Volume 9 Edition 5 2012 - The ASIA Miner

Volume 9 Edition 5 2012 - The ASIA Miner

Volume 9 Edition 5 2012 - The ASIA Miner

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

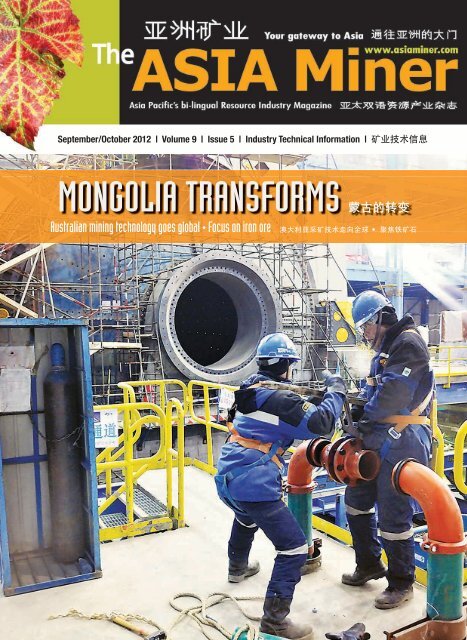

September/October <strong>2012</strong> | <strong>Volume</strong> 9 | Issue 5 | Industry Technical Information | 矿 业 技 术 信 息<br />

MONGOLIA TRANSFORMS 蒙 古 的 转 变<br />

Australian mining technology goes global • Focus on iron ore 澳 大 利 亚 采 矿 技 术 走 向 全 球 • 聚 焦 铁 矿 石

FEATURES<br />

Australian technology Mining technology developed by Australian companies is ensuring that the global<br />

mining industry is meeting the challenges of a world that needs more and more resources but which is also<br />

demanding more in terms of environmental protection, safety, employment opportunities and accountability.<br />

Leading the charge with technology development is the Commonwealth Scientific and Industrial Research<br />

Organization (CSIRO) backed by government, industry groups and industry itself. This special feature looks<br />

at how Australian technology is changing the face of mining. ..............................................From page 74<br />

Electric Shovels A case study by P&H Mining Equipment compares the performance of a P&H AC-powered<br />

rope shovel against its DC-powered shovel with the results providing interesting reading. .............................91<br />

Screen Systems W.S. Tyler’s large vibrating screen handles high production demands ........................94<br />

LEADING DEVELOPMENTS<br />

Asian Intelligence With Myanmar’s economy starting to open up after years of isolation fr om the West, foreign<br />

investment in mining is actively being encouraged by the new democratically elected government .......6<br />

Mongolia Metallurgical test results have confirmed the quality of the magnetite ore at Haranga Resources’<br />

Selenge Iron Ore Project and represent a substantial progression of the project....................................10<br />

Exploration Drilling is progressing well in the Tenge/Ruoni area of Baobab Resources’ Tete pig iron,<br />

vanadium and titanium project in Mozambique. ..................................................................................104<br />

AROUND THE REGION<br />

Mongolia Prophecy Coal is consolidating its holdings in Chandgana Basin of central Mongolia. .............8<br />

China Chinese copper demand is expected to be stronger in the second half of <strong>2012</strong>. ........................38<br />

Indonesia Padang Resources is turning its full attention to the Paser Coal Project in East Kalimantan. ......49<br />

Philippines A Chinese company intends to purchase 600,000 tonnes of iron ore from Astra Resources. .....56<br />

Vietnam Asian <strong>Miner</strong>al Resources will conduct a detailed study for smelter at its Ban Phuc project. .....57<br />

Malaysia Lynas Corporation is focusing on the phase two expansion at its rare earths process plant........58<br />

South Pacific Glass Earth Gold has commissioned a second gold recovery unit at Hecklers Mine.........6<br />

Central Asia Copper production at Central Asia Metals’ Kounrad plant is exceeding expectations. ......62<br />

Australia Centrex Metals is on track to complete a DFS at its Fusion Magnetite Project by early 2013. .....64<br />

India NSL Consolidated has received multiple purchase orders from Indian steel producers............... 68<br />

Papua New Guinea <strong>The</strong> feasibility study for Marengo Mining’s Yandera project is nearing completion. ......70<br />

<strong>The</strong> Oyu Tolgoi Copper-Gold Project (OT) in Mongolia’s<br />

South Gobi is transforming the North Asian<br />

country into a strong mining and manufacturing<br />

centre sandwiched between the major markets of<br />

China and Russia. <strong>The</strong> project is operated by Oyu<br />

Tolgoi LLC, a Mongolian company owned by Rio<br />

Tinto, Turquoise Hill Resources (formerly Ivanhoe<br />

Mines) and the Mongolian Government. OT is more<br />

than 94% complete and initial output of concentrate<br />

is set to begin by the end of <strong>2012</strong>.<br />

Photo Turquoise Hill Resources.<br />

DEPARTMENTS<br />

Advertisers’ Index ....................................102<br />

Calendar of Events ....................................72<br />

From the Editor ............................................2<br />

Product News ............................................95<br />

Subscription Form ....................................102<br />

Supplier News ............................................98<br />

Sharyn Gol gains approval ................................ 34 Battery grade is achieved..................................40 First gold from Martabe.................................... 52<br />

September/October <strong>2012</strong> | <strong>ASIA</strong> <strong>Miner</strong> | 1

From <strong>The</strong> Editor<br />

Uncertain times for mining in Mongolia<br />

THE very nature of the coalition government formed after Mongolia’s parliamentary<br />

election seems certain to result in an increase in politization, polarization,<br />

confrontation and divisiveness in the r esource-rich North Asian<br />

nation. In terms of mineral resources, the coalition will be under substantial<br />

pressure to be more populist with policies and, therefore, resource nationalism<br />

will be a greater risk, investors will be a lot less willing to part with funds<br />

to support Mongolian mining pr ojects and there will be elevated levels of<br />

volatility for the country’s resource equities. <strong>The</strong> impending election created<br />

much uncertainty in the first half of <strong>2012</strong> and ther e has been little change<br />

By John Miller /Editor<br />

since the late June election. This has not been beneficial to the nation’ s mining<br />

industry, which has also not been aided by a period of global economic softening and reduced<br />

demand for Mongolia’s main resource, coal, from its biggest customer, China.<br />

Pre-election murmurs of reviewing the investment agreement for the Oyu Tolgoi Copper-Gold<br />

Project of Rio Tinto and Turquoise Hill Resources (formerly Ivanhoe) have intensified as has the<br />

possibility of the 7.5 billion tonne Tavan Tolgoi (TT) Coal Project remaining entirely in Mongolian<br />

hands. Few major Mongolian projects are progressing smoothly with Aluminum Corp of China<br />

Ltd’s (Chalco) attempted takeover of SouthGobi Resour ces a prime example. <strong>The</strong> announcement<br />

earlier this year prompted Parliament to pass legislation capping foreign investment purchases<br />

to below 50% unless gover nment approval is attained. Mongolia has also dragged its<br />

feet over renewing some of SouthGobi’s licences, scaring away customers, squashing production<br />

and causing SouthGobi’s share price to plummet.<br />

This uncertainty is being exacerbated by continuing problems with issuing new exploration licences<br />

and renewals while there is also considerable ambiguity surrounding the term ‘strategic<br />

importance’ in relation to certain mineral deposits.<br />

Regarding the Oyu Tolgoi agreement, private Mongolian investment company Frontier Securities<br />

states that 12 MPs from the original 20 who signed a petition this year seeking to r evise<br />

the agreement were elected to the new Parliament, and as such the pr obability of a revival of<br />

this call cannot be ruled out. Regarding TT, Frontier says that with new Prime Minister Norov Altanhuyag’s<br />

extensive experience in the project, it believes TT will advance, broadly speaking, as<br />

planned and that new Government will aim to make it a success. However, again due to populist<br />

and resource nationalist pressures, Frontier believes that there is likelihood of some concessions<br />

of certain degree in one way or another to these pressures.<br />

<strong>The</strong>se issues need to be resolved if Mongolians are to receive full benefits of the country’s mineral<br />

wealth and the coalition’s major player, the Mongolian Democratic Party, is well placed to do that as<br />

indicated by the level-headed and generally fair mining sector policies outlined in its pre-election platform.<br />

Its overall policies are characterized by low taxes and support of production and industry with<br />

the goal of establishing a comfortable middle class and an emphasis on cr eating jobs and income<br />

for Mongolians, universal residential programs, paying attention to their health, education, safe environment,<br />

freedom and liberties. At the same time, policies popular with voters such as incr eases<br />

in salaries and pensions are likely to continue as well as much needed targeted social programs.<br />

