The Lampo Group, Inc. 1749 Mallory Lane Brentwood, TN 37027 ...

The Lampo Group, Inc. 1749 Mallory Lane Brentwood, TN 37027 ...

The Lampo Group, Inc. 1749 Mallory Lane Brentwood, TN 37027 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

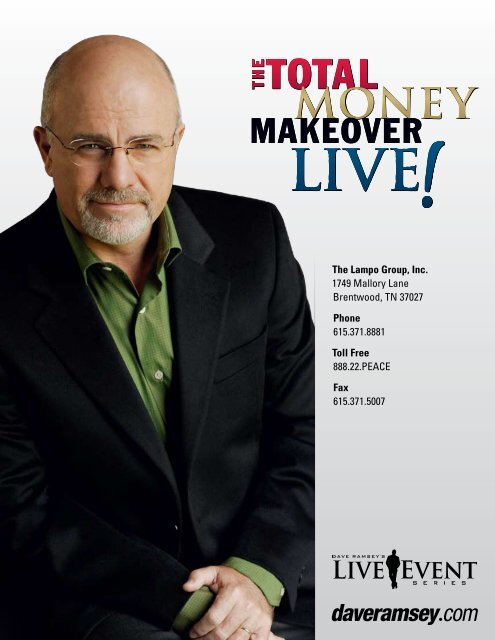

<strong>The</strong> <strong>Lampo</strong> <strong>Group</strong>, <strong>Inc</strong>.<br />

<strong>1749</strong> <strong>Mallory</strong> <strong>Lane</strong><br />

<strong>Brentwood</strong>, <strong>TN</strong> <strong>37027</strong><br />

Phone<br />

615.371.8881<br />

Toll Free<br />

888.22.PEACE<br />

Fax<br />

615.371.5007

Welcome to the largest event<br />

on personal finance in the<br />

United States! Dave Ramsey is<br />

a personal money-management<br />

expert, an extremely popular<br />

national radio personality and<br />

best-selling author of <strong>The</strong> Total<br />

Money Makeover, Financial<br />

Peace, and More Than Enough.<br />

Ramsey knows first-hand what<br />

financial peace means in his own life—living a true rags-toriches-to-rags-to-riches<br />

story. By age 26, he had established<br />

a four-million-dollar real estate portfolio, only to lose it by age<br />

30. He has since rebuilt his financial life and now devotes<br />

himself full-time to helping ordinary people understand the<br />

forces behind their financial distress and how to set things<br />

right. Through his proven plan, Ramsey helps people eliminate<br />

debt and credit cards, learn to budget, avoid bankruptcy, build<br />

wealth, and find financial peace.<br />

Ramsey founded <strong>The</strong> <strong>Lampo</strong> <strong>Group</strong>, <strong>Inc</strong>. to provide financial<br />

counseling, through various means, to the public. More than<br />

750,000 families have completed Financial Peace University,<br />

with the typical family saving $2,700 and paying off $5,300<br />

of debt. Over 650,000 people have attended a Dave Ramsey<br />

Live event. Ramsey created Financial Peace Jr. and authored<br />

six children’s books designed to help parents teach sound<br />

financial principles to their children. Active in more than 5,000<br />

schools in all 50 states, Foundations in Personal Finance<br />

educates high school students on the importance of financial<br />

planning and the dangers of debt. Ramsey’s syndicated<br />

newspaper column, “Dave Says,” is read by over six million<br />

readers weekly. <strong>The</strong> Dave Ramsey Show is syndicated to more<br />

than 400 radio stations nationwide with more than 4.5 million<br />

weekly listeners.<br />

<strong>The</strong> <strong>Lampo</strong> <strong>Group</strong>, <strong>Inc</strong>.<br />

Copyright © 1994, 2009<br />

ALL RIGHTS RESERVED<br />

First Printing Spring 1994<br />

Updated July 2009, 5hr<br />

This publication is designed to provide accurate and<br />

authoritative information with regard to the subject<br />

matter covered. It is sold with the understanding<br />

that the publisher is not engaged in rendering legal,<br />

accounting, or other professional advice. If legal<br />

advice or other expert professional assistance is<br />

required, the services of a competent professional<br />

person should be sought.<br />

—From a Declaration of Principles jointly<br />

adopted by a Committee of the American Bar<br />

Association and a Committee of Publishers<br />

and Associations.<br />

Published by <strong>The</strong> <strong>Lampo</strong> <strong>Group</strong>, <strong>Inc</strong>.<br />

