Guaranteed Account - CUNA Mutual Group

Guaranteed Account - CUNA Mutual Group

Guaranteed Account - CUNA Mutual Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Guaranteed</strong> <strong>Account</strong><br />

(Now retirement really can feel this secure)

In today’s economy, we’re all looking for<br />

ways to make the future feel safer.<br />

Like many people, you’ve spent your life working<br />

hard, saving diligently, and following a retirement<br />

investment strategy designed with an eye to the<br />

long-term.<br />

But the economic crisis may have turned your<br />

plans upside down or set them back. So where do<br />

you go from here How do you keep investing with<br />

a sense of security that the bottom won’t fall out<br />

of your savings<br />

The <strong>Guaranteed</strong> <strong>Account</strong> can help.<br />

<strong>CUNA</strong> <strong>Mutual</strong> <strong>Group</strong>’s stable value options have historically<br />

offered rates similar to short- and intermediate-term<br />

bonds, without their volatility.<br />

$50,000<br />

$40,000<br />

$30,000<br />

$20,000<br />

$10,000<br />

$0<br />

Dec-84<br />

Dec-86<br />

Growth of $10,000<br />

CMG Stable Value<br />

USF Money Market<br />

3 Year Treasuries<br />

Dec-88<br />

Dec-90<br />

Dec-92<br />

Dec-94<br />

These returns are the annualized returns for the period from 12/31/1984 to 12/31/2010.<br />

The Stable Value <strong>Account</strong> percentage is based upon the average of monthly rates<br />

credited to group fixed annuity contracts of CMFG Life Insurance Company from<br />

12/31/1984 to 12/31/2010, the Money Market rate is the average of the monthly rates<br />

earned on the Ultra Series Money Market Fund during the same period, while the<br />

U.S. Treasury return calculations are based on publicly available interest rates each<br />

month. Past performance is no indication of how these products will perform in the<br />

future. For additional information on the differences between the products being<br />

compared and how these statistics were derived see footnote on the back cover. 1<br />

Dec-96<br />

Dec-98<br />

Dec-00<br />

Dec-02<br />

Dec-04<br />

Dec-06<br />

Dec-08<br />

Dec-10

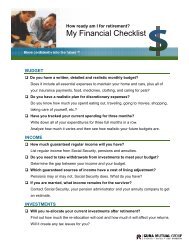

Every investor, regardless of age and circumstance,<br />

can benefit from keeping a portion of their assets<br />

in a stable value account. This can create a strong<br />

foundation for an investor with a long timeline, and<br />

helps protect a lifetime of hard work for investors who<br />

are closer to, or in, retirement. So how much is enough<br />

Though the actual investment amount will be<br />

determined by an individual’s needs and risk tolerance,<br />

this general rule is a starting point to discuss with your<br />

investment professional:<br />

Percentage invested in equities =<br />

Your age – 30 = % <strong>Guaranteed</strong> <strong>Account</strong><br />

These examples illustrate different investing scenarios based on varying ages and life stages.<br />

10%<br />

<strong>Guaranteed</strong><br />

<strong>Account</strong><br />

20%<br />

<strong>Guaranteed</strong><br />

<strong>Account</strong><br />

30%<br />

<strong>Guaranteed</strong><br />

<strong>Account</strong><br />

90%<br />

Equities<br />

80%<br />

Equities<br />

70%<br />

Equities<br />

Sydney, age 40<br />

(40 – 30 = 10)<br />

Laurie, age 50<br />

(50 – 30 = 20)<br />

George, age 60<br />

(60 – 30 = 30)<br />

Guarantee of principal.<br />

Your investment is guaranteed by CMFG Life<br />

Insurance Company (CMFG Life). 2 Few investment<br />

options can offer this kind of promise. The <strong>Guaranteed</strong><br />

<strong>Account</strong> can because it’s backed by the strength and<br />

strong capital ratios of CMFG Life, an industry leader<br />

for more than 75 years. CMFG Life has an “A” (excellent)<br />

ranking from AM Best and a long history of stability. 3<br />

No hidden fees.<br />

With the <strong>Guaranteed</strong> <strong>Account</strong> there’s no guesswork<br />

