Part 1 - Otto Marine Limited

Part 1 - Otto Marine Limited

Part 1 - Otto Marine Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Click to edit Master text styles<br />

Second level<br />

Third level<br />

Fourth level<br />

Fifth level<br />

10 December 2009<br />

1<br />

4 th January 2010

DISCLAIMER<br />

This presentation and the associated slides contain confidential information about <strong>Otto</strong> <strong>Marine</strong> <strong>Limited</strong> (the “Company”) and its subsidiaries and<br />

associates (together with the Company, the “Group”).<br />

By accepting such information, the recipient agrees to keep permanently confidential all information contained herein and that it will use such<br />

information only for the purpose it has disclosed to the Company for participating in this presentation and not for other purposes and will not<br />

divulge any such information to any other party without the express consent of the Company. Any reproduction of such information, in whole or<br />

in part, is prohibited without the permission of the Company.<br />

This presentation includes only summary information and does not purport to be comprehensive. The information contained in this presentation<br />

has not been subject to independent verification. No promise, guarantee, representation, warranty or undertaking, express or implied, is made as<br />

to, and no reliance should be placed on, the fairness, accuracy, reliability, completeness or correctness of the information or opinions contained<br />

herein. Neither the Company, any other company within the Group or its advisors, nor any of their directors, officers or employees or any<br />

representatives of such persons, shall have any responsibility or liability whatsoever (in negligence or otherwise) for any loss arising from any use<br />

of the information or any other information or material discussed.<br />

This presentation contains forward-looking statements relating to the business, financial performance and results of the Company. These<br />

statements are based on current beliefs, expectations or assumptions and are subject to unknown risks and uncertainties that could cause actual<br />

results, performance or events to differ materially from those described in such statements. These risks, uncertainties and other factors include, but<br />

are not limited to, economic conditions globally, the impact of competition, political and economic developments in countries in which the Group<br />

operates and regulatory developments in those countries and internationally, foreign exchange rates, oil and gas prices and the completion of<br />

ongoing transactions. Many of these factors are beyond the Company's ability to control or predict. Although the Company believes that its<br />

expectations and the information in this presentation were based upon reasonable assumptions at the time when they were made, it can give no<br />

assurance that those expectations will be achieved or that the actual results will be as set out in this presentation.<br />

Nothing in this presentation constitutes and shall not in any circumstances be construed as an invitation or an offer to purchase or the solicitation<br />

of an offer to purchase any securities issued by the Company or any advice or recommendation with respect to such securities and no part of this<br />

presentation shall form the basis of or be relied upon in connection with any contract or commitment whatsoever.<br />

2

Agenda<br />

• Overview of <strong>Otto</strong> <strong>Marine</strong><br />

• Investment Merits<br />

• Business Segments<br />

• Financial Highlights<br />

• Industry Outlook, Growth Strategies<br />

3

Click to edit Master text styles<br />

Second level<br />

Third level<br />

Fourth level<br />

Fifth level<br />

4

<strong>Otto</strong> <strong>Marine</strong> <strong>Limited</strong><br />

• Offshore <strong>Marine</strong> Group - in Shipbuilding/ repair & conversion,<br />

Chartering and Specialised offshore services<br />

• Headquartered in Singapore – commercial, procurement,<br />

and treasury support to our overseas’ operations (Indonesia,<br />

China, UAE, etc)<br />

• Shipyard in Batam Indonesia – strong management and<br />

engineering team capable of delivering complex and deep water<br />

offshore vessels<br />

• Strategic direction – provider of specialised offshore vessels<br />

and services in niche technical segments (i.e. seismic, subsea,<br />

offshore construction, etc.,)<br />

• Customers – primarily specialised offshore service providers in<br />

niche segments, and fleet operators in the O&G industry<br />

5

Investment merits<br />

• Earnings track record - CAGR 114.54% in EPS from FY2005 to FY2008<br />

• Order book of S$601 million (30 Sep) – delivered 27 OSV in last 4 years<br />

worth USD450m<br />

• Fast track OSV chartering - S$400m (10 Dec 09) forward chartering revenue<br />

secured on 5 to 10 years<br />

• Specialised Offshore services – service and vessel provider in strategic<br />

niche segments which command higher margin (i.e. seismic, subsea vessels for<br />

well intervention, ROV, IMR, etc)<br />

• Reputable customer base – ABCmaritime, Esnaad, Falcon Energy Group<br />

<strong>Limited</strong>, GC Rieber, Mosvold Supply, <strong>Marine</strong> Subsea AS, Norshore Shipping,<br />