Our Mission Statement<br />

“<strong>The</strong> <strong>Lampo</strong> <strong>Group</strong>, <strong>Inc</strong>. is providing<br />

biblically based, common sense<br />

education and empowerment which<br />

gives HOPE to everyone from the<br />

financially secure to the financially<br />

distressed.”<br />

For More Information<br />

Please contact <strong>The</strong> <strong>Lampo</strong> <strong>Group</strong>, <strong>Inc</strong>.<br />

at 888.22.PEACE or visit us online<br />

at daveramsey.com

more resources available at:<br />

<strong>The</strong> American Dream<br />

Imagine if…<br />

A 30-year-old couple made $48,000 a year and saved 15% ($7,200 per year or<br />

$600 per month) in a 401(k) at 12% growth.<br />

At 70 years old, they will have…<br />

$7,058,863.50 in the 401(k).<br />

Imagine if…<br />

That same couple fully funded a Roth IRA at $5,000 each per year (a total of $10,000),<br />

which would be $833 per month, at 12% growth.<br />

At 70 years old they will have…<br />

$9,803,937.87—TAX FREE!<br />

What if…<br />

That same 30-year-old couple, DEBT FREE, does both<br />

At 70 years old, they will have…<br />

401(k) $7,058,863.50<br />

Roth IRA $9,803,937.87<br />

Total $16,862,801.37<br />

...and to think—this could be you.<br />

3

Snapshots of America’s Finances<br />

Wall Street Journal<br />

Nearly 70% of consumers live paycheck to paycheck.<br />

Gallup/Bankrate.com<br />

68% of Americans could not cover a $5,000 emergency with<br />

cash without having to go into debt for it.<br />

U.S. Courts<br />

Annual bankruptcy filings have almost doubled since the bankruptcy laws were<br />

reformed in 2005, bringing us back over the one-million-per-year mark.<br />

Federal Reserve and U.S. Census Bureau<br />

<strong>The</strong> average American household has $91,000 in debt, and the total consumer<br />

debt has doubled since 1980. In 1980, the total consumer debt was $1.3 trillion;<br />

today, it is $2.6 trillion.<br />

A Marist Institute Poll Published in USA Today<br />

55% of Americans “always” or “sometimes” worry about their money.<br />

Christian Financial Concepts<br />

In 1929, only 2% of the homes in America had a mortgage against<br />

them. By 1962, only 2% did not have a mortgage against them.<br />

Multiple Studies<br />

Conflict over money is still the leading cause of divorce today.<br />

4 If you will live like no one else, later you can live like no one else

USA Today<br />

Due to a lack of savings, 60% of the 77 million baby<br />

boomers will not have the means to support their current<br />

standard of living when they reach retirement.<br />

AARP Poll<br />

28% of Americans spent more time watching reality TV last month than they spent<br />

