May/June 2013 - The ASIA Miner

May/June 2013 - The ASIA Miner May/June 2013 - The ASIA Miner

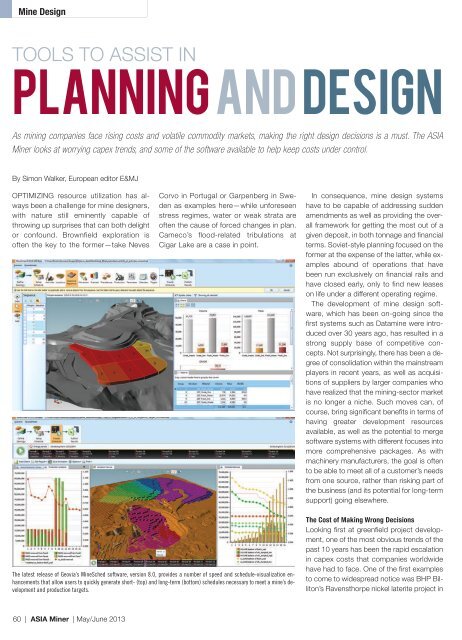

Mine Design TOOLS TO ASSIST IN planninganddesign As mining companies face rising costs and volatile commodity markets, making the right design decisions is a must. The ASIA Miner looks at worrying capex trends, and some of the software available to help keep costs under control. By Simon Walker, European editor E&MJ OPTIMIZING resource utilization has always been a challenge for mine designers, with nature still eminently capable of throwing up surprises that can both delight or confound. Brownfield exploration is often the key to the former—take Neves Corvo in Portugal or Garpenberg in Sweden as examples here—while unforeseen stress regimes, water or weak strata are often the cause of forced changes in plan. Cameco’s flood-related tribulations at Cigar Lake are a case in point. In consequence, mine design systems have to be capable of addressing sudden amendments as well as providing the overall framework for getting the most out of a given deposit, in both tonnage and financial terms. Soviet-style planning focused on the former at the expense of the latter, while examples abound of operations that have been run exclusively on financial rails and have closed early, only to find new leases on life under a different operating regime. The development of mine design software, which has been on-going since the first systems such as Datamine were introduced over 30 years ago, has resulted in a strong supply base of competitive concepts. Not surprisingly, there has been a degree of consolidation within the mainstream players in recent years, as well as acquisitions of suppliers by larger companies who have realized that the mining-sector market is no longer a niche. Such moves can, of course, bring significant benefits in terms of having greater development resources available, as well as the potential to merge software systems with different focuses into more comprehensive packages. As with machinery manufacturers, the goal is often to be able to meet all of a customer’s needs from one source, rather than risking part of the business (and its potential for long-term support) going elsewhere. The latest release of Geovia’s MineSched software, version 8.0, provides a number of speed and schedule-visualization enhancements that allow users to quickly generate short- (top) and long-term (bottom) schedules necessary to meet a mine’s development and production targets. The Cost of Making Wrong Decisions Looking first at greenfield project development, one of the most obvious trends of the past 10 years has been the rapid escalation in capex costs that companies worldwide have had to face. One of the first examples to come to widespread notice was BHP Billiton’s Ravensthorpe nickel laterite project in 60 | ASIA Miner | May/June 2013

