DOCUMENTS FOR THE ANNUAL GENERAL MEETING

DOCUMENTS FOR THE ANNUAL GENERAL MEETING

DOCUMENTS FOR THE ANNUAL GENERAL MEETING

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MOL Plc. Annual General Meeting 2013 Documents<br />

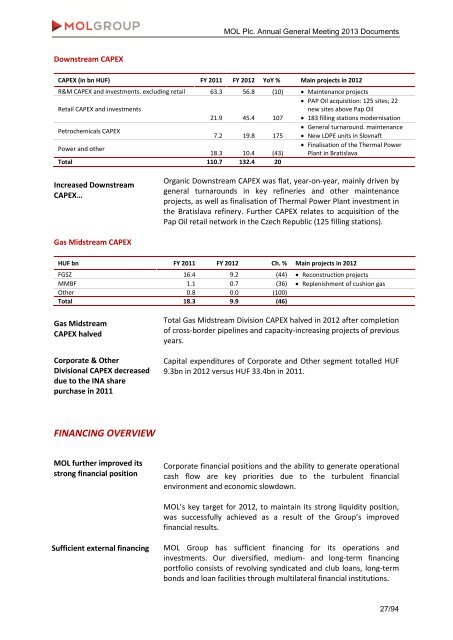

Downstream CAPEX<br />

CAPEX (in bn HUF) FY 2011 FY 2012 YoY % Main projects in 2012<br />

R&M CAPEX and investments. excluding retail 63.3 56.8 (10) Maintenance projects<br />

Retail CAPEX and investments<br />

21.9 45.4 107<br />

PAP Oil acquisition: 125 sites; 22<br />

new sites above Pap Oil<br />

183 filling stations modernisation<br />

Petrochemicals CAPEX<br />

General turnaround. maintenance<br />

7.2 19.8 175 New LDPE units in Slovnaft<br />

Power and other<br />

Finalisation of the Thermal Power<br />

18.3 10.4 (43) Plant in Bratislava<br />

Total 110.7 132.4 20<br />

Increased Downstream<br />

CAPEX…<br />

Organic Downstream CAPEX was flat, year-on-year, mainly driven by<br />

general turnarounds in key refineries and other maintenance<br />

projects, as well as finalisation of Thermal Power Plant investment in<br />

the Bratislava refinery. Further CAPEX relates to acquisition of the<br />

Pap Oil retail network in the Czech Republic (125 filling stations).<br />

Gas Midstream CAPEX<br />

HUF bn FY 2011 FY 2012 Ch. % Main projects in 2012<br />

FGSZ 16.4 9.2 (44) Reconstruction projects<br />

MMBF 1.1 0.7 (36) Replenishment of cushion gas<br />

Other 0.8 0.0 (100)<br />

Total 18.3 9.9 (46)<br />

Gas Midstream<br />

CAPEX halved<br />

Corporate & Other<br />

Divisional CAPEX decreased<br />

due to the INA share<br />

purchase in 2011<br />

Total Gas Midstream Division CAPEX halved in 2012 after completion<br />

of cross-border pipelines and capacity-increasing projects of previous<br />

years.<br />

Capital expenditures of Corporate and Other segment totalled HUF<br />

9.3bn in 2012 versus HUF 33.4bn in 2011.<br />

FINANCING OVERVIEW<br />

MOL further improved its<br />

strong financial position<br />

Corporate financial positions and the ability to generate operational<br />

cash flow are key priorities due to the turbulent financial<br />

environment and economic slowdown.<br />

MOL’s key target for 2012, to maintain its strong liquidity position,<br />

was successfully achieved as a result of the Group’s improved<br />

financial results.<br />

Sufficient external financing<br />

MOL Group has sufficient financing for its operations and<br />

investments. Our diversified, medium- and long-term financing<br />

portfolio consists of revolving syndicated and club loans, long-term<br />

bonds and loan facilities through multilateral financial institutions.<br />

27/94