planning and preparing for retirement over the past 10 years.<br />

If you will live like no one else, later you can live like no one else.<br />

5

Baby Step One<br />

$1,000 in an Emergency Fund<br />

“You must prepare yourself by previously<br />

thinking out and practicing how to act on<br />

any accident or emergency so you are<br />

never taken by surprise.”<br />

— Sir Robert Baden-Powell

Baby Step One<br />

to start an “Emergency Fund.”<br />

You must<br />

money.<br />

You must pay yourself .<br />

Give, save, then pay .<br />

$750,378<br />

$1,000 One-Time Investment.<br />

No withdrawal. Age 25 to 65 (40 years)<br />

$400,000<br />

$300,000<br />

$200,000<br />

Where you put your money<br />

DOES MATTER!<br />

$100,000<br />

0<br />

$10,285<br />

$93,050<br />

6% Return 12% Return 18% Return<br />

8 If you will live like no one else, later you can live like no one else.

more resources available at:<br />

Debunking the Myth<br />

If you tell a lie or spread a<br />

often enough,<br />

loud enough, and long enough, the myth becomes accepted as<br />

.<br />

Debt has been<br />

to us in so many forms and<br />

so aggressively since the 1960s, that to even imagine living without<br />

it requires a complete paradigm .<br />

Myth: Car are a way of life, and<br />

you’ll always have one.<br />

Truth: Staying away from car payments by driving reliable<br />

used cars is what the typical millionaire does. This is<br />

they became millionaires.<br />

Buy used! Check out used<br />

car lots and look into repo<br />

auctions, but the best deals<br />

you can find are usually<br />

from individuals.<br />

Myth: You can get a good deal on a car.<br />

Truth: A new car loses of its value<br />

in the first four years. This is the largest purchase most<br />

consumers make that goes down in value.<br />

Do <strong>The</strong> Math<br />

____.<br />

A new car selling for $28,800 (2008 average) will lose about $17,280<br />

of its value in the first four years, making it worth $11,520. You are<br />

losing $360 per month in value!<br />

If you will live like no one else, later you can live like no one else.<br />

9

Myth:<br />

your car is what sophisticated<br />

financial people do. You should always lease things that<br />

go down in value. In addition, there are tax advantages.<br />

Truth:<br />

Consumer Reports, Smart Money magazine, and a<br />

good calculator will tell you that the car lease is the<br />

most<br />

way to finance and operate a<br />

vehicle.<br />

Myth:<br />

You need to take out a credit card or car loan to “build<br />

your<br />

.” You must build your<br />

FICO score to prosper.<br />

Truth: <strong>The</strong> FICO score is an “I debt”<br />

score. Why would you want to go into debt so you have<br />

the opportunity to go further into debt<br />

Myth: You need a credit card to a car, check in<br />

to a hotel, or make a purchase over the phone or web.<br />

<strong>The</strong>re’s not a single<br />

credit card that offers<br />

anything near 12% to 18%<br />

“cash back!”<br />

Truth: A card will do all of that, except<br />

for a few major rental companies. Check in advance.<br />

Myth: “I pay mine off every , with no annual<br />

fee. I get brownie points, air miles, and a free hat.”<br />

Truth: Over 100 million Americans do pay<br />

off the balance every month.<br />

10 If you will live like no one else, later you can live like no one else.

Truth:<br />

You spend more when you use plastic because<br />

spending cash .<br />

According to Sallie Mae,<br />

82% of college students<br />

don’t pay off their credit<br />

card balances every month.<br />

Myth: I’ll make sure my gets a credit<br />

card so he/she can learn to be responsible with money.<br />

Truth: Teens are a huge of credit<br />

card companies today. Anyone with half a brain<br />

realizes how stupid this myth is.<br />

Myth: Debt is a and should be used<br />

to create prosperity.<br />

Truth: <strong>The</strong> borrower is to the lender.<br />

How much could you<br />

, invest, blow, and<br />

if you had no payments<br />

Survey Says...<br />

When surveyed, the<br />

Forbes 400 were asked<br />

“What is the most<br />

important key to building<br />

wealth” 75% replied that<br />

becoming and staying debt<br />

free was the number one<br />

key to building wealth.<br />

Remember: Change is a Process!<br />

Change is a , not an ,<br />

and yet we worship the event in our culture.<br />

We<br />

the process.*<br />

the event and we<br />

* From John Maxwell’s <strong>The</strong> 21 Irrefutable Laws of Leadership, “<strong>The</strong> Law of Process”<br />