on the rate of return. The interest rate is set at the<br />

time of investment, and you will receive 100% of the<br />

declared interest rate. 4 You can figure out exactly<br />

what your account is worth at any given time, without<br />

worrying you’ll have to adjust later<br />

for hidden fees.<br />

Know your interest rate.<br />

CMFG Life intends to declare new interest rates<br />

quarterly, if necessary. You’ll have access to the new<br />

rates when they go into effect.<br />

Contributions, transfers, and withdrawals<br />

at any time—without penalty or hassle.<br />

You can move money into and out of the account<br />

whenever the time is right for you, without surrender<br />

charges, fees, or restrictions. 5 For investors, the<br />

account is as liquid as most money market funds, but<br />

with a guaranteed payback. 2<br />

The option to create a lifetime income stream.<br />

Unlike many stable value funds, the <strong>Guaranteed</strong><br />

<strong>Account</strong> can be converted to an annuity to provide<br />

a steady flow of income throughout the retirement<br />

years. You’ll have a choice of lifetime income options<br />

to meet your unique retirement needs.

1<br />

The comparison of stable value accounts, money market funds, and 3-year U.S. Treasuries only shows the differences in annualized rates of return.<br />

The stable value account may be subject to a market value adjustment and may be less liquid than a money market mutual fund or U.S Treasury<br />

Securities. Money market funds invest in short-term notes and interest rates fluctuate daily. The Ultra Series Money Market fund’s performance may<br />

not be indicative of the performance of all money market funds. U.S. Treasury Securities are subject to daily changes in market value. In addition,<br />

U.S. Treasuries are backed by the full faith and credit of the U.S. Government. The comparison is not suggesting that stable value options<br />

are better than money market funds or U.S. Treasuries. Individual investor needs determine suitability. Contracts or prospectuses should be<br />

reviewed for specific features and limitations. The stable value accounts offered by CMFG Life Insurance Company are a fixed group annuity<br />

contract. The terms and conditions of those annuity contracts have been amended and are re-filed from time to time, however, the interest<br />

crediting methods have the same stable value objective.<br />

2<br />

All guarantees are subject to the ability of CMFG Life Insurance Company to honor such guarantees.<br />

3<br />

Based on CMFG Life Insurance Company’s 2010 annual report. “A” excellent rating is the third-highest of 16 categories assigned by A.M. Best.<br />

4<br />

If your employer cancels the contract, your investment in the <strong>Guaranteed</strong> <strong>Account</strong> will be subject to a market value adjustment. This<br />

adjustment is determined by comparing today’s yield to the average yield over the last 60 months of the Merrill Lynch BBB 7- to 10-year U.S.<br />

Corporate Index. The adjustment is applied to participant accounts and may be negative.<br />

5<br />

You should carefully consider the risks of the contract before allocating any amounts to the contract. Exchanges between <strong>Guaranteed</strong> <strong>Account</strong><br />

and any available fund can be made any business day. The Stable Value interest is credited daily. There are no penalties assessed by the<br />

<strong>Guaranteed</strong> <strong>Account</strong> for benefit payments or other withdrawals taken by participants. Investment and insurance products are not federally<br />

insured, involve investment risk, may lose value, and are not obligations of or guaranteed by any financial institution other than<br />

CMFG Life Insurance Company.<br />

The <strong>Guaranteed</strong> <strong>Account</strong> is a fixed, group annuity issued by CMFG Life Insurance Company. After any guaranteed interest period, interest is set<br />

quarterly and applied on an annual basis. Any stated interest rate may not have been adjusted to reflect plan administration, transaction or<br />

contract fees. Certain contract fees are currently waived.<br />

Annuities are not insured by the FDIC/NCUSIF, are not obligations or deposits of any bank/credit union, nor guaranteed by any bank/credit union,<br />

and involve risk, including the possible loss of principal invested if the issuing insurance company is unable to meet its obligation.<br />

<strong>CUNA</strong> <strong>Mutual</strong> <strong>Group</strong> is the marketing name for <strong>CUNA</strong> <strong>Mutual</strong> Holding Company, a mutual insurance holding company, its subsidiaries and affiliates.<br />

10001277-MHC-0411 © <strong>CUNA</strong> <strong>Mutual</strong> <strong>Group</strong>, 2011 All Rights Reserved.<br />

CMFG Life Insurance Company<br />

2000 Heritage Way<br />

Waverly, Iowa 50677<br />

www.cunamutual.com/guaranteedaccount