It will have to ensure it works closely with the other coalition partners and ther e will be mistakes<br />

made while walking this tightr ope, but such is the str ength and potential of Mongolia’s<br />

mining sector that the country’s economy is still certain to be led in an upward direction by the<br />

industry for years to come. It will not be an easy task for the new Prime Minister whose coalition’s<br />

priority is sustainable development of Mongolia’s tiny but fast-growing economy while also<br />

trying to please its impatient citizens as well as its two giant neighbours Russia and China.<br />

Since essentially voters have empowered the new Parliament with a strong resource nationalist<br />

mandate, the coalition is likely to stick to the pre-election stance of complying with the law<br />

on regulation of foreign investment into enterprises of strategic significance but it is of utmost<br />

importance that the new government also sends the right signals to foreign investors.<br />

WWW.<strong>ASIA</strong>MINER.COM<br />

<strong>The</strong> <strong>ASIA</strong> <strong>Miner</strong>®<br />

Suite 9, 880 Canterbury Road,<br />

Box Hill, Melbourne,Victoria, 3128 Australia<br />

Phone: +61 3 9899 2981 Mobile: + 61 417 517 863<br />

Editor —John Miller, john@asiaminer.com<br />

Graphic Designer—Christine Hensley, chensley@mining-media.com<br />

Editorial Director—Steve Fiscor, sfiscor@mining-media.com<br />

Europe—Simon Walker, simon.iets@btinternet.com<br />

North America—Russ Carter, russ.carter.emj@gmail.com<br />

Latin America—Oscar Martinez,martin1@ctcinternet.cl<br />

South Africa—Antonio Ruffini,antonior@webafrica.org.za<br />

SALES<br />

Publisher—Lanita Idrus, lanita@asiaminer.com<br />

North America—Victor Matteucci, vmatteucci@mining-media.com<br />

Latin America—Mauricio Godoy, mgodoy@mining-media.com<br />

Germany, Austria, Switzerland— Gerd Strasmann<br />

strasmannmedia@t-online.de<br />

Rest of Europe—Colm Barry, colm.barry@telia.com<br />

Jeff Draycott, jeff.draycott@WOMPint.com<br />

Japan—Masao Ishiguro, Ishiguro@irm.jp<br />

Indonesia—Dimas Abdillah, dimas@lagunagroup.net<br />

Mining Media International<br />

8751 East Hampden Ave, Suite B-1<br />

Denver, Colorado 80231, U.S.A.<br />

Phone: +1 303-283-0640 Fax: +1 303-283-0641<br />

President—Peter Johnson, pjohnson@mining-media.com<br />

Subscriptions: $120/year—Tanna Holzer,<br />

tholzer@mining-media.com<br />

Accounting—Lorraine Mestas, lmestas@mining-media.com<br />

<strong>The</strong> <strong>ASIA</strong> <strong>Miner</strong>® is published six times per year by Mining Media<br />

International. Every endeavour is made to ensure that the contents<br />

are correct at time of publication. <strong>The</strong> Publisher and Editors do not<br />

endorse the opinions expressed in the magazine. Editorial advice<br />

is non-specific and readers are advised to seek pr ofessional advice<br />

for specific issues. Images and written material submitted for<br />

publication are sent at the owners risk and while every car e is<br />

taken, <strong>The</strong> <strong>ASIA</strong> <strong>Miner</strong>® does not accept liability for loss or damage.<br />

<strong>The</strong> <strong>ASIA</strong> <strong>Miner</strong>® reserves the right to modify editorial and advertisement<br />

content. <strong>The</strong> contents may not be reproduced in whole<br />

or in part without the written permission of the publisher.<br />

Copyright 2011 Mining Media International Pty Ltd<br />

ISSN: 1832-7966<br />

2 | <strong>ASIA</strong> <strong>Miner</strong> | September/October <strong>2012</strong>

Asian Intelligence<br />

Top iron-ore miner still confident in China<br />

VALE, the world’s number two mining company<br />

by market capitalization and the world’s<br />

number one iron-ore producer, remains confident<br />

that the Chinese economy will continue<br />

to expand strongly, despite recent deceleration<br />

of the growth rate to 7.6% in the second<br />

quarter of this year. Between 1999 and 2009,<br />

China’s economy grew at an annual average<br />

real rate of 10.3%, while between 1989 and<br />

1999 the equivalent figure was 9.9%.<br />

Vale executive director iron-ore and strategy<br />

José Carlos Martins told Brazilian media<br />

recently. “China is going through a process of<br />

structural change, which will mean a r eduction<br />

in the rate of investment and an increase<br />

in consumption. <strong>The</strong> exter nal sector is also<br />

Iron ore miner Vale expects China to continue to play the leading role in determining to strength of the global iron ore industry.<br />

reducing its dynamism but the economy will<br />

still grow between 7% and 8% this year , a<br />

number that is still enviable.” In coming years,<br />

he expects the use of steel to manufactur e<br />

vehicles, whitegoods and homes in China to<br />

increase while the use in infrastructure, capital<br />

equipment, other machinery and equipment<br />

and export products will decline.<br />

Vale expects Chinese iron-ore demand to<br />

rise by 5% this year. Iron-ore prices have fallen<br />

from about $170/tonne in 2011 to around<br />

$140/tonne this year, but Vale says this is the<br />

result of increasing competition in the market,<br />

not a fall in demand. José Carlos Martins<br />

says the company's shipments to China continue<br />

to grow. “We do not have problems placing<br />

our volumes in China. It is a question of<br />

availability, competitiveness, quality and price.<br />

“<strong>The</strong> price will remain volatile, in a band of<br />

$120 to $180 delivered to China, but probably<br />

below $150 in the next few months. <strong>The</strong><br />

Western economy is in recession and China<br />

is passing through a structural adjustment.<br />

We are no longer going to see the exuberance<br />

of the past few years, however, we see<br />

very healthy growth.”<br />

For the past decade, ir on-ore prices have<br />

been driven by a demand growth that continually<br />

outstripped supply but in the next few<br />

years new mines will enter operation and,<br />

with a reduced rate of growth in demand, the<br />

price will be more influenced by the supply.<br />

Vale is not concerned about its level of dependence<br />

on China. “Companies sell where<br />

there is a market and the market is China.<br />

Vale is less dependent on China than our direct<br />

competitors as we also sell in Brazil,<br />

the Americas, Eur ope, the Middle East,<br />

Japan, Korea, as well as in China. What<br />

many see as a problem, we see as a solution.<br />

If we wanted to r educe our dependence<br />

on China, we would have to r educe<br />

production, because the other markets<br />

don’t have the capacity to absorb this volume,”<br />

José Carlos Martins adds.<br />

China’s building bolsters zinc market<br />

<strong>ASIA</strong>-PACIFIC is the largest zinc producing region<br />

in the world, and upcoming zinc mining<br />

projects in Australia, China and India are set to<br />

push production even higher, states a report<br />

by mining experts GBI Research. ‘Zinc Mining<br />

Market in Asia-Pacific to 2020’ states that demand<br />

from galvanized steel makers is rising in<br />

the region, as populations expand and housing<br />

projects are announced, keeping investor interest<br />

alive and the zinc industry buoyant.<br />

Substantial reserves in China, Australia and<br />

Kazakhstan support Asia’s zinc mining industry.<br />

According to the US Geological Survey,<br />

Asia-Pacific had the largest zinc r eserves in<br />

the world at the end of 2010 with 122 million<br />

tonnes, with Australia and China accounting<br />

for around 78%. Most zinc r eserves in Australia<br />

are in Queensland, New South Wales,<br />

Western Australia and V ictoria, while Hubei<br />

and Guangdong Sheng provinces accounted<br />

for the majority of reserves in China.<br />

Planned and upcoming zinc pr ojects in<br />

Australia, China and India will incr ease the<br />

region’s production levels in the next few<br />

years. This anticipated boost in activity is<br />

driven by a surging demand for galvanized<br />

steel used in construction. China’s domestic<br />

consumption is expected to incr ease from<br />

around 5.229 million tonnes in 2010 to<br />

roughly 6.506 million tonnes by 2020, due<br />

to its plan to build 36 million units of affordable<br />

housing by 2015.<br />

Overall zinc metal consumption in the Asia-<br />

Pacific stood at an estimated 6.4 million tonnes<br />

in 2011, with China accounting for<br />

almost 90% of this. Regional consumption<br />

this decade is expected to gr ow at a compound<br />

annual growth rate (CAGR) of around<br />

1.6% to reach about 7.8 million tonnes by<br />

2020, due to galvanized steel demand.<br />

However, the skilled labor shortage in Australia<br />

could pose a threat to the Asia-Pacific<br />

zinc industry, as the second largest zinc<br />

company in the region has been experiencing<br />

a skilled labor shortage. Beginning in<br />

2004, the situation worsened as the global<br />

financial crisis forced the resources sector<br />

to lay off around 28,300 personnel in 2008-<br />

2009. Since then, as the industry has gradually<br />

recovered, the shortage has become<br />

more apparent and is soon expected to become<br />

a major concern.<br />

Asia-Pacific zinc ore production was about<br />

6.6 million tonnes in 2011 and during the period<br />

<strong>2012</strong>-2020, production in Asia-Pacific is<br />

estimated to increase at a CAGR of about<br />

4% to 9.6 million tonnes. China was the<br />

major contributor to r egional production in<br />

2011 with 58.3% and is expected to r emain<br />

the leading source in the future.<br />

4 | <strong>ASIA</strong> <strong>Miner</strong> | September/October <strong>2012</strong>