If you will live like no one else, later you can live like no one else.<br />

11

READY FOR THE NEXT STEP<br />

CHANGE<br />

STARTS<br />

HERE<br />

TODAY<br />

ONLY! $ 99<br />

(Regular Price - $169)<br />

LIFETIME<br />

MEMBERSHIP<br />

with Deluxe Envelope System

FINANCIAL PEACE UNIVERSITY:<br />

It’s more than a class!<br />

Lifetime membership to Dave’s 13-week class so<br />

you can attend anytime, anywhere it’s offered to<br />

the public.<br />

Budget forms you can personalize to learn to<br />

make a budget that works<br />

Dave’s New York Times Bestseller<br />

Financial Peace Revisited<br />

Audio CDs of every lesson so you can listen<br />

whenever you want—at home or on the road<br />

TODAY ONLY!<br />

Get a FREE DELUXE ENVELOPE SYSTEM<br />

with your LIFETIME FPU MEMBERSHIP!<br />

HEAR WHAT<br />

FPU GRADUATES<br />

ARE SAYING!<br />

“FPU offered something tangible and<br />

meaningful that people can hang on to.<br />

So many courses are all theory, not the<br />

nuts and bolts to hold the information<br />

together, but FPU is different! It saves<br />

marriages and gives people hope!”<br />

—Shari<br />

“For the fi rst time in my life, I feel like<br />

I have direction with my money. FPU<br />

saved my family!”<br />

—Lance<br />

“I feel like a huge weight has been taken<br />

off my shoulders. I have no credit card<br />

debt. It’s unbelievable!”<br />

—Joan & Richard<br />

VISIT THE FPU TABLE<br />

or go to daveramsey.com/fpu for more information.<br />

daveramsey.com/fpu 888.22PEACE

All BOOKS, DVDs, CDs, and SOFTWARE<br />

$10 EACH TODAY ONLY<br />

FOR AN EVEN BETTER DEAL, TAKE ADVANTAGE OF THESE SPECIALS:<br />

<strong>The</strong> Total Money Makeover Special<br />

4 ITEMS, ONLY<br />

$30<br />

<br />

<br />

<br />

<br />

<strong>The</strong> Starter Special<br />

6 ITEMS, ONLY<br />

$50<br />

<br />

<br />

<br />

<br />

<br />

<br />

<strong>The</strong> Complete Do-It-Yourself Special<br />

14 ITEMS, ONLY<br />

$100

Baby Step Two<br />

Pay Off All Debt with the Debt Snowball<br />

“Do not accustom yourself toconsider<br />

debt only as an inconvenience;<br />

you will find it a calamity.”<br />

— Samuel Johnson

Baby Step Two<br />

Pay off all debt using the “ .”<br />

Proverbs 6:4–5 (NKJV)<br />

Give no sleep to your eyes, nor slumber to your eyelids. Deliver<br />

yourself like a gazelle from the hand of the hunter, and like a bird<br />

from the hand of the fowler.<br />

So get Gazelle<br />

! <strong>The</strong>n follow these…<br />

Steps Out of Debt<br />

1. You must money.<br />

2. Quit more !<br />

3. really works.<br />

eBay has a huge following,<br />

but also check out sites like<br />

craigslist.org and kijiji.com<br />

that don’t have a seller’s<br />

fee. Of course, there’s<br />

the old standby—the<br />

garage sale.<br />

4. something.<br />

5. Take a part-time .<br />

16 If you will live like no one else, later you can live like no one else

more resources available at:<br />

<strong>The</strong> Debt Snowball<br />

List your debts in order, from the smallest balance to the largest. Don’t be concerned with<br />

interest rates, unless two debts have a similar payoff balance. In that case, list the one with<br />

the higher interest rate first. As you start eliminating debts, you’ll start to build some serious<br />

momentum. <strong>The</strong>se quick wins will keep you motivated, so you’ll be able to stay on track.<br />

<strong>The</strong> idea of the snowball is simple: pay minimum payments on all of your debts except for the<br />

smallest one. <strong>The</strong>n, attack that one with gazelle intensity! Every extra dollar you can get your<br />

hands on should be thrown at that smallest debt until it is gone. <strong>The</strong>n, you attack the second<br />

one. Every time you pay a debt off, you add its old minimum payment to the next debt in the<br />

snowball. So, as the snowball rolls over, it picks up more snow. Get it<br />

<strong>The</strong> “New Payment” is the total of the previous debt’s payment PLUS the current debt’s<br />

minimum. As these payments compound, you’ll start making huge payments as you work<br />

Debt Snowball (Form 10)<br />

down the list.<br />

Total Minimum New<br />

Item Payoff Payment Payment<br />

____________________________________ ___________ ___________ ___________<br />

____________________________________ ___________ ___________ ___________<br />

____________________________________ ___________ ___________ ___________<br />

____________________________________ ___________ ___________ ___________<br />

____________________________________ ___________ ___________ ___________<br />

____________________________________ ___________ ___________ ___________<br />

____________________________________ ___________ ___________ ___________<br />

____________________________________ ___________ ___________ ___________<br />

____________________________________ ___________ ___________ ___________<br />

____________________________________ ___________ ___________ ___________<br />

If you will live like no one else, later you can live like no one else<br />

____________________________________ ___________ ___________ ___________<br />

17

“This is one of the best-laid-out curriculum packages I’ve seen.<br />

<strong>The</strong> advice and knowledge this package teaches are absolutely crucial.”<br />