Robert Knutzen Shipholdings<br />

• Strong engineering and experienced management team – average of 34<br />

years experience in offshore vessels building<br />

• Current geographic operation - West Africa, Asia, Australia, New Zealand<br />

7

Investment merits<br />

Reputable customer base includes:<br />

8

Investment merits Directors Team<br />

Front L to R: Yaw Chee Siew, Lee Kok Wah, William Alastair Morrison,<br />

Back L to R: Craig Foster Pickett, Reggie Thien and Ng Chee Keong<br />

9

Investment merit Executive Officers Team<br />

Standing L to R: Lum Kin Wah, Tom Chua Peng Chua, Michael See Kian Heng<br />

Seated L to R: Peter Jantzen and Ang Kim Choon Eric<br />

10

Business segments<br />

We have three main business segments<br />

Shipbuilding / Repair<br />

Construction of complex, highspec<br />

& environment friendly<br />

offshore support vessels (e.g.<br />

AHTS, PSV, offshore<br />

construction vessel)<br />

Repair and conversion of a wide<br />

range of vessels (e.g. offshore<br />

support vessels, ocean-going<br />

tug)<br />

Sophisticated vessels for North<br />

Sea operations that meet the<br />

ABS or DNV class<br />

Owns 64 ha shipyard in Batam<br />

−<br />

−<br />

Selective outsourcing to<br />

China shipyards<br />

Build-to-order<br />

Ship Chartering<br />

100% owned (10 Dec 09)<br />

−<br />

• 5 tugs & 5 barges,<br />

• 1x 61m vessel<br />

• 2 X 10,800bhp AHTS<br />

• 2 X 6,000bhp AHTS<br />

− 12 vessels joining ’09/’10<br />

Strategic partnerships<br />

−<br />

−<br />

15 vessels operational:-<br />

Operational:-<br />

−<br />

−<br />

2x 300men AWB<br />

4 X 5,150bhp AHTS<br />

Under construction:-<br />

− 3 joining in ’09/’10<br />

−<br />

9 earmarked for JV<br />

partners.<br />

Specialised Services<br />

Service and vessel provider in<br />

strategic niche segments which<br />

command higher margin such<br />

as seismic and subsea vessels<br />

I. Seismic operator –<br />

Reflect Geophysical<br />

II. ROV vessel provider –<br />

JV with GC Rieber<br />

We have integrated business segments which position <strong>Otto</strong> to capitalise on the upside<br />

