Annual report - HSE

Annual report - HSE

Annual report - HSE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

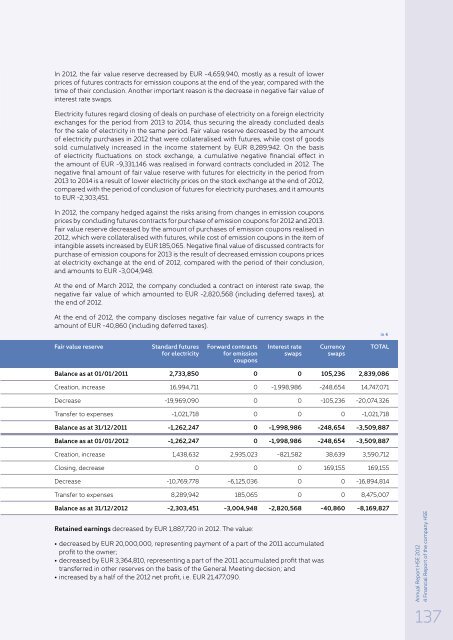

In 2012, the fair value reserve decreased by EUR -4,659,940, mostly as a result of lower<br />

prices of futures contracts for emission coupons at the end of the year, compared with the<br />

time of their conclusion. Another important reason is the decrease in negative fair value of<br />

interest rate swaps.<br />

Electricity futures regard closing of deals on purchase of electricity on a foreign electricity<br />

exchanges for the period from 2013 to 2014, thus securing the already concluded deals<br />

for the sale of electricity in the same period. Fair value reserve decreased by the amount<br />

of electricity purchases in 2012 that were collateralised with futures, while cost of goods<br />

sold cumulatively increased in the income statement by EUR 8,289,942. On the basis<br />

of electricity fluctuations on stock exchange, a cumulative negative financial effect in<br />

the amount of EUR -9,331,146 was realised in forward contracts concluded in 2012. The<br />

negative final amount of fair value reserve with futures for electricity in the period from<br />

2013 to 2014 is a result of lower electricity prices on the stock exchange at the end of 2012,<br />

compared with the period of conclusion of futures for electricity purchases, and it amounts<br />

to EUR -2,303,451.<br />

In 2012, the company hedged against the risks arising from changes in emission coupons<br />

prices by concluding futures contracts for purchase of emission coupons for 2012 and 2013.<br />

Fair value reserve decreased by the amount of purchases of emission coupons realised in<br />

2012, which were collateralised with futures, while cost of emission coupons in the item of<br />

intangible assets increased by EUR 185,065. Negative final value of discussed contracts for<br />

purchase of emission coupons for 2013 is the result of decreased emission coupons prices<br />

at electricity exchange at the end of 2012, compared with the period of their conclusion,<br />

and amounts to EUR -3,004,948.<br />

At the end of March 2012, the company concluded a contract on interest rate swap, the<br />

negative fair value of which amounted to EUR -2,820,568 (including deferred taxes), at<br />

the end of 2012.<br />

At the end of 2012, the company discloses negative fair value of currency swaps in the<br />

amount of EUR -40,860 (including deferred taxes).<br />

in €<br />

Fair value reserve Standard futures Forward contracts Interest rate Currency TOTAL<br />

for electricity for emission swaps swaps<br />

coupons<br />

Balance as at 01/01/2011 2,733,850 0 0 105,236 2,839,086<br />

Creation, increase 16,994,711 0 -1,998,986 -248,654 14,747,071<br />

Decrease -19,969,090 0 0 -105,236 -20,074,326<br />

Transfer to expenses -1,021,718 0 0 0 -1,021,718<br />

Balance as at 31/12/2011 -1,262,247 0 -1,998,986 -248,654 -3,509,887<br />

Balance as at 01/01/2012 -1,262,247 0 -1,998,986 -248,654 -3,509,887<br />

Creation, increase 1,438,632 2,935,023 -821,582 38,639 3,590,712<br />

Closing, decrease 0 0 0 169,155 169,155<br />

Decrease -10,769,778 -6,125,036 0 0 -16,894,814<br />

Transfer to expenses 8,289,942 185,065 0 0 8,475,007<br />

Balance as at 31/12/2012 -2,303,451 -3,004,948 -2,820,568 -40,860 -8,169,827<br />

Retained earnings decreased by EUR 1,887,720 in 2012. The value:<br />

• decreased by EUR 20,000,000, representing payment of a part of the 2011 accumulated<br />

profit to the owner;<br />

• decreased by EUR 3,364,810, representing a part of the 2011 accumulated profit that was<br />

transferred in other reserves on the basis of the General Meeting decision; and<br />

• increased by a half of the 2012 net profit, i.e. EUR 21,477,090.<br />

<strong>Annual</strong> Report <strong>HSE</strong> 2012<br />

4 Financial Report of the company <strong>HSE</strong><br />

137