— <strong>Group</strong> Magazine <br />

Insist that your church get<br />

Generation Change for the<br />

TEENS in your church today!<br />

Dave Ramsey’s Generation Change is a<br />

four-session DVD series that teaches teens:<br />

<br />

<br />

<br />

<br />

<br />

<br />

SPECIAL LEADER’S KIT PRICE<br />

$160 AT TODAY’S EVENT!<br />

(includes leader materials and 8 student kits)<br />

888.22.PEACE | daveramsey.com

Baby Step Three<br />

3 to 6 Months of Expenses in Savings<br />

“Thatch your roof before rainy<br />

weather; dig your well before you<br />

become parched with thirst.”<br />

— Chinese Proverb

Baby Step Three<br />

months of expenses in savings.<br />

According to a 2008 survey<br />

by the National Foundation<br />

for Credit Counseling,<br />

roughly 76 million adults say<br />

they do not have any<br />

non-retirement savings.<br />

Of those who do have a<br />

cash fund, 61% don’t have<br />

enough to cover three<br />

months of income.<br />

Emergency funds must be easy to access, or .<br />

Market accounts are easily accessible,<br />

often have no penalties for early withdrawals, and often have<br />

check-writing privileges.<br />

Remember...<br />

A fully funded emergency fund is not a wealth-building tool.<br />

It will rain, and this will be your umbrella.<br />

Emergency Fund Savings<br />

Men: “Boring, not sophisticated .”<br />

Women: “Most<br />

key to our financial plan.”<br />

An emergency fund can turn a<br />

an inconvenience.<br />

into<br />

You should save for three basic reasons:<br />

1.<br />

2.<br />

3.<br />

20 If you will live like no one else, later you can live like no one else

Baby Step Four<br />

Invest 15% of <strong>Inc</strong>ome into Roth IRAs and Pre-Tax Retirement Plans<br />

“Preparation for old age should begin<br />

no later than one’s teens. A life which<br />

is empty of purpose until 65 will not<br />

suddenly become filled on retirement.”<br />

— Arthur E. Morgan

Baby Step Four<br />

Invest<br />

and pre-tax retirement.<br />

of household income into Roth IRAs<br />

<strong>The</strong> question isn’t at what<br />

age I want to retire, it’s at<br />

what income.<br />

— George Foreman<br />

It has been said that Albert Einstein called<br />

interest the eighth wonder of the world.<br />

$100 per month from age 25 to 65 at 12% = $ .<br />

IRAs and<br />

secret government formulas to wealth.<br />

are<br />

YOU MUST START !<br />

And there are a million reasons why.<br />

Why 15%<br />

Don’t invest more than 15%. <strong>The</strong> extra money will help you with the<br />