of the O&M industry<br />

12

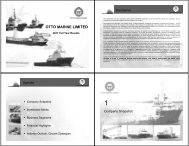

Focus on high specifications and higher value vessels<br />

5 th largest AHTS builder globally<br />

8.4%<br />

7.8% 7.3%<br />

44.0%<br />

Nam<br />

Cheong<br />

Aker<br />

6.7%<br />

Dubai<br />

Drydocks<br />

Sinopacific<br />

Group<br />

6.2%<br />

<strong>Otto</strong><br />

<strong>Marine</strong><br />

5.6%<br />

4.5%<br />

3.4%<br />

3.4%<br />

ABG<br />

Shipyard<br />

Yangzhou<br />

Kleven Fincantieri<br />

Dayang<br />

Verft<br />

2.8%<br />

Jaya<br />

Others<br />

Note: Ten shipyards which have ~ 56% market share of global order<br />

book in AHTS vessel construction. Remaining 44% is shared by ><br />

35 yards, predominantly in China.<br />

Target European / North Sea<br />

market that require ABS or DNV<br />

class vessels<br />

Global customer base<br />

− Mosvold Supply AS<br />

− Norshore AS<br />

− ABCmaritime<br />

Ship designs from renowned<br />

Norwegian design houses<br />

− Marin Teknikk AS<br />

− Vik-Sandvik<br />

Selective outsourcing<br />

− Allows focus on sophisticated<br />

vessels in Batam shipyard<br />

Source: Braemar Seascope Offshore as at 2008<br />

14

Strategically located shipyard<br />

Singapore<br />

Headquarters<br />

Strategic advantage due to Singapore’s position as<br />

a regional marine and offshore industry hub<br />

− Access to marine and offshore support<br />

− Access to expertise<br />

− Close proximity to SEA shipbuilding hub<br />

− Ready supply of qualified Indonesian workers<br />

Batam, Indonesia<br />

Own and operate PT. Batamec - 64 hectare<br />

shipyard in Batam<br />

Major South-East Asian shipbuilding hub<br />

− Access to large pool of workers in Indonesia<br />

− Only 1 hour away from Singapore by ferry<br />

We are able to access marine expertise in Singapore and utilise<br />

a ready supply of workers in Indonesia<br />

15

Ship building: Complex offshore support vessels<br />

Small to medium AHTS<br />

(< 14,000 bhp)<br />

Large AHTS<br />

(> 14,000 bhp)<br />

Offshore construction vessel<br />

Supply & anchor handling role<br />

Drilling Unit for field support<br />

Supports Jack-Ups & standard depth Semisubmersibles and construction duties<br />

Work barge with<br />

300 pax accommodation<br />

Platform supply vessel<br />

Other vessels<br />

<br />

To support accommodation<br />

requirements<br />

<br />

Transportation of cargo to<br />

offshore oil rigs and platforms<br />

<br />

<br />

<br />

Utility vessels<br />

Work maintenance boats<br />

Others<br />

We have a specialised focus on North Sea class offshore support vessels<br />

16

Shipbuilding: Efficient usage of shipyard<br />

We utilise the Syncrolift® system to maximise the efficiency of our shipyard<br />

Syncrolift®<br />

What is a Syncrolift®<br />

Large lifting system,<br />

which raises and<br />

lowers vessels in and<br />

out of the water for<br />

dry-docking ashore<br />

What does it do<br />

Allows construction of up<br />

to sixteen 5,000 bhp to<br />

10,800 bhp vessels at any<br />

one time<br />

Able to move vessels in<br />

and out of the water<br />

efficiently and effectively<br />

Why is it important to us<br />

Allows construction of<br />

more new builds and<br />

repair of more vessels<br />

simultaneously<br />

Higher productivity and<br />

economies of scale<br />

We invest in and upgrade our shipyard in order to enjoy higher productivity and<br />

economies of scale<br />

17

Shipbuilding: Strong engineering capabilities<br />

Right mix of personnel and tools needed for sophisticated vessels<br />

Led by highly qualified senior engineers<br />

In-house design team<br />

Investments in software<br />

Detailed engineering<br />

+<br />

=<br />

Team of naval architects<br />

and engineers<br />

Key benefits<br />

3D design software,<br />

TRIBON®<br />

Minimises errors resulting in a more efficient shipbuilding process<br />

Greater accuracy in shipbuilding<br />

Productivity and cost efficiency<br />

Precise virtual model<br />

We utilise our strong engineering capabilities to provide<br />

turnkey solutions for our customers<br />

18

Shipbuilding Order Book<br />

Strong growth in order book<br />

(SGD millions)<br />

411<br />

731<br />

800<br />

601<br />

2<br />

2005 2006 2007 2008 3Q2009<br />

S$601 mn as at 30 September 2009<br />

9 vessels in order book<br />

− Comprising 4 AHTS vessels, 3 PSVs, 1 offshore construction vessel and 1<br />

accommodation work barge<br />

− Delivery of vessels through 2011<br />

Cash deposits and prepayment of 30% collected<br />

Major equipment and material costs locked in<br />

Strong order book provides visibility for our future financial performance<br />

19

Ship building: Order Book with contract signed<br />

Vessel Types 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11<br />

AHTS 21000bhp 92.5m<br />

AHTS 21000bhp 92.5m<br />

AHTS 21000bhp 92.5m<br />

AHTS 21000bhp 92.5m<br />

AWB 300 Men Work Barge<br />

PSV 3200ton MT 6009 - MFSV<br />

PSV 3200ton MT 6009L - MFSV<br />

PSV 3200ton MT 6009L - MFSV<br />

OCS Offshore construction vessels<br />

Legends<br />

Sold to Strategic <strong>Part</strong>ner<br />

Sold to Third <strong>Part</strong>y<br />

20