Asian Intelligence<br />

Myanmar is open to mining investment<br />

WITH Myanmar’s economy starting to open up<br />

after years of isolation fr om the West, foreign<br />

investment in mining is being actively encouraged<br />

by the new government. Indicative of the<br />

interest now being shown in the country’s relatively<br />

unexploited r esources was the attendance<br />

of more than 300 participants fr om 25<br />

countries at the inaugural Myanmar Mining<br />

Summit in the capital Yangon during July.<br />

<strong>The</strong> event was organized by Singapor e-<br />

based CMT (Centre for Management Technology)<br />

along with the country’ s mines<br />

ministry. CMT’s event manager Fu Huiyan<br />

said: “<strong>The</strong> response was really positive as mining<br />

companies and investors are really keen<br />

to explore the opportunities in Myanmar’s mining<br />

sector.” It was so positive that CMT is already<br />

planning the country’s second mining<br />

summit for January 2013.<br />

With a wealth of minerals and natural r e-<br />

sources, from oil and coal to copper , gold<br />

and zinc, mining companies around the world<br />

are keen to invest in Myanmar but ther e are<br />

still challenges to overcome, including overhauling<br />

laws to ensure investors are protected<br />

when putting up their funds, development<br />

of infrastructure and overhauling the banking<br />

system. Myanmar ranks 180th, a spot shared<br />

with Afghanistan, on Transparency International’s<br />

list of the world’ s most graft-ridden<br />

countries, which ranks 183 nations.<br />

A Ministry of Mines of ficial, Win Htein, told<br />

delegates: “For investors who would like to do<br />

exploration to confirm the reserve of a deposit<br />

or to start with the grassroots exploration operations<br />

in a virgin land, they may apply accordingly<br />

clearly stating their intentions. Funds<br />

required to conduct the prospecting, exploration<br />

and feasibility study are borne by the investor<br />

100% at their own risk.” He said that as<br />

the export of ores is not allowed, the gover n-<br />

ment is encouraging firms to set up mineral<br />

processing plants and export the product.<br />

<strong>The</strong> conference was told that seven for eign<br />

companies from Australia, China, Russia, Thailand<br />

and Vietnam already have mining operations,<br />

in zinc, ir on, gold and other metals.<br />

Global Resources Corp’s chairman Stephen<br />

Everett says smaller Australian exploration and<br />

mining firms are well placed to enter Myanmar.<br />

“Australian entrepreneurial junior companies<br />

are often the first movers going into remote<br />

areas,” Stephen Everett says pointing<br />

to examples in South America, Africa and<br />

parts of Asia. “We have a significant track<br />

record in terms of being ahead of the game<br />

in terms of exploration processing.” He says<br />

Australia’s strong reputation in environmental<br />

and social responsibility will work in favour<br />

of new investors.<br />

A Canadian company has already applied for<br />

a licence to explore for gold deposits in remote<br />

central Burma. Northquest’ s president and<br />

CEO Jon North, a geologist by trade, says he<br />

as optimistic that his company will win an exploration<br />

permit from the government.<br />

Antimony technical collaboration in Myanmar<br />

INTEGRATED antimony exploration and development<br />

company Tri-Star has entered into an<br />

agreement with RDP Singapore (RDPS) under<br />

which Tri-Star will provide technical collaboration<br />

and advice to RDPS in r elation to its Myanmar<br />

antimony pr ojects, which include<br />

exploration rights surrounding two existing producing<br />

deposits and any additional antimony<br />

projects identified there by Tri-Star or RDPS.<br />

<strong>The</strong> first stage of the agr eement will involve<br />

Tri-Star providing technical expertise to RDPS<br />

and performing a series of geological and metallurgical<br />

assessments at the antimony pr o-<br />

: A sample of antimony mineralization. Myanmar is a rich source of antimony ore material.<br />

jects. Following the completion of the initial assessment<br />

work, the board of directors of Tri-<br />

Star will make a decision regarding any further<br />

collaboration with RDPS. <strong>The</strong> Boar d expects<br />

this initial work to be completed within 6 to 12<br />

months and subject to the r esults of the assessments<br />

the Board will consider further investment<br />

in the projects and seek to negotiate<br />

an exclusive offtake arrangement with RDPS.<br />

RDPS, a subsidiary of Resour ce Development<br />

Partners, the London-based mining finance<br />

house specializing in natural resource<br />

investments. RDPS is a private holding company<br />

incorporated in Singapore which invests<br />

in the Myanmar mining industry, in addition to<br />

other sectors. <strong>The</strong> principals, James Hyndes<br />

and Christian West, have regional investment<br />

and mining experience, and are supported by<br />

a strong board with members based in South<br />

East Asia and Myanmar.<br />

RDPS has identified two operating antimony<br />

mines in Myanmar and will focus on expanding<br />

the surrounding prospective areas<br />

over which it owns the exploration rights.<br />

RDPS is engaged in seeking other projects of<br />

merit and its strategy is to develop str ong<br />

local relationships in key commodity sectors.<br />

Tri-Star’s managing director Emin Eyi says,<br />

“<strong>The</strong> experience RDPS has, together with the<br />

strength of its relationships locally, means the<br />

company is very well positioned to develop opportunities<br />

in Myanmar and we look forward to<br />

utilizing our geological and metallurgical skills<br />

in assisting them, and in turn the Myanmar resource<br />

industry, to improve standards and enhance<br />

exploration and pr oduction potential.<br />

Importantly, we are encouraged by the possible<br />

sourcing of raw materials which can potentially<br />

be processed at Tri-Star’s proposed UAE<br />

roaster facilities in the future.”<br />

6 | <strong>ASIA</strong> <strong>Miner</strong> | September/October <strong>2012</strong>

Asian Intelligence<br />

8 | <strong>ASIA</strong> <strong>Miner</strong> | September/October <strong>2012</strong>