next two baby steps. But don’t invest less either. You’ll miss out<br />

on some of the power of compound interest.<br />

22 If you will live like no one else, later you can live like no one else

Age Ben Invests Arthur Invests<br />

19 $2,000 $2,240 0 0<br />

20 $2,000 $4,749 0 0<br />

21 $2,000 $7,558 0 0<br />

22 $2,000 $10,706 0 0<br />

23 $2,000 $14,230 0 0<br />

24 $2,000 $18,178 0 0<br />

25 $2,000 $22,599 0 0<br />

26 $2,000 $27,551 0 0<br />

27 0 $30,857 $2,000 $2,240<br />

28 0 $34,560 $2,000 $4,749<br />

29 0 $38,708 $2,000 $7,558<br />

30 0 $43,352 $2,000 $10,706<br />

31 0 $48,554 $2,000 $14,230<br />

32 0 $54,381 $2,000 $18,178<br />

33 0 $60,907 $2,000 $22,599<br />

34 0 $68,216 $2,000 $27,551<br />

35 0 $76,802 $2,000 $33,097<br />

36 0 $85,570 $2,000 $39,309<br />

37 0 $95,383 $2,000 $46,266<br />

38 0 $107,339 $2,000 $54,058<br />

39With only a $16,000 0 $120,220 $2,000 $62,785<br />

40investment, Ben 0 $134,646 $2,000 $72,559<br />

41has saved over 0 two $150,804 $2,000 $83,506<br />

42million dollars 0 for $168,900 $2,000 $95,767<br />

43retirement!<br />

0 $189,168 $2,000 $109,499<br />

44 0 $211,869 $2,000 $124,879<br />

45 0 $237,293 $2,000 $142,104<br />

46 0 $265,768 $2,000 $161,396<br />

47 0 $297,660 After investing $2,000 $183,004<br />

48 0 $333,379 $78,000, Arthur $2,000 $207,204<br />

49 0 $373,385 still never caught $2,000 $234,308<br />

50 0 $418,191 up with Ben! $2,000 $264,665<br />

51 0 $468,374 $2,000 $289,665<br />

52 0 $524,579 $2,000 $336,745<br />

53 0 $587,528 $2,000 $379,394<br />

54 0 $658,032 $2,000 $427,161<br />

55 0 $736,995 $2,000 $480,660<br />

56 0 $825,435 $2,000 $540,579<br />

57 0 $924,487 $2,000 $607,688<br />

58 0 $1,035,425 $2,000 $682,851<br />

59 0 $1,159,676 $2,000 $767,033<br />

60 0 $1,298,837 $2,000 $861,317<br />

61 0 $1,454,698 $2,000 $966,915<br />

62 0 $1,629,261 $2,000 $1,085,185<br />

63 0 $1,824,773 $2,000 $1,217,647<br />

64 0 $2,043,746 $2,000 $1,366,005<br />

65 0 $2,000<br />

$2,288,996 $1,532,166<br />

Ben & Arthur<br />

Ben and Arthur both<br />

save $2,000 per year<br />

at 12%.<br />

Ben starts at age 19<br />

and STOPS at age 26.<br />

Arthur starts at age<br />

27 and STOPS at age<br />

65 … and he never<br />

caught up.<br />

If you will live like no one else, later you can live like no one else<br />

23

Give portions to seven,<br />

yes to eight, for you do not<br />

know what disaster may<br />

come upon the land.<br />

— Ecclesiastes 11:2 (NIV)<br />

Understanding Investments<br />

A. Diversification<br />

Diversification means to .<br />

Diversification<br />

risk.<br />

I’m putting all my money<br />

in taxes. It’s the only thing<br />

guaranteed to go up.<br />

— Mark Twain<br />

B. Mutual Funds<br />

Investors pool their<br />

to invest.<br />

Professional portfolio managers manage the pool or<br />

.<br />

Your return comes as the<br />

.<br />

of the funds is<br />

Mutual Funds are<br />

term investments.<br />

C. Diversify in Fund Types / Invest<br />

25% in and funds.<br />

25% in funds.<br />

25% in funds.<br />

25% in Aggressive funds.<br />

24 If you will live like no one else, later you can live like no one else

...because at age 65, the adventure has just begun.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

to purchase, visit:

Baby Step Five<br />

College Funding<br />

“<strong>The</strong> direction in which education starts a<br />

man will determine his future life.”<br />

— Plato

Baby Step Five<br />

College<br />

First Rule of College: .<br />

Take the time to<br />

attending college.<br />

the cost of<br />

<strong>The</strong> average college student graduates with<br />

in student loan debt (includes graduate and undergraduate).<br />

Student Loans<br />

Finaid.org reports that 70% of all students—graduate and<br />

undergraduate—borrow money for school expenses.<br />

An Education Savings Account (ESA), or “Education<br />

,” funded in a growth stock mutual fund is best.<br />

According to a 2008 study<br />

by Sallie Mae and Gallup,<br />

only 9% of families use<br />

college savings funds like<br />

ESAs and 529s.<br />

What about 529s<br />

529s are less flexible and should be used only if you make more<br />

than $200,000 annually and/or have maxed out your ESA.<br />

and<br />

tuition are not smart investments because the rate of return is low.<br />

28 If you will live like no one else, later you can live like no one else

...because your kids deserve a debt-free start.<br />

Baby Step Six<br />

Pay Off Your Home Early<br />

“A mortgage casts a shadow<br />

on the sunniest field.”<br />

— Robert Green Ingersoll

Baby Step Six<br />

Pay off home .<br />

<strong>The</strong> best mortgage is the<br />

one you never have! But<br />

if you must take one out,<br />

your best option is a 15-year<br />

fixed, and payments should<br />

be no more than 25% of<br />

your TAKE HOME PAY.<br />

What could you do if you had<br />

payments<br />

Myth: It is wise to keep my home mortgage to get the<br />

deduction.<br />

Truth: Tax deductions are no .<br />

Myth: Borrowing on my at low rates,<br />

and investing to make more, is sophisticated and wise.<br />

Truth: After adjusting for taxes and ,<br />

there is no real net return.<br />

A $200,000 Mortgage at 6% Interest<br />

30 Years<br />

15 Years<br />

Cash<br />

You pay back the loan amount, in addition<br />

to $231,683 in interest.<br />

You pay back the loan amount, in addition<br />

to $103,797 in interest.<br />

You pay 0% in interest.<br />

30 If you will live like no one else, later you can live like no one else

Do Not Be Conformed<br />

And do not be conformed<br />

to this world, but be<br />

transformed by the<br />

renewing of your mind.<br />

— Romans 12:2 (NKJV)<br />

<strong>The</strong> Definition of Insanity<br />

Doing the same thing over and over again,<br />

expecting a different result.<br />

People do not get the best use of their money and/or they have<br />

money problems for two reasons:<br />

1.<br />

2. Reflection of character<br />

<strong>The</strong> flow of money in your life and relationships represents the<br />