Mine Design Western Australia, where the initial $1 billion cost more than doubled between 2005 and 2008. The mine failed, and BHP sold it to First Quantum Minerals for $340 million in 2010. First Quantum in turn spent some $370 million on re-engineering it and bringing it back into production, which itself was nearly double the company’s original $190 million re-engineering estimate. In point of fact, cost overruns are more of the rule than the exception. In November, the management consultants Accenture published a report titled Achieving superior delivery of capital projects, which makes alarming reading if for no other reason that it highlights the scale of the overrun problem. The survey that provided the foundation for the report sought the views of 31 senior industry respondents with responsibility for capital projects around the world. Of these, 22 respondents were involved with mining projects, and the other nine with metals. According to Accenture, “less than a third (30%) of the respondents reported staying within 25% of approved budgets for all projects, and less than a fifth (17%) said they completed all projects within a 10% budget range.” Put in financial terms, the implications— as well as the sums involved—are huge. Accenture estimates that capex for metals and mining projects will have been more than $140 billion last year, with the prospect of $1 trillion to $1.5 trillion being spent between 2011 and 2025. “With $100–$200 billion in annual spend, the impact of project delivery overruns on individual companies and the industry as a whole is enormous,” the company commented. “When asked what typically causes delays in project schedules, survey respondents cited the availability of talent (57%), new or unconsidered regulatory requirements (45%) and insufficient detail during the planning stage (42%),” Accenture added, while pointing out that mining projects are often more complex than metals projects, so are more likely to experience longer delays and higher cost overruns. In some ways, though, that seems counter-intuitive since smelter and metallurgy projects in general can be highly complex and, in consequence, risk budgets being broken. The high capex requirements for today’s nickellaterite treatment plants is a case in point, relying as they do on autoclaves and sophisticated hydrometallurgy. Leading Attributes and Recommendations However, that is by far from being the whole picture, since a host of other factors can come into play. Looking purely at the key reasons for cost overruns, and setting aside the question of whether or not a company can attract competent staff and contractors (which is an issue in its own right), it is difficult to understand how projects can fall foul of factors as obvious as ‘unconsidered regulatory requirements’ and ‘insufficient detail during the planning stage.’ Those, frankly, are fundamentals that any company considering a major investment should be capable of addressing, and it begs questions that shareholders should be posing if they feel that their interests (and investments) are not be husbanded properly. Still, there are some companies that can and do deliver projects on schedule and budget, even faced with the pressures of skilled-labor shortages and rising equipment costs. According to Accenture, a number of common attributes identify them: • They make fewer revisions to the approved schedule; • They make significantly fewer changes during construction; and • They have greater confidence in their own culture in delivering projects. In addition, these companies make wider use of analytics, including key performance indicators, and have better access to performance data across multiple dimensions, such as timeliness, accuracy, range and source. In its report, Accenture defined five key recommendations for effective project delivery: • Establish strong project governance and risk-management tools; • Proactively manage external stakeholders’ increasing expectations for sustainability; • Optimize scarce talent through portfolio management, organizational flexibility and training; • Integrate information systems among capital project players; and • Accelerate operational readiness. “Addressing cost and time objectives of capital projects is a prime opportunity to achieve competitive advantage,” Accenture concluded. “Ideally, capital projects should be run as high-stakes businesses with targeted objectives, clear delivery strategies and careful monitoring to track progress toward high performance.” And this, of course, is where good design has a major part to play. Sector Movements Among consolidations that have recently taken place within the mine-design software companies, the current wave of acquisitions seems to have started in April 2010 when CAE bought out The Datamine Group. It followed this in January 2011 by adding Century Systems Technologies to its portfolio, thereby boosting its capabilities in geological data-management and governance systems. Shortly afterward, Switzerland-based ABB acquired the Australian mining-software developer, Mincom, bundling it into its existing software systems unit as Ventyx. During 2012, meanwhile, the major change came with the French 3-D specialist, Dassault Systèmes’, $360-million purchase of Vancouver-based Gemcom, now part of Dassault’s Geovia brand. At the time, its CEO Rick Moignard explained the potential benefits of the move: “Advanced technologies in 3-D modelling and simulation will not only enable engineers and geologists to model and visualize resources but also improve sustainable mine productivity,” he said. Orebody modelling led the way in bringing computerization into mine design. Today’s mine engineers have a plethora of competing products to assist them in interpreting geological data and optimizing resource extraction. Some software focuses specifically on geological resource data; other packages address surface-mine layouts; yet more take specific mining methods such as block caving, providing the design department with the tools to model the resource and apply ‘whatif’ tests to determine the effects of production schedule changes or commodity-price movements on the operation’s viability and resource utilization. In the remainder of this article, E&MJ looks at some of the mine-design software packages that are currently available. There are, of course, many other providers; the common thread here is that each of the suppliers mentioned was among those that exhibited at last year’s MINExpo. RungePincockMinarco In 2005, the Australian software developer, Runge, took the unexpected step of buying out U.S.-based mining consultants, Pincock, Allen & Holt, with the subsequent addition of Minarco-MineConsult boosting its consultancy arm. In December, the company, which today claims to be the world’s largest independent group of mining tech- May/June 2013 | ASIA Miner | 61