Mongolia<br />

Positive magnetite test results from Selenge<br />

METALLURGICAL test results have confirmed<br />

the quality of the magnetite ore at Haranga Resources’<br />

Selenge Iron Ore Project and represent<br />

a substantial progression of the project.<br />

All three prospects tested produced a consistent,<br />

premium quality magnetite concentrate<br />

with an average grade of more than 65% iron<br />

and very low average silica content.<br />

Coarse grind Davis Tube Recovery (DTR)<br />

tests were completed on 469 composite<br />

samples representing the entirety of the iron<br />

mineralization drilled thus far at Bayantsogt<br />

deposit while DTR tests were completed on<br />

all zones of mineralization drilled at the Dund<br />

Bulag and Huiten Gol prospects.<br />

<strong>The</strong> tests showed that on the whole contaminant<br />

levels are low, apart from sulphur at<br />

Bayantsogt. This can be floated, as it is primarily<br />

in pyrite, or blended with the nearby<br />

lower sulphur material. <strong>The</strong> concentrates produced<br />

are of excellent quality and would<br />

achieve a significant price premium.<br />

Selenge’s higher grade zones may be upgradable<br />

using simple ‘crush and screen’ followed<br />

by dry magnetic separation. This is the process<br />

used at the neighbouring Eruu Gol mine, Mongolia’s<br />

largest iron ore export mine. Beneficiating<br />

the higher grade zones close to surface at Selenge<br />

in this manner would allow for earlier commercial<br />

production and Haranga plans further<br />

test work to examine this potential outcome.<br />

Selenge is in the heart of Mongolia’ s premier<br />

iron ore development region with excellent<br />

access to the main Trans-Mongolian rail<br />

liner and nearby rail spurs. Ir on mineralization<br />

has been identified at four primary exploration<br />

targets, all within 10km of each<br />

other. All four targets ar e associated with<br />

large magnetic skarn hills and lie within a<br />

well-defined structural corridor than contains<br />

the major iron ore deposits in the region.<br />

<strong>The</strong> 2011 drill program was concentrated at<br />

Bayantsogt, the northernmost of the targets<br />

but first pass drilling was also conducted at<br />

Dund Bulag and Huiten Gol. <strong>The</strong> Bayantsogt<br />

program yielded an initial inferr ed resource of<br />

32.8 million tonnes at an average<br />

grade of 24.4% iron and<br />

included some higher grade<br />

zones. It was based on the<br />

first 35 holes drilled and mineralization<br />

remains open in all<br />

directions and at depth. Further<br />

extension and infill drilling<br />

is expected to expand the resource<br />

and convert most of it<br />

to the JORC measur ed and<br />

indicated categories.<br />

Dund Bulag is the largest<br />

of the magnetite skar n hills<br />

at Selenge, coincident with<br />

a magnetic anomaly mor e<br />

than twice as large as Bayantsogt in ar ea.<br />

Five holes were drilled along one cross section<br />

in 2011 with four containing very wide<br />

iron intersections. An exploration target of<br />

120-250 million tonne has been set. Huiten<br />

Gol was the third target to be drilled but no<br />

exploration target has yet been set. <strong>The</strong> drilling<br />

intersected thinner, higher-grade lodes<br />

of iron from surface.<br />

Another magnetite skarn hill at Undur Ukhaa<br />

looks to be an adjunct of nearby Dund Bulag<br />

and will be drilled this year along with a number<br />

of other similar anomalies at Selenge that ar e<br />

yet to be ground checked. <strong>The</strong> <strong>2012</strong> Selenge<br />

drilling program has recently begun.<br />

Drilling by Haranga Resources at the Haranga Iron Ore Project in northern Mongolia.<br />

Voyager to seek KM mining licence<br />

VOYAGER Resources has started work to<br />

convert existing exploration licences at the<br />

KM Copper Project in southern Mongolia into<br />

mining licences and expects this pr ocess to<br />

be completed later this year. This follows the<br />

successful completion of a study aimed at reviewing<br />

the extensive drilling, geology and<br />

geophysical database generated at KM in the<br />

last 12 months. This study has identified a<br />

number of high priority drill targets.<br />

<strong>The</strong> KM project is in the Erdene Island Arc Terrain,<br />

which is one of a number of tectonic ter -<br />

rains that extend across the Gobi and southern<br />

regions of Mongolia that have been pr oven to<br />

host a number of mineralized copper porphyry<br />

systems, including the giant Oyu Tolgoi deposit.<br />

Results generated by Voyager at KM have<br />

been highly encouraging. More than 50,000<br />

metres of drilling has highlighted some of the<br />

most promising copper results in Mongolia<br />

since the discovery of Oyu Tolgoi. <strong>The</strong>se results<br />

and the r ecent study, supports Voyager’s<br />

belief that KM has the potential to host<br />

a significant copper porphyry system.<br />

<strong>The</strong> company’s primary focus is now targeting<br />

the larger copper porphyry and it will undertake<br />

a more comprehensive and targeted<br />

drill program in the latter half of this year . <strong>The</strong><br />

company may also look to utilize deeper induced<br />

polarization (IP) technology in the coming<br />

months as this has pr oven to be highly successful<br />

in targeting drill holes at Oyu Tolgoi.<br />

Although little work has been completed on<br />

the Daltiin Ovor Copper -Gold Project in the<br />

past 12 months, Voyager has recently undertaken<br />

ground magnetics and it has now commenced<br />

soil geochemistry across the project.<br />

Daltiin Ovor is northeast of KM in south central<br />

Mongolia and 600km southwest of Ulaanbaatar.<br />

<strong>The</strong> project, which is within the Bayankhongor<br />

Gold Belt, <strong>The</strong> project has been previously<br />

trenched and drilled with high grade gold, silver<br />

and copper mineralization being identified in<br />

three separate exposures located over a strike<br />

length of about 900 metres.<br />

No further activity has been undertaken by<br />

Voyager at the Khongor Copper-Gold Project<br />

in southern Mongolia and the company is assessing<br />

a number of options to further advance<br />

the project.<br />

Voyager has raised about $4.464 million in<br />

an option entitlement issue with the funds to<br />

be primarily used to focus on additional drilling<br />

and the application for a mining licence at KM.<br />

10 | <strong>ASIA</strong> <strong>Miner</strong> | September/October <strong>2012</strong>

Mongolia<br />

Oyu Tolgoi ahead of schedule for production<br />

THE massive Oyu Tolgoi Copper-Gold Project of Rio T into and Turquoise<br />

Hill Resources, formerly Ivanhoe Mines, is nearing completion<br />

and remains on track for commer cial production in the first half of<br />

2013. At the end of July construction work was 94% complete and<br />

initial output of copper and gold concentrate is set to begin befor e<br />

the end of this year, six months ahead of schedule.<br />

nstalling a ball mill at the Oyu Tolgoi project of Oyu Tolgoi LLC.<br />

Construction of an overland conveyor at the Oyu Tolgoi Copper-Gold Project.<br />

Rio Tinto is managing the development of Oyu Tolgoi and owns a 51%<br />

stake in Turquoise Hill, which in turn holds a 66% stake in the project to<br />

the Mongolian government’s 34% interest. <strong>The</strong> Mongolian operating<br />

company for the project is Oyu Tolgoi LLC. <strong>The</strong> cost for the first phase<br />

of development is not expected to exceed the forecast US$6.2 billion.<br />

In addition to bringing forwar d the completion date by finishing<br />

an extraordinary amount of construction in 27 months instead of<br />

33, the progress has also enabled pr oduct marketing while the<br />

price of copper is stable, which is of great significance to the financial<br />

vitality of Mongolia.<br />

Oyu Tolgoi, Mongolian words that in English mean ‘turquoise hill’, is<br />

one of the world’s largest undeveloped copper and gold assets, with a<br />

measured and indicated resource estimated at 41 billion pounds of<br />

copper and 21 million ounces of gold. <strong>The</strong> project employs more than<br />

9600 Mongolians in development and nearly 1700 domestic entities<br />

and organizations have supplied the pr oject since its inception. Additionally,<br />

more than 1000 domestic suppliers provided goods and services<br />

valued at US$1.3 billion to the project in 2011 alone.<br />

Oyu Tolgoi LLC is committed to contributing to a sustainable future<br />

for Mongolia. At least 9 out of 10 employees will be Mongolian once<br />

the mine is in pr oduction and Oyu Tolgoi is investing US$58 million<br />

dollars in training and education, and an additional US$27 million in<br />

the Workforce Employment Project designed to help address the general<br />

skills shortage in Mongolia.<br />

Additional diesel-powered electrical generating capacity has been<br />

installed at the South Gobi Desert site to meet power needs during<br />

construction, and electrical transmission lines running from neighbouring<br />

China are in place but the project is still waiting for a supply agreement<br />

to be signed between the two countries befor e power can be<br />

imported. Turquoise Hill Resources says transmission lines in Mongolia<br />

and China have been tested with full power loads and ar e ready for<br />

commissioning, and the venture is pushing on with arrangements to<br />

ensure power from China is available in the second half of the year.<br />

Commercial discussions on a power deal between the countries<br />

continue, it said, adding that if negotiations aren’t successful a dedicated<br />

power plant will be r equired which will set back the start of<br />

commercial output.<br />

As well as providing a major boost to Mongolia’s economy, the project<br />

is also contributing to development of infrastructure. A new international<br />

standard airport is being constructed with a runway mor e<br />

than 3km-long and capable of r eceiving Boeing 737 and C130 air -<br />

craft. <strong>The</strong> Khanbumbat airport site will boast the single largest piece<br />

of concrete to be poured in the Gobi, if not Mongolia. Using three separate<br />

machines in a ‘Paving Train’ which paves just under a metr e<br />

of concrete with 44cm thickness in a minute, the concrete will be laid<br />

in months, not years. <strong>The</strong> airport development pr oject is scheduled<br />

to be completed by October <strong>2012</strong>.<br />

<strong>The</strong> new name for Ivanhoe Mines was approved by shareholders<br />

at the annual meeting on June 28. Turquoise Hill’s chief executive<br />

officer Kay Priestly says, “Changing our name to Turquoise Hill Resources<br />

marks another milestone in our corporate history. Our new<br />

name more closely aligns the company with our world-class Oyu<br />

Tolgoi project and will have added significance as we rapidly approach<br />

the start of production.”<br />

12 | <strong>ASIA</strong> <strong>Miner</strong> | September/October <strong>2012</strong>

