Annual report - HSE

Annual report - HSE

Annual report - HSE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Emission coupons are not amortised, since they are purchased for individual periods in<br />

which they are used. Emission coupons received from the government are initially valuated<br />

at EUR 1 per coupon at simultaneous increase in long-term deferred revenue.<br />

Goodwill appears in consolidation and represents a surplus of cost over the company’s<br />

share in fair value of acquired recognisable assets, liabilities and contingent liabilities of the<br />

subsidiary on the date of acquisition. Goodwill is recognised as an asset and is examined<br />

at least once per year due to impairment. Each impairment is immediately recognised in<br />

the consolidated income statement and is not subsequently reversed. In case of disposal<br />

of subsidiary, the adequate amount of goodwill is included in the establishment of profit/<br />

loss in sales and effect on the Group’s profit or loss.<br />

Amortisation is accounted for on a straight-line basis, taking into account the useful life of<br />

each individual (integral) part of an intangible asset. The amortisation is measured at cost<br />

when an asset is available for use.<br />

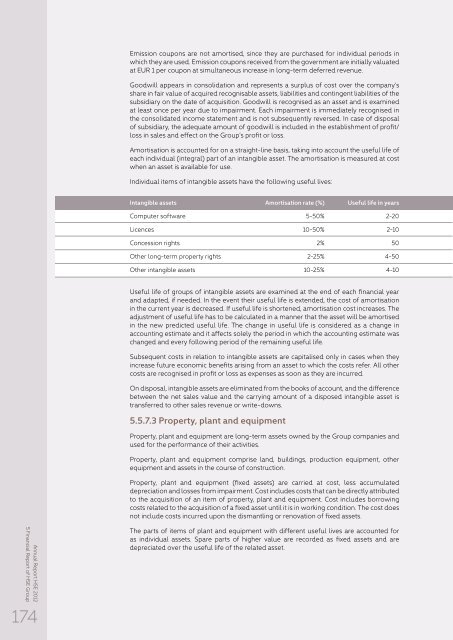

Individual items of intangible assets have the following useful lives:<br />

Intangible assets Amortisation rate (%) Useful life in years<br />

Computer software 5-50% 2-20<br />

Licences 10-50% 2-10<br />

Concession rights 2% 50<br />

Other long-term property rights 2-25% 4-50<br />

Other intangible assets 10-25% 4-10<br />

Useful life of groups of intangible assets are examined at the end of each financial year<br />

and adapted, if needed. In the event their useful life is extended, the cost of amortisation<br />

in the current year is decreased. If useful life is shortened, amortisation cost increases. The<br />

adjustment of useful life has to be calculated in a manner that the asset will be amortised<br />

in the new predicted useful life. The change in useful life is considered as a change in<br />

accounting estimate and it affects solely the period in which the accounting estimate was<br />

changed and every following period of the remaining useful life.<br />

Subsequent costs in relation to intangible assets are capitalised only in cases when they<br />

increase future economic benefits arising from an asset to which the costs refer. All other<br />

costs are recognised in profit or loss as expenses as soon as they are incurred.<br />

On disposal, intangible assets are eliminated from the books of account, and the difference<br />

between the net sales value and the carrying amount of a disposed intangible asset is<br />

transferred to other sales revenue or write-downs.<br />

5.5.7.3 Property, plant and equipment<br />

Property, plant and equipment are long-term assets owned by the Group companies and<br />

used for the performance of their activities.<br />

Property, plant and equipment comprise land, buildings, production equipment, other<br />

equipment and assets in the course of construction.<br />

Property, plant and equipment (fixed assets) are carried at cost, less accumulated<br />

depreciation and losses from impairment. Cost includes costs that can be directly attributed<br />

to the acquisition of an item of property, plant and equipment. Cost includes borrowing<br />

costs related to the acquisition of a fixed asset until it is in working condition. The cost does<br />

not include costs incurred upon the dismantling or renovation of fixed assets.<br />

5 Financial Report of <strong>HSE</strong> Group<br />

<strong>Annual</strong> Report <strong>HSE</strong> 2012<br />

174<br />

The parts of items of plant and equipment with different useful lives are accounted for<br />

as individual assets. Spare parts of higher value are recorded as fixed assets and are<br />

depreciated over the useful life of the related asset.