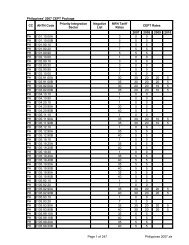

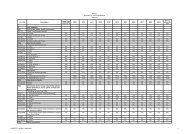

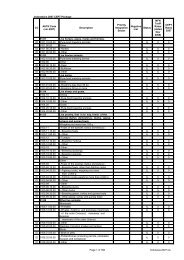

REPORTING COUNTRY: Malaysia

REPORTING COUNTRY: Malaysia

REPORTING COUNTRY: Malaysia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

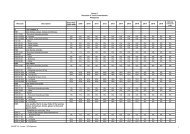

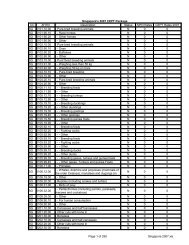

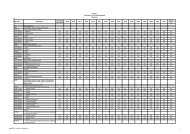

No.<br />

HS Code<br />

MFN Rates<br />

Product Description<br />

2002 2007 Current<br />

Compressors other than those of subheadings Nos. 8414.30<br />

841480510 and8414.40:<br />

gas compression<br />

25<br />

8454<br />

841480520<br />

8455<br />

module for use in oil drilling operations<br />

Compressors other than those of subheadings Nos. 8414.30<br />

and8414.40: compressors for automotive air-conditioners<br />

30% OR RM 60 W.I.T.H<br />

841480590<br />

8456<br />

Compressors other than those of subheadings Nos. 8414.30<br />

and8414.40: other<br />

Nil<br />

8457 841480900 Other Nil<br />

8458 841490110 For fans: blades for ceiling fans 30<br />

841490120<br />

8459<br />

of subheading Nos. 8414.51 190, 8414.51 990, 8414.59 190<br />

and8414.59 990<br />

20<br />

8460 841490190 For fans: other 30<br />

8461 841490200 For subheadings Nos. 8414.60 100 and 8414.80 110 Nil<br />

8462 841490300 For subheading No. 8414.80 200 20<br />

8463 841490400 For pumps or compressors 5<br />

8464 841490900 Other 5<br />

8465 841510000 - Window or wall types, self-contained or split-system 30<br />

8466 841520000 - Of a kind used for persons, in motor vehicles 30<br />

8467 841581100 for use in aircraft Nil<br />

8468 841581200 for use in railway rolling stock Nil<br />

8469 841581300 for use in road vehicles 30<br />

8470 841581900 other 30<br />

8471 841582100 for use in aircraft Nil<br />

8472 841582200 for use in railway rolling stock Nil<br />

8473 841582300 for use in road vehicles 30<br />

8474 841582900 other 30<br />

8475 841583100 for use in aircraft Nil<br />

8476 841583200 for use in railway rolling stock Nil<br />

8477 841583300 for use in road vehicles 30<br />

8478 841583900 other 30<br />

841590100<br />

8479<br />

for subheading Nos. 8415.81 100, 8415.81 200, 8415.82 100,<br />

8415.82 200, 8415.83 100 and 8415.83 200<br />

Nil<br />

8480 841590900 other 30<br />

8481 841610000 - Furnace burners for liquid fuel Nil<br />

8482 841620000 - Other furnace burners, including combination burners Nil<br />

841630000<br />

8483<br />

- Mechanical stockers, including their mechanical grates,<br />

mechanical ash dischargers and similar appliances<br />

Nil<br />

8484 841690000 - Parts Nil<br />

841710000<br />

8485<br />

- Furnaces and ovens for the roasting, melting or other heattreatment<br />

of ores, pyrites or of metals<br />

Nil<br />

8486 841720000 - Bakery ovens, including biscuit ovens Nil<br />

8487 841780000 - Other Nil<br />

8488 841790000 - Parts Nil<br />

8489 841810110 Electrically operated: not over 350 litres 30<br />

8490 841810120 Electrically operated: over 350 litres 30<br />

8491 841810900 Other 30<br />

8492 841821110 Electrically operated: not over 350 litres 30<br />

8493 841821120 Electrically operated: over 350 litres 30<br />

8494 841821910 Other: not over 350 litres 30<br />

8495 841821990 Other: over 350 litres 30<br />

8496 841822100 not over 350 litres 30<br />

8497 841822200 over 350 litres 30