Mongolia<br />

14 | <strong>ASIA</strong> <strong>Miner</strong> | September/October <strong>2012</strong>

Mongolia<br />

A coal seam at Prophecy Coal’s Chandgana project in central Mongolia.<br />

Prophecy to acquire Tugalgatai licences<br />

PROPHECY Coal is consolidating its coal<br />

holdings in the Chandgana Basin of central<br />

Mongolia by agreeing to purchase assets<br />

relating to certain Tugalgatai coal exploration<br />

licences from Tethys Mining LLC. <strong>The</strong><br />

Tugalgatai licences are contiguous to Prophecy’s<br />

Chandgana licences which host a<br />

measured resource of 650 million tonnes<br />

and an indicated r esource of 540 million<br />

tonnes of thermal coal.<br />

According to records reviewed by Prophecy<br />

Tethys applied to register a resource estimate<br />

of 2.33 billion tonnes of thermal coal for the Tugalgatai<br />

licences with the <strong>Miner</strong>als Resour ce<br />

Council of Mongolia. <strong>The</strong> resources registered<br />

by Tethys are not NI 43-101 compliant. Pr o-<br />

phecy expects to conduct work in due course<br />

with a view of preparing an NI 43-101 estimate<br />

of the contained resource at Tugalgatai.<br />

Since announcing the proposed acquisition,<br />

Prophecy has arranged a US$10 million<br />

secured debt facility with W aterton<br />

Global Value with these funds to be used to<br />

complete the purchase of the Tugalgatai licences.<br />

Waterton Global’s portfolio manager<br />

Cheryl Brandon says, “We look forward<br />

to working with Prophecy Coal to finance<br />

the company as they continue to expand in<br />

the Chandgana Basin. <strong>The</strong> Waterton Global<br />

facility provides the required capital to complete<br />

the $10 million coal licence acquisition<br />

and implement the company’s production<br />

growth strategy in the region.”<br />

Since 2005, Tethys has performed detailed<br />

exploration on the Tugalgatai licences<br />

including drilling and geophysical methods,<br />

and conducted geotechnical, hydrogeological,<br />

environmental and topographic studies.<br />

Exploration results indicate a large<br />

and geologically simple coal occurr ence<br />

within these licences that is similar to Prophecy’s<br />

Chandgana licences. <strong>The</strong> coal<br />

seam is continuous acr oss the Nyalga<br />

Basin and outcrops to the northwest, with<br />

the main coal seam measuring up to 30<br />

metres in thickness.<br />

Prophecy’s chairman and CEO John Lee<br />

says, “By consolidating the Chandgana coal<br />

basin of about 300sqkm, Prophecy is looking<br />

for greater economies of scale to potentially<br />

produce low-cost electricity at the Chandgana<br />

mine mouth power plant, and further<br />

develop coal to chemicals and coal gasification<br />

projects. It’s also possible to further increase<br />

the resource through exploration in<br />

this highly prospective basin.”<br />

Meanwhile, Prophecy has recently temporarily<br />

suspended mining operations at its<br />

Ulaan Ovoo pr oject in the country’ s north<br />

owing to the fact that its stockpile of 187,000<br />

tonnes is sufficient to meet contractual supply<br />

obligations through the balance of <strong>2012</strong>.<br />

About 80 mining staff were laid-off and paid<br />

aggregate severance of about $100,000 to<br />

comply with local employment laws. Some<br />

15 staff members remain on site for equipment<br />

and site maintenance, shipping and security<br />

operations during the shutdown.<br />

<strong>The</strong> shutdown is expected to run for around<br />

6 months but could end sooner if any significant<br />

new coal sale agr eements are entered<br />

into. Start-up can be implemented in a matter<br />

of weeks. Management is using the downtime<br />

to work with Mongolian of ficials to seek road<br />

and bridge improvements, and to open Zeltura<br />

border to facilitate Russia export sales.<br />

Prophecy debuts power division<br />

PROPHECY Coal has debuted<br />

Prophecy Power Corp, the company’ s<br />

wholly-owned Mongolian subsidiary focused<br />

on the power sector in Mongolia.<br />

Prophecy Power, formerly known as<br />

East Energy Corp, was incorporated in<br />

2010 with the specific business objective<br />

of supplying power to Mongolia through<br />

construction of the Chandgana <strong>The</strong>rmal<br />

Power Plant. Another Pr ophecy subsidiary<br />

Chandgana LLC will develop the<br />

Chandgana Coal Pr oject in parallel to<br />

ensure fuel supply to Prophecy Power.<br />

Prophecy Power’s proposed 600MW<br />

mine mouth power plant complex will be<br />

built next to Prophecy Coal’s Chandgana<br />

coal deposit in central Mongolia, next to a<br />

paved highway, just 60km fr om Undurkhann<br />

for the east electricity grid connection<br />

leading to Choibalsan and 120km<br />

from Baganuur for the west electricity grid<br />

connection leading to Ulaanbaatar.<br />

Prophecy Power obtained approval of<br />

its Environmental Impact Assessment<br />

(EIA) from the Ministry of Natur e and<br />

Tourism in November 2010. In November<br />

2011, the Ministry of Natural Resour ces<br />

and Energy granted a construction licence-the<br />

first of its kind in Mongolia..<br />

Since obtaining this licence, the company<br />

has been in discussions with the<br />

Mongolian government to finalize a power<br />

purchase agreement (PPA) to secur e<br />

Mongolia’s long-term energy supply, and<br />

enable project financing and construction<br />

to move forwar d. In parallel, Pr ophecy<br />

Power has been in discussions with several<br />

private Mongolia companies r egarding<br />

bi-lateral power purchase agreements.<br />

A coal supply agr eement is in place<br />

whereby Chandgana LLC will supply 3<br />

million tonnes of coal annually.<br />

In December 2011, Prophecy Power distributed<br />

a request for proposal to six engineering,<br />

procurement and construction<br />

(EPC) contractors. After site visits and technical<br />

sessions were conducted Prophecy<br />

received proposals from all six contractors<br />

and in July shortlisted three based on construction<br />

capability, equipment quality, time<br />

to deployment and price. Pr ophecy is in<br />

discussions with candidates to formulate<br />

final quotes, and expects to finalize EPC<br />

selection by October 1.<br />

16 | <strong>ASIA</strong> <strong>Miner</strong> | September/October <strong>2012</strong>