you operate.<br />

under which<br />

Financial Problems<br />

Men lose<br />

is a .<br />

because with men, money usually<br />

Women face<br />

, or even<br />

, because usually with women money<br />

represents .<br />

32 If you will live like no one else, later you can live like no one else

Singles and <strong>The</strong>ir Money<br />

Time<br />

(no time) and fatigue can lead to poor<br />

money management.<br />

Beware of<br />

by<br />

buying, which can be brought on<br />

or the “I owe it to myself” syndrome.<br />

Prevention—You Need a Personal Trainer!<br />

Develop an<br />

relationship.<br />

• Someone to discuss major<br />

with.<br />

• Someone to discuss your<br />

with.<br />

Probably the world’s<br />

greatest humorist was<br />

the man who named them<br />

easy payments.<br />

— Stanislas<br />

• Accountability friends must love you enough to be brutally<br />

honest and promise to do so for your own good.<br />

• Suggested possibilities: pastor, parent, relative, boss, etc.<br />

For which of you, intending<br />

to build a tower, does not<br />

sit down first and count<br />

the cost, whether he has<br />

enough to finish it.<br />

— Luke 14:28 (NKJV)<br />

If you will live like no one else, later you can live like no one else<br />

33

Written Workout Routine<br />

You must have a written<br />

plan.<br />

A budget is when you say, “ me the money.”<br />

Most people hate the word “budget” because it has a<br />

and<br />

connotation, and<br />

they never had a budget that .<br />

A good cash flow plan should be a<br />

based plan.<br />

A practical tool is the<br />

system.<br />

A written plan removes the “management by ”<br />

from your finances so the money works harder.<br />

How many marriages<br />

would be better if the<br />

husband and the wife<br />

clearly understood that<br />

they’re on the same side<br />

— Anonymous<br />

Important!<br />

A written plan, if actually lived on and agreed on, will remove<br />

much of the guilt, shame and fear that may now be part of any<br />

necessity purchases like food and clothes.<br />

A written plan gives the<br />

person<br />

empowerment, self-accountability and .<br />

34 If you will live like no one else, later you can live like no one else

more resources available at:<br />

A written plan, if actually lived and agreed on, will remove<br />

many of the<br />

from your<br />

marriage, and add a new level of unity to your marriage.<br />

<strong>The</strong><br />

likes the budget because it gives them<br />

control, and they feel like they are taking care of loved ones.<br />

<strong>The</strong><br />

can appear irresponsible to nerds.<br />

spirit feels controlled (not cared for) and<br />

If you will live like no one else, later you can live like no one else<br />

35

Baby Step Seven<br />

Build Wealth and Give!<br />

“<strong>The</strong>re is a wonderful mythical law of<br />

nature that the three things we crave<br />

most in life—happiness, freedom, and<br />

peace of mind—are always attained by<br />

giving them to someone else.”<br />

— Peyton Conway March

Baby Step Seven<br />

Build Wealth and !<br />

<strong>The</strong> most powerful wealth-building tool is your .<br />

Wealth is not an escape mechanism, it is a tremendous<br />

.<br />

Proverbs 13:22 (NKJV)<br />

A good man leaves an inheritance to his children’s children.<br />

Have , , and<br />

.<br />

Giving is possibly the most<br />

with money.<br />

you will ever have<br />

No one would remember<br />

the Good Samaritan if he<br />

didn’t have money.<br />

— Margaret Thatcher<br />

A Paradox: Wealth will make you more of what you are.<br />

Psalm 62:10 (NKJV)<br />

If riches increase, do not set your heart on them.<br />

38 If you will live like no one else, later you can live like no one else

...because this is the way life should be.<br />

Emergency Fund<br />

$1,000 to start your emergency fund<br />

<strong>The</strong> Debt Snowball<br />

Pay off all debt using the debt snowball<br />

Fully Funded Emergency Fund<br />

Three to six months of expenses in savings<br />

Retirement<br />

Invest 15% of household income into<br />

Roth IRAs and pre-tax retirement<br />

College Fund<br />

College funding for children<br />

Pay Off Mortgage<br />

Pay off home early<br />

Build Wealth and Give<br />

Invest in mutual funds and real estate, and give money away

Answer Key<br />

Baby Step 1<br />

$1,000<br />

Save<br />

First<br />

Bills<br />

Myth<br />

Truth<br />

Marketed<br />

Shift<br />

Payments<br />

How<br />

New<br />

60%<br />

Leasing<br />

Expensive<br />

Credit<br />

Love<br />

Rent<br />

Debit<br />

Month<br />

Not<br />

Hurts<br />

Teenager<br />

Target<br />

Tool<br />

Slave<br />

Save<br />

Give<br />

Process<br />

Event<br />

Over-estimate<br />

Under-estimate<br />

Baby Step 2<br />

Debt Snowball<br />

Intense<br />

Save<br />

Borrowing<br />

Money<br />

Prayer<br />

Sell<br />

Job<br />

Baby Step 3<br />

3–6<br />

Liquid<br />

Money<br />

Enough<br />

Important<br />

Crisis<br />

Emergency Fund<br />

Purchases<br />

Wealth Building<br />

Baby Step 4<br />

15%<br />

Compound<br />

1,176,477<br />

Roth<br />

401(k)s<br />

Now<br />

Spread Around<br />

Lowers<br />

Money<br />

Fund<br />

Value<br />

<strong>Inc</strong>reased<br />

Long<br />

Growth<br />

<strong>Inc</strong>ome<br />

Growth<br />

International<br />

Growth<br />

Baby Step 5<br />

Funding<br />

Pay Cash<br />

Research<br />

$42,406<br />

IRA<br />

Savings Bonds<br />

Pre-Paid<br />

Baby Step 6<br />

Early<br />

No<br />

Tax<br />

Bargain<br />

Home<br />

Risk<br />

Ignorance<br />

Short Fall<br />

Value System<br />

Self-Esteem<br />

Scorecard<br />

Fear<br />

Terror<br />

Security<br />

Poverty<br />

Impulse<br />

Stress<br />

Accountability<br />

Purchases<br />

Budget<br />

Cash Flow<br />

Show<br />

Bread<br />

Water<br />

Worked<br />

Zero<br />

Envelope<br />

Crisis<br />

Single<br />

Control<br />

Money Fights<br />

Nerd<br />

Free<br />

Baby Step 7<br />

Give<br />

<strong>Inc</strong>ome<br />

Responsibility<br />

Fun<br />

Invest<br />

Give<br />

Fun<br />

CHANGE<br />

STARTS<br />

HERE<br />

<br />

TO YOUR COMMUNITY<br />

PLACES LIKE:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Go to daveramsey.com/fpu for more information.