

cap. For life. Vesting at 20 years.<br />

1<br />

As of 2007. 2 As of 2009. 3 As of 2011. N/A means that information was not available.<br />

Cap on<br />

firm net<br />

20%<br />

recent changes<br />

10% In 2006, the firm reduced its cap to 10% from 15%<br />

and introduced a haircut of 1–5% applicable to<br />

senior partners.<br />

15% A previous plan vested at 20 years of service.<br />

15% Firm recently established a variable annuity plan.<br />

10%<br />

N/A<br />

8%<br />

4%<br />