Mongolia<br />

Joint venture finds coking coal projects<br />

THE Ekhgoviin Chuluu LLC joint ventur e<br />

company of Xanadu Mines and Noble Group<br />

has signed an agreement to earn an 80% interest<br />

in the Khus Coking Coal Pr oject and<br />

has also signed an option agreement for the<br />

Khar Servegen Coking Coal Pr oject, both in<br />

the South Gobi region of Mongolia. Exploration<br />

drilling began at the former in July while<br />

due diligence began on the latter also in July.<br />

Ekhgoviin Chuluu (EC) was formed in early<br />

2011 with Noble Group to be the vehicle to<br />

acquire and explore for quality hard coking<br />

coal targets in Mongolia. EC maintains its<br />

own technical team with the head coal geologist<br />

having prior in country experience with<br />

a large US group. Noble and Xanadu’s Ulaanbaatar<br />

office provides high level oversight to<br />

EC in both technical and commercial matters.<br />

EC has over the past 12 months acquir ed a<br />

number of early stage licence ar eas which are<br />

prospective for coking coal and of a pr oduct<br />

quality sufficient to withstand softer end mar -<br />

kets. EC has recently acquired two licence areas<br />

in the south which will be subject to initial exploration<br />

programs during the current quarter. EC<br />

will continue to develop its existing and potential<br />

asset base over the balance of this year.<br />

<strong>The</strong> Khus pr oject is strategically located<br />

490km south-southeast of Ulaanbaatar and<br />

140km north of Khangi-Mandula port at the<br />

Chinese border. Reconnaissance reverse circulation<br />

drilling has started with 10 widely spaced<br />

drill holes planned for about 3000 metres.<br />

It is about 25km northeast and along-strike<br />

from the recently discovered Ail Bayan Bituminous<br />

Coal Mine. No physical exploration<br />

has been carried out to date, however EC<br />

geologists believe this greenfield project may<br />

potentially represent the basin extension from<br />

the Ail Bayan coal deposit.<br />

<strong>The</strong> highly prospective Khar Servegen project<br />

is about 620km southwest of Ulaanbaatar,<br />

125km northeast of Ceke-Shiveekhur en<br />

port at the Chinese border and 70km east of<br />

Ovoot Tolgoi/Nariin Sukhait Bituminous coking<br />

coal mines. Due diligence drilling and<br />

coal quality analysis is under way.<br />

Xanadu is progressing with divestment of<br />

its two thermal coal assets, Khar T arvaga<br />

and Galshar, to focus its attention on its EC<br />

coking coal joint venture and its copper and<br />

gold portfolio. A number of parties have<br />

held discussions with Xanadu on the assets<br />

and Macquarie Capital (Hong Kong) Ltd is<br />

advising on this process.<br />

Xanadu also has the Nuurstei Coking Coal<br />

Project in the south central part of the Khuvsgul<br />

Province. <strong>The</strong> two contiguous licences lie<br />

about 13km south-southwest of the provincial<br />

centre of Moron and are only 8km fr om the<br />

proposed Northern Mongolian rail line that will<br />

link Moron with the rail spur at Erdenet.<br />

Xanadu Mines has a number of prospects throughout Mongolia. <strong>The</strong> coal prospects are indicated by the black<br />

stars, the metal prospects by the red stars and the joint venture coking coal prospects by yellow stars.<br />

Xanadu to begin Elgen-Zost drilling<br />

XANADU Mines will this month begin a<br />

10,000 metre reverse circulation drill program<br />

at the Elgen-Zost Gold Pr oject in southern<br />

Mongolia following the award of a contract to<br />

Major Drilling. <strong>The</strong> project consists of three<br />

low to intermediate sulphidation epithermal<br />

prospects - Elgen Uul, Suug and Zost Uul -<br />

within a 35km-long east-west orientated corridor<br />

of alteration and mineralization with the<br />

main exploration target being high-grade gold<br />

in quartz-aldularia veins at depth.<br />

<strong>The</strong> precious metal exploration project is in<br />

Dornogovi Province, about 680km southsoutheast<br />

of Ulaanbaatar . It is just 30km<br />

north of the Mongolian-Chinese bor der and<br />

the international border crossing at Mandal.<br />

Exploration drilling has been carried out at<br />

the Sharchuluut Uul (Yellow Mountain) porphyry<br />

copper pr oject with four holes for<br />

3197.8 metres. All holes reached their target<br />

depths and were completed without incident.<br />

Drilling has shown that the Sharchuluut alteration<br />

system is impressive in size and vector<br />

IP suggests it may extend east-west with<br />

at least 2km strike length, and be up to 400<br />

metres thick in multiple advanced argillic<br />

zones. <strong>The</strong> general interpretation of the lithocap<br />

and geological structur e suggests the<br />

porphyry source for the advanced argillic alteration<br />

zones lies to the south, or possibly<br />

along strike of the lithocap. Assay results are<br />

expected shortly but Xanadu believes Shar -<br />

chuluut has the hallmarks of a porphyry system<br />

with very large-scale potential.<br />

<strong>The</strong> Amgalant copper-gold porphyry project<br />

is in Omnogovi Province of southern Mongolia,<br />

about 480km south-southeast of Ulaanbaatar.<br />

It is in the central part of the highly prospective<br />

South Gobi Porphyry belt, about<br />

110km northeast of the Oyu T olgoi coppergold<br />

deposit and less than 40km west of the<br />

Tsagaan Suvarga copper-molybdenum deposit.<br />

Reconnaissance exploration and geophysics<br />

have commenced at the pr oject with a<br />

total of 200 grab samples were taken.<br />

Meanwhile, Xanadu continues to pr ogress<br />

activities to meet certain conditions pr ecedent<br />

related to the acquisition of the Oyut<br />

Ulaan porphyry copper project (OU) from Temuujin<br />

Mining Corp. OU is about 275km<br />

northeast of Oyu Tolgoi and 60km west of the<br />

industrial centre of Sainshand and the main<br />

Trans Mongolian Railway. Limited exploration<br />

has been completed on the project.<br />

18 | <strong>ASIA</strong> <strong>Miner</strong> | September/October <strong>2012</strong>

Mongolia<br />

SouthGobi curtails coal operations<br />

A COMBINATION of external factors has<br />

seen SouthGobi Resources curtail operations<br />

at its Mongolian pr ojects with little<br />

change expected this quarter. Uncertainty<br />

created by the proposed proportional takeover<br />

of the company by the Aluminum<br />

Corporation of China Limited (Chalco)<br />

which resulted in a <strong>Miner</strong>al Resources Authority<br />

of Mongolia move to suspend exploration<br />

and mining activity on certain<br />

licences and the gover nment unveiling a<br />

new law to cap foreign investment in strategic<br />

sectors, various infrastructur e constraints<br />

in Mongolia and the softening of<br />

inland China coking coal markets ar e primary<br />

factors behind the decision.<br />

During the second quarter operations<br />

were wound back but by the end of June<br />

they had been fully curtailed with the company<br />

also suspending uncommitted capital<br />

expenditures and exploration expenditures.<br />

For the thr ee months to June 30<br />

SouthGobi produced 270,000 tonnes of<br />

raw coal compared to 870,000 tonnes for<br />

the same period in 2011.<br />

In the same period the company sold<br />

160,000 tonnes at an average realized selling<br />

price of US$62.56 per tonne compar ed to<br />

sales of 1.05 million tonnes at an average<br />

price of US$54.06 per tonne in the second<br />

quarter of 2011. Customers were reluctant to<br />

enter into significant sales contracts during<br />

this period owing to the uncertainty facing the<br />

company as well as the softening of China’s<br />

markets closest to SouthGobi’s operations.<br />

Other factors centred on constraints at Shivee<br />

Khuren border crossing during the first<br />

half of the year . <strong>The</strong> opening of expanded<br />

border crossing infrastructure was delayed;<br />

the crossing was closed for extended periods<br />

during the Chinese New Year and Mongolian<br />

Tsagaan Sar public holidays; and the existing<br />

gravel road used to transport coal fr om<br />

SouthGobi’s Ovoot T olgoi mine and<br />

neighbouring mines to the crossing was closed<br />

for more than four weeks.<br />

On May 28, the expanded bor der crossing<br />

infrastructure, consisting of eight new<br />

border gates exclusively for coal transportation,<br />

opened at Shivee Khur en. <strong>The</strong> expanded<br />

border crossing infrastructure will<br />

eliminate the existing bottleneck and is expected<br />

to incr ease annual capacity to<br />

about 20 million tonnes or mor e. In June,<br />

due to the expanded infrastructure, South-<br />

Gobi’s customers exported 580,000 tonnes<br />

of Ovoot T olgoi coal, mostly fr om<br />

customer inventories, to China, r epresenting<br />

a monthly export record from the mine.<br />

Due to the uncertainty surrounding South-<br />

Gobi’s business, the company anticipates its<br />

operations will remain fully curtailed in the<br />

third quarter. Further, it cautions that production<br />

volumes, sales volumes and pricing for<br />

the full year of <strong>2012</strong> cannot be estimated.<br />

Its largest shar eholder Ivanhoe Mines<br />

and Chalco have agreed to an additional<br />

30-day extension to the pr oportional takeover<br />

bid. Chalco has agr eed to make a<br />

takeover bid on or before September 4 and<br />

thereafter the bid must be taken up after<br />

36 days at the earliest if conditions ar e all<br />

met. Ivanhoe has enter ed into a lock-up<br />

agreement and has agreed to tender all its<br />

SouthGobi shares to Chalco.<br />

20 | <strong>ASIA</strong> <strong>Miner</strong> | September/October <strong>2012</strong>

