Annual report - HSE

Annual report - HSE

Annual report - HSE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

per emission coupon with each sale of electricity from the abovementioned production<br />

companies without simultaneous purchase of emission coupons with regard to emission<br />

factor CO 2<br />

/MWh. This applies also to the companies TEŠ and TET.<br />

In 2011, the company <strong>HSE</strong> decided to partly protect itself against risks of change in the price<br />

of emission coupons by adopting the Strategy of Trading with Emission Coupons in the<br />

Period 2013-2020 and the Decision on Purchase of Emission Coupons for the Purposes<br />

of Own Production after 2012. These measures stipulates that, in a certain period after<br />

the sales of own electricity production in TEŠ and TET, the company has to buy a certain<br />

share of emission coupons. As a result, in 2011 Agreements on Emission Coupon Portfolio<br />

Management was signed with TEŠ and TET, which stipulate that the company <strong>HSE</strong><br />

manages the emission coupons of both companies and takes care of sufficient amount of<br />

coupons to cover liabilities to the government.<br />

Therefore, by the end of 2012 the company <strong>HSE</strong> purchased 1,740,462 emission coupons<br />

that TEŠ and TET will use after 2012. The carrying amount of coupons totals EUR<br />

20,763,198. With this acquisition, <strong>HSE</strong> hedged a portion of revenue from sales of TET and<br />

TEŠ production in advance against fluctuation in price of emission coupons.<br />

Disclosures of transactions with emission coupons are presented in Sections 4.5.8.1 (1)<br />

Intangible assets, 4.5.8.2 (17) Net sales revenue and 4.5.8.2 (19) Costs of goods, materials<br />

and services.<br />

in €<br />

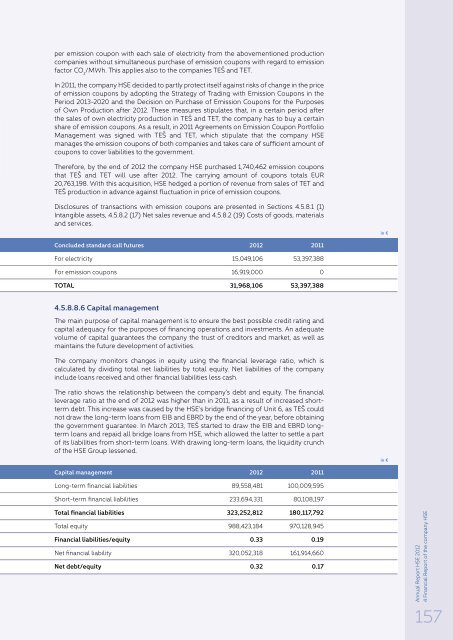

Concluded standard call futures 2012 2011<br />

For electricity 15,049,106 53,397,388<br />

For emission coupons 16,919,000 0<br />

TOTAL 31,968,106 53,397,388<br />

4.5.8.8.6 Capital management<br />

The main purpose of capital management is to ensure the best possible credit rating and<br />

capital adequacy for the purposes of financing operations and investments. An adequate<br />

volume of capital guarantees the company the trust of creditors and market, as well as<br />

maintains the future development of activities.<br />

The company monitors changes in equity using the financial leverage ratio, which is<br />

calculated by dividing total net liabilities by total equity. Net liabilities of the company<br />

include loans received and other financial liabilities less cash.<br />

The ratio shows the relationship between the company’s debt and equity. The financial<br />

leverage ratio at the end of 2012 was higher than in 2011, as a result of increased shortterm<br />

debt. This increase was caused by the <strong>HSE</strong>’s bridge financing of Unit 6, as TEŠ could<br />

not draw the long-term loans from EIB and EBRD by the end of the year, before obtaining<br />

the government guarantee. In March 2013, TEŠ started to draw the EIB and EBRD longterm<br />

loans and repaid all bridge loans from <strong>HSE</strong>, which allowed the latter to settle a part<br />

of its liabilities from short-term loans. With drawing long-term loans, the liquidity crunch<br />

of the <strong>HSE</strong> Group lessened.<br />

in €<br />

Capital management 2012 2011<br />

Long-term financial liabilities 89,558,481 100,009,595<br />

Short-term financial liabilities 233,694,331 80,108,197<br />

Total financial liabilities 323,252,812 180,117,792<br />

Total equity 988,423,184 970,128,945<br />

Financial liabilities/equity 0.33 0.19<br />

Net financial liability 320,052,318 161,914,660<br />

Net debt/equity 0.32 0.17<br />

<strong>Annual</strong> Report <strong>HSE</strong> 2012<br />

4 Financial Report of the company <strong>HSE</strong><br />

157