- Page 12: Asian Intelligence Evolution opens

- Page 16: Central Asia Kazax closes Lomo iron

- Page 20: Central Asia Exploration agreement

- Page 24: Central Asia Chaarat to begin with

- Page 28: Central Asia Delays in Pakrut const

- Page 32: China Solid production at Jiangsu p

- Page 36 and 37: Malaysia J Resources to increase Pe

- Page 38 and 39: Thailand Positive PEA for Southeast

- Page 40 and 41: Central Asia 1.2 million ounce gold

- Page 42 and 43: Myanmar Centurion secures Ba Mauk c

- Page 44 and 45: Philippines Co-O expansion nears co

- Page 46 and 47: Indonesia Jatenergy to invest in ne

- Page 48 and 49: Mongolia Erdene and Teck align for

- Page 50 and 51: Australia Federal approval for Toro

- Page 52 and 53: Papua New Guinea Mincor begins fiel

- Page 54 and 55: South Pacific Vatukoula begins mini

- Page 56 and 57: International Project Survey ANNUAL

- Page 58 and 59: International Project Survey lion i

- Page 60 and 61: International Project Survey Projec

- Page 64 and 65: Mine Design Multiple grade value sh

- Page 66 and 67: Mine Design CAE Moves Deeper into M

- Page 68 and 69: Product News Tenova Bateman Technol

- Page 70 and 71: Supplier News Keep manuals up to da

- Page 72 and 73: Supplier News TPC inventor Erlau ma

- Page 74: Exploration Spotlight Tuvatu minera

Mine Design<br />

TOOLS TO ASSIST IN<br />

planninganddesign<br />

As mining companies face rising costs and volatile commodity markets, making the right design decisions is a must. <strong>The</strong> <strong>ASIA</strong><br />

<strong>Miner</strong> looks at worrying capex trends, and some of the software available to help keep costs under control.<br />

By Simon Walker, European editor E&MJ<br />

OPTIMIZING resource utilization has always<br />

been a challenge for mine designers,<br />

with nature still eminently capable of<br />

throwing up surprises that can both delight<br />

or confound. Brownfield exploration is<br />

often the key to the former—take Neves<br />

Corvo in Portugal or Garpenberg in Sweden<br />

as examples here—while unforeseen<br />

stress regimes, water or weak strata are<br />

often the cause of forced changes in plan.<br />

Cameco’s flood-related tribulations at<br />

Cigar Lake are a case in point.<br />

In consequence, mine design systems<br />

have to be capable of addressing sudden<br />

amendments as well as providing the overall<br />

framework for getting the most out of a<br />

given deposit, in both tonnage and financial<br />

terms. Soviet-style planning focused on the<br />

former at the expense of the latter, while examples<br />

abound of operations that have<br />

been run exclusively on financial rails and<br />

have closed early, only to find new leases<br />

on life under a different operating regime.<br />

<strong>The</strong> development of mine design software,<br />

which has been on-going since the<br />

first systems such as Datamine were introduced<br />

over 30 years ago, has resulted in a<br />

strong supply base of competitive concepts.<br />

Not surprisingly, there has been a degree<br />

of consolidation within the mainstream<br />

players in recent years, as well as acquisitions<br />

of suppliers by larger companies who<br />

have realized that the mining-sector market<br />

is no longer a niche. Such moves can, of<br />

course, bring significant benefits in terms of<br />

having greater development resources<br />

available, as well as the potential to merge<br />

software systems with different focuses into<br />

more comprehensive packages. As with<br />

machinery manufacturers, the goal is often<br />

to be able to meet all of a customer’s needs<br />

from one source, rather than risking part of<br />

the business (and its potential for long-term<br />

support) going elsewhere.<br />

<strong>The</strong> latest release of Geovia’s MineSched software, version 8.0, provides a number of speed and schedule-visualization enhancements<br />

that allow users to quickly generate short- (top) and long-term (bottom) schedules necessary to meet a mine’s development<br />

and production targets.<br />

<strong>The</strong> Cost of Making Wrong Decisions<br />

Looking first at greenfield project development,<br />

one of the most obvious trends of the<br />

past 10 years has been the rapid escalation<br />

in capex costs that companies worldwide<br />

have had to face. One of the first examples<br />

to come to widespread notice was BHP Billiton’s<br />

Ravensthorpe nickel laterite project in<br />

60 | <strong>ASIA</strong> <strong>Miner</strong> | <strong>May</strong>/<strong>June</strong> <strong>2013</strong>