Mongolia<br />

ONGOING drilling by Kincora Copper has intersected<br />

significant high-grade copper at the<br />

Bronze Fox project and gold at the Tourmaline<br />

Hills project. Of particular significance is<br />

a 180 metre intersection of continuous copper<br />

mineralization at the West Kasulu zone of<br />

Bronze Fox in southeast Mongolia.<br />

<strong>The</strong> West Kasulu discovery is at the centre<br />

of Kincora’s group of exploration licences and<br />

at the west border of licence 15000X. This licence<br />

is 140km northeast of Oyu Tolgoi and<br />

sits in the same metallogenic belt.<br />

Partial drill core from a recent hole intersected<br />

the 180 metre interval. <strong>The</strong> average<br />

copper grade acr oss the 180 metr es is<br />

0.5% copper and 0.1 grams/tonne gold<br />

with associated molybdenum mineralization<br />

up to 0.33%. This included 37 metres averaging<br />

0.829% copper, 0.14 grams/tonne<br />

gold, and 0.04% molybdenum fr om 573<br />

metres or 1.11% copper equivalent. This, in<br />

turn, included 13 metres from 595 metres<br />

averaging 1.14% copper, 0.17 grams/tonne<br />

gold and 694ppm molybdenum, equating<br />

to a copper equivalent of 1.57%.<br />

High-grade copper intersected at Bronze Fox<br />

<strong>The</strong> mineralization begins from surface and<br />

remains open at depth. Further cor e cutting<br />

and sampling is ongoing with the hole continuing<br />

below 1000 metres. <strong>The</strong> results confirm<br />

the potential for a deep high grade<br />

porphyry-style copper deposit and incr ease<br />

management’s confidence that the exploration<br />

program could be reaching the edge of<br />

Copper mineralization in a core sample from the West<br />

Kasulu zone of Kincora’s Bronze Fox project.<br />

a large, high-grade copper and gold r e-<br />

source. Further drilling will test the extent of<br />

the mineralization and will track the halo east<br />

and west which runs for 2km.<br />

Kincora’s president and CEO John Rickus<br />

says, “<strong>The</strong>se exciting results confirm that higher<br />

grade zones exist within this exceptionally<br />

large system. For the r emainder of the year<br />

our team will continue to explore a number of<br />

high priority targets to establish the extent of<br />

the copper and gold mineralization on the<br />

Bronze Fox properties.”<br />

Partial assays have also been r eturned for<br />

the Tourmaline Hills pr oject, one of the licences<br />

acquired from Forbes and Manhattan<br />

through an exchange of shares in April <strong>2012</strong>.<br />

Further core cutting and sampling is ongoing.<br />

<strong>The</strong> best results are: 1 metre from 39 metres<br />

@ 2.74 grams/tonne gold and 5 metr es<br />

from 60 metres @ 2.65 grams/tonne; 6 metres<br />

from 39 metres @ 0.67 grams/tonne with<br />

up to 1.18 grams/tonne and 1 metr e from<br />

154 metres @ 0.8 grams/tonne; 14 metr es<br />

from 273 metres @ 0.39 grams/tonne with up<br />

to 1.49 grams/tonne.<br />

Kincora has recently closed a non-brokered<br />

private placement of convertible notes with<br />

Origo Partners PLC valued at up to US$2.5<br />

million. Origo is the largest shar eholder of<br />

Kincora with 29.28%. Proceeds of the placement<br />

will be used for further development on<br />

Kincora’s properties in Mongolia.<br />

September/October <strong>2012</strong> | <strong>ASIA</strong> <strong>Miner</strong> | 21

Mongolia<br />

Maiden coal resource for Teeg licence<br />

DRAIG Resources has announced a maiden<br />

JORC-compliant ivresource of 75 million tonnes<br />

for its Teeg licence in central southern Mongolia<br />

plus an additional exploration target of between<br />

25 million and 1200 million tonnes. <strong>The</strong> JORC<br />

report adds that there is compelling evidence for<br />

a significant deposit of high-grade coal with metallurgical<br />

potential in a coal seam with a true<br />

average coal thickness of 24.12 metres.<br />

<strong>The</strong> 22.2sqkm Teeg licence is in the Bayanteeg<br />

district of Ovorhangay province and is<br />

one of eight licences owned by Draig across<br />

the Ovorhangay and South Gobi regions. <strong>The</strong><br />

Ovorhangay licences are about 130km from<br />

the provincial capital Aryayheer and about<br />

520km southwest of Ulaanbaatar.<br />

<strong>The</strong> resource estimate was determined using<br />

the results of geological mapping, trenching, induces<br />

polarization and resistivity surveys, 6784<br />

metres of drilling and coal sample analysis. Draig<br />

believes the results confirm the highly prospective<br />

nature of Teeg and the wider Bayanteeg<br />

area. Logging of the drill data has encouraged<br />

the company. Coal was intercepted in 18 holes<br />

of the phase 1 drill program over 6000 metres.<br />

A series of steeply-dipping coal seam intersections<br />

were logged at shallow open-pit mineable<br />

depths along a north-westerly strike.<br />

<strong>The</strong> first phase drill pr ogram was focused<br />

Draig Resources’ coal licences are in the Ovorhangay and South Gobi provinces of southern Mongolia.<br />

on confirming one of the potential sequences<br />

identified in a 2011 due diligence pr ogram,<br />

which intersected black coal seams of up to<br />

40 metres. Two drill rigs worked ar ound the<br />

clock to achieve up to 300 metr es per day,<br />

with one rig diamond drilling to cor e the representative<br />

coal intervals for quality and petrographic<br />

analysis. <strong>The</strong> best coal seams<br />

intercepted were those with an appar ent<br />

thickness of between 36 and 86 metres.<br />

<strong>The</strong> company’s managing director Mark<br />

Earley says, “All the coal we intercepted was<br />

relatively shallow and definitely at open pit<br />

mineable levels. <strong>The</strong> T eeg licence shows<br />

great promise, based on the drilling we have<br />

done to date. Our aim is to complement<br />

these results with the drilling to be undertaken<br />

in our phase 2 pr ogram which will include<br />

our South Gobi licences.<br />

“Defining a 75 million tonnes coal r esource<br />

plus the exploration target is an excellent achievement,<br />

particular after only one exploration<br />

drilling campaign on Teeg. We now have a significant<br />

coal resource, our resources are at<br />

open pit mineable levels and we have identified<br />

large drill target areas to pursue.”<br />

Altan Rio starts Chandman-Yol drilling<br />

DRILLING has started at the Chandman-Y ol<br />

copper-gold porphyry project in western Mongolia<br />

after Altan Rio <strong>Miner</strong>als secur ed a contractor<br />

for the work. <strong>The</strong> 3000 metre diamond<br />

drill program is targeting two high-priority tar -<br />

gets identified during the company’s field work<br />

in 2011 and have not been drilled before.<br />

<strong>The</strong> Ovoot target was discovered by reconnaissance<br />

profiling and is the str ongest anomaly<br />

identified at Chandman. It is near<br />

surface and of substantial size, with dimensions<br />

of more than 2km-long, 1km-wide, and<br />

up to 800 metres thick. Copper staining is visible<br />

in vertical fractur es at surface dir ectly<br />

above the IP feature, which provides strong<br />

evidence of geochemical leakage from depth.<br />

Ovoot represents a compelling target for potentially<br />

large tonnage resources.<br />

<strong>The</strong> Takhilt target hosts outcropping coppergold<br />

porphyry intrusion with disseminated copper<br />

oxide staining. Follow-up soil geochemical<br />

sampling has delineated a r obust copper soil<br />

anomaly about 600 metres in diameter. Rock<br />

chip sampling locally assayed up to 30<br />

grams/tonne gold and +1% copper . Takhilt<br />

also represents a compelling target for shallow,<br />

but potentially large-scale, resources.<br />

Altan Rio has also announced that its ear n-<br />

in for 90% of one of the Onon epithermal gold<br />

tenements in northeast Mongolia is expected<br />

to be completed this quarter. “<strong>The</strong> company<br />

will complete the final stage of the ear n-in by<br />

issuing private Mongolian company Er denyn<br />

Erel LLC 240,000 common shares in the capital<br />

of Altan Rio. <strong>The</strong> remaining two Onon tenements<br />

are already owned by the company ,”<br />

says Altan Rio’s president Evan Jones.<br />

Onon is an early stage gold exploration project<br />

where previous work has identified numerous<br />

gold and arsenic anomalies associated<br />

with epithermal-style mineralization. <strong>The</strong> three<br />

tenements cover an area of 137sqkm.<br />

Meanwhile, results from the inaugural 1902<br />

metre drilling campaign at Altan Rio’ s Khavchuu<br />

gold project in northern Mongolia have<br />

confirmed significant gold anomalies. Seven<br />

wide-spaced reconnaissance core holes were<br />

drilled at the 71sqkm pr oject between March<br />

and May this year, with five holes intersecting<br />

major gold and/or arsenic anomalies which are<br />

known to indicate orogenic gold deposits in the<br />

region. One hole intersected high grade gold<br />

of 11.49 grams/tonne over 1 metre in an area<br />

on the edge of a large Boroo granitoid.<br />

Evan Jones says, “I am pleased to shar e<br />

this discovery of high grade gold mineralization<br />

in a Boroo-style geological setting with<br />

potential large tonnage possibilities. Our exploration<br />

team has successfully demonstrated<br />

its ability to target and explor e the large<br />

Khavchuu gold system, only 10km from Centerra<br />

Gold’s Boroo mine and mill complex.<br />

We are encouraged by these results.”<br />

22 | <strong>ASIA</strong> <strong>Miner</strong> | September/October <strong>2012</strong>

