Earths - Avalon Rare Metals

Earths - Avalon Rare Metals

Earths - Avalon Rare Metals

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE RACE FOR RARE<br />

e<br />

<strong>Rare</strong> earths are where you find them, and<br />

for <strong>Avalon</strong> <strong>Rare</strong> <strong>Metals</strong> that has turned<br />

out to be near Great Slave Lake in the<br />

Northwest Territories. These cabins on the<br />

company’s development site make for an<br />

iconic Canadian outpost.<br />

22 L’ACTUALITÉ CHIMIQUE CANADIENNE FÉVRIER 2012

BUSINESS | THIS TEXT CHANGES EACH ISSUE<br />

arths<br />

By Tim Lougheed<br />

Toronto’s <strong>Avalon</strong> <strong>Rare</strong> <strong>Metals</strong> has joined the global<br />

race to extract rare earth chemicals - key elements<br />

in many energy -generating green technologies.<br />

FEBRUARY 2012 CANADIAN CHEMICAL NEWS 23

H<br />

umanity’s longstanding love affair with gold may<br />

not have waned, but we are being wooed by some<br />

serious rivals in the periodic table. They are the<br />

rare earths, which are actually metals and not<br />

all that rare. These 17 elements are appearing in<br />

more and more of our high technology hardware, particularly<br />

the latest generation of green energy-generating<br />

technology. And with more than 95 per cent of the world’s<br />

rare earth production taking place within China, which has<br />

announced its intention to reserve that supply for its own<br />

growing use, the hunt is on to diversify the world market for<br />

these hot commodities.<br />

Such dramatic attention to rare earths is comparatively<br />

recent. They have often been regarded by prospectors as little<br />

more than a nuisance, comparatively useless materials that<br />

interfere with the refining of tantalum or niobium, the kinds<br />

of metals that really make money. In fact, until the 1980s the<br />

world’s largest source of rare earths was a mine in California’s<br />

Mojave Desert, which was shut down as demand tapered off.<br />

By 2010, however, Colorado Congressman Mike Coffman<br />

had introduced American legislation that would brand<br />

rare earths as economically strategic. “Our nation must act<br />

to protect our security interests with regard to rare earth<br />

elements,” Coffman said last year. “China is neither an ally<br />

of the United States nor is it a reliable trade partner when<br />

it comes to these strategic metals.” Dubbed RESTART,<br />

for <strong>Rare</strong> <strong>Earths</strong> Supply-Chain Technology and Resources<br />

Transformation Act, the proposal would promote the development<br />

of all relevant exploration, mining and processing<br />

capacity. The move parallels the revival of output from the<br />

Mojave Desert mine, which is expected to ramp up sharply<br />

in the next few years. Meanwhile, companies are scouring<br />

obscure corners of the globe elsewhere to investigate other<br />

sources of rare earths.<br />

One of the most promising of those sites is near Great Slave<br />

Lake in Canada’s Northwest Territories. Known formally as<br />

the Nechalacho <strong>Rare</strong> Earth Elements Deposit, it is located<br />

at Thor Lake, about 200 kilometres east of Yellowknife. The<br />

site was initially surveyed in the 1930s, when all that was in<br />

evidence was a large body of granite and gabbro, a form of<br />

igneous rock comparable to basalt. By the 1970s, aerial surveys<br />

with a gamma ray spectrometer showed high radiometric<br />

values raised the possibility of uranium. The readings were<br />

actually caused by thorium, which turned out to be affiliated<br />

with a substantial collection of rare earths.<br />

That survey and the ensuing discovery was made by<br />

Highwood Resources, a predecessor to Vancouver-based<br />

Beta Minerals, which held the mining lease on the property.<br />

Over the next 30 years, it would invest some $12 million to<br />

assess the rare earths potential of Thor Lake, sinking some<br />

200 test holes. Nevertheless, there was little incentive for<br />

more ambitious development while the price of most rare<br />

earths remained low and the logistics of extracting them<br />

from such an isolated location remained daunting.<br />

By 2005, representatives of Toronto-based <strong>Avalon</strong> <strong>Rare</strong><br />

<strong>Metals</strong> were prepared to adopt a different perspective and<br />

the company acquired the title to Thor Lake from Beta. This<br />

move was spearheaded by <strong>Avalon</strong> CEO Don Bubar, who has<br />

subsequently been lauded for his prescience with regard to<br />

the demand for rare earths.<br />

Among those at the heart of this strategic acquisition is<br />

Bill Mercer, who has headed up the Thor Lake project for<br />

<strong>Avalon</strong> since 2007. He explains that in just a few years, the<br />

demand for rare earths has been nurtured by a new generation<br />

of consumer products that take advantage of these<br />

elements. A typical example is an innovative electric motor<br />

introduced by the U.K.-based firm Dyson, which has used it<br />

24 L’ACTUALITÉ CHIMIQUE CANADIENNE FÉVRIER 2012

BUSINESS | RARE EARTHS<br />

1<br />

(1) Senior geologist and<br />

camp manager Chris Pedersen<br />

considers some of <strong>Avalon</strong><br />

<strong>Rare</strong> <strong>Metals</strong>’ collection of<br />

earth samples with project<br />

geologist Martin Heiligmann.<br />

(2) An <strong>Avalon</strong> geologist logs<br />

information collected from<br />

drill cores.<br />

2<br />

to transform such mundane products as vacuum cleaners and<br />

table fans. The motor boasts remarkable speed and efficiency<br />

because its electrical contacts are suspended by powerful<br />

magnets, made from the rare earth neodymium.<br />

The ionic properties of that element, as well as samarium,<br />

praseodymium and dysprosium, make for some of the<br />

strongest known magnets, including some that function<br />

at temperatures high enough to remain viable in harsher<br />

settings like automobile engines. Such properties also make<br />

it possible for at least 11 rare earths to enhance the optical<br />

amplification by materials that generate laser beams. This<br />

technology, which a few decades ago would have been a<br />

rarity outside of a formal research setting, now crops up in<br />

all manner of electronic appliances, from children’s video<br />

games to office projector displays.<br />

These new applications have expanded the market for<br />

rare earths, although Mercer points out that it remains much<br />

smaller than more primary metals such as copper. The latter<br />

might see annual global production of 15 million tonnes of<br />

production, while rare earths would be about one per cent<br />

of that volume. However, these elements could fetch a<br />

price that is 10 times higher, which is one of the key factors<br />

behind <strong>Avalon</strong>’s push in Thor Lake.<br />

Even so, Bubar suggests that the site may not be delivering<br />

any product until 2016, although he noted that the company<br />

would like to accelerate that timeline if possible. The wait<br />

reflects the challenges posed by rare earths, which cannot<br />

only be difficult to find, but even more difficult to extract<br />

in a usable form. “These elements tend to be stored in very<br />

refractory minerals,” says Jim Franklin, an exploration<br />

FEBRUARY 2012 CANADIAN CHEMICAL NEWS 25

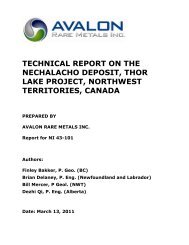

ENERGY<br />

PRODUCTION<br />

ENERGY<br />

REDUCTION<br />

ENERGY<br />

EFFICIENCY<br />

LIFESTYLE<br />

PETROLEUM<br />

REFINING<br />

La<br />

HIGH-POWERED<br />

ELECTRIC MOTORS<br />

Dy<br />

Nd<br />

NEW GENERATION<br />

VEHICLES<br />

La<br />

Tb<br />

UV FILTERS<br />

IN GLASS<br />

Ce<br />

REDUCING FUEL<br />

CONSUMPTION<br />

Nd<br />

LIGHTER<br />

VEHICLES IMPROVED<br />

PERFORMANCE<br />

Dy<br />

GENERATION<br />

VEHICLES<br />

Nd Sm<br />

RECHARGEABLE<br />

BATTERIES<br />

La<br />

ENERGY-EFFICIENT<br />

LIGHTING<br />

COLOUS SCREEN<br />

LCDS/PDPS<br />

Eu Tb Y<br />

COMPONENTS TO<br />

HARDWARE<br />

Nd<br />

MEDICAL<br />

SERVICES<br />

Pr Eu Nd Gd<br />

<strong>Rare</strong> earth elements<br />

are especially useful<br />

in a new generation<br />

of consumer products<br />

to boost speed<br />

and efficiency as<br />

well as improve<br />

product efficacy .<br />

RARE<br />

IDIOSYNCRASIES<br />

La (Lanthanum) Nd (Neodymium) Dy (Dysprosium) Tb (Terbium) Ce (Cerium)<br />

Sm (Samarium) Pr (Praseodymium) Eu (Europium) Y (Yttrium) Gd (Gadolium)<br />

Most of the rare earths consist of the elements<br />

between the lanthanum (atomic number 57) and<br />

lutetium (atomic number 71), with two outliers:<br />

scandium (atomic number 21) and yttrium (atomic<br />

number 39). In spite of their collective name, most<br />

of them are as plentiful in the earth’s crust as copper.<br />

However, they are much more widely dispersed,<br />

seldom occurring in concentrations that would allow<br />

for easy detection or high-volume extraction.<br />

Such dispersal is related to the accepted<br />

account of their origins, which begin hundreds of<br />

kilometres deep in the earth’s mantle, from which<br />

they are thrust up at high velocity. This rapid flow<br />

spreads them thinly near the surface, where they<br />

can occupy mineral bodies that are a kilometre or<br />

more across. In addition, many of those minerals<br />

are refractory, a quality that determines how<br />

readily they break down under chemical or physical<br />

action. A typical example is zircon, which resists<br />

erosion so well that it is often used to calibrate<br />

measurements of 'deep time,' which determine the<br />

age of geological features.<br />

<strong>Rare</strong> earths accommodate such minerals because<br />

of their signal feature, an unexpected decrease<br />

in the radii of the ionic forms of these atoms. This<br />

results in those rare earths with lower atomic<br />

numbers and atomic weights actually having larger<br />

atoms than elements that are higher in the periodic<br />

table. Consequently, the heavier a rare earth, the<br />

more tightly it will bind to other atoms and the more<br />

difficult it will be to separate them.<br />

MEDICAL<br />

SERVICES<br />

Ce<br />

geologist who spent much of his career with the Geological Survey of<br />

Canada. “They just don’t dissolve very easily. As a result, a standard<br />

analysis that involves an acidic dissolution of the rock doesn’t necessarily<br />

break them down.”<br />

According to Franklin, commercially viable techniques for analyzing<br />

these minerals did not appear until the 1990s, with the advent of induction<br />

coupled plasma emission spectroscopy. This approach is now<br />

regularly used to identify the presence of rare earths at levels as low as<br />

parts per trillion, at a cost of less than $100 per sample.<br />

Even so, Mercer adds that life remains complicated when it comes to<br />

extracting and refining individual rare earths. <strong>Avalon</strong> expects the Thor<br />

Lake development to include froth floatation, a process for separating<br />

these metals from the surrounding material based on its tolerance for the<br />

presence of water. It can be a messy business, one that has been met with<br />

new environmental regulations in the United States. However, he and<br />

Franklin remain confident that a steady market pull will ensure that these<br />

restrictions do not restrain the company’s efforts; the find is simply too<br />

rich to ignore. “It has all the rare earths, but it also has what geologists call<br />

high field strength elements, which are zirconium, niobium, hafnium, and<br />

tantalum,” says Mercer. “Gallium also tends to be enriched in it.”<br />

Moreover, the concentration of rare earths at this site is as much as three<br />

orders of magnitude greater than those found in the Chinese deposits. That<br />

bodes well for responding to observers who fear that there simply will not<br />

be enough rare earths around to go into the growing assortment of devices<br />

that rely on these elements. And Franklin insists that neither these devices<br />

nor the metals will ultimately become priced out of reach, now that the<br />

rush for rare earths is on. “For varying reasons, commodities have this<br />

cyclical approach,” he says. “Uranium goes through cycles; gold is clearly<br />

well up in one right now. It’s a supply and demand thing. Right now people<br />

are worried about the supply. We will find lots of rare earths,” he says.<br />

26 L’ACTUALITÉ CHIMIQUE CANADIENNE FÉVRIER 2012