Company Profile<br />

Techenomics: Analyzing oil for better efficiency<br />

TECHENOMICS is an independent laboratory with more than 15<br />

years’ experience in oil analysis in Indonesia. Techenomics uses<br />

an internationally recognized ASTM method tailored to work the<br />

oil analysis to provide maximum benefits to customers. <strong>The</strong> company<br />

operates in South East Asia through PT Tekenomiks Indonesia<br />

(PTTI) as well as in Australia, Madagascar and Mongolia.<br />

PTTI’s laboratory has also been accredited according to<br />

ISO 17025. A special feature is that customers are free to<br />

discuss and consult directly with engineers so that they not<br />

only get accurate analysis results but also can get solutions<br />

to the problems encountered in their respective units.<br />

PTTI is able to analyze oil from a wide range of products<br />

but has also developed other more specialist lubricant tests,<br />

including hydraulic foaming testing and engine coolant tests.<br />

Oil analysis is the analytical examination of a lubricant’s<br />

property, suspended contaminants and wear debris. It is performed<br />

during routine preventative maintenance to provide<br />

meaningful and accurate information on lubricants and the<br />

machine’s condition. Oil analysis is the best tool to penetrate<br />

into the working heart of the equipment to reveal vital information<br />

about its condition and performance.<br />

Techenomics laboratories are capable of analyzing many<br />

different types of lubricants in both petrol and diesel engines<br />

from mining companies, power stations, agricultural machinery,<br />

paper mills, offshore, marine, road and rail freight companies.<br />

Techenomics can test wear metal, viscosity, TBN, tan,<br />

cleanliness and the lubricant viscosity. All this is done in accordance<br />

with updated ASTM standards. To ensure the accuracy<br />

of results, the company is also registered for ASTM<br />

International’s Interlaboratory Cross Check Program.<br />

Hydraulic foaming testing<br />

With hydraulic foaming testing an<br />

analysis is done in accordance with<br />

ASTM D 892 where the foaming<br />

tendency and foaming stability are<br />

assessed. Foam tendency describes<br />

the amount of foam generated immediately<br />

after the fluid is agitated<br />

and aerated, while foam stability<br />

quantifies the amount of foam remaining<br />

10 minutes after cessation<br />

of aeration. This work is supported<br />

by other analyses such as cleanliness,<br />

Millipore testing and water<br />

content. This enables customers to<br />

Members of the team from PT Tekenomiks Indonesia.<br />

better determine the cause of the<br />

high value of their foaming in lubricating<br />

action that could eventually<br />

determine the proper maintenance<br />

and repairs to their hydraulic unit.<br />

Coolant testing<br />

As the automotive industry grows<br />

larger, engine designs keep<br />

changing, making the cooling<br />

systems work harder than ever to<br />

protect against corrosion and<br />

build-up of contamination. Engine<br />

coolant testing at Techenomics<br />

can help identify the condition of<br />

the coolant to ensure proper cooling<br />

operation. Studies have<br />

shown that a majority of engine<br />

failures are due to issues within<br />

the coolant system. Even though<br />

coolants are used to prevent<br />

problems like pitting, cavitation,<br />

corrosion, electrolysis and erosion;<br />

improper maintenance of<br />

the fluid can create a negative<br />

impact on the engine system and<br />

engine coolant testing can identify<br />

these problems.<br />

Fuel testing<br />

Diesel fuel analysis can identify potential<br />

causes for fuel filter plugging,<br />

smoking, loss of power, poor injector<br />

performance, malfunctioning throttle<br />

position sensors and sticking valves.<br />

Testing also confirms a diesel fuel’s<br />

sulphur content, biodiesel content<br />

and compliance with manufacturer<br />

specifications and standards for<br />

cleanliness that could affect equipment<br />

warranty requirements.<br />

Transformer oil analysis<br />

Transformer oil analysis is an essential<br />

part of a cost-efficient<br />

maintenance program. It is well<br />

known that regular oil analysis is<br />

useful in monitoring the condition<br />

of engines, turbines and other oil<br />

lubricated equipment. <strong>The</strong> same<br />

can be said for transformer oils<br />

used to insulate many transformers<br />

and other electrical distribution<br />

equipment. <strong>The</strong> analysis of insulating<br />

oils provides information<br />

about the oil, but also enables the<br />

detection of other possible problems,<br />

including contact arcing<br />

and aging insulating paper.<br />

Refurbishment of waste oil<br />

PTTI has developed a system for<br />

processing used oil that can be<br />

reused as an ingredient in the<br />

blasting process. Use of used oil is<br />

proven to reduce diesel fuel consumption<br />

and can deliver cost reductions<br />

of up to 50-75% of diesel<br />

fuel as well as having environmental<br />

benefits.<br />

One customer is Kitadin Tandung<br />

Mayang, part of the Banpu<br />

Group, which has a used oil processing<br />

unit with an hourly capacity<br />

of 600 litres. With daily oil<br />

consumption in blasting averaging<br />

3000-4000 litres, the use of used<br />

oil has resulted in annual savings<br />

of about $1.5 million.<br />

24 | <strong>ASIA</strong> <strong>Miner</strong> | September/October <strong>2012</strong>

LPT Tekenomiks Indonesia laboratories have been accredited according to ISO 17025.<br />

Oil analysis and condition<br />

monitoring software<br />

Mining companies spend hundreds<br />

of thousands, even millions,<br />

of dollars on maintenance of mining<br />

equipment, but what if you<br />

could prevent a lot of these costs,<br />

extend the life of your equipment,<br />

lower unscheduled downtime and<br />

save your company money<br />

Techenomics can help do this with<br />

its fully integrated condition monitoring<br />

and oil analysis software<br />

package, Blue Oceans, which is<br />

designed to allow maintenance<br />

personnel to schedule and record<br />

equipment maintenance, including<br />

the recording of all oil analysis results,<br />

lubricant and fuel usage, and<br />

monitor the wear on magnetic<br />

plugs and trays.<br />

Results for each sample are reviewed,<br />

interpreted and managed<br />

by Blue Oceans software<br />

and recommendations given by<br />

trained technicians with a background<br />

in equipment maintenance<br />

and oil analysis. Blue<br />

Oceans also manages the results<br />

of sample analysis for clients.<br />

With this software package, users<br />

can, in one place, easily track<br />

their past and present oil monitoring<br />

results. Trending tools are also<br />

available for ongoing condition<br />

monitoring, and oil and fuel<br />

analysis. Blue Oceans software<br />

also offers a flexible reporting format<br />

that can be modified to suit<br />

the specific needs of customers.<br />

Techenomics’ Blue Oceans customized<br />

maintenance software,<br />

provides the ability to monitor<br />

and control all aspects of lubrication<br />

usage, oil analysis, data<br />

trending, magnetic plug inspections,<br />

static wear tray monitoring<br />

and fuel usage.<br />

Importing and exporting<br />

historical data<br />

Techenomics has multiple options<br />

for importing and extracting a<br />

client’s historical oil analysis and<br />

condition monitoring data from<br />

the existing company or from the<br />

Blue Oceans’ database. It is<br />

common for a company to request<br />

their historical data be sent<br />

to them electronically or posted.<br />

Techenomics can accept the historical<br />

data in almost any format<br />

such as csv, txt, xls and more.<br />

Historical data is owned by the<br />

client not the company that has<br />

provided the work. Some companies<br />

charge to provide historical<br />

data but Techenomics does not -<br />

it is free and widely available for<br />

any client via the export methods<br />

in Blue Oceans.<br />

Historical data importing times<br />

depend on the amount of data<br />

required to import as well as the<br />

formats provided. Timings can<br />

range from within a week to two<br />

months, and updates on<br />

progress